by Calculated Risk on 12/31/2016 08:11:00 AM

Saturday, December 31, 2016

Schedule for Week of Jan 1, 2017

Happy New Year!

The key report this week is the December employment report on Friday.

Other key indicators include the December ISM manufacturing and non-manufacturing indexes, the November trade deficit, and December auto sales.

Also the Q4 quarterly Reis surveys for office, apartment and malls will be released this week.

All US markets will be closed in observance of the New Year's Day Holiday.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 53.8, up from 53.2 in November.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 53.8, up from 53.2 in November.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 53.2% in November. The employment index was at 52.3%, and the new orders index was at 53.0%.

10:00 AM: Construction Spending for November. The consensus is for a 0.6% increase in construction spending.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q4 2016 Office Survey of rents and vacancy rates.

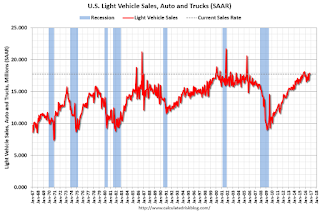

All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in December, from 17.9 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in December, from 17.9 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

2:00 PM: The Fed will release the FOMC minutes for the December meeting.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 172,000 payroll jobs added in December, down from 216,000 added in November.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, down from 265 thousand the previous week.

Early: Reis Q4 2016 Apartment Survey of rents and vacancy rates.

10:00 AM: the ISM non-Manufacturing Index for December. The consensus is for index to decrease to 56.8 from 57.2 in November.

8:30 AM: Employment Report for December. The consensus is for an increase of 175,000 non-farm payroll jobs added in December, down from the 178,000 non-farm payroll jobs added in November.

The consensus is for the unemployment rate to increase to 4.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November, the year-over-year change was 2.25 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through October. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $44.5 billion in November from $42.6 billion in October.

Early: Reis Q4 2016 Mall Survey of rents and vacancy rates.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is a 2.5% decrease in orders.

Friday, December 30, 2016

"Mortgage Rates Slightly Lower to End 2016"

by Calculated Risk on 12/30/2016 04:18:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Lower to End 2016

Mortgage rates moved lower for a 3rd consecutive day to end 2016, bringing them to the lowest levels in more than 3 weeks for many lenders. December 8th was the last time rates were lower. As of yesterday, 4.25% regained the status of the "most prevalent" conventional 30yr fixed quote on top tier scenarios. Quite a few lenders remain at 4.375% and a scant few are down to 4.125%.Here is a table from Mortgage News Daily:

While this is all good news in the context of the past few weeks, 2016 nonetheless ends with one of the worst 2-month losing streaks in the history of mortgage rates. Specifically, the 5 weeks following the election were the worst 5 weeks on record, going back to the Spring of 1987.

emphasis added

A few Graphs for 2016

by Calculated Risk on 12/30/2016 11:41:00 AM

Here are a few graphs for 2016.

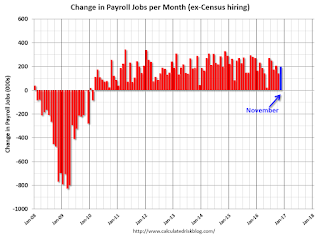

The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 178 thousand in November (private payrolls increased 156 thousand).

Job growth has averaged 180,000 per month this year.

The peak year for job growth in this cycle was 2014 with just over 3 million jobs added. Job growth was at 2.74 million in 2015, and job growth was probably around 2.2 million in 2016.

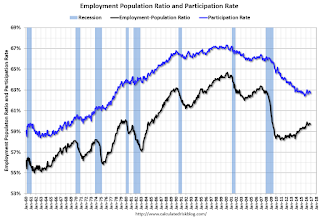

The second graph shows the employment population ratio and the participation rate.

A key story in 2016 was that the labor force participation rate (blue) increased slightly - from 62.6% in December 2015 to 62.7%.

Correction: Earlier I posted the participation rates for the 25 to 54 year old age group, not 16+.

Based on demographics, the participation rate will start declining again as more baby boomers retire - and continue declining for the next decade.

The increase in the participation rate this year suggests the labor market was strong enough to attract enough workers to overcome the demographic trend.

