by Calculated Risk on 5/31/2017 07:29:00 PM

Wednesday, May 31, 2017

Thursday: Unemployment Claims, ADP Employment, ISM Mfg, Construction Spending, Auto Sales

Thursday:

• At 8:15 AM ET, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in May, down from 177,000 added in April.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 234 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April. The employment index was at 52.0% in April, and the new orders index was at 54.8%.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

• All day: Light vehicle sales for May. The consensus is for light vehicle sales to be at 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined in April, Lowest since January 2008

by Calculated Risk on 5/31/2017 04:29:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 1.07% in April, from 1.12% in March. The serious delinquency rate is down from 1.40% in April 2016.

This is the lowest serious delinquency rate since January 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.33 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until this Summer.

Note: Freddie Mac reported earlier.

Fed's Beige Book: Modest to Moderate expansion, Labor markets "Tighten"

by Calculated Risk on 5/31/2017 02:08:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Philadelphia based on information collected on or before May 22, 2017."

Most of the twelve Federal Reserve Districts reported that their economies continued to expand at a modest or moderate pace from early April through late May. Boston and Chicago signaled that growth in their Districts had slowed somewhat to a modest pace since the prior Beige Book period, while New York indicated that activity had flattened out. Consumer spending softened with many Districts noting little or no change in nonauto retail sales, while auto sales have edged down from last year's record highs in several Districts; tourism activity has continued to keep pace with the general economy. Meanwhile, the majority of Districts continued to report moderate growth in manufacturing activity and in most nonfinancial service sectors. Construction of new homes and nonresidential structures also continued to grow at modest to moderate rates, as did sales of existing homes; nonresidential leasing picked up a bit. Lending volume trends tended to mirror (and support) the general activity of the economy. Agricultural conditions remained mixed with some regions negatively affected by unusually wet weather. Most energy sectors tended to modestly improve. A majority of Districts reported that firms expressed positive near-term outlooks; however, optimism waned somewhat in a few Districts.And a few excerpts on real estate:

...

Labor markets continued to tighten, with most Districts citing shortages across a broadening range of occupations and regions. Despite supply constraints impeding the ability of firms to attract and retain qualified workers, most Districts reported that employment continued to grow at a modest to moderate pace. Similarly, most firms across the Districts noted little change to the recent trend of modest to moderate wage growth, although many firms reported offering higher wages to attract workers where shortages were most severe.

emphasis added

New York: Housing markets across the District have been mixed but, on balance, steady since the last report. New York City's rental market has remained mostly steady, though increased landlord concessions have further lowered effective rents and spurred some pickup in leasing, especially at the high end. In contrast, rents continued to rise across northern New Jersey, the Lower Hudson Valley, southwestern Connecticut and upstate New York.

The sales market for homes has strengthened in northern New Jersey and across upstate New York but has been essentially flat in New York City...

San Franciso: Real estate market activity continued to grow at a strong pace, but activity varied by region. Residential construction activity remained strong in urban centers but slowed to a moderate pace in some rural regions, due in part to especially wet ground conditions in areas of the Mountain West. Permits for single and multi-family units edged up, but contacts noted that construction was somewhat hampered by shortages of available land in some areas. Supply shortages and strong demand continued to fuel rapid home price growth in most parts of the District; contacts in urban centers reported that bids routinely came in significantly above the asking prices. Demand for commercial real estate loans in California remained strong.

Updated: Chicago PMI Increases in May

by Calculated Risk on 5/31/2017 11:15:00 AM

Earlier, the Chicago PMI was reported at 55.2. That has now been corrected to 59.4. This was above the consensus forecast.

Here is the updated report on the Chicago PMI: May Chicago Business Barometer at 59.4 vs 58.3 in April

The MNI Chicago Business Barometer increased to 59.4 in May from 58.3 in April, the highest level since November 2014.

...

“May’s rise in the MNI Chicago Business Barometer provides a further boost to the business environment. Rising pressure on backlogs and delivery times accompanied with higher production levels suggests firms’ expectations of a busy summer,” said Shaily Mittal, senior economist at MNI Indicators.

emphasis added

NAR: Pending Home Sales Index decreased 1.3% in April, down 3.3% year-over-year

by Calculated Risk on 5/31/2017 10:05:00 AM

From the NAR: Pending Home Sales Scale Back 1.3 Percent in April

Pending home sales in April slumped for the second consecutive month and were down year-over-year nationally and in all four major regions, according to the National Association of Realtors®. Only the West saw an increase in contract signings last month.This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 1.3 percent to 109.8 in April from a downwardly revised 111.3 in March. After last month's decline, the index is now 3.3 percent below a year ago, which is the first year-over-year decline since last December and the largest since June 2014 (7.1 percent).

