by Calculated Risk on 12/31/2018 03:58:00 PM

Monday, December 31, 2018

Question #7 for 2019: How much will wages increase in 2019?

Earlier I posted some questions for next year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

7) Real Wage Growth: Wage growth picked up in 2018 (up 3.1% year-over-year as of November). How much will wages increase in 2019?

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth had been running close to 2% since 2010, and picked up a little in 2015, and more in 2016.

The red line is real wage growth (adjusted using headline CPI). Real wages increased during the crisis because CPI declined sharply. CPI was very low in 2015 - due to the decline in oil prices - so real wage growth picked up in 2015.

Real wage growth trended down in 2017, and picked up a little in 2018.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

![]() The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid).

The Atlanta Fed Wage tracker showed nominal wage growth close to 4% in late 2016, but dipped in 2017. At the end of 2018, wage growth was back up to close to 4%.

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3.5% in 2019 according to the CES.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Question #8 for 2019: How much will Residential Investment increase?

by Calculated Risk on 12/31/2018 01:13:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

8) Residential Investment: Residential investment (RI) was sluggish in 2018, and new home sales were mostly unchanged from 2017. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2019? How about housing starts and new home sales in 2019?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2018:

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the start of the recovery was sluggish.

Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year through 2017.

We don't have the data for Q4 2018 yet, but it appears RI will make a small negative contribution to GDP in 2018.

RI as a percent of GDP is still low - close to the lows of previous recessions.

Housing starts are on pace to increase close to 5% in 2018, although growth slowed toward the end of 2018.

Even after the significant increase over the last several years, the approximately 1.26 million housing starts in 2018 will still be the 18th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the seven lowest years were 2008 through 2014). The other lower years were the bottoms of previous recessions.

Note: Due to the government shutdown, New Home sales for November are not available.

New home sales in 2018, through October, were up about 3% compared to the same period in 2017. However, sales were soft in Q4, and I estimate sales were about the same in 2018 as in 2017.

Here is a table showing housing starts and new home sales since 2005. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will increase further over the next few years.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2,068 | --- | 1,283 | --- |

| 2006 | 1,801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1,355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1,003 | 8.5% | 437 | 1.9% |

| 2015 | 1,112 | 10.9% | 501 | 14.7% |

| 2016 | 1,174 | 5.6% | 561 | 12.0% |

| 2017 | 1,203 | 2.5% | 613 | 9.3% |

| 20181 | 1,263 | 5.0% | 613 | 0.0% |

| 12018 estimated | ||||

Most analysts are looking for starts and new home sales to increase to slightly in 2019. For example, the NAHB is forecasting a slight increase in starts (to 1.269 million), and no change in home sales in 2019. And Fannie Mae is forecasting a slight increase in starts (to 1.265 million), and for new home sales to increase to 619 thousand in 2019.

My sense is the weakness in late 2018 will continue into 2019, and starts will be down year-over-year, but not a huge decline. My guess is starts will decrease slightly in 2019 and new home sales will be close to 600 thousand.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Dallas Fed: "Texas Manufacturing Expands Modestly, Outlook Worsens"

by Calculated Risk on 12/31/2018 10:38:00 AM

From the Dallas Fed: Texas Manufacturing Expands Modestly, Outlook Worsens

Texas factory activity continued to expand rather modestly in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, inched down one point to 7.3.This was the last of the regional Fed surveys for December.

Other indexes of manufacturing activity also suggested modest growth in December, although demand growth picked up a bit. The capacity utilization index fell from 9.4 to 7.6, and the shipments index dipped to 6.1. Meanwhile, the new orders index moved up five points to 14.4, and the growth rate of new orders index edged up to 5.8.

Perceptions of broader business conditions turned slightly negative in December. The general business activity index plummeted 23 points to -5.1, hitting its lowest level since mid-2016. The company outlook index also fell markedly, dropping 17 points to -3.4, also a two-and-a-half-year low. More than 20 percent of manufacturers noted their outlook worsened this month.

Labor market measures suggested continued but slightly slower employment growth and longer workweeks in December. The employment index retreated five points to 11.0, a level still above average.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will decline significantly in December and probably be below the consensus forecast of 58.0 (to be released on Thursday, January 3rd).

