by Calculated Risk on 8/31/2019 08:11:00 AM

Saturday, August 31, 2019

Schedule for Week of September 1, 2019

The key report this week is the August employment report on Friday.

Other key indicators include the August ISM manufacturing and non-manufacturing indexes, August auto sales, and the July trade deficit.

Fed Chair Jerome Powell will participate in a discussion on Friday.

For data nerds, the BLS will release their update Labor Force Projections on Wednesday.

All US markets will be closed in observance of the Labor Day holiday.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 51.5, up from 51.2 in July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 51.5, up from 51.2 in July.Here is a long term graph of the ISM manufacturing index.

The PMI was at 51.2% in July, the employment index was at 51.7%, and the new orders index was at 50.8%.

10:00 AM: Construction Spending for July. The consensus is for a 0.3% increase in construction spending.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $55.2 billion in July unchanged from $55.2 billion in June.

During the Day: The BLS is scheduled to release Labor Force projections through 2028.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.8 million in July (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.8 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 150,000 payroll jobs added in August, down from 156,000 added in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, unchanged from 215 thousand the previous week.

10:00 AM: the ISM non-Manufacturing Index for August. The consensus is for index to increase to 54.0 from 53.7 in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 158,000 non-farm payroll jobs in August, down from the 164,000 non-farm payroll jobs added in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 158,000 non-farm payroll jobs in August, down from the 164,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to be unchanged at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In July the year-over-year change was 2.246 million jobs.

A key will be the change in wages.

12:30 PM: Discussion with Fed Chair Jerome Powell, Economic Outlook and Monetary Policy, Discussion with Thomas J. Jordan, Chairman of the Swiss National Bank, hosted by the Swiss Institute of International Studies, University of Zurich, Zurich, Switzerland

Friday, August 30, 2019

Fannie Mae: Mortgage Serious Delinquency Rate Declined in July, Lowest Since June 2007

by Calculated Risk on 8/30/2019 04:18:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency declined to 0.67% in July, from 0.70% in June. The serious delinquency rate is down from 0.88% in July 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency rate for Fannie Mae since June 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.51% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.22% are seriously delinquent, For recent loans, originated in 2009 through 2018 (93% of portfolio), only 0.32% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase in the delinquency rate in late 2017 was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Hurricanes and Economic Data

by Calculated Risk on 8/30/2019 01:33:00 PM

For everyone in Florida - stay safe!

Frequently there is a temporary slowdown in several growth indicators following a large natural disaster. And usually there is a pretty rapid bounce back following the disaster.

Hurricane Dorian might negatively impact Q3 GDP, and September auto sales and housing.

Since this coming week is not the BLS reference week (includes the 12th of the month), there will probably be limited impact on September employment.

The first economic indicator to be impacted by the hurricane will probably be weekly unemployment claims.

The dashed line on the graph is the current 4-week average. Several events are labeled (9/11, Hurricanes Katrina, Sandy, Harvey and Irma, and the 2013 government shutdown). The great recession is obvious.

In 2017, weekly claims jumped from 238,000 to 293,000 following hurricane Harvey.

However, last year, following Hurricane Florence making landfall along the Carolina's coast as a category 1 hurricane, there was little impact on employment claims - despite significant rainfall and loss of life.

If Dorian makes landfall as a major hurricane, I expect some increase in weekly unemployment claims.

We might also see an impact on housing and auto sales in September. These will not be indicators of a recession, and we should expect any impacted indicator to rebound fairly quickly.

Stay safe.

Q3 GDP Forecasts: Around 2%

by Calculated Risk on 8/30/2019 11:17:00 AM

From Merrill Lynch:

3Q GDP tracking rose 0.2pp to 2.1% qoq saar [Aug 29 estimate]From Goldman Sachs:

emphasis added

We boosted our Q3 GDP tracking estimates by two tenths to +2.2% (qoq ar). [Aug 29 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.8% for 2019:Q3. [Aug 30 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 2.0 percent on August 30, down from 2.3 percent on August 26. [Aug 30 estimate]CR Note: These early estimates suggest real GDP growth will be around 2% annualized in Q3.

Personal Income increased 0.1% in July, Spending increased 0.6%

by Calculated Risk on 8/30/2019 08:35:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $23.9 billion (0.1 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $44.4 billion (0.3 percent) and personal consumption expenditures (PCE) increased $93.1 billion (0.6 percent).The July PCE price index increased 1.4 percent year-over-year and the July PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI increased 0.1 percent in July and Real PCE increased 0.4 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through July 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was slightly above expectations.

Note that core PCE inflation was at expectations.

Thursday, August 29, 2019

Friday: Personal Income and Outlays

by Calculated Risk on 8/29/2019 07:32:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, July 2019. The consensus is for a 0.3% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for August.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 92.3.

By Request, and Just For Fun: Stock Market as Barometer of Policy Success

by Calculated Risk on 8/29/2019 04:21:00 PM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

CR Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 29% under Mr. Trump - compared to up 44% under Mr. Obama for the same number of market days.

