by Calculated Risk on 7/17/2011 08:23:00 PM

Sunday, July 17, 2011

Lawler: Early Read on Existing Home Sales in June

From economist Tom Lawler:

Based on what data I've seen so far, I estimate that existing home sales, as estimated by the NAR, ran at a seasonally adjusted annual rate of about 4.72 million in June, down from 4.81 million in May. That is below consensus, but is what the incoming data suggest [CR note: consensus is 4.9 million SAAR]. It's actually not shockingly inconsistent with the pending sales data, which showed a huge drop in April and then an increase in May, since the lag from pending to closed is on average over a month -- though it appears to vary a boatload across various markets.

Trying to gauge the NAR's inventory measure from actual listings data has been tricky, but as best as I can tell from the relationship between actual listings and the NAR's number, the NAR will probably report a decline in listings on the month of about 1 to 1.5%.

Pending sales in June appear to have increased slightly from May.

CR Notes: The NAR reported existing home sales at a 4.81 million (SAAR) in May, inventory of 3.72 million units, and 9.3 months of supply.

Based on Tom Lawler's estimate, this will be the lowest level of inventory in June since 2005. And sales will decline about 10% YoY from June 2010 - the last month that was boosted by the homebuyer tax credit. Months of supply would increase slightly from May.

No official word yet on when the NAR will release their benchmark revision (expected later this summer - and expected to show significant downward revisions to sales and inventory for the last several years).

Yesterday:

• Summary for Week Ending July 15th

• Schedule for Week of July 17th

U.S. Government Receipts as Percent of GDP

by Calculated Risk on 7/17/2011 05:05:00 PM

Yesterday:

• Summary for Week Ending July 15th

• Schedule for Week of July 17th

Several readers have asked me for source data on U.S. government receipts and outlays. I've also been asked if receipts are really near a record low since WWII as a percent of GDP.

First, here is the budget data from the Congressional Budget Office (CBO). Under "Supplemental Material", the CBO provides historical budget data in both PDF and excel formats.

The White House also provides historical data on budget receipts and outlays. This is from the CBO for 2010 and earlier.

The data shows that total receipts are near a record low as a percent of GDP since WWII. The record low was in 1950, and it will be close this year (in fiscal 2011). But that masks some significant change in the mix of receipts.

The following graph shows receipts by source as a percent of GDP since WWII.

Both income (blue) and corporate taxes (red) are near record lows. Combined income and corporate taxes could rise almost 50% (as a percent of GDP) and receipts would still only be at the median for the 50 years from 1946 through 1996.

Notice the sharp decline in off-budget social insurance in 2011 (Social Security insurance). That is mostly the reduction in the payroll taxes for this year.

Also hidden in the "other" category has been the sharp reduction in the estate tax.

Apartment Construction increases in Los Angeles

by Calculated Risk on 7/17/2011 12:03:00 PM

From Roger Vincent at the LA Times: Apartments are the development du jour among builders

If you see a building under construction, it's most likely an apartment complex.The pickup in apartment construction is one of the few bright spots for construction employment and residential investment. If there was an increase in housing starts in June, the increase was probably from multi-family starts. (June housing starts will be released on Tuesday).

...

Homeownership goes in and out of favor, UCLA professor Stuart Gabriel said, and now it's in decline.

"The pendulum swings back and forth a bit," Gabriel said. "Homeownership is not dead, it's just in a period of adjustment."

Least popular are homes in remote "exurbs" far from cities, he said. With gasoline prices at sustained highs, many people want to be closer to their jobs in urban centers where the most affordable housing is often apartments.

Demographics and generational trends are also working in favor of apartments. Many renters in their 20s and 30s are delaying marriage and childbearing ... and cherish the mobility to move where their careers take them. Other young people who have moved back home with their parents or doubled up with friends can be expected to rent their own apartments when they get jobs or feel more secure about their employment.

...

Permits to build nearly 1,000 apartments were issued in May in the city of Los Angeles, the most since November 2008, the Construction Industry Research Board said.

It is important to note that even with a strong increase in multi-family construction, it is from a very low level, and multi-family is a small part of residential investment (RI).