Sunday, December 30, 2018

Sunday Night Futures

by Calculated Risk on 12/30/2018 08:58:00 PM

Weekend:

• Schedule for Week of December 30, 2018

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 12 and DOW futures are up 130 (fair value).

Oil prices were down slightly over the last week with WTI futures at $45.40 per barrel and Brent at $53.27 per barrel. A year ago, WTI was at $60, and Brent was at $67 - so oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.25 per gallon. A year ago prices were at $2.49 per gallon, so gasoline prices are down 24 cents per gallon year-over-year.

December 2018: Unofficial Problem Bank list declined to 77 Institutions, Q4 2018 Transition Matrix

by Calculated Risk on 12/30/2018 08:21:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for December 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for December 2018. During the month, the list fell by one to 77 institutions after three removals and two additions. Assets increased by $915 million to $54.8 billion. A year ago, the list held 103 institutions with assets of $20.9 billion.

This month, actions have been terminated against Persons Banking Company, Forsyth, GA ($312 million); The Citizens State Bank, Okemah, OK ($86 million); and Bison State Bank, Bison, KS ($10 million). Additions this month include Patriot Bank, National Association, Stamford, CT ($915 million Ticker: PNBK); and Quontic Bank, Astoria, NY ($407 million).

With it being the end of the fourth quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,738 institutions have appeared on a weekly or monthly list since the start of publication. Only 4.4 percent of the banks that have appeared on a list remain today as 1,661 institutions have transitioned through the list. Departure methods include 976 action terminations, 406 failures, 261 mergers, and 18 voluntary liquidations. Of the 389 institutions on the first published list, only 6 or 1.5 percent, are still designated as being in a troubled status more than nine years later. The 406 failures represent 23.4 percent of the 1,738 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 179 | (68,279,301) | |

| Unassisted Merger | 41 | (10,072,112) | |

| Voluntary Liquidation | 5 | (10,672,586) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | 204,571 | ||

| Still on List at 12/31/2018 | 6 | 1,096,664 | |

| Additions after 8/7/2009 | 71 | 53,724,357 | |

| End (6/30/2018) | 77 | 54,821,021 | |

| Intraperiod Removals1 | |||

| Action Terminated | 797 | 323,352,219 | |

| Unassisted Merger | 220 | 82,620,807 | |

| Voluntary Liquidation | 13 | 2,515,855 | |

| Failures | 248 | 125,152,210 | |

| Total | 1,278 | 533,641,091 | |

| 1Institution not on 8/7/2009 or 12/31/2018 list but appeared on a weekly list. | |||

Saturday, December 29, 2018

Schedule for Week of December 30th

by Calculated Risk on 12/29/2018 08:11:00 AM

Happy New Year!

Special Note on Government Shutdown: If the Government shutdown continues, then some releases will be delayed. As an example, this week, construction spending will not be released if the government is shutdown. However, the BLS will release the December employment report as scheduled.

The key report this week is the December employment report on Friday.

Other key indicators include the December ISM manufacturing index, and December auto sales.

Also the Q4 quarterly Reis surveys for office and malls will be released this week.

On Friday, Fed Chair Jay Powell, and former Fed Chairs Ben Bernanke and Janet Yellen will be interviewed.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

All US markets will be closed in observance of the New Year's Day Holiday.

10:00 AM: Corelogic House Price index for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in December, down from 179,000 added in November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, down from 216 thousand the previous week.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 59.3 in November.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 59.3 in November.Here is a long term graph of the ISM manufacturing index.

The PMI was at 59.3% in November, the employment index was at 58.4%, and the new orders index was at 62.1%.

10:00 AM: Construction Spending for November. The consensus is for a 0.3% increase in construction spending.

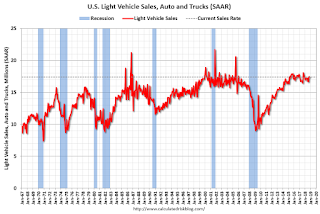

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

Early: Reis Q4 2018 Office Survey of rents and vacancy rates.

8:30 AM: Employment Report for December. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for December. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 155,000 jobs added in November, and the unemployment rate was at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In November the year-over-year change was 2.443 million jobs.

