by Calculated Risk on 8/31/2018 04:56:00 PM

Friday, August 31, 2018

Fannie Mae: Mortgage Serious Delinquency rate decreased in July, Lowest since Oct 2007

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 0.88% in July, down from 0.97% in June. The serious delinquency rate is down from 1.00% in July 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency for Fannie Mae since October 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.80% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 5.01% are seriously delinquent, For recent loans, originated in 2009 through 2018 (91% of portfolio), only 0.37% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q3 GDP Forecasts

by Calculated Risk on 8/31/2018 02:47:00 PM

From Goldman Sachs:

We boosted our tracking estimate of Q3 GDP growth by one tenth to +3.0% (qoq ar). [Aug 30 estimate].From Merrill Lynch:

emphasis added

Weak trade data sliced 0.2pp from 3Q GDP tracking, leaving our estimate at 3.3% qoq saar. [Aug 31 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.1 percent on August 30, down from 4.6 percent on August 24. [Aug 30 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q3 stands at 2.0%. [Aug 31 estimate]CR Note: The range has narrowed, but it is still early. It looks like GDP will be in the 3s in Q3.

Labor Slack and the Participation Rate (Spreadsheet included)

by Calculated Risk on 8/31/2018 12:16:00 PM

Back in June, Politico obtained some responses to questions from Senators by recently confirmed Richard Clarida:

Clarida, who has been nominated for Fed vice chairman, indicated that he believes there’s more slack in the labor market. He noted that the labor force participation rate for prime-age workers, particularly men, has not gone back to pre-recession levels. “I also think this group could represent an additional margin of slack in the sense that some of them could be enticed to reenter the labor force as the demand for labor continues to strengthen,” he said.This is an interesting question.

The decline in the overall Labor Force Participation Rate (LFPR) following the great recession can be divided into three parts: 1) economic weakness, 2) age related demographics, and 3) ongoing trends such as young people staying in school longer, more people working longer, more people taking time off mid-career to travel, and many other reasons.

What we'd like to know - as Clarida noted - is how much of the decline in the LFPR has been due to economic weakness. This would give an idea of how much slack is remaining in the labor market.

Removing the age related demographic changes is straightforward, but accounting for the ongoing trends is much more difficult (but important as the following graphs will show).

The first graph shows the overall participation rate (all civilians 16+ years old) and the employment population ratio.

Click on graph for larger image.

Click on graph for larger image.The Labor Force Participation Rate (Blue) was unchanged in July at 62.9%. This is the percentage of the 16+ year old population in the labor force.

The overall LFPR has declined significantly since the recession, and has been mostly moving sideways recently.

The second graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - just based on changes in age groups.

Important Note on Data: All BLS Population data is based on Census 2014 National Population Projections Tables. These projections probably overstate the current population, especially in the prime working age groups. This analysis did not include corrections to these projections (that Census will address soon).

To adjust by age groups, the participation rate for each age and sex group was held to the 2007 levels (all data NSA). The decline in the participation rate is due to age related demographics. As large groups move from high participation ages to lower participation ages, the overall participation rate declines.

To adjust by age groups, the participation rate for each age and sex group was held to the 2007 levels (all data NSA). The decline in the participation rate is due to age related demographics. As large groups move from high participation ages to lower participation ages, the overall participation rate declines.Some analysts just looked at age related demographics to estimate the remaining slack in the labor force participation rate. However, as I've noted many times, there are long term trends that are important too.

The third graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - based on both changes in age AND long term trends. Note: Trends are hard, but most of the trend projections were close (some were not).

The third graph shows the overall LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be - since 2007 - based on both changes in age AND long term trends. Note: Trends are hard, but most of the trend projections were close (some were not).Using this graph, a couple of years ago when others were arguing that "most of the decline in the labor force participation rate" was due to economic weakness, I argued that most (approximately two-thirds) was related to a combination of demographics and long term trends.

The difference between using just age related demographics, and a combination of Age and Trend, is especially important for prime age workers.

The fourth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.

The fourth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.Using just age adjusted demographics, it appears there is significant labor slack remaining and someone using this graph would expect the prime LFPR to increase to from the current 82.1% to around 83% over the next few years.

However, if we look at the long trends, we wouldn't expect the prime LFPR to increase significantly.

The fifth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.

The fifth graph shows the prime (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.My estimates of the trends could be off (most groups seem close, although estimates from some groups were way off - like 55 to 59 year old women).

But this analysis suggests the Prime LFPR is close to the expected level and might only increase a few tenths of a percent from here.

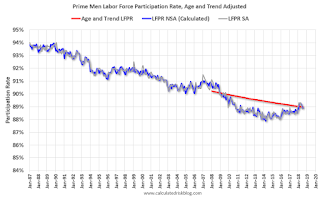

And finally, here is a look at Prime Age Men as Richard Clarida suggested.

The sixth graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.

