by Calculated Risk on 12/26/2018 06:45:00 PM

Wednesday, December 26, 2018

Thursday: Unemployment Claims, New Home Sales (Postponed)

Note: New Home sales will not be released on Thursday due to the Government Shutdown.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher Today or Tomorrow

Mortgage rates were unchanged in some cases today and higher in others. The discrepancy is a result of the timing of today's market movements. The most important thing to know is that lenders who are unchanged today will almost certainly be higher tomorrow, unless the bond market stages an impressive comeback between now and tomorrow morning.Thursday:

...

In the bigger picture, the past few days of weakness are complicated. On the one hand, there is an argument to overlook them due to the idiosyncratic nature of holiday season trading. On the other hand, bonds have had 2 stellar months, and some of the movement we're seeing suggests they may be running into their first major correction against those 2 months of strength. In other words, rates have moved lower very nicely for 2 months and they're now threatening to bounce. [30YR FIXED - 4.625-4.75%]

emphasis added

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 214 thousand the previous week.

• At 9:00 AM: FHFA House Price Index for October 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM: POSTPONED New Home Sales for November from the Census Bureau. The consensus is for 560 thousand SAAR, up from 544 thousand in October.

Zillow Case-Shiller Forecast: Similar House Price Gains in November

by Calculated Risk on 12/26/2018 04:43:00 PM

The Case-Shiller house price indexes for October were released earlier. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: October Case-Shiller Results and November Forecast: Phoenix Replaces Seattle Among Top Three Home-Price Gainers

Home prices were steady in October, gaining 5.5 percent year-over-year, the same as September, according to the Case-Shiller home price index. The gain was slightly above Zillow’s forecast, and we expect another 5.5 percent year-over-year increase in November.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be about the same in November as in October.

Real House Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/26/2018 01:28:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.5% year-over-year in October

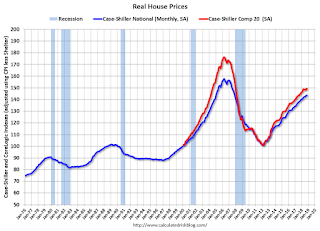

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 11.4% above the previous bubble peak. However, in real terms, the National index (SA) is still about 8.9% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 12.4% below the bubble peak.

The year-over-year increase in prices has slowed to 5.5% nationally, and will probably slow more as inventory picks up.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $286,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/26/2018 11:06:00 AM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Richmond Fed: "Fifth District Manufacturing Activity Weakened in December"

by Calculated Risk on 12/26/2018 10:19:00 AM

From the Richmond Fed: Fifth District Manufacturing Activity Weakened in December

Fifth District manufacturing activity weakened in December, according to the latest survey from the Richmond Fed. The composite index dropped from 14 in November to −8 in December, weighed down by drops in the indexes for new orders and shipments. At −25, the shipments index was its lowest reading since April 2009. However, the third component, the index for employment, rose. Respondents indicated a deterioration in local business conditions, as this index fell to −25, its lowest reading on record, but most firms were optimistic that conditions would improve.This is the weakest reading for this survey since 2016. All of the regional manufacturing surveys have been weaker in December than in November (the Dallas Fed survey will be released Monday).

Survey results suggested employment growth among many manufacturing firms in December, but firms continued to struggle to find workers with the necessary skills. Respondents expected this problem to continue in the coming months but anticipated continued employment growth as well.

emphasis added

Case-Shiller: National House Price Index increased 5.5% year-over-year in October

by Calculated Risk on 12/26/2018 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Phoenix Replaces Seattle in Top Three Cities in Annual Gains According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.5% annual gain in October, remaining the same from the previous month. The 10-City Composite annual increase came in at 4.7%, down from 4.9% in the previous month. The 20City Composite posted a 5.0% year-over-year gain, down from 5.2% in the previous month.

Las Vegas, San Francisco and Phoenix reported the highest year-over-year gains among the 20 cities. In October, Las Vegas led the way with a 12.8% year-over-year price increase, followed by San Francisco with a 7.9% increase and Phoenix with a 7.7% increase. Six of the 20 cities reported greater price increases in the year ending October 2018 versus the year ending September 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.1% in October. The 10-City and 20-City Composites did not report any gains for the month. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase in October. The 10-City Composite and the 20-City Composite posted 0.5% and 0.4% month-over-month increases, respectively. In October, nine of 20 cities reported increases before seasonal adjustment, while 18 of 20 cities reported increases after seasonal adjustment.

“Home prices in most parts of the U.S. rose in October from September and from a year earlier,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The combination of higher mortgage rates and higher home prices rising faster than incomes and wages means fewer people can afford to buy a house. Fixed rate 30-year mortgages are currently 4.75%, up from 4% one year earlier. Home prices are up 54%, or 40% excluding inflation, since they bottomed in 2012. Reduced affordability is slowing sales of both new and existing single family homes. Sales peaked in November 2017 and have drifted down since then.

