by Calculated Risk on 6/27/2013 10:12:00 PM

Thursday, June 27, 2013

Friday: Chicago PMI, Consumer Sentiment

Three interesting reads ...

From Merrill Lynch on house prices:

The momentum in home prices has continued to exceed even our bullish expectations. The S&P Case-Shiller index increased 16.7% annualized in 1Q and continued to climb higher in April, sending prices to a 12.1% yoy rate. We therefore have revised up our forecast for home prices from 8% 4Q/4Q growth this year to 11.8% 4Q/4Q. The three factors boosting home prices have been: shrinking share of distressed properties, low months supply and an increase in momentum; we believe the latter is the most powerful.I expect more inventory to come on the market, and for price increases to slow.

...

We also maintain our forecast that home price appreciation will slow to 6.5% next year with a risk of annual price declines within the next five years. This is decidedly not the beginning of a housing bubble.

From Peter Nicholas and Jon Hilsenrath at the WSJ on the next Fed Chairperson: White House Assembles List of Potential Bernanke Successors at Fed

People familiar with the process wouldn't divulge any names on the shortlist, but said there was no front-runner. The White House is still in an early stage of the process and might not announce its selection until the early fall, they said.Let me help - the front runner is Fed Vice Chair Janet Yellen.

And Josh Lehner looks at state level employment data and expects an upward revision to national employment: State Employment Revisions, 2012q4

Using this quick method of comparing the different data series, the private sector sum of all the individual states is expected to be revised upward by approximately 500,000 (0.5%) for December. However, the topline U.S. employment estimate is currently larger than the sum of states would suggest. As such, we can expect a somewhat smaller upward revisions of around one month’s worth of job gains (200,000) in the national figures.Friday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for June will be released. The consensus is for a decrease to 55.0, down from 58.7 in May.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for June). The consensus is for a reading of 83.0.

Hotels: Occupancy Rate tracking pre-recession levels

by Calculated Risk on 6/27/2013 07:08:00 PM

Another update on hotels from HotelNewsNow.com: STR: Chicago tops weekly ADR, RevPAR gains

Overall, the U.S. hotel industry’s occupancy rose 0.5% to 72.5%, its ADR increased 4.1% to $111.64 and its RevPAR grew 4.6% to $80.96.The 4-week average of the occupancy rate is close to normal levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Through June 22nd, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking the pre-recession levels. The occupancy rate will probably increase over the next couple of months - the summer travel season is here!

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Freddie Mac: Mortgage Rates highest since July 2011

by Calculated Risk on 6/27/2013 03:06:00 PM

From Freddie Mac today: Mortgage Rates Roiling From Taper Talk

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates jumping along with bond yields amid recent Fed remarks that it could begin tapering its bond purchases later this year. The average 30-year fixed-rate mortgage rose from 3.93 percent last week to 4.46 percent this week; the highest it has been since the week of July 28, 2011. ...Mortgage rates have increased for seven consecutive weeks, and spiked higher last week.

30-year fixed-rate mortgage (FRM) averaged 4.46 percent with an average 0.8 point for the week ending June 27, 2013, up from last week when it averaged 3.93 percent. Last year at this time, the 30-year FRM averaged 3.66 percent.

15-year FRM this week averaged 3.50 percent with an average 0.8 point, up from last week when it averaged 3.04 percent. A year ago at this time, the 15-year FRM averaged 2.94 percent.

This graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.48% and 30 year mortgage rates are at 4.46% (according to Freddie Mac). Based on the relationship from the graph, if the ten year yield stays in this range, 30 year mortgage rates might move down next week to 4.4% or so in the Freddie Mac survey.

Note: The yellow markers are for the last three years with the ten year yield below 3%. A trend line through the yellow markers only is a little lower, but still over 4.2% at the current 10 year Treasury yield.

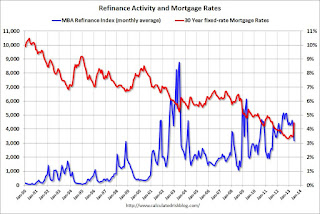

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down almost 42% over the last 7 weeks) and will probably decline significantly if rates stay at this level.

