by Calculated Risk on 2/28/2011 10:17:00 PM

Monday, February 28, 2011

Home Sales: Record Percentage of Cash Buyers in California

From Lauren Beale at the LA Times: Cash-only home sales rise in California

All-cash buyers grabbed a record 30.9% share of the Golden State's houses and condos in January ... Cash activity has been brisk for months in foreclosure-ridden areas such as Riverside and San Bernardino. But now, the cash buyer has become a major player in Southern California's most expensive communities, where cash deals account for as much as two-thirds of home sales.At the low end it is probably mostly investors. The high end has always had a fairly high percentage of cash buyers, but this is very high. The good news is these buyers will never have negative equity (unless they take out a mortgage).

...

In the Southland's $1-million-and-up market, 29.2% of buyers paid cash last year — the highest percentage since 1994, DataQuick statistics show. For homes selling for $5 million and up, 62.2% paid cash.

The large percentage of cash buyers is part of the reason that the MBA purchase index has not been tracking home sales very closely (it also appears that the NAR has been overstating sales).

Libya Updates

by Calculated Risk on 2/28/2011 05:23:00 PM

By request ...

• From the NY Times: Libya Wages Counterattack Against Rebels on 3 Fronts

Colonel Muammar el-Qaddafi’s forces struck back on three fronts on Monday, using fighter jets, special forces units and regular army troops in an escalation of hostilities that brought Libya closer to civil war.• From the NY Times: U.S. Readies Military Options on Libya

The attacks by the colonel’s troops on an oil refinery in central Libya and on cities on either side of the country ... showed that despite defections by the military, the government still possessed powerful assets, including fighter pilots willing to bomb Libyan cities.

• From the Telegraph: West ready to use force against Col Gaddafi amid chemical weapon fears

The Prime Minister disclosed that he would not rule out “the use of military assets” as Britain “must not tolerate this regime using military forces against its own people”. Britain and America are also thought to be considering arming rebel forces in Libya.• From al Jazeera: Live Blog - Libya March 1

...

Mr Cameron told MPs that Britain and its allies were considering using fighter jets to impose a no-fly zone over Libya

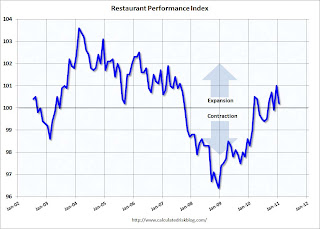

Restaurant Performance Index declines in January

by Calculated Risk on 2/28/2011 02:08:00 PM

This is one of several industry specific indexes I track each month.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The index declined to 100.2 in January, barely indicating expansion.

More "Blame it on the snow!"

Unfortunately the data for this index only goes back to 2002.

From the National Restaurant Association: Restaurant Performance Index Declined in January Amid Weather-Dampened Sales and Traffic Levels

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.2 in January, down 0.8 percent from its December level. Despite the decline, January marked the fourth time in the last five months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

Due in large part to extreme weather conditions in some parts of the country, sales levels were dampened in January. Thirty-nine percent of restaurant operators reported a same-store sales gain between January 2010 and January 2011, down from 48 percent of operators who reported higher same-store sales in December.

...

Restaurant operators also reported a net decline in customer traffic levels in January.

...

For the fourth consecutive month, restaurant operators reported a positive outlook for staffing gains in the months ahead.

Dallas Fed: Texas Manufacturing Activity Picks Up

by Calculated Risk on 2/28/2011 11:31:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks Up

Texas factory activity increased in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose to 10 following a reading near zero in January.This is the last of the regional Fed surveys for February. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

...

Labor market indicators continued to reflect more hiring, a longer workweek and rising labor costs. The employment index came in at a reading of 11, up from 9 last month. The hours worked index was unchanged at 4, while the wages and benefits index fell from 15 to 9.

...

Prices continued to climb in February. The raw materials price index edged up from 62 to 63, with 64 percent of firms noting an increase in input costs compared with only 1 percent noting a decrease.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through February), and averaged five Fed surveys (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

The ISM index for February will released tomorrow, Mar 1st. The consensus is for a slight decrease to 60.5 from the strong 60.8 in January.

The regional surveys suggest the ISM manufacturing index will be around 60 (strong expansion). The 60.8 reading in January was the highest level since May 2004, and any reading above 61.4 would be the highest since 1983.

Chicago PMI Strong in February, Pending Home Sales decline in January

by Calculated Risk on 2/28/2011 10:00:00 AM

• From the Chicago Business Barometer™ Grew: The overall index increased to 71.2 from 68.8 in January. This was above consensus expectations of 68.0. Note: any number above 50 shows expansion.

"EMPLOYMENT continued to show expansion;". The employment index decreased to a still strong 59.8 from 64.1.

"NEW ORDERS nudged upward, still at the highest level since December 1983;". The new orders index increased to 75.9 from 75.7.

This was another strong report.

• From the NAR: Pending Home Sales Decline in January

The Pending Home Sales Index,* a forward-looking indicator, declined 2.8 percent to 88.9 based on contracts signed in January from a downwardly revised 91.5 in December [revised down sharply from 93.7]. The index is 1.5 percent below the 90.3 level in January 2010 when a tax credit stimulus was in place. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This suggests existing home sales in February and March will be somewhat lower than in January.

Personal Income and Outlays Report for January

by Calculated Risk on 2/28/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $133.2 billion, or 1.0 percent ... Personal consumption expenditures (PCE) increased $23.7 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in January, in contrast to an increase of 0.3 percent in December.

...

The January change in disposable personal income (DPI) was affected by two large special factors. Reduced employee contributions for government social insurance ... boosted personal income in January by reducing the employee social security contribution rates ... The January change in DPI was affected by the expiration of the Making Work Pay provisions of the American Recovery and Reinvestment Act of 2009, which boosted personal current taxes and reduced DPI ... Excluding these two special factors ... DPI increased $11.4 billion, or 0.1 percent, in January

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Real PCE declined in January after increasing sharply in Q4. Note: The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter - so this still shows growth over Q4.