The sixth graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be just based on changes in age.Using just age adjusted demographics, we'd expect the LFPR for prime age men to be increasing slightly. This is because of the older prime workers leaving the labor force and being replaced by younger workers. This suggests significant slack in the labor market for prime age men (as Clarida suggested).

However, if we account for long term trends, there might be little slack remaining for prime age men.

The seventh graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.

The seventh graph shows the prime Men Only (25 to 54 years old) LFPR (NSA and SA) since 1987, and what we'd expect the LFPR to be based on both changes in age AND long term trends.Looking at this graph (and my trend estimates could be off) there is little slack for prime age men.

Of course long term trends can change. For example, the LFPR for women was increasing for decades, and peaked in the year 2000 at just over 60%, but has declined since then. If we used the period from 1950 to 2000 to predict the LFPR for women today, we would expect something close to 70%. However the LFPR for women in July was only 57.3%.

With the caveat that trends may change and are difficult to forecast, I'd conclude: 1) that long term trends are important for forecasting the LFPR, and 2) there is little slack remaining in the labor market.

Here is my spreadsheet. Please feel free to put in your own estimate of the long term trends.

Hotels: Occupancy Rate Unchanged Year-over-Year

by Calculated Risk on 8/31/2018 08:46:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 25 August

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 19-25 August 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 20-26 August 2017, the industry recorded the following:

• Occupancy: flat at 69.5%

• Average daily rate (ADR): +1.8% to US$127.55

• Revenue per available room (RevPAR): +1.8% to US$88.69

...

STR analysts note that percentage changes in several markets were negatively affected by a comparison with the week of the Great American Eclipse in 2017. emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is close to the record year in 2017. Note: 2017 finished strong due to the impact of the hurricanes.

On a seasonal basis, the 4-week average of the occupancy rate will decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, August 30, 2018

Friday: Chicago PMI

by Calculated Risk on 8/30/2018 06:45:00 PM

From Merrill Lynch on August NFP:

We forecast that nonfarm payrolls increased by 205k in August ... We take signal from our payrolls tracker based on internal BAC data which increased by 245k in August, though we are fading our official forecast as nonfarm payrolls has tended to grow below trend in August in the first estimate by 40k since 2012.Friday:

...

We expect average hourly earnings to increase by 0.3% mom ... wages should grow by 2.8% yoy ... We look for the unemployment rate to tick down by 0.1pp to 3.8% ... owing to strong job gains and little change in the labor force participation rate at 62.9%.

• At 9:45 AM ET, Chicago Purchasing Managers Index for August. The consensus is for a reading of 63.5, down from 65.5 in July.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 95.3.

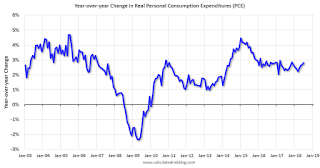

Year-over-year Change in Real Personal Consumption Expenditures (PCE)

by Calculated Risk on 8/30/2018 12:03:00 PM

Earlier I posted a graph showing real monthly personal consumption expenditures (PCE) based on the monthly BEA report.

Here is a graph showing the year-over-year change in real PCE since 2003.

In July, the YoY change was 2.8%, about the same level as for the last few years.

There was a significant decline in real PCE during the great recession, and real PCE was fairly weak during the first few years of the recovery - partially due to the ongoing weakness in housing following the housing bubble and bust.

More recently real PCE has been increasing at a fairly steady rate between 2.0% and 3.0% per year.

Personal Income increased 0.3% in July, Spending increased 0.4%

by Calculated Risk on 8/30/2018 08:50:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $54.8 billion (0.3 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $52.5 billion (0.3 percent) and personal consumption expenditures (PCE) increased $49.3 billion (0.4 percent).The July PCE price index increased 2.3 percent year-over-year and the July PCE price index, excluding food and energy, increased 2.0 percent year-over-year.

Real DPI increased 0.2 percent in July and Real PCE increased 0.2 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through July 2018 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was at expectations.

Weekly Initial Unemployment Claims increased to 213,000

by Calculated Risk on 8/30/2018 08:33:00 AM

The DOL reported:

In the week ending August 25, the advance figure for seasonally adjusted initial claims was 213,000, an increase of 3,000 from the previous week's unrevised level of 210,000. The 4-week moving average was 212,250, a decrease of 1,500 from the previous week's unrevised average of 213,750. This is the lowest level for this average since December 13, 1969 when it was 210,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,250.

This was close to the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, August 29, 2018

Thursday: Personal Income and Outlays, Unemployment Claims

by Calculated Risk on 8/29/2018 06:21:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 210 thousand the previous week.

• Also at 8:30 AM, Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

Chemical Activity Barometer "Softens" in August

by Calculated Risk on 8/29/2018 01:42:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Softens as Pace of Growth Slows

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), was flat in August remaining at 122.14 on a three-month moving average (3MMA) basis. This continued a general softening trend since the first quarter. The barometer is up 3.8 percent year-over-year (Y/Y/), a slower pace than of that earlier in the year and similar to that seen in the second half of 2017. The unadjusted CAB also was flat, and follows a 0.3 percent decline in July. August readings indicate gains in U.S. commercial and industrial activity well into the first quarter 2019, but at a slower pace as growth has turned over.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has softened recently, suggesting further gains in industrial production in 2018 and early 2019, but at a slower pace.

