by Calculated Risk on 3/31/2014 09:16:00 PM

Monday, March 31, 2014

Tuesday: Auto Sales, ISM Mfg Index, Construction Spending, Q1 Office Vacancy Survey

Oh no, not April 1st! From the NY Times: Beware the April Fools’ Jokes Coming From Madison Avenue

In the last three or four years, the ranks of pranksters seem to have grown, partly because of the ability of social media to rapidly communicate and amplify messages. For instance, a trick pulled off for April Fools’ Day last year by FreshDirect — the introduction of a blueberry and banana hybrid called a “bluenana” — was “a hit with our customers, garnering lots of buzz across social media,” said Jodi Kahn, chief consumer officer at FreshDirect.Tuesday:

...

Time will tell whether any of the jokes for 2014 will rank among the funniest — and most successful in fooling consumers — of previous April Fools’ Days. Among those was a “left-handed” Whopper from Burger King in 1998 and an announcement in 1996 that Taco Bell had bought the Liberty Bell and renamed it the Taco Liberty Bell.

• Early: Reis Q1 2014 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.

• At 9:00 AM ET, the Markit US PMI Manufacturing Index for March.

• At 10:00 AM, the ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for a 0.1% increase in construction spending.

Fannie Mae: Mortgage Serious Delinquency rate declined in February, Lowest since November 2008

by Calculated Risk on 3/31/2014 05:40:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in February to 2.27% from 2.33% in January. The serious delinquency rate is down from 3.13% in February 2013, and this is the lowest level since November 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 2.29% from 2.34% in January. Freddie's rate is down from 3.15% in February 2013, and is at the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.86 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in late 2015.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Weekly Update: Housing Tracker Existing Home Inventory up 6.7% year-over-year on March 31st

by Calculated Risk on 3/31/2014 03:51:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

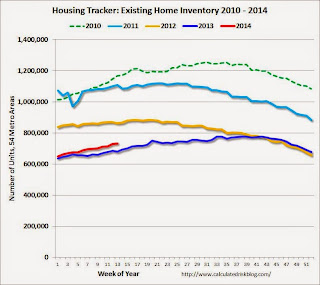

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year, and finished up about 2.7% YoY.

Inventory in 2014 (Red) is now 6.7% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Restaurant Performance Index indicates expansion in February

by Calculated Risk on 3/31/2014 01:51:00 PM

From the National Restaurant Association: Restaurant Performance Index Remained Above 100 in February Despite Continued Dampened Customer Traffic Levels

Although challenging weather conditions in many parts of the country continued to impact customer traffic in February, the National Restaurant Association’s Restaurant Performance Index (RPI) remained above 100 for the 12th consecutive month. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.5 in February, down 0.2 percent from January’s level of 100.7. Despite the modest decline, the fact that the overall RPI remains above 100 continues to signify expansion in the index of key industry indicators.

“Restaurant operators continued to report net positive same-store sales results in February, despite customer traffic levels that were challenged by the weather,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Looking forward, operators are generally optimistic about sales gains in the months ahead, although they aren’t as bullish about the overall economy.””

...

Although results were mixed in February, restaurant operators reported net positive same-store sales for the 12th consecutive month. ... In contrast, restaurant operators reported a net decline in customer traffic for the third consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.5 in February, down from 100.7 in January. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and this is fairly positive considering the terrible weather in February.

Dallas Fed: Texas Manufacturing Strengthens Further

by Calculated Risk on 3/31/2014 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Strengthens Further

Texas factory activity increased for the eleventh month in a row in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 10.8 to 17.1, indicating output grew at a stronger pace than in February.A solid report.

Other measures of current manufacturing activity also reflected more robust growth. The new orders index rose to a nine-month high of 14.7 ... Labor market indicators reflected stronger employment growth and longer workweeks. The March employment index rose markedly to a 21-month high of 15.

...

The general business activity index moved up to a six-month high of 4.9 after slipping to zero last month.

Expectations regarding future business conditions remained optimistic in March. The index of future general business activity edged up to 17.6, and the index of future company outlook rose 7 points to 27.4.

This is the last of the regional surveys. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

This suggests some increase in the March ISM survey to be released tomorrow, Tuesday, April 1st.

Chicago PMI declines to 55.9

by Calculated Risk on 3/31/2014 09:45:00 AM

From the Chicago ISM:

March 2014:

The Chicago Business Barometer decreased 3.9 points in March to 55.9, the lowest level since August, led by a decline in New Orders and a sharp fall in Employment. ...This was below the consensus estimate of 58.5.

Although New Orders remained firm above the 50 breakeven level, they eased for the second consecutive month pointing to a slight softening in demand. Like the Barometer, New Orders posted the lowest reading since August. Order Backlogs also decreased, to their lowest level since September.

Employment, the second biggest contributor to the Barometer’s decline, decreased sharply in March, erasing nearly all of February’s double digit rise.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist of MNI Indicators said, “March saw a significant weakening in activity following a five month spell of firm growth. It’s too early to tell, though, if this is the start of a sustained slowdown or just a blip.”