Early: Reis Q4 2018 Mall Survey of rents and vacancy rates.

10:15 AM to 12:15 PM: Federal Reserve chairs: Joint Interview, Neil Irwin of the NY Times will interview Fed Chair Jay Powell, and former Fed Chairs Ben Bernanke and Janet Yellen.

Friday, December 28, 2018

Q4 GDP Forecasts: Mid 2s

by Calculated Risk on 12/28/2018 02:18:00 PM

From Goldman Sachs:

We also lowered our Q4 GDP tracking estimate by one tenth to +2.6% (qoq ar). [Dec 28 estimate)From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.5% for 2018:Q4 and 2.1% for 2019:Q1. [Dec 28 estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.7 percent on December 21, down from 2.9 percent on December 18 [Dec 21 estimate]CR Note: These estimates suggest GDP in the mid-2s for Q4.

Question #9 for 2019: What will happen with house prices in 2019?

by Calculated Risk on 12/28/2018 11:36:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

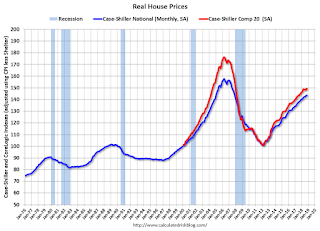

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 5% in 2018. What will happen with house prices in 2019?

The following graph shows the year-over-year change through October 2018, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 4.7% compared to October 2017, the Composite 20 SA was up 5.1% and the National index SA was up 5.5% year-over-year. Other house price indexes have indicated similar gains (see table below).

The price increases in 2018 were lower than in 2017, and YoY price growth slowed towards the end of 2018.

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-18 | 5.1% |

| Case-Shiller National | Oct-18 | 5.5% |

| CoreLogic | Oct-18 | 5.4% |

| FHFA Purchase Only | Oct-18 | 5.6% |

Inventories will probably increase further in 2019, but will probably still be somewhat low historically. Even though the housing market has slowed recently (fewer sales), and inventory has increased, there will be little panic selling because lending standards have been decent over the last several years. There are always people that have to sell because of the 3-Ds: Divorce, Death and Disease, but solid lending means there is no current need to sell because of a fourth D: Debt (like happened during the housing bust).

Low inventories, and a decent economy suggests further price increases in 2019.

Last year I wrote:

"Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year."That happened in 2018, and we might see more drag from the higher mortgage rates in 2019.

If inventory increases further year-over-year as I expect by December 2019, it seems likely that price appreciation will slow to the low single digits - maybe around 3%.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Chicago PMI Decreased Slighly in December

by Calculated Risk on 12/28/2018 10:29:00 AM

From the Chicago PMI: Chicago Business Barometer Moderates to 65.4 in December

The MNI Chicago Business Barometer eased to 65.4 in December, down 1.0 point from November’s 66.4.This was above the consensus forecast of 62.4.

...

After two consecutive months of higher readings, the Employment indicator receded in December, hitting a three-month low, although did remain above the neutral-50 mark.

…

“The MNI Chicago Business Barometer saw 2018 out in good health, assisted by a firm uptick in Production, cementing the best calendar quarter outturn in a year,” said Jai Lakhani, Economist at MNI Indicators.

“Encouragingly, inflationary pressures subsided for a fifth consecutive month and should this continue, it will ease the burden on firms‘ productive capacities. Still, concerns over tariffs continue to linger in the background and stir uncertainty,” he added.

emphasis added

NAR: Pending Home Sales Index Decreased 0.7% in November

by Calculated Risk on 12/28/2018 10:03:00 AM

From the NAR: Pending Home Sales See 0.7 Percent Drop in November

Pending home sales overall slipped in November, but saw minor increases in the Northeast and the West, according to the National Association of Realtors®.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.7 percent to 101.4 in November, down from 102.1 in October. However, year-over-year contract signings dropped 7.7 percent, making this the eleventh straight month of annual decreases.

...

The PHSI in the Northeast rose 2.7 percent to 95.1 in November, and is now 3.5 percent below a year ago. In the Midwest, the index fell 2.3 percent to 98.1 in November and is 7.0 percent lower than November 2017.

