by Calculated Risk on 6/28/2013 09:59:00 PM

Friday, June 28, 2013

Goldman on The Impact on GDP of Higher Mortgage Rates

A few brief excerpts from a research note by economists Kris Dawsey and Hui Shan at Goldman Sachs: The Drag from Higher Mortgage Rates

The rise in mortgage rates may impact the economy through two broad channels: (1) the direct impact on construction activity and home sales, which feed into the residential investment component of GDP, and (2) the indirect effects of lower home prices and less refinancing activity on consumption.My view - as I noted in House Prices and Mortgage Rates earlier this week - is that higher mortgage rates might slow price increases, but not lead to a decline in prices. I'll look into the relationship between mortgage rates and activity, but my first guess is the recent increase in rates will not slow the recovery in residential investment.

Complementing our past research on the impact of mortgage rates on various aspects of housing, we use a vector autoregression (VAR)-based approach to trace out the potential impact of the rise in mortgage rates. This analysis points to a manageable total impact on real GDP growth over the coming year of roughly two tenths of a percentage point. The direct effects of higher mortgage rates are likely to be larger in magnitude than the indirect effects.

Our estimate is subject to uncertainty. On the one hand, factors other than housing affordability―such as origination capacity constraints and borrower credit quality issues―are at present probably more important constraints than they have been historically. As a result, the sensitivity of housing indicators to changes in mortgage rates may be lower than historical estimates suggest. On the other hand, for technical reasons the nature of our statistical analysis may understate the magnitude of the potential impact.

Fannie Mae, Freddie Mac: Mortgage Serious Delinquency rates declined in May, Lowest since early 2009

by Calculated Risk on 6/28/2013 04:20:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in May to 2.83% from 2.93% in April. The serious delinquency rate is down from 3.57% in May 2012, and this is the lowest level since January 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 2.85% from 2.91% in April. Freddie's rate is down from 3.50% in May 2012, and this is the lowest level since May 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until 2016 or even 2017.

Zillow: Case-Shiller House Price Index expected to show over 12% year-over-year increase in May

by Calculated Risk on 6/28/2013 02:19:00 PM

The Case-Shiller house price indexes for May will be released Tuesday, July 30th. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Zillow makes a strong argument that the Case-Shiller index is currently overstating national house price appreciation.

Zillow Predicts Another 12% Annual Increase in Case-Shiller Indices for May

The Case-Shiller data for April came out [Tuesday] and, based on this information and the May 2013 Zillow Home Value Index (released last week), we predict that next month’s Case-Shiller data (May 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) increased 12.1 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) increased 12.2 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from April to May will be 1.3 percent for the 20-City Composite and 1.6 percent for the 10-City Composite Home Price Indices (SA).The following table shows the Zillow forecast for the May Case-Shiller index.

...

The Case-Shiller indices are giving an inflated sense of national home value appreciation because they are biased toward the large, coastal metros currently seeing such enormous home value gains, and because they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed. In contrast, the ZHVI does not include foreclosure resales and shows home values for May 2013 up 5.4 percent from year-ago levels. We expect home value appreciation to continue to moderate in 2013, rising only 4.1 percent between May 2013 and May 2014. Further details on our forecast of home values can be found here, and more on Zillow’s full May 2013 report can be found here.

To forecast the Case-Shiller indices, we use the March Case-Shiller index level, as well as the April Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with April foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

| Zillow May Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | May 2012 | 151.75 | 152.67 | 139.2 | 140.06 |

| Case-Shiller (last month) | Apr 2013 | 165.63 | 168.76 | 152.37 | 155.37 |

| Zillow Forecast | YoY | 12.2% | 12.2% | 12.1% | 12.1% |

| MoM | 2.8% | 1.6% | 2.4% | 1.3% | |

| Zillow Forecasts1 | 170.3 | 171.4 | 156.0 | 157.2 | |

| Current Post Bubble Low | 146.46 | 149.55 | 134.07 | 136.85 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 16.3% | 14.6% | 16.4% | 14.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Restaurant Performance Index at 14 month high in May

by Calculated Risk on 6/28/2013 11:54:00 AM

From the National Restaurant Association: Restaurant Performance Index Hits 14-Month High on Positive Sales and Customer Traffic Results

Buoyed by stronger same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) hit a 14-month high in May. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.8 in May, up 0.9 percent from April and the third consecutive monthly gain. May also represented the third straight month that the RPI surpassed the 100 level, which signifies expansion in the index of key industry indicators.