“Panellists, though, were optimistic about the future. Asked about the outlook for demand over the next three months, the majority of businesses said they expected tosee a pick-up.” he added.

emphasis added

Sunday, March 30, 2014

Monday: Chicago PMI, Dallas Fed Mfg Survey, Yellen

by Calculated Risk on 3/30/2014 09:05:00 PM

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for March. The consensus is for a decrease to 58.5, down from 59.8 in February.

• At 9:55 AM, Speech, Fed Chair Janet Yellen, Strengthening Communities, At the 2014 National Interagency Community Reinvestment Conference, Chicago, Ill.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March. This is the last of the regional Fed manufacturing surveys for March.

Weekend:

• Schedule for Week of March 30th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 8 and DOW futures are up 65 (fair value).

Oil prices are up with WTI futures at $101.46 per barrel and Brent at $107.95 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.53 per gallon (up over the last two months, but still down from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Merrill and Nomura on March Employment Report

by Calculated Risk on 3/30/2014 11:28:00 AM

Here are some excepts from two research reports ... first, from Ethan Harris at Merrill Lynch:

We expect a solid jobs report in March with payroll growth of 230,000, reflecting a weather-induced snapback. We saw a modest recovery in job growth in February, with acceleration to 175,000 from 129,000 in January and 84,000 in December. The gain in February occurred despite still-harsh winter weather, implying pent-up activity. The survey week in February had poor conditions with snowstorms across the East coast. In contrast, the survey week in March was notably warmer, allowing for greater economic activity, particularly construction and manufacturing. ... Given the noise in the data, we advise smoothing through the recent swings and focus on a six month moving average, which is trending between 180-190K, revealing decent job growth. As the economy builds momentum, as we expect, we should see this trend move above 200K.And from Nomura:

We look for the unemployment rate to hold steady at 6.7%. The household survey has been quite strong, with job growth averaging 445,000 over the prior four months. The series is typically mean-reverting, suggesting there is a risk of weakening in March. We also think the labor force participation rate will inch higher as confidence about labor market prospects continues to improve, assuggested by the conference board survey (the labor differential in March weakened slightly, but has been on an upward trend).

Also of interest will be average hourly earnings and the work week. Average hourly earnings surged 0.4% mom to bring the yoy rate up to 2.2%. We do not expect such strong gains to continue and look for a slowdown to 0.2% mom which still translates to a 2.3% yoy increase. The risk, however, is to the upside. We think the workweek will rebound to 34.3 after falling to 34.2 in February, which we believe was largely due to weather conditions given the spike in the percent of workers who said they couldn’t report to work due to harsh weather.

[W]e are forecasting a 190k increase in private payrolls with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 195k. Furthermore, given the weaker labor market indicators within regional manufacturing surveys, we expect manufacturing employment to remain unchanged in March. Lastly, we expect the household survey to show that the unemployment rate fell 0.1pp to 6.6% in March.The consensus is for an increase of 206,000 non-farm payroll jobs in March, up from the 175,000 non-farm payroll jobs added in February.

Average weekly hours worked for private industries fell below trend in the past three months, most likely a result of the inclement weather which likely shortened the workweek at some businesses. However, given that the weather was better in March, we expect average weekly hours to rebound to 34.4 from 34.2 in February.

The consensus is for the unemployment rate to decline to 6.6% in March.

I'll write an employment report preview later this week after more data for March is released.

Saturday, March 29, 2014

Unofficial Problem Bank list declines to 538 Institutions, Q1 2014 Transition Matrix

by Calculated Risk on 3/29/2014 04:03:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 28, 2014.

Changes and comments from surferdude808:

The FDIC released its enforcement action activity through February 2014 today as anticipated. In that month, the FDIC was very busy terminating enforcement actions. For the week, there were 14 removals that leave the list at 538 institutions with assets of $174.3 billion. A year ago, the list held 791 institutions with assets of $290.0 billion. During March 2014, the list declined by 28 institutions and $8.0 billion in assets after 23 action terminations, four mergers, and one voluntary liquidation.

Removals included 12 action terminations against the following: Florida Bank, Tampa, FL ($536 million); Foundation Bank, Bellevue, WA ($364 million); First Bank of Dalton, Dalton, GA ($188 million); Proficio Bank, Cottonwood Heights, UT ($169 million); Regal Bank & Trust, Owings Mills, MD ($143 million); Bank of George, Las Vegas, NV ($112 million); RiverBank, Spokane, WA ($103 million); Security State Bank, Iron River, WI ($81 million); Bank of Bozeman, Bozeman, MT ($59 million); OmniBank, Bay Springs, MS ($47 million); Key Community Bank, Inver Grove Heights, MN ($42 million); and Cowboy State Bank, Ranchester, WY ($41 million). Hartford Savings Bank, Hartford, WI ($175 million) exited through a voluntary liquidation and Great Northern Bank, Saint Michael, MN ($71 million) through an unassisted merger.