However - don't expect much new office construction any time soon, from the LA Times: It's still an office tenant's market in the Southland

Leonhardt: "We're Spent"

by Calculated Risk on 7/17/2011 08:47:00 AM

From David Leonhardt at the NY Times: How the Bursting of the Consumer Bubble Continues to Hold the Economy Back (ht Ann)

THERE is no shortage of explanations for the economy’s maddening inability to leave behind the Great Recession and start adding large numbers of jobs ... the real culprit — or at least the main one — has been hiding in plain sight. We are living through a tremendous bust. It isn’t simply a housing bust. It’s a fizzling of the great consumer bubble ...Here is the NY Fed paper by Jonathan McCarthy that Leonhardt mentions: Discretionary Services Expenditures in This Business Cycle

The auto industry is on pace to sell 28 percent fewer new vehicles this year than it did 10 years ago — and 10 years ago was 2001, when the country was in recession. Sales of ovens and stoves are on pace to be at their lowest level since 1992. Home sales over the past year have fallen back to their lowest point since the crisis began. And big-ticket items are hardly the only problem.

The Federal Reserve Bank of New York recently published a jarring report on what it calls discretionary service spending, a category that excludes housing, food and health care and includes restaurant meals, entertainment, education and even insurance. Going back decades, such spending had never fallen more than 3 percent per capita in a recession. In this slump, it is down almost 7 percent, and still has not really begun to recover.

...

Business executives are only rational to hold back on hiring if they do not know when their customers will fully return. Consumers, for their part, are coping with a sharp loss of wealth and an uncertain future

The pronounced weakness in personal consumption expenditures (PCE) for services has been an unusual feature of the 2007-09 recession and the slow recovery from it. Even in 2010:Q4, when real PCE increased at a relatively robust 4.1 percent annual rate, real PCE on services rose at only a 1.4 percent rate. This weakness has been especially evident in “discretionary” services (to be defined below), which fell more in the recent recession than in previous recessions and since have rebounded more sluggishly. In this post, I suggest that the continued sluggishness in these expenditures lends a note of caution regarding the sustainability of recent PCE strength. ... this in turn raises some concern about the future strength of the recovery.

The chart below shows how much real per capita (to account for differing rates of population growth over time) discretionary services expenditures fell from their previous peak—a zero value in this chart means that these expenditures were above their previous peak. The drop in discretionary services expenditures in the last recession was much more severe than in previous recessions ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Because many of these expenditures can be deferred when economic conditions are strained (for example, eating at home rather than eating out, or passing on the visit to Disney World) and given the increasing share of services in the economy, discretionary services will remain a significant factor in business cycles. In the recent recession, the large rise in unemployment and the sharp drop in household wealth appear to have led households to reduce discretionary services expenditures to a greater extent than we have seen previously, as they attempted to maintain a smoother path of non-discretionary services expenditures.This is one of the reasons I track some items of discretionary spending like hotels and restaurants.

... the fact that discretionary services expenditures remain significantly below their previous peaks is of concern for the overall economic outlook. Although these expenditures can be deferred in instances of temporary income drops, the sluggish recovery in these expenditures suggests, consistent with the permanent income/life cycle hypothesis, that households may perceive more persistent shocks to their overall wealth. ... Accordingly, the continued sluggishness of discretionary service expenditures at this point in the expansion lends a note of caution regarding the recently improved economic growth outlook.

To take this a step further - with the lack of demand, there is still too much excess capacity in most areas of the economy for a large contribution from new investment (except in equipment and software). We see this excess in housing (there is an excess supply of vacant housing units), and excess capacity in overall industrial production. There is also excess existing supply in office space, retail space, and other categories of commercial real estate.

In addition, household debt, as a percent of income, remains very high and household deleveraging is ongoing. That is why so many companies identify their number one problem as "lack of customers" (see the small business survey released this week).

Until the excess capacity (and excess supply) is absorbed, and household balance sheets are back in order, the recovery will remain sluggish.

Saturday, July 16, 2011

HousingTracker: Homes For Sale inventory down 10.9% Year-over-year in mid-July

by Calculated Risk on 7/16/2011 10:33:00 PM

Last month, Tom Lawler posted on how the NAR estimates existing home inventory. The NAR does NOT aggregate data from the local boards (see Tom's post for how the NAR estimates inventory). Sometime this summer, I expect the NAR to revise down their estimates of inventory and sales for the last few years. Also the NAR methodology for estimating sales and inventory will likely (hopefully) be changed.