NAR: Pending Home Sales Index Decreased 0.7% in July

by Calculated Risk on 8/29/2018 10:03:00 AM

From the NAR: Pending Home Sales Trail Off 0.7 Percent in July

Pending home sales stepped back in July and have now fallen on an annual basis for seven straight months, according to the National Association of Realtors®.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.7 percent to 106.2 in July from 107.0 in June. With last month’s decline, contract signings are now down 2.3 percent year-over-year.

...

The PHSI in the Northeast climbed 1.0 percent to 94.6 in July, but is still 2.3 percent below a year ago. In the Midwest the index inched up 0.3 percent to 102.2 in July, but is still 1.5 percent lower than July 2017.

Pending home sales in the South declined 1.7 percent to an index of 122.1 in July, and are 0.9 percent below a year ago. The index in the West decreased 0.9 percent in July to 94.7, and is 5.8 percent below a year ago.

emphasis added

Q2 GDP Revised up to 4.2% Annual Rate

by Calculated Risk on 8/29/2018 08:36:00 AM

From the BEA: National Income and Product Accounts Gross Domestic Product: Second Quarter 2018 (Second Estimate)

Real gross domestic product (GDP) increased 4.2 percent in the second quarter of 2018, according to the “second” estimate released by the Bureau of Economic Analysis. The growth rate was 0.1 percentage point more than the “advance” estimate released in July. In the first quarter, real GDP increased 2.2 percent.PCE growth was revised down from 4.0% to 3.8%. Residential investment was revised down from -1.1% to -1.6%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 4.1 percent. With this second estimate for the second quarter, the general picture of economic growth remains the same; the revision primarily reflected upward revisions to nonresidential fixed investment and private inventory investment that were partly offset by a downward revision to personal consumption expenditures (PCE). Imports which are a subtraction in the calculation of GDP, were revised down.

emphasis added

Here is a Comparison of Second and Advance Estimates.

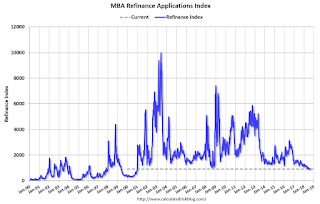

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 8/29/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 24, 2018.

... The Refinance Index decreased three percent from the previous week. The seasonally adjusted Purchase Index decreased one percent from one week earlier. The unadjusted Purchase Index decreased three percent compared with the previous week and was three percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.78 percent from 4.81 percent, its lowest rate since the week ending July 20, 2018, with points increasing to 0.46 from 0.42 (including the origination fee) for 80 percent loanto-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, August 28, 2018

Wednesday: GDP, Pending Home Sales

by Calculated Risk on 8/28/2018 07:51:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 2nd quarter 2018 (Second estimate). The consensus is that real GDP increased 4.0% annualized in Q2, down from the advance estimate of 4.1%.

• At 10:00 AM, Pending Home Sales Index for July. The consensus is for no change in the index.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in July

by Calculated Risk on 8/28/2018 04:37:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in July was 0.78%, down from 0.82% in June. Freddie's rate is down from 0.85% in July 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since March 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate late last year was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.75% range - but this is close to a bottom.

Note: Fannie Mae will report for July soon.

Zillow Case-Shiller Forecast: Slower House Price Gains in July

by Calculated Risk on 8/28/2018 04:28:00 PM

The Case-Shiller house price indexes for June were released today. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: June Case-Shiller Results and July Forecast

It’s hard not to notice the winds beginning to shift in the housing market. But those changes have yet to reach the point where they’ve fully transitioned from home buyer headwinds into tailwinds, and likely won’t until at least the end of the decade.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be smaller in July than in June.

Still, the signs of change are here: The U.S. National Case-Shiller Home Price Index climbed 6.2 percent in June from a year earlier, slightly slower than the 6.4 percent annual growth recorded in May. June prices rose 0.3 percent from May – slightly below expectations.

...

But the slowdown, and the changes it brings, will be gradual. Inventory, when it begins to rise, will be coming up from incredibly low levels. Home value growth remains well above historic norms, even as it slows in some markets – and that rapid growth still makes saving an adequate down payment a challenge for many buyers. And while sellers are seemingly more open to cutting their initial asking price than in recent months, that trend is more prominent at the upper end of the market where there is more selection.

...

