by Calculated Risk on 4/30/2009 11:46:00 PM

Thursday, April 30, 2009

Chrysler Bankruptcy Issues

For those interested in the legal issues surrounding the Chrysler bankruptcy, here are a couple of posts from attorney Steven Jakubowski.

First, an overview of situation and Chrysler balance sheet:

Part I: Assessing The Financial Carnage

Second, a discussion of some of the legal issues:

Part II: Testing The Limits Of Section 363 Sales

Jakubowski concludes:

So, who will win? Really, only the true speculator and/or holder of Chrysler credit default swaps will (and perhaps Fiat if they--unlike their predecessors--can make it work), as my first post on the financial carnage at Chrysler demonstrates. My guess is that after much briefing, discovery, and expedited litigation over the next 60 days, Judge Gonzalez will show enough angst to worry both sides that they stand to lose, thus resulting in a compromise that settles the matter and allows the transaction to go forward. But with all Chrysler plants and operations now idled pending a final sale, the pressure to get the deal consummated and return people to work will be so overwhelming that it's hard to imagine Judge Gonzalez not approving the transaction in some form that's acceptable to everyone (except perhaps the dissenting lenders).

New Homes Demolished in Victorville, CA

by Calculated Risk on 4/30/2009 08:49:00 PM

Hat tip to several - thanks! Note: Victorville is east of Los Angeles at the southern edge of the Mojave desert.

Report: Stress Test Results Delayed

by Calculated Risk on 4/30/2009 08:34:00 PM

From Bloomberg: U.S. Stress Test Results Delayed as Early Conclusions Debated

The Federal Reserve will postpone the release of stress tests on the biggest U.S. banks while executives debate preliminary findings with examiners ... The results, originally scheduled for publication on May 4, now may not be revealed until toward the end of next week ... A new release date may be announced as soon as tomorrow, they said.Note that President Obama announced today that GMAC would be receiving government aide (as part of Chrysler deal, GMAC will takeover all financing of Chrysler vehicles). GMAC is one of the 19 banks undergoing stress tests.

CNBC: Stress Test Results for Each Bank May be Released

by Calculated Risk on 4/30/2009 05:54:00 PM

From CNBC: US May Release Stress Test Results for Specific Banks

U.S. officials are leaning toward announcing the "stress test" results of individual banks next week instead of just summary results ...Transparency is important. It seems the basic principle should be: Banks that require public support should disclose the details of the stress tests to the public.

The plan on exactly how to release the results "is not very far along," the source said, adding that regulators are looking to disclose a lot of supervisory information about banks that is usually kept confidential.

If a bank does not want to disclose details of the stress test - no problem, they are a private enterprise. But shouldn't they immediately return any TARP money and stop using any special Fed/FDIC/Treasury liquidity programs?

April Economic Summary in Graphs

by Calculated Risk on 4/30/2009 04:00:00 PM

Here is a collection of real estate and economic graphs for data released in April ...

New Home Sales in March

New Home Sales in MarchThe first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the lowest sales for March since the Census Bureau started tracking sales in 1963. (NSA, 34 thousand new homes were sold in March 2009; the previous low was 36 thousand in March 1982).

From: New Home Sales: 356 Thousand SAAR in March

Housing Starts in March

Housing Starts in MarchTotal housing starts were at 510 thousand (SAAR) in March, just above the revised record low of 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 358 thousand in March; just above the revised record low in January (356 thousand).

From: Housing Starts: Near Record Low

Construction Spending in February

Construction Spending in FebruaryThis graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

"Residential construction was at a seasonally adjusted annual rate of $275.1 billion in February, 4.3 percent below the revised January estimate of $287.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $390.7 billion in February, 0.3 percent above the revised January estimate of $389.5 billion."

From: Construction Spending Declines in February

March Employment Report

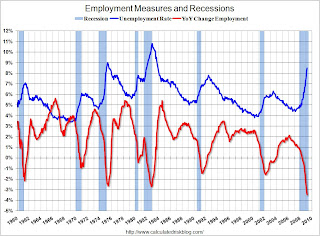

March Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 663,000 in March. January job losses were revised to

741,000. The economy has lost almost 3.3 million jobs over the last 5 months, and over 5 million jobs during the 15 consecutive months of job losses.

The unemployment rate rose to 8.5 percent; the highest level since 1983.

From: Employment Report: 663K Jobs Lost, 8.5% Unemployment Rate

March Retail Sales

March Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

On a monthly basis, retail sales decreased 1.1% from February to March (seasonally adjusted), but sales are off 10.7% from March 2008 (retail and food services decreased 9.4%). Automobile and parts sales declined 2.3% in March (compared to February), but excluding autos, all other sales declined -0.9%.

