by Calculated Risk on 1/30/2009 01:22:00 PM

Friday, January 30, 2009

The Rebalancing Continues ...

The rebalancing of the U.S. economy is ongoing. The savings rate is rising, consumption is falling, and the trade deficit is declining ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows Personal Consumption Expenditures (PCE) as a percent of GDP. Note: the graph doesn't start at zero to better show the change.

PCE as a percent of GDP declined to 69.6% in Q4, the lowest level since Q2 2001.

Some analysts think the U.S. will return to the days of Ozzie and Harriet with PCE as a percent of GDP in the low 60s, but I think a decline to around 68% is more likely. Net exports as a percent of GDP has declined sharply to 3.7% of GDP. This is the smallest deficit since the end of the '01 recession.

Net exports as a percent of GDP has declined sharply to 3.7% of GDP. This is the smallest deficit since the end of the '01 recession.

Since GDP = C + I + G + (X − M), the decline in C is being offset by the improvement in net trade (X - M).

As we all know, I (investment) is declining and some components of investment (like non-residential investment in structures) will decline sharply in 2009. G (government) will increase with the Obama stimulus package, and the goal is to increase G until Investment bottoms out. We will see, but the rebalancing of the U.S. economy that we discussed several years ago is now happening.

Note:

C = Personal Consumption expenditures.

I = Gross private domestic investment.

G = Government consumption expenditures and gross investment.

X = exports

M = imports.

Fannie Mae Extends Eviction Suspension Another Month

by Calculated Risk on 1/30/2009 12:11:00 PM

From Fannie Mae: Fannie Mae Extends Eviction Suspension Another Month (hat tip Bradley)

Fannie Mae (FNM/NYSE) today announced that it will extend its suspension of evictions from Fannie Mae-owned single-family properties through February 28, 2009. The suspension applies to all single-family properties including owner-occupied properties that have been foreclosed upon as well as foreclosed properties occupied by renters.It is usually easier to sell a vacant home, but with the glut of homes on the market, and because the foreclosure is not the fault of the renter, this policy seems to make sense.

The company this month began implementing its National Real Estate Owned (REO) Rental Policy that allows qualified renters in Fannie Mae-owned foreclosed properties to stay in their homes. The new policy applies to renters occupying any type of single-family foreclosed properties at the time Fannie Mae acquires the property. Eligible renters will be offered a new month-to-month lease with Fannie Mae or financial assistance for their transition to new housing should they choose to vacate the property. The properties must meet state laws and local code requirements for a rental property. On behalf of the company, property managers are contacting renters in Fannie Mae-owned foreclosed properties to notify them of their options.

Investment as a Percent of GDP

by Calculated Risk on 1/30/2009 09:09:00 AM

Here are a couple of graphs on the investment slump. Residential real residential fixed investment decreased at an a 23.6% annualized rate in Q4. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows residential investment (RI) as a percent of GDP since 1947. Residential investment has fallen to 3.07% of GDP. This is the lowest residential investment, as a percent of GDP, since WW II.

I'll post more on the components of RI in a few days when the supplemental data is released. The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.

Investment in software and equipment declined at a 27.8% annualized rate in Q4. Cliff diving! This investment is at the lowest rate since the '70s.

However investment in non-residential structures only declined at a 1.8% annualized rate. As a percent of GDP, non-residential structure investment actually increased slightly in Q4. This story will change in 2009, and non-residential structure investment will be a significant drag on GDP.

I'll have much more on non-residential structures in a few days ...

This investment slump is a huge part of the recession story. Residential led the economy into recession (as is typical) and now non-residential investment is falling off a cliff - or, as in the case of non-residential structures, will fall off a cliff in 2009.

GDP Declines 3.8% in Q4

by Calculated Risk on 1/30/2009 08:31:00 AM

I'll have more a little later ...

From the BEA: GROSS DOMESTIC PRODUCT: FOURTH QUARTER 2008 (ADVANCE)

From MarketWatch: U.S. Q4 GDP down 3.8%, inventories limit downturn

The U.S. economy contracted at a 3.8% annualized rate in the fourth quarter but the decline would have been worse except that the government counts an unwanted buildup of goods on store shelves as growth.