“The May increase in the Restaurant Performance Index was driven by broad-based gains in the current situation indicators, most notably positive same-store sales and customer traffic results,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association. “In addition, restaurant operators remain optimistic about continued sales growth and a majority plan to make a capital expenditure in the next six months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 101.6 in May – up 1.6 percent from a level of 100.1 in April. May represented the strongest Current Situation Index reading since March 2012, and signifies expansion in the current situation indicators.

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.8 in May from 101.0 in April. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Final June Consumer Sentiment at 84.1, Chicago PMI declines to 51.6

by Calculated Risk on 6/28/2013 10:00:00 AM

Click on graph for larger image.

• The final Reuters / University of Michigan consumer sentiment index for June decreased to 84.1 from the May reading of 84.5, but up from the preliminary June reading of 82.7.

This was above the consensus forecast of 83.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

• From the Chicago ISM:

June 2013:

The Chicago Business BarometerTM declined to 51.6 in June, the largest monthly drop since October 2008, and down from a 14-month high of 58.7 in May. The gyrations seen over the past few months are not typical for the Barometer and some of this might be attributable to the unseasonable weather conditions.PMI: Decreased to 51.6 from 58.7. (Above 50 is expansion).

...

Of the five Business Activity measures which make up the Barometer, four declined with only the Employment indicator posting an increase. Order Backlogs plunged deep into contraction to the lowest level since September 2009 and was the single biggest drag on Barometer. Faster Supplier Delivery times and declines in Production and New Orders also contributed to the Barometer’s weakness.

This was well below the consensus estimate of 55.0.

Thursday, June 27, 2013

Friday: Chicago PMI, Consumer Sentiment

by Calculated Risk on 6/27/2013 10:12:00 PM

Three interesting reads ...

From Merrill Lynch on house prices:

The momentum in home prices has continued to exceed even our bullish expectations. The S&P Case-Shiller index increased 16.7% annualized in 1Q and continued to climb higher in April, sending prices to a 12.1% yoy rate. We therefore have revised up our forecast for home prices from 8% 4Q/4Q growth this year to 11.8% 4Q/4Q. The three factors boosting home prices have been: shrinking share of distressed properties, low months supply and an increase in momentum; we believe the latter is the most powerful.I expect more inventory to come on the market, and for price increases to slow.

...

We also maintain our forecast that home price appreciation will slow to 6.5% next year with a risk of annual price declines within the next five years. This is decidedly not the beginning of a housing bubble.

From Peter Nicholas and Jon Hilsenrath at the WSJ on the next Fed Chairperson: White House Assembles List of Potential Bernanke Successors at Fed

People familiar with the process wouldn't divulge any names on the shortlist, but said there was no front-runner. The White House is still in an early stage of the process and might not announce its selection until the early fall, they said.Let me help - the front runner is Fed Vice Chair Janet Yellen.

And Josh Lehner looks at state level employment data and expects an upward revision to national employment: State Employment Revisions, 2012q4

Using this quick method of comparing the different data series, the private sector sum of all the individual states is expected to be revised upward by approximately 500,000 (0.5%) for December. However, the topline U.S. employment estimate is currently larger than the sum of states would suggest. As such, we can expect a somewhat smaller upward revisions of around one month’s worth of job gains (200,000) in the national figures.Friday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for June will be released. The consensus is for a decrease to 55.0, down from 58.7 in May.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for June). The consensus is for a reading of 83.0.