The unemployment rate decreased in November to 4.6%.

The unemployment rate was down from 5.0% in December 2015. The unemployment rate would have fallen further if not for the increase in the labor force participation rate.

Note the low for the unemployment rate in the previous cycles was 4.4% in 2006, and 3.8% in 2000. It wouldn't take much to be below the 2006 low.

And now to housing ...

Both existing home and home sales have been increasing, and the gap is closing.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

This graph shows the year-over-year change in inventory and the months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Inventory decreased 9.3% year-over-year in November compared to November 2015.

Months of supply was at 4.0 months in November.

The low level of existing home inventory continues to be a key story.

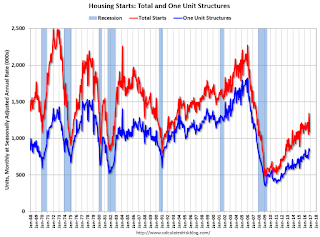

This graph shows the huge collapse in housing starts following the housing bubble, and that housing starts then mostly moved sideways for two years.

Housing is now recovering (but starts are still historically low) - so there is room to run.

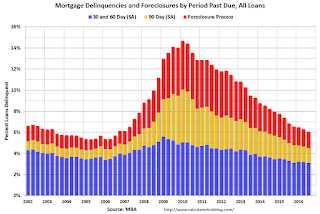

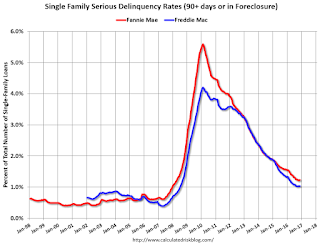

Another piece of good news is mortgage delinquencies are almost back to normal.

Note that the total percent delinquencies and foreclosures is below the 2002 level.

The percent of loans 30 and 60 days delinquent ticked down in Q3, and is below the normal historical level.

The 90 day bucket declined further in Q3, but remains a little elevated.

The percent of loans in the foreclosure process continues to decline, and is still above the historical average.

The 90 day bucket and foreclosure inventory are still elevated, but should be close to normal in 2017. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

Some more good news for housing is that REO (Real Estate Owned) inventories at Fannie and Freddie are almost back to normal.

REO inventory decreased in Q3 for both Fannie and Freddie, and combined inventory is down 31% year-over-year.

Delinquencies are falling, but there are still a number of properties in the foreclosure process with long time lines in judicial foreclosure states - but this is getting close to normal levels of REOs.

Remember this is just a portion of the total REO inventory. Private label securities (the worst of the worst lending) and banks and thrifts also hold a number of REOs.

Industrial production is 18.9% above the recession low, and is close to the pre-recession peak.

The recovery in consumer spending has been ongoing, and seem to have picked up in recent years.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 2.7% annual rate in Q4 2016. (using the mid-month method, PCE was increasing 3.2%). This suggests decent PCE growth in Q4.

So PCE had a solid year in 2016.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

Best to all

Chicago PMI decreases in December

by Calculated Risk on 12/30/2016 09:58:00 AM

Chicago PMI: December Chicago Business Barometer Down 3.0 Points to 54.6

The MNI Chicago Business Barometer fell 3.0 points to 54.6 in December from 57.6 in November, led by declines in both New Orders and Order Backlogs.This was below the consensus forecast of 57.0.

After a disappointing start to the fourth quarter, the latest results suggest economic conditions have improved somewhat, with the Barometer averaging 54.3 in Q4, the highest in two years.

The December decline was led by a slowdown in New Orders, which fell 6.7 points to 56.5, giving up most of the November gain that had left it running at the fastest pace since June.

...

“The Chicago Business Barometer ended 2016 in a much healthier position than a year ago when it slipped into contraction. This is largely owed to stronger outturns in the second half of the year and is testament to the resilience of the US economy.

“Most respondents to our survey remain upbeat about the fate of their business as we head into 2017, buoyed by fresh hope of better things to come under the new administration. Hopefully, 2017 can build on the momentum generated in the latter stages of 2016.” said Jamie Satchithanantham, economist at MNI Indicators.

emphasis added

Thursday, December 29, 2016

Fannie Mae: Mortgage Serious Delinquency rate increased in November

by Calculated Risk on 12/29/2016 04:49:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate increased to 1.23% in November, up from 1.21% in October. The serious delinquency rate is down from 1.58% in November 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.35 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% for about 8 more months.