We have updated the Unofficial Problem Bank List transition matrix through the first quarter of 2014. Full details are available in the accompanying table and a visual of the trends may be found in accompanying chart. Since the Unofficial Problem Bank List appeared in August 2009, 1,665 institutions have graced the list with only 32.3% or 538 remaining on the list. Removals total 1,127 with 555 coming through action termination. Another 375 have failed, 183 found a merger partner, and 14 exited through a voluntary liquidation. In the first quarter of 2014, action terminations accelerated to their fastest pace as 9.7 percent or 60 of the 595 institutions at the start of the quarter had their action terminated.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 129 | (43,313,416) | |

| Unassisted Merger | 31 | (6,663,407) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 153 | (184,209,338) | |

| Asset Change | (11,291,149) | ||

| Still on List at 3/31/2014 | 72 | 20,252,005 | |

| Additions after 8/7/2009 | 466 | 154,056,606 | |

| End (3/31/2014) | 538 | 174,308,611 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 426 | 187,850,337 | |

| Unassisted Merger | 152 | 70,216,490 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 222 | 110,834,945 | |

| Total | 810 | 371,225,914 | |

| 1Institution not on 8/7/2009 or 3/31/2014 list but appeared on a weekly list. | |||

Schedule for Week of March 30th

by Calculated Risk on 3/29/2014 08:52:00 AM

This will be a busy week for economic data with several key reports including the March employment report on Friday.

Other key reports include the ISM manufacturing index on Tuesday, February vehicle sales on Tuesday, the ISM service index on Thursday, and the February trade deficit report on Thursday.

Also, Reis is scheduled to release their Q1 surveys of rents and vacancy rates for apartments, offices and malls.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a decrease to 58.5, down from 59.8 in February.

9:55 AM: Speech, Fed Chair Janet Yellen, Strengthening Communities, At the 2014 National Interagency Community Reinvestment Conference, Chicago, Ill.

10:30 AM: Dallas Fed Manufacturing Survey for March. This is the last of the regional Fed manufacturing surveys for March.

Early: Reis Q1 2014 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

9:00 AM ET: The Markit US PMI Manufacturing Index for March.

10:00 AM ET: ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.

10:00 AM ET: ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in February at 53.2%. The employment index was at 52.3%, and the new orders index was at 54.5%.

10:00 AM: Construction Spending for February. The consensus is for a 0.1% increase in construction spending.

Early: Reis Q1 2014 Apartment Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in March, up from 139,000 in February.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for a 0.8% increase in February orders.

Early: Reis Q1 2014 Mall Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 320 thousand from 311 thousand.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. Imports and exports increased in January.

The consensus is for the U.S. trade deficit to decrease to $38.5 billion in February from $39.1 billion in January.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a reading of 53.5, up from 51.6 in February. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: Employment Report for March. The consensus is for an increase of 206,000 non-farm payroll jobs in March, up from the 175,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to decline to 6.6% in March.

This graph shows the percentage of payroll jobs lost during post WWII recessions through February.

This graph shows the percentage of payroll jobs lost during post WWII recessions through February.The economy has added 8.7 million private sector jobs since employment bottomed in February 2010 (8.0 million total jobs added including all the public sector layoffs).

There are still almost 129 thousand fewer private sector jobs now than when the recession started in 2007. Private sector employment at a new high will probably be a headline for the March report.

Friday, March 28, 2014

Headline for Next Friday: "U.S. Private Employment at All Time High"

by Calculated Risk on 3/28/2014 07:13:00 PM

Just a quick note, private U.S. employment is currently 129 thousand below the pre-recession peak. With the release of the March employment report next Friday, private employment will probably be at an all time high.

However total employment is still 666 thousand below the pre-recession peak due to all the government layoffs. Total employment will probably be at a new high sometime this summer.

I guess I'm going to have to retire the following graph soon ... (once call the "THE SCARIEST JOBS CHART EVER").

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percentage of payroll jobs lost during post WWII recessions through February.

This is total non-farm payrolls, so I'll be posting this for a few more months.

Of course this doesn't include growth of the labor force ...

Housing: The increase in inventory in the West

by Calculated Risk on 3/28/2014 03:36:00 PM

Housing Tracker (Department of Numbers) has inventory for a number of cities. Right now we are seeing inventories up sharply year-over-year in several cities in the West.

Note: Housing Tracker is reporting total inventory is up slightly year-over-year in Las Vegas. However, non-contingent inventory has doubled year-over-year according to GLVAR. Contingent inventory includes short sales that make remain contingent for a significant period awaiting lender approval.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change in several cities in the West.

Inventory is up 88% in Sacramento, up 57% in Phoenix, up 40% in Riverside, and up 33% in Orange County.

However inventory is only up 3% in San Francisco and 9% in San Diego (Las Vegas total inventory is up 3%, but non-contingent inventory has doubled).

With more inventory, price increases should slow.

BLS: State unemployment rates were "little changed" in February

by Calculated Risk on 3/28/2014 10:55:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in February. Twenty-nine states had unemployment rate decreases from January, 10 states had increases, and 11 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island continued to have the highest unemployment rate among the states in February, 9.0 percent. North Dakota again had the lowest jobless rate, 2.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan, South Carolina, Nevada and Florida have seen the largest declines and many other states have seen significant declines.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at 9% in only one state: Rhode Island. Illinois is at 8.7%, Nevada at 8.5%, and California at 8.0%.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate above 11% (red).Currently one state has an unemployment rate at or above 9% (purple), four states at or above 8% (light blue), and 13 states at or above 7% (blue).