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 8/29/2019 01:15:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 24 August

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 18-24 August 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 19-25 August 2018, the industry recorded the following:

• Occupancy: +0.8% to 70.1%

• Average daily rate (ADR): +0.5% to US$128.57

• Revenue per available room (RevPAR): +1.2% at US$90.08

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year), unless there is a strong boost due to hurricane impacted areas.

Seasonally, the occupancy rate will now start to decline as the peak summer travel season ends.

Data Source: STR, Courtesy of HotelNewsNow.com

NAR: "Pending Home Sales Decline 2.5% in July"

by Calculated Risk on 8/29/2019 10:03:00 AM

From the NAR: Pending Home Sales Decline 2.5% in July

ending home sales fell in July, reversing course on two consecutive months of gains, according to the National Association of Realtors®. Of the four major regions, each reported a drop in contract activity, although the greatest decline came in the West.This was well below expectations of a 0.3% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 2.5% to 105.6 in July, down from 108.3 in June. Year-over-year contract signings fell 0.3%, doing an about-face of the prior month’s increase.

...

All regional indices are down from June. The PHSI in the Northeast fell 1.6% to 93.0 in July and is now 0.9% lower than a year ago. In the Midwest, the index dropped 2.5% to 101.0 in July, 1.2% less than July 2018.

Pending home sales in the South decreased 2.4% to an index of 122.7 in July, but that number is 0.1% higher than last July. The index in the West declined 3.4% in July to 93.5 but still increased 0.3% above a year ago.

emphasis added

Weekly Initial Unemployment Claims increased to 215,000

by Calculated Risk on 8/29/2019 08:58:00 AM

The DOL reported:

In the week ending August 24, the advance figure for seasonally adjusted initial claims was 215,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 209,000 to 211,000. The 4-week moving average was 214,500, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 500 from 214,500 to 215,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 214,500.

This was close to the consensus forecast.

Q2 GDP Revised Down to 2.0% Annual Rate

by Calculated Risk on 8/29/2019 08:52:00 AM

From the BEA: Gross Domestic Product, Second Quarter 2019 (Second Estimate); Corporate Profits, Second Quarter 2019 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the second quarter of 2019, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 3.1 percent.PCE growth was revised up from 4.3% to 4.7%. Residential investment was revised down from -1.5% to -2.9%. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.1 percent. The revision primarily reflected downward revisions to state and local government spending, exports, private inventory investment, and residential investment that were partly offset by an upward revision to personal consumption expenditures (PCE). Imports which are a subtraction in the calculation of GDP, were unrevised.

emphasis added

Here is a Comparison of Second and Advance Estimates.

Wednesday, August 28, 2019

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 8/28/2019 07:25:00 PM

Thursday:

• At 8:30 AM: Gross Domestic Product, 2nd quarter 2019 (second estimate). The consensus is that real GDP increased 2.0% annualized in Q2, down from the advance estimate of 2.1% in Q2.

• Also at 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, up from 209 thousand last week.

• At 10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.3% decrease in the index.

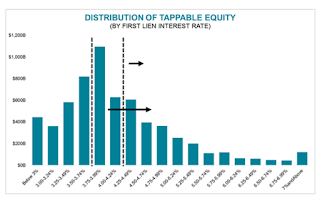

Black Knight on "Tappable Equity"

by Calculated Risk on 8/28/2019 04:23:00 PM

Here are some comments and two graphs from Black Knight on tappable equity.

Tappable equity grew by >$335B in Q2 2019

• Tappable equity growth had been slowing in recent quarters due to rising interest rates and slowing home price growth

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the Black Knight's estimate of "tappable equity".

• However, its Q2 growth rate was slightly above Q1’s (+4.2% vs. 3%)

• A total of $6.3T in tappable equity is now held by 45M U.S. mortgage holders

• That’s the highest volume ever recorded, and 26% above the mid-2006 peak of $5T

This graph from Black Knight shows the distribution of "tappable equity" by first lien mortgage rate.

This graph from Black Knight shows the distribution of "tappable equity" by first lien mortgage rate.• Nearly half (49%) of the 45M homeowners with tappable equity have 1st lien interest rates ≥4.25%, making refi an attractive option (most also fall into the population of refinance candidates we’ve been tracking)CR Note: A pickup in cash out refinancing could give a small boost to the economy.

• 76% have rates at or above 3.75% – these folks could potentially tap into home equity with little change to their existing 30-year rate, or perhaps even a slight improvement

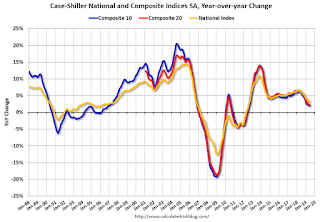

Zillow Case-Shiller Forecast: Lower YoY Price Gains in July compared to June

by Calculated Risk on 8/28/2019 01:09:00 PM

The Case-Shiller house price indexes for June were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: June Case-Shiller Results and July Forecast: Phoenix Posts Largest YoY Gains

Annual home price gains continued their gradual slowdown in June, although the pace of those declines has slowed from earlier this year. While prices are still climbing, the rate of annual appreciation appears to have leveled off near its long-term average, after consistently falling from a high point reached in the spring of last year.