Zillow’s expects Case-Shiller data for July, to be released September 25, to show national home-price appreciation of 6.1 percent year-over-year.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/28/2018 01:02:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through June 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

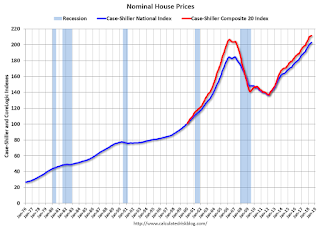

Real House Prices and Price-to-Rent Ratio in June

by Calculated Risk on 8/28/2018 11:01:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.2% year-over-year in June

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 9.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 9.6% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 15.7% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 6%. In June, the index was up 6.2% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $285,000 today adjusted for inflation (42%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to December 2004 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

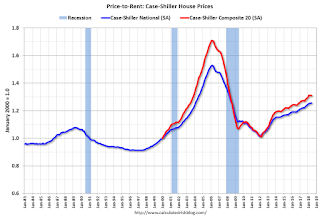

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Richmond Fed: "Fifth District Manufacturing Firms Reported Strong Growth in August"

by Calculated Risk on 8/28/2018 10:05:00 AM

From the Richmond Fed: Fifth District Manufacturing Firms Reported Strong Growth in August

Fifth District manufacturing activity expanded in August, according to results of the most recent survey from the Federal Reserve Bank of Richmond. The composite index rose from 20 in July to 24 in August, as all three components (shipments, new orders, and employment) increased. Respondents remained optimistic in August, expecting growth to continue in the coming months.This was the last of the regional Fed surveys for August.

Employment and wages continued to rise, yet manufacturing firms continued to struggle to find workers with the skills they needed, as this indicator dropped to −17, its lowest value on record.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be solid in August, but below 60 (to be released on Tuesday, September 4th).

Case-Shiller: National House Price Index increased 6.2% year-over-year in June

by Calculated Risk on 8/28/2018 09:11:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Las Vegas Leads Price Gains in June According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in June, down from 6.4% in the previous month. The 10-City Composite annual increase came in at 6.0%, down from 6.2% in the previous month. The 20-City Composite posted a 6.3% year-over-year gain, down from 6.5% in the previous month.

Las Vegas, Seattle and San Francisco continued to report the highest year-over-year gains among the 20 cities. In June, Las Vegas led the way with a 13.0% year-over-year price increase, followed by Seattle with a 12.8% increase and San Francisco with a 10.7% increase. Six of the 20 cities reported greater price increases in the year ending June 2018 versus the year ending May 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.8% in June. The 10-City and 20-City Composites reported increases of 0.4% and 0.5%, respectively. After seasonal adjustment, the National Index recorded a 0.3% month-over-month increase in June. The 10-City and 20-City Composites both posted 0.1% month-over-month increases. Nineteen of 20 cities reported increases in June before seasonal adjustment, while 17 of 20 cities reported increases after seasonal adjustment.

“Home prices continue to rise across the U.S.” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “However, even as home prices keep climbing, we are seeing signs that growth is easing in the housing market. Sales of both new and existing homes are roughly flat over the last six months amidst news stories of an increase in the number of homes for sale in some markets. Rising mortgage rates – 30 year fixed rate mortgages rose from 4% to 4.5% since January – and the rise in home prices are affecting housing affordability.

“The west still leads the rise in home prices with Las Vegas displacing Seattle as the market with the fastest price increase. Population and employment growth often drive homes prices. Las Vegas is among the fastest growing U.S. cities based on both employment and population, with its unemployment rate dropping below the national average in the last year. The northeast and mid-west are seeing smaller home price increases. Washington, Chicago and New York City showed the three slowest annual price gains among the 20 cities covered.”

emphasis added

Click on graph for larger image.

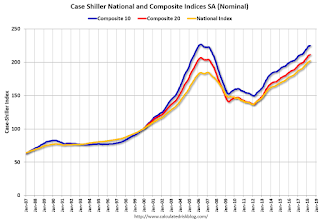

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 0.9% from the bubble peak, and up 0.1% in June (SA).

The Composite 20 index is 2.3% above the bubble peak, and up 0.1% (SA) in June.

The National index is 9.8% above the bubble peak (SA), and up 0.3% (SA) in June. The National index is up 48.5% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.0% compared to June 2017. The Composite 20 SA is up 6.3% year-over-year.

The National index SA is up 6.2% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, August 27, 2018

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 8/27/2018 07:36:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher (or Lower) Depending on Lender

Mortgage rates moved higher for some lenders and lower for others, depending on how that particular lender adjusted their rate sheets on Friday afternoon. … moves are relatively quite small in the bigger picture. On this scale, we're only talking about the upfront costs associated with any given rate as opposed to the actual payment ("note") rate itself. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for June. The consensus is for a 6.5% year-over-year increase in the Comp 20 index for June.

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

Vehicle Sales Forecast: Sales Around 16.8 Million SAAR in August

by Calculated Risk on 8/27/2018 04:24:00 PM

The automakers will report August vehicle sales on Tuesday, September 4th.

Note: There were 27 selling days in August 2018, unchanged from 27 in August 2017.

