by Calculated Risk on 11/17/2009 02:11:00 PM

Tuesday, November 17, 2009

DataQuick: SoCal Home Sales Increase

From DataQuick: Southland home sales up again, drop in median price smallest in 2 years

Southern California home sales rose in October as prices showed more signs of firming. The median sale price fell by the smallest amount in two years, the result of a shrinking inventory of homes for sale and government and industry efforts to stoke demand and curtail foreclosures ...DataQuick does a good job of describing the uncertainties concerning the housing market.

...

Last month 22,132 new and resale houses and condos closed escrow in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was up 2.8 percent from 21,539 in September and also up 2.8 percent from 21,532 a year earlier, according to MDA DataQuick of San Diego.

October marked the 16th month in a row with a year-over-year sales gain, although last month’s was the smallest of those increases. ...

Sales increases over the last two months can be partially attributed to the recent increase in short sales, which take longer to close escrow. The result is that some summer deals that might normally have closed earlier instead closed in September and October. ...

[also] A rush by some to take advantage of the federal tax credit for first-time buyers ...

FHA mortgages accounted for 38.3 percent of all Southland purchase loans last month, compared with 32.5 percent a year ago and just 2 percent two years ago. ...

“The government is playing a huge role in stabilizing and, to some extent, reinvigorating the housing market,” said John Walsh, MDA DataQuick president. “Its actions have triggered ultra-low mortgage rates, plentiful low-down-payment (FHA) financing, an extended and expanded tax credit for home buyers, and programs and political pressure aimed at reducing foreclosures.”

“The real question now is how well can the market perform next year as some of the government stimulus disappears,” he continued. “The more upbeat outlooks suggest a strengthening economy and job market will help pick up the slack, and that demand for lower-cost foreclosures will remain robust. The more negative forecasts assume, among other things, a much slower economic recovery, more foreclosures than the market can readily digest, and more turbulence in the credit markets.”

The latter outlook suggests today’s market stability is contrived and will prove short-lived – nothing more than a temporary price plateau – while the former suggests home prices are currently at or near bottom.

...

Recent month-to-month and year-over-year gains in the median sale price reflect, in large part, a shift of late toward foreclosures representing a lower percentage of sales. It’s mainly the result of lenders and loan servicers increasingly steering distressed borrowers into either an attempted short sale or loan modification. This reduction in foreclosures is key because over the past two years foreclosed properties were often the most aggressively priced on the market.

Last month, foreclosure resales – houses and condos sold in October that had been foreclosed on in the prior 12 months – made up 40.6 percent of all Southland resales. That was up insignificantly from 40.4 percent in September and down from a high of 56.7 percent in February this year.

As sales of lower-cost foreclosures began to wane earlier this year, sales in higher-cost neighborhoods picked up. High-end homes began to account for a greater share of all sales and helped reverse the steep slide in the median price. Over the past few months, however, the high-end’s share of total sales has flattened out.

...

Foreclosure activity remains high by historical standards, although mortgage default notices have flattened out or trended lower in many areas lately.

emphasis added

The increase in FHA insured loans is amazing: from 2% in 2007 to 39.3% last month.

Friday, October 23, 2009

Existing Home Sales Increase in September

by Calculated Risk on 10/23/2009 10:00:00 AM

The NAR reports: Big Rebound in Existing-Home Sales Shows First-Time Buyer Momentum

Existing-home sales – including single-family, townhomes, condominiums and co-ops – jumped 9.4 percent to a seasonally adjusted annual rate of 5.57 million units in September from a level of 5.10 million in August, and are 9.2 percent higher than the 5.10 million-unit pace in September 2008.

...

Total housing inventory at the end of September fell 7.5 percent to 3.63 million existing homes available for sale, which represents an 7.8-month supply2 at the current sales pace, down from an 9.3-month supply in August.

Click on graph for larger image in new window.

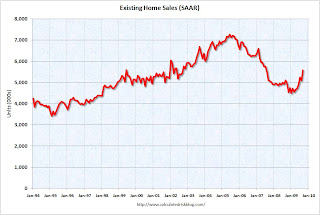

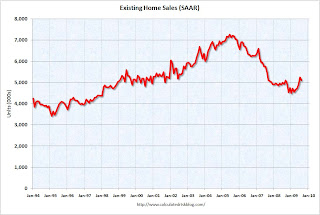

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. For the fourth consecutive month, sales were higher in 2009 than in 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. For the fourth consecutive month, sales were higher in 2009 than in 2008. It's important to note that many of these transactions are either investors or first-time homebuyers. Also many of the sales are distressed sales (short sales or REOs).

Early information from a large annual consumer study to be released November 13, the 2009 National Association of Realtors® Profile of Home Buyers and Sellers, shows that first-time home buyers accounted for more than 45 percent of home sales during the past year. A separate practitioner survey shows that distressed homes accounted for 29 percent of transactions in September.

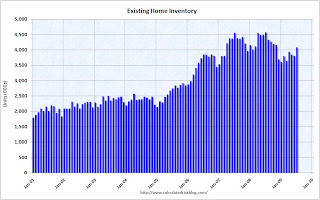

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.63 million in September (August inventory was revised upwards significantly). The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.63 million in September (August inventory was revised upwards significantly). The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory peaks in July or August, so some of this decline is seasonal.

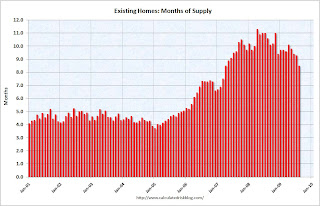

The fourth graph shows the 'months of supply' metric for the last six years.

The fourth graph shows the 'months of supply' metric for the last six years.Months of supply was decline to 7.8 months.

Sales increased, and inventory decreased, so "months of supply" declined. A normal market has under 6 months of supply, so this is still high.

It is important to note that sales in September were distorted by the first time home buyer tax credit, and this activity will fade - whether or not the credit is extended.

Monday, October 19, 2009

Campbell Surveys: ‘Mini-Boom’ in Existing Home Market

by Calculated Risk on 10/19/2009 02:21:00 PM

Excerpts posted with permission from Campbell Surveys

In September the housing market took a major turn to the upside, according to respondents to the Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions. Real estate agent survey respondents reported average residential property prices rose 6% from August to September ...As we've discussed before, there is a buying frenzy right now in the existing home market, especially at the low end. Unfortunately existing home sales add little to the economy (compared to new home sales). And the impact is even less than usual right now because many of the marginal buyers are using the first-time homebuyer tax credit as their downpayment, and have little additional money to spend on furniture or upgrades.

The reported month-to-month price increase of 6% was driven by high demand for REO –also commonly referred to as foreclosed properties--according to transaction data reported by survey respondents. ...

The average price for non-distressed properties remained nearly constant between August and September. ...

Strong demand for moderately priced REO caused time-on-market for these properties to decline markedly. In August, damaged REO stayed on the market an average of 9.4 weeks; by September, time-on-market had declined to 7.0 weeks. For move-in ready REO, time-on-market declined from 8.0 weeks in August to 5.9 weeks in September. In contrast, average time-on-market for non-distressed properties rose from 13.0 weeks in August to 14.2 weeks in September.

First–time homebuyer demand for properties continued to be strong in the month of September. First-time homebuyers accounted for 42% of home purchase transactions in September. ...

Many agents indicated an REO buying frenzy in local markets, especially California. “Entry level REO's are taken by the storm! Many multiple offers!” exclaimed a California agent. “Low inventory and high demand are resulting in 20-60 offers on most properties in the entry level to moderate price points. First-time homebuyers have difficulty competing with investors and high down-payment buyers,” reported another real estate agent located in California. “Banks and listing agents are pricing these REO's at liquidation prices to encourage a bidding war and it's working,” wrote a real estate agent located in Florida.

Despite reporting strong increases in both average prices and number of transactions, real estate agents responding to the survey gave a hint of looming problems caused by rising unemployment. For the third month in a row, the survey’s inventory index showed rising inventories of short sale properties, while inventories of REO properties were flat or declining.

emphasis added

For the economy, the numbers to track are housing starts, new home sales, and residential investment - not existing home sales.

Tuesday, October 13, 2009

DataQuick: SoCal home sales "inch up"

by Calculated Risk on 10/13/2009 01:23:00 PM

From DataQuick: Southern California home sales inch up; median price steady

Last month 21,539 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was up 0.2 percent from 21,502 in August and up 5.1 percent from 20,497 a year earlier, according to MDA DataQuick of San Diego.Although DataQuick doesn't track short sales, we can estimate from the Sacramento data that another 15% or so of sales in SoCal were short sales - so probably over half the sales are distressed.

September marked the 15th month in a row with a year-over-year sales gain, although last month’s was the smallest of those increases. ... The small uptick in September sales from August was atypical. On average, sales have fallen 9.5 percent between those two months.

...

“There were more than just normal, seasonal forces at work in these September sales numbers. More attempts at short sales, which typically take longer, and new appraisal rules no doubt delayed some deals this summer, causing them to close in September rather than August. September probably also got a boost from people opting to buy sooner rather than later to take advantage of the federal tax credit for first-time buyers, which is set to expire next month,” said John Walsh, MDA DataQuick president.

...

Foreclosure resales – houses and condos sold in September that had been foreclosed on at some point in the prior 12 months – made up 40.4 percent of all Southland homes resold last month. That was down slightly from a revised 41.7 percent foreclosure resales in August and down from a high of 56.7 percent in February this year.

...

A common form of financing used by first-time buyers in more affordable neighborhoods remained near record levels. Government-insured FHA mortgages made up 36.4 percent of all home purchase loans last month ...

Foreclosure activity remains high by historical standards.

emphasis added

This report suggests sales were strong in September - similar to other regional reports.

We will probably see a decrease in year-over-year sales soon, as the first-time homebuyer tax credit buying frenzy subsides later this year.

Tuesday, September 29, 2009

Survey: Home Purchase Market by Homebuyer Category

by Calculated Risk on 9/29/2009 11:20:00 PM

Here is some national data on the types of homebuyers in August. This is from a survey by Campbell Communications (excerpted with permission).

Source: Tracking Real Estate Market Conditions, a whitepaper regarding the Campbell/Inside Mortgage Finance Monthly Survey on Real Estate Market Conditions. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Campbell survey breaks out sales by buyer type.

According to the Campbell survey about 64% of sales in August were to first-time buyers and investors.

Survey results show that first-time homebuyers, motivated by first-time homebuyer tax credit, made up the largest component of demand in August 2009. In the summer months, current homeowners also make up a significant component of demand. (Note: rounding on graph figures precludes totaling to 100%.)

For comparison, here is the same breakdown for Q2.

For comparison, here is the same breakdown for Q2.According to the Campbell survey over 70% of sales in Q2 were to first-time buyers and investors.

Whenever the tax credit expires (whether or not is extended), the percent of first time buyers will decline.

Thursday, September 24, 2009

Existing Home Sales Decline in August

by Calculated Risk on 9/24/2009 10:00:00 AM

The NAR reports: Existing-Home Sales Ease Following Four Monthly Gains

Existing-home sales – including single-family, townhomes, condominiums and co-ops – declined 2.7 percent to a seasonally adjusted annual rate1 of 5.10 million units in August from a pace of 5.24 million in July, but remain 3.4 percent above the 4.93 million-unit level in August 2008. In the previous four months, sales had risen a total of 15.2 percent.

...

Total housing inventory at the end of August fell 10.8 percent to 3.62 million existing homes available for sale, which represents an 8.5-month supply at the current sales pace, down from a 9.3-month supply in July. Unsold inventory totals are 16.4 percent lower than a year ago

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Aug 2009 (5.1 million SAAR) were 2.7% lower than last month, and were 3.4% higher than August 2008 (4.93 million SAAR).

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. As in June and July, sales (NSA) were slightly higher in August 2009 than in August 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. As in June and July, sales (NSA) were slightly higher in August 2009 than in August 2008.It's important to note that many of these transactions are either investors or first-time homebuyers. Also many of the sales are distressed sales (short sales or REOs).

An NAR practitioner survey shows first-time buyers purchased 30 percent of homes in August, and that distressed homes accounted for 31 percent of transactions; both were unchanged from July.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.62 million in August. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.62 million in August. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory peaks in July or August.

Note: many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs and other shadow inventory - so this inventory number is probably low.

The fourth graph shows the 'months of supply' metric for the last six years.

The fourth graph shows the 'months of supply' metric for the last six years.Months of supply was steady at 8.5 months.

Sales decreased, but inventory decreased more, so "months of supply" declined. A normal market has under 6 months of supply, so this is still very high.

Note: New Home sales will be released tomorrow.

Thursday, September 17, 2009

DataQuick: California Bay Area Sales Decline

by Calculated Risk on 9/17/2009 03:20:00 PM

From DataQuick: Bay Area August home sales and median price fall

Bay Area home sales bucked the seasonal norm and fell last month from July, though they remained higher than a year ago for the 12th consecutive month. The region’s overall median sale price also declined as a greater portion of sales occurred in more affordable areas ...This sales decline in August is being reported in many areas.

A total of 7,518 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was down 14.3 percent from 8,771 in July and up 4.0 percent from 7,232 in August 2008, according to MDA DataQuick of San Diego.

...

“Part of the mid-summer pause in the market could have been caused by home shoppers becoming frustrated by market conditions they didn’t anticipate. In many areas there were fewer homes, especially cheap foreclosures, to choose from, and lots of talk about multiple offers and all-cash deals. It might have driven some back to the sidelines,” said John Walsh, MDA DataQuick president.

“At the same time, people are still concerned about job security, and about how many foreclosures might yet hit the market,” he said. “There are ongoing reports of mortgage delinquencies rising, yet the number of homes being foreclosed on has trended down lately. It’s bred a lot of uncertainty among the pundits and the public about how many more foreclosures are coming, when they’ll hit, and what impact they’ll have on prices.”

The 14.3 percent drop in sales between July and August was atypical, given the average change between those two months is a gain of 3.4 percent. ...

The median’s $35,000 drop between July and August was mainly the result of a shift toward a higher percentage of sales occurring in lower-cost inland areas. Although sales fell across the region and home price spectrum, some costlier areas saw the biggest declines. Sales fell the most – 21.1 percent – between July and August in Santa Clara County. Its share of total Bay Area sales fell to 23.1 percent in August, down from 25.1 percent in July.

...

Foreclosure resales made up 32.5 percent of total August resales, up from 31.2 percent in July but down from 36.0 percent a year ago. The August percentage was higher than July’s, despite fewer foreclosed homes selling last month, because of the sharp drop in non-foreclosure resales in August.

...

Foreclosures are off their recent peak but remain high historically ... and non-owner occupied buying is above-average in some markets, MDA DataQuick reported.

And the shift back to more low end homes - even with the lower foreclosure inventory in the low end areas - is a bad sign for the mid-to-high end of the housing market. This suggest prices will fall further in those areas.

It appears the first-time homebuyer frenzy is started to fade, although investors are still buying in the low end areas.

Tuesday, September 01, 2009

Pending Home Sales Increase in July

by Calculated Risk on 9/01/2009 10:00:00 AM

From the NAR: Pending Home Sales on a Record Roll

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in July, increased 3.2 percent to 97.6 from a reading of 94.6 in June, and is 12.0 percent higher than July 2008 when it was 87.1. The index is at the highest level since June 2007 when it was 100.7.The increase in pending sales has been mostly from lower priced homes with demand from first time home buyers (taking advantage of the tax credit) and investors.

...

NAR estimates that about 1.8 to 2.0 million first-time buyers will take advantage of the $8,000 tax credit this year, with approximately 350,000 additional sales that would not have taken place without the credit.

emphasis added

And look at the cost of the tax credit! If NAR is close to being correct, 2 million buyers will claim the tax credt - times $8,000 - is $16 billion. But this only resulted in "approximately 350,000 additional sales".

So this tax credit cost taxpayers about $45,000 per each additional home sold. Not very effective ... especially considering most of these are lower priced homes.

Wednesday, August 26, 2009

Distressing Gap: Ratio of Existing to New Home Sales

by Calculated Risk on 8/26/2009 11:18:00 AM

For graphs based on the new home sales report this morning, please see: New Home Sales Increase in July

According to the Q2 Campbell national survey of real estate agents, over 63% of sales in Q2 were distressed. The number of distressed sales has probably declined in Q3, but it is still very high. The July NAR survey shows "distressed homes accounted for 31 percent of transactions", but their survey is very limited. And even using the NAR numbers, distressed sales are running around 1.5 million this year.

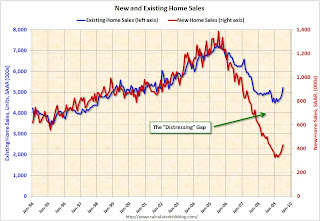

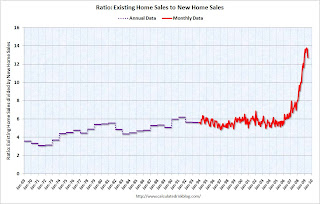

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including July new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through July.

As I've noted before, I believe this gap was caused by distressed sales. Even with the recent rebound in new and existing home sales, the gap is still very wide. The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

The ratio could decline because of a further increase in new home sales, or a decrease in existing home sales - or a combination of both. I expect the ratio will decline mostly from a decline in existing home sales as the first-time home buyer frenzy subsides, and as the foreclosure crisis moves into mid-to-high priced areas (with fewer cash flow investors).

From a longer term graph of the ratio, see my post last month.

Friday, August 21, 2009

DataQuick: California Bay Area home sales hit 4-year high

by Calculated Risk on 8/21/2009 01:19:00 PM

From DataQuick: Bay Area home sales hit 4-year high; median price up again

Bay Area home sales rose last month to the highest level for a July in four years as deals above $500,000 continued to accelerate. ...As always, be very careful with the median home price. DataQuick does a good job of explaining how it is being distorted by the mix of homes sold.

The median’s $43,000 gain between June and July was mainly the result of a shift toward a greater portion of sales occurring in higher-priced neighborhoods. The trend has been fueled this summer by several factors, including: More distress in high-end areas, leading to more motivated sellers; more buyers sensing a bottom could be near; and increased availability of larger home loans, which had become more expensive and far more difficult to obtain after the credit crunch hit two years ago.

...

As high-end sales have taken off in recent months, sales of foreclosures in less-expensive inland areas have tapered off. Last month 34.2 percent of the Bay Area homes that resold were foreclosure resales – homes resold in July that had been foreclosed on in the prior 12 months. Last month’s foreclosure resale level was the lowest since it was 33.3 percent in July 2008. Foreclosure resales peaked at 52 percent of all Bay Area resales in February this year.

...

“Evidence is mounting that in some areas we’ve approached at least a soft bottom for home prices,” [John Walsh, MDA DataQuick president] said. “But we continue to view that possibility with an abundance of caution, given all of the uncertainty over future foreclosure inventories and ongoing job cuts. The market remains vulnerable.”

A total of 8,771 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 1.5 percent from 8,664 in June and up 15.6 percent from 7,586 in July 2008.

Although last month’s sales were the highest for the month of July in four years, and the highest for any month since August 2006, they were still 7.8 percent lower than the average of 9,512 homes sold during the month of July going back to 1988, when DataQuick’s statistics begin. July sales have varied between a low of 6,666 sales in 1995 and a peak of 14,258 in 2004.

... Foreclosure activity is off its recent peak but remains high by historical standards ...

emphasis added

Last year financing for higher priced homes was very difficult, so it is no surprise that with a combination of increasing distressed sales in the mid-to-high end areas, and more financing, sales have picked up some.

Existing Home Sales increase in July

by Calculated Risk on 8/21/2009 10:00:00 AM

The NAR reports: Strong Gain in Existing-Home Sales Maintains Uptrend

Existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 7.2 percent to a seasonally adjusted annual rate of 5.24 million units in July from a level of 4.89 million in June, and are 5.0 percent above the 4.99 million-unit pace in July 2008.

...

Total housing inventory at the end of July rose 7.3 percent to 4.09 million existing homes available for sale, which represents a 9.4-month supply at the current sales pace, which was unchanged from June because of the strong sales gain.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2009 (5.24 million SAAR) were 7.2% higher than last month, and were 5.0% lower than July 2008 (4.99 million SAAR).

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. As in June, sales (NSA) were slightly higher in July 2009 than in July 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. As in June, sales (NSA) were slightly higher in July 2009 than in July 2008.It's important to note that many of these transactions are either investors or first-time homebuyers. Also many of the sales are distressed sales (short sales or REOs).

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 4.09 million in July. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 4.09 million in July. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory peaks in July or August. This increase in inventory was a little more than usual.

Note: many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs and other shadow inventory - so this inventory number is probably low.

The fourth graph shows the 'months of supply' metric for the last six years.

The fourth graph shows the 'months of supply' metric for the last six years.Months of supply was steady at 9.4 months.

Sales increased, and inventory increased, so "months of supply" was steady. A normal market has under 6 months of supply, so this is still very high.

Note: New Home sales will be released next Wednesday.

Existing Home Sales and First-Time Buyers

by Calculated Risk on 8/21/2009 08:53:00 AM

Existing home sales for July will be released at 10 AM ET.

From CNBC: Existing Home Sales May Top 5 Million: ING Analysts

Existing home sales may have crossed the 5 million mark in July, as buyers are coming back to the market, analysts from ING bank said in a market research note Friday.But no mention of the first-time home buyer frenzy? As I noted earlier:

...

"The surge in the number of signed contracts… suggests existing home sales are about to cross the 5-million mark. There is a fair chance sales already crossed that barrier last month," the note said.

...

"Sales pushing above 5.1 million – the pre-Lehman level – would help to make a convincing case that this is not just a correction, but a real pick-up in activity," ING analysts wrote.

Expect a surge in existing home sales (and some new home sales) over the next few months. Expect all kinds of reports that the bottom has been reached. (Like the ING report via CNBC)

Expect the frenzy to end ...

Here is a repeat of a graph by buyer type in Q2 from the Campbell survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.According to the Campbell survey first-time buyers accounted for 43% of sales in Q2 (investors another 29%).

Source: Summary Report--Real Estate Agents Report on Home Purchases and Mortgages, Campbell Communications, June 2009 (excerpted with permission)

Tuesday, August 18, 2009

DataQuick: SoCal Sales Increase, Some Activity in High End Areas

by Calculated Risk on 8/18/2009 01:39:00 PM

From DataQuick: Southland home sales rise again as higher-cost areas awaken

Southern California homes sold last month at the fastest clip for a July in three years and the fastest pace for any month since December 2006. ...Last year sales were very low in the high end areas, so some year-over-year pickup isn't surprising. Unfortunately DataQuick didn't break out the actual numbers.

A total of 24,104 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was up 3.6 percent from 23,262 in June and up 18.6 percent from 20,329 a year ago, according to San Diego-based MDA DataQuick.

July’s sales total was 8.7 percent lower than the average number sold in July – 26,410 – since 1988, when DataQuick’s statistics begin. July home sales have ranged from a low of 16,225 in July 1995 to a peak of 38,996 in 2003.

Sales have increased year-over-year for 13 consecutive months. ...

Although sales of lower-cost foreclosures have tapered off, the high end of the housing market has awakened this summer from a long slumber, during which sales had been at or near record lows. July sales of existing single-family houses rose above a year ago in many coastal towns, including Manhattan Beach, Redondo Beach, Huntington Beach, Newport Beach, Carlsbad, Encinitas and La Jolla. Among the higher-cost Southland communities not posting such a gain were Malibu, Rancho Palos Verdes, Beverly Hills, Brentwood and Del Mar.

...

Last month 43.4 percent of the Southland houses and condos that resold had been foreclosed on in the prior year – the lowest level since June 2008. July’s foreclosure resales figure was down from 45.3 percent in June and from a peak 56.7 percent in February 2009.

...

“Have prices hit bottom? While some data continue to hint at that, it remains an especially risky call to make given the uncertainty over the magnitude of future job losses and foreclosures. The recent drop in foreclosure resales, coupled with the rise in high-end sales, has helped stabilize some of the regional home price measures. But there’s still quite a bit of distress out there, and plenty of unknowns with regard to how lenders and borrowers will choose to proceed,” said John Walsh, DataQuick president.

...

Investors and other absentee buyers, defined as those who will have their property tax bills sent to a different address, bought 19.4 percent of the Southland homes sold last month. That’s up from 15.5 percent a year ago and a monthly average since 2000 of about 15 percent. San Bernardino County had the highest share of absentee buyers in July: 27 percent.

...

Foreclosure activity remains near record levels ...

emphasis added

Close to 20% of properties are being bought by investors, and 43.4% are foreclosure resales. These numbers are still very high and will probably increase after the Summer.

Monday, August 17, 2009

Home Seller Motivations

by Calculated Risk on 8/17/2009 06:32:00 PM

Here is some national data on buyer motivations in Q2. This is from a survey by Campbell Communications (posted with permission).

Credit: Summary Report--Real Estate Agents Report on Home Purchases and Mortgages, Campbell Communications, June 2009 Click on graph for larger image in new window.

Click on graph for larger image in new window.

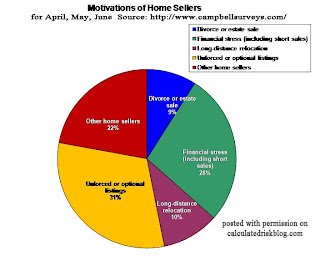

This graph shows the motivation of non-REO home sellers.

From Campbell Survey:

We told respondents, “Please think of the number of non-REO listings you currently have and then specify the number of home sellers by motivation. If more than one motivation applies, please select the single motivation that is most important; skip any motivation that does not apply.” Significantly, we found that unforced or optional listings account for only 31% of non-REO listings. Financial stress (including short sales) account for over a quarter. Other significant motivations include long distance relocation and divorce or estate sales.See Distressed Sales and Types of Buyers for a breakdown of REOs, short sales, and non-distressed buyers.

A previous survey question on home purchase transactions found that 51%, or approximately half, of the home purchase market is non-REO transactions. Combining the above question’s results with this data, we can impute that only 16% of the agent-sold residential real estate market—REO and non-REO properties—is a result of unforced or optional listings.

emphasis added

Friday, August 14, 2009

First-time Home Buyer Frenzy

by Calculated Risk on 8/14/2009 01:03:00 PM

Yesterday I posted some data from Campbell Communications (National Data: Distressed Sales and Types of Buyers)

Here is a repeat of the graph by buyer type: According to the Campbell survey first-time buyers accounted for 43% of sales in Q2 (investors another 29%).

According to the Campbell survey first-time buyers accounted for 43% of sales in Q2 (investors another 29%).

Source: Summary Report--Real Estate Agents Report on Home Purchases and Mortgages, Campbell Communications, June 2009 (excerpted with permission)

These numbers are higher than the numbers reported by NAR for Q2:

"An NAR practitioner survey in June showed first-time buyers accounted for 29 percent of transactions, unchanged from May ..."However I believe the Campbell numbers are closer to actual.

I've talked with several people - and there is a buying frenzy right now. First-time homebuyers, especially those with a limited downpayment, are desperate.

From the Chicago Tribune: First-time buyers race to beat credit deadline

With a growing sense of urgency, first-time buyers are searching for homes, worried that time is running out on an $8,000 federal tax credit.Also from Reuters: Race is on as U.S. home buyer tax credit nears end

Real estate agents say they're seeing a surge of first-timers who want to close on a property by Nov. 30, the deadline for the credit. The rush has set off bidding wars and stirred up a normally quiet August market.

"We're inundated," said Paula Clark, an agent with Coldwell Banker.

To meet the Nov. 30 deadline, buyers need to have a contract by around Sept. 30, because inspections, mortgage approvals and other details typically take about two months.

"I am willing to settle for something" to finish buying quickly, said 20-year old Kielar, who works at the Denver County Jail, and is a part-time student. The tax credit carrot "is speeding up the process," she said, adding that "$8,000 could help remodel the house, redo carpets and cabinets."In addition $8,000 to the Federal tax credit, there are some state programs, as a nexample from Newsday.com: NYS rolls out tax credit for first-time home buyers - but most of the frenzy is being driven by the Federal Tax credit.

For loans backed by the Federal Housing Administration (FHA), which require a minimum 3.5 percent downpayment, the $8,000 can be also be applied upfront toward the purchase rather than later on tax returns like other mortgages.

A few key points:

Expect a surge in existing home sales (and some new home sales) over the next few months. Expect prices at the low end to rise (simple supply and demand). Expect all kinds of reports that the bottom has been reached.

Expect the frenzy to end ...

Tuesday, August 04, 2009

Pending Home Sales Index Increases in June

by Calculated Risk on 8/04/2009 10:01:00 AM

From the NAR: Uptrend Continues in Pending Home Sales

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in June, rose 3.6 percent to 94.6 from an upwardly revised reading of 91.3 in May, and is 6.7 percent above June 2008 when it was 88.7.The increase in pending sales has been mostly from lower priced homes with demand from first time home buyers (taking advantage of the tax credit) and investors. As Yun notes, the demand from first time buyers will probably fade in another month or two.

...

"Activity has been consistently much stronger for lower priced homes,” [Lawrence Yun, NAR chief economist] said. “Because it may take as long as two months to close on a home after signing a contract, first-time buyers must act fairly soon to take advantage of the $8,000 tax credit because they must close on the sale by November 30.”

Monday, July 27, 2009

Distressing Gap: Ratio of Existing to New Home Sales

by Calculated Risk on 7/27/2009 11:38:00 AM

For graphs based on the new home sales report this morning, please see: New Home Sales increase in June, Highest since November 2008

Last week the National Association of Realtors (NAR) reported that distressed properties accounted 31 percent of sales in June. Distressed sales include REO sales (foreclosure resales) and short sales, and based on the 4.89 million existing home sales (SAAR) that puts distressed sales at about a 1.5 million annual rate in June.

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including June new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through June.

As I've noted before, I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.  The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio. The small decline in June ratio was because of the increase in new home sales.

The ratio could decline because of increase in new home sales, or a decrease in existing home sales - or a combination of both.  The third graph shows the ratio back to 1969 (annual data before 1994).

The third graph shows the ratio back to 1969 (annual data before 1994).

Note: the NAR has changed their data collection over time and the older data does not include condos: Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began.

Thursday, July 23, 2009

Existing Home Sales increase in June

by Calculated Risk on 7/23/2009 10:00:00 AM

The NAR reports: Existing-Home Sales Up Again

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 3.6 percent to a seasonally adjusted annual rate of 4.89 million units in June from a downwardly revised pace of 4.72 million in May, but are 0.2 percent lower than the 4.90 million-unit level in June 2008.

...

Total housing inventory at the end of June fell 0.7 percent to 3.82 million existing homes available for sale, which represents a 9.4-month supply at the current sales pace, down from a 9.8-month supply in May.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2009 (4.89 million SAAR) were 3.6% higher than last month, and were 0.2% lower than June 2008 (4.90 million SAAR).

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. For the first time in several years, sales (NSA) were slightly higher in June 2009 than in June 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. For the first time in several years, sales (NSA) were slightly higher in June 2009 than in June 2008.It's important to note that the NAR says about one-third of these sales were foreclosure resales or short sales. Although these are real transactions, this means activity (ex-distressed sales) is much lower.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.82 million in June. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.82 million in June. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory increases in June, and peaks in July or August. This decrease in inventory was a little unusual.

Also, many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs and other shadow inventory - so this inventory number is probably low.

The fourth graph shows the 'months of supply' metric for the last six years.

The fourth graph shows the 'months of supply' metric for the last six years.Months of supply declined to 9.4 months.

Sales increased slightly, and inventory decreased, so "months of supply" decreased. A normal market has under 6 months of supply, so this is still very high.

I'll have more soon ...

Note: New Home sales will be released on Monday.

Thursday, July 16, 2009

DataQuick: California Bay Area home sales Increase

by Calculated Risk on 7/16/2009 02:10:00 PM

Note: Ignore the median price, especially during periods when the mix is changing rapidly.

From DataQuick: Bay Area home sales and median price rise

Home sales in the Bay Area jumped to their highest level in almost three years, the result of improved mortgage availability and a perception among potential buyers that prices have bottomed out. ...This is still far from a normal market with 37.3% of sales foreclosure resales. And prices will probably continue to fall for some time, especially in the higher priced areas since there are few move-up buyers.

A total of 8,644 new and resale houses and condos sold across the nine-county Bay Area in June. That was up 16.1 percent from 7,447 in May and up 20.4 percent from 7,178 in June 2008, according to San Diego-based MDA DataQuick.

Home sales have increased on a year-over-year basis the last ten months. June sales have varied from a low of 7,118 in 1993 to 15,735 in 2004 in DataQuick’s statistics, which go back to 1988. Last month was 16.1 percent below the 10,306 for an average June.

...

Financing with home loans above the old “jumbo” limit of $417,000 edged up to the highest level in almost a year. Last month 28.8 percent of all Bay Area mortgages were jumbos, the highest since 31.9 percent in August last year and well above the bottom of 17.1 percent last January. Two years ago jumbos accounted for more than 60 percent of all home purchase loans.

...

Last month 37.3 percent of all homes resold in the Bay Area had been foreclosed on in the prior 12 months, down from 40.5 percent in May and the lowest since 36.0 percent in August 2008. The peak was 52.0 percent in February this year. By county, foreclosure resales ranged last month from 6.3 percent of all resales in Marin to 62.7 percent in Solano.

...

Foreclosure activity remains near record levels ...

Wednesday, July 15, 2009

DataQuick: SoCal Homes Sales Up

by Calculated Risk on 7/15/2009 05:08:00 PM

Note: Ignore the median home price during periods of rapidly changing mix.

From DataQuick: Southland home sales highest since late ’06; median price up again

Southern California home sales rose in June to the highest level in 30 months as the number of deals above $500,000 continued to climb. ...

A total of 23,262 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was up 12.0 percent from 20,775 in May and up 29.0 percent from a revised 18,032 a year ago, according to San Diego-based MDA DataQuick.

Sales have increased year-over-year for 12 consecutive months.

June’s sales were the highest for that month since 2006, when 31,602 homes sold, but were 17.7 percent below the average June sales total since 1988, when DataQuick’s statistics begin. June sales peaked at 40,156 in 2005 and hit a low last year.

Foreclosures remained a major force in June, but their impact on the resale market eased for the third consecutive month.

Foreclosure resales – homes sold in June that had been foreclosed on in the prior 12 months – represented 45.3 percent of Southland resales last month, down from 49.7 percent in May and down from a peak 56.7 percent in February this year. Last month’s level was the lowest since foreclosure resales were 43.7 percent of resales in July 2008.

...

The recent shift toward higher-cost markets contributing more to overall sales has put upward pressure on the region’s median sale price – the point where half of the homes sold for more and half for less. The median dived sharply over the past year not just because of price depreciation but because of a shift toward an unusually large share of sales occurring in lower-cost, foreclosure-heavy areas.

...

“The rising median should still be viewed mainly as a sign the market’s moving back toward a more normal distribution of sales across the home price spectrum.” ... said John Walsh, DataQuick president.

...

Foreclosure activity remains near record levels ... Financing with multiple mortgages is low, down payment sizes and flipping rates are stable, and non-owner occupied buying is above-average in some markets, MDA DataQuick reported.