Final March Consumer Sentiment at 80.0

by Calculated Risk on 3/28/2014 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for March decreased to 80.0 from the February reading of 81.6, and was up slightly from the preliminary March reading of 79.9.

This was below the consensus forecast of 80.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Personal Income increased 0.3% in February, Spending increased 0.3%

by Calculated Risk on 3/28/2014 08:44:00 AM

The BEA released the Personal Income and Outlays report for February:

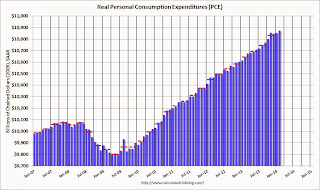

Personal income increased $47.7 billion, or 0.3 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $30.8 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in February, compared with an increase of 0.1 percent in January. ... The price index for PCE increased 0.1 percent in February, the same increase as in January. The PCE price index, excluding food and energy, increased 0.1 percent in February, the same increase as in January.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q1 PCE growth (first two months of the quarter), PCE was increasing at a 1.3% annual rate in Q1 2014 (using mid-month method, PCE was increasing less than 1.0%). This suggests weak PCE growth in Q1, but I expect PCE to increase faster in March.

Thursday, March 27, 2014

Friday: February Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 3/27/2014 07:27:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 80.5, up from the preliminary reading of 79.9, but down from the February reading of 81.6.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for February 2014.

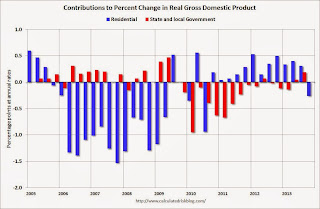

Here is an update based on the third estimate of Q4 GDP release today. The following graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments (red) appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local government contribution was zero in Q4 after revisions.

I expect state and local governments to make a small positive contribution to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.

House Prices and Lagged Data

by Calculated Risk on 3/27/2014 02:55:00 PM

Two years ago I wrote a post titled House Prices and Lagged Data. In early 2012, I had just called the bottom for house prices (see: The Housing Bottom is Here), and in the "lagged data" post I was pointing out that the Case-Shiller house price index has a serious data lag - and that we had to wait several months to see if prices had actually bottomed (the call was correct).

Now I'm looking for price increases to slow, and once again we have to remember that the Case-Shiller data has a serious lag. (Note: the following is updated from the post two years ago)

All data is lagged, but some data is lagged more than others.

In times of economic stress, I tend to watch the high frequency data closely: initial weekly unemployment claims, monthly manufacturing surveys, and consumer sentiment. The “high frequency” data is lagged, but the lag is usually just a week or two.

Most of the time I focus on the monthly employment report, quarterly GDP, housing starts, new home sales and retail sales. The lag for most of this data is several weeks. As an example, the BLS reference period contains the 12th of the month, so the report is lagged a few weeks by the time it is released. The housing starts and new home sales data released recently were for February, so the lag is also a few weeks after the end of the month. The advance estimate of quarterly GDP is released several weeks after the end of the quarter.

But sometimes the lag can be much longer. Two days ago, the January Case-Shiller house price index was released. This is actually a three month average for house sales closed in November, December and January.

But remember that the purchase agreement for a house that closed in November was probably signed in September or early October. So some portion of the Case-Shiller index will be for contract prices 6 to 7 months ago!

Other house price indexes have less of a lag. CoreLogic uses a weighted 3 month average with the most recent month weighted the most, the Black Knight house price index is for just one month (not an average).

But, if price increases have slowed - as Jed Kolko argues using asking prices - then the key point is that the Case-Shiller index will not show the slowdown for some time. Just something to remember ...

Kansas City Fed: Regional Manufacturing increased in March

by Calculated Risk on 3/27/2014 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Increased

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity increased, and producers’ expectations were mostly stable at solid levels.The last regional Fed manufacturing survey for March will be released on Monday, March 31st (Dallas Fed). In general - with the exception of the Richmond survey - the regional surveys have been positive in March and suggest improvement in the ISM manufacturing index.

“We saw acceleration in regional factory activity in March, to the fastest pace in over two years”, said Wilkerson. “However, several respondents noted the stronger growth was in part making up for weather-related softness in previous months.”

The month-over-month composite index was 10 in March, up from 4 in February and 5 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity increased at both durable and non-durable goods-producing plants, particularly for plastic and machinery products. Other month-over-month indexes also improved. The production index jumped from 3 to 22, its highest level in 3 years, and the shipments and new orders indexes also climbed higher. The order backlog index edged up from -4 to -1, and the new orders for exports index also increased slightly. The employment index moderated from 3 to 0, and both inventory indexes eased somewhat.

emphasis added

NAR: Pending Home Sales Index down 10.5% year-over-year in February

by Calculated Risk on 3/27/2014 10:00:00 AM

From the NAR: February Pending Home Sales Continue Slide

The Pending Home Sales Index, a forward-looking indicator based on contract signings, dipped 0.8 percent to 93.9 from a downwardly revised 94.7 in January, and is 10.5 percent below February 2013 when it was 104.9. The February reading was the lowest since October 2011, when it was 92.2.A few comments:

...