Also personal income less transfer payments increased again in January. This increased to $9,427 billion (SAAR, 2005 dollars) from $9,325 billion in December.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover, but has improved recently - and is still 3.2% below the previous peak.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover, but has improved recently - and is still 3.2% below the previous peak.The personal saving rate increased to 5.8% in January.

Personal saving as a percentage of disposable personal income was 5.8 percent in January, compared with 5.4 percent in December.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report. When the recession began, I expected the saving rate to rise to 8% or more. With a rising saving rate, consumption growth would be below income growth. But that 8% rate was just a guess. It is possible the saving rate has peaked, or it might rise a little further, but either way most of the adjustment has already happened.

The 1.0% increase in personal income was well above expectations of 0.4%, although spending only increased 0.2% (compared to expectations of 0.4%). The core price index for PCE increased 0.1 percent in January - slightly below expectations.

Overall this is a decent report. Even with the decline in real PCE, the 1.0% increase in income, the increase in the saving rate - and sharp increase in personal income less transfer payments - all were good news.

Weekend on U.S. economy:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

Sunday, February 27, 2011

Ireland to try to renegotiate bail-out terms

by Calculated Risk on 2/27/2011 08:24:00 PM

Earlier on U.S. economy:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

• From the Telegraph: Enda Kenny to call for bail-out to be renegotiated

Ireland's new leader [Enda Kenny] travels to Helsinki on Friday for a meeting ... with the German chancellor and French president over the EU and International Monetary Fund austerity programme.Watch the yield on Ireland's Ten Year bond today.

He will plead with the EU for reduced interest rates .... [and] will also ask that investors, often other European financial institutions, take on some of an £85 billion debt burden of Irish banks, currently carried by taxpayers.

• After the Friday meeting in Helsinki on March 4th, there will be a special eurozone debt crisis summit on March 11th.

• Here are the Ten Year yields for Portugal, Spain, Greece, and Belgium (ht Nemo)

Jobs, Jobs, Jobs

by Calculated Risk on 2/27/2011 03:38:00 PM

As a reminder, the weak payroll report for January was blamed on the snow. Usually I don't buy the weather excuses, but it did appear weather played a role this time. When the report was released, I wrote:

The 36,000 payroll jobs added was far below expectations of 150,000 jobs, however this was probably impacted by bad weather during the survey reference period. If so, there should be a strong bounce back in the February report.That is a key reason the consensus is so high for February. Bloomberg has the consensus at 180,000, MarketWatch has 200,000, Goldman's forecast is 200,000, and I heard ISI is at 230,000).

It will be useful to average the two months to estimate the current pace of payroll growth - especially if weather played a role in January and there is a strong bounce back in February.

And we have to remember the numbers are grim:

• There are 7.7 million fewer payroll jobs now than before the recession started in December 2007.

• Almost 14 million Americans are unemployed.

• Of those unemployed, 6.2 million have been unemployed for six months or more.

• Another 8.4 million are working part time for economic reasons,

• About 4 million more have left the labor force since the start of the recession (we can see this in the dramatic drop in the labor force participation rate),

• of those who have left the labor force, about 1 million are available for work, but are discouraged and have given up.

A simple calculation: If the economy is adding 125,000 jobs per month (average over two months), it would take over 5 years to add back the 7.7 million lost payroll jobs - and that doesn't even include population growth. Grim is an understatement.

Earlier:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

Schedule for Week of February 27th

by Calculated Risk on 2/27/2011 08:29:00 AM

Earlier: Summary for Week ending February 25th

The key report for this week will be the February employment report to be released on Friday, March 4th.

Other key reports include the Personal Income and Outlays report on Monday, the ISM manufacturing index on Tuesday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Thursday. Also Fed Chairman Ben Bernanke will deliver the Semiannual Monetary Policy Report to the Congress on Tuesday (Senate) and Wednesday (House).

8:30 AM: Personal Income and Outlays for January. The consensus is for a 0.4% increase in personal income and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.2%.

8:30 AM: New York Fed President William Dudley speaks on the economic outlook

8:45 AM: Boston Fed President Eric Rosengren, panel discussion, "Lessons Learned from the Global Meltdown."

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a slight decrease to a still very strong 68.0 (down from 68.8 in January).

10:00 AM: Pending Home Sales for January. The consensus is for a slight decline in pending sales (a leading indicator for existing home sales).

10:30 AM: Dallas Fed Manufacturing Survey for February. The Texas production index was down sharply last month to 0.2 (from 15.3 in December), but is expected to show improvement in February.

10:00 AM: ISM Manufacturing Index for February.

The consensus is for a decrease to 60.5 from the strong 60.8 in January. All of the regional manufacturing surveys showed strong improvement in February.

The consensus is for a decrease to 60.5 from the strong 60.8 in January. All of the regional manufacturing surveys showed strong improvement in February.The PMI was at 60.8% in January, the highest level since May 2004. Some forecasts are as high as 63, and any reading above 61.4 would be the highest since 1983.

10:00 AM: Construction Spending for January. The consensus is for a 0.4% decrease in construction spending.

10:00 AM: Fed Chairman Ben Bernanke testimony, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

All day: Light vehicle sales for February. Light vehicle sales are expected to increase to 12.7 million (Seasonally Adjusted Annual Rate), from 12.6 million in January.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate. Edmunds is forecasting: "Edmunds.com analysts predict that February's Seasonally Adjusted Annualized Rate (SAAR) will be 12.64 million, up from 12.54 in January 2011."

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has declined over the last few weeks suggesting weak home sales through the first few months of 2011.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for +180,000 payroll jobs in February, down slightly from the 187,000 reported in January.

10:00 AM: Fed Chairman Ben Bernanke testimony, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: Fed Beige Book, Informal review by the Federal Reserve Banks of current economic conditions in their Districts

2:15 PM: Atlanta Fed President Dennis Lockhart speaks on economic outlook

8:00 PM: Fed Chairman Ben Bernanke, "Challenges for State and Local Governments", At the Citizens Budget Commission Annual Dinner in New York

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims had been trending down over the last couple of months. The consensus is for a slight increase to 396,000 from 391,000 last week.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a slight increase to 59.5 from 59.4 in January.