…

Housing demand remains strong as buyers are encouraged by rising wages and by mortgage rates that just keep falling amid growing economic uncertainty. Would-be buyers stand with pre-approved mortgages in hand. However, they’ve become unwilling to pay escalating prices for the relatively low inventory of homes that are on the market and instead are making sellers wait and even drop list prices.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 2.9% in July, down from 3.1% in June.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 2.9% in July, down from 3.1% in June. The Zillow forecast is for the 20-City index to decline to 1.9% YoY in July from 2.1% in June, and for the 10-City index to decline to 1.6% YoY compared to 1.8% YoY in June.

Real House Prices and Price-to-Rent Ratio in June

by Calculated Risk on 8/28/2019 09:08:00 AM

Here is the post yesterday on Case-Shiller: Case-Shiller: National House Price Index increased 3.1% year-over-year in June

It has been over eleven years since the bubble peak. In the Case-Shiller release last week, the seasonally adjusted National Index (SA), was reported as being 13.2% above the previous bubble peak. However, in real terms, the National index (SA) is still about 7.6% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 14.6% below the bubble peak.

The year-over-year increase in prices has slowed to 3.1% nationally, and I expect price growth might slow a little more, but not turn negative this year.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $287,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to February 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio has been moving sideways to down recently.

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

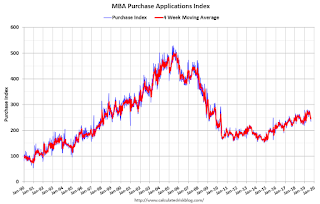

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 8/28/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 23, 2019.

... The Refinance Index decreased 8 percent from the previous week and was 167 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

“U.S. Treasury yields were volatile over the course of the week, as the ongoing trade dispute between the U.S. and China continued to generate uncertainty among investors. Rates increased for the first time since the week of July 12, but were still 80 basis points lower than the beginning of the year,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “With rates edging higher, refinances and purchase applications fell, at 8 percent and 6 percent, respectively.”

Added Kan, “Purchase applications were still up around 2 percent year-over-year last week, but the drop in rates this summer have not yet led to a significant boost in activity. Uncertainty over the near-term economic outlook and low supply continue to be the predominant headwinds for prospective homebuyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 3.94 percent from 3.90 percent, with points increasing to 0.38 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to under 4%.

With lower rates, we saw a recent sharp increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 2% year-over-year.

Tuesday, August 27, 2019

2020 Economic Forecast featuring the UCI Paul Merage School of Business

by Calculated Risk on 8/27/2019 09:40:00 PM

On October 23rd, I will be one of three speakers at the "2020 Economic Forecast featuring the UCI Paul Merage School of Business" in Newport Beach, California, sponsored by the Newport Beach Chamber of Commerce.

UCI Finance Professor Christopher Schwarz and I will be discussing the 2020 economic outlook, and Dr. Richard Afable will be discussing "The Future of the Healthcare System".

This is a lunch time event (from 11:15 am to 1:30 pm) at the Balboa Bay Resort.

Click here for more information and tickets. Tickets are $65 for members, and $75 for non-members and includes lunch. (I'm speaking for free).

Or click on the banner below.

"Chemical Activity Barometer Down in August"

by Calculated Risk on 8/27/2019 02:04:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Down in August

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), fell 0.1 percent in August on a three-month moving average (3MMA) basis following a similar drop in July and four months of gains. On a year-over-year (Y/Y) basis, the barometer was flat at 0.0 percent (3MMA).

The unadjusted measure of the CAB fell 0.5 percent in August after a 0.1 percent gain in July. The diffusion index was 59 percent in August. The diffusion index marks the number of positive contributors relative to the total number of indicators monitored. The CAB reading for July was revised upward by 0.58 points and that for June by 0.62 points.

“A pattern of fluctuating CAB readings – months up followed by months down – indicates late-cycle activity,” said Kevin Swift, chief economist at ACC. “The barometer signals gains in U.S. commerce into early 2020, but at a slow pace, while rising volatility suggests change may be coming.”

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year change in the CAB suggests that the YoY increase in industrial production will probably slow further.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/27/2019 12:34:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through June 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Richmond Fed: "Manufacturing Activity Was Moderate in August"

by Calculated Risk on 8/27/2019 10:10:00 AM

From the Richmond Fed: Manufacturing Activity Was Moderate in August

Fifth District manufacturing activity was moderate in August, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite index rose from −12 in July to 1 in August, buoyed by increases in the indexes for shipments and new orders. However, the third component, employment, fell.This was the last of the regional Fed surveys for August.

...

Survey results suggested that many firms saw employment decline while the average workweek increased in August. Respondents reported persistent wage growth but still struggled to find workers with the necessary skills.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

The regional surveys were weak again in August, but slightly better than in July.

Based on these regional surveys, it seems likely the ISM manufacturing index for August will be weak again.

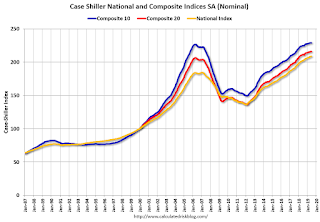

Case-Shiller: National House Price Index increased 3.1% year-over-year in June

by Calculated Risk on 8/27/2019 09:10:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Phoenix Replaces Las Vegas as Top City in Annual Gains According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.1% annual gain in June, down from 3.3% in the previous month. The 10-City Composite annual increase came in at 1.8%, down from 2.2% in the previous month. The 20-City Composite posted a 2.1% year-over-year gain, down from 2.4% in the previous month.