The PHSI in the Northeast declined 2.4 percent to 77.1 in February, and is 7.4 percent below a year ago. In the Midwest the index rose 2.8 percent to 95.3 in February, but is 8.5 percent lower than February 2013. Pending home sales in the South fell 4.0 percent to an index of 106.3 in February, and are 9.3 percent below a year ago. The index in the West increased 2.3 percent in February to 86.1, but is 16.5 percent below February 2013.

• Mr. Yun once gain blamed some of the weakness on the weather (the weather was unusually bad again in February), but the index remained weak in the South too (down 9.3% year-over-year and probably not weather), and in the West (down 16.5% year-over-year partially related to low inventories).

• My view is there were several reasons for the decline in this index: weather in some areas, fewer distressed sales, less investor buying, fewer "pending" short sales, and low inventories. I think fewer distressed sales, fewer "pending" short sales, and less investor buying are all signs of a healthier market - even if overall sales decline.

• Mr Yun's forecast for 2014 is 5.0 million existing home sales, down from his earlier forecast of 5.1 million existing home sales this year. I'll take the under on his current forecast, and I think it would be a positive sign if sales were under 5 million in 2014 as long as distressed sales continue to decline and conventional sales increase.

• Of course, with housing, what really matters for the economy and employment is new home sales and housing starts, not existing home sales.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

Q4 GDP Revised up to 2.6%, Weekly Initial Unemployment Claims decline to 311,000

by Calculated Risk on 3/27/2014 08:30:00 AM

From the BEA: Gross Domestic Product, 4th quarter and annual 2013 (third estimate); Corporate Profits, 4th quarter and annual 2013

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.6 percent in the fourth quarter of 2013 (that is, from the third quarter to the fourth quarter), according to the "third" estimate released by the Bureau of Economic Analysis. ...Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 2.6% to 3.3%. Private investment was revised down.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.4 percent. With this third estimate for the fourth quarter, the general picture of economic growth remains largely the same; personal consumption expenditures (PCE) was larger than previously estimated, while private investment in inventories and in intellectual property products were smaller than previously estimated ...

The DOL reports:

In the week ending March 22, the advance figure for seasonally adjusted initial claims was 311,000, a decrease of 10,000 from the previous week's revised figure of 321,000. The 4-week moving average was 317,750, a decrease of 9,500 from the previous week's revised average of 327,250.The previous week was revised up from 320,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 317,750.

This was below the consensus forecast of 325,000. The 4-week average is moving down and is close to normal levels during an expansion.

Wednesday, March 26, 2014

Thursday: Q4 GDP (3rd Estimate), Unemployment Claims, Pending Home Sales

by Calculated Risk on 3/26/2014 06:55:00 PM

From the Federal Reserve: Comprehensive Capital Analysis and Review

The Federal Reserve on Wednesday announced it has approved the capital plans of 25 bank holding companies participating in the Comprehensive Capital Analysis and Review (CCAR). The Federal Reserve objected to the plans of the other five participating firms--four based on qualitative concerns and one because it did not meet a minimum post-stress capital requirement.Thursday:

...

When considering an institution's capital plan, the Federal Reserve considers both qualitative and quantitative factors. These include a firm's capital ratios under severe economic and financial market stress and the strength of the firm's capital planning process. After the Federal Reserve objects to a capital plan, the institution may only make capital distributions with prior written approval from the Federal Reserve.

...

Based on qualitative concerns, the Federal Reserve objected to the capital plans of Citigroup Inc.; HSBC North America Holdings Inc.; RBS Citizens Financial Group, Inc.; and Santander Holdings USA, Inc. The Federal Reserve objected to the capital plan of Zions Bancorporation because the firm did not meet the minimum, post-stress tier-1 common ratio of 5 percent.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 320 thousand.

• Also at 8:30 AM, The third estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 2.7% annualized in Q4, revised up from the second estimate of 2.4%.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 0.8% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

Vehicle Sales Forecasts: March Rebound

by Calculated Risk on 3/26/2014 03:30:00 PM

Auto sales were clearly impacted by the harsh winter weather in January and February. For an excellent article on weather and auto sales, see Weakening Economy or Just Bad Winter? by Atif Mian and Amir Sufi. Now we will see if sales rebound ...

Note: The automakers will report March vehicle sales on Tuesday, April 1st. Sales in February were at a 15.3 million seasonally adjusted annual rate (SAAR), and it appears there will be a solid increase in March.

Here are a couple of forecasts:

From Kelley Blue Book: New-Car Sales Expected To Rise 2 Percent In March, Fall 0.3 Percent In First Quarter 2014

New-vehicle sales are expected to rise 2 percent year-over-year to a total of 1.48 million units, and an estimated 15.7 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ... A 15.7 million SAAR would mark the seventeenth consecutive month above 15 million and the greatest March since 2007.Note: In March 2014, there was one less selling day than in March 2013 (26 days vs. 27 last year).