A clearer picture of the scope of the weakness in the fourth quarter, which excludes the inventory buildup, contracted at a 5.1% pace, the weakest in 28 years.

...

Consumer spending fell 3.5%, including a 7.1% drop in spending on services, a 3.5% drop in spending on durable goods and a 22.4% decline in spending on nondurable goods, the weakest in 21 years.

Business investment fell 20.1% in the fourth quarter, subtracting 2.3 percentage points from growth. ...

Investments in equipment and software dropped 27.8%, the weakest in 50 years.

Investments in structures fell 19.1%, the largest decline since the first quarter of 1975.

Exports fell 19.7% in the fourth quarter, while imports, which are a subtraction from the calculation of GDP, fell 15.7%. As a result, the narrowing trade deficit added 0.09 percentage points to growth.

Government spending increased 1.9% after rising 5.8% in the third quarter. ...

Businesses added $6.2 billion to their inventories after cutting them by $29.6 billion in the third quarter. The change in inventories added 1.32 percentage points to growth.

Residential investment fell 23.6% in the fourth quarter ...

Thursday, January 29, 2009

Q4 GDP Forecasts: Consensus 5.4% Decline

by Calculated Risk on 1/29/2009 11:44:00 PM

As a late night thread, here are some forecasts for Q4 GDP.

From the LA Times: Economy is going from bad to worse, reports show

Many economists think the economic output declined in the fourth quarter at an annual rate of 5% or more -- which would make it the worst quarter for the U.S. economy since 1982.From CNNMoney:

"It will be bad," said Nigel Gault, chief U.S. economist at IHS Global Insight, a forecasting firm in Lexington, Mass. He estimated that the economy shrank at a 5.3% annual rate in the three months that ended Dec. 31.

...

"It's going to confirm what we already know, and that is that we're in a severe recession," said Ben Herzon, senior economist with forecasting firm Macroeconomic Advisers in St. Louis, who expects the report to show a decline of 5.5%.

The gross domestic product is expected to have declined by an annual rate of 5.4% in the fourth quarter, according to a consensus of economist expectations from Briefing.com.Goldman Sachs most recent estimate is for real GDP to decline by 5.9%.

Northern Trust is forecasting a decline of 4.7%.

Looks like tomorrow will be interesting.

WSJ: Option ARM Defaults Rising

by Calculated Risk on 1/29/2009 09:17:00 PM

From Ruth Simon at the WSJ: Option ARMs See Rising Defaults (hat tip ShortCourage)

Nearly $750 billion of option adjustable-rate mortgages, or option ARMs, were issued from 2004 to 2007, according to Inside Mortgage Finance ... Rising delinquencies are creating fresh challenges for companies such as Bank of America Corp., J.P. Morgan Chase & Co. and Wells Fargo & Co. that acquired troubled option-ARM lenders.If 61% of the $750 billion in Option ARMs default, and with a 50% loss severity, the losses to lenders will be about $225 billion - far less than for subprime, but still a huge problem.

...

As of December, 28% of option ARMs were delinquent or in foreclosure, according to LPS Applied Analytics ... An additional 7% involve properties that have already been taken back by the lenders. ... Just over half of subprime loans were delinquent, in foreclosure, or related to bank-owned properties as of December. The nearly $750 billion of option ARMs issued from 2004 to 2007 compares with roughly $1.9 trillion each of subprime and jumbo mortgages in that period.

Nearly 61% of option ARMs originated in 2007 will eventually default, according to a recent analysis by Goldman Sachs ...

The key problem with Option ARMs is that they were used as affordability products, mostly in California and Florida, because buyers couldn't qualify for fixed rate mortgages or even regular ARMs. It should have been no surprise that most borrowers chose the negatively amortizing option; it was the only one they could afford!

Credit Crisis Indicators

by Calculated Risk on 1/29/2009 08:19:00 PM

It's been awhile, and by popular demand ...

