by Calculated Risk on 10/10/2010 09:53:00 PM

Sunday, October 10, 2010

Fed's Dudley: Costs of higher capital requirements under Basel III are "exaggerated"

Earlier:

The following speech focuses on Basel III capital and liquidity standards.

From NY Fed President William Dudley: Basel and the Wider Financial Stability Agenda

[T]he new standards will require banking organizations to significantly increase the amount of high-quality, loss-absorbing capital that they hold; significantly improve risk capture in trading, counterparty credit, securitization and other activities that the prior regulatory capital requirements did not adequately capture; make it more expensive for banks to provide liquidity guarantees to shadow banks; constrain the leverage that banking companies can take by introducing a credible, non-risk-based backstop; and increase the capacity of banks to absorb shocks that might temporarily impede their ability to access short-term funding markets. While these changes apply directly only to large internationally active banks, they will have wider ramifications for the financial system as a whole, including nonbanks and the capital markets.Note that the word "intended" is highlighted in the speech. The requirement are intended to encourage banks to change thier business models and reduce risk.

...

The new capital rules are intended to provide strong incentives for banks to change their business models in ways that make the system more stable and reduce the negative impact their actions have on others—for instance, by providing incentives to standardize OTC derivatives contracts and clear such standardized trades through central counterparties. To understand what these new requirements mean for the amount of capital banks will ultimately have to hold, it is important to note that one of the intended consequences of these changes is for banks to adjust their business models in ways that reduce the risks their activities generate.

And on the costs:

[S]ome argue that the new [Basel] standards are too severe. They argue that, in the short run, the higher standards could lead to a significant constraint in credit that could hurt the nascent economic expansion. And, they argue, in the long run, that the higher capital standards will inevitably drive up lending costs and that this will hurt economic performance. Although I believe the new standards do impose some real costs on the financial system in order to achieve real benefits, I believe that concerns over the costs are exaggerated.The new standards will be phased in over several years.

Summary for Week ending Oct 9th

by Calculated Risk on 10/10/2010 03:55:00 PM

A summary of last week - mostly in graphs.

The weak employment report all but guaranteed QE2 will be announced on November 3rd. The "whisper" number is for an announcement of an initial $500 billion in purchases of long term Treasury securities over the following six months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The dotted line is ex-Census hiring. The two lines have joined since the decennial Census is almost over.

The BLS reported:

1) Nonfarm payroll employment decreased by -95,000 in September

2) the Unemployment Rate was unchanged at 9.6%

3) Private employment increased by 64,000.

4) Government employment declined by 159,000 (mostly Census and local government).

5) Census 2010 employment decreased 77,000 in September.

6) so there were 18,000 payroll jobs lost ex-Census.

Note: This will be the last "ex-Census" report until the 2020 Census!

The second graph shows the unemployment rate vs. recessions.

The second graph shows the unemployment rate vs. recessions.The unemployment rate has mostly moved sideways since falling to 9.7% in January 2010.

The economy has gained 334,000 jobs over the last year, and lost 7.75 million jobs since the recession started in December 2007. However the preliminary benchmark revision (to be announced with the January 2011 report) is for a downward revision of 366,000 jobs as of March 2010 - and that suggests over 8.1 million jobs have been lost since the start of the employment recession.

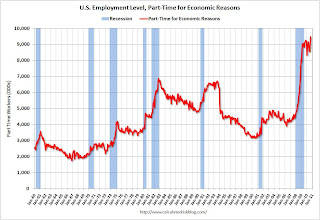

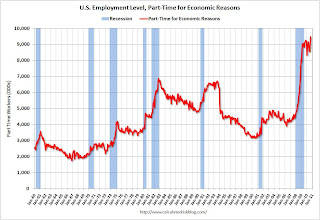

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 9.472 million in September, up sharply from August.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 9.472 million in September, up sharply from August. This is a new record high, and is obviously bad news.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 17.1% in September from 16.7% in August. The high for U-6 was 17.4% in October 2009.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.The Employment-Population ratio was steady at 58.5% in September (the same low level as in August).