"Following two months of weaker-than-expected sales, the industry should start to bounce back in March," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Although we aren't expected to hit 16 million SAAR, indications show that consumers are returning to showrooms in spring. The momentum built in March should set the market up for a big month in April.

From J.D. Power: Auto Sales Recovering After Slow Start to 2014

Cold and snowy weather may have depressed new-vehicle sales in January and February of 2014, but customers are returning to dealership showrooms in March, according to a new sales forecast jointly issued by J.D. Power and LMC Automotive. According to the latest forecast, retail sales are expected to demonstrate a 7% increase over March 2013, with 1,148,338 new cars, trucks, SUVs, and minivans rolling into American driveways.J.D. Power didn't provide a fleet forecast or SAAR forecast, but this suggests a significant increase over the February rate.

Additionally, the average transaction price for those new vehicles remains above $29,300, the highest ever for the month of March and $700 higher than in March 2013, reflecting continued economic strength and improved consumer confidence.

"The severe weather had an impact on retail sales in January and February, but as the weather has improved, so have sales," said John Humphrey, senior vice president of the global automotive practice at J.D. Power. "Additionally, stronger pricing coupled with lower reliance on fleet continues to bode well for the overall health of the sector."

At the start of March 2014, automakers had stockpiled an 80-day supply of new vehicles, while a 60-day supply is considered ideal. LMC Automotive isn't concerned, though, and expects a faster selling rate to reduce inventories to normal levels.

Chemical Activity Barometer for March Suggests "continued modest growth"

by Calculated Risk on 3/26/2014 12:37:00 PM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Equity Prices Drive Chemical Activity Barometer Growth Despite Continued Adverse Weather

While winter weather extremes continue to impact economic reporting, strengthening chemical equity prices drove solid gains in the American Chemistry Council’s (ACC) monthly Chemical Activity Barometer (CAB), released today. March’s reading featured a gain of 0.3% over February on a three-month moving average basis (3MMA), rebounding past the average 0.2% gain in late 2013, and pointing to modest but continued growth in the U.S. economy through the fourth quarter of 2014. Strengthening chemical equity prices in February and March are a positive signal and a major factor in this month’s CAB reading. The economic indicator, shown to lead U.S. business cycles by an average of eight months at cycle peaks, is up 2.5 percent over a year ago, at an improved year-earlier pace. The CAB reading for February was revised upwards slightly from earlier reports.

“Winter weather extremes have carried into March and continue to impact many of the economic readings, but all signs point to an expanding U.S. economy through 2014,” said Kevin Swift, chief economist at the American Chemistry Council. “Strengthening chemical equity prices, combined with the expansion of sales in intermediate goods, which constitute roughly 85% of overall chemical sales, are encouraging signs for the continued health of the U.S. economy.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests that continued growth.

Freddie Mac: Mortgage Serious Delinquency rate declined in February, Lowest since February 2009

by Calculated Risk on 3/26/2014 10:27:00 AM

Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 2.29% from 2.34% in January. Freddie's rate is down from 3.15% in February 2013, and this is the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for February on Monday, March 31st.

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.86 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2015.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of distressed sales for another 2 years (mostly in judicial foreclosure states).

MBA: Mortgage Purchase Applications Increase, Refinance Applications Decrease

by Calculated Risk on 3/26/2014 07:01:00 AM

From the MBA: Purchase Applications Increase in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 21, 2014. ...

The Refinance Index decreased 8 percent from the previous week, including an 8.1 percent decline in conventional refinance applications and a 5.8 percent decline in government refinance applications; the government refinance index dropped to the lowest level since July 2011. In contrast, the seasonally adjusted Purchase Index increased 3 percent from one week earlier, driven mainly by a 4.0 percent increase in conventional purchase applications....

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.56 percent, the highest level since January 2014, from 4.50 percent, with points increasing to 0.29 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) increased to 4.45 percent from 4.39 percent, with points increasing to 0.27 from 0.19 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Tuesday, March 25, 2014

Zillow: Case-Shiller House Price Index expected to show 12.8% year-over-year increase in February

by Calculated Risk on 3/25/2014 07:12:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

The Case-Shiller house price indexes for January were released today. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

It looks like the year-over-year change for Case-Shiller will continue to slow. From Zillow: Case-Shiller Forecast Showing Moderate Slowdown in February

The Case-Shiller data for January 2014 came out this morning, and based on this information and the February 2014 Zillow Home Value Index (ZHVI, released March 19) we predict that next month’s Case-Shiller data (February 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 12.8 and 13.1 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from January to February will be 0.6 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). ... Officially, the Case-Shiller Composite Home Price Indices for February will not be released until Tuesday, April 29.The following table shows the Zillow forecast for the February Case-Shiller index.

| Zillow February Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Feb 2013 | 159.09 | 162.52 | 146.51 | 149.81 |

| Case-Shiller (last month) | Jan 2013 | 180.08 | 182.6 | 165.50 | 168.03 |

| Zillow Forecast | YoY | 13.1% | 13.1% | 12.8% | 12.8% |

| MoM | --- | 0.6% | --- | 0.6% | |

| Zillow Forecasts1 | 179.9 | 183.7 | 165.3 | 169.0 | |

| Current Post Bubble Low | 146.45 | 149.69 | 134.07 | 136.92 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 22.8% | 22.7% | 23.3% | 23.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Comment on House Prices: Graphs, Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 3/25/2014 01:51:00 PM

S&P/Case-Shiller's website crashed this morning. For some reason people seem to care about house prices!