Phoenix, Las Vegas and Tampa reported the highest year-over-year gains among the 20 cities. In June, Phoenix led the way with a 5.8% year-over-year price increase, followed by Las Vegas with a 5.5% increase, and Tampa with a 4.7% increase. Six of the 20 cities reported greater price increases in the year ending June 2019 versus the year ending May 2019.

...

Before seasonal adjustment, the National Index posted a month-over-month increase of 0.6% in June. The 10-City Composite posted a 0.2% increase and the 20-City Composite reported a 0.3% increase for the month. After seasonal adjustment, the National Index recorded a 0.2% month-over-month increase in June. The 10-City and the 20-City Composites did not report any gains. In June, 19 of 20 cities reported increases before seasonal adjustment, while 17 of 20 cities reported increases after seasonal adjustment.

“Home price gains continue to trend down, but may be leveling off to a sustainable level,” says Philip Murphy, Managing Director and Global Head of Index Governance at S&P Dow Jones Indices. “The average YOY gain declined to 3.0% in June, down from 3.1% the prior month. However, fewer cities (12) experienced lower YOY price gains than in May (13).

“The southwest (Phoenix and Las Vegas) remains the regional leader in home price gains, followed by the southeast (Tampa and Charlotte). With three of the bottom five cities (Seattle, San Francisco, and San Diego), much of the west coast is challenged to sustain YOY gains. For the second month in a row, however, only Seattle experienced outright decline with YOY price change of -1.3%. The U.S. National Home Price NSA Index YOY price change in June 2019 of 3.1% is exactly half of what it was in June 2018. While housing has clearly cooled off from 2018, home price gains in most cities remain positive in low single digits. Therefore, it is likely that current rates of change will generally be sustained barring an economic downturn.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.0% from the bubble peak, and down slightly in June (SA) from May.

The Composite 20 index is 4.5% above the bubble peak, and up slightly (SA) in June.

The National index is 13.2% above the bubble peak (SA), and up 0.2% (SA) in June. The National index is up 53.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 1.9% compared to June 2018. The Composite 20 SA is up 2.2% year-over-year.

The National index SA is up 3.1% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, August 26, 2019

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 8/26/2019 07:38:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Mixed Versus Friday, Depending on Lender

Mortgage rates are sort of all over the place at the moment, and almost never where you'd expect. Those who haven't been following the bond market too closely generally expect higher rates than what we've been seeing recently. Those who are well-versed in the longstanding relationship between mortgages and Treasury yields generally expect rates to have fallen MUCH faster than they actually have.Tuesday:

…

All of the above having been said, the average lender is still very close to the lowest levels in 3 years. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]

emphasis added

• At 9:00 AM, S&P/Case-Shiller House Price Index for June. The consensus is for a 2.3% year-over-year increase in the Comp 20 index for June.

• Also at 9:00 AM, FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

Freddie Mac: Mortgage Serious Delinquency Rate declined in July

by Calculated Risk on 8/26/2019 04:35:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in July was 0.61%, down from 0.63% in June. Freddie's rate is down from 0.78% in July 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since November 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for July soon.

Merrill and Goldman on Housing

by Calculated Risk on 8/26/2019 01:03:00 PM

A few excerpts from two research pieces on housing.

From Merrill Lynch: Housing: something for everyone What comes next?

[W]e are making some tweaks to the housing forecast. Housing starts are likely to edge down this year to 1.24mn but recover next year. Existing home sales should also come in lower this year at 5.30 million and hold around this pace in 2020. The story for new home sales is a bit better with 650k this year and 660k next. In other words, further sideways motion for housing activity, leaving it a benign factor for the overall economy.From Goldman Sachs: Can Lower Rates Still Boost Housing?

[O]ur estimate of the lag time between changes in interest rates and housing activity suggests the bulk of the boost is yet to come. ... we update our outlook for the growth boost from housing via both the homebuilding channel and the impact of refinancing, mortgage equity withdrawal, and housing wealth effects on consumer spending. Our model points to a healthy rebound to a 4% growth pace of residential investment in 2019H2 and an increase in the total contribution from housing to GDP growth from -0.05pp in H1 to +0.15pp in H2.CR Notes: This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Click on graph for larger image.

Click on graph for larger image.Year-to-date, starts are down 3.1% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year were the most difficult.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. Now it is possible starts will be unchanged or up slightly in 2019 compared to 2018.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).Year-to-date (through July), sales are up 4.1% compared to the same period in 2018.

The second half comparisons will be easier, so sales should be higher in 2019 than in 2018.

So my view is housing will be a positive for the economy in the 2nd half of 2019.

Dallas Fed: "Texas Manufacturing Expansion Picks Up Pace"

by Calculated Risk on 8/26/2019 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Picks Up Pace

Texas factory activity expanded at a faster clip in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, shot up nine points to 17.9, its highest reading in nearly a year.Some improvement, but another weak regional report.