From: Retail Sales Decline in March

LA Port Traffic in March

LA Port Traffic in MarchThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 6% below last March and 35% above last month.

Outbound traffic was 9.8% below March 2008, and 25% above February.

From: LA Port Import Traffic Rebounds

U.S. Imports and Exports Through February

U.S. Imports and Exports Through FebruaryThe first graph shows the monthly U.S. exports and imports in dollars through February 2009. The recent rapid decline in foreign trade continued in February. Note that a large portion of the recent decline in imports was related to the fall in oil prices, however the decline in February was mostly non-oil related.

From: U.S. Trade Deficit: Lowest Since 1999

March Capacity Utilization

March Capacity UtilizationThis is some serious cliff diving. Also - since capacity utilization is at a record low (the series starts in 1967), there is little reason for investment in new production facitilies.

The Federal Reserve reported that "industrial production fell 1.5 percent in March after a similar decrease in February. For the first quarter as a whole, output dropped at an annual rate of 20.0 percent, the largest quarterly decrease of the current contraction. At 97.4 percent of its 2002 average, output in March fell to its lowest level since December 1998 and was nearly 13 percent below its year-earlier level.

From: Industrial Production Declines Sharply in March

NAHB Builder Confidence Index in April

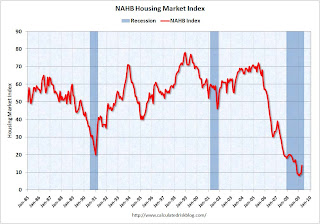

NAHB Builder Confidence Index in AprilThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 14 in April from 9 in March. The record low was 8 set in January.

The increase in April follows five consecutive months at either 8 or 9.

From: NAHB: Builder Confidence Increases in April

Architecture Billings Index for March

Architecture Billings Index for March"After a series of historic lows, the Architecture Billings Index (ABI) was up more than eight points in March. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI rating was 43.7, up from the 35.3 mark in February. This was the first time since September 2008 that the index was above 40..."

From: Architecture Billings Index Increases in March

Vehicle Miles driven in February

Vehicle Miles driven in FebruaryThis graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis.

From: DOT: U.S. Vehicle Miles Off 0.9% in February

Existing Home Sales in March

Existing Home Sales in March This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2009 (4.57 million SAAR) were 3.0% lower than last month, and were 7.1% lower than March 2008 (4.92 million SAAR).

It's important to note that about 45% of these sales were foreclosure resales or short sales. Although these are real transactions, this means activity (ex-distressed sales) is under 3 million units SAAR.

From: Existing Home Sales Decline in March

Existing Home Inventory March

Existing Home Inventory MarchThis graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.74 million in March. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Typically inventory increases slightly in March, and then really increases over the next few months of the year until peaking in the summer. This decrease in inventory was small, and the next few months will be key for inventory.

Also, most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs - this is possible, but not confirmed.

From: Existing Home Sales Decline in March

Case Shiller House Prices for February

Case Shiller House Prices for FebruaryThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.6% from the peak, and off 2.1% in February.

The Composite 20 index is off 30.7% from the peak, and off 2.2% in February.

From: Case-Shiller: House Prices Fall Sharply in February

Homeownership Rate for Q1

Homeownership Rate for Q1The homeownership rate decreased to 67.3% and is now back to the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased because of demographics and changes in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

From: Q1 2009: Homeownership Rate at 2000 Levels

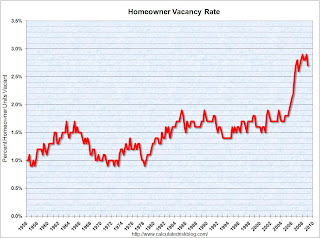

Homeownership Vacancy Rate Q1

Homeownership Vacancy Rate Q1The homeowner vacancy rate was 2.7% in Q1 2009.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

This leaves the homeowner vacancy rate about 1.0% above normal ...

From: Q1 2009: Homeownership Rate at 2000 Levels

Rental Vacancy Rate for Q1

Rental Vacancy Rate for Q1The rental vacancy rate was steady at 10.1% in Q1 2009.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%.

From: Q1 2009: Homeownership Rate at 2000 Levels

Unemployment Claims

Unemployment ClaimsThis graph shows weekly claims and continued claims since 1971.

The four week moving average is at 637,250, off 21,500 from the peak 3 weeks ago.

Continued claims are now at 6.27 million - the all time record.

From: Unemployment Claims: Record Continued Claims

Restaurant Performance Index for March

Restaurant Performance Index for March"The outlook for the restaurant industry improved in March, as the National Restaurant Association’s comprehensive index of restaurant activity rose for the third consecutive month. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.7 in March, up 0.2 percent from February and 1.3 percent during the last three months."