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate was also steady at 64.7% in September. This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are 6.123 million workers who have been unemployed for more than 26 weeks and still want a job. This is 4.0% of the civilian workforce. It appears the number of long term unemployed has peaked ... Although this may be because people are giving up.

Employment Report Summary

The number of private sector jobs increased modestly by 64,000, otherwise the underlying details of the employment report were grim.

The negatives include the loss of 18,000 jobs ex-Census, the sharp increase in part time workers for economic reasons (and jump in U-6 unemployment rate), hours worked were flat (down for manufacturing workers), the employment-population ratio and labor force participation were flat at very low levels, and the unemployment rate was flat at a very high level.

This was another weak employment report.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.The September ISM Non-manufacturing index was at 53.2%, up from 51.5% in August - and above expectations of 52.0%. The employment index showed slight expansion in September at 50.2%, up from 48.2% in August. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the office vacancy rate starting in 1991.

This graph shows the office vacancy rate starting in 1991.Reis is reporting the vacancy rate rose to 17.5% in Q3 2010, up from 17.4% in Q2 2010, and up from 16.6% in Q3 2009. The peak following the previous recession was 16.9%.

From the WSJ Signs of Recovery For Office Market

It appears the rate of increase in the vacancy rate has slowed - and rents may be stabilizing.

Reis reported that the vacancy rate for large regional malls fell to 8.8% in Q3 from 9.0% in Q2. The vacancy rate at strip malls fell to 10.9%.

Reis reported that the vacancy rate for large regional malls fell to 8.8% in Q3 from 9.0% in Q2. The vacancy rate at strip malls fell to 10.9%.At regional malls, the record vacancy rate was 9.0% in Q2 2010 (Reis started tracking regional malls in 2000). The record vacancy rate for strip malls was in 1990 at 11.1%.

From Reuters: U.S. mall vacancy rate dips for first time in 3 years

And on apartment vacancies: From Ilaina Jonas at Reuters: US apartment vacancy rate drops sharply in 3rd qtr.

The national vacancy rate fell to 7.2 percent from 7.8 percent in the second quarter as renters soaked up 84,382 more units than were vacated ...This is for large apartment building in major cities, and it shows a significant drop in the vacancy rate.

Best wishes to all.

Schedule for Week of Oct 10th

by Calculated Risk on 10/10/2010 12:30:00 PM

The key release this week will be September retail sales on Friday. Also Fed Chairman Ben Bernanke will try to explain the objectives of QE2 on Friday "Monetary Policy Objectives and Tools in a Low-Inflation Environment".

Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for September (a measure of transportation).

CoreLogic House Price Index for August. This release could show further declines in house prices. The index is a weighted 3 month average for June, July and August.

Association of American Railroads rail traffic indicators for September. Trucking, rail traffic and the Ceridian diesel fuel index are all measures of transportation (a coincident indicator).

2:45 PM ET: Federal Reserve Vice Chair Janet Yellen speaks at the National Association for Business Economics meeting in Denver: "Macroprudential Supervision and Monetary Policy in the Post-Crisis World"

7:30 AM: NFIB Small Business Optimism Index for September. This index has been showing small businesses remain pessimistic and the survey shows that the major concern of small businesses is lack of customers.

11:45 AM: Kansas City Fed President Thomas Hoenig speaks at the National Association for Business Economics meeting in Denver. "The Economic Outlook and Monetary Policy: Challenges Ahead"

2:00 PM: FOMC Minutes, Meeting of September 21, 2010. Investors will focus on any discussion of QE2.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit. The index has increased a little recently - possibly due to borrowers trying to beat the slightly tighter FHA requirements.

7:45 PM: Richmond Fed President Jeffrey Lacker will speak in Chapel Hill, NC.

8:30 AM: The initial weekly unemployment claims report will be released. Consensus is for a slight decrease to 443K from 445K last week.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $44 billion (from $42.8 billion in July).

8:30 AM: Producer Price Index for September. The consensus is for a 0.1% increase in producer prices.