Treasuries have rebounded somewhat since the beginning of the year, and there was tepid demand today for Five Year Treasuries, from Bloomberg: Treasuries Drop as Record Sale Draws Higher-Than-Forecast Yield

Treasuries plunged as the government sold a record $30 billion of five-year notes at a higher yield than forecast, indicating weak demand.

The auction, which caps a week when the Treasury raised $78 billion in notes and bonds, may signal investors will have trouble absorbing the as-much-as $2.5 trillion in debt the U.S. is likely to issue this year ...

“We’re seeing a bit of indigestion,” said Larry Dyer, a U.S. interest-rate strategist with HSBC Securities (USA)

Click on graph for larger image in new window.

Click on graph for larger image in new window.The 10-year yield is at 2.82% today, well above the record low of 2.07% set on Dec 18th.

This graph shows the 10 year yield since 1962. The smaller graph shows the ten year yield since the start of 2008. In the bigger scheme, this has been a fairly small rebound in yield.

The yield on 3 month treasuries has risen to 0.22%. I guess that means less fear than a yield of zero!

| The TED spread was stuck above 2.0 for some time. The peak was 4.63 on Oct 10th. The TED spread has finally moved below 1.0, although a normal spread is around 0.5. |

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding close to zero. If the credit crisis eases, I'd expect a significant further decline in this spread - although this is good progress.

The Federal Reserve assets decreased to $1.93 trillion this week from a high of over $2.3 trillion in December.

The Federal Reserve assets decreased to $1.93 trillion this week from a high of over $2.3 trillion in December.Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

This is interesting too, from Bloomberg: U.S. Commercial Paper Falls Most on Record as Fed Buying Drops

Corporate borrowing in the commercial paper market shrank the most on record as companies sold less 90- day debt to the Federal Reserve.By these indicators, the Fed is making progress.

U.S. commercial paper outstanding fell $98.8 billion, or 5.9 percent, to a seasonally adjusted $1.59 trillion during the week ended Jan. 28, the Fed said today in Washington. Financial issuance accounted for almost all of the drop, falling $93.5 billion, or 12.7 percent, to $641.8 billion.

The decline in the commercial paper market signals improved conditions as financial companies find other funding sources such as government-backed corporate bonds, Tony Crescenzi, chief bond- market strategist at Miller Tabak & Co. in New York, said in a note to clients today.

$4 Trillion Bank Bailout?

by Calculated Risk on 1/29/2009 05:36:00 PM

From CNBC: Bank Bailout Could Cost Up to $4 Trillion: Economists

Goldman Sachs estimated that it would take on the order of $4 trillion to buy troubled mortgage and consumer debt. That number could shrink if the program were limited to only certain loans or banks, but it could also grow if other asset classes such as commercial real estate loans were included.We need more details ...

...

The Wall Street Journal said government officials had discussed spending $1 trillion to $2 trillion to help restore banks to health, citing people familiar with the matter.

...

The government would not necessarily have to spend the full $4 trillion to buy the assets. If it follows the model used in a Federal Reserve program to support consumer and small business loans, the government could potentially put up just 10 percent of the total.

"Unprecedented and shocking" Decline in Air Cargo

by Calculated Risk on 1/29/2009 02:48:00 PM

More cliff diving ...

From the International Air Transport Association: Cargo Plummets 22.6% in December (hat tip Bob_in_MA)

In the month of December global international cargo traffic plummeted by 22.6% compared to December 2007. The same comparison for international passenger traffic showed a 4.6% drop. The international load factor stood at 73.8%.

For the full-year 2008, international cargo traffic was down 4.0%, passenger traffic showed a modest increase of 1.6%, and the international load factor stood at 75.9%.

“The 22.6% free fall in global cargo is unprecedented and shocking. There is no clearer description of the slowdown in world trade. Even in September 2001, when much of the global fleet was grounded, the decline was only 13.9%,” said Giovanni Bisignani, IATA’s Director General and CEO.” Air cargo carries 35% of the value of goods traded internationally.

...