From: Restaurant Performance Index Increases Slightly

New Home Sales: March

New Home Sales: MarchThis graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in March 2009 were at a seasonally adjusted annual rate of 356,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.From: New Home Sales: 356 Thousand SAAR in March

This is 0.6 percent (±19.0%)* below the revised February rate of 358,000 and is 30.6 percent (±10.7%) below the March 2008 estimate of 513,000.

New Home Months of Supply: March

New Home Months of Supply: MarchThere were 10.7 months of supply in March - significantly below the all time record of 12.5 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of March was 311,000. This represents a supply of 10.7 months at the current sales rate."

From: New Home Sales: 356 Thousand SAAR in March

Hotel Occupancy Off 8.4 Percent

by Calculated Risk on 4/30/2009 02:05:00 PM

From HotelNewsNow.com: STR reports U.S. data for week ending 25 April

In year-over-year measurements, the industry’s occupancy fell 8.4 percent to end the week at 59.4 percent. Average daily rate dropped 6.1 percent to finish the week at US$100.44. Revenue per available room [RevPAR] for the week decreased 14.1 percent to finish at US$59.67.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 9.6% from the same period in 2008.

The average daily rate is down 6.1%, so RevPAR is off 14.1% from the same week last year.

The Q1 advance GDP report showed a 44.2% annualized in decline in non-residential structure investment, and I expect lodging investment to decline even more over the next 18 to 24 months. Why build more hotels with RevPAR off 14% YoY?

Chrysler Bankruptcy Announcement at Noon ET

by Calculated Risk on 4/30/2009 11:40:00 AM

From CNBC: Chrysler To File for Bankruptcy, Sources Tell CNBC

Chrysler will file for bankruptcy ... two administration officials said Thursday.Here is the CNBC feed.

...

A statement from President Barack Obama and members of his autos task force on Chrysler's situation and the auto industry is scheduled for 12 Noon EST.

...

The stance will likely set the tone for similar discussions with bondholders of General Motors which is now on the clock to restructure its operations by the end of May.

Restaurant Performance Index Increases Slightly

by Calculated Risk on 4/30/2009 11:06:00 AM

Note: Any reading below 100 shows contraction. So the improvement in the index to 97.7 means the business is still contracting, but contracting at a slower pace.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved as the Restaurant Performance Index Rose for the Third Consecutive Month

The outlook for the restaurant industry improved in March, as the National Restaurant Association’s comprehensive index of restaurant activity rose for the third consecutive month. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.7 in March, up 0.2 percent from February and 1.3 percent during the last three months.

“Although the RPI remained below 100 for the 17th consecutive month, which signals contraction, there are clear signs of improvement,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Restaurant operators reported a positive six-month economic outlook for the first time in 18 months, and capital spending plans rose to a 9-month high.”

...

Restaurant operators also reported negative customer traffic levels for the 19th consecutive month in March.

...

Capital spending activity in the restaurant industry held relatively steady in recent months.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007.

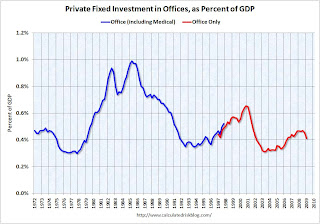

Q1: Office, Mall and Lodging Investment

by Calculated Risk on 4/30/2009 09:27:00 AM

Here are some graphs of office, mall and lodging investment through Q1 2009 based on the underlying detail data released this morning by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.33% of GDP in Q3 2008 and is now declining sharply (0.28% in Q1 2009).

I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. As projects are completed, mall investment should fall much further.

Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. As projects are completed, mall investment should fall much further.

As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said earlier this year:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."

The third graph shows office investment as a percent of GDP since 1972. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

The third graph shows office investment as a percent of GDP since 1972. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

The non-residential structures investment bust is here and will continue for some time.

Unemployment Claims: Record Continued Claims

by Calculated Risk on 4/30/2009 08:45:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 25, the advance figure for seasonally adjusted initial claims was 631,000, a decrease of 14,000 from the previous week's revised figure of 645,000. The 4-week moving average was 637,250, a decrease of 10,750 from the previous week's revised average of 648,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 18 was 6,271,000, an increase of 133,000 from the preceding week's revised level of 6,138,000. The 4-week moving average was 6,076,000, an increase of 131,500 from the preceding week's revised average of 5,944,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 637,250, off 21,500 from the peak 3 weeks ago.

Continued claims are now at 6.27 million - the all time record.

Next week I'll add the chart that normalizes the data by covered employment.

This is another very weak report, however the decline in the four-week average of weekly claims suggests there is a reasonable chance that the peak in weekly claims has happened for this cycle.