11:00 AM: Minneapolis Fed President Narayana Kocherlakota speaks on labor markets and monetary policy

2:15 PM: Atlanta Fed President Dennis Lockhart speaks on the economy and labor

8:30 AM: Employment Report for February.

The consensus is for an increase of 179,000 non-farm payroll jobs in February, after the disappointing 36,000 jobs added in January.

The consensus is for an increase of 179,000 non-farm payroll jobs in February, after the disappointing 36,000 jobs added in January. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for February is in blue.

The consensus is for the unemployment rate to increase to 9.1% from 9.0% in January.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions - aligned at maximum job losses.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions - aligned at maximum job losses.This shows the severe job losses during the recent recession - there are currently 7.7 million fewer jobs in the U.S. than when the recession started.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for January. The consensus is for a 2.2% increase in orders.

10:00 AM: Fed Vice Chair Janet Yellen, Panel Discussion, Improving the International Monetary and Financial System, At the International Symposium of the Banque de France, Paris, France

Best Wishes to All!

Saturday, February 26, 2011

Libya Updates: Obama calls for Gaddafi to step down, U.N. meets tomorrow

by Calculated Risk on 2/26/2011 08:06:00 PM

Earlier on U.S. economy: Summary for Week ending February 25th

UPDATE: from the WSJ: U.N. Imposes Sanctions on Gadhafi

The United Nations Security Council Saturday night unanimously imposed an arms embargo on Libya, referred its leaders to the International Criminal Court and slapped financial and trade sanctions on Col. Moammar Gadhafi and his inner circle in an effort to stop them from killing more Libyan civilians.• From the WaPo: Obama calls for Gaddafi to step down as leader of Libya

"Widespread and systematic attacks currently taking place in Libya against the civilian population may amount to crimes against humanity" and "those responsible for the attacks" must be held accountable, the resolution said.

In a statement, the White House said Obama told Merkel that "when a leader's only means of staying in power is to use mass violence against his own people, he has lost the legitimacy to rule and needs to do what is right for his country by leaving now." Secretary of State Hillary Rodham Clinton issued a statement Saturday also demanding that Gaddafi step down.• The Telegraph blog that is updated frequently: Libya protests: live

23.53 Our New York correspondent Jon swaine has been at the UN, where Libya's ambassador defected earlier today. Read his full report here.• From al Jazeera: Live Blog - Libya Feb 27

23:42 The full UN Security Council is due to meet tomorrow at 4pm GMT (11am in NYC) to discuss possible sanctions against Gaddafi.

2:38am Al Jazeera understands the UN Security Council resolution will freeze the assets of six members of the Gaddafi family, including the Libyan leader - while 16 members of his administration will be slapped with a travel ban. Waiting on news of the vote...• From the WSJ: Pro-Rebel Officers Vow Defense of Eastern Libya

• From the NY Times: Long Bread Lines and Barricades in Libya’s Capital

Summary for Week ending February 25th

by Calculated Risk on 2/26/2011 02:36:00 PM

With the exception of housing, most of the U.S. economic data last week was fairly positive. We were also reminded of several potential downside risks to the U.S. economy, as falling house prices, higher oil prices, the European financial crisis, and state and local government cutbacks, were all in the news.

The focus last week was once again on the Middle East and North Africa, and especially on the historic and tragic events in Libya. These events have pushed U.S. oil prices to around $100 per barrel and have raised questions about the possible drag of higher oil prices on the U.S. economy.

The European financial crisis has been on the back burner, but yields are still elevated and there are key Euro Zone meetings scheduled in March. I expect this to be front page news again soon.

And a downward revision to state and local government spending contributed to the downward revision in the Q4 real GDP growth estimate, revised down to 2.8% from 3.2%. And several state budgets were in the news, especially the Wisconsin political battles.

The Case-Shiller house price index showed house prices are still falling – for the sixth consecutive month – and more house price declines are expected with the high levels of inventory and a high percentage of distressed sales. Eleven of the twenty Case-Shiller cities are now at new post-bubble lows: Atlanta, Charlotte, Chicago, Detroit, Las Vegas, Miami, New York, Phoenix, Portland (OR), Seattle and Tampa, and more will probably follow. Also new home sales remained weak in January.

These are all risks to 2011 economic growth.

But other economic news was more positive. On employment, all of the preliminary indicators suggested an increase in hiring. The four week average of initial weekly unemployment claims fell to the lowest level since 2008. The regional manufacturing surveys all suggest an increase in employment. The Reuters / University of Michigan consumer sentiment index was at the highest level in three years.

And growth in manufacturing continues to be strong. The Richmond Fed reported Manufacturing Activity Advanced at a Healthy Pace in February, and the the Kansas City Fed reported Manufacturing activity matched an all-time survey high in February. This suggests a strong ISM manufacturing report on March 1st.

Below is a summary of economic data last week mostly in graphs:

• Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

S&P/Case-Shiller reported that home prices are close to a post-bubble low.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.2% from the peak and still 2.4% above the May 2009 post-bubble bottom.

The Composite 20 index is also off 31.2% from the and only 0.8% above the May 2009 post-bubble bottom and will probably be at a new post-bubble low in January.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

From S&P:

From S&P:

Eleven MSAs posted new index level lows in December 2010, since their 2006/2007 peaks. These cities are Atlanta, Charlotte, Chicago, Detroit, Las Vegas, Miami, New York, Phoenix, Portland (OR), Seattle and Tampa.Prices are now falling just about everywhere, and more cities are hitting new post-bubble lows. Both composite indices are still slightly above the post-bubble low, but the indexes will probably be at new lows in early 2011.

• New Home Sales decreased in January

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 284 thousand. This is down from a revised 325 thousand in December.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 284 thousand. This is down from a revised 325 thousand in December.This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. New home sales have averaged 293 thousand per month (annual rate) over the last nine months - all below the previous record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of January.

The previous record low for January was 24 thousand in 2009 and 2010.

Starting in 1973 the Census Bureau broke down inventory into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke down inventory into three categories: Not Started, Under Construction, and Completed.The inventory of completed homes for sale fell to 78,000 units in January. And the combined total of completed and under construction is at the lowest level since this series started.