Note: Freddie Mac reported earlier.

Freddie Mac: Mortgage Serious Delinquency rate unchanged in November

by Calculated Risk on 12/29/2016 11:12:00 AM

Freddie Mac reported that the Single-Family serious delinquency rate in November was at 1.03%, unchanged from 1.03% in October. Freddie's rate is down from 1.36% in November 2015.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.33 percentage points over the last year, and at that rate of improvement, the serious delinquency rate could be below 1% in December or January.

Note: Fannie Mae will probably report tomorrow.

Weekly Initial Unemployment Claims decrease to 265,000

by Calculated Risk on 12/29/2016 08:34:00 AM

The DOL reported:

In the week ending December 24, the advance figure for seasonally adjusted initial claims was 265,000, a decrease of 10,000 from the previous week's unrevised level of 275,000. The 4-week moving average was 263,000, a decrease of 750 from the previous week's unrevised average of 263,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 95 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 263,000.

This was above the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, December 28, 2016

Duy: Is The Fed About To Experience A Repeat of 2016?

by Calculated Risk on 12/28/2016 06:05:00 PM

From Tim Duy at Fed Watch: Is The Fed About To Experience A Repeat of 2016?

In the most recent Summary of Economic Projections, Fed officials penciled in three 25bp rate hikes for 2017. The reality, however, could be very different. We all remember how “four” became “one” in 2016. The median dots are neither a promise nor an official forecast. As 2016 progressed, forecasts associated with a lower path of SEP “dots” evolved as the consensus view of policymakers. Will the same happen this year? I don’t think so; it is hard to see the Fed on pause for another twelve months.Three hikes may be more likely than one, but right now I think two hikes is the most likely - but it depends on the data and on fiscal policy (a great unknown).

...

Bottom Line: The economic situation on the ground is very different from December of last year. Whereas the decision to raise rates at that time looked ill-advised, this latest action appears more appropriate given the likely medium-term path of the US economy. Assuming the US economy is near full employment, that path likely contains enough upward pressure on activity to justify more than one more rate increase in 2017. Three I think is more likely than one. That said, the change in administrations and the path of fiscal policy creates uncertainties in both directions.

Question #8 for 2017: How much will Residential Investment increase?

by Calculated Risk on 12/28/2016 02:08:00 PM

Two days ago I posted some questions for next year: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

8) Residential Investment: Residential investment (RI) was sluggish in 2016, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2017? How about housing starts and new home sales in 2017?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2016.

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish. Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year since then.

RI as a percent of GDP is still very low - close to the lows of previous recessions - and was sluggish in 2016.

Housing starts are on pace to increase close to 5% in 2016. And even after the significant increase over the last four years, the approximately 1.16 million housing starts in 2016 will still be the 13th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the seven lowest years were 2008 through 2014). The other lower years were the bottoms of previous recessions.

New home sales in 2016 were up about 12% compared to 2015 at close to 560 thousand.

Here is a table showing housing starts and new home sales over the last decade. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That would suggest starts would increase close to 30% over the next few years from the 2016 level.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2068 | --- | 1,283 | --- |

| 2006 | 1801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1003 | 8.5% | 437 | 1.9% |

| 2015 | 1112 | 10.9% | 501 | 14.7% |

| 20161 | 1163 | 4.6% | 562 | 12.2% |

| 12016 estimated | ||||

Most analysts are looking for starts to increase to around 1.25 million in 2017, and for new home sales of around 600 to 650 thousand. This would be an increase of around 7% for starts and maybe 10% for new home sales.

I think there will be further growth in 2017, but I think a combination of higher mortgage rates, less multi-family starts, and not enough lots for low-to-mid range new homes will mean sluggish growth in 2017.

