by Calculated Risk on 11/19/2012 12:35:00 PM

Monday, November 19, 2012

Existing Home Sales: A Solid Report

First, this report is a reminder that we have to be careful with the NAR data. The NAR revised down inventory for September from 2.32 million to 2.17 million (a downward revision of 6.5%). And the months-of-supply for September was revised down to 5.6 months from 5.9 months. These are very large revisions.

The percent distressed share (foreclosures and short sales) is also questionable. The NAR reported:

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 24 percent of October sales (12 percent were foreclosures and 12 percent were short sales), unchanged from September; they were 28 percent in October 2011.However this percentage is from an unscientific survey of Realtors, and other data suggests a larger decline in the share of distressed sales.

Oh well, I wish we had better data for the existing home market.

However, overall, this was a solid report. Based on historical turnover rates, I think "normal" sales would be in the 4.5 to 5.0 million range. So, existing home sales at 4.79 million are in the normal range.

Of course a "normal" market would have very few distressed sales, so there is still a long ways to go, but the market is headed in the right direction. The key to returning to "normal" are more conventional sales and fewer distressed sales. Not all areas report the percentage of distressed sales - that is why the NAR uses an unscientific survey - but the areas that do have shown a sharp decline in distressed sales, and a sharp increase in conventional sales.

Of course what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

The NAR reported inventory decreased to 2.14 million units in October, down from 2.17 million in September. This is down 21.9% from October 2011, and down 25% from the inventory level in October 2005 (mid-2005 was when inventory started increasing sharply). This is the lowest level for the month of October since 2001.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Click on graph for larger image.

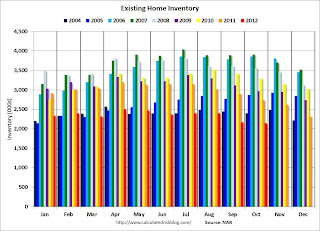

Click on graph for larger image.This graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of October since 2001, and inventory is below the level in October 2005 (not counting contingent sales). Earlier this year I argued months-of-supply would be below 6 towards the end of the year, and months-of-supply fell to 5.4 months in October (a normal range).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in October (red column) are sharply above last year (there were 2 more selling days this year in October). Sales are well below the bubble years of 2005 and 2006.

Sales NSA in October (red column) are sharply above last year (there were 2 more selling days this year in October). Sales are well below the bubble years of 2005 and 2006.Earlier:

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

• Existing Home Sales graphs