8:15 AM: Fed Chairman Ben S. Bernanke will speak at the Federal Reserve Bank of Boston Conference "Monetary Policy Objectives and Tools in a Low-Inflation Environment"

8:30 AM: Consumer Price Index for September. The consensus is for a 0.2% increase in prices. This is being closely watched for further disinflation, and also because Q3 is the quarter the annual annual cost-of-living adjustment (COLA) is calculated for Social Security (this will make it official that there will be no change in 2011).

8:30 AM: Retail Sales for September. The consensus is for a 0.4% increase from August.

8:30 AM: Empire Manufacturing Survey for October. The consensus is for a reading of 8.0, up from 4.1 in September. These regional surveys have been showing a slowdown in manufacturing and are being closely watched right now.

9:15 AM: Atlanta Fed President Dennis Lockhart participates in a question-and-answer session on the economy in Atlanta.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for October. The consensus is for a slight increase to 69.0 from 68.2 in September.

10:00 AM: Manufacturing and Trade: Inventories and Sales for August. Consensus is for a 0.4% increase in inventories in August.

After 4:00 PM: The FDIC has really slowed down closing banks - even though the Unofficial problem bank list continues to increase. The pace of closures will probably pickup soon ...

8:15 AM: Boston Fed President Eric Rosengren speaks at Federal Reserve Bank of Boston Conference

Pearlstein on Foreclosure-Gate

by Calculated Risk on 10/10/2010 09:08:00 AM

From Steve Pearlstein at the WaPo: To sort this mess, both banks and borrowers must do the right thing

Listening to the fiery rhetoric about the mortgage mess emanating from politicians this week, you'd think that big bad banks were trying to foreclose on hundreds of thousands of homeowners who were current on their payments but had become victims of sloppy business practices.I've pointed this out several times: the basic facts are 1) the homeowners have a mortgage and 2) the homeowner is seriously delinquent.

...

But if, as appears to be the case, the overwhelming majority of homeowners facing foreclosure have fallen far behind on their payments, then it is a good deal harder to summon up the same moral outrage over reports that the banks and loan service companies cut corners, failed to keep the right documents and engaged in shoddy and even fraudulent practices. Just because the banks and servicers have screwed up doesn't mean they and their investors are no longer entitled to get their money back.

Certainly banks and servicers should, at their own expense, be sent back to do things right. Those who engaged in fraud should be punished. And if there are legitimate questions about who owns a loan, those will need to be resolved before the proceeds of any foreclosure are distributed.

But none of that changes the basic reality that there are millions of Americans who took out mortgages they could not support on houses they could not afford.

As Tom Lawler wrote "mortgage servicers who messed up should bear all of the costs associated with their mess up". And I'd prefer alternatives to foreclosure (mortgage modification or even short sales / deed-in-lieu), but we also need to remember that the basic facts are not in dispute.

Saturday, October 09, 2010

IMF: Concern about fragile economy and exchange rates

by Calculated Risk on 10/09/2010 09:57:00 PM

Via MarketWatch: Summary of IMF meeting communique

Global economy: “Economic recovery is proceeding, but remains fragile and uneven across the membership. Faced with this source of potential stress, we underscore our strong commitment to continue working collaboratively to secure strong, sustainable and balanced growth and to refrain from policy actions that would detract from this shared goal. ... The rejection of protectionism in all its forms must remain a key element of our coordinated response to the crisis; renewed efforts are urgently needed to bring the Doha Round to a successful conclusion.”Not that anything will come of this, but clearly the IMF is still concerned about the "fragile" economy, and about exchange rates.

...

Mandate for international monetary stability: “While the international monetary system has proved resilient, tensions and vulnerabilities remain as a result of widening global imbalances, continued volatile capital flows, exchange rate movements and issues related to the supply and accumulation of official reserves. Given that these issues are critically important for the effective operation of the global economy and the stability of the international monetary system, we call on the Fund to deepen its work in these areas, including in-depth studies to help increase the effectiveness of policies to manage capital flows. We look forward to reviewing further analysis and proposals over the next year.”

Music: "Nobody Knows the Bubbles I've Seen"

by Calculated Risk on 10/09/2010 04:55:00 PM

Watch for the "Hoocoodanode" mention (A Tanta snark and the name of our message board) ...

