by Calculated Risk on 4/23/2012 11:08:00 AM

Monday, April 23, 2012

FNC: February Residential Property Values Down 0.8%

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and RadarLogic indexes.

From FNC: February Residential Property Values Down 0.8%

FNC’s latest Residential Price Index™ (RPI), released Friday, indicates that U.S. residential property values continued to show signs of persistent weakening - ending in February with a seventh consecutive month-to-month decline. Despite sharply rising activities in existing home sales and new housing starts from a year ago, prices on non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales) continue to slide, down 0.8% from February or 3.0% from a year ago.

...

All three RPI composites (the National, 30-MSA, and 10-MSA indices) show similar month-to-month declines in February, down about a percentage point from January. ... The indices’ year-to-year trends continue to show signs of improvement. According to the national RPI, home prices nationwide declined at a seasonally adjusted rate of 3.0% in February, the slowest pace in the last 20 months. The year-to-year declines at the nation’s top housing markets, as indicated by the 30- and 10-MSA composites, have also decelerated to below 4.0% -- their slowest pace since May 2010.

Click on graph for larger image.

Click on graph for larger image.This graph is based on the FNC index (four composites) through February 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The indexes are generally showing less of a year-over-year decline in February (I think prices will fall seasonally through the March report). This is the smallest year-over-year decline in the FNC index since the housing tax credit expired.

The February Case-Shiller index will be released tomorrow, and the consensus is for a 3.3% decrease in year-over-year prices (NSA) in February. (Zillow is forecasting that Case-Shiller will report a 3.5% decline for the Composite 10 index, and a 3.4% decline for the Composite 20).

Eurozone Worries Again

by Calculated Risk on 4/23/2012 08:54:00 AM

A few stories:

From the Financial Times: Eurozone angst spooks investors

Markets reacted nervously on Monday to the socialists’ first-round victory in France’s presidential election, as the eurozone crisis claimed another victim on Monday with the collapse of the Dutch government.From the WSJ: Euro-Zone's Private Sector Shrinking Fast

excerpt with permission

The euro zone's private sector contracted in April at the sharpest pace since November, damaged by a steep decline in the manufacturing sector, suggesting the region won't rebound quickly from the recession recent data are pointing to.From the WSJ: Spain's Economy Dwindling

The preliminary composite PMI for the euro zone slumped to 47.4 in April from March's 49.1, Markit's preliminary purchasing managers' index showed Monday. The April manufacturing PMI slipped to 46 from March's 47.7 while the services PMI also declined to 47.9 from 49.2 over the same period ...

Spain's central bank said Monday that the country's economy contracted 0.4% in the first quarter from the fourth, evidence that a worsening downturn is making it tougher for Madrid to reach ambitious austerity targets.

On an annual basis, the economy contracted 0.5%, the first negative reading after seven-consecutive quarters of modest growth, the Bank of Spain said in its monthly economic report. This marks the official end of a mild recovery between late 2010 and late 2011 ...

Sunday, April 22, 2012

Sunday Night Futures

by Calculated Risk on 4/22/2012 11:30:00 PM

From the NY Times: Hollande and Sarkozy Head to Runoff in French Race

The Socialist candidate, François Hollande, won a narrow victory in Sunday’s first round of France’s presidential elections, riding promises of economic growth and a general dislike for the incumbent, Nicolas Sarkozy, into a favorable position before a runoff with Mr. Sarkozy on May 6.It sounds link Hollande is leading right now. The election in Greece is also scheduled for May 6th.

The strong showing by the left and anger on the political extremes seemed to reflect a desire for change in France after 17 years of centrist, conservative presidents. And it could continue an anti-incumbency trend that began with the economic crisis in Western Europe, where center-right governments dominate from Britain to Spain to Germany.

It may also represent the first stirrings of a challenge to the German-dominated narrative of the euro crisis, which holds that public debt and runaway spending are the main culprits and that austerity must precede growth.

The Asian markets are mostly red tonight. The Nikkei is down about 0.3%, but the Shanghai Composite is up 0.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down slightly, and Dow futures are down 20.

Oil: WTI futures are down to $103.81 (this is down from $109.77 in February) and Brent is up to $118.79 per barrel.

Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

• FOMC Meeting Preview

From the WSJ: Hilsenrath's FOMC Preview

by Calculated Risk on 4/22/2012 07:58:00 PM

This is very similar to my FOMC Meeting Preview this morning.

From Jon Hilsenrath at the WSJ: A Forecast of What the Fed Will Do: Stand Pat

The changing forecast will be one of the most important topics of discussion at the central bank's policy meeting Tuesday and Wednesday, when officials will update their quarterly economic projections.Also on "QE", Paul Krugman has two short comments: What We Talk About When We Talk About QE and QE Or Not QE, That Is The Question. I frequently point out in the comments that the Fed is buying agency MBS, not private label garbage. Apparently there is widespread misunderstanding on this point. Krugman writes:

...

The new forecasts could project a little more inflation in 2012 than the Fed forecast in January, thanks in part to a recent rise in gasoline prices. It could also project a little less unemployment for 2012, thanks to recent declines in the jobless rate.

...

But the overall growth outlook for 2012 doesn't seem to have changed much from a few months ago.

...

Against the backdrop of a little more inflation and a little less unemployment than expected in the short-run, a scattering of officials might say that short-term interest rates should go up sooner than they projected in January to forestall a run-up in consumer prices.

...

But with many officials still doubtful about the durability of the recovery and expecting inflation to recede, the broader view at the Fed seems likely to favor sticking to their plan to keep rates low until late 2014.

Reading a few comments, I think it’s really important to emphasize that the Fed is only buying agency mortgage-backed securities — that is, the stuff that already has an implicit Federal guarantee. A lot of readers seem to think that the Fed is buying subprime MBS or something like that, handing over money for worthless paper. Not so.Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

Housing Survey: Fewer "low ball" Offers in 2012

by Calculated Risk on 4/22/2012 03:23:00 PM

From Kenneth Harney at the WaPo: Low-ball bidders in many markets learn they can no longer get a steal on a house

A year ago, according to researchers at the National Association of Realtors, one out of 10 members surveyed in a monthly poll complained about low-ball offers on houses listed for sale. In the latest survey — conducted in March among 4,500 agents and brokers across the country but not yet released — there were hardly any. Instead, the focus of volunteered comments has shifted to declining inventory levels — fewer houses available to sell — and multiple offers on well-priced listings.Harney concludes that low ball offers might have worked in 2008 through 2011, but this is 2012.

A low-ball offer typically involves a contract submitted to a seller where the price proposed by the purchaser is 25 percent or more below list. ...

... in local markets where inventories are tight and competition for homes rising, realty agents say that buyers looking to steal houses by low-balling their offers are ending up at the back of the line, their contracts either rejected out of hand or countered close to the original asking price.

Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

• FOMC Meeting Preview

FOMC Meeting Preview

by Calculated Risk on 4/22/2012 11:36:00 AM

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the program to "extend the average maturity of its holdings of securities" (scheduled to end in June), or to the program to "reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities". I don't expect further accommodation (aka "QE3") to be announced at this meeting.

On Wednesday the FOMC statement will be released around 12:30 PM ET, the FOMC projections will be released at 2:00 PM, and Fed Chairman Ben Bernanke will hold a quarterly press briefing at 2:15 PM.

A few things to look for:

1) FOMC participants' projections of the appropriate target federal funds rate. This will be the second quarterly release of the participants' view of the appropriate path for the Fed funds rate. I've included the charts from the January FOMC meeting below. It is unlikely that there will be any significant change in views, but there might be some slight shift in when some participants think the Fed should start raising the Fed funds rate.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

The April chart will be compared to the January chart for any shift in views, but the changes will probably be minor.

Most participants will probably still think the Fed Funds rate will be in the current range into 2014.

2) Fed Chairman Press Briefing. At the press briefing, Chairman Bernanke will discuss the new FOMC forecasts including the two charts on the Fed funds rate. Growth forecasts were routinely revised down last year, but it appears that GDP forecasts will remain mostly unchanged this quarter. However the unemployment rate for 2012 will probably be revised down given that the March unemployment rate was already at the lower range of the FOMC's Q4 2012 forecast. The inflation forecast might be revised up slightly.

One again Bernanke will be asked about the possibility of a large scale MBS purchase program (QE3), and I expect he will leave the door open for further accomodation based on incoming data.

Here are the updated forecasts from the January meeting (including the November forecasts to show the change). The GDP projection for 2012 will probably be mostly unchanged.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| January 2012 Projections | 2.2 to 2.7 | 2.8 to 3.2 | 3.3 to 4.0 |

| November 2011 Projections | 2.5 to 2.9 | 3.0 to 3.5 | 3.0 to 3.9 |

The unemployment rate declined to 8.2% in March, and the projection for 2012 will probably be revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

| November 2011 Projections | 8.5 to 8.7 | 7.8 to 8.2 | 6.8 to 7.7 |

The forecasts for overall and core inflation will probably be revised up slightly or left unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| January 2012 Projections | 1.4 to 1.8 | 1.4 to 2.0 | 1.6 to 2.0 |

| November 2011 Projections | 1.4 to 2.0 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| January 2012 Projections | 1.5 to 1.8 | 1.5 to 2.0 | 1.6 to 2.0 |

| November 2011 Projections | 1.5 to 2.0 | 1.4 to 1.9 | 1.5 to 2.0 |

3) Possible Statement Changes. The FOMC met last month, and the economic data has been a little weaker since the March meeting - so the statement will probably be slightly more downbeat than the March statement.

As an example, the first two sentences in March might be changed slightly. From the March statement:

Information received since the Federal Open Market Committee met in January suggests that the economy has been expanding moderately. Labor market conditions have improved further; the unemployment rate has declined notably in recent months but remains elevated.Perhaps "moderately" will be changed to "at a modest to moderate pace" as described in the recent Beige Book. And improvements in labor conditions have slowed. The phrase "prices of crude oil and gasoline have increased lately" could be removed, or altered to reflect that prices have been mostly stable since the March meeting.

Given the recent developments in Europe, investors will probably focus on any change to this sentence in the second paragraph: "Strains in global financial markets have eased, though they continue to pose significant downside risks to the economic outlook."

The sentence "The Committee ... currently anticipates that economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014" seems redundant given the FOMC Fed Funds rate projections, but might remain in the statement to make it clear there is no change to policy.

I expect the focus will once again be on the press briefing and the FOMC forecasts.

Yesterday:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

Saturday, April 21, 2012

Unofficial Problem Bank list declines to 939 Institutions

by Calculated Risk on 4/21/2012 09:06:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 20, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, the OCC released its enforcement action activity through mid-March this week, which contributed to many changes to the Unofficial Problem Bank List. In all, there were 12 removals and seven additions that result in the list having 939 institutions with assets of $365.6 billion. A year ago, the list held 976 institutions with assets of $422.2 billion.

The removals, which are centered in Texas, Michigan, and Minnesota, include 10 action terminations, one failure, and one unassisted merger. Action terminations include Citizens Bank, Flint MI ($9.2 billion Ticker: CRBC); Sterling Bank and Trust, FSB, Southfield, MI ($762 million); The Central National Bank of Alva, Alva, OK ($276 million); First National Bank of Jasper, Jasper, TX ($222 million); First National Bank Minnesota, St. Peter, MN ($190 million); Northwestern Bank, National Association, Dilworth, MN ($138 million); Texas Heritage National Bank, Daingerfield, TX ($109 million); Peoples National Bank Leadville, Leadville, CO ($50 million); Uvalde National Bank, Uvalde, TX ($30 million); and Flint River National Bank, Camilla, GA ($27 million). The failure removal was Fort Lee Federal Savings Bank, FSB, Fort Lee, NJ ($52 million) and the other removal was American Bank of Texas, National Association, Marble Falls, TX ($775 million), which merged on unassisted basis.

The seven additions were Tulsa National Bank, Tulsa, OK ($175 million); Choice Bank, Oshkosh, WI ($175 million Ticker: CBKW); The First National Bank of Absecon, Absecon, NJ ($160 million Ticker: ASCN); Flatbush Federal Savings and Loan Association, Brooklyn, NY ($143 million Ticker: FLTB); Atlas Bank, Brooklyn, NY ($108 million); Mojave Desert Bank, National Association, Mojave, CA ($105 million Ticker: MOJA); and Auburn Savings Bank, FSB, Auburn, ME ($78 million Ticker: ABBB).

Other changes include Prompt Corrective Action orders issued against Citizens First National Bank, Princeton, IL ($1.0 billion Ticker: PNBC) and Security Bank, National Association, North Lauderdale, FL ($95 million). Next week, we anticipate the FDIC will release its enforcement action activity through March 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative bank failures for each year starting in 2008. There have been 431 bank failures since the beginning of 2008, and so far closings this year are on pace for around 50 failures compared to 140 in 2009, 157 in 2010, and 92 in 2011.

Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

Schedule for Week of April 22nd

by Calculated Risk on 4/21/2012 01:05:00 PM

Earlier:

• Summary for Week Ending April 20th

The key U.S. economic report for the coming week is the Q1 advance GDP report to be released on Friday. Also New Home sales and the Case-Shiller house price index will be released on Tuesday.

The Fed's FOMC holds a two day meeting on Tuesday and Wednesday, and Fed Chairman Ben Bernanke will hold a press conference following the FOMC announcement on Wednesday. The FOMC will release participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

No economic releases scheduled.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February.

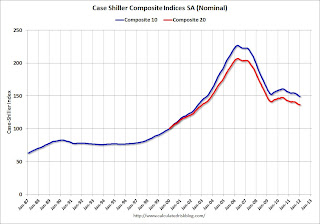

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through January 2012 (the Composite 20 was started in January 2000).

The consensus is for a 3.3% decrease year-over-year in prices (NSA) in February. I expect these indexes to be at new post-bubble lows, not seasonally adjusted. The CoreLogic index declined 0.8% in February (NSA).

10:00 AM ET: New Home Sales for March from the Census Bureau.

10:00 AM ET: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for an increase in sales to 318 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 313 thousand in February. This might be a little low based on recent comments and the homebuilder confidence survey.

10:00 AM: Conference Board's consumer confidence index for April. The consensus is for a decrease to 69.7 from 70.2 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April. The consensus is for an increase to 8 for this survey from 7 in March (above zero is expansion).

10:00 AM: FHFA House Price Index for February 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders.

12:30 PM: FOMC Meeting Announcement. No changes are expected to interest rates or to "operation twist".

2:00 PM: FOMC Forecasts The will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 375,000 from 386,000 last week.

8:30 AM: Chicago Fed National Activity Index (March). This is a composite index of other data.

10:00 AM ET: Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for April. The index was at 9 in March (above zero is expansion).

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1.

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column is the forecast for Q1 GDP.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for April). The consensus is for no change from the preliminary reading of 75.7.

Summary for Week ending April 20th

by Calculated Risk on 4/21/2012 08:27:00 AM

For a few months the incoming data was above expectations. This was a combination of somewhat stronger reports and very low expectations. Since then expectations have increased, and the data has been a little weaker - so the data has been mostly below expectations for several weeks now. This doesn't suggest a sharp slowdown, just more sluggish growth as the economy continues to recover from the financial crisis, and as household continue to deleverage.

This was another week of somewhat disappointing data, a key exception being very strong retail sales in March. Housing starts declined in March, although the decline was mostly due to the volatile multi-family sector (and permits were up suggesting a bounce back next month). Existing home sales were below expectations, but inventory was down again – and is now down 21.8% year-over-year. Weekly initial unemployment claims declined, but the overall level is still fairly high.

Here is a summary in graphs:

• Housing Starts declined in March

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 654 thousand (SAAR) in March, down 5.8% from the revised February rate of 694 thousand (SAAR). Note that February was revised down from 698 thousand.

Single-family starts declined 0.2% to 462 thousand in March. February was revised up to 463 thousand from 457 thousand.

Total starts are up 37% from the bottom, and single family starts are up 31% from the low.

This was well below expectations of 700 thousand starts in March, but mostly because of multi-family starts.

• Retail Sales increased 0.8% in March

On a monthly basis, retail sales were up 0.8% from February to March (seasonally adjusted), and sales were up 6.5% from March 2011. Ex-autos, retail sales increased 0.8% in March.

On a monthly basis, retail sales were up 0.8% from February to March (seasonally adjusted), and sales were up 6.5% from March 2011. Ex-autos, retail sales increased 0.8% in March. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 23.6% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted)

This was above the consensus forecast for retail sales of a 0.3% increase in March, and above the consensus for a 0.6% increase ex-auto.

• Existing Home Sales in March: 4.48 million SAAR, 6.3 months of supply

The NAR reports: Existing-Home Sales Decline in March but Inventory Down, Prices Stabilizing

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in March 2012 (4.48 million SAAR) were 2.6% lower than last month, and were 5.2% above the March 2011 rate.

According to the NAR, inventory decreased to 2.37 million in March from 2.40 million in February. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventoryInventory decreased 21.8% year-over-year in March from March 2011. This is the thirteenth consecutive month with a YoY decrease in inventory.

Months of supply was unchanged at 6.3 months in March.

This was below to expectations of sales of 4.62 million.

• Weekly Initial Unemployment Claims at 386,000

The DOL reports: "In the week ending April 14, the advance figure for seasonally adjusted initial claims was 386,000, a decrease of 2,000 from the previous week's revised figure of 388,000. The 4-week moving average was 374,750, an increase of 5,500 from the previous week's revised average of 369,250."

The DOL reports: "In the week ending April 14, the advance figure for seasonally adjusted initial claims was 386,000, a decrease of 2,000 from the previous week's revised figure of 388,000. The 4-week moving average was 374,750, an increase of 5,500 from the previous week's revised average of 369,250."The previous week was revised up to 388,000 from 380,000. Claims for two weeks ago were revised down.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,750. This is the highest level for the 4-week moving average since January.

• AIA: Architecture Billings Index indicates expansion in March

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Positive Conditions Persist for Architecture Billings Index

This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in March (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing mid-year.

• Industrial Production unchanged in March, Capacity Utilization declines

This graph shows Capacity Utilization. This series is up 11.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.6% is still 1.7 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in March at 96.6; however February was revised up from 96.2.

The consensus was for a 0.3% increase in Industrial Production in March, and for a decrease to 78.6% (from 78.7%) for Capacity Utilization. Although below consensus, with the February revisions, this was close to expectations.

• Other Economic Stories ...

• NAHB Builder Confidence declines in April

• Residential Remodeling Index increases 3% in February

• NY Fed: Manufacturing Activity "improved modestly" in April

• Philly Fed: "Regional manufacturing activity expanded modestly" in April Survey

• State Unemployment Rates decline in 30 states in March

Friday, April 20, 2012

FT Alphaville: FOMC pre-preview

by Calculated Risk on 4/20/2012 09:27:00 PM

From Cardiff Garcia at FT Alphaville: Flies in the Fed’s ointment

Yep, nearly time to start talking about the next FOMC meeting, a two-day affair that begins this Tuesday.Garcia quotes Neal Soss at Credit Suisse regarding the FOMC participants' projections of the appropriate target federal funds rate:

Any big decisions regarding further quantitative easing are more likely to be taken later, closer to when Operation Twist is scheduled to end in mid-June. (Expect to see more stories using the “wait-and-see mode” formulation.) But on the schedule is the second iteration of the individual participants’ federal funds rate projections, and that could be interesting.

"While we expect that 2014 guidance to be reaffirmed at the April meeting, we also think it likely that the distribution as a whole would shift slightly inward in time."So the distribution of projections will be closely scrutinized (this allows the "hawks" to argue for raising rate sooner, even though the 2014 guidance will almost certainly be reiteritated.) Garcia concludes:

It’s true that the US economy is on surer footing now than six months ago, but recently we’ve also had a payroll report that was weak relative to prior months; home prices have continued to fall; and the downward trend in jobless claims was revealed to be less impressive than we thought and even might have stalled (yeah, we know, the last one could just be seasonality issues). European debt markets have again become a focal point and there’s no way to know how fiscal-cliff-mageddon will turn out.CR: I'll have another preview in the next few days, but I don't expect any significant changes announced next week.