Pending home sales in the South fell 2.7 percent to an index of 115.7 in November, which is 7.4 percent lower than a year ago. The index in the West increased 2.8 percent in November to 87.2 and fell 12.2 percent below a year ago.

emphasis added

Thursday, December 27, 2018

Friday: Pending Home Sales, Chicago PMI

by Calculated Risk on 12/27/2018 07:29:00 PM

Friday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for December. The consensus is for a reading of 62.4, down from 66.4 in November.

• At 10:00 AM, Pending Home Sales Index for November. The consensus is for a 1.5% increase in the index.

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 12/27/2018 04:06:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 15 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 9-15 December 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 10-16 December 2017, the industry recorded the following:

• Occupancy: +1.3% to 57.3%

• Average daily rate (ADR): +3.2% to US$119.10

• Revenue per available room (RevPAR): +4.6% to US$68.25

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, year-to-date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will be low through January.

Data Source: STR, Courtesy of HotelNewsNow.com

Question #10 for 2019: Will housing inventory increase or decrease in 2019?

by Calculated Risk on 12/27/2018 12:50:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

10) Housing Inventory: Housing inventory increased in 2018 from very low levels. Will inventory increase or decrease in 2019?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see red arrow on first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2018.

According to the NAR, inventory decreased seasonally to 1.74 million in November from 1.85 million in October. However inventory in November was up from 1.67 million in November 2017.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Note that inventory is still 15% to 20% below the levels for November 2014 and 2015.

Inventory increased 4.2% year-over-year in November compared to November 2017. Months of supply was at 3.9 months in November.

This increase followed several years of declining year-over-year inventory (see blue line).

A year ago I wrote: "The recent change in the tax law might lead to more inventory in certain areas, and I'll be tracking that over the course of the year." And sure enough, in certain areas, inventory was up significantly year-over-year (but still relatively low). For example, inventory in California was up 31% year-over-year. However months-of-supply in California only increased to 3.7 months from 2.9 months a year earlier. This is still on the low side.

I expect to see inventory up again year-over-year in December 2019. My reasons for expecting more inventory are 1) inventory is still historically low (inventory in November 2018 was the second lowest since 2000), 2) higher mortgage rates, and 3) further negative impact in certain areas from new tax law.

If correct, this will keep house price increases down in 2019 (probably lower than the 5% or so gains in 2018).

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Philly Fed: State Coincident Indexes increased in 43 states in November

by Calculated Risk on 12/27/2018 12:13:00 PM

From the Philly Fed:

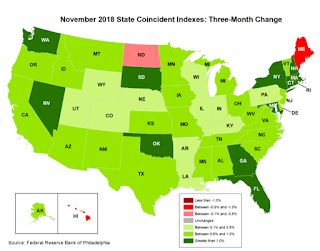

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2018. Over the past three months, the indexes increased in 47 states and decreased in three states, for a three-month diffusion index of 88. In the past month, the indexes increased in 43 states, decreased in three states, and remained stable in four, for a one-month diffusion index of 80.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In November, 45 states had increasing activity (including minor increases).

Data and the #TrumpShutdown

by Calculated Risk on 12/27/2018 10:00:00 AM

If the shutdown doesn't end quickly - the one in January 2018 lasted just two days - several agencies will not release regular government reports. For the current week, the November new home sales report will be delayed.

Update: The BLS is fully funded, and the December employment report will be released on time.

Private data - like the pending home sales report this week - will still be released. All Federal Reserve data will continue to be released (separate funding).

Also, the DOL will continue to process unemployment claims and release the weekly initial unemployment claims report.

If the shutdown lasts through this week, we should see a spike in claims in the report released the following week.

The following graph shows the 4-week moving average of weekly claims since January 2000 with various event driven spikes labeled.

Note the spike related to the 2013 government shutdown. Weekly claims jumped 66,000 in the week following the shutdown in 2013. We will probably see a similar spike in the report released the week of December 31st (if the shutdown does not end quickly).

Another impact from the shutdown will be on mortgage lending.

In 2013, the IRS stopped processing 4506-T forms (the required two years of tax returns for mortgage lending). For loans ready to close, this will not be a problem. And lenders can still accept applications, but this could slow closings a few weeks depending on the duration of the shutdown.

There are many other impacts from the shutdown, and hopefully it will be resolved soon.

