by Calculated Risk on 7/16/2011 11:09:00 AM

Saturday, July 16, 2011

Summary for Week Ending July 15th

Last week was filled with disappointing data. So much so that Goldman Sachs downgraded their forecast last night:

Following another week of weak economic data, we have cut our estimates for real GDP growth in the second and third quarter of 2011 to 1.5% and 2.5%, respectively, from 2% and 3.25%. Our forecasts for Q4 and 2012 are under review, but even excluding any further changes we now expect the unemployment rate to come down only modestly to 8¾% at the end of 2012.Before we get to the data, there were a couple other key stories last week: 1) the European bank stress tests disappointed most analysts (only a few banks were required to raise capital, see from the Financial Times: Banks’ stress test pass rate under fire), and 2) the debt ceiling negotiations continued, although this appears to be almost over (see: Debt Ceiling Charade: Almost Over).

The main reason for the downgrade is that the high-frequency information on overall economic activity has continued to fall substantially short of our expectations.

...

One key question in coming months is whether final demand recovers to the 2%-2½% pace that is probably necessary to keep GDP growth near trend and prevent the unemployment rate from rising more noticeably.

• Retail Sales increased 0.1% in June

On a monthly basis, retail sales increased 0.1% from May to June (seasonally adjusted, after revisions), and sales were up 8.1% from June 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales have been mostly moving sidways since March.

Retail sales are up 16.6% from the bottom, and now 2.5% above the pre-recession peak.

This was about at expectations for no change in retail sales. Retail sales ex-autos were unchanged, and gas station sales declined 1.3% last month as prices fell. Another weak retail sales report ...

• Trade Deficit increased sharply in May to $50.2 billion

The Department of Commerce reports:

[T]otal May exports of $174.9 billion and imports of $225.1 billion resulted in a goods and services deficit of $50.2 billion, up from $43.6 billion in April, revised. May exports were $1.0 billion less than April exports of $175.8 billion. May imports were $5.6 billion more than April imports of $219.4 billion.

Exports decreased in May and imports increased (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to May 2010; imports are almost back to the pre-recession peak, and up about 16% compared to May 2010.

Exports decreased in May and imports increased (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to May 2010; imports are almost back to the pre-recession peak, and up about 16% compared to May 2010.The petroleum deficit increased in May as both prices and the quantity of oil imported increased. Oil averaged $108.70 per barrel in May, up from $103.18 per barrel in April, and up from $76.95 in May 2010. There is a bit of a lag with prices, and import prices will probably be a little lower in June.

The trade deficit with China increased to $24.96 billion (NSA), so once again the deficit is mostly oil and China.

• Industrial Production increased 0.2% in June, Capacity Utilization unchanged

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is still "3.7 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Industrial production increased in June to 93.1.

Industrial production increased in June to 93.1.Both industrial production and capacity utilization have been moving sideways recently. This was below the consensus forecast of a 0.4% increase in Industrial Production in June, and an increase to 76.9% for Capacity Utilization.

The suggests there is still significant excess industrial capacity.

• NFIB: Small Business Optimism Index "basically unchanged" in June

From the National Federation of Independent Business (NFIB): Small Business Optimism Stagnates

This graph shows the small business optimism index since 1986. The index decreased to 90.8 in June from 90.9 in May.

This graph shows the small business optimism index since 1986. The index decreased to 90.8 in June from 90.9 in May.This index is still very low - and had been trending up - but optimism has declined for four consecutive months now.

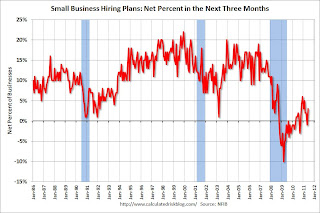

This graph shows the net hiring plans for the next three months.

Hiring plans increased in June and this is the highest level since February.

Hiring plans increased in June and this is the highest level since February.According to NFIB: “Although June’s employment growth was weak, 15 percent (seasonally adjusted) of small firms reported unfilled job openings, a 3 point increase and an indication that the unemployment rate will ease back below 9 percent in the coming months. "

Weak sales is still the top business problem with 24 percent of the owners reporting that weak sales continued to be their top business problem in June.

• Ceridian-UCLA: Diesel Fuel index increased in June

Press Release: Pulse of Commerce Index Rebounds – Up 1.0 Percent In June

Press Release: Pulse of Commerce Index Rebounds – Up 1.0 Percent In JuneThis graph shows the index since January 2000.

This index has mostly been moving sideways all year. As Leamer noted, this "could be the start of a positive trend, but a one month spike does not make a trend, particularly in light of the many false starts experienced over the last year."

• Consumer Sentiment declines sharply in July

The preliminary July Reuters / University of Michigan consumer sentiment index declined sharply to 63.8 from 71.5 in June.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.This was well below the consensus forecast of 71.0 and definitely in the recession range.

• Other Economic Stories ...

• AAR: Rail Traffic soft in June

• BLS: Job Openings unchanged in May

• NY Fed: Empire State Survey indicates contraction

• Key Measures of Inflation ease in June

• Eight Banks Fail European Stress Tests

Have a great weekend!