Wednesday, April 29, 2009

Chrysler Deal Collapses, Bankruptcy all but Certain

by Calculated Risk on 4/29/2009 11:57:00 PM

From the NY Times: Chrysler Bankruptcy Looms as Deal on Debt Falters

Last-minute efforts by the Treasury Department to win over recalcitrant Chrysler debtholders failed Wednesday night, setting up a near-certain bankruptcy filing by the American automaker ... Chrysler was expected to seek Chapter 11 protection on Thursday ...It sounds like the Administration expects a short bankruptcy. It will be interesting to see if the debtholders do better than the $2.25 billion they were offered.

Milken Conference: Credit Markets and the Role of Finance

by Calculated Risk on 4/29/2009 10:39:00 PM

A couple of videos from the Milken conference. The first one includes Lewis Ranieri, who is generally given significant credit for creating the private MBS market, and has been warning about the MBS market for several years.

Ranieri makes a number of comments on housing starting at 11:50. I disagree with his assertion about prices being near the bottom - although it is probably true in some areas.

The second video is on the Credit Markets (ht Bob_in_MA). He suggests the discussion is interesting near the end when Milken draws parallels to the 1970s:

More Chrysler: Treasury Increases Offer to Debtholders

by Calculated Risk on 4/29/2009 07:15:00 PM

From the WSJ: Treasury Sweetens Offer to Lenders In Chrysler Bankruptcy Talks

The U.S. Treasury, in a last-ditch effort to avoid a bankruptcy filing by Chrysler LLC, has sweetened its most recent offer to lenders by $250 million ... Lenders, who had until 6 p.m. to vote on the offer ... were notified at 4:30 via conference call and were sent to a Web site to vote for the deal.Down to the last few hours ...

Such a deal can't be approved outside bankruptcy court without 100% consent from lenders....

One reason Chrysler may need to file for bankruptcy is so that Fiat can clear out hundreds of auto dealers from its sales network, which is easier to do in bankruptcy where dealer franchisee agreements can quickly be rejected or amended. The automaker also has asbestos and environmental liabilities which Fiat does not want and are more easily shed in bankruptcy court.

...

Plans were under way for President Barack Obama to deliver a speech about Chrysler on Thursday morning. People who have been briefed on the matter said two versions of the speech were being drafted ...

WaPo: Chrysler BK Would Install Fiat Management

by Calculated Risk on 4/29/2009 05:37:00 PM

From the WaPo: Sources: Chrysler Bankruptcy Plan Would Oust CEO, Install Fiat Management

Chrysler chief executive Robert Nardelli would be replaced by the management of Italian automaker Fiat under a bankruptcy plan that the United States is preparing for the storied automaker...The deadline is tomorrow.

If the bankruptcy proceeds as expected ... The ownership of the new company would be divided between the union's retiree health fund, which would get a 55 percent stake, Fiat, which would get at least a 35 percent stake, and the United States, which would take an 8 percent stake. The Canadian government would receive two percent.

Chrysler's creditors would get $2 billion in cash and no equity stake. The automaker's current owner Cerberus Capital Management would be wiped out.

Ranieri: Housing Is ‘Shouting Distance’ From Bottom

by Calculated Risk on 4/29/2009 03:55:00 PM

From Bloomberg: Lewis Ranieri Says Housing Is ‘Shouting Distance’ From Bottom

“I’m actually very enthusiastic about housing, and I haven’t said that in five years,’’ Ranieri said, speaking on a panel at the Milken Institute Global Conference in Beverly Hills, California. “We’re within shouting distance of a bottom.”The article says Ranieri was talking about prices, but that isn't clear from the quote. He might be talking about residential investment. Prices will fall further ...

And a look at the markets ...

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

See Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries".

FOMC Statement: As Previous Announced, Will Buy $1.75 Trillion in MBS, Agency Debt and Treasuries

by Calculated Risk on 4/29/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in March indicates that the economy has continued to contract, though the pace of contraction appears to be somewhat slower. Household spending has shown signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit. Weak sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories, fixed investment, and staffing. Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time. Nonetheless, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve will buy up to $300 billion of Treasury securities by autumn. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is facilitating the extension of credit to households and businesses and supporting the functioning of financial markets through a range of liquidity programs. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of financial and economic developments.

GDP Report: The Good News

by Calculated Risk on 4/29/2009 11:41:00 AM

Although Q1 GDP was very negative due to the sharp investment slump (this was expected, see: Q1 GDP will be Ugly), the decline in Q1 was weighted towards lagging sectors. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This table shows the contribution to GDP for several sectors in Q1 2009 compared to Q4 2008.

The leading sectors are on the left, the lagging sectors towards the right.