While we wait for the NAR, I think the HousingTracker data that Tom mentioned might be a better estimate of changes in inventory (and always more timely). Ben at HousingTracker.net is tracking the aggregate monthly inventory for 54 metro areas.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the NAR estimate of existing home inventory through May (left axis) and the HousingTracker data for the 54 metro areas through mid-July. The HousingTracker data shows a steeper decline (as mentioned above, the NAR will probably revise down their inventory estimates this summer).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the mid-July listings - for the 54 metro areas - declined 10.9% from last year.

Of course there is a large percentage of distressed inventory, and various categories of "shadow inventory" too. But the decline in listed inventory will put less downward pressure on house prices and is something to watch carefully all year.

Earlier:

• Summary for Week Ending July 15th

• Schedule for Week of July 17th

Schedule for Week of July 17th

by Calculated Risk on 7/16/2011 06:02:00 PM

Earlier:

• Summary for Week Ending July 15th

Three key housing reports will be released this week: July homebuilder confidence on Monday, June housing starts on Tuesday, and June existing home sales on Wednesday.

The Philly Fed manufacturing survey will be released on Thursday. Also the speech by NY Fed VP Brian Sack on Wednesday might be interesting.

10 AM ET: The July NAHB homebuilder survey. The consensus is for a reading of 14, up slightly from 13 in June. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

8:30 AM: Housing Starts for June. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

8:30 AM: Housing Starts for June. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit. Total housing starts were at 560 thousand (SAAR) in May, up 3.5% from the revised April rate of 541 thousand. Single-family starts increased 3.7% to 419 thousand in May.

The consensus is for an increase to 575,000 (SAAR) in June.

Early: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

Early: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).This graph shows the Architecture Billings Index since 1996. The index decreased in May to 47.2 from 47.6 in April. Anything below 50 indicates a decrease in billings.

This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through summer (not counting all cash purchases).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.9 million at a Seasonally Adjusted Annual Rate (SAAR) in June, up from 4.81 million SAAR in May.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.9 million at a Seasonally Adjusted Annual Rate (SAAR) in June, up from 4.81 million SAAR in May.Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). Perhaps the NAR will provide an update on when these revisions will be released.

Expected: The Moody's/REAL Commercial Property Price Indices (commercial real estate price index) for May.

6:15 PM: NY Fed Vice President Brian Sack speaks before the Money Marketeers of New York University.

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims has been elevated for the last couple of months. The consensus is for an increase to 415,000 from 405,000 last week.

10:00 AM: Philly Fed Survey for July. The consensus is for a reading of 5.0 (above zero indicates expansion), up from -7.7 last month.

10:00 AM: Conference Board Leading Indicators for June. The consensus is for a flat reading for this index.

10:00 AM: FHFA House Price Index for May 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Fed Chairman Ben Bernanke on the Dodd-Frank Act, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate.

10:00 AM: Regional and State Employment and Unemployment for June 2011

Summary for Week Ending July 15th

by Calculated Risk on 7/16/2011 11:09:00 AM

Last week was filled with disappointing data. So much so that Goldman Sachs downgraded their forecast last night:

Following another week of weak economic data, we have cut our estimates for real GDP growth in the second and third quarter of 2011 to 1.5% and 2.5%, respectively, from 2% and 3.25%. Our forecasts for Q4 and 2012 are under review, but even excluding any further changes we now expect the unemployment rate to come down only modestly to 8¾% at the end of 2012.Before we get to the data, there were a couple other key stories last week: 1) the European bank stress tests disappointed most analysts (only a few banks were required to raise capital, see from the Financial Times: Banks’ stress test pass rate under fire), and 2) the debt ceiling negotiations continued, although this appears to be almost over (see: Debt Ceiling Charade: Almost Over).

The main reason for the downgrade is that the high-frequency information on overall economic activity has continued to fall substantially short of our expectations.

...

One key question in coming months is whether final demand recovers to the 2%-2½% pace that is probably necessary to keep GDP growth near trend and prevent the unemployment rate from rising more noticeably.

• Retail Sales increased 0.1% in June

On a monthly basis, retail sales increased 0.1% from May to June (seasonally adjusted, after revisions), and sales were up 8.1% from June 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales have been mostly moving sidways since March.