“2009 is shaping up to be one of the toughest years ever for international aviation. The 22.6% drop in international cargo traffic in December puts us in un-charted territory and the bottom is nowhere in sight. Keep your seatbelts fastened and prepare for a bumpy ride and a hard landing,” said Bisignani.

emphasis added

Regulator to Bank: Find Buyer or Else

by Calculated Risk on 1/29/2009 01:56:00 PM

We rarely get advance notice for Bank Failure Friday, but this might be one ...

From the Baltimore Sun: Suburban Federal Savings Bank told to sell

Federal banking regulators have told Crofton-based Suburban Federal Savings Bank that it must be sold by Friday or face a possible government takeover.

The 53-year-old thrift has been trying to recover from losses on soured real-estate loans. In documents filed last week, the Office of Thrift Supervision ordered Suburban to merge with another institution or accept "appointment of a conservator or receiver."

If Suburban were to be seized, it would be the first bank to fail in Maryland since 1992, the tail end of the savings and loan crisis.

Suburban, which has seven branches and about $354 million in assets, was supposed to submit a binding merger agreement to the OTS by last Friday, but neither the regulator nor Suburban officials would say yesterday whether a plan was submitted.

Philly Fed: Activity Declined in Every State in December

by Calculated Risk on 1/29/2009 12:04:00 PM

Here is a new record that will never be broken! The Philly Fed index shows - for the first time ever - declining activity in all states in December (see bottom graph).

Here is the Philadelphia Fed state coincident index release for December.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for December 2008. The indexes decreased in all 50 states for the month (a one-month diffusion index of -100). For the past three months, the indexes increased in three states, Louisiana, North Dakota, and Wyoming, and remained unchanged in one state, Alaska.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. Almost all states are showing declining activity over the last three months.

This is what a widespread recession looks like based on the Philly Fed states indexes.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. For the first time ever, the Philly Fed index showed no states with increasing activity.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. For the first time ever, the Philly Fed index showed no states with increasing activity. The indexes decreased in all 50 states for the month (a one-month diffusion index of -100).Most of the U.S. was has been in recession since December 2007 based on this indicator - and now ALL states are see declining activity.

Record Low New Homes Sales in December

by Calculated Risk on 1/29/2009 10:00:00 AM

The Census Bureau reports, New Home Sales in December were at a seasonally adjusted annual rate of 331 thousand. This is the lowest sales rate the Census Bureau has ever recorded (starting in 1963).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for December since 1966. (NSA, 23 thousand new homes were sold in December 2008, 23 thousand were sold in December 1966).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in December 2008 were at a seasonally adjusted annual rate of 331,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 14.7 percent (±13.9%)* below the revised November of 388,000 and is 44.8 percent (±10.8%) below the December 2007 estimate of 600,000.

The months of supply is at an ALL TIME RECORD 12.9 months in December (this is seasonally adjusted)!

The months of supply is at an ALL TIME RECORD 12.9 months in December (this is seasonally adjusted)!The seasonally adjusted estimate of new houses for sale at the end of December was 357,000. This represents a supply of 12.9 months at the current sales rate.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly since starts have fallen off a cliff.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly since starts have fallen off a cliff.Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

This is a another very weak report. Record low sales. Record high months of supply. Ouch. I'll have more on new home sales later today ...

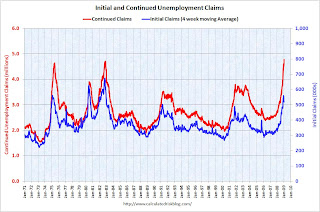

Continued Unemployment Claims at Record High

by Calculated Risk on 1/29/2009 09:13:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 24, the advance figure for seasonally adjusted initial claims was 588,000, an increase of 3,000 from the previous week's revised figure of 585,000. The 4-week moving average was 542,500, an increase of 24,250 from the previous week's revised average of 518,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 17 was 4,776,000, an increase of 159,000 from the preceding week's revised level of 4,617,000. The 4-week moving average was 4,630,000, an increase of 66,500 from the preceding week's revised average of 4,563,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 542,500; still below the recent peak of 558,750

in December.