Other measures of manufacturing activity also suggested faster expansion in August. The shipments index rose seven points to 17.6, and the capacity utilization index rose five points to 15.7, both reaching 11-month highs. The new orders index moved up from 5.5 to 9.3, while the growth rate of orders index was largely unchanged at 1.8.

Perceptions of broader business conditions improved in August. The general business activity index pushed into positive territory for the first time in four months, rising nine points to 2.7. Similarly, the company outlook index rose to 5.0 following three months in negative territory. However, the index measuring uncertainty regarding companies’ outlooks jumped nine points to 18.6, a reading well above average.

Labor market measures suggested slower growth in employment and work hours in August. The employment index remained positive but retreated 11 points to 5.5, a level closer to average. Eighteen percent of firms noted net hiring, while 12 percent noted net layoffs. The hours worked index edged down to 4.0.

emphasis added

Chicago Fed "Index points to slower economic growth in July"

by Calculated Risk on 8/26/2019 08:44:00 AM

From the Chicago Fed: Index points to slower economic growth in July

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.36 in July from +0.03 in June. All four broad categories of indicators that make up the index decreased from June, and all four categories made negative contributions to the index in July. The index’s three-month moving average, CFNAI-MA3, moved up to –0.14 in July from –0.30 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in July (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, August 25, 2019

Sunday Night Futures

by Calculated Risk on 8/25/2019 08:48:00 PM

Weekend:

• Schedule for Week of August 25, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

• Also at 8:30 AM, Durable Goods Orders for July from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 14 and DOW futures are down 143 (fair value).

Oil prices were up over the last week with WTI futures at $53.22 per barrel and Brent at $58.53 barrel. A year ago, WTI was at $70, and Brent was at $74 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.58 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down 25 cents year-over-year.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 8/25/2019 12:52:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 17 August

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 11-17 August 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 12-18 August 2018, the industry recorded the following:

• Occupancy: -1.0% to 71.7%

• Average daily rate (ADR): +0.4% to US$130.89

• Revenue per available room (RevPAR): -0.6% at US$93.90

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years - but has been a little soft YoY in recent weeks.

Seasonally, the occupancy rate will now start to decline as the peak summer travel season ends.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, August 24, 2019

Schedule for Week of August 25, 2019

by Calculated Risk on 8/24/2019 08:11:00 AM

The key report this week is second estimate of Q2 GDP.

Other key reports include Personal Income and Outlays for July and Case-Shiller house prices for June.

For manufacturing, the August Richmond and Dallas Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August.

9:00 AM: S&P/Case-Shiller House Price Index for June.

9:00 AM: S&P/Case-Shiller House Price Index for June.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.3% year-over-year increase in the Comp 20 index for June.

9:00 AM: FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 2nd quarter 2019 (second estimate). The consensus is that real GDP increased 2.0% annualized in Q2, down from the advance estimate of 2.1% in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, up from 209 thousand last week.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.3% decrease in the index.

8:30 AM ET: Personal Income and Outlays, July 2019. The consensus is for a 0.3% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 92.3.

Friday, August 23, 2019

Lawler: Updated “Demographic” Outlook Using Recent Population Estimates by Age

by Calculated Risk on 8/23/2019 04:00:00 PM

From housing economist Tom Lawler: Updated “Demographic” Outlook Using Recent Population Estimates by Age

Executive Summary: Analysts who use intermediate or long term population projections to forecast key economic variables such as labor force growth, household growth, etc. should recognize that the latest official Census intermediate and long term population projections (produced in 2017 and referred to as “Census 2017”) are out of date. Specifically, Census 2017 materially over-predicted births, materially under-predicted deaths (mainly for non-elderly adults), and somewhat over-predicted net international migration (NIM) for each of the last several years. In addition, the assumptions in Census 2017 projections over the next several years (and more) are almost certainly too high for births, too low for deaths, and too high for NIM. As a result, population growth, household growth, and labor force growth over the next few years will be lower than forecasts based on the Census 2017 population projections. How much lower depends critically on net international migration, which in the current environment is a big unknown.

Using more realistic assumptions on births and deaths by age, I have developed updated population projections by age through 2021 assuming (1) net international migration in each year is the same as in 2018; and (2) there is no international migration in 2020 or 2021. I did the latter scenario to highlight the importance of net international migration assumptions on population projections.

--------------------------------------------------------------------------------------------

Earlier this year the Census Bureau released its latest (“Vintage 2018) estimates of the US resident population by single year of age for July 1, 2018, as well as for July of each of the previous 8 years. These latest estimates give analysts a new starting point that can be used to update population projections by age using assumptions about births, deaths by age, and net international migration by age. These population projections are key inputs into forecasts of other key economic variables such as the labor force and US households.

While many analysts prefer to use “official” Census population projections in forecasting other key economic variables, there are several reasons why this is often not a good idea. First, official Census population projections are only released every couple of years, and may be out of date. And second, such projections may have assumptions about the key drivers of population growth that may not be viewed as “reasonable.”

The latest official Census population projections were done in late 2017 and released to the public in early 2018. The “starting point” for these projections was the “Vintage 2016” population estimates, and population estimates for 2016 have since been revised. In addition, current estimates of births, deaths, and net international migration from 2016 to 2018 are significantly different from the “Census 2017” projections. And finally, the assumptions in the “Census 2017” projections for the key drivers of population changes, especially death rates by age, are not realistic or consistent with recent actual death rates by age.

The latest estimate of the US resident population on July 1, 2018 was 327,167,434, which is 724,477 lower than the Census 2017 projection for that date. Fewer births, more deaths, and lower international migration all contributed to the projection shortfall. Below is a table showing the differences between the latest July 1 2018 population estimate and the July 1, 2018 forecast from the Census 2017 projection by key component.

| Census 2017 Projections | Vintage 2018 Estimates | Difference | |

|---|---|---|---|

| 7/1/2016 | 323,127,513 | 323,071,342 | (56,171) |

| Births: 7/1/2016 - 6/30/2018 | 8,129,169 | 7,757,482 | (371,687) |

| Deaths: 7/1/2016 - 6/30/2018 | 5,363,099 | 5,593,449 | 230,350 |

| Net Int'l Migration: 7/1/2016 - 6/30/2018 | 1,998,328 | 1,932,059 | (66,269) |

| 7/1/2018 | 327,891,911 | 327,167,434 | (724,477) |

Births from 7/1/2016 to 6/30/2018 were significantly below projected levels from Census 2017. In addition, the National Center for Health Statistics (NCHS) recently estimated that US births in 2018 (calendar year) totaled just 3,788,235, the lowest annual number of births in 32 years, and a whopping 306,730 below the Census 2017 projection for the 12 month period ending June 2019.

Deaths from 7/1/2016 to 6/30/2018 were significantly above projected levels from Census 2017. While the Census Bureau did not release estimates of deaths (or net international migration) by age in its “Vintage 2018” release, Census does use data from the NCHS on deaths by age, and these data indicate that most of the higher than projected deaths from Census 2017 were in the 20-74 year old age groups.

The Census 2017 population projections were based on a dated “death rate” table, as well as on projections that death rates for most age groups would decline each year. In fact, however, death rates for many age groups have increased over the past few years. The assumptions on deaths from Census 2017 over the next several years are almost certainly way too low, especially for the 20-74 year old age groups.

Finally the latest Census estimates of net international migration (NIM) from 7/1/2016 to 6/30/2018 are somewhat below the Census 2017 projections. Moreover, updated estimates for NIM (which are, unfortunately, subject to considerable error) suggest a materially different age distribution than that assumed in the Census 2017 projections.

Below is a table comparing the latest Census estimates of the US resident population for 2018 with the projections from Census 2017 for 2018 by 5-year ago groups.

| US Resident Population, 7/1/2018 | |||

|---|---|---|---|

| Vintage 2018 Estimate | Census 2017 Projection | Difference | |

| Total | 327,167,434 | 327,891,911 | -724,477 |

| 0-4 | 19,810,275 | 20,172,617 | -362,342 |

| 5-9 | 20,195,642 | 20,166,270 | 29,372 |

| 10-14 | 20,879,527 | 20,866,300 | 13,227 |

| 15-19 | 21,097,221 | 21,084,451 | 12,770 |

| 20-24 | 21,873,579 | 21,966,919 | -93,340 |

| 25-29 | 23,561,756 | 23,601,976 | -40,220 |

| 30-34 | 22,136,018 | 22,125,395 | 10,623 |

| 35-39 | 21,563,587 | 21,556,772 | 6,815 |

| 40-44 | 19,714,301 | 19,728,816 | -14,515 |

| 45-49 | 20,747,135 | 20,786,395 | -39,260 |

| 50-54 | 20,884,564 | 20,923,227 | -38,663 |

| 55-59 | 21,940,985 | 22,012,901 | -71,916 |

| 60-64 | 20,331,651 | 20,408,221 | -76,570 |

| 65-69 | 17,086,893 | 17,127,778 | -40,885 |

| 70-74 | 13,405,423 | 13,418,850 | -13,427 |

| 75-79 | 9,267,066 | 9,274,592 | -7,526 |

| 80-84 | 6,127,308 | 6,131,125 | -3,817 |

| 85+ | 6,544,503 | 6,539,306 | 5,197 |

As the table shows, there are significant differences between the “Vintage 2018” population estimates and the projections from Census 2017, not just in the total but also in the age distribution.

In “Vintage 2018” Census also provided updated population projections for 2019, which are used (among other things) as “controls” for the household employment estimates for 2019. Below is a table comparing the Vintage 2018 population projections for 2019 with the Census 2017 projections for 2019.

| Resident Population Projections for 7/1/2019 | |||

|---|---|---|---|

| Vintage 2018 | Census 2017 | Difference | |

| Total | 329,158,518 | 330,268,840 | -1,110,322 |

| 0-4 | 19,702,853 | 20,304,120 | -601,267 |

| 5-9 | 20,222,613 | 20,180,503 | 42,110 |

| 10-14 | 20,829,999 | 20,814,198 | 15,801 |

| 15-19 | 21,114,493 | 21,100,800 | 13,693 |

| 20-24 | 21,744,207 | 21,861,558 | -117,351 |

| 25-29 | 23,612,082 | 23,693,302 | -81,220 |

| 30-34 | 22,510,095 | 22,522,671 | -12,576 |

| 35-39 | 21,798,813 | 21,798,185 | 628 |

| 40-44 | 19,979,623 | 20,003,487 | -23,864 |

| 45-49 | 20,443,042 | 20,491,118 | -48,076 |

| 50-54 | 20,515,438 | 20,559,577 | -44,139 |

| 55-59 | 21,912,472 | 22,001,226 | -88,754 |

| 60-64 | 20,608,057 | 20,712,610 | -104,553 |

| 65-69 | 17,487,028 | 17,543,604 | -56,576 |

| 70-74 | 14,060,332 | 14,076,777 | -16,445 |

| 75-79 | 9,678,247 | 9,685,598 | -7,351 |

| 80-84 | 6,327,181 | 6,329,092 | -1,911 |

| 85+ | 6,611,943 | 6,590,414 | 21,529 |

(Note: The Vintage 2018 projection for 2019 appears to have assumed the same number as births as for 2018, though recent data suggest that births were lower.)

If analysts had used the Census 2017 population projections to forecast the US labor force and the number of US households, and had been accurate in their forecasts of labor force participation rates and headship rates, they would have over-predicted the size of the labor force in mid-2019 by about 400,000, and over-predicted the number of households in mid-2019 by about 260,000.

Obviously, Census 2017 population projections have not tracked recent estimates and projections very well. In addition, Census 2017 assumptions for births, deaths, and net international migration are likely to be considerable off from likely “actuals” for the years ahead.

For analysts who use intermediate and long term population projections to forecast other key economic or social variables such as household growth, labor force growth, social security/medicare enrollment/payments, college enrollment, etc., it seems clear that it would not be appropriate to use the Census 2017 population projections. However, these are the latest “official” projections that have been released, and many analysts prefer to use “official” projections. Moreover, formulating one’s own population projections by age requires one to make assumptions not just on total births, deaths, and NIM, but also deaths and NIM by single year of age, and there aren’t timely publicly-released data on either of the latter.

To help some of these analysts, I have, using some unpublished data on recent trends, produced US resident population projections through 2021 using the following assumptions:

1. Annual births from 2019 through 2021 are the same as those in calendar year 2018 (3,788,235);

2. Deaths rates by age are similar to those in 2018 (though somewhat lower for age groups that saw a sizable increase over the last few years); and

3. Net International Migration by age is the same each year as the Census estimates for 2018.

Note that the biggest “wild card” in assumptions is NIM; not only are recent estimates subject to much higher uncertainty than the other two key drivers of population growth, but it is also virtually impossible in the current political environment to make a reasonable projection for NIM. For example, recent actions by the Administration set to take effect in mid-October would, if implemented, have a significantly negative impact on immigration over the next few years.

I also have produced population projections by age assuming no international migration (this is not necessarily the same as no immigration, as a lot of people leave the country for abroad each year). I did this to highlight the importance of NIM on the outlook for the population.

Note that I did not use the Vintage 2018 projections for 2019, but instead used the assumptions discussed above.

These alternative projections are shown on the next page for select age groups.