Retail sales are up 16.6% from the bottom, and now 2.5% above the pre-recession peak.

This was about at expectations for no change in retail sales. Retail sales ex-autos were unchanged, and gas station sales declined 1.3% last month as prices fell. Another weak retail sales report ...

• Trade Deficit increased sharply in May to $50.2 billion

The Department of Commerce reports:

[T]otal May exports of $174.9 billion and imports of $225.1 billion resulted in a goods and services deficit of $50.2 billion, up from $43.6 billion in April, revised. May exports were $1.0 billion less than April exports of $175.8 billion. May imports were $5.6 billion more than April imports of $219.4 billion.

Exports decreased in May and imports increased (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to May 2010; imports are almost back to the pre-recession peak, and up about 16% compared to May 2010.

Exports decreased in May and imports increased (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to May 2010; imports are almost back to the pre-recession peak, and up about 16% compared to May 2010.The petroleum deficit increased in May as both prices and the quantity of oil imported increased. Oil averaged $108.70 per barrel in May, up from $103.18 per barrel in April, and up from $76.95 in May 2010. There is a bit of a lag with prices, and import prices will probably be a little lower in June.

The trade deficit with China increased to $24.96 billion (NSA), so once again the deficit is mostly oil and China.

• Industrial Production increased 0.2% in June, Capacity Utilization unchanged

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is still "3.7 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Industrial production increased in June to 93.1.

Industrial production increased in June to 93.1.Both industrial production and capacity utilization have been moving sideways recently. This was below the consensus forecast of a 0.4% increase in Industrial Production in June, and an increase to 76.9% for Capacity Utilization.

The suggests there is still significant excess industrial capacity.

• NFIB: Small Business Optimism Index "basically unchanged" in June

From the National Federation of Independent Business (NFIB): Small Business Optimism Stagnates

This graph shows the small business optimism index since 1986. The index decreased to 90.8 in June from 90.9 in May.

This graph shows the small business optimism index since 1986. The index decreased to 90.8 in June from 90.9 in May.This index is still very low - and had been trending up - but optimism has declined for four consecutive months now.

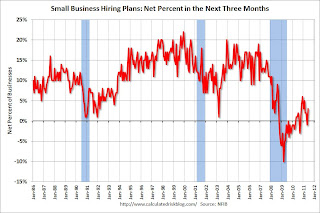

This graph shows the net hiring plans for the next three months.

Hiring plans increased in June and this is the highest level since February.

Hiring plans increased in June and this is the highest level since February.According to NFIB: “Although June’s employment growth was weak, 15 percent (seasonally adjusted) of small firms reported unfilled job openings, a 3 point increase and an indication that the unemployment rate will ease back below 9 percent in the coming months. "

Weak sales is still the top business problem with 24 percent of the owners reporting that weak sales continued to be their top business problem in June.

• Ceridian-UCLA: Diesel Fuel index increased in June

Press Release: Pulse of Commerce Index Rebounds – Up 1.0 Percent In June

Press Release: Pulse of Commerce Index Rebounds – Up 1.0 Percent In JuneThis graph shows the index since January 2000.

This index has mostly been moving sideways all year. As Leamer noted, this "could be the start of a positive trend, but a one month spike does not make a trend, particularly in light of the many false starts experienced over the last year."

• Consumer Sentiment declines sharply in July

The preliminary July Reuters / University of Michigan consumer sentiment index declined sharply to 63.8 from 71.5 in June.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.This was well below the consensus forecast of 71.0 and definitely in the recession range.

• Other Economic Stories ...

• AAR: Rail Traffic soft in June

• BLS: Job Openings unchanged in May

• NY Fed: Empire State Survey indicates contraction

• Key Measures of Inflation ease in June

• Eight Banks Fail European Stress Tests

Have a great weekend!

Unofficial Problem Bank list declines to 995 Institutions

by Calculated Risk on 7/16/2011 08:27:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

There is the unofficial problem bank list for July 15, 2011.

Changes and comments from surferdude808:

It was an active week for the Unofficial Problem Bank List with 11 removals and two additions. The net result of the changes leave the list at 995 institutions with assets of $416.2 billion, down from 1,004 institutions and assets of $418.8 billion last week.