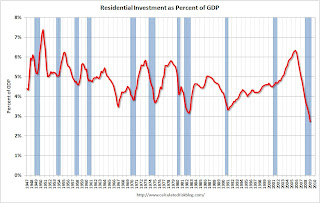

There has been a shift from leading sectors to lagging sectors, although the negative contribution from residential investment was larger in Q1 than in Q4 2008.

However it appears that the slump in residential investment (mostly new home construction and home improvement) is slowing, and I expect the contribution to Q2 2009 to be close to zero - after declining for 13 consecutive quarters.

This doesn't mean the downturn is over, but this does suggest that the worst of the GDP declines is probably over.

For more, see Business Cycle: Temporal Order. Here is a repeat of the table showing a simplified typical temporal order for emerging from a recession:

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Note: Any recovery will probably be sluggish, because household balance sheets still need repair (more savings), and any rebound in residential investment will probably be small because of the huge overhang of existing inventory. As I noted in Temporal Order, at least we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

The Investment Slump

by Calculated Risk on 4/29/2009 09:13:00 AM

The huge investment slump was the key story in Q1. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (RI) has been declining for 13 consecutive quarters, and Q1 2009 was the worst quarter (in percentage terms) of the entire bust. Residential investment declined at a 38% annual rate in Q1.

This puts RI as a percent of GDP at 2.7%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

Business investment in equipment and software was off 33.8% (annualized), and investment in non-residential structures was off 44.2% (annualized).

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - fell off a cliff. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - it is the best predictor of future economic activity.

GDP Declines 6.1% in Q1

by Calculated Risk on 4/29/2009 08:32:00 AM

From the BEA: Gross Domestic Product: First Quarter 2009 (Advance)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 6.1 percent in the first quarter of 2009 ...So PCE increased (as expected), but investment slumped sharply in all categories.

Real personal consumption expenditures increased 2.2 percent in the first quarter, in contrast to a decrease of 4.3 percent in the fourth. ...

Real nonresidential fixed investment decreased 37.9 percent in the first quarter ...

Nonresidential structures decreased 44.2 percent ...

Equipment and software decreased 33.8 percent ...

Real residential fixed investment decreased 38.0 percent ...

From Rex Nutting at MarketWatch: GDP falls 6.1% on record drop in investment

The two-quarter contraction is the worst in more than 60 years. The big story for the first quarter was in the business sector, where firms halted new investments, and shed workers and inventories at a dizzying pace ...For the stress tests, the baseline scenario for Q1 was minus 5.0%, and the more adverse scenario was minus 6.9%, so, before revisions, Q1 is between the two scenarios. More to come ...

Tuesday, April 28, 2009

Late Night Open Thread

by Calculated Risk on 4/28/2009 11:49:00 PM

By popular request ... the futures are up slightly ahead of the GDP report. Asian markets are mostly up (Nikkei is off over 2%).

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

Best to all.

Commercial Real Estate: "World of hurt"

by Calculated Risk on 4/28/2009 09:23:00 PM

From the Financial Times: Commercial mortgages at risk

“Commercial real estate is in a world of hurt and will be for at least the next two years,” said Ross Smotrich, analyst at Barclays Capital. “This is a capital intensive business in which lending capacity has diminished because of the absence of securitisation, while the fundamentals are driven by the overall economy so both occupancy and rents are declining.”Rising vacancy rates and falling rents ... not the best fundamentals. The story is the same for retail, multi-family, industrial, and hotels. CRE: A world of hurt.

... At the end of the first quarter, defaults and payments more than 60 days late were at 1.53 per cent of outstanding mortgages. Fitch said they could reach 4 per cent by the end of 2010.

Jim the Realtor: Still Flippin'

by Calculated Risk on 4/28/2009 06:45:00 PM

This REO was bought for $163,000 in January, repaired, and then listed for $265,000. It went pending the first week.

Jim says this house was in similar condition as this REO disaster.

Tiered House Price Indices

by Calculated Risk on 4/28/2009 05:03:00 PM

On more Case-Shiller graph ...

The following graph is based on the Case-Shiller Tiered Price Indices for San Francisco. Case-Shiller has tiered pricing data for all 20 cities in the Composite 20 index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that prices increased faster for lower priced homes than higher priced homes. And prices have also fallen faster too.

It now appears mid-to-high priced homes are overpriced compared to lower priced homes - although prices will probably continue to fall for all three tiers. Because of foreclosure activity, I expect the lower priced areas to bottom (especially in real terms) before the higher priced areas.

For those interested, Case-Shiller also has condo price indices for five cities: Los Angeles, San Francisco, Chicago, Boston and New York.