From J.D. Power: Retail Sales Poised for Largest Gain of 2018; Spending Expected to Fall for Second Straight Month

New-vehicle retail sales in August are expected to rise from a year ago according to a forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,280,400 units, a 1.3% increase compared with August 2017. [16.8 million SAAR] (Note: August 2018 has the same number of selling days as last year.)It appears August will be another solid month for vehicle sales. Through July, sales were down slightly compared to the same period in 2017.

“With no large disruptions from storms this year, new vehicle sales in August are expected to see the largest gain of the year,” said Thomas King, Senior Vice President of the Data and Analytics Division at J.D. Power. “Last year, Hurricanes Harvey and Irma made landfall during the end of the month, affecting Labor Day sales events. Labor Day remains one of the most heavily shopped periods in the year, accounting for nearly 3% of annual sales, as consumers take advantage of discounts that extend through the first weekend of September.”

emphasis added

Last year, August was the weakest sales month of the year at 16.45 million SAAR, due to the impact of the hurricanes. Following the hurricanes, sales were strong through the end of the year in 2017 as hurricane victims replaced cars damaged during the storms. So, even though sales will be up YoY in August, sales will probably down YoY for the last four months of the year.

Housing Inventory Tracking

by Calculated Risk on 8/27/2018 01:34:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was unchanged year-over-year (YoY) in July, this followed 37 consecutive months with a YoY decline.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento and also Phoenix (through July) and total existing home inventory as reported by the NAR (through July 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 20% year-over-year in July (inventory was still very low), and has increased YoY for ten consecutive months.

Also note that inventory was up slightly YoY in Las Vegas in July (red), the first YoY increase in Las Vegas since May 2015.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally.

Dallas Fed: "Robust Expansion in Texas Manufacturing Continues"

by Calculated Risk on 8/27/2018 11:19:00 AM

From the Dallas Fed: Robust Expansion in Texas Manufacturing Continues

exas factory activity maintained its strong momentum in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, held steady at 29.3.The regional surveys for August have mostly indicated somewhat slower growth as compared to July. The last of the regional surveys (Richmond Fed) for August will be released tomorrow.

Other indexes of manufacturing activity also indicated continued solid expansion in August. The new orders index changed little at 23.9, while the growth rate of orders index moved up three points to 19.9. The capacity utilization index was unchanged at 25.2, and the shipments index slipped five points to 26.0.

Perceptions of broader business conditions remained highly positive this month, although uncertainty remained elevated. The general business activity index edged down to 30.9, while the company outlook index rose seven points to 27.3, with more than 30 percent of manufacturers saying their outlook had improved from July. The index measuring uncertainty regarding companies’ outlooks held fairly steady in August at 16.2, well above its readings in the first half of the year.

Labor market measures continued to suggest robust hiring and longer work hours. The employment index remained at a 13-year high of 28.9. Thirty-four percent of firms noted net hiring, compared with 5 percent noting net layoffs. The hours worked index edged down to 19.0.

emphasis added

Chicago Fed "Index points to a moderation in economic growth in July"

by Calculated Risk on 8/27/2018 08:37:00 AM

From the Chicago Fed: Index points to a moderation in economic growth in July

Led by slower growth in production-related indicators, the Chicago Fed National Activity Index (CFNAI) declined to +0.13 in July from +0.48 in June. Three of the four broad categories of indicators that make up the index decreased from June, but three of the four categories made positive contributions to the index in July. The index’s three-month moving average, CFNAI-MA3, moved down to +0.05 in July from +0.20 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in July (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, August 26, 2018

Sunday Night Futures

by Calculated Risk on 8/26/2018 07:40:00 PM

Weekend:

• Schedule for Week of Aug 26, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5 and DOW futures are up 62 (fair value).

Oil prices were up over the last week with WTI futures at $68.66 per barrel and Brent at $75.65 per barrel. A year ago, WTI was at $48, and Brent was at $52 - so oil prices are up about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.36 per gallon - so gasoline prices are up 47 cents per gallon year-over-year.

New Home Prices

by Calculated Risk on 8/26/2018 08:11:00 AM

As part of the new home sales report released last week, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in July 2018 was $328,700. The average sales price was $394,300."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in July 2018 was $394,300, and the median price was $328,700. Both are well above the bubble high (this is due to both a change in mix and rising prices).

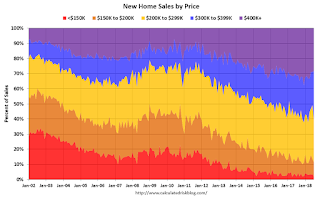

The second graph shows the percent of new homes sold by price.

The $400K+ bracket has increased significantly since the housing recovery started. Still, a majority of new homes (about 60%) in the U.S., are in the $200K to $400K range.

Saturday, August 25, 2018

Schedule for Week of August 26, 2018

by Calculated Risk on 8/25/2018 08:11:00 AM

The key report this week is the second estimate of Q2 GDP.

Other key indicators include Personal Income and Outlays for July and Case-Shiller house prices for June.

For manufacturing, the Dallas and Richmond Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August.