• January Existing Home Sales: 5.36 million SAAR, 7.6 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in January 2010 (5.36 million SAAR) were 2.7% higher than last month, and were 5.3% higher than January 2010.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change. According to the NAR, inventory decreased to 3.38 million in January from 3.56 million in December.

Although inventory decreased from December to January, inventory increased 3.1% YoY in January. This is the sixth consecutive month of year-over-year increases in inventory, although the increase in January was lower than the previous months. But any increase is bad news with the high level of inventory.

Although inventory decreased from December to January, inventory increased 3.1% YoY in January. This is the sixth consecutive month of year-over-year increases in inventory, although the increase in January was lower than the previous months. But any increase is bad news with the high level of inventory.Inventory should increase in February and March, and this is something to watch closely over the next few months.

This graph shows existing home sales Not Seasonally Adjusted (NSA).

This graph shows existing home sales Not Seasonally Adjusted (NSA).The red column in January is for 2011. Sales NSA were about the same level as the last three years. January is usually the weakest month of the year for existing home sales (followed by February). The real key is what happens in the spring and summer.

The bottom line: Sales increased slightly in January (using the old method to estimate sales), apparently due to an increase in investor purchases of distressed properties at the low end. Inventory remains very high, and the year-over-year increase in inventory is very concerning.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% to 15% or more in 2009 and 2010). The numbers released this week will probably be revised down significantly this summer.

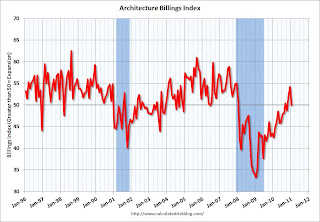

• AIA: Architecture Billings Index shows no change in January

From the American Institute of Architects: Billings at Architecture Firms Hold Steady in January

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year 2011 or so.

• Consumer Sentiment increases in February

The final February Reuters / University of Michigan consumer sentiment index increased to 77.5, the highest level in three years.

The final February Reuters / University of Michigan consumer sentiment index increased to 77.5, the highest level in three years.This was above the consensus forecast of 75.4.

In general consumer sentiment is a coincident indicator. This is still fairly low, but improving.

• Total REO decreased slightly in Q4

This graph from economist Tom Lawler shows an estimate of all the REO inventory. Lawler writes:

This graph from economist Tom Lawler shows an estimate of all the REO inventory. Lawler writes: Based on the FDIC’s QBP report, as well as preliminary data on REO for private-label securities (using Barclay’s Capital data, as I don’t have data from my other source yet), REO inventory at “the F’s,” FDIC-insured institutions, and PLS would look as follows [see graph]From CR: REO inventory is still below the levels in 2008 - but not much - and that was when prices were falling quickly. I think the various lenders are a little more careful disposing of REOs now, but the level of REOs suggest downward house price pressure.

• Other Economic Stories ...

• Q4 real GDP growth revised down to 2.8% annualized rate

• From Nick Timiraos: Home Sales Data Doubted

• From David Streitfeld at the NY Times: Shiller says house prices could fall 15% to 25%

• From MarketWatch: Consumer confidence jumps in February

• From the American Trucking Association: ATA Truck Tonnage Index Surged 3.8 Percent in January

• Unofficial Problem Bank list increases to 960 Institutions

Best wishes to all!

Buffett on Housing

by Calculated Risk on 2/26/2011 12:24:00 PM

A few excerpts from Warren Buffett's annual letter to shareholders.

On Housing:

A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some point.He wrote the same thing last year:

[W]ithin a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious.Last year I disagreed, but now I think a recovery will probably "begin" within "a year or so".

On Clayton (manufactured homes):

At Clayton, we produced 23,343 homes, 47% of the industry’s total of 50,046. Contrast this to the peak year of 1998, when 372,843 homes were manufactured. (We then had an industry share of 8%.)CR Note: This is close to the record low for manufacturing homes set in 2009 of 49.8 thousand units.

Clayton owns 200,804 mortgages that it originated. (It also has some mortgage portfolios that it purchased.) At the origination of these contracts, the average FICO score of our borrowers was 648, and 47% were 640 or below. Your banker will tell you that people with such scores are generally regarded as questionable credits.Note: The worst performing mortgages originated during the housing bubble were NOT protected by a government guarantee, instead they were the product of the Wall Street driven originate-to-distribute model. But I agree with Buffett's comments on how prudent lending "concentrates the mind", and about putting people into homes they can afford.

Nevertheless, our portfolio has performed well during conditions of stress. ...

Our borrowers get in trouble when they lose their jobs, have health problems, get divorced, etc. The recession has hit them hard. But they want to stay in their homes, and generally they borrowed sensible amounts in relation to their income. In addition, we were keeping the originated mortgages for our own account, which means we were not securitizing or otherwise reselling them. If we were stupid in our lending, we were going to pay the price. That concentrates the mind.

If home buyers throughout the country had behaved like our buyers, America would not have had the crisis that it did. Our approach was simply to get a meaningful down-payment and gear fixed monthly payments to a sensible percentage of income. This policy kept Clayton solvent and also kept buyers in their homes.

... a house can be a nightmare if the buyer’s eyes are bigger than his wallet and if a lender – often protected by a government guarantee – facilitates his fantasy. Our country’s social goal should not be to put families into the house of their dreams, but rather to put them into a house they can afford.

Unofficial Problem Bank list increases to 960 Institutions

by Calculated Risk on 2/26/2011 08:51:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 25, 2011.

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions for January 2011, which contributed to many changes for the Unofficial Problem Bank List. This week, there are three removals and 12 additions leaving the Unofficial Problem Bank List at 960 institutions. The net changes added $8.9 billion in assets, which is the largest weekly asset increase since June 18, 2010 when $19 billion was added. The average net weekly change has been about seven additions and $1.7 billion in assets. However, the aggregate assets on the list declined this week by $4.7 billion to $413.8 billion from $418.9 billion as 2010q3 financials were replaced by year-end figures. Positively, the change in financials caused a $13.6 billion decline in assets.CR Note: The FDIC released the Q4 Quarterly Banking Profile this week. The FDIC reported 884 official "problem" institutions at the end of 2010 (the highest since 1992) with $390 billion in assets. There are a total 6,529 commercial banks and 1,128 savings institutions, so about 11.5% are on the "problem" list. Assets of all institutions are $13.1 trillion, so problem institutions have just under 3% of total assets.

