by Calculated Risk on 1/03/2019 08:19:00 AM

Thursday, January 03, 2019

ADP: Private Employment increased 271,000 in December

Private sector employment increased by 271,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 175,000 private sector jobs added in the ADP report.

...

“We wrapped up 2018 with another month of significant growth in the labor market,“ said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Although there were increases in most sectors, the busy holiday season greatly impacted both trade and leisure and hospitality. Small businesses also experienced their strongest month of job growth all year.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses continue to add aggressively to their payrolls despite the stock market slump and the trade war. Favorable December weather also helped lift the job market. At the current pace of job growth, low unemployment will get even lower.”

The BLS report for December will be released Friday, and the consensus is for 180,000 non-farm payroll jobs added in November.

MBA: "Mortgage Applications Decrease Over Two Week Period in Latest MBA Weekly Survey"

by Calculated Risk on 1/03/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 9.8 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 28, 2018. The results include adjustments to account for the Christmas holiday.

... The Refinance Index decreased 12 percent from two weeks ago. The seasonally adjusted Purchase Index decreased 8 percent from two weeks earlier. The unadjusted Purchase Index decreased 46 percent compared with two weeks ago and was 6 percent lower than the same week one year ago.

...

“Mortgage applications fell over the past two weeks – even as the 30-year fixed-rate mortgage decreased to 4.84 percent, its lowest since September 2018. Investors continued to show a preference for safer U.S. Treasuries, as concerns over U.S. and global economic growth, along with uncertainty over the current government shutdown, drove rates lower,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Even with lower borrowing costs, both purchase and refinance applications decreased over the two-week holiday period, as both conventional and government applications dropped. Part of the decline in mortgage applications was possibly because of the government shutdown, as concerns over delays in FHA application processing times likely contributed to the weakness in activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.84 percent from 4.86 percent, with points decreasing to 0.42 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is down 6% year-over-year.

Wednesday, January 02, 2019

Thursday: ADP Employment, Unemployment Claims, ISM Mfg Survey, Auto Sales, and More

by Calculated Risk on 1/02/2019 08:45:00 PM

Thursday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in December, down from 179,000 added in November.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, down from 216 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 59.3 in November. The PMI was at 59.3% in November, the employment index was at 58.4%, and the new orders index was at 62.1%.

• At 10:00 AM, POSTPONED Construction Spending for November. The consensus is for a 0.3% increase in construction spending.

• All day, Light vehicle sales for December. The consensus is for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).

• Early, Reis Q4 2018 Office Survey of rents and vacancy rates.

Question #2 for 2019: How much will the economy grow in 2019?

by Calculated Risk on 1/02/2019 05:37:00 PM

Earlier I posted some questions for this year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

2) Economic growth: Economic growth was around 3% in 2018. Most analysts are expecting growth to slow in 2019 as the impact of the tax cuts wears off. How much will the economy grow in 2019?

First, since I'm frequently asked, I don't see a recession starting in 2019.

Here is a table of the annual change in real GDP since 2005. Economic activity has mostly been in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%., although demographics are improving (more prime age workers).

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). For 2018, I used a 2.6% annual growth rate in Q4 2018 (this gives 3.1% Q4 over Q4 or 2.9% real annual growth).

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.5% | 3.1% |

| 2006 | 2.9% | 2.6% |

| 2007 | 1.9% | 2.0% |

| 2008 | -0.1% | -2.8% |

| 2009 | -2.5% | 0.2% |

| 2010 | 2.6% | 2.6% |

| 2011 | 1.6% | 1.6% |

| 2012 | 2.2% | 1.5% |

| 2013 | 1.8% | 2.6% |

| 2014 | 2.5% | 2.7% |

| 2015 | 2.9% | 2.0% |

| 2016 | 1.6% | 1.9% |

| 2017 | 2.2% | 2.5% |

| 20181 | 2.9% | 3.1% |

| 1 2018 estimate based on 2.6% Q4 annualized real growth rate | ||

The FOMC is projecting real GDP growth of 2.3% to 2.5% in 2019 (Q4 over Q4).