Liberty Property Trust on Leasing and Cap Rates

by Calculated Risk on 4/28/2009 03:46:00 PM

Here are a few interesting comment from the Liberty Property Trust conference call (ht Brian). Note LRY is a REIT specializing in industrial and office properties.

Let me turn to our operating performance and real estate fundamentals. Normally the first quarter is our slowest quarter for the year. But in addition, we clearly felt the full impact of the economic downturn in our markets. We leased 2.8 million square feet in the quarter, down 50% from our leasing productivity in the fourth quarter. This decline is totally consistent with what we are seeing in the markets, a 40% decline in deal activity from 2008 levels. Occupancy declined to 90.1% driven by a decline in our renewal percentage to 54.1%. This renewal decline was driven by our industrial portfolio, since our office and flex renewal rates were 72 and 63% respectively. What happened were three large industrial expirations that simply shut down their operations. A pattern that I think we are going the see more of throughout the rest of 2009. Consistent with the competitive nature of the markets, rents were flat.New tenants are making sure their landlords will stay in business! And from the Q&A on cap rates:

...

We are seeing the manifestation of the [soft economy] as more tenants downsize at the end of their lease. On last quarters call we discussed a recent trend where tenants were asking for rent relief and for the most part we were saying no, but more recently we were seeing an additional trend where good tenants with strong credit come to us before the end of their lease looking for rate reduction in current rent in exchange for additional lease term. In these instances we conduct a thorough economic analysis considering the credit of the tenant, the length of the proposed term, the health of the market and the extent to which we do business or could do business with that customer in multiple markets to. To date we are only completed a few of these “blend and extend” transactions, but we believe in a tenant driven market tenants will continue to ask their landlord to participate. While our portfolio has higher occupancy than the market in most of our cities, aggressive competitive behavior is rapidly affecting rental rates and concessions. On new leases and to a lesser degree on renewal leases, market rents are generally lower, varying by product type availability of competitive space, size, credit and term. The range is wide from slightly up to down as much as 20%. Concessions on new leases primarily in the form of free rent have increased during the first quarter and also vary by market and by lease term. Some leases have none. Some leases a few months and some as much as one month per year to as much as six months in the lease…A new phenomenon that is beginning to have a positive impact on our ability to get deals done is the fact that tenants and brokers that represent them are now underwriting landlords [for credit quality].

Analyst: With $100 million of asset sales that you guys are looking to do, are you looking for a range of cap rates or what kind of timing you are looking at there?These are probably industrial buildings with higher cap rates than offices or retail, but cap rates have clearly risen significantly. Rents are falling, cap rates are rising - and that means prices are cliff diving.

LRY: We’re staying with our original guidance on the range which I believe was eight to 11% ...

Analyst: Maybe I missed it but for the 35 million that you sold in the quarter did you guys provide a cap rate on that.

LRY: It was about mid nines.

More Details on Making Home Affordable Second Lien Program

by Calculated Risk on 4/28/2009 01:21:00 PM

Press Release from the U.S. Treasury: Obama Administration Announces New Details on Making Home Affordable Program

Under the Second Lien Program, when a Home Affordable Modification is initiated on a first lien, servicers participating in the Second Lien Program will automatically reduce payments on the associated second lien according to a pre-set protocol. Alternatively, servicers will have the option to extinguish the second lien in return for a lump sum payment under a pre-set formula determined by Treasury, allowing servicers to target principal extinguishment to the borrowers where extinguishment is most appropriate.Here is the program update.

And a couple of examples of how the 2nd lien program would work.

Here are the basics (the interest rate reduction is for 5 years):

For amortizing loans (loans with monthly payments of interest and principal), we will share the cost of reducing the interest rate on the second mortgage to 1 percent. Participating servicers will be required to follow these steps to modify amortizing second liens:The interest only second lien structure is similar with the interest rate being reduced to 2%.Reduce the interest rate to 1 percent; Extend the term of the modified second mortgage to match the term of the modified first mortgage, by amortizing the unpaid principal balance of the second lien over a term that matches the term of the modified first mortgage; Forbear principal in the same proportion as any principal forbearance on the first lien, with the option of extinguishing principal under the Extinguishment Schedule; After five years, the interest rate on the second lien will step up to the then current interest rate on the modified first mortgage, subject to the Interest Rate Cap on the first lien, set equal to the Freddie Mac Survey Rate; The second mortgage will re-amortize over the remaining term at the higher interest rate(s); and Investors will receive an incentive payment from Treasury equal to half of the difference between (i) the interest rate on the first lien as modified and (ii) 1 percent, subject to a floor.

Although this is a serious reduction in the interest rate, this will probably attractive to 2nd lien investors - since the loss severity on second liens is so high. What happens in five years when the rates change for all these borrowers with negative equity?

Chrysler: Deal Reached with Creditors

by Calculated Risk on 4/28/2009 12:23:00 PM

From the NY Times: Deal Is Set on Chrysler Debt That May Avert Bankruptcy

The Treasury Department has worked out a preliminary agreement with Chrysler’s largest secured creditors ...The initial Treasury offer was $1.0 billion, and the banks countered at $4.5 billion and 40% equity in the new Chrysler. These is no mention of equity in the story.

Chrysler has about $6.9 billion in secured debt owned by big banks such as Citigroup and JPMorgan Chase and a group of hedge funds. Under the proposal, all of the debt would be canceled in exchange for $2 billion in cash...

Case-Shiller: City Data

by Calculated Risk on 4/28/2009 11:22:00 AM

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined more than 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

In Phoenix, house prices have declined more than 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

Prices fell by 1% or more in most Case-Shiller cities in February, with Phoenix off 5.0% for the month alone.

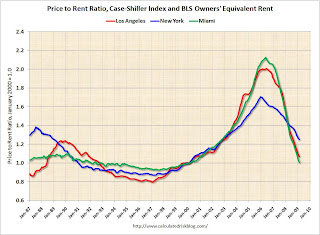

And here is the price-to-rent ratio for a few cities ... The second graph shows the price-to-rent ratio for Miami, Los Angeles and New York. This is similar to the national price-to-rent ratio, but uses local prices and local Owners' equivalent rent.

The second graph shows the price-to-rent ratio for Miami, Los Angeles and New York. This is similar to the national price-to-rent ratio, but uses local prices and local Owners' equivalent rent.

This ratio is getting close to normal for LA and Miami (Miami is back to the Jan 2000 ratio), but still has further to fall in NY.

Note: The Owners' Equivalent Rent (OER) is still increasing according to the BLS, however there are many reports of falling rents that isn't showing up yet in the OER.

House Prices: Compared to Stress Test Scenarios, and Seasonal Pattern

by Calculated Risk on 4/28/2009 10:14:00 AM

For more on house prices, please see: Case-Shiller: Prices Fall Sharply in February Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph compares the Case-Shiller Composite 10 index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index, February: 154.70

Stress Test Baseline Scenario, February: 157.26

Stress Test More Adverse Scenario, February: 154.01

It has only been two months, but prices are tracking the More Adverse scenario so far.

But we have to remember the headline Case-Shiller is not seasonally adjusted, and there is a strong seasonal pattern. Update: there is a seasonally adjusted data set here. This graph shows the month to month change (annualized) for the Case-Shiller Composite 10 index.

This graph shows the month to month change (annualized) for the Case-Shiller Composite 10 index.

Prices usually decline at the fastest rate in the winter months (or increase the least with rising prices), and prices decline the slowest during the summer. Just something to remember when the month-to-month price declines slow this summer.

This is why we use the year-over-year (YoY) price change too (in previous post). The YoY change for the Composite 10 is -18.8%, the worst YoY change was last month (January 2009 at -19.4%). About the same.

I'll have some Case-Shiller city data soon.

Case-Shiller: House Prices Fall Sharply in February

by Calculated Risk on 4/28/2009 09:05:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for February this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.6% from the peak, and off 2.1% in February.

The Composite 20 index is off 30.7% from the peak, and off 2.2% in February.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.8% over the last year.

The Composite 20 is off 18.6% over the last year.

This is near the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

I'll have more on house prices including a comparison to the stress test scenarios soon.

Report: BofA, Citi Told May Need to Raise Capital

by Calculated Risk on 4/28/2009 12:48:00 AM

From the WSJ: Fed Pushes Citi, BofA to Increase Capital

Regulators have told Bank of America Corp. and Citigroup Inc. that the banks may need to raise more capital ...The article also notes that the results of the stress test could be released the week of May 4th - and not on May 4th as originally announced.

Executives at both banks are objecting to the preliminary findings ...

Industry analysts and investors predict that some regional banks, especially those with big portfolios of commercial real-estate loans, likely fared poorly on the stress tests. Analysts consider Regions Financial Corp., Fifth Third Bancorp and Wells Fargo & Co. to be among the leading contenders for more capital....

No one will believe the test results if Citi isn't required to raise more capital.

Monday, April 27, 2009

Robert Shiller at Seattle Pacific University

by Calculated Risk on 4/27/2009 08:49:00 PM

Professor Shiller spoke at Seattle Pacific University today. After the Q&A, reader Erik asked Shiller:

Q: Why does the FHFA (OFHEO) index show house price gains for the last two months, whereas the Case-Shiller is showing prices are still falling.I'll revisit this question soon, but I prefer the Case-Shiller index.