| US Resident Population: Alternative Projections | ||||

|---|---|---|---|---|

| Census 2017 Projections | ||||

| 7/1/2018 | 7/1/2019 | 7/1/2020 | 7/1/2021 | |

| Total | 327,891,911 | 330,268,840 | 332,639,102 | 334,998,398 |

| 0-14 | 61,205,187 | 61,298,821 | 61,408,926 | 61,510,603 |

| 15-24 | 43,051,370 | 42,962,358 | 42,937,831 | 43,004,867 |

| 25-34 | 45,727,371 | 46,215,973 | 46,491,403 | 46,716,390 |

| 35-44 | 41,285,588 | 41,801,672 | 42,351,795 | 43,006,437 |

| 45-54 | 41,709,622 | 41,050,695 | 40,615,037 | 40,324,022 |

| 55-64 | 42,421,122 | 42,713,836 | 42,782,544 | 42,593,657 |

| 65-74 | 30,546,628 | 31,620,381 | 32,789,437 | 33,953,050 |

| 75+ | 21,945,023 | 22,605,104 | 23,262,129 | 23,889,372 |

| Flat Births, More Realistic Death Rates, Flat NIM | ||||

| 7/1/2018 | 7/1/2019 | 7/1/2020 | 7/1/2021 | |

| Total | 327,167,434 | 329,072,705 | 330,917,403 | 332,700,753 |

| 0-14 | 60,885,444 | 60,698,571 | 60,507,167 | 60,290,588 |

| 15-24 | 42,970,800 | 42,861,557 | 42,822,738 | 42,882,730 |

| 25-34 | 45,697,774 | 46,128,836 | 46,337,496 | 46,484,660 |

| 35-44 | 41,277,888 | 41,786,370 | 42,323,937 | 42,961,919 |

| 45-54 | 41,631,699 | 40,958,397 | 40,507,001 | 40,198,337 |

| 55-64 | 42,272,636 | 42,516,252 | 42,534,068 | 42,293,993 |

| 65-74 | 30,492,316 | 31,537,868 | 32,667,883 | 33,780,930 |

| 75+ | 21,938,877 | 22,584,854 | 23,217,113 | 23,807,596 |

| Flat Births, More Realistic Death Rates, No International Migration | ||||

| 7/1/2018 | 7/1/2019 | 7/1/2020 | 7/1/2021 | |

| Total | 327,167,434 | 329,072,705 | 329,940,031 | 330,747,524 |

| 0-14 | 60,885,444 | 60,698,571 | 60,284,355 | 59,860,569 |

| 15-24 | 42,970,800 | 42,861,557 | 42,537,458 | 42,330,317 |

| 25-34 | 45,697,774 | 46,128,836 | 46,069,155 | 45,934,117 |

| 35-44 | 41,277,888 | 41,786,370 | 42,209,180 | 42,720,399 |

| 45-54 | 41,631,699 | 40,958,397 | 40,468,714 | 40,117,461 |

| 55-64 | 42,272,636 | 42,516,252 | 42,507,588 | 42,241,276 |

| 65-74 | 30,492,316 | 31,537,868 | 32,649,225 | 33,742,244 |

| 75+ | 21,938,877 | 22,584,854 | 23,214,356 | 23,801,141 |

Below are tables showing the differences between the latter two scenarios and the Census 2017 population projections.

| Alternate Population Projections vs. Census 2017 Projections | ||||

|---|---|---|---|---|

| Flat Births, More Realistic Death Rates, Flat NIM | ||||

| Total | -724,477 | -1,196,135 | -1,721,699 | -2,297,645 |

| 0-14 | -319,743 | -600,250 | -901,759 | -1,220,015 |

| 15-24 | -80,570 | -100,801 | -115,093 | -122,137 |

| 25-34 | -29,597 | -87,137 | -153,907 | -231,730 |

| 35-44 | -7,700 | -15,302 | -27,858 | -44,518 |

| 45-54 | -77,923 | -92,298 | -108,036 | -125,685 |

| 55-64 | -148,486 | -197,584 | -248,476 | -299,664 |

| 65-74 | -54,312 | -82,513 | -121,554 | -172,120 |

| 75+ | -6,146 | -20,250 | -45,016 | -81,776 |

| Flat Births, More Realistic Death Rates, No International Migration | ||||

| 7/1/2018 | 7/1/2019 | 7/1/2020 | 7/1/2021 | |

| Total | -724,477 | -1,196,135 | -2,699,071 | -4,250,874 |

| 0-14 | -319,743 | -600,250 | -1,124,571 | -1,650,034 |

| 15-24 | -80,570 | -100,801 | -400,373 | -674,550 |

| 25-34 | -29,597 | -87,137 | -422,248 | -782,273 |

| 35-44 | -7,700 | -15,302 | -142,615 | -286,038 |

| 45-54 | -77,923 | -92,298 | -146,323 | -206,561 |

| 55-64 | -148,486 | -197,584 | -274,956 | -352,381 |

| 65-74 | -54,312 | -82,513 | -140,212 | -210,806 |

| 75+ | -6,146 | -20,250 | -47,773 | -88,231 |

Obviously, the outlook for population growth, labor force growth, household formations, and other economic variables over the next few years depends critically on one’s assumptions about net international migration. The “flat births/flat NIM” scenario is probably a “high” forecast, given, recent Trump administration actions/policies, while the “no international migration” scenario is more designed to show what population growth would look like without international migration. In the “flat births/flat NIM” scenarios growth in the labor force over the next two years would be about 0.1% lower per year than forecasts based on Census 2017, while household growth would be about 120,000 lower per year. In the no international migration scenario labor force growth over the next two years would be 0.4% lower per year, and household growth would be about 370,000 per year lower per year, than Census 2017-based forecasts.

A few Comments on July New Home Sales

by Calculated Risk on 8/23/2019 11:58:00 AM

New home sales for July were reported at 635,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised up, combined.

Sales for June were revised up to a new cycle high.

Annual sales in 2019 should be the best year for new home sales since 2007.

Earlier: New Home Sales decreased to 635,000 Annual Rate in July, Sales in June revised up to New Cycle High.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

Sales in July were up 4.3% year-over-year compared to July 2018.

Year-to-date (through July), sales are up 4.1% compared to the same period in 2018.

The second half comparisons will be easier, so sales should be higher in 2019 than in 2018.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Even though distressed sales are down significantly, following the bust, new home builders focused on more expensive homes - so the gap has only closed slowly.

I still expect this gap to close. However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Q3 GDP Forecasts: Around 2%

by Calculated Risk on 8/23/2019 11:46:00 AM

From Merrill Lynch:

We continue to track 2.1% qoq saar for 3Q. 2Q GDP growth is likely to be revised modestly lower in the second release to 1.8% from the advance estimate of 2.1%. [Aug 23 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.8% for 2019:Q3. [Aug 23 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 2.2 percent on August 16, unchanged from August 15 after rounding. [Aug 16 estimate] (next update on Aug 26th)CR Note: These early estimates suggest real GDP growth will be around 2% annualized in Q3.