Kansas City Fed: Regional Manufacturing contracted in June

by Calculated Risk on 6/27/2013 12:29:00 PM

From the Kansas City Fed: Tenth District Manufacturing Survey Fell Modestly

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity fell modestly, although producers’ expectations for future activity continued to increase.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“We were a bit discouraged to see factory activity decline in June after it expanded slightly in May,” said Wilkerson. “But quite a few contacts lost production or had shipments delayed due to regional storms and flooding, so the downturn appears like it may be temporary.”

The month-over-month composite index was -5 in June, down from 2 in May but equal to -5 in April and March ... Other month-over-month indexes showed mixed results. The production index dropped from 5 to -17, its lowest level since March 2009, and the shipments and new orders indexes also fell markedly. The order backlog and employment indexes increased somewhat but still remain slightly below zero.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

All of the regional surveys - except Kansas City - showed expansion in June, and the Kansas City region was impact by flooding. The ISM index for June will be released Monday, July 1st, and these surveys suggest a reading above 50 (expansion).

Personal Income increase 0.5% in May, Spending increased 0.3%

by Calculated Risk on 6/27/2013 10:33:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $69.4 billion, or 0.5 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $29.0 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in May, in contrast to a decrease of 0.1 percent in April. ... The price index for PCE increased 0.1 percent in May, in contrast to a decrease of 0.3 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of less than 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q2 PCE growth (first two months of the quarter), PCE was increasing at a 1.8% annual rate in Q2 2013 (using mid-month method, PCE was increasing at 1.5% rate). This suggests GDP growth will be weaker in Q2 than in Q1.

Last week I posted Four Charts to Track Timing for QE3 Tapering . Here is an update to the inflation charts.

This graph is for PCE prices.

This graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through May, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The second graph is for core PCE prices.

The second graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through May, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It is possible that the FOMC could start to taper QE3 purchases in December, but it would take a pickup in the economy AND an increase in inflation. (September tapering is less likely, but not impossible - but the pickup would have to be significant over the next two months).

NAR: Pending Home Sales index increased in May

by Calculated Risk on 6/27/2013 10:06:00 AM

From the NAR: May Pending Home Sales Reach Highest Level in Over Six Years

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 6.7 percent to 112.3 in May from a downwardly revised 105.2 in April, and is 12.1 percent above May 2012 when it was 100.2; the data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

Contract activity is at the strongest pace since December 2006 when it reached 112.8; pending sales have been above year-ago levels for the past 25 months.

...

The PHSI in the Northeast was unchanged at 92.3 in May but is 14.3 percent above a year ago. In the Midwest the index jumped 10.2 percent to 115.5 in May and is 22.2 percent higher than May 2012. Pending home sales in the South rose 2.8 percent to an index of 121.8 in May and are 12.3 percent above a year ago. The index in the West jumped 16.0 percent in May to 109.7, but with limited inventory is only 1.1 percent above May 2012.

With limited inventory at the low end and fewer foreclosures, we might see flat existing home sales going forward (the NAR is forecasting a 9% increase this year to 5.07 million sales).

Weekly Initial Unemployment Claims decline to 346,000

by Calculated Risk on 6/27/2013 08:36:00 AM

NOTE: The BEA reported on Personal Income and Outlays for May.

Personal income increased $69.4 billion, or 0.5 percent ... Personal consumption expenditures (PCE) increased $29.0 billion, or 0.3 percent.The consensus was for a 0.2% increase in personal income in May, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%. I'll have more on this report soon.

The price index for PCE increased 0.1 percent in May ... The PCE price index, excluding food and energy, increased 0.1 percent

The DOL reports:

In the week ending June 22, the advance figure for seasonally adjusted initial claims was 346,000, a decrease of 9,000 from the previous week's revised figure of 355,000. The 4-week moving average was 345,750, a decrease of 2,750 from the previous week's revised average of 348,500.The previous week was revised up from 354,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 345,750.