Hotels: Occupancy Rate tracking pre-recession levels

by Calculated Risk on 6/27/2013 07:08:00 PM

Another update on hotels from HotelNewsNow.com: STR: Chicago tops weekly ADR, RevPAR gains

Overall, the U.S. hotel industry’s occupancy rose 0.5% to 72.5%, its ADR increased 4.1% to $111.64 and its RevPAR grew 4.6% to $80.96.The 4-week average of the occupancy rate is close to normal levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Through June 22nd, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking the pre-recession levels. The occupancy rate will probably increase over the next couple of months - the summer travel season is here!

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Freddie Mac: Mortgage Rates highest since July 2011

by Calculated Risk on 6/27/2013 03:06:00 PM

From Freddie Mac today: Mortgage Rates Roiling From Taper Talk

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates jumping along with bond yields amid recent Fed remarks that it could begin tapering its bond purchases later this year. The average 30-year fixed-rate mortgage rose from 3.93 percent last week to 4.46 percent this week; the highest it has been since the week of July 28, 2011. ...Mortgage rates have increased for seven consecutive weeks, and spiked higher last week.

30-year fixed-rate mortgage (FRM) averaged 4.46 percent with an average 0.8 point for the week ending June 27, 2013, up from last week when it averaged 3.93 percent. Last year at this time, the 30-year FRM averaged 3.66 percent.

15-year FRM this week averaged 3.50 percent with an average 0.8 point, up from last week when it averaged 3.04 percent. A year ago at this time, the 15-year FRM averaged 2.94 percent.

This graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.48% and 30 year mortgage rates are at 4.46% (according to Freddie Mac). Based on the relationship from the graph, if the ten year yield stays in this range, 30 year mortgage rates might move down next week to 4.4% or so in the Freddie Mac survey.

Note: The yellow markers are for the last three years with the ten year yield below 3%. A trend line through the yellow markers only is a little lower, but still over 4.2% at the current 10 year Treasury yield.

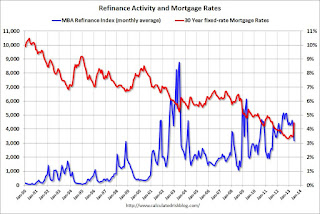

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down almost 42% over the last 7 weeks) and will probably decline significantly if rates stay at this level.

Kansas City Fed: Regional Manufacturing contracted in June

by Calculated Risk on 6/27/2013 12:29:00 PM

From the Kansas City Fed: Tenth District Manufacturing Survey Fell Modestly

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity fell modestly, although producers’ expectations for future activity continued to increase.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“We were a bit discouraged to see factory activity decline in June after it expanded slightly in May,” said Wilkerson. “But quite a few contacts lost production or had shipments delayed due to regional storms and flooding, so the downturn appears like it may be temporary.”

The month-over-month composite index was -5 in June, down from 2 in May but equal to -5 in April and March ... Other month-over-month indexes showed mixed results. The production index dropped from 5 to -17, its lowest level since March 2009, and the shipments and new orders indexes also fell markedly. The order backlog and employment indexes increased somewhat but still remain slightly below zero.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

All of the regional surveys - except Kansas City - showed expansion in June, and the Kansas City region was impact by flooding. The ISM index for June will be released Monday, July 1st, and these surveys suggest a reading above 50 (expansion).

Personal Income increase 0.5% in May, Spending increased 0.3%

by Calculated Risk on 6/27/2013 10:33:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $69.4 billion, or 0.5 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $29.0 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in May, in contrast to a decrease of 0.1 percent in April. ... The price index for PCE increased 0.1 percent in May, in contrast to a decrease of 0.3 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of less than 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q2 PCE growth (first two months of the quarter), PCE was increasing at a 1.8% annual rate in Q2 2013 (using mid-month method, PCE was increasing at 1.5% rate). This suggests GDP growth will be weaker in Q2 than in Q1.

Last week I posted Four Charts to Track Timing for QE3 Tapering . Here is an update to the inflation charts.

This graph is for PCE prices.

This graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through May, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The second graph is for core PCE prices.

The second graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through May, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It is possible that the FOMC could start to taper QE3 purchases in December, but it would take a pickup in the economy AND an increase in inflation. (September tapering is less likely, but not impossible - but the pickup would have to be significant over the next two months).