Duration of Unemployment

by Calculated Risk on 10/09/2010 11:45:00 AM

An update by request ...

Click on graph for larger image.

Click on graph for larger image.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Note: The BLS reports 15+ weeks, so the 15 to 26 weeks number was calculated.

In Setpember 2010, the number of unemployed for 27 weeks or more declined to 6.123 million (seasonally adjusted) from 6.249 million in August. It appears the number of long term unemployed has peaked, but it is still very difficult for these people to find a job - and this is a very serious employment issue.

The 5 to 14 week category declined in September, however the less than 5 week category continued to increase - and is now at the highest level since January 2010.

The less than 5 week category shows how the turnover in the labor market has changed. Back in the '70s and '80s there was much more turnover in the labor market. And that added turnover is a key reason the overall unemployment rate was higher in the early '80s recession than right now.

Note: Even though these numbers are all seasonally adjusted, they can't be added together to calculate the unemployment rate.

And a repeat of a popular graph ...

And a repeat of a popular graph ...

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The dotted line is ex-Census hiring. The two lines have joined since the decennial Census is almost over.

Best to all

Employment posts yesterday (with many graphs):

Unofficial Problem Bank List 877 Institutions

by Calculated Risk on 10/09/2010 07:27:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 8, 2010.

Changes and comments from surferdude808:

The number of institutions on the Unofficial Problem Bank List remained unchanged this week at 877 but assets rose slightly from $416.1 billion to $417.3 billon.

Three institutions were removed with one because of action termination -- First National Bank and Trust Company ($296 million), and two others -- First National Bank & Trust Company in Larned ($34 million) and Clear Creek National Bank ($24 million) because they merged into other banks that are on the Unofficial Problem Bank List.

Additions this week include Valley Bank, Roanoke, VA ($763 million Ticker: VYFC); Fullerton Community Bank, FSB, Fullerton, CA ($705 million); and Fort Lee Federal Savings Bank, FSB, Fort Lee, NJ ($75 million), which received about $1.3 million of TARP capital in May 2009.

We anticipate for the OCC to release its actions from mid-August through mid-September next Friday.

Friday, October 08, 2010

Late night Foreclosure-Gate

by Calculated Risk on 10/08/2010 11:36:00 PM

From Dina ElBoghdady at the WaPo: Buyers anxiously await foreclosure deals to go through

From David Streitfeld and Nelson Schwartz at the NY Times: Largest U.S. Bank Halts Foreclosures in All States

Note: the media is in a frenzy about this, but I've hardly mentioned it other than linking to a few articles and posting Tom Lawler's piece about Who will, and who should "pay"?.

Best to all.

Employment posts today (with many graphs):

Daily Show on Foreclosure-Gate

by Calculated Risk on 10/08/2010 07:26:00 PM

While we wait for the FDIC ...

From the Daily Show (link if embed doesn't work) Foreclosure Crisis

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Foreclosure Crisis | ||||

| www.thedailyshow.com | ||||

| ||||

Impact of estimated Benchmark Revision on Job Losses

by Calculated Risk on 10/08/2010 03:05:00 PM

This morning I mentioned the annual benchmark revision for the employment report - here are some more details, and a graph showing the impact on job losses.

As part of the employment report, the BLS released the preliminary annual benchmark revision of minus 366,000 payroll jobs. This will be finalized next February when the January 2011 employment report is released. Usually the preliminary estimate is pretty close to the final benchmark estimate.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the impact of the preliminary benchmark revision on job losses in percentage terms from the start of the employment recession.

The red line on the graph is the current estimate, and the dotted line shows the impact of estimated coming benchmark revision. This puts the current payroll employment about 8.1 million jobs below the pre-recession peak in December 2007.

Using the preliminary benchmark estimate, this means that payroll employment in March 2010 was 366,000 lower than originally estimated. This is slightly larger than a normal adjustment (see table below). So in February 2011, the payroll numbers will be revised down to reflect this estimate. The number is then "wedged back" to the previous revision (March 2009).

