by Calculated Risk on 11/19/2012 06:40:00 PM

Monday, November 19, 2012

Existing Home Sales: The Increase in Conventional Sales

Earlier I pointed out that one the keys for housing to return to "normal" are more conventional sales and fewer distressed sales. Not all areas report the percentage of distressed sales, and the NAR uses an unscientific survey to estimate distressed sales.

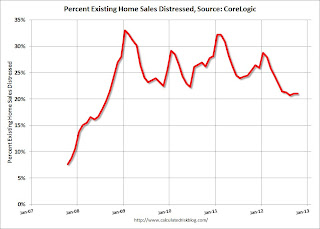

CoreLogic estimates the percent of distressed sales each month, and they were kind enough to send me their series. The first graph below shows CoreLogic's estimate of the distressed share starting in October 2007.

Click on graph for larger image.

Click on graph for larger image.

Note that the percent distressed increases every winter. This is because distressed sales happen all year, and conventional sales follow the normal seasonal pattern of stronger in the spring and summer, and weaker in the winter.

This is why the Case-Shiller seasonal adjustment increased in recent years.

Also note that the percent of distressed sales over the last 5 months is at the lowest level since mid-2008, but still very high.

The second graph shows the NAR existing home series using the CoreLogic share of distressed sales.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.

Using this method (NAR estimate for sales, CoreLogic estimate of share), conventional sales are now back up to around 3.8 million SAAR. The NAR reported total sales were up 10.9% year-over-year in October, but using this method, conventional sales were up almost 18% year-over-year.

Earlier:

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

• Existing Home Sales: A Solid Report

• Existing Home Sales graphs

Early: Housing Forecasts for 2013

by Calculated Risk on 11/19/2012 04:49:00 PM

Towards the end of each year I start to collect some housing forecasts for the following year. Here was a summary of forecasts for 2012. Right now it looks like new home sales will be around 365 thousand this year, and total starts around 750 thousand or so.

From Hui Shan, Sven Jari Stehn, Jan Hatzius at Goldman Sachs:

We project housing starts to continue to rise, reaching an annual rate of 1.0 million by the end of 2013 and 1.5 million by the end of 2016.Fannie Mae Chief Economist Doug Duncan is forecasting an 18.4% increase in housing starts in 2013 to 888 thousand, and single family starts increasing to 611 thousand.

Duncan projects new single family home sales to increase to 433 thousand from around 368 thousand this year. Duncan projects existing home sales will increase slightly to 4.76 million next year.

I'll be adding more forecasts, but I think we will see another solid percentage increase for housing starts and new home sales next year.

Existing Home Sales: A Solid Report

by Calculated Risk on 11/19/2012 12:35:00 PM

First, this report is a reminder that we have to be careful with the NAR data. The NAR revised down inventory for September from 2.32 million to 2.17 million (a downward revision of 6.5%). And the months-of-supply for September was revised down to 5.6 months from 5.9 months. These are very large revisions.

The percent distressed share (foreclosures and short sales) is also questionable. The NAR reported:

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 24 percent of October sales (12 percent were foreclosures and 12 percent were short sales), unchanged from September; they were 28 percent in October 2011.However this percentage is from an unscientific survey of Realtors, and other data suggests a larger decline in the share of distressed sales.

Oh well, I wish we had better data for the existing home market.

However, overall, this was a solid report. Based on historical turnover rates, I think "normal" sales would be in the 4.5 to 5.0 million range. So, existing home sales at 4.79 million are in the normal range.

Of course a "normal" market would have very few distressed sales, so there is still a long ways to go, but the market is headed in the right direction. The key to returning to "normal" are more conventional sales and fewer distressed sales. Not all areas report the percentage of distressed sales - that is why the NAR uses an unscientific survey - but the areas that do have shown a sharp decline in distressed sales, and a sharp increase in conventional sales.

Of course what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

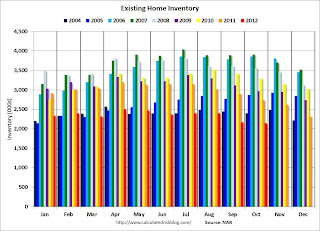

The NAR reported inventory decreased to 2.14 million units in October, down from 2.17 million in September. This is down 21.9% from October 2011, and down 25% from the inventory level in October 2005 (mid-2005 was when inventory started increasing sharply). This is the lowest level for the month of October since 2001.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of October since 2001, and inventory is below the level in October 2005 (not counting contingent sales). Earlier this year I argued months-of-supply would be below 6 towards the end of the year, and months-of-supply fell to 5.4 months in October (a normal range).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in October (red column) are sharply above last year (there were 2 more selling days this year in October). Sales are well below the bubble years of 2005 and 2006.