My guess is starts will increase to just over 1.2 million in 2017 and new home sales will be in the low 600 thousand range.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

NAR: Pending Home Sales Index decreased 2.5% in November, down 0.4% year-over-year

by Calculated Risk on 12/28/2016 10:06:00 AM

From the NAR: Pending Home Sales Backpedal in November

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 2.5 percent to 107.3 in November from 110.0 in October. After last month's decrease in activity, the index is now 0.4 percent below last November (107.7) and is at its lowest reading since January (105.4).This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

...

The PHSI in the Northeast nudged forward 0.6 percent to 97.5 in November, and is now 5.7 percent above a year ago. In the Midwest the index declined 2.5 percent to 103.5 in November, and is now 2.4 percent lower than November 2015.

Pending home sales in the South decreased 1.2 percent to an index of 118.7 in November and are now 1.3 percent lower than last November. The index in the West fell 6.7 percent in November to 101.0, and is now 1.0 percent below a year ago.

emphasis added

Tuesday, December 27, 2016

Zillow Forecast on Case-Shiller Index: "Expect a (Very) Modest Slowdown" in November

by Calculated Risk on 12/27/2016 05:55:00 PM

The Case-Shiller house price indexes for October were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: November Case-Shiller Forecast: Expect a (Very) Modest Slowdown

After several months in a row of accelerating growth in U.S. home prices, the pace of appreciation is expected to slow somewhat in November, according to Zillow’s November Case-Shiller forecast.The year-over-year change for the 10-city and 20-city indexes will probably be slightly lower in the November report compared to the October report. The change for the National index will probably be about the same.

The November Case-Shiller national index is expected to grow 5.6 percent year-over-year and 0.7 percent month-to-month (seasonally adjusted), on par with the pace of annual growth and down slightly from the 0.9 percent monthly appreciation recorded in October. We expect the 10-city index to grow 4.1 percent year-over-year and 0.4 percent (SA) from October, and the 20-city index is expected to grow 5 percent annually and 0.5 percent (SA) from October. Both annual and seasonally adjusted monthly appreciation forecasted for November for the 10- and 20-city indices would be slower than that recorded in October.

Zillow’s November Case-Shiller forecast is shown in the table below. These forecasts are based on today’s October Case-Shiller data release and the November 2016 Zillow Home Value Index. The November S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, January 31.

Question #9 for 2017: What will happen with house prices in 2017?

by Calculated Risk on 12/27/2016 02:54:00 PM

Yesterday I posted some questions for next year: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

7) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 6% or so in 2016. What will happen with house prices in 2017?

The following graph shows the year-over-year change through October 2016, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 4.3% compared to October 2015, the Composite 20 SA was up 5.1% and the National index SA was up 5.6% year-over-year. Other house price indexes have indicated similar gains (see table below).

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-16 | 5.1% |

| Case-Shiller National | Oct-16 | 5.6% |

| CoreLogic | Oct-16 | 6.7% |

| Zillow | Nov-16 | 6.5% |

| Black Knight | Oct-16 | 5.6% |

| FHFA Purchase Only | Oct-16 | 6.2% |

Most analysts are forecasting prices will increase in the 3% to 5% range in 2017.

Inventories will probably remain low in 2017, although I expect inventories to increase on a year-over-year basis by December of 2017. Low inventories, and a decent economy suggests further price increases in 2017.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2017, it seems likely that price appreciation will slow to the low-to-mid single digits.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Real Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/27/2016 11:55:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.6% year-over-year in October

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the National Index, not seasonally adjusted (NSA) was reported as being at a new nominal high. The seasonally adjusted (SA) index was reported as being at the previous the bubble peak. However, in real terms, the National index (SA) is still about 15.3% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 5%. In October, the index was up 5.6% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $277,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at the bubble peak, and the Case-Shiller Composite 20 Index (SA) is back to July 2005 levels, and the CoreLogic index (NSA) is back to August 2005.