Weekly Initial Unemployment Claims decreased to 216,000

by Calculated Risk on 12/27/2018 08:34:00 AM

The DOL reported:

In the week ending December 22, the advance figure for seasonally adjusted initial claims was 216,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 214,000 to 217,000. The 4-week moving average was 218,000, a decrease of 4,750 from the previous week's revised average. The previous week's average was revised up by 750 from 222,000 to 222,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,000.

This was close to the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, December 26, 2018

Thursday: Unemployment Claims, New Home Sales (Postponed)

by Calculated Risk on 12/26/2018 06:45:00 PM

Note: New Home sales will not be released on Thursday due to the Government Shutdown.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher Today or Tomorrow

Mortgage rates were unchanged in some cases today and higher in others. The discrepancy is a result of the timing of today's market movements. The most important thing to know is that lenders who are unchanged today will almost certainly be higher tomorrow, unless the bond market stages an impressive comeback between now and tomorrow morning.Thursday:

...

In the bigger picture, the past few days of weakness are complicated. On the one hand, there is an argument to overlook them due to the idiosyncratic nature of holiday season trading. On the other hand, bonds have had 2 stellar months, and some of the movement we're seeing suggests they may be running into their first major correction against those 2 months of strength. In other words, rates have moved lower very nicely for 2 months and they're now threatening to bounce. [30YR FIXED - 4.625-4.75%]

emphasis added

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 214 thousand the previous week.

• At 9:00 AM: FHFA House Price Index for October 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM: POSTPONED New Home Sales for November from the Census Bureau. The consensus is for 560 thousand SAAR, up from 544 thousand in October.

Zillow Case-Shiller Forecast: Similar House Price Gains in November

by Calculated Risk on 12/26/2018 04:43:00 PM

The Case-Shiller house price indexes for October were released earlier. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: October Case-Shiller Results and November Forecast: Phoenix Replaces Seattle Among Top Three Home-Price Gainers

Home prices were steady in October, gaining 5.5 percent year-over-year, the same as September, according to the Case-Shiller home price index. The gain was slightly above Zillow’s forecast, and we expect another 5.5 percent year-over-year increase in November.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be about the same in November as in October.

Real House Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/26/2018 01:28:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.5% year-over-year in October

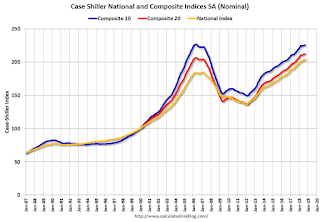

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 11.4% above the previous bubble peak. However, in real terms, the National index (SA) is still about 8.9% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 12.4% below the bubble peak.

The year-over-year increase in prices has slowed to 5.5% nationally, and will probably slow more as inventory picks up.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $286,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/26/2018 11:06:00 AM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Richmond Fed: "Fifth District Manufacturing Activity Weakened in December"

by Calculated Risk on 12/26/2018 10:19:00 AM

From the Richmond Fed: Fifth District Manufacturing Activity Weakened in December

Fifth District manufacturing activity weakened in December, according to the latest survey from the Richmond Fed. The composite index dropped from 14 in November to −8 in December, weighed down by drops in the indexes for new orders and shipments. At −25, the shipments index was its lowest reading since April 2009. However, the third component, the index for employment, rose. Respondents indicated a deterioration in local business conditions, as this index fell to −25, its lowest reading on record, but most firms were optimistic that conditions would improve.This is the weakest reading for this survey since 2016. All of the regional manufacturing surveys have been weaker in December than in November (the Dallas Fed survey will be released Monday).

Survey results suggested employment growth among many manufacturing firms in December, but firms continued to struggle to find workers with the necessary skills. Respondents expected this problem to continue in the coming months but anticipated continued employment growth as well.

emphasis added

Case-Shiller: National House Price Index increased 5.5% year-over-year in October

by Calculated Risk on 12/26/2018 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Phoenix Replaces Seattle in Top Three Cities in Annual Gains According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.5% annual gain in October, remaining the same from the previous month. The 10-City Composite annual increase came in at 4.7%, down from 4.9% in the previous month. The 20City Composite posted a 5.0% year-over-year gain, down from 5.2% in the previous month.

Las Vegas, San Francisco and Phoenix reported the highest year-over-year gains among the 20 cities. In October, Las Vegas led the way with a 12.8% year-over-year price increase, followed by San Francisco with a 7.9% increase and Phoenix with a 7.7% increase. Six of the 20 cities reported greater price increases in the year ending October 2018 versus the year ending September 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.1% in October. The 10-City and 20-City Composites did not report any gains for the month. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase in October. The 10-City Composite and the 20-City Composite posted 0.5% and 0.4% month-over-month increases, respectively. In October, nine of 20 cities reported increases before seasonal adjustment, while 18 of 20 cities reported increases after seasonal adjustment.

“Home prices in most parts of the U.S. rose in October from September and from a year earlier,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The combination of higher mortgage rates and higher home prices rising faster than incomes and wages means fewer people can afford to buy a house. Fixed rate 30-year mortgages are currently 4.75%, up from 4% one year earlier. Home prices are up 54%, or 40% excluding inflation, since they bottomed in 2012. Reduced affordability is slowing sales of both new and existing single family homes. Sales peaked in November 2017 and have drifted down since then.

“The largest gains were seen in Las Vegas where home prices rose 12.8% in the last 12 months, compared to an average of 5.3% across the other 19 cities. This is a marked change from the housing collapse in 2006-12 when Las Vegas was the hardest hit city with prices down 62%. After the last recession, Las Vegas diversified its economy by adding a medical school, becoming a regional center for health care, and attracting high technology employers. Employment is increasing 3% annually, twice as fast as the national rate.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up slightly from the bubble peak, and up 0.5% in October (SA).

The Composite 20 index is 3.3% above the bubble peak, and up 0.4% (SA) in October.

The National index is 11.4% above the bubble peak (SA), and up 0.5% (SA) in October. The National index is up 50.6% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to October 2017. The Composite 20 SA is up 5.1% year-over-year.

The National index SA is up 5.5% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Tuesday, December 25, 2018

Wednesday: Case-Shiller House Prices

by Calculated Risk on 12/25/2018 10:12:00 PM

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for October. The consensus is for a 5.0% year-over-year increase in the Comp 20 index for October.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December.

A Christmas Present for UberNerds

by Calculated Risk on 12/25/2018 08:11:00 AM

NOTE: If you are not familiar with Tanta, please read about her here. You will be happy you did - she was amazing.

A special present for UberNerds - an unpublished Tanta post (written Dec 31, 2007):

And from Tanta's 2007 Post: A Very Nerdy Christmas (see her post for an explanation of the origins of the Mortgage Pig™)Pig Rulz

There have been some misconceptions in the comments about Mortgage Pig™. I do not wish to enter a new year on the wrong track.

Mortgage Pig™ does not have a "name" except Mortgage Pig™. Assertions about Mortgage Pig™'s "name," "address," "job," "significant other," or favorite swill are not canonical. Anyone who asserts knowledge of such things in any communication, written or otherwise, is creating an Internet Urban Legend. Next thing you know they'll be telling you that you can Get Rich Qwik in RE investing.

Happy Holidays to all! CR

Monday, December 24, 2018

Ten Economic Questions for 2019

by Calculated Risk on 12/24/2018 02:28:00 PM

Here is a review of the Ten Economic Questions for 2018.

Below are my ten questions for 2019. I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2019, and - when there are surprises - to adjust my thinking.

1) Administration Policy: These are dangerous times. When Mr. Trump was elected, I was not too concerned about the short term (Luckily the economy was in good shape, and the cupboard was full). But after almost two years of chaos - and the loss of some stabilizing cabinet officers - I'm more concerned. Will Mr. Trump negatively impact the economy in 2019?

2) Economic growth: Economic growth was around 3% in 2018. Most analysts are expecting growth to slow in 2019 as the impact of the tax cuts wears off. How much will the economy grow in 2019?

3) Employment: Through November 2018, the economy has added 2,268,000 thousand jobs, or 206 thousand per month. This was the best year since 2015. Job creation was up from 182 thousand per month in 2017, and up from 195 thousand per month in 2016. Will job creation in 2019 be as strong as in 2018? Will job creation pick up further? Or will job creation slow in 2019?

4) Unemployment Rate: The unemployment rate was at 3.7% in November, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.5% to 3.7% range in Q4 2019. What will the unemployment rate be in December 2019?

5) Inflation: The inflation rate has increased and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

6) Monetary Policy: The Fed raised rates four times in 2018. Currently the Fed is forecasting two more rate hikes in 2019. Some analysts are forecasting three rate hikes. Will the Fed raise rates in 2019, and if so, by how much?

7) Real Wage Growth: Wage growth picked up in 2018 (up 3.1% year-over-year as of November). How much will wages increase in 2019?

8) Residential Investment: Residential investment (RI) was sluggish in 2018, and new home sales were mostly unchanged from 2017. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2019? How about housing starts and new home sales in 2019?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 5% in 2018. What will happen with house prices in 2019?

10) Housing Inventory: Housing inventory increased in 2018. Will inventory increase further in 2019?

There are other important questions, but these are the ones I'm focused on right now. I'll write on each of these questions over the next couple of weeks.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Chicago Fed "Index Points to an Increase in Economic Growth in November"

by Calculated Risk on 12/24/2018 09:12:00 AM

From the Chicago Fed: Index Points to an Increase in Economic Growth in November

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.22 in November from a neutral reading in October. Two of the four broad categories of indicators that make up the index increased from October, and three of the four categories made positive contributions to the index in November. The index’s three-month moving average, CFNAI-MA3, moved down to +0.12 in November from +0.23 in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in November (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, December 23, 2018

Sunday Night Futures

by Calculated Risk on 12/23/2018 08:59:00 PM

Note: Treasury Secretary Steven Mnuchin put out a strange statement today saying that major banks have told him they "have ample liquidity available for lending". Uh, weird - since no one is concerned about liquidity at this time.

Weekend:

• Schedule for Week of December 23, 2018

• Review: Ten Economic Questions for 2018

Monday:

• At 8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

• At The NYSE and the NASDAQ will close early at 1:00 PM ET.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are up slightly (fair value).

Oil prices were down sharply over the last week with WTI futures at $45.49 per barrel and Brent at $53.58 per barrel. A year ago, WTI was at $58, and Brent was at $65 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.31 per gallon. A year ago prices were at $2.43 per gallon, so gasoline prices are down 12 cents per gallon year-over-year.

Review: Ten Economic Questions for 2018

by Calculated Risk on 12/23/2018 11:26:00 AM

At the end of last year, I posted Ten Economic Questions for 2018. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2018 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is a review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

My sense is the low end of the housing market will be fine. The Mortgage Interest Deduction (MID) will be capped at interest on a mortgage up to $750,000 instead of $1,000,000, so the lower priced markets will not be hit by the reduction in the MID. There might be some additional taxes for these buyers due to the limits on SALT and property taxes, but this should be minor.It does appear that housing in states like California were negatively impacted by the new tax law. Many areas are now seeing a year-over-year increase in inventory (probably mostly due to higher mortgage rates, but some due to the new tax law) - and price growth has slowed.

I also expect the high end of the market to be fine. The high end is already doing well even with the MID capped at $1 million. For these buyers, the bigger impact will be the SALT and property tax limitations, but there will be offsets for these buyers due to the lower rates - and these buyers will likely benefit from the corporate tax cuts. Many of these buyers will also benefit from the changes to the Alternative Minimum Tax (AMT).

It is the upper-mid-range in the certain markets that will probably slow. This might be in the $750,000 to $1.5 million price range. These potential buyers probably don't benefit from the AMT or corporate changes, but they will likely be hit by the SALT and property tax limits.

9) Question #9 for 2018: Will housing inventory increase or decrease in 2018?

… right now my guess is active inventory will increase in 2018 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2018).According to the November NAR report on existing home sales, inventory was up 4.2% year-over-year in November. Also some areas are reporting sharply higher YoY increases, and it is clear inventory will be up this year.

8) Question #8 for 2018: What will happen with house prices in 2018?

Inventories will probably remain low in 2018, although I expect inventories to increase on a year-over-year basis by December of 2018. Low inventories, and a decent economy suggests further price increases in 2018.The recent CoreLogic data showed prices up 5.4% year-over-year in October. This was the slowest appreciation in nearly two years. It appears likely that price appreciation will slow as expected.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2018, it seems likely that price appreciation will slow to the low-to-mid single digits.

7) Question #7 for 2018: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 to 1.3 million in 2018, and for new home sales of around 650 thousand.Through November, starts were up about 5% year-over-year compared to the same period in 2017, and on pace for about 1.26 million this year. New home sales were also up about 3% year-over-year and on pace for about 620 thousand in 2018.

I also think there will be further growth in 2018. My guess is starts will increase to just over 1.25 million in 2018 and new home sales will be just over 650 thousand.

6) Question #6 for 2018: How much will wages increase in 2018?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3% in 2018 according to the CES.Through November 2018, nominal hourly wages were up 3.1% year-over-year. This is faster than last year, and it appears wages will increase at a slightly faster rate in 2018 than in 2017.

5) Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

My current guess is the Fed will hike three times in 2018.The Fed hiked four times in 2018.

As an aside, many new Fed Chairs have faced a crisis early in their term. A few examples, Paul Volcker took office in August 1979, and inflation hit almost 12% (up from 7.9% the year before), and the economy went into recession as Volcker raised rates. Alan Greenspan took office in August 1987, and the stock market crashed almost 34% within a couple months of Greenspan taking office (including over 20% in one day!). And Ben Bernanke took office in February 2006, just as house prices peaked - and he was challenged by the housing bust, great recession and financial crisis.

Hopefully Jerome Powell will see smoother sailing.

4) Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

The Fed is projecting core PCE inflation will increase to 1.7% to 1.9% by Q4 2018. However there are risks for higher inflation with the labor market near full employment, and new tax law providing some fiscal stimulus.As of November, inflation has moved up close to the Fed's target.

I do think there are structural reasons for low inflation, but currently I think PCE core inflation (year-over-year) will increase in 2018 and be closer to 2% by Q4 2018 (up from 1.4%), but too much inflation will still not be a serious concern in 2018.

3) Question #3 for 2018: What will the unemployment rate be in December 2018?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the high 3's by December 2018 from the current 4.1%.The unemployment rate was at 3.7% in November.

2) Question #2 for 2018: Will job creation slow further in 2018?

So my forecast is for gains of around 150,000 to 167,000 payroll jobs per month in 2018 (about 1.8 million to 2.0 million year-over-year) . Lower than in 2017, but another solid year for employment gains given current demographics.Through November 2018, the economy has added 2,268,000 thousand jobs, or 206,000 per month. This is above my forecast, and the economy will add more jobs in 2018 than in 2017.

1) Question #1 for 2018: How much will the economy grow in 2018?

It is possible that there will be a pickup in growth in 2018 due to a combination of factors.GDP growth was at 2.2% in Q1, 4.2% in Q2, and 3.4% in Q3. Most estimates suggest growth in the mid to high 2s in Q4. This would put GDP growth at close to 3% for 2018.

The new tax policy should boost the economy a little in 2018, and there will probably be some further economic boost from oil sector investment in 2018 since oil prices have increased recently. Also the housing recovery is ongoing, however auto sales are mostly moving sideways.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2018. And a 3% handle is possible if there is some pickup in productivity.

In March 2018, I wrote When the Story Changes, Be Alert. I noted that the economic winds were shifting, and there were more downside risks to the economy. As the year progressed, those downside risks started impacting the economy, but still, overall, 2018 unfolded about as expected, although employment gains were somewhat higher than I forecast.

Saturday, December 22, 2018

Schedule for Week of December 23, 2018

by Calculated Risk on 12/22/2018 08:11:00 AM

Happy Holidays and Merry Christmas!

The key economic reports this week are November New Home sales, and October Case-Shiller House Prices.

Note: If the government is shutdown, the new home sales report will probably be delayed.

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

The NYSE and the NASDAQ will close early at 1:00 PM ET.

All US markets will be closed in observance of the Christmas Holiday.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.0% year-over-year increase in the Comp 20 index for October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 214 thousand the previous week.

9:00 AM: FHFA House Price Index for October 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 560 thousand SAAR, up from 544 thousand in October.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for a reading of 62.4, down from 66.4 in November.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 1.5% increase in the index.