The three removals include the failed Valley Community Bank, St. Charles, IL ($124 million) and action terminations against Lafayette Community Bank, Lafayette, IN ($131 million) and American Continental Bank, City Of Industry, CA ($129 million).

Most notable among the 12 additions this week are BankAtlantic, Fort Lauderdale, FL ($4.5 billion Ticker: BBX); Bridgeview Bank Group, Bridgeview, IL ($1.5 billion); EVB, Tappahannock, VA ($1.1 billion Ticker: EVBS); PrimeSouth Bank, Blackshear, GA ($422 million); and West Pointe Bank, Oshkosh, WI ($409 million).

Other changes include the FDIC issuing a Prompt Corrective Action order against Seattle Bank, Seattle, WA ($468 million) and terminating one against Idaho First Bank, McCall, ID ($77 million).

After the monthly release of actions by the FDIC, it would not be unusual for the Unofficial Problem Bank List to trend down until the middle of next month as closings tend to outpace new order issuance during this part of the month. Until next week, try to have a safe & sound banking week.

Friday, February 25, 2011

Big Banks Warn of Mortgage Servicer Settlement Costs

by Calculated Risk on 2/25/2011 09:15:00 PM

Update: From Cheyenne Hopkins at American Banker: Don't Believe Everything You Read: The Real Skinny on Servicer Settlement Talks (ht Nemo)

Regulators have not agreed on a dollar figure, and $20 billion is in the words of one source involved in the negotiations "a crazy figure."From Nelson Schwartz and Eric Dash at the NY Times DealBook: 3 Banks Warn of Big Penalties in Mortgage Inquiries

Several big banks warned investors on Friday that they could face sizable financial penalties as a result of state and federal investigations into abusive mortgage practices.Earlier stories suggested the penalties and "equitable remedies" could total $20 billion for all mortgage servicers.

...

The state and federal inquiries “could result in material fines, penalties, equitable remedies (including requiring default servicing or other process changes), or other enforcement actions, and result in significant legal costs,” Bank of America said

Wells Fargo said in its filing that it was “likely that one or more of the government agencies will initiate some type of enforcement action,” including possible “civil money penalties.”

Citigroup acknowledged that federal and state regulators were investigating its foreclosure processes, which could result in increased expenses, fines and other legal remedies ...

Bank Failure #23 in 2011: Valley Community Bank, St. Charles, Illinois

by Calculated Risk on 2/25/2011 06:06:00 PM

Radioactive assets

Toxicity rise

by Soylent Green is People

From the FDIC: First State Bank, Mendota, Illinois, Assumes All of the Deposits of Valley Community Bank, St. Charles, Illinois

As of December 31, 2010, Valley Community Bank had approximately $123.8 million in total assets and $124.2 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22.8 million. ... Valley Community Bank is the 23rd FDIC-insured institution to fail in the nation this year, and the second in Illinois.It is Friday ...

Total REO: Private Label, Banks, and "Fs"

by Calculated Risk on 2/25/2011 04:54:00 PM

Yesterday I noted that the combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased 71% compared to Q4 2009 (year-over-year comparison). As I noted, this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph from economist Tom Lawler shows an estimate of all the REO inventory. Lawler writes:

Based on the FDIC’s QBP report, as well as preliminary data on REO for private-label securities (using Barclay’s Capital data, as I don’t have data from my other source yet), REO inventory at “the F’s,” FDIC-insured institutions, and PLS would look as follows [see graph]From CR: REO inventory is still below the levels in 2008 - but not much - and that was when prices were falling quickly. I think the various lenders are a little more careful disposing of REOs now, but the level of REOs suggest downward house price pressure.

The 2nd graph (repeated from yesterday) just shows the REO inventory for Fannie, Freddie and FHA through Q4 2010.

The 2nd graph (repeated from yesterday) just shows the REO inventory for Fannie, Freddie and FHA through Q4 2010.The REO inventory for the "Fs" has increased sharply over the last year, from 172,368 at the end of 2009 to a record 295,307 at the end of 2010. Although this slowed in Q4 - as the "Fs" slowed foreclosures - this will probably increase some more in 2011.

Fed's Yellen on Unconventional Monetary Policy and Communications

by Calculated Risk on 2/25/2011 03:20:00 PM

This speech from Fed Vice Chair Janet Yellen provides the Fed's view of the impact of QE2: Unconventional Monetary Policy and Central Bank Communications (see Effectiveness of Asset Purchases and the associated graphs).

Yellen also commented on forward guidance:

Down the road, once the recovery is well established and the appropriate time for beginning to firm the stance of policy appears to be drawing near, the FOMC will naturally need to adjust its "extended period" guidance and develop an alternative communications strategy to shape market expectations about the policy outlook.This is part of the timeline I outlined earlier this week: When will the Fed raise rates?

My view is the Fed will complete the $600 billion “QE2” large-scale asset purchase program (probably in June, but they may taper it off), then they will stop the reinvestment of maturing MBS and Treasury Securities (could be concurrent with the end of QE2), and then the FOMC will change the "extended period" language. That suggests the Fed will not raise until 2012 at the earliest.

Earlier today, Richmond Fed President Jeffrey Lacker suggested QE2 might end early, via MarketWatch:

Federal Reserve should seriously consider adjusting its $600 billion bond-buying program in light of a recent pickup in U.S. economic activity, said Jeffrey Lacker, president of the Richmond Federal Reserve Bank, on Tuesday.I think it is very unlikely the program will end early. Note: I've heard suggestions that high oil prices might lead to an expanded QE2 (or QE3) - that also seems unlikely to me at this point. It would probably take renewed weakness in the U.S. economy before we see additional stimulus.

...

“The distinct improvement in the economic outlook since the [bond-buying] program was initiated suggests taking that re-evaluation quite seriously,” Lacker said ...

Europe Update

by Calculated Risk on 2/25/2011 12:30:00 PM

A few notes and stories ...