Here is the website and the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices). This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

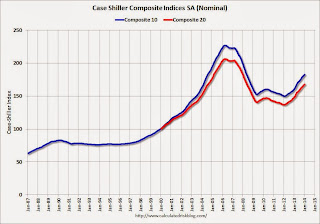

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

Here is the press release from S&P: Pace of Home Price Gains Slow According to the S&P/Case-Shiller Home Price Indices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 19.5% from the peak, and up 0.8% in January (SA). The Composite 10 is up 21.9% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 18.7% from the peak, and up 0.8% (SA) in January. The Composite 20 is up 22.6% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is up 13.5% compared to January 2013.

The Composite 20 SA is up 13.2% compared to January 2013.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in January seasonally adjusted. (Prices increased in 7 of the 20 cities NSA) Prices in Las Vegas are off 44.8% from the peak, and prices in Dallas and Denver are at new highs (SA).

This was at the consensus forecast for a 13.3% YoY increase.

I've been hearing reports of a slowdown in house price increases (more than the usual seasonal slowdown), and perhaps this slowdown in price increases is finally showing up in the Case-Shiller index. This makes sense since inventory is starting to increase.

According to Trulia chief economist Jed Kolko, asking price increases have slowed down recently, and Kolko expects that price slowdown will "hit Feb sales prices and get reported in April index releases".

It might take a few months, but I also expect to see smaller year-over-year price increases going forward.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (about 38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2004 levels (and also back up to Q3 2008), and the Case-Shiller Composite 20 Index (SA) is back to Oct 2004 levels, and the CoreLogic index (NSA) is back to August 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q2 2001 levels, the Composite 20 index is back to June 2002, and the CoreLogic index back to May 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q2 2001 levels, the Composite 20 index is back to Sept 2002 levels, and the CoreLogic index is back to Dec 2002.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

A comment on the New Home Sales report

by Calculated Risk on 3/25/2014 11:56:00 AM

Earlier: New Home Sales at 440,000 Annual Rate in February

The Census Bureau reported that new home sales in January and February combined were 68,000 not seasonally adjusted (NSA). This is the same as last year NSA - so there was no growth over the first two months of the year.

Weather probably played a small role in the lack of growth, but higher mortgage rates and higher prices probably were probably bigger factors.

Also this was a difficult comparison period. Sales in 2013 were up 16.8% from 2012, but sales in January and February 2013 were up over 28% from the same months of the previous year! The comparisons to last year will be easier in a few months - and I expect to see solid growth again this year.

On revisions: Although sales in January were revised down by 13 thousand, sales in November and December were revised up a combined 18 thousand - so overall revisions were positive.

Note: Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the 440 thousand sales rate in February. So I expect the housing recovery to continue.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through February 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some more or move sideways (distressed sales will slowly decline and be partially offset by more conventional / equity sales). And I expect this gap to close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 440,000 Annual Rate in February

by Calculated Risk on 3/25/2014 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 440 thousand.

January sales were revised down from 468 thousand to 455 thousand, and December sales were revised up from 427 thousand to 441 thousand (November was revised up slightly too).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in February 2014 were at a seasonally adjusted annual rate of 440,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.3 percent below the revised January rate of 455,000 and is 1.1 percent below the February 2013 estimate of 445,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Even with the increase in sales over the last two years, new home sales are still near the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in February to 5.2 months from 5.0 months in January.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of February was 189,000. This represents a supply of 5.2 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is still low, but moving up. The combined total of completed and under construction is also very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2014 (red column), 35 thousand new homes were sold (NSA). Last year 36 thousand homes were also sold in February. The high for February was 109 thousand in 2005, and the low for February was 22 thousand in 2011.

This was at expectations of 440,000 sales in February.

I'll have more later today .

Case-Shiller: Comp 20 House Prices increased 13.2% year-over-year in January

by Calculated Risk on 3/25/2014 09:17:00 AM

Note: The S&P website crashed (again), and I'll post graphs and more later today.

From the WSJ: U.S. Home Prices Rise 13.2% in January

According to the S&P/Case-Shiller home price report, the home price index covering 10 major U.S. cities increased 13.5% in the year ended in January. The 20-city price index advanced 13.2% ...

... "From the bottom in 2012, prices are up 23% and the housing market is showing signs of moving forward with more normal price increases." [said David Blitzer, chairman of the index committee at S&P Dow Jones Indices.]

...