For details on the benchmark revision process, see from the BLS: Methodology

"The benchmark adjustment, a standard part of the payroll survey estimation process, is a once-a-year re-anchoring of the sample-based employment estimates to full population counts available principally through unemployment insurance (UI) tax records filed by employers with State Employment Security Agencies."The following table shows the benchmark revisions since 1979.

| Year | Percent difference | Difference in thousands |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -366 estimate |

Earlier employment posts today (with many graphs):

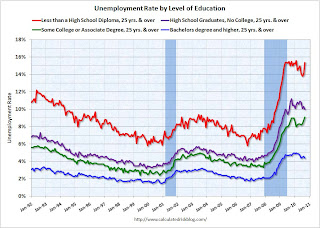

Unemployment by Level of Education and Employment Diffusion Indexes

by Calculated Risk on 10/08/2010 12:34:00 PM

By request ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

Note that the unemployment rate increased sharply for all four categories in 2008 and into 2009.

Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - but education didn't seem to matter as far as the recovery rate in unemployment following the 2001 recession. All four groups recovered slowly.

Earlier this year, the group with "less than a high school diploma" recovered a little better than the more educated groups - possibly because of the tax credit related increase in construction - but that changed in September as the unemployment rate increased sharply.

For the group with some college or an associate degree, the unemployment rate is at a new high for this employment recession.

Diffusion Indexes

This is a little more technical ...

The BLS diffusion index for total private employment declined to 49.8 from 54.1 in August. For manufacturing, the diffusion index declined to 46.3 from 48.2 in August.

The BLS diffusion index for total private employment declined to 49.8 from 54.1 in August. For manufacturing, the diffusion index declined to 46.3 from 48.2 in August.

Both indexes are down sharply from earlier this year.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The increases in the diffusion indexes in 2009 and earlier this year, was a clear positive in the monthly employment reports. However the decrease in the diffusion indexes over the last few months (falling below 50% for both in September), is disappointing.

Earlier employment posts today (with many graphs):

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 10/08/2010 09:50:00 AM

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions, aligned at Bottom

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the bottom of the recession (Both the 1991 and 2001 recessions were flat at the bottom, so the choice was a little arbitrary).

The dotted line shows the impact of Census hiring. As of the end of September, there were only 6,000 temporary 2010 Census workers still on the payroll. So the gap between the solid and dashed red lines is almost completely gone.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) rose by 612,000 over the month to 9.5 million. Over the past 2 months, the number of such workers has increased by 943,000. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 9.472 million in September, up sharply from August.

This is a new record high, and is obviously bad news.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 17.1% in September from 16.7% in August. The high for U-6 was 17.4% in October 2009. Grim.

Employment-Population Ratio

The Employment-Population ratio was steady at 58.5% in September (the same as in August).

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate was also steady at 64.7% in September. This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.

When the employment picture eventually improves, people will return to the labor force and the participation rate will increase from these very low levels. And that will put upward pressure on the unemployment rate.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are 6.123 million workers who have been unemployed for more than 26 weeks and still want a job. This is 4.0% of the civilian workforce. It appears the number of long term unemployed has peaked ... Although this may be because people are giving up.

The number of long term unemployed is staggering - still over 6 million people who are looking for a job.

Summary

The underlying details of the employment report were grim. The number of private sector jobs increased modestly by 64,000, otherwise ...

The negatives include the loss of 18,000 jobs ex-Census, the sharp increase in part time workers for economic reasons (and jump in U-6 unemployment rate), hours worked were flat (down for manufacturing workers), the employment-population ratio and labor force participation were flat at very low levels, and the unemployment rate was flat at a very high level.

Overall this was a weak report.

September Employment Report: 18K Jobs Lost ex-Census, 9.6% Unemployment Rate

by Calculated Risk on 10/08/2010 08:30:00 AM

Note: This will be the last "ex-Census" report this decade.