Continued claims are now at 4.78 million - a new record - just above the previous all time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

By these measures the current recession is already about the same severity as the '90/'91 recession.

Ford $5.9 Billion Loss

by Calculated Risk on 1/29/2009 09:04:00 AM

From MarketWatch: Ford loses nearly $6 billion as revenue beats target

Ford Motor Co. reported Thursday a fourth-quarter loss of $5.9 billion ... Revenue dropped 34% to $29.2 billion as car sales dried up in the U.S. market.And Ford is the healthiest of the U.S. automakers ...

Late Night: Credit Union Bailout, Ford Job Cuts, Citi Oversight

by Calculated Risk on 1/29/2009 12:39:00 AM

Just a few more stories to discuss ...

From the WaPo: U.S. Aid Goes to Credit Unions

The federal government yesterday expanded its bailout to another vulnerable sector, saying it will inject $1 billion into a nonprofit company that provides banking services to the credit union industry.The story is interesting. Many Credit Unions send funds to U.S. Central Corporate Federal Credit Union to invest, and Central invested in ... what else ... mortgage-related securities!

The government also will guarantee tens of billions of dollars in previously uninsured deposits in a move that aims to forestall a crisis of confidence in a system once considered unshakable because of its conservative business practices.

The National Credit Union Administration ... said it was acting to protect the nearly 90 million Americans who use a retail credit union.

From Bloomberg: Ford Credit Will Cut 1,200 Workers as U.S. Auto Sales Slide

Ford Motor Co.’s finance unit will eliminate 20 percent of its workforce, or about 1,200 workers, as part of a cost-cutting move as U.S. auto sales rate falls to the lowest since 1982.Expect a huge loss tomorrow too!

From the WSJ: Agreement Boosts Citi Oversight

Citigroup Inc. has recently started operating under a regulatory agreement that could subject the company to greater restrictions on its operations.That is a little vague ... but clearly there is a cease-desist-order, MOU, or some other directive.

...

In a contract spelling out terms of the government bailout package, Treasury required Citigroup to disclose whether it or any of its subsidiaries are subject to any cease-and-desist orders, memorandums of understanding, consent orders, or other enforcement actions or regulatory agreements.

In a document attached to the contract, Citigroup didn't check a box indicating that it isn't operating under any such directives. Instead, the document states: "Certain items previously disclosed to the company's appropriate federal banking agency."

Wednesday, January 28, 2009

Genworth Tightens Mortgage Insurance Guidelines

by Calculated Risk on 1/28/2009 10:13:00 PM

Genworth sent out a notice of tighter guidelines for mortgage insurance today effective Monday February 2nd. Some of the changes are pretty significant.

As an example, loans over $417K in California are ineligible for MI. Period. The same with attached housing in Florida - ineligible.

Here are some of the rules:

Underwriting Guideline Changes – Effective February 2, 2009• Minimum Credit Score = 680

• Maximum Debt to Income (DTI) = 41% regardless of AUS or Submission Channel

• High Cost Loans (> $417,000) Minimum Credit Score = 740o Loan amounts > $417,000 in CA – Ineligible• Cash Out Refinance – Ineligible

• Second Homes – Ineligible

• Manufactured Homes – Ineligible

• Construction to Permanent – Ineligible

Declining/Distressed Markets Changes – Effective February 2, 2009You can see the old rules and guidelines here. You can type in your zip code and "discover if the property is in a Declining/Distressed Market". (I think this is the old rules and will change on Monday)• Minimum Credit Score = 700o AZ, CA, FL, NV = 720 (as per existing guidelines)• Maximum Debt-to-Income = 41% regardless of AUS or submission channel

• Additions to our Declining/Distressed Markets Listo 17 states added in their entirety

o 69 MSA/CBSA added

o Please see Attachment A for a complete list of new markets

Here is the current list of distressed markets. This included the following entire states: Arizona, California, Connecticut, Delaware, Florida, Michigan, Nevada, and New Jersey.