9:00 AM ET: S&P/Case-Shiller House Price Index for June.

9:00 AM ET: S&P/Case-Shiller House Price Index for June.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.5% year-over-year increase in the Comp 20 index for June.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Second estimate). The consensus is that real GDP increased 4.0% annualized in Q2, down from the advance estimate of 4.1%.

10:00 AM: Pending Home Sales Index for July. The consensus is for no change in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 210 thousand the previous week.

8:30 AM: Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for a reading of 63.5, down from 65.5 in July.

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 95.3.

Friday, August 24, 2018

Oil Rigs: "Horizontal oil rigs roll off modestly"

by Calculated Risk on 8/24/2018 03:07:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on August 24, 2018:

• Oil rigs let off again this week

• Total oil rigs fell, -9 to 860

• Horizontal oil rigs declined, -2 to 766

...

• Visual inspection suggests that rigs continue to roll off gently from here for the next several weeks.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q3 GDP Forecasts

by Calculated Risk on 8/24/2018 11:18:00 AM

From Goldman Sachs:

We lowered our Q3 GDP tracking estimate by one tenth to +3.1% (qoq ar). We also lowered our past-quarter tracking estimate for Q2 by one tenth to 3.9%" [Aug 22 estimate].From Merrill Lynch:

emphasis added

The data added 0.2pp to 3Q GDP tracking, bringing it up to 3.5%. 2Q tracking remains at 4.1%. [Aug 24 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.6 percent on August 24, up from 4.3 percent on August 16. [Aug 24 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q3 stands at 2.0%. [Aug 24 estimate]CR Note: Still a wide range, and it is early, but GDP in the 3s seems likely.

Fed Chair Powell: "Risk management suggests looking beyond inflation for signs of excesses"

by Calculated Risk on 8/24/2018 10:25:00 AM

Speech by Fed Chair Jerome Powell: Monetary Policy in a Changing Economy. A few excerpts:

Experience has revealed two realities about the relation between inflation and unemployment, and these bear directly on the two questions I started with. First, the stars are sometimes far from where we perceive them to be. In particular, we now know that the level of the unemployment rate relative to our real-time estimate of u* will sometimes be a misleading indicator of the state of the economy or of future inflation. Second, the reverse also seems to be true: Inflation may no longer be the first or best indicator of a tight labor market and rising pressures on resource utilization. Part of the reason inflation sends a weaker signal is undoubtedly the achievement of anchored inflation expectations and the related flattening of the Phillips curve. Whatever the cause, in the run-up to the past two recessions, destabilizing excesses appeared mainly in financial markets rather than in inflation. Thus, risk management suggests looking beyond inflation for signs of excesses.

...

Let me conclude by returning to the matter of navigating between the two risks I identified--moving too fast and needlessly shortening the expansion, versus moving too slowly and risking a destabilizing overheating. Readers of the minutes of FOMC meetings and other communications will know that our discussions focus keenly on the relative salience of these risks. The diversity of views on the FOMC is one of the great virtues of our system. Despite differing views on these questions and others, we have a long institutional tradition of finding common ground in coalescing around a policy stance.

I see the current path of gradually raising interest rates as the FOMC's approach to taking seriously both of these risks. While the unemployment rate is below the Committee's estimate of the longer-run natural rate, estimates of this rate are quite uncertain. The same is true of estimates of the neutral interest rate. We therefore refer to many indicators when judging the degree of slack in the economy or the degree of accommodation in the current policy stance. We are also aware that, over time, inflation has become much less responsive to changes in resource utilization.

While inflation has recently moved up near 2 percent, we have seen no clear sign of an acceleration above 2 percent, and there does not seem to be an elevated risk of overheating. This is good news, and we believe that this good news results in part from the ongoing normalization process, which has moved the stance of policy gradually closer to the FOMC's rough assessment of neutral as the expansion has continued. As the most recent FOMC statement indicates, if the strong growth in income and jobs continues, further gradual increases in the target range for the federal funds rate will likely be appropriate.

The economy is strong. Inflation is near our 2 percent objective, and most people who want a job are finding one. My colleagues and I are carefully monitoring incoming data, and we are setting policy to do what monetary policy can do to support continued growth, a strong labor market, and inflation near 2 percent.

emphasis added

2018 Jackson Hole Economic Policy Symposium Agenda

by Calculated Risk on 8/24/2018 08:27:00 AM

Note: the presented papers are usually posted to the Kansas City Fed's site fairly quickly. On twitter.

2018 Economic Policy Symposium: Changing Market Structures and Implications for Monetary Policy. Times listed on program are Mountain Standard Time.

From Merrill Lynch on Jackson Hole Symposium:

We expect the papers presented to be primarily academic in nature and of only marginal interest to the markets: this would be consistent with the recent shift away from using Jackson Hole as a forum for policy signaling.