• The Irish election is today. The polls stay open until 10 PM (5 PM ET).

Here is the Irish Times for election results. The yield on Ireland's Ten Year bond is up to 9.35% - very near the all time high.

• There is a meeting of several EU leaders, apparently including Angela Merkel and Nicolas Sarkozy, in Helsinki on March 4th, and then a special eurozone debt crisis summit on March 11th.

• Portugal will probably be high on the agenda. The yield on Portugal's Ten Year bond is at 7.55% - an all time high.

• There has been some concern about Italy because they import a large amount of oil from Libya. The yield on Italy's Ten Year bond is up to 4.85% - but the WSJ reports Italy’s €9.5B Bond Sale Goes Smoothly.

• And on oil, Bloomberg reports: Spain Cuts Speed Limit on Highways as Oil Surges on Libya (ht Brian)

Spain will cut the speed limit on its highways, slash the price of train tickets and increase the use of biofuels after oil prices surged because of turmoil in North Africa.• Here are the Ten Year yields for Spain, Greece, and Belgium. Still elevated ...

Spain will reduce the speed limit on highways to 110 kilometers per hour (68 miles per hour) from 120 kilometers per hour ...

Consumer Sentiment increases in February

by Calculated Risk on 2/25/2011 09:55:00 AM

The final February Reuters / University of Michigan consumer sentiment index increased to 77.5, the highest level in three years.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was above the consensus forecast of 75.4.

In general consumer sentiment is a coincident indicator. This is still fairly low, but improving.

Q4 real GDP growth revised down to 2.8% annualized rate

by Calculated Risk on 2/25/2011 08:30:00 AM

From the BEA: Gross Domestic Product, 4th quarter 2010 (second estimate)

The small downward revision came mostly from PCE, imports, and state and local government expenditures (see table at bottom for changes in contribution to GDP).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

The dashed line is the median growth rate of 3.05%. The current recovery is still below trend growth.

The following table shows the changes from the advance release (this is the Contributions to Percent Change in Real Gross Domestic Product).

| Contributions to Percent Change in Q4 Real Gross Domestic Product | |||

|---|---|---|---|

| Advance | 2nd Estimate (Revision) | Change | |

| Percent change at annual rate: | |||

| Gross domestic product | 3.2 | 2.8 | -0.4 |

| Percentage points at annual rates: | |||

| Personal consumption expenditures | 3.04 | 2.88 | -0.16 |

| Goods | 2.26 | 2.2 | -0.06 |

| Durable goods | 1.48 | 1.44 | -0.04 |

| Nondurable goods | 0.78 | 0.76 | -0.02 |

| Services | 0.78 | 0.68 | -0.1 |

| Gross private domestic investment | -3.2 | -3.13 | 0.07 |

| Fixed investment | 0.5 | 0.57 | 0.07 |

| Nonresidential | 0.43 | 0.51 | 0.08 |

| Structures | 0.02 | 0.11 | 0.09 |

| Equipment and software | 0.41 | 0.39 | -0.02 |

| Residential | 0.08 | 0.06 | -0.02 |

| Change in private inventories | -3.7 | -3.7 | 0 |

| Net exports of goods and services | 3.44 | 3.35 | -0.09 |

| Exports | 1.04 | 1.18 | 0.14 |

| Goods | 0.85 | 0.99 | 0.14 |

| Services | 0.19 | 0.19 | 0 |

| Imports | 2.4 | 2.17 | -0.23 |

| Goods | 2.29 | 2.07 | -0.22 |

| Services | 0.11 | 0.11 | 0 |

| Government consumption expenditures and gross investment | -0.11 | -0.31 | -0.2 |

| Federal | -0.01 | -0.02 | -0.01 |

| National defense | -0.11 | -0.12 | -0.01 |

| Nondefense | 0.1 | 0.1 | 0 |

| State and local | -0.1 | -0.29 | -0.19 |

Thursday, February 24, 2011

Hotels: RevPAR up 10.2% compared to same week in 2010

by Calculated Risk on 2/24/2011 10:46:00 PM

Here is the weekly update on hotels from HotelNewsNow.com: San Diego tops ADR, RevPAR weekly increases

Overall, the U.S. hotel industry’s occupancy increased 6.7% to 59.1%, ADR was up 3.3% to US$99.32, and RevPAR finished the week up 10.2% to US$58.72.Note: RevPAR: Revenue per Available Room.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The occupancy rate really fell off a cliff in the 2nd half of 2008, and then 2009 was the worst year for the occupancy rate since the Great Depression. The occupancy rate started to improve in the Spring of 2010, and was above the 2008 rates later in the year.

However, so far, 2011 is closer to the weak occupancy rates of 2009 and early 2010 than to the median for 2000 through 2007 - although it does appear occupancy improved last week.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Earlier today:

• New Home Sales decrease in January

• Home Sales: Distressing Gap

• Fannie, Freddie, FHA combined REO Inventory at Record Level

Fannie, Freddie, FHA combined REO Inventory at Record Level

by Calculated Risk on 2/24/2011 06:37:00 PM

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased to a record 295,307 units at the end of Q4, although REO inventory decreased slightly for both Fannie Mae and Freddie Mac in Q4 (compared to Q3). The REO inventory increased 71% compared to Q4 2009 (year-over-year comparison).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q4 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 172,368 at the end of 2009 to a record 295,307 at the end of 2010.

From Fannie Mae: Fannie Mae Reports Fourth-Quarter and Full-Year 2010 Results

Given the large number of seriously delinquent loans in our single-family guaranty book of business and the large current and anticipated supply of single-family homes in the market, we expect it will take years before our REO inventory approaches pre-2008 levels.Also, this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs.

Freddie Mac reports smaller loss, Expects falling house prices, Requests $500 Million from Treasury

by Calculated Risk on 2/24/2011 04:34:00 PM

From Freddie Mac: Freddie Mac Fourth Quarter 2010 Financial Results

Freddie Mac today reported a net loss of $113 million for the quarter ended December 31, 2010, compared to a net loss of $2.5 billion for the quarter ended September 30, 2010. For the full-year 2010, the company reported a net loss of $14.0 billion, compared to a net loss of $21.6 billion for the full-year 2009.Freddie Mac reported that REO inventory was at 72,079 at the end of Q4, up 60% from Q4 2009 (45,047), but down slightly from Q3 2010.

...

[The FHFA] as Conservator, will submit a $500 million draw request to Treasury ...

“As we begin 2011, the housing recovery remains vulnerable to high levels of unemployment, delinquencies and foreclosures,” [Freddie Mac Chief Executive Officer Charles E. Haldeman, Jr.] said. “Nevertheless, certain economic indicators showed improvement in late 2010. While this trend offers some encouragement, we expect national home prices to decline this year as housing will continue to take some time to recover."

Misc: Another Solid Manufacturing Survey, Mortgage Rates Fall, Libya Updates

by Calculated Risk on 2/24/2011 03:04:00 PM

UPDATE: CNBC: US Cannot Confirm Rumors Gaddafi Shot; Oil Tumbles

• From the Kansas City Fed: Manufacturing activity matched an all-time survey high in February

The month-over-month composite index was 19 in February, up from 7 in January and 14 in December. This reading matched all-time survey highs reached several times from late 2003 to early 2005.This follows solid reports from the NY Fed (Empire State), Philly Fed, and the Richmond Fed. The Texas survey will be released on Monday, Feb 28th, and these surveys suggest a strong reading in the ISM manufacturing survey to be released on March 1st.

...

The production index rose to 23, its highest level since early 2006, and the shipments, new orders, and order backlog indexes also increased. The employment index jumped from 8 to 23, a ten-year high, and the new orders for exports index also edged higher.

...

Price indexes generally increased, or remained elevated from last month’s record high.

• From Freddie Mac: 30-Year Fixed-Rate Mortgage Eases Just Below 5 Percent

30-year fixed-rate mortgage (FRM) averaged 4.95 percent with an average 0.6 point for the week ending February 24, 2011, down from last week when it averaged 5.0 percent. Last year at this time, the 30-year FRM averaged 5.05 percent.Libya updates:

• From the NY Times: Qaddafi Strikes Back as Rebels Close In on Libyan Capital

• From the WSJ: Libya Rebels Vow Offensive as Gadhafi Blames al Qaeda

• The Telegraph blog that is updated frequently: Libya protests: live

• From al Jazeera: Live Blog - Libya Feb 24

• From Jim Hamilton at Econbrowser: Libya, oil prices, and the economic outlook

[O]ne wouldn't begin to anticipate significant effects on U.S. GDP until the price of oil got above about $130 a barrel, or until the second half of this year. ... My bottom line is that events as they have unfolded so far are not in the same ballpark as the major historical oil supply disruptions, and are unlikely to produce big enough economic multipliers that they could precipitate a new economic downturn. ... But the worry of course is that the big geopolitical changes we've been seeing didn't stop with Tunisia, and didn't stop with Egypt. So maybe it's not a good idea to assume it's all going to stop with Libya, either.Earlier: New Home Sales

• New Home Sales decrease in January

Existing Home Sales:

• January Existing Home Sales: 5.36 million SAAR, 7.6 months of supply

• Existing Home Inventory increases 3.1% Year over Year

House Prices:

• Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

• Real House Prices fall to 2000 Levels, Update on NAR Overstating Sales

• House Prices: Price-to-rent, Price-to-median Household Income

Graph Galleries: New Home sales, existing home sales, House prices

Home Sales: Distressing Gap

by Calculated Risk on 2/24/2011 12:41:00 PM

Note: The National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers. As I noted in January, this benchmarking is expected to result in significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009 and 2010. Even with these revisions, most of the following "distressing gap" will remain.

This graph shows existing home sales (left axis) and new home sales (right axis) through January. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the homebuyer tax credits (the initial credit in 2009, followed by the 2nd credit in 2010). There were also two smaller bumps for new home sales related to the tax credits. The recent increase in existing home sales (before downward revisions) appears to be due to a combination of lower prices and investors buying low end properties.

Note: it is important to note that existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

In a few years - when the excess housing inventory is absorbed and the number of distressed sales has declined significantly - I expect existing home-to-new home sales to return to something close to this historical relationship.

New Home Sales decrease in January

by Calculated Risk on 2/24/2011 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 284 thousand. This is down from a revised 325 thousand in December.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in January 2011 were at a seasonally adjusted annual rate of 284,000 ... This is 12 6 12.6 percent (±11.2%) below the revised December rate of 325,000 and is 18.6 percent (±15.4%) below the January 2010 estimate of 349,000.And a long term graph for New Home Months of Supply:

Months of supply increased to 7.9 in January from 7.0 months in December. The all time record was 12.1 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply increased to 7.9 in January from 7.0 months in December. The all time record was 12.1 months of supply in January 2009. This is still high (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of January was 188,000. This represents a supply of 7.9 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale fell to 78,000 units in January. And the combined total of completed and under construction is at the lowest level since this series started.

This is the "good" news - in most areas the 'completed' and 'under construction' inventory of new homes is fairly lean.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of January.

The previous record low for January was 24 thousand in 2009 and 2010.

This was below the consensus forecast of 310 thousand homes sold (SAAR).

New home sales have averaged 293 thousand per month (annual rate) over the last nine months - all below the previous record low. Another very weak report ...

Weekly Initial Unemployment Claims decrease to 391,000

by Calculated Risk on 2/24/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 19, the advance figure for seasonally adjusted initial claims was 391,000, a decrease of 22,000 from the previous week's revised figure of 413,000. The 4-week moving average was 402,000, a decrease of 16,500 from the previous week's revised average of 418,500.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 16,500 to 402,000.

The sharp drop in the 4-week average since late last year suggests some improvement in the labor market. There is nothing magical about the 400,000 level, but breaking below that level would be a good sign.

Wednesday, February 23, 2011

Report: $20 Billion Mortgage Servicer Settlement being Discussed

by Calculated Risk on 2/23/2011 09:39:00 PM

From Nick Timiraos, Dan Fitzpatrick and Ruth Simon at the WSJ: Mortgage Deal Takes Shape

The Obama administration is trying to push through a settlement over mortgage-servicing breakdowns ... some state attorneys general and federal agencies are pushing for banks to pay more than $20 billion in civil fines or to fund a comparable amount of loan modifications for distressed borrowers ...This is just preliminary - and is just a broad outline of a possible settlement. This is the first I've heard of a possible number for fines and/or loan modifications.