Real House Prices

In real terms, the National index is back to March 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to September 2003 levels, the Composite 20 index is back to April 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.6% year-over-year in October

by Calculated Risk on 12/27/2016 09:10:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P CoreLogic Case-Shiller National Index Extends New High as Price Gains Continues

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.6% annual gain in October, up from 5.4% last month. The 10-City Composite posted a 4.3% annual increase, up from 4.2% the previous month. The 20-City Composite reported a year-over-year gain of 5.1%, up from 5.0% in September.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last nine months. In October, Seattle led the way with a 10.7% year-over-year price increase, followed by Portland with 10.3%, and Denver with an 8.3% increase. 10 cities reported greater price increases in the year ending October 2016 versus the year ending September 2016.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in October. The 10-City Composite remains unchanged and the 20-City Composite posted a 0.1% increase in October. After seasonal adjustment, the National Index recorded a 0.9% month-overmonth increase, while both the 10-City and 20-City Composites each reported a 0.6% month-overmonth increase. 13 of 20 cities reported increases in September before seasonal adjustment; after seasonal adjustment, all 20 cities saw prices rise.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.0% from the peak, and up 0.6% in October (SA).

The Composite 20 index is off 7.8% from the peak, and up 0.6% (SA) in October.

The National index is at the previous peak (SA), and up 0.85% (SA) in October. The National index is up 35.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to October 2015.

The Composite 20 SA is up 5.1% year-over-year.

The National index SA is up 5.6% year-over-year.

Note: According to the data, prices increased in all 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, December 26, 2016

Question #10 for 2017: Will housing inventory increase or decrease in 2017?

by Calculated Risk on 12/26/2016 07:27:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

10) Housing Inventory: Housing inventory declined in 2015 and 2016. Will inventory increase or decrease in 2017?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2016.

According to the NAR, inventory decreased to 1.85 million in November 2016 from 2.04 million in November 2015.

This was the lowest level for the month of November since 2000.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Inventory decreased 9.3% year-over-year in November compared to November 2015. (blue line). Note that the blue line (year-over-year change) turned slightly positive in 2013, but has been negative since mid-2015.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

I've heard reports of more inventory in some coastal areas of California, in New York city and for high rise condos in Miami. But we haven't seen a change in trend for inventory yet.

The recent increase in interest rates might impact inventory. Looking back at the "taper tantrum" in May and June 2013 suggests we might see more inventory in the coming months. In May 2013, inventory was down 13% year-over-year, but by September 2013, inventory was unchanged year-over-year. However that change in year-over-year inventory was part of an ongoing trend (look at 2013 in the second graph above), and the "taper tantrum" might not have been the cause.

I was wrong on inventory last year, but right now my guess is active inventory will increase in 2017 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2017). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent increase in interest rates.

If correct, this will keep house price increases down in 2017 (probably lower than the 5% or so gains in 2014, 2015 and 2016).

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Ten Economic Questions for 2017

by Calculated Risk on 12/26/2016 11:56:00 AM

Here is a review of the Ten Economic Questions for 2016.

Here are my ten questions for 2017. I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2017, and - when there are surprises - to adjust my thinking.

1) US Policy: There is significant uncertainty as to fiscal and regulatory policy in 2017. This is probably the biggest risk for the US economy this coming year. I assume some sort of tax cuts will be passed, possibly some additional infrastructure spending, and possibly some deregulation.

These is the potential for significant policy mistakes - like defaulting on the debt (seems unlikely) - or the start of a trade war. Usually at this point in the transition process, there is a pretty clear understanding of the new administration's policy proposals, but not this time. I'll write much more about this issue.

2) Economic growth: Heading into 2017, most analysts are pretty sanguine and expecting some pickup in growth due to tax cuts and infrastructure spending. How much will the economy grow in 2017?

3) Employment: Through November, the economy has added almost 2,000,000 jobs this year, or 180,000 per month. As expected, this was down from the 230 thousand per month in 2015. Will job creation in 2017 be as strong as in 2016? Or will job creation be even stronger, like in 2014 or 2015? Or will job creation slow further in 2017?

4) Unemployment Rate: The unemployment rate was at 4.6% in November, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 4.5% to 4.6% range in Q4 2017. What will the unemployment rate be in December 2017?

5) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

6) Monetary Policy: The Fed raised rates this month, and now the question is how much will the Fed raise rates in 2017? The market is pricing in three 25 bps rate hikes in 2017, and most analysts expect two to three hikes in 2017. Will the Fed raise rates in 2017, and if so, by how much?