"Expectations and recent data point to continued home price gains for 2014. Although most analysts do not expect the same rapid increases we saw last year, the consensus is for moderating gains," the report said.

Monday, March 24, 2014

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 3/24/2014 08:59:00 PM

A reminder of a friendly bet I made with NDD on housing starts and new home sales in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.NDD has Starts and Permits. I have Starts and New Home sales.

Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" in a few months, but not now due to the severe weather and limited starts and sales in many parts of the country).

In February 2013, new home sales were at a 445 thousand seasonally adjusted annual rate (SAAR). For me to win, new home sales would have to be up 20% or at 534 thousand SAAR in February (not likely).

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January. The consensus is for a 13.3% year-over-year increase in the Composite 20 index (NSA) for January. The Zillow forecast is for the Composite 20 to increase 13.0% year-over-year, and for prices to increase 0.5% month-to-month seasonally adjusted.

• Also at 9:00 AM, FHFA House Price Index for January 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for a decrease in sales to 440 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 468 thousand in January.

• Also at 10:00 AM, the Conference Board's consumer confidence index for March. The consensus is for the index to increase to 78.6 from 78.1.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for March.

Weekly Update: Housing Tracker Existing Home Inventory up 6.2% year-over-year on March 24th

by Calculated Risk on 3/24/2014 04:27:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year, and finished up about 2.7% YoY.

Inventory in 2014 (Red) is now 6.2% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Black Knight (formerly LPS): House Price Index unchanged in January, Up 8.0% year-over-year

by Calculated Risk on 3/24/2014 01:43:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight (formerly LPS), Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Flat for the Month; Up 8.0 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services (formerly the LPS Data & Analytics division) released its latest Home Price Index (HPI) report, based on January 2014 residential real estate transactions. ... The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increase was less in January (8.0%) than in December (8.4%), November (8.5%) and October (8.8%), so this suggests price increases might be slowing.

The LPS HPI is off 14.0% from the peak in June 2006.

Note: The press release has data for the 20 largest states, and 40 MSAs. Prices increased in 10 of the 20 largest states in January and were unchanged in two. LPS shows prices off 44.3% from the peak in Las Vegas, off 36.8% in Orlando, and 34.9% off from the peak in Riverside-San Bernardino, CA (Inland Empire). "After many months of hitting new peaks, Texas and its major metros backed off trend of consecutive new highs."

Note: Case-Shiller for January will be released tomorrow.

Black Knight on Mortgages: "Nearly 1 million fewer loans in U.S. non-current population since last February"

by Calculated Risk on 3/24/2014 09:45:00 AM

According to Black Knight (formerly LPS) First Look report for February, the percent of loans delinquent decreased in February compared to January, and declined by more than 12% year-over-year.

Also the percent of loans in the foreclosure process declined further in January and were down 34% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 5.97% from 6.27% in January. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.22% in February from 2.48% in January.

The number of delinquent properties, but not in foreclosure, is down 419,000 properties year-over-year, and the number of properties in the foreclosure process is down 579,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for February in early April.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| February 2014 | January 2014 | February 2013 | |

| Delinquent | 5.97% | 6.27% | 6.80% |

| In Foreclosure | 2.22% | 2.35% | 3.38% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,749,000 | 1,851,000 | 1,927,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,242,000 | 1,289,000 | 1,483,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,115,000 | 1,175,000 | 1,694,000 |

| Total Properties | 4,106,000 | 4,315,000 | 5,104,000 |

Chicago Fed: "Economic activity increased in February"

by Calculated Risk on 3/24/2014 08:42:00 AM

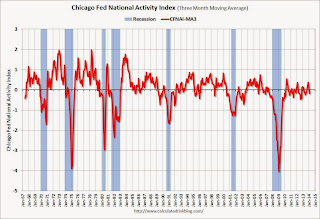

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth increased in February

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.14 in February from –0.45 in January. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.18 in February from +0.02 in January, marking its first reading below zero in six months. February’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in February (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, March 23, 2014

Sunday Night Futures

by Calculated Risk on 3/23/2014 08:33:00 PM

Jon Hilesenrath at the WSJ points out that even if the Fed starts raising rates a little earlier than expected, rates are expected to be below normal for a long time: Inside Fed Statement Lurks Hint on Rates

The Fed, in its official policy statement, said it planned to keep short-term rates below what it sees as appropriate for a normal economy even after the unemployment rate and inflation revert to typical levels.Monday:

In 2016, for example, the Fed projects the jobless rate will reach 5.4%, economic output will be growing at a rate near 3% and inflation will be just below 2%. That level of unemployment would be lower than the average over the past 50 years.

Yet officials see the Fed's target short-term interest rate at just over 2% at the end of 2016, well below the 4% they consider appropriate for an economy running on all cylinders.

• At 8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

• Early, Black Knight (formerly LPS) will release their monthly "First Look" at February mortgage performance data.

Weekend:

• Schedule for Week of March 23rd

• The Favorable Demographics for Apartments

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices are mixed with WTI futures at $99.21 per barrel and Brent at $106.92 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.51 per gallon (up sharply over the last month, but still down from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |