by Calculated Risk on 4/27/2009 12:52:00 PM

Monday, April 27, 2009

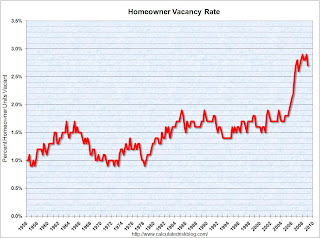

Q1 2009: Homeownership Rate at 2000 Levels

The homeownership rate is back to the level of Q2 2000. So much for the homeownership gains of the last 8+ years. Gone.

This morning the Census Bureau reported the homeownership and vacancy rates for Q1 2009. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate decreased to 67.3% and is now back to the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased because of demographics and changes in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

The homeowner vacancy rate was 2.7% in Q1 2009. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

This leaves the homeowner vacancy rate about 1.0% above normal, and with approximately 75 million homeowner occupied homes; this gives about 750 thousand excess vacant homes.

The rental vacancy rate was steady at 10.1% in Q1 2009.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 40 million units or about 820,000 units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 40 million units or about 820,000 units absorbed.

This would suggest there are about 820 thousand excess rental units in the U.S.

There are also approximately 100 thousand excess new homes above the normal inventory level (for home builders) - plus some uncounted condos.

If we add this up, 820 thousand excess rental units, 750 thousand excess vacant homes, and 100 thousand excess new home inventory, this gives about 1.7 million excess housing units in the U.S. that need to be absorbed over the next few years. (Note: this data is noisy, so it's hard to compare numbers quarter to quarter, but this is probably a reasonable approximation).

These excess units will keep pressure on housing starts and prices for some time.