From the BLS:

Nonfarm payroll employment edged down (-95,000) in September, and the unemployment rate was unchanged at 9.6 percent, the U.S. Bureau of Labor Statistics reported today. Government employment declined (-159,000), reflecting both a drop in the number of temporary jobs for Census 2010 and job losses in local government. Private-sector payroll employment continued to trend up modestly (+64,000).Census 2010 hiring decreased 77,000 in September. Non-farm payroll employment decreased 18,000 in September ex-Census.

Both July and August payroll employment were revised down. The change in total nonfarm payroll employment for July was revised from -54,000 to -66,000, and the change for August was revised from -54,000 to -57,000.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate vs. recessions.

Nonfarm payrolls decreased by 95 thousand in August. The economy has gained 334 thousand jobs over the last year, and lost 7.75 million jobs since the recession started in December 2007.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).The dotted line is ex-Census hiring. The two lines have joined since the decennial Census is almost over.

For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: The preliminary benchmark payroll revision is minus 366,000 jobs. This is a little larger than the normal adjustment (last year was especially large). The actual adjustment will be made in February 2011. This is the preliminary estimate of the annual revision, from the BLS: "The benchmark adjustment, a standard part of the payroll survey estimation process, is a once-a-year re-anchoring of the sample-based employment estimates to full population counts available principally through unemployment insurance (UI) tax records filed by employers with State Employment Security Agencies."

This is another weak employment report. I'll have much more soon ...

For more, see next post: Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

Thursday, October 07, 2010

NY Times: Foreclosure-Gate starting to impact home sales

by Calculated Risk on 10/07/2010 10:23:00 PM

From Andrew Martin and David Streitfeld at the NY Times: Flawed Foreclosure Documents Thwart Home Sales

[A]s a scandal unfolds over mortgage lenders’ shoddy preparation of foreclosure documents, the fallout is beginning to hammer the housing market, especially in states like Florida where distressed properties are abundant. ... the agents are being told the freeze will last 30 to 90 days ...This will probably just be a delay. And the delays will mostly be in the judicial foreclosure states, although the story has one example of a house withdrawn from the market in California.

[One Florida] agency had 35 deals that were supposed to close this month. As of Thursday, Fannie had postponed 11 of them.

Video of Krugman, Feldstein and Hatzius from Oct 5th

by Calculated Risk on 10/07/2010 08:00:00 PM

Here is the video of Professors Paul Krugman and Martin Feldstein (former Reagan advisor and NBER president), and Jan Hatzius, chief economist of Goldman Sachs:

The Economic Policy Institute conference on October 5, 2010

I'm not sure who is the most pessimistic.

Lawler: “Foreclosure-Gate”: Who Will, and Who Should “Pay”?

by Calculated Risk on 10/07/2010 05:09:00 PM

CR Note: This is from economist Tom Lawler, who joked today: Maybe large servicers should be forced to put up billions in "claims fund," like BP? (the latter "caused" slime, while the former are just "slimy"!)

The mortgage-foreclosure debacle, which started with a story about a GMAC “technicality” (and included a “GMAC denies foreclosure moratorium” story) but which quickly “ballooned” as more mortgage servicers were “implicated,” has now exploded into a full-blown “issue” of unknown proportions. One thing is pretty clear – many larger mortgage servicers simply “screwed up” by trying to deal with the surge in foreclosures by taking shortcuts to keep costs down, and this mistake has blown up in their faces.

But … is it just “their” faces?

It seems pretty clear that one of the outcomes of the recent “revelations” is that many foreclosures will be postponed; there will be more “refilings” of foreclosure petitions that will cost money; more borrowers facing foreclosures will hire lawyers, and servicers will have to reimburse more borrowers for legal fees; and some foreclosures could be delayed for quite a while. It is unclear at this point whether there will be any significant number of completed foreclosures that might be reversed, but if so that’s gonna cost! Net, there are going to be significant costs that someone is going to have to bear.

But who will bear those costs? Will it be mortgage servicers? Well, if they also own the mortgage, sure. But what about for loans they service for others (including private-label securities, Fannie, Freddie, FHA, VA, …)? Who’s a’ gonna’ pay?