However, two stories will swirl around the meetings. The first is the issue of Fed independence. ... We do not expect Chair Powell to discuss Fed independence in his speech at 10am today, and there will be no Q&A. …

The other issue of interest will be the Fed's tightening plans. In terms of policy rates, in our view the Fed has no reason to deviate from its pace of quarterly rate hikes unless either the macro data slow substantially or core inflation moves substantially higher. The more proximate concern is monetary policy implementation. Specifically, the Fed funds rate continues to move towards the upper bound of the Fed's target range. Mark Cabana has argued that this is because of bank demand for excess reserves in order to satisfy post-crisis regulatory requirements. The risk is that the Fed will have to stop unwinding its balance sheet earlier than the markets are expecting in order to keep the funds rate within the target range. The July / August meeting minutes mention that the Fed will address its operating framework in the fall.

emphasis added

Thursday, August 23, 2018

Friday: Fed Chair Powell Speech, Durable Goods

by Calculated Risk on 8/23/2018 07:22:00 PM

The schedule for the 2018 Jackson Hole Economic Policy Symposium will be released here.

Friday:

• At 8:30 AM ET, Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.2% decrease in durable goods orders.

• At 10:00 AM, Speech by Fed Chair Jerome Powell, "Monetary Policy in a Changing Economy", At the Federal Reserve Bank of Kansas City Economic Policy Symposium, Jackson Hole, Wyo.

Black Knight: National Mortgage Delinquency Rate Decreased in July, Lowest Since March 2006

by Calculated Risk on 8/23/2018 02:59:00 PM

From Black Knight: Black Knight’s First Look: Increased Mortgage Cures in July Push Delinquencies to Lowest Level Since March 2006; Foreclosure Starts Rise 11 Percent

• Continued hurricane-related cure activity pushed delinquencies to their lowest level in more than 12 yearsAccording to Black Knight's First Look report for July, the percent of loans delinquent decreased 3.4% in July compared to June, and decreased 7.5% year-over-year.

• Foreclosure starts rose 11 percent over June’s 17-year low to 48,300, for the highest total in three months

• Though starts rose nationwide, foreclosure referrals in hurricane-affected areas of Texas increased by a higher-than-average 19 percent

• Fewer completions and an increase in starts caused foreclosure inventory to rise slightly in July, for just the second such increase in the past three years

• Improving delinquencies outweighed the slight increase in foreclosures, bringing the total non-current population (all loans 30 or more days delinquent or in active foreclosure) to a more than 12-year low

The percent of loans in the foreclosure process increased 0.7% in July and were down 27.3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.61% in July, down from 3.74% in June.

The percent of loans in the foreclosure process increased slightly in July to 0.57% (from 0.56% in June).

The number of delinquent properties, but not in foreclosure, is down 125,000 properties year-over-year, and the number of properties in the foreclosure process is down 105,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2018 | June 2018 | July 2017 | July 2016 | |

| Delinquent | 3.61% | 3.74% | 3.90% | 4.51% |

| In Foreclosure | 0.57% | 0.56% | 0.78% | 1.09% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,861,000 | 1,925,000 | 1,986,000 | 2,286,000 |

| Number of properties in foreclosure pre-sale inventory: | 293,000 | 291,000 | 398,000 | 550,000 |

| Total Properties | 2,154,000 | 2,216,000 | 2,384,000 | 2,836,000 |

A few Comments on July New Home Sales

by Calculated Risk on 8/23/2018 11:38:00 AM

New home sales for July were reported at 627,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months, combined, were revised down.

Sales in July were up 12.8% year-over-year compared to July 2017. This was strong YoY growth, however this was an easy comparison since new home sales were soft in mid-year 2017.

Earlier: New Home Sales decrease to 627,000 Annual Rate in July.

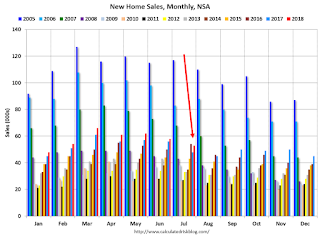

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Note that new home sales have been up year-over-year every month this year (so far).

Sales are up 7.2% through July compared to the same period in 2017. Decent growth so far, and the next month will also be an easy comparison to 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors. And new home sales had a strong last few months in 2017, so the comparisons will be more difficult.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next few years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing Activity "Expanded at a Slightly Slower Pace" in August

by Calculated Risk on 8/23/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Slightly Slower Pace

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a slightly slower pace, while expectations remained solid.The regional surveys for August have mostly indicated somewhat slower growth as compared to July.

“Our composite index came down a bit again in August,” said Wilkerson. “But the pace of growth in regional factories is still at the solid levels that prevailed in late 2017 and early 2018.”

...

The month-over-month composite index was 14 in August, down from readings of 23 in July and 28 in June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Growth in factory activity remained relatively stable at nondurable goods plants, while durable goods activity slowed slightly, particularly for machinery, computers and electronics. Most month-over-month indexes moderated in August, but were still generally solid. The production, new orders, employment, and new orders for exports indexes all decreased modestly. In contrast, the shipments index rose from 12 to 18 after falling considerably last month. The finished goods inventory index dipped slightly, while the raw material inventory index was unchanged.

emphasis added

New Home Sales decrease to 627,000 Annual Rate in July

by Calculated Risk on 8/23/2018 10:10:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 627 thousand.

The previous three months were revised down, combined (June was revised up, but April and May were revised down).

"Sales of new single-family houses in July 2018 were at a seasonally adjusted annual rate of 627,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.7 percent below the revised June rate of 638,000, but is 12.8 percent above the July 2017 estimate of 556,000. "

emphasis added

Click on graph for larger image.

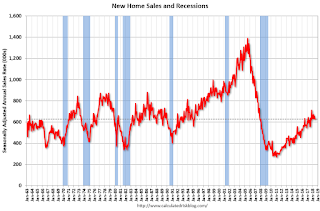

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

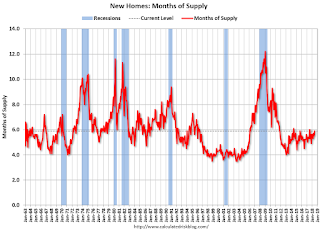

The second graph shows New Home Months of Supply.

The months of supply increased in July to 5.9 months from 5.7 months in June.

The months of supply increased in July to 5.9 months from 5.7 months in June. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of July was 309,000. This represents a supply of 5.9 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is also somewhat low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2018 (red column), 53 thousand new homes were sold (NSA). Last year, 48 thousand homes were sold in July.

The all time high for July was 117 thousand in 2005, and the all time low for July was 26 thousand in 2010.

This was below expectations of 648,000 sales SAAR, and the previous months were revised down, combined. I'll have more later today.

Weekly Initial Unemployment Claims decreased to 210,000

by Calculated Risk on 8/23/2018 08:32:00 AM

The DOL reported:

In the week ending August 18, the advance figure for seasonally adjusted initial claims was 210,000, a decrease of 2,000 from the previous week's unrevised level of 212,000. The 4-week moving average was 213,750, a decrease of 1,750 from the previous week's unrevised average of 215,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,750.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, August 22, 2018

Thursday: New Home Sales, Unemployment Claims

by Calculated Risk on 8/22/2018 08:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 212 thousand the previous week.

• At 9:00 AM, FHFA House Price Index for June 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for July from the Census Bureau. The consensus is for 648 thousand SAAR, up from 631 thousand in June.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

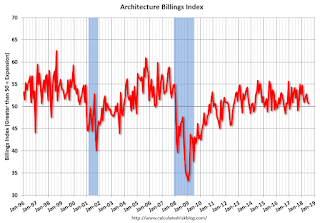

AIA: "July architecture firm billings remain positive despite growth slowing"

by Calculated Risk on 8/22/2018 03:21:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: July architecture firm billings remain positive despite growth slowing

Architecture firm billings growth slowed again in July but remained positive overall for the tenth consecutive month, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for July was 50.7 compared to 51.3 in June. Any score over 50 represents billings growth. While July’s ABI shows that aggregate demand for architecture firm services continues to increase, much of that growth came from one region—the South.

“Billings at architecture firms in the South remained robust in July, offsetting declining billings in other regions of the country,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Despite the dip in the overall ABI number in July, firms are still reporting a healthy increase in new projects.”

...

• Regional averages: West (49.6), Midwest (49.3), South (55.2), Northeast (48.0)

• Sector index breakdown: multi-family residential (54.6), institutional (51.1), commercial/industrial (50.1), mixed practice (48.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.7 in July, down from 51.3 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018 and into 2019.

FOMC Minutes: "Trade disputes a potentially consequential downside risk", Yield Curve Discussion

by Calculated Risk on 8/22/2018 02:06:00 PM

Still on pace for 4 rate hikes in 2018. Some excerpts:

From the Fed: Minutes of the Federal Open Market Committee, July 31-August 1, 2018:

Some participants noted that stronger underlying momentum in the economy was an upside risk; most expressed the view that an escalation in international trade disputes was a potentially consequential downside risk for real activity. Some participants suggested that, in the event of a major escalation in trade disputes, the complex nature of trade issues, including the entire range of their effects on output and inflation, presented a challenge in determining the appropriate monetary policy response. emphasis addedAnd on the yield curve:

Participants also discussed the possible implications of a flattening in the term structure of market interest rates. Several participants cited statistical evidence for the United States that inversions of the yield curve have often preceded recessions. They suggested that policymakers should pay close attention to the slope of the yield curve in assessing the economic and policy outlook. Other participants emphasized that inferring economic causality from statistical correlations was not appropriate. A number of global factors were seen as contributing to downward pressure on term premiums, including central bank asset purchase programs and the strong worldwide demand for safe assets. In such an environment, an inversion of the yield curve might not have the significance that the historical record would suggest; the signal to be taken from the yield curve needed to be considered in the context of other economic and financial indicators.