The mailing today added many more MSAs and the following additional entire states: Colorado, Maine, New Hampshire, Rhode Island, Wisconsin, Hawaii, Maryland, New Mexico, Utah, Idaho, Massachusetts, Ohio, Vermont, Kansas, Minnesota, Oregon, Washington.

Just more tightening ...

House Passes Stimulus Plan

by Calculated Risk on 1/28/2009 07:13:00 PM

From the NY Times: House Passes Obama’s Stimulus Package

Without a single Republican vote, President Obama won House approval on Thursday for an $819 billion economic recovery plan as Congressional Democrats sought to hold down their own difference over the enormous package of tax cuts and spending.It sounds like the stimulus package will pass the Senate and be signed into law by mid-Feb. The WSJ has some state by state stats and graphics (for those with access).

...

As Senate Democrats prepare to bring their version to the floor on Monday, Democrats from the House and the administration indicated they would ultimately accept a provision in the emerging Senate package that would adjust the alternative minimum tax to hold down many middle-class Americans’ income taxes for 2009.

The provision, which would drive the overall cost of the package to nearly $900 billion, was not in the legislation passed by the House.

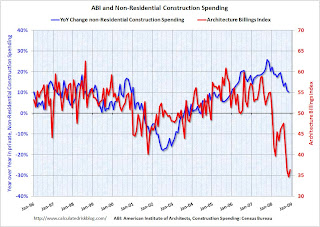

Architecture Billings Index as a Leading Indicator of Construction Spending

by Calculated Risk on 1/28/2009 05:59:00 PM

Back in 2005, Kermit Baker and Diego Saltes of the American Institute of

Architects wrote a white paper: Architecture Billings as a Leading Indicator of Construction

Here is a graph from their paper: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph from 2005 compares the Architecture Billings Index from the American Institute of Architects and year-over-year change in non-residential construction spending from the Census Bureau. The correlation is pretty strong (see the paper for more). The second graph is an update through Dec 2008 for the ABI, and Nov 2008 for construction spending.

The second graph is an update through Dec 2008 for the ABI, and Nov 2008 for construction spending.

I've had to change the scale to fit the collapse in the ABI on the graph.

The ABI typically leads construction spending by about 9 to 12 months according to AIA chief economist Kermit Baker. This graph also suggests the collapse will be very sharp, and although there isn't enough data to know if this is predictive of the percentage decline in spending, it does suggest a possible year-over-year decline of perhaps 30% in non-residential construction spending.

In November, private non-residential construction spending was at $428.2 billion annual rate. A 30% decline would be to an annual rate of $300 billion or so. Ouch.

Truck Tonnage Index: Cliff Diving

by Calculated Risk on 1/28/2009 05:19:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Plummeted 11.1 Percent in December (hat tip Dave of SV)  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index plunged 11.1 percent in December 2008, marking the largest month-to-month reduction since April 1994, when the unionized less-than-truckload industry was in the midst of a strike. December’s drop was the third-largest single-month drop since ATA began collecting the data in 1973. In December, the seasonally adjusted tonnage index equaled just 98.3 (2000 = 100), its lowest level since December 2000. The not seasonally adjusted index edged 0.6 percent higher in December.

Compared with December 2007, the index declined 14.1 percent, the biggest year-over-year decrease since February 1996. During the fourth quarter, tonnage was down 6.0 percent from the same quarter in 2007.

ATA Chief Economist Bob Costello said the December reading confirms that the United States is in the thick of a recession. “Motor carrier freight is a reflection of the tangible-goods economy, and December’s numbers leave no doubt that the United States is in the worst recession in decades,” Costello said. “It is likely truck tonnage will not improve much before the third quarter of this year. The economy is expected to contract through the first half of 2009 and then only grow slightly through the end of the year.”

Starbucks to close another 300 stores, Cut 7,000 Jobs

by Calculated Risk on 1/28/2009 04:22:00 PM

More bad employment news. And more bad news for mall owners ...

From MarketWatch: Starbucks plans to close 300 more shops as profit drops