“The largest gains were seen in Las Vegas where home prices rose 12.8% in the last 12 months, compared to an average of 5.3% across the other 19 cities. This is a marked change from the housing collapse in 2006-12 when Las Vegas was the hardest hit city with prices down 62%. After the last recession, Las Vegas diversified its economy by adding a medical school, becoming a regional center for health care, and attracting high technology employers. Employment is increasing 3% annually, twice as fast as the national rate.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up slightly from the bubble peak, and up 0.5% in October (SA).

The Composite 20 index is 3.3% above the bubble peak, and up 0.4% (SA) in October.

The National index is 11.4% above the bubble peak (SA), and up 0.5% (SA) in October. The National index is up 50.6% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to October 2017. The Composite 20 SA is up 5.1% year-over-year.

The National index SA is up 5.5% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Tuesday, December 25, 2018

Wednesday: Case-Shiller House Prices

by Calculated Risk on 12/25/2018 10:12:00 PM

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for October. The consensus is for a 5.0% year-over-year increase in the Comp 20 index for October.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December.

A Christmas Present for UberNerds

by Calculated Risk on 12/25/2018 08:11:00 AM

NOTE: If you are not familiar with Tanta, please read about her here. You will be happy you did - she was amazing.

A special present for UberNerds - an unpublished Tanta post (written Dec 31, 2007):

And from Tanta's 2007 Post: A Very Nerdy Christmas (see her post for an explanation of the origins of the Mortgage Pig™)Pig Rulz

There have been some misconceptions in the comments about Mortgage Pig™. I do not wish to enter a new year on the wrong track.

Mortgage Pig™ does not have a "name" except Mortgage Pig™. Assertions about Mortgage Pig™'s "name," "address," "job," "significant other," or favorite swill are not canonical. Anyone who asserts knowledge of such things in any communication, written or otherwise, is creating an Internet Urban Legend. Next thing you know they'll be telling you that you can Get Rich Qwik in RE investing.

Happy Holidays to all! CR

Monday, December 24, 2018

Ten Economic Questions for 2019

by Calculated Risk on 12/24/2018 02:28:00 PM

Here is a review of the Ten Economic Questions for 2018.

Below are my ten questions for 2019. I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2019, and - when there are surprises - to adjust my thinking.

1) Administration Policy: These are dangerous times. When Mr. Trump was elected, I was not too concerned about the short term (Luckily the economy was in good shape, and the cupboard was full). But after almost two years of chaos - and the loss of some stabilizing cabinet officers - I'm more concerned. Will Mr. Trump negatively impact the economy in 2019?

2) Economic growth: Economic growth was around 3% in 2018. Most analysts are expecting growth to slow in 2019 as the impact of the tax cuts wears off. How much will the economy grow in 2019?

3) Employment: Through November 2018, the economy has added 2,268,000 thousand jobs, or 206 thousand per month. This was the best year since 2015. Job creation was up from 182 thousand per month in 2017, and up from 195 thousand per month in 2016. Will job creation in 2019 be as strong as in 2018? Will job creation pick up further? Or will job creation slow in 2019?

4) Unemployment Rate: The unemployment rate was at 3.7% in November, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.5% to 3.7% range in Q4 2019. What will the unemployment rate be in December 2019?

5) Inflation: The inflation rate has increased and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

6) Monetary Policy: The Fed raised rates four times in 2018. Currently the Fed is forecasting two more rate hikes in 2019. Some analysts are forecasting three rate hikes. Will the Fed raise rates in 2019, and if so, by how much?

7) Real Wage Growth: Wage growth picked up in 2018 (up 3.1% year-over-year as of November). How much will wages increase in 2019?

8) Residential Investment: Residential investment (RI) was sluggish in 2018, and new home sales were mostly unchanged from 2017. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2019? How about housing starts and new home sales in 2019?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 5% in 2018. What will happen with house prices in 2019?

10) Housing Inventory: Housing inventory increased in 2018. Will inventory increase further in 2019?

There are other important questions, but these are the ones I'm focused on right now. I'll write on each of these questions over the next couple of weeks.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Chicago Fed "Index Points to an Increase in Economic Growth in November"

by Calculated Risk on 12/24/2018 09:12:00 AM

From the Chicago Fed: Index Points to an Increase in Economic Growth in November

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.22 in November from a neutral reading in October. Two of the four broad categories of indicators that make up the index increased from October, and three of the four categories made positive contributions to the index in November. The index’s three-month moving average, CFNAI-MA3, moved down to +0.12 in November from +0.23 in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in November (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.