The 4-week average has mostly moved sideways over the last few months. Claims were close to the 345,000 consensus forecast.

Wednesday, June 26, 2013

Thursday: Personal Income and Outlays for May, Weekly Unemployment Claims

by Calculated Risk on 6/26/2013 09:59:00 PM

From Cardiff Garcia at the FT Alphaville: Rates and the US housing market

We don’t mean to be entirely dismissive of the prevailing higher rates. The economy didn’t need any shade thrown at one of its few bright spots, especially with the continued fiscal drag and steady-but-unimpressive employment gains. Low rates not only spur along housing but also make credit more affordable for buying durable goods and automobiles, purchases of which often accompany newly formed households.Thursday:

And there isn’t much evidence (yet) to show that the fundamental supply-side problems we previously discussed have been mitigated, as such improvements would partly depend on the housing market’s continued rebound and wider improvements in the economy.

But at least the higher rates have arrived at a time when the housing market had favourable momentum.

• At 8:30 AM ET, the Personal Income and Outlays report for May. The consensus is for a 0.2% increase in personal income in April, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for an decrease to 345 thousand from 354 thousand last week.

• At 10:00 AM, the Pending Home Sales Index for May from the NAR. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for June. This is the last of the regional manufacturing surveys for June. The consensus is for a reading of 4 for this survey, up from 2 in May (Above zero is expansion).

House Prices and Mortgage Rates

by Calculated Risk on 6/26/2013 05:20:00 PM

Several people have asked me about a comment from Fannie Mae chief economist Doug Duncan as quoted in a NY Times article a couple of weeks ago: In a Shift, Interest Rates Are Rising

“There’s no strong correlation between interest rates and home prices,” said Douglas Duncan, chief economist at Fannie Mae.Duncan is correct.

However, a key difference now compared to earlier periods, is that there is more investor buying. And investors will compare their returns on different investments - and rising rates will probably slow investor demand for real estate, even if they are all cash buyers. But, in general, I think rising rates might slow price increases but not lead to a decline in prices (we might see some seasonal declines).

I'll post some more thoughts on the relationship between house prices and interest rates (long term readers might remember I wrote about this in 2005), but first I'd like to post a couple of graphs.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Corelogic House Price Index (started in 1976) and 30 year fixed mortgage rates as reported by Freddie Mac in their weekly Primary Mortgage Market Survey® .

Even with mortgage rates rising sharply in the late '70s, house prices continued to increase. And there were a few spikes in interest rates (like in 2000) that didn't slow price increases.

The second graph shows the same data, but with house prices in real terms (adjusted for inflation).

The second graph shows the same data, but with house prices in real terms (adjusted for inflation).Real prices were fairly flat in the late '70s and early '80s ... so maybe the spike in interest rates slowed price increases ... and then the economic weakness in the early '80s kept prices from rising even as mortgage rates declined.

In the early '90s, economic weakness (and the unwinding of a small housing bubble in certain states), lead to falling real prices even as mortgage rates declined.

The bottom line is other factors (like a stronger economy) have a bigger impact on house prices than changes in mortgage rates.

Philly Fed: State Coincident Indexes increased in 33 States in May

by Calculated Risk on 6/26/2013 01:59:00 PM

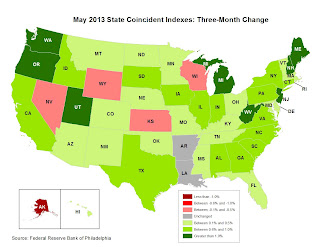

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2013. In the past month, the indexes increased in 33 states, decreased in eight states, and remained stable in nine, for a one-month diffusion index of 50. Over the past three months, the indexes increased in 43 states, decreased in five, and remained stable in two, for a three-month diffusion index of 76.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In May, 37 states had increasing activity, down from 44 in April (including minor increases). This measure has been and up down over the last few years since the recovery has been sluggish.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map is mostly green again and suggests that the recovery is geographically widespread.