Sales NSA in October (red column) are sharply above last year (there were 2 more selling days this year in October). Sales are well below the bubble years of 2005 and 2006.Earlier:

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

• Existing Home Sales graphs

NAHB Builder Confidence increases in November, Highest since May 2006

by Calculated Risk on 11/19/2012 11:12:00 AM

I'll have some more comments on the Existing Home Sales report later this morning, but this is important too ...

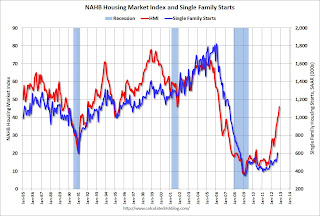

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 5 points in November to 46. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Five Points in November

Builder confidence in the market for newly built, single-family homes posted a solid, five-point gain to 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for November, released today. This marks the seventh consecutive monthly gain in the confidence gauge and brings it to its highest point since May of 2006.

“While our confidence gauge has yet to breach the 50 mark -- at which point an equal number of builders view sales conditions as good versus poor -- we have certainly made substantial progress since this time last year, when the HMI stood at 19,” observed NAHB Chief Economist David Crowe. “At this point, difficult appraisals and tight lending conditions for builders and buyers remain limiting factors for the burgeoning housing recovery, along with shortages of buildable lots that have begun popping up in certain markets.”

...

Two out of three of the HMI’s component indexes registered gains in November. The component gauging current sales conditions posted the biggest increase, with an eight-point gain to 49 – its highest mark in more than six years. Meanwhile, the component measuring sales expectations for the next six months held above 50 for a third consecutive month with a two-point gain to 53, and the component measuring traffic of prospective buyers held unchanged at 35 following a five-point gain in the previous month.

All four regions of the country posted gains in their HMI three-month moving averages as of November. The South posted a four-point gain to 43, while the Midwest and West each posted three-point gains, to 45 and 47, respectively, and the Northeast posted a two-point gain to 31. (Note, the HMI survey was conducted in the two weeks immediately following Hurricane Sandy and therefore does reflect builder sentiment during that period.)

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October housing starts will be released tomorrow). This was above the consensus estimate of a reading of 41.

Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

by Calculated Risk on 11/19/2012 10:00:00 AM

The NAR reports: Existing-Home Sales Rise in October with Ongoing Price and Equity Gains

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 2.1 percent to a seasonally adjusted annual rate of 4.79 million in October from a downwardly revised 4.69 million in September, and are 10.9 percent above the 4.32 million-unit level in October 2011.

...

Total housing inventory at the end of October fell 1.4 percent to 2.14 million existing homes available for sale, which represents a 5.4-month supply at the current sales pace, down from 5.6 months in September, and is the lowest housing supply since February of 2006 when it was 5.2 months. Listed inventory is 21.9 percent below a year ago when there was a 7.6-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2012 (4.79 million SAAR) were 2.1% higher than last month, and were 10.9% above the October 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.14 million in October down from 2.17 million in September. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

According to the NAR, inventory declined to 2.14 million in October down from 2.17 million in September. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.Months of supply declined to 5.4 months in October.

This was slightly above expectations of sales of 4.74 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

LA Times: "Most aid from mortgage settlement in California going to short sales"

by Calculated Risk on 11/19/2012 08:41:00 AM

Update: Here is the national report: Continued Progress: A Report from the National Mortgage Settlement

From Alejandro Lazo and Scott Reckard at the LA Times: Most aid from mortgage settlement in [California] going to short sales

Short sales, which allow underwater borrowers to sell their homes for less than they owe, have become the dominant type of relief offered in California by the big banks, according to a report on the settlement expected to be made public Monday.Short sales were becoming more frequent prior to the mortgage settlement, but this is probably why short sales now out number foreclosures in many areas.

Under the settlement, banks were required to give homeowners aid in the form of principal reduction, short sales and other modifications. Banks get credit for both principal reductions and short sales under the agreement, but must give 60% of the relief nationally through principal reduction to families who keep their homes. ...

Through Sept. 30, the three banks had provided $8.4 billion, according to data from [UC Irvine law professor Katherine Porter's] office, putting them well on track to fulfill their obligations. About 68% of that money went toward providing short sales for homeowners. Principal reductions on first and second mortgages made up the rest of the California aid.

Sunday, November 18, 2012

Monday: Existing Home Sales, Homebuilder Confidence

by Calculated Risk on 11/18/2012 09:00:00 PM

First on the recession in the Euro Zone from Jim Hamilton: Europe in recession

The Business Cycle Dating Committee of the Centre for Economic Policy Research (the European counterpart of the U.S. NBER) last week issued a declaration that Europe entered a new recession a year ago, dating the business cycle peak at 2011:Q3.This was pretty obvious a year ago.

Monday:

• At 10:00 AM ET, Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 4.74 million on seasonally adjusted annual rate (SAAR) basis. Sales in September 2012 were 4.75 million SAAR. Economist Tom Lawler estimates the NAR will report sales at 4.84 million SAAR. Goldman Sachs is forecasting a decline in sales to 4.67 million, and Merrill Lynch is forecasting 4.60 million.

• Also at 10:00 AM, the NAHB will release their November homebuilder survey. The consensus is for a reading of 41, unchanged from October. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

The Asian markets are green tonight, with the Nikkei up 1.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 6 and DOW futures are up 46.

Oil prices are up slightly with WTI futures at $87.48 per barrel and Brent at $109.46 per barrel. Gasoline prices are still falling a little.

Weekend:

• Summary for Week Ending Nov 16th

• Schedule for Week of Nov 18th

And on mortgage delinquencies:

• Press Release: Q3 National Delinquency Survey

• Q3 MBA National Delinquency Survey Graph and Comments

• Mortgage Delinquencies by Loan Type in Q3

• Serious Mortgage Delinquencies and In-Foreclosure by State

• Percent of Mortgage Seriously Delinquent over time, Selected States

Two more questions this week for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Table of Short Sales and Foreclosures for Selected Cities in October

by Calculated Risk on 11/18/2012 05:26:00 PM

Economist Tom Lawler sent me the table below of short sales and foreclosures for a few selected cities in October. Keep this table in mind when the NAR releases existing home sales tomorrow.

The NAR headline number will probably be close to the 4.75 million SAAR in September, but there are other signs of significant change in the housing market. First, inventory has declined sharply, and there is very little inventory in many areas. Second, it appears that the share of conventional sales in certain markets has increased significantly (these are normal sales - not foreclosures or short sales). Both the decline in inventory, and the increase in conventional sales, are signs of moving towards a more normal housing market.

Look at the right two columns in the table below (Total "Distressed" Share for Oct 2012 compared to Oct 2011). In every area that reports distressed sales, the share of distressed sales is down year-over-year - and down significantly in most areas. The NAR will release some distressed sales measurements tomorrow from an unscientific survey of Realtors - and I have little confidence in the survey results - but these local reports suggest distressed sales have fallen sharply in many areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Oct 2012 to Oct 2011. Foreclosure sales have declined in all these areas, and some of the declines have been stunning (the Nevada sales were impacted by a new foreclosure law).

Also there has been a shift from foreclosures to short sales. In most areas, short sales now far out number foreclosures, although Minneapolis is an exception with more foreclosures than short sales.

Imagine that the number of total sales doesn't change over the next year - some people would argue that is "bad" news and the housing market isn't recovering. But also imagine that the share of distressed sales declines 25%, and conventional sales increase to make up the difference. That would be a positive sign! As I noted a week ago, conventional sales in Sacramento were up 55% year-over-year in October (there were 2 more selling days in Oct 2012, but that is still a stunning increase). Too bad we don't have better national numbers on the share of distressed / conventional sales, but this table suggests some improvement.

Table from Tom Lawler:

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Oct | 11-Oct | 12-Oct | 11-Oct | 12-Oct | 11-Oct | |

| Las Vegas | 44.7% | 25.4% | 11.6% | 48.1% | 56.3% | 73.5% |

| Reno | 40.0% | 32.0% | 12.0% | 38.0% | 52.0% | 70.0% |

| Phoenix | 26.2% | 29.2% | 12.9% | 35.6% | 39.1% | 64.8% |

| Sacramento | 35.7% | 26.8% | 12.0% | 37.3% | 47.7% | 64.1% |

| Minneapolis | 10.5% | 12.6% | 25.1% | 33.6% | 35.6% | 46.2% |

| Mid-Atlantic (MRIS) | 11.7% | 15.2% | 9.1% | 16.0% | 20.7% | 31.2% |

| California (DQ)* | 26.0% | 24.9% | 17.4% | 34.0% | 43.4% | 58.9% |

| Lee County, FL*** | 20.4% | 19.8% | 16.4% | 33.7% | 36.8% | 53.5% |

| Hampton Roads VA | 28.3% | 33.2% | ||||

| Northeast Florida | 44.7% | 48.4% | ||||

| Chicago | 42.5% | 43.6% | ||||

| Charlotte | 13.2% | 17.4% | ||||

| Spokane WA | 8.4% | 20.4% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Birmingham AL | 30.8% | 35.5% | ||||

| Metro Detroit | 32.5% | 38.3% | ||||

| *share of existing home sales, based on property records | ||||||

| *** SF only | ||||||

Percent of Mortgage Seriously Delinquent over time, Selected States

by Calculated Risk on 11/18/2012 01:32:00 PM

A key question is: What has happened to the mortgage delinquency rate over time by state?

For the graph below I plotted the serious delinquency rate for several states over time (states selected by serious delinquency rate in Q1 2010 - at the national peak). Although the national delinquency rate has been steadily declining, the state level data shows different patterns. There has been dramatic improvement in some non-judicial states, like Arizona and California - and some judicial foreclosure states are still seeing the seriously delinquent rate increase, like New Jersey and New York.

Previous posts on Q3 delinquencies:

• Press Release: Q3 National Delinquency Survey

• Q3 MBA National Delinquency Survey Graph and Comments

• Mortgage Delinquencies by Loan Type in Q3

• Serious Mortgage Delinquencies and In-Foreclosure by State

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

I picked the states with the highest serious delinquency rate in Q1 2010 (Serious delinquencies peaked nationally in Q1 2010).

The red column for each state is the Q1 2010 data.

The light blue column was for Q2 2007. This was just as the serious delinquency rate started to increase nationally. Even then, the serious delinquency rate was elevated in some states like Michigan, Ohio and Indiana.

The states that have seen the most improvement - Arizona, California, Michigan, Nevada - are all non-judicial states. Florida is a judicial state that has seen some decline in the seriously delinquent rate. However the serious delinquency rate in New Jersey and New York has increased since Q1 2010.

The national data is useful, but with the different foreclosure processes, we also need to look at state and local data. Some states will be back to a "normal" delinquency rate soon - other states will take years.

Serious Mortgage Delinquencies and In-Foreclosure by State

by Calculated Risk on 11/18/2012 10:15:00 AM

Last week the MBA released the results of their Q3 National Delinquency Survey. One of the key points was the difference in the number of mortgages in the foreclosure process between judicial and non-judicial foreclosure states.

The first graph below (repeat) is from the MBA and shows the percent of loans in the foreclosure process by state.

The second graph shows all stages of delinquency (and in-foreclosure) by states, sorted by the percent seriously delinquent (90+ days plus in-foreclosure).

Previous posts on Q3 delinquencies:

• Q3 MBA National Delinquency Survey Graph and Comments

• Mortgage Delinquencies by Loan Type in Q3

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (13.04% in foreclosure down from 13.70% in Q2), New Jersey (8.87% up from 7.65%), Illinois (6.83% down from 7.11%), New York (6.46% down from 6.47%) and Nevada (the only non-judicial state in the top 13 at 5.93% down from 6.09%).

California (2.63% down from 3.07%) and Arizona (2.51% down from 3.24%) are now well below the national average.

The second graph includes all delinquent loans (sorted by percent seriously delinquent).

The second graph includes all delinquent loans (sorted by percent seriously delinquent).

Florida and New Jersey have the highest percentage of serious delinquent loans, followed by Nevada, Illinois, New York, Maine and Maryland. Nevada still leads with the highest percent of loans 90+ days delinquent.

Previous high delinquency states like California and Arizona are now well down the list.