by Calculated Risk on 3/27/2014 07:27:00 PM

Thursday, March 27, 2014

Friday: February Personal Income and Outlays, Consumer Sentiment

Friday:

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 80.5, up from the preliminary reading of 79.9, but down from the February reading of 81.6.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for February 2014.

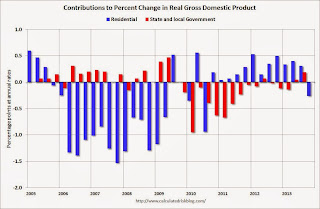

Here is an update based on the third estimate of Q4 GDP release today. The following graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments (red) appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local government contribution was zero in Q4 after revisions.

I expect state and local governments to make a small positive contribution to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.