Note: The Trump administration projected 3.5% annual real growth over Mr. Trump's term: "Boost growth to 3.5 percent per year on average, with the potential to reach a 4 percent growth rate." (now removed from Trump website). That hasn't happened.

As expected, there was a pickup in growth in 2018 due to a combination of factors.

The new tax policy boosted the economy a little in 2018, and there was some economic boost from oil sector investment in 2018 since oil prices increased in 2017 and early 2018. And demographics improved (it appears the prime working age population is growing again, compared to declining a few years ago, although the data is unclear).

Looking to 2019, fiscal policy will still be a positive for growth - although the boost will fade over the course of the year, and become a drag in 2020. And oil prices declined sharply in late 2018, and this will be a drag on economic growth in 2019. Auto sales are mostly moving sideways, and housing has been under pressure due to higher mortgage rates and the new tax plan.

These factors suggest growth will slow in 2019, probably to the low 2s -and maybe even a 1 handle.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

by Calculated Risk on 1/02/2019 12:51:00 PM

Earlier I posted some questions for this year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

3) Employment: Through November 2018, the economy has added 2,268,000 thousand jobs, or 206 thousand per month. This was the best year since 2015. Job creation was up from 182 thousand per month in 2017, and up from 195 thousand per month in 2016. Will job creation in 2019 be as strong as in 2018? Will job creation pick up further? Or will job creation slow in 2019?

For review, here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total and private employment gains, 2014 and 2015 were the best years since the '90s, and it appears job growth peaked for this cycle in 2014.

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,411 | 3,216 | 195 |

| 1998 | 3,049 | 2,736 | 313 |

| 1999 | 3,181 | 2,720 | 461 |

| 2000 | 1,938 | 1,674 | 264 |

| 2001 | -1,726 | -2,277 | 551 |

| 2002 | -511 | -744 | 233 |

| 2003 | 120 | 162 | -42 |

| 2004 | 2,041 | 1,894 | 147 |

| 2005 | 2,517 | 2,331 | 186 |

| 2006 | 2,095 | 1,886 | 209 |

| 2007 | 1,148 | 860 | 288 |

| 2008 | -3,569 | -3,749 | 180 |

| 2009 | -5,061 | -4,987 | -74 |

| 2010 | 1,053 | 1,269 | -216 |

| 2011 | 2,090 | 2,402 | -312 |

| 2012 | 2,151 | 2,218 | -67 |

| 2013 | 2,301 | 2,368 | -67 |

| 2014 | 3,005 | 2,876 | 129 |

| 2015 | 2,712 | 2,561 | 151 |

| 2016 | 2,344 | 2,138 | 206 |

| 2017 | 2,188 | 2,163 | 25 |

| 20181 | 2,443 | 2,395 | 48 |

| 12018 is Year-over-year job gains through November | |||

The good news is job market still has solid momentum heading into 2019.

The bad news - for job growth - is that a combination of a slowing economy, demographics and a labor market nearing full employment suggests fewer jobs will be added in 2019.

In 2018, employment was boosted by some fiscal stimulus, higher energy prices (helped in some areas), and supply was boosted by Puerto Ricans moving to the mainland following hurricane Maria.

In 2019, the fiscal stimulus will fade, lower energy prices will hurt some areas, and the supply boost from Puerto Rico is probably over.

Note: Too many people compare to the '80s and '90s, without thinking about changing demographics. The prime working age population (25 to 54 years old) was growing 2.2% per year in the '80s, and 1.3% per year in the '90s. The prime working age population has actually declined slightly this decade. Note: The prime working age population is now growing slowly again, and growth will pick up the 2020s.

The second table shows the change in construction and manufacturing payrolls starting in 2006.

| Construction Jobs (000s) | Manufacturing (000s) | |

|---|---|---|

| 2006 | 152 | -178 |

| 2007 | -195 | -269 |

| 2008 | -789 | -896 |

| 2009 | -1047 | -1375 |

| 2010 | -187 | 120 |

| 2011 | 144 | 207 |

| 2012 | 113 | 158 |

| 2013 | 208 | 123 |

| 2014 | 363 | 208 |

| 2015 | 337 | 69 |

| 2016 | 190 | -9 |

| 2017 | 250 | 207 |

| 20181 | 282 | 288 |

| 12018 is Year-over-year job gains through November | ||

Energy related construction and manufacturing hiring was solid in 2017 and 2018 as oil prices increased. However, in 2019, energy related employment will probably decline since oil price have fallen sharply recently. Also, for manufacturing, there will probably be little or no growth in the auto sector in 2019.

So my forecast is for gains of around 133,000 to 167,000 payroll jobs per month in 2019 (about 1.6 million to 2.0 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Question #4 for 2019: What will the unemployment rate be in December 2019?

by Calculated Risk on 1/02/2019 10:34:00 AM

Earlier I posted some questions for this year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

4) Unemployment Rate: The unemployment rate was at 3.7% in November, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.5% to 3.7% range in Q4 2019. What will the unemployment rate be in December 2019?

This first graph shows the unemployment rate since 1960.

The unemployment rate has declined steadily after peaking at 10% following the great recession.

The current unemployment rate (3.7%) is below the low (3.8%) at the end of the '90s expansion, and at the lowest rate since 1969.

As I've mentioned before, current demographics share some similarities to the '60s, and the unemployment rate bottomed at 3.4% in the '60s - and we might see the unemployment rate that low again this cycle. If we look further back in time, the unemployment rate was as low as 2.5% in the 1950s.

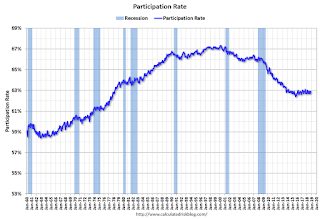

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate.

On participation: We can be pretty certain that the participation rate will decline over the next decade or longer based on demographic trends. However, over the last several years, the participation rate has been fairly steady as the strong labor market offset the long term trend.

The participation increased significantly starting in the late 60s as the Boomer generation entered the workforce and women participated at a much higher rate.

Since 2000, the participation rate has generally declined, mostly due to demographics.

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.7% | -0.2 | 5.6% |

| 2015 | 62.7% | 0.0 | 5.0% |

| 2016 | 62.7% | 0.0 | 4.7% |

| 2017 | 62.7% | 0.0 | 4.1% |

| 20181 | 62.9% | 0.2 | 3.7% |

| 12018 is for November 2018. | |||

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the mid 3's by December 2019 from the current 3.7%. My guess is based on the participation rate being mostly unchanged in 2019, and for decent job growth in 2019, but less than in 2018 or 2017.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

U.S. Light Vehicle Sales increase to 17.5 million annual rate in December

by Calculated Risk on 1/02/2019 08:43:00 AM

Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.47 million SAAR in December.

That is up 5% year-over-year from June 2017, and up 4% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for June (red, light vehicle sales of 17.47 million SAAR from AutoData).

This was above the consensus forecast for June.

Note that the increase in sales at the end of 2017 was due to buying following the hurricanes.

Sales will probably move sideways or decline in 2018 after setting new sales records in both 2015 and 2016.

Note: dashed line is current estimated sales rate.

CoreLogic: House Prices up 5.1% Year-over-year in November

by Calculated Risk on 1/02/2019 08:42:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports November Home Prices Increased by 5.1 Percent Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 5.1 percent year over year from November 2017. On a month-over-month basis, prices increased by 0.4 percent in November 2018. (October 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)CR Note: The CoreLogic YoY increase has been in the 5% to 7% range for the last few years. This is near the bottom of that range - and slowing. The year-over-year comparison has been positive for almost seven consecutive years since turning positive year-over-year in February 2012.

Looking ahead, the CoreLogic HPI Forecast indicates home prices will increase by 4.8 percent on a year-over-year basis from November 2018 to November 2019. On a month-over-month basis, home prices are expected to decrease by 0.8 percent from November to December 2018. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The rise in mortgage rates has dampened buyer demand and slowed home-price growth,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Interest rates for new 30-year fixed-rate loans averaged 4.9 percent during November, the highest monthly average since February 2011. These higher rates and home prices have reduced buyer affordability. Home sellers are responding by lowering their asking price, which is reflected in the slowing growth of the CoreLogic Home Price Index.”

emphasis added

Tuesday, January 01, 2019

Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

by Calculated Risk on 1/01/2019 05:33:00 PM

Earlier I posted some questions for this year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

5) Inflation: The inflation rate has increased and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

Although there are different measure for inflation (including some private measures) they mostly show inflation slightly above the Fed's 2% inflation target. Core PCE was below the target at 1.8% YoY in October.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.2%. Core PCE is for October and increased 1.8% year-over-year.

On a monthly basis, median CPI was at 4.1% annualized, trimmed-mean CPI was at 2.3% annualized, and core CPI was at 2.5% annualized.

The Fed is projecting core PCE inflation will increase to 2.0% to 2.1% by Q4 2019. There are risks for higher inflation with the labor market near full employment, however I do think there are structural reasons for low inflation (demographics, few employment agreements that lead to wage-price-spiral, etc).

So, although I think core PCE inflation (year-over-year) will increase in 2019 and be around 2% by Q4 2019 (up from 1.9%), I think too much inflation will still not be a serious concern in 2019.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

by Calculated Risk on 1/01/2019 11:15:00 AM

Earlier I posted some questions for this year: Ten Economic Questions for 2019. I'm adding some thoughts, and maybe some predictions for each question.

6) Monetary Policy: The Fed raised rates four times in 2018. Currently the Fed is forecasting two more rate hikes in 2019. Some analysts are forecasting three rate hikes. Will the Fed raise rates in 2019, and if so, by how much?

The Fed raised rates once in 2015, once again in 2016, three times in 2017, and four times in 2018. Currently the target range for the federal funds rate is 2-1/4 to 2‑1/2 percent.

There is a wide range of views on the FOMC. As of December, looking at the "dot plot", the FOMC participants see the following number of rate hikes in 2019:

| 25bp Rate Hikes in 2019 | FOMC Members |

|---|---|

| One Rate Cut | 0 |

| No Hikes | 2 |

| One | 4 |

| Two | 5 |

| Three | 6 |

| Four | 0 |

The main view of the FOMC is about two rate hikes in 2018.

Goldman Sachs economists wrote last week:

“We have made a further downgrade to our funds rate call. We now see a probability-weighted 1.2 hikes in all of 2019, from 1.6 hikes previously."The economy slowed in the 2nd half of 2018, and it seems likely the FOMC will "pause" in Q1 (and maybe for the first half of 2019). However, as the economy approaches full employment, the FOMC will be watching for any pickup in inflation, and that could lead to more rate hikes.

I think one or two rate hikes in 2019 seem likely, and my current guess is just one hike in the 2nd half of the year.

As an aside, many new Fed Chairs have faced a crisis early in their term. A few examples, Paul Volcker took office in August 1979, and inflation hit almost 12% (up from 7.9% the year before), and the economy went into recession as Volcker raised rates. Alan Greenspan took office in August 1987, and the stock market crashed almost 34% within a couple months of Greenspan taking office (including over 20% in one day!). And Ben Bernanke took office in February 2006, just as house prices peaked - and he was challenged by the housing bust, great recession and financial crisis.

Hopefully Jerome Powell will see smoother sailing.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?