From a “who should” perspective, any increase in losses associated with mistakes made by mortgage servicers, especially if those mistakes involved not following state foreclosure laws, which is a “violation” of most servicing contracts, the answer is crystal clear – the mortgage servicers. But how easy is it going to be to determine losses associated with mistakes by mortgage servicers? What are the “rules” on what a servicer can “recoup” in terms of costs associated with foreclosure when a servicer makes a mistake in private-label deals? With loans serviced for Fannie and Freddie, or FHA? What about delays in foreclosures clearly associated with servicer mistakes, which generally result in increased loss severities? Mortgage investors shouldn’t bear those costs, but how can they be sure they won’t?

What if there is a national “foreclosure moratorium” triggered by mortgage servicer mistakes that ultimately increase the severity of losses? Who “pays the price” in reality, as opposed to who “should?” Will there be lawsuits from mortgage investors whose loans and/or loans backing securities they own find that their incidence and/or severity of loss was adversely impacted by servicers mistakes, and will they be able to ensure that servicers who “screwed up” bear those losses instead of them?

I don’t know the “technically right” answers to any of the above questions, but it is crystal clear that the “right” answer should be that mortgage servicers who messed up should bear all of the costs associated with their mess up.

CR Note: This is from economist Tom Lawler

Consumer Credit declines in August

by Calculated Risk on 10/07/2010 03:19:00 PM

The Federal Reserve reports:

In August, total consumer credit decreased at an annual rate of 1-3/4 percent. Revolving credit decreased at an annual rate of 7-1/4 percent, and [Non] revolving credit increased at an annual rate of 1-1/4 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the increase in consumer credit since 1978. The amounts are nominal (not inflation adjusted).

Revolving credit (credit card debt) is off 15.2% from the peak. Non-revolving debt (auto, furniture, and other loans) is off 1.1% from the peak. Note: Consumer credit does not include real estate debt. This has been very different from previous recessions with the decline in non-revolving debt.

Fed's Fisher: QE2 "debate still to take place"

by Calculated Risk on 10/07/2010 01:33:00 PM

From Dallas Fed President Richard Fisher: To Ease or Not to Ease? What Next for the Fed?

I am afraid that despite recent speculation in the press and among market pundits, we did little at that meeting to settle the debate as to whether the Committee might actually engage in further monetary accommodation, or what has become known in the parlance of Wall Street as “QE2,” a second round of quantitative easing. It would be marked by an expansion of our balance sheet beyond its current footings of $2.3 trillion through the purchase of additional Treasuries or other securities. To be sure, some in the marketplace―including those with the most to gain financially―read the tea leaves of the statement as indicating a bias toward further asset purchases, executed either in small increments or in a “shock-and-awe” format entailing large buy-ins, leaving open only the question of when.Fisher suggests the debate on QE2 isn't over (he opposes QE2). However he is not a voting member of the FOMC this year (an alternate). He is always fun to read - but barring some upside surprise, I think QE2 will be announced on November 3rd.

Since the FOMC meeting, a handful of my colleagues have fanned further speculation about QE2 by signaling their personal positions on the matter quite openly in recent speeches and interviews in the major newspapers. Hence the headline in yesterday’s Wall Street Journal, “Central Banks Open Spigot,” a declaration that surely gave the ghosts of central bankers past the shivers and sent a tingle down the spine of gold bugs from Bemidji to Beijing.

...

There is a great deal of legitimate debate still to take place within the FOMC on the subject of quantitative easing and the pros and cons and costs and benefits of further monetary accommodation. Whatever we might do, if anything, must be consistent with long-term price stability and not add to the nightmare of confusing signals already being sent to job creators.

What will we likely decide at the next FOMC meeting? ... “You’ll find out soon enough.”

Weekly Initial Unemployment Claims decrease

by Calculated Risk on 10/07/2010 08:41:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Oct. 2, the advance figure for seasonally adjusted initial claims was 445,000, a decrease of 11,000 from the previous week's revised figure of 456,000. The 4-week moving average was 455,750, a decrease of 3,000 from the previous week's revised average of 458,750.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 3,000 to 455,750.

The 4-week moving average has been moving sideways at an elevated level since last December - and that suggests a weak job market.