ATA Truck Tonnage Index increased in January

by Calculated Risk on 2/23/2011 06:22:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Surged 3.8 Percent in January

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 3.8 percent in January after rising a revised 2.5 percent in December 2010. The latest jump put the SA index at 117.1 (2000=100) in January, which was the highest level since January 2008. In December, the SA index equaled 112.7.

...

ATA Chief Economist Bob Costello said that he was very pleased with January’s robust gain, especially considering the winter storms during the month. “Many fleets told us that freight was solid in January, although operations were as challenge due to the winter storms that hit large parts of the country.” Costello also stated that the latest tonnage numbers indicate that the economy is growing at a good clip early in 2011 and he expects a solid first half of the year. “At this point, the biggest threat is the recent run-up in oil prices, which could dampen consumer spending.”

Click on map for graph gallery.

Click on map for graph gallery.This graph from the ATA shows the Truck Tonnage Index since Jan 2007.

This is the highest level since January 2008 - and truck tonnage is increasing again after stalling out last spring and summer. I agree with Costello that the biggest short term threat to the economy is high oil prices.

Earlier posts on existing home sales and home prices:

• January Existing Home Sales: 5.36 million SAAR, 7.6 months of supply

• Existing Home Inventory increases 3.1% Year over Year

• Real House Prices fall to 2000 Levels, Update on NAR Overstating Sales

• Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

• House Prices: Price-to-rent, Price-to-median Household Income

Real House Prices and the Unemployment Rate

by Calculated Risk on 2/23/2011 03:13:00 PM

Back in 2009, when the house price bottom callers were out in force, I pointed out that real house prices usually bottom after the unemployment rate peaks - and sometimes several years after the peak (like in the '90s).

Below is a comparison of real house prices and the unemployment rate using the Corelogic house price index (starts in 1976) and the Case-Shiller Composite 10 index (starts in 1987). Both indexes are adjusted by CPI less shelter.

Click on image for larger graph in graph gallery.

Click on image for larger graph in graph gallery.

The two previous national declines in real house prices are evident on the graph (early '80s and early '90s). The dashed green lines are drawn at the peak of the unemployment rate following the peak in house prices.

In the early '80s, real house prices declined until the unemployment rate peaked, and then increased sluggishly for a few years. Following the late 1980s housing bubble, real house prices declined for several years after the unemployment rate peaked.

Although there are periods when there is no relationship between the unemployment rate and house prices - like during the bursting of the stock market bubble - this graph suggests that house prices do not bottom in real terms until the unemployment rate has peaked - and probably not until a few years later (the recent housing bubble dwarfed the previous housing bubbles, and the bust will probably take some time).

Clearly this analysis was correct since real house prices are now at post-bubble lows! I'd expect real prices (inflation adjusted) to fall for another 2 or 3 years, even if nominal prices bottom in 2011.

Fed's Hoenig: Financial Reform: Post Crisis?

by Calculated Risk on 2/23/2011 02:02:00 PM

From Kansas City Fed President Thomas Hoenig: Financial Reform: Post Crisis?

Fifteen years ago, I gave a speech entitled “Rethinking Financial Regulation,” which summarized the major threats facing our financial system. My suggestion then was to take steps to reduce interdependencies among large institutions and to limit them to relatively safe activities if they chose to provide essential banking and payments services and be protected by the federal safety net. I also argued that safety net protection and public assistance should not be extended to large organizations extensively engaged in nontraditional and high-risk activities. A final point of those remarks was that central banks must pursue policies that preserve financial stability. I am going to repeat those suggestions today, and as often as the opportunity allows. History is on my side.I don't always agree with Hoenig, but I think he is correct about the large banks.

Today, I am convinced that the existence of too big to fail financial institutions poses the greatest risk to the U.S. economy. The incentives for risk-taking have not changed post-crisis and the regulatory factors that helped create the crisis remain in place. We must make the largest institutions more manageable, more competitive, and more accountable. We must break up the largest banks, and could do so by expanding the Volcker Rule and significantly narrowing the scope of institutions that are now more powerful and more of a threat to our capitalistic system than prior to the crisis.

Earlier posts on existing home sales and home prices:

• January Existing Home Sales: 5.36 million SAAR, 7.6 months of supply

• Existing Home Inventory increases 3.1% Year over Year

• Real House Prices fall to 2000 Levels, Update on NAR Overstating Sales

• Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

• House Prices: Price-to-rent, Price-to-median Household Income

Existing Home Inventory increases 3.1% Year over Year

by Calculated Risk on 2/23/2011 11:30:00 AM

Earlier the NAR released the existing home sales data for January; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

IMPORTANT: On a seasonal basis, inventory usually bottoms in December and January, and then will start increasing again in February and March. Since the NAR "months-of-supply" metric uses Seasonally Adjusted (SA) sales, but Not Seasonally Adjusted (NSA) inventory, this seasonal decline in inventory leads to a lower "months-of-supply" in December and January.

The key is to recognize the seasonal pattern, and watch the YoY change in inventory.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Although inventory decreased from December to January, inventory increased 3.1% YoY in January. This is the sixth consecutive month of year-over-year increases in inventory, although the increase in January was lower than the previous months. But any increase is bad news with the high level of inventory.

Inventory should increase in February and March, and this is something to watch closely over the next few months.

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red column in January is for 2011.

Sales NSA were about the same level as the last three years. January is usually the weakest month of the year for existing home sales (followed by February). The real key is what happens in the spring and summer.

The bottom line: Sales increased slightly in January (using the old method to estimate sales), apparently due to an increase in investor purchases of distressed properties at the low end. The NAR noted "Investors accounted for 23 percent of purchases in January, up from 20 percent in December and 17 percent in January 2010 ... Distressed homes edged up to a 37 percent market share in January from 36 percent in December"

Inventory remains very high, and the year-over-year increase in inventory is very concerning.