7) Real Wage Growth: Wage growth picked up in 2016. How much will wages increase in 2017?

8) Residential Investment: Residential investment (RI) was sluggish in 2016, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2017? How about housing starts and new home sales in 2017?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% to 6% or so in 2016. What will happen with house prices in 2017?

10) Housing Inventory: Housing inventory declined in 2015 and 2016. Will inventory increase or decrease in 2017?

There are other important questions, but these are the ones I'm focused on right now. I'll write on each of these questions over the next couple of weeks.

Vehicle Sales Forecast: Sales Over 17 Million SAAR Again in December, On Track for Record Year in 2016

by Calculated Risk on 12/26/2016 09:53:00 AM

The automakers will report December vehicle sales on Wednesday, January 4th.

Note: There were 27 selling days in December 2016, down from 28 in December 2015.

From WardsAuto: December Light-Vehicle Sales to Push U.S. Market to New Record

December U.S. light-vehicle sales are forecast to finish strong enough for 2016 to top 2015’s record 17.396 million units. However, actual volume largely will be determined by results in the final third of the month, because a major portion of December’s deliveries typically occur after Christmas.Here is a table (source: BEA) showing the 5 top years for light vehicle sales through November, and the top 5 full years. 2016 will probably finish in the top 3, and could be the best year ever - just beating last year.

The forecast 17.7 million-unit seasonally adjusted annual rate is below November’s 17.8 million, but above December 2015’s 17.4 million.

...

Despite the drop in December’s volume, total 2016 sales will end at 17.41 million units, barely edging out the all-time high set last year.

emphasis added

| Light Vehicle Sales, Top 5 Years and Through November | ||||

|---|---|---|---|---|

| Through November | Full Year | |||

| Year | Sales (000s) | Year | Sales (000s) | |

| 1 | 2000 | 16,109 | 2015 | 17,396 |

| 2 | 2001 | 15,812 | 2000 | 17,350 |

| 3 | 2016 | 15,783 | 2001 | 17,122 |

| 4 | 2015 | 15,766 | 2005 | 16,948 |

| 5 | 1999 | 15,498 | 1999 | 16,894 |

Sunday, December 25, 2016

Happy Holidays!

by Calculated Risk on 12/25/2016 08:19:00 AM

Happy Holidays and Merry Christmas to All!

Whose woods these are I think I know."Stopping by Woods on a Snowy Evening" by Robert Frost

His house is in the village though;

He will not see me stopping here

To watch his woods fill up with snow.

My little horse must think it queer

To stop without a farmhouse near

Between the woods and frozen lake

The darkest evening of the year.

He gives his harness bells a shake

To ask if there is some mistake.

The only other sound’s the sweep

Of easy wind and downy flake.

The woods are lovely, dark and deep,

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Enjoy the season!

Saturday, December 24, 2016

Schedule for Week of Dec 25, 2016

by Calculated Risk on 12/24/2016 08:09:00 AM

This will be a light week for economic data.

Happy Holidays and Merry Christmas!

All US markets will be closed in observance of the Christmas Holiday.

9:00 AM ET: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the September 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.1% year-over-year increase in the Comp 20 index for October. The Zillow forecast is for the National Index to increase 5.7% year-over-year in October.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.5% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, down from 275 thousand the previous week.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for a reading of 57.0, down from 57.6 in November.

Friday, December 23, 2016

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in November

by Calculated Risk on 12/23/2016 05:26:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in November.

On distressed: The total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are mostly down in these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | |

| Las Vegas | 4.0% | 7.1% | 6.5% | 6.2% | 10.5% | 13.3% | 26.9% | 33.2% |

| Reno** | 2.0% | 4.0% | 3.0% | 4.0% | 5.0% | 8.0% | ||

| Phoenix | 1.5% | 2.9% | 2.2% | 3.8% | 3.7% | 6.7% | 23.4% | 29.1% |

| Sacramento | 2.6% | 4.4% | 2.4% | 3.6% | 5.0% | 8.0% | 12.9% | 22.9% |

| Minneapolis | 1.8% | 2.6% | 4.8% | 9.6% | 6.6% | 12.2% | 12.7% | 16.6% |

| Mid-Atlantic | 3.1% | 3.9% | 9.4% | 11.9% | 12.6% | 15.8% | 17.5% | 20.9% |

| Florida SF | 2.2% | 3.7% | 8.1% | 15.3% | 10.3% | 19.0% | 29.5% | 37.7% |

| Florida C/TH | 1.3% | 2.4% | 6.1% | 13.4% | 7.4% | 15.7% | 57.2% | 65.4% |

| Chicago (city) | 15.5% | 18.6% | ||||||

| Spokane | 6.7% | 9.8% | ||||||

| Northeast Florida | 13.7% | 26.2% | ||||||

| Rhode Island | 9.2% | 11.2% | ||||||

| Tucson | 23.1% | 32.2% | ||||||

| Knoxville | 21.3% | 26.0% | ||||||

| Peoria | 23.2% | 27.2% | ||||||

| Georgia*** | 19.7% | 25.2% | ||||||

| Omaha | 18.1% | 20.6% | ||||||

| Richmond VA | 8.8% | 10.2% | 17.2% | 21.0% | ||||

| Memphis | 10.9% | 15.3% | ||||||

| Springfield IL** | 5.6% | 8.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Review: Ten Economic Questions for 2016

by Calculated Risk on 12/23/2016 02:31:00 PM

At the end of each year, I post Ten Economic Questions for the coming year. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2016 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is a review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2016: How much will housing inventory increase in 2016?

Right now my guess is active inventory will increase in 2016 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2016). I don't expect a double digit surge in inventory, but maybe a mid-single digit increase year-over-year. If correct, this will keep house price increases down in 2015 (probably lower than the 5% or so gains in 2014 and 2015).According to the November NAR report on existing home sales, inventory was down 9.3% year-over-year in August, and the months-of-supply was at 4.0 months. It is clear inventory will decrease in 2016. Note: I changed my view on inventory early this year (one of the key reasons for writing down expectations - so we can change our views when the data is different than expected).

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

9) Question #9 for 2016: What will happen with house prices in 2016?

Low inventories, and a decent economy suggests further price increases in 2016. However I expect we will see prices up less in 2016, than in 2015, as measured by these house price indexes - mostly because I expect more inventory.It is early, but the recently released Case-Shiller data showed prices up 5.5% year-over-year in September. The price increase is slightly higher than in 2015 (prices were up 5.25% nationally in 2015), probably due to less inventory.

8) Question #8 for 2016: How much will Residential Investment increase?

My guess is growth of around 4% to 8% in 2016 for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts will shift a little more towards single family in 2016.Through November, starts were up 4.8% year-over-year compared to the same period in 2015. New home sales were up 12.7% year-over-year. Starts will increase as expected; new home sales will be higher than I expected.

7) Question #7 for 2016: What about oil prices in 2016?

It is impossible to predict an international supply disruption, however if a significant disruption happens, then prices will move higher. Continued weakness in Europe and China seems likely, however sluggish demand will be somewhat offset by less tight oil production. It seems like the key oil producers (Saudi, etc) will continue production at current levels. This suggests in the short run (2016) that prices will stay low, but probably move up a little in 2016. I'll guess WTI will be up from the current price [WTI at $38 per barrel] by December 2016 (but still under $50 per barrel).As of this morning, WTI futures are at $52.85 per barrel. Prices moved up as expected, but are a little above $50.

6) Question #6 for 2016: Will real wages increase in 2016?

For this post the key point is that nominal wages have been only increasing about 2% per year with some pickup in 2015. As the labor market continues to tighten, we should start see more wage pressure as companies have to compete more for employees. I expect to see some further increase in nominal wage increases in 2016 (perhaps over 3% later in the year). The year-over-year change in real wages will depend on inflation, and I expect headline CPI to pickup some this year as the impact on headline inflation of declining oil prices fades.Through November, nominal hourly wages were up 2.5% year-over-year. This is a pickup from last year - and wage growth appears to be trending up. Wages will increase at a faster rate in 2016 than in 2015.

5) Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

I've seen several people arguing the Fed will be cutting rates by the end of 2016 - I think that is unlikely. Instead I think the Fed will be cautious - and they will not want to reverse course. Right now I think something around three rate hikes in 2016 is likely.Events have pushed the Fed to delay rate increases, and the Fed only hiked once in 2016.

4) Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

Due to some remaining slack in the labor market (example: elevated level of part time workers for economic reasons), I expect these measures of inflation will be close to the Fed's target in 2016.It is early, but inflation has moved up close to the Fed target through November.

So currently I think core inflation (year-over-year) will increase further in 2016, but too much inflation will not be a serious concern in 2016.

3) Question #3 for 2016: What will the unemployment rate be in December 2016?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to around 4.5% by December 2016. My guess is based on the participation rate declining slightly in 2016 and for decent job growth in 2016 (however less in 2016 than in 2015).The unemployment rate was 4.6% in November, down from 5.0% in December 2015.

2) Question #2 for 2016: How many payroll jobs will be added in 2016?

Energy related construction hiring will decline in 2016, but I expect other areas of construction to be solid. For manufacturing, growth in the auto sector will probably slow this year, but the drag on manufacturing employment from the strong dollar should be less in 2016.Through November 2016, the economy has added almost 2 million jobs; or 180,000 per month. It now appears employment gains will be lower than in 2015 (as expected).200,000 per month in 2016.

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - but probably not the severe contraction as in 2015, and more companies will have difficulty finding qualified candidates. Even with some boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2016 than in 2015.

So my forecast is for gains of around 200,000 payroll jobs per month in 2015. Lower than in 2015, but another solid year for employment gains given current demographics.

1) Question #1 for 2016: How much will the economy grow in 2016?

In addition, the sharp decline in oil prices should be a net positive for the US economy in 2016. And, hopefully, the negative impact from the strong dollar will fade in 2016.GDP growth was sluggish again in the first half (just up 1.1% annualized), and solid in Q3. GDP is now tracking 2.5% in Q4. This would be GDP growth just over 2% from Q4 2015 to Q4 2016.

The most likely growth rate is in the mid-2% range again ...

In general, 2016 unfolded as expected with some key exceptions (one of the reasons I write down what I think will happen). I changed my view on Fed rate hikes earlier this year to just one hike. And existing home inventory is declined again this year.

Residential investment, oil prices, inflation, wage growth and employment were about as I expected.

A few Comments on November New Home Sales

by Calculated Risk on 12/23/2016 11:41:00 AM

New home sales for November were reported at 592,000 on a seasonally adjusted annual rate basis (SAAR). This was above the consensus forecast, however the previous months combined were revised down slightly.

Sales were up 16.5% year-over-year in November, and this is the best month for November (NSA) since 2007. And sales are up 12.7% year-to-date compared to the same period in 2015.

This is very solid year-over-year growth.

Note that these sales (for November) mostly happened while mortgage rates were increasing (but still below the current level). So far the increase in rates hasn't impacted sales, but we need to wait a few months to see the impact.

Earlier: New Home Sales increase to 592,000 Annual Rate in November.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 12.7% year-over-year, because of very strong year-over-year growth over the last seven months.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year. I was too pessimistic on new home sales this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

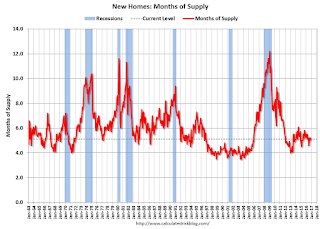

New Home Sales increase to 592,000 Annual Rate in November

by Calculated Risk on 12/23/2016 10:09:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 592 thousand.

The previous three months were revised down slightly.

"Sales of new single-family houses in November 2016 were at a seasonally adjusted annual rate of 592,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.2 percent above the revised October rate of 563,000 and is 16.5 percent above the November 2015 estimate of 508,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 5.1 months.

The months of supply decreased in November to 5.1 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of November was 250,000. This represents a supply of 5.1 months at the current sales rate"

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2016 (red column), 41 thousand new homes were sold (NSA). Last year, 36 thousand homes were sold in November. This was the highest sales for November since 2007.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was above expectations of 580,000 sales SAAR in November. I'll have more later today.