by Calculated Risk on 8/27/2019 09:10:00 AM

Tuesday, August 27, 2019

Case-Shiller: National House Price Index increased 3.1% year-over-year in June

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Phoenix Replaces Las Vegas as Top City in Annual Gains According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.1% annual gain in June, down from 3.3% in the previous month. The 10-City Composite annual increase came in at 1.8%, down from 2.2% in the previous month. The 20-City Composite posted a 2.1% year-over-year gain, down from 2.4% in the previous month.

Phoenix, Las Vegas and Tampa reported the highest year-over-year gains among the 20 cities. In June, Phoenix led the way with a 5.8% year-over-year price increase, followed by Las Vegas with a 5.5% increase, and Tampa with a 4.7% increase. Six of the 20 cities reported greater price increases in the year ending June 2019 versus the year ending May 2019.

...

Before seasonal adjustment, the National Index posted a month-over-month increase of 0.6% in June. The 10-City Composite posted a 0.2% increase and the 20-City Composite reported a 0.3% increase for the month. After seasonal adjustment, the National Index recorded a 0.2% month-over-month increase in June. The 10-City and the 20-City Composites did not report any gains. In June, 19 of 20 cities reported increases before seasonal adjustment, while 17 of 20 cities reported increases after seasonal adjustment.

“Home price gains continue to trend down, but may be leveling off to a sustainable level,” says Philip Murphy, Managing Director and Global Head of Index Governance at S&P Dow Jones Indices. “The average YOY gain declined to 3.0% in June, down from 3.1% the prior month. However, fewer cities (12) experienced lower YOY price gains than in May (13).

“The southwest (Phoenix and Las Vegas) remains the regional leader in home price gains, followed by the southeast (Tampa and Charlotte). With three of the bottom five cities (Seattle, San Francisco, and San Diego), much of the west coast is challenged to sustain YOY gains. For the second month in a row, however, only Seattle experienced outright decline with YOY price change of -1.3%. The U.S. National Home Price NSA Index YOY price change in June 2019 of 3.1% is exactly half of what it was in June 2018. While housing has clearly cooled off from 2018, home price gains in most cities remain positive in low single digits. Therefore, it is likely that current rates of change will generally be sustained barring an economic downturn.”

emphasis added

Click on graph for larger image.

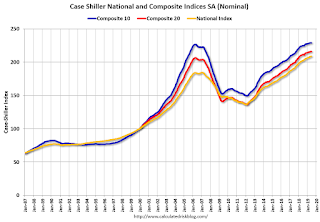

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.0% from the bubble peak, and down slightly in June (SA) from May.

The Composite 20 index is 4.5% above the bubble peak, and up slightly (SA) in June.

The National index is 13.2% above the bubble peak (SA), and up 0.2% (SA) in June. The National index is up 53.1% from the post-bubble low set in December 2011 (SA).

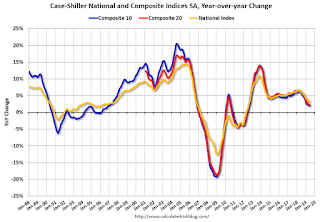

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 1.9% compared to June 2018. The Composite 20 SA is up 2.2% year-over-year.

The National index SA is up 3.1% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.