A (Erik's notes): He thought about it for a bit, and said "I haven't studied it yet", I think it is because the "OFHEO index doesn't capture foreclosures as much our index." They tend to use conventional mortgages more and conventional mortgages seem to hold out longer and as a result "there may be an upward bias to their numbers." He then paused and said, the OFHEO numbers are a bit fishy (he looked perplexed) to me because they seem to have broken the smooth trend (he gestured with his hand the trend and finished with an upward movement) and I can't quite figure out where they came from, but I suspect it is from them capturing too few foreclosures or us capturing too many (laughs) even OFHEO has said they don't know why or can't explain their own numbers from the last two months.

Tim at the Seattle Bubble Blog has more: Robert Shiller at SPU—Psychology and the Housing Market

One amusing part of the afternoon session was a story Dr. Shiller related about a localized Los Angeles housing bubble in 1885. In describing the mentality in 1885 Los Angeles, he said that people thought “Los Angeles is special!” He also quoted from an article in the LA Times which was published during the aftermath of the collapse in 1886:Also, the Case-Shiller house price index for February will be released tomorrow morning (Tuesday).We Californians have learned something. And that is that home prices can’t just go up forever—they have to be supported by something. Never again will Californians make this mistake....

For anyone interested in hearing the entire afternoon lecture, you can listen to it right here:

GM Bondholders Respond to Exchange Offer

by Calculated Risk on 4/27/2009 06:20:00 PM

This morning GM offered to exchange equity in the restructured company for the outstanding $27 billion in debt. The bondholders responded negatively ...

Statement from ad hoc committee of GM bondholders via WSJ:

... The current offer is neither reasonable nor adequate. Both the union and the bondholders hold unsecured claims against GM. However, the union's VEBA would receive a 50 percent recovery in cash and a 39 percent stake in a new GM for its $20 billion in obligations; while bondholders, who own more than $27 billion in GM bonds and have the same legal rights as the unions, would only receive a mere 10 percent of the restructured company and essentially no cash.Apparently the bondholders are preparing a counteroffer.

The offer was made unilaterally, without any prior discussion or negotiation with bondholders and in spite of repeated calls for dialogue.

...

This offer demonstrates that the company and the auto task force, unfortunately, are pinning their hopes on an extremely risky and legally questionable turnaround in bankruptcy court, instead of engaging its lenders and workers in the very type of negotiations that could avoid such a fate.

Truck Tonnage: More Cliff Diving in March

by Calculated Risk on 4/27/2009 04:38:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Plunged 4.5 Percent in March Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 4.5 percent in March, marking the first month-to-month decrease of 2009. The gains during the previous two months, which totaled 4.5 percent, were erased with March’s drop. (February’s increase was revised down to 1.5 percent.) In March, the SA tonnage index equaled just 101.4 (2000 = 100), which is its lowest level since March 2002. The fleets did report higher volumes than in February, as the not seasonally adjusted (NSA) index increased 10.2 percent, but that is well below the 15 to 20 percent range that NSA tonnage usually rises from February to March. In March, the NSA index equaled 104.7.This suggests the economy was still very weak in March.

Compared with March 2008, tonnage contracted 12.2 percent, which was the second-worst year-over-year decrease of the current cycle. In December 2008, the largest year-over-year contraction, tonnage dropped 12.5 percent from a year earlier.

ATA Chief Economist Bob Costello said he wasn’t too surprised at March’s reading. “Many fleets were telling us during March that freight was getting a little better. The problem is that freight should be significantly better in March, which is why the seasonally adjusted index fell,” Costello said. “While the industry is desperate for some positive news, it is unfortunate that March’s data suggests the industry has not hit bottom just yet.”

U.S. Homeownership by Age Group

by Calculated Risk on 4/27/2009 02:57:00 PM

The previous post on the homeownership rate prompted several questions about what happens when the boomers retire? Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the homeownership by age group for three different time periods: 1985, 2000, and 2007. Back in 1985, the homeownership rate declined significantly after people turned 70. However, more recently, the homeownership rate has stayed above 80% for those in the 70 to 75 cohort, and close to 80% for people over 75.

I expect the homeownership rate to remain high for the boomer generation too. Although there will probably be a geographic shift as the boomer generation retires (towards the sun states) and some downsizing, I don't think the aging of the boomer generation will negatively impact the homeownership rate for 15 years or more.

And that reminds me of an animation I made several years ago showing the U.S. population distribution by age from 1920 to 2000 (plus 2005).

Animation updates every 2 seconds.

The graphs for 1900 and 1910 have a similar shape as 1920. With the medical advances of the 20th Century, we would expect the shape of the distribution to become flatter as fewer people die of illnesses in the prime of their lives.

There are a couple of things to watch for: