by Calculated Risk on 4/21/2012 01:05:00 PM

Saturday, April 21, 2012

Schedule for Week of April 22nd

Earlier:

• Summary for Week Ending April 20th

The key U.S. economic report for the coming week is the Q1 advance GDP report to be released on Friday. Also New Home sales and the Case-Shiller house price index will be released on Tuesday.

The Fed's FOMC holds a two day meeting on Tuesday and Wednesday, and Fed Chairman Ben Bernanke will hold a press conference following the FOMC announcement on Wednesday. The FOMC will release participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

No economic releases scheduled.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February.

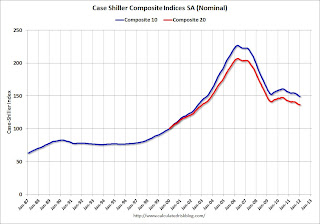

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through January 2012 (the Composite 20 was started in January 2000).

The consensus is for a 3.3% decrease year-over-year in prices (NSA) in February. I expect these indexes to be at new post-bubble lows, not seasonally adjusted. The CoreLogic index declined 0.8% in February (NSA).

10:00 AM ET: New Home Sales for March from the Census Bureau.

10:00 AM ET: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for an increase in sales to 318 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 313 thousand in February. This might be a little low based on recent comments and the homebuilder confidence survey.

10:00 AM: Conference Board's consumer confidence index for April. The consensus is for a decrease to 69.7 from 70.2 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April. The consensus is for an increase to 8 for this survey from 7 in March (above zero is expansion).

10:00 AM: FHFA House Price Index for February 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders.

12:30 PM: FOMC Meeting Announcement. No changes are expected to interest rates or to "operation twist".

2:00 PM: FOMC Forecasts The will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 375,000 from 386,000 last week.

8:30 AM: Chicago Fed National Activity Index (March). This is a composite index of other data.

10:00 AM ET: Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for April. The index was at 9 in March (above zero is expansion).

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1.

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column is the forecast for Q1 GDP.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for April). The consensus is for no change from the preliminary reading of 75.7.