Among the removals are five cures, four failures, and two unassisted mergers. Actions were terminated against Intercredit Bank, National Association, Miami, FL ($258 million); Heritage Bank National Association, Spicer, MN ($170 million); The American National Bank of Beaver Dam, Beaver Dam, WI ($110 million); Gibraltar Bank, Oak Ridge, NJ ($95 million); and The First National Bank of Cold Spring, Cold Spring, MN ($74 million). The four failures are First Peoples Bank, Port Saint Lucie ($228 million Ticker: FPBI); High Trust Bank, Stockbridge, GA ($193 million); One Georgia Bank, Atlanta, GA ($186 million); and Summit Bank, Prescott, AZ ($72 million). The removals from unassisted merger are Cascade Bank, Everett, WA ($1.5 billion); and Bank of Greensburg, Greensburg, LA ($92 million). Long time readers may remember the less than forthright conversations we had with Cascade Bank about it becoming subject to an enforcement action. Still we are happy to see them migrate off the list without failing.

The two additions this week are Mission National Bank, San Francisco, CA ($1984 million Ticker: MNBO); and Traders National Bank, Tullahoma, TN ($156 million).

This message was posted on the OTS enforcement web page "On July 21, 2011, the Office of Thrift Supervision will become part of the Office of the Comptroller of the Currency. Check back on July 21 for more information." We anticipate for the OTS website to be taken down and their practice of timely disclosures of enforcement actions to stop. Actions against thrifts will likely be disclosed on a monthly basis in the same manner the OCC uses for national banks.

Friday, July 15, 2011

Debt Ceiling Charade: Almost Over

by Calculated Risk on 7/15/2011 11:27:00 PM

I've been hearing from more and more people that they are concerned about the debt ceiling negotiations. Many of these people are busy with their daily lives, and they don't usually pay close attention to politics or budget issues.

This concern is probably why consumer sentiment fell sharply in the Reuters / University of Michigan preliminary July survey.

No worries.

The debt ceiling is about paying the bills, not the deficit. However it is not uncommon for the party in control of Congress to try to use the debt ceiling as a tool to try to negotiate on budget priorities. That is what has been happening.

But at any time Congress can agree to pay the bills, and they will this time too. As Senator McConnell (R) noted this week, if the U.S. defaults, the American people would blame the party in control of Congress - the Republican party - and the "Republican brand" would be forever toxic. The leaders of the party can't allow that to happen, and the are now looking for the exit.

From Lisa Mascaro and Kathleen Hennessey at the LA Times: House Republicans brace for compromise on debt

Republican leaders in the House have begun to prepare their troops for politically painful votes to raise the nation's debt limit ... Republican leaders orchestrated a series of public moves intended to soften the blow for conservatives. They agreed to give the House an opportunity to vote on two top conservative priorities: a so-called cut-cap-and-balance bill, which would order $111 billion in cuts in federal programs for 2012 and impose a cap on future spending, and a constitutional amendment that would require a balanced federal budget.Ignore the votes this coming week. These bills will not pass the Senate, and no Republican or Democratic President would sign them anyway - they are just for show. The real votes start the following week, and the debt ceiling will be increased.

The Democratic leadership in the Senate is also expected to allow votes on one, and perhaps both, measures. Neither is expected to become law ... Congress is likely to spend much of next week on those measures, then could take up a debt ceiling measure in the Senate toward the end of next week.

This is almost over.

Bank Failure #55: Summit Bank, Prescott, AZ

by Calculated Risk on 7/15/2011 09:18:00 PM

Setback Summit soon shutdown

Shambled shipwreck sunk!

by Soylent Green is People

From the FDIC: The Foothills Bank, Yuma, Arizona, Assumes All of the Deposits of Summit Bank, Prescott, Arizona

As of March 31, 2011, Summit Bank had approximately $72.0 million in total assets and $66.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.3 million. ... Summit Bank is the 55th FDIC-insured institution to fail in the nation this year, and the second in Arizona.That makes four today.

Earlier:

• From the NY Fed: Empire State Manufacturing Survey indicates conditions deteriorated in July

• Consumer Sentiment declines sharply in July

• Industrial Production increased 0.2% in June, Capacity Utilization unchanged

• Eight Banks Fail European Stress Tests

• Key Measures of Inflation ease in June