...

The PHSI in the Northeast decreased 1.7 percent to 97.2 in April, and is now 0.6 percent below a year ago. In the Midwest the index fell 4.7 percent to 104.4 in April, and is now 6.1 percent lower than April 2016.

Pending home sales in the South declined 2.7 percent to an index of 125.9 in April and are now 2.3 percent below last April. The index in the West jumped 5.8 percent in April to 100.0, but is still 4.2 percent below a year ago.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 5/31/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 26, 2017.

... The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 7 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.17 percent, with points decreasing to 0.32 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

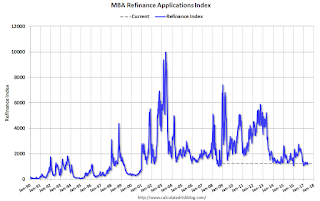

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up 7% year-over-year.

Tuesday, May 30, 2017

Wednesday: Chicago PMI, Pending Home Sales, Beige Book

by Calculated Risk on 5/30/2017 07:21:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways Near Long-Term Lows

Mortgage rates remained relatively unchanged again today. This continues the sideways trend leading into Memorial Day weekend. As the current week progresses, we can expect to see volatility increase thanks to the presence of more significant economic data.Wednesday:

For what it's worth, being "sideways" at current levels [30 year fixed at 4.0%] wouldn't be anything to complain about. Only a handful of days since the presidential election have seen rates any lower.

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 57.5, down from 58.3 in April.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 5/30/2017 03:25:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

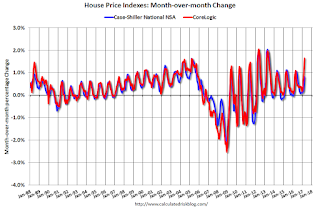

This graph shows the month-to-month change in the CoreLogic (through March 2017) and NSA Case-Shiller National index since 1987 (through March 2017). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Dallas Fed: "Texas Manufacturing Expansion Picks Up Pace" in May

by Calculated Risk on 5/30/2017 12:29:00 PM

From the Dallas Fed: Texas Manufacturing Expansion Picks Up Pace

Texas factory activity increased at a faster pace in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, moved up eight points to 23.3, reaching its highest level since April 2014.This was the last of the regional Fed surveys for May.

Other measures of current manufacturing activity also rose to levels not seen since mid-2014. The new orders index pushed up to 18.1, and the growth rate of orders index rose to 12.3, marking its fifth consecutive positive reading. The capacity utilization index moved up to 19.4, with roughly a third of firms noting increased utilization. The shipments index surged 15 points to 24.7, reaching a level not seen in nearly 10 years.

Perceptions of broader business conditions improved again in May. The general business activity index held fairly steady at 17.2, and the company outlook index rose five points to 20.2.

Labor market measures indicated continued employment gains and markedly longer workweeks this month. The employment index came in at 8.3, posting a fifth positive reading in a row. Eighteen percent of firms noted net hiring, compared with 10 percent noting net layoffs. The hours worked index shot up 10 points to 15.7, its highest reading in six years.

emphasis added

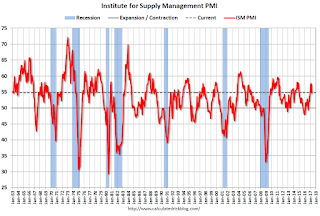

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

It seems likely the ISM manufacturing index will be mostly unchanged or decline slightly in May, but still show solid expansion (to be released on Thursday).

Real House Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/30/2017 10:22:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.8% year-over-year in March

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 2.4% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.8% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In March, the index was up 5.8% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to October 2005 levels, and the CoreLogic index (NSA) is back to October 2005.

Real House Prices

In real terms, the National index is back to May 2004 levels, the Composite 20 index is back to March 2004, and the CoreLogic index back to March 2004.

In real terms, house prices are back to early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, the Composite 20 index is back to September 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, prices are back to early 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.8% year-over-year in March

by Calculated Risk on 5/30/2017 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Seattle, Portland, Dallas and Denver Lead Gains in S&P Corelogic Case-Shiller Home Price Indices

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.8% annual gain in March, up from 5.7% last month and setting a 33-month high. The 10-City Composite and the 20-City Composite indices came in at 5.2% and 5.9% annual increases, respectively, unchanged from last month.

Seattle, Portland, and Dallas reported the highest year-over-year gains among the 20 cities. In March, Seattle led the way with a 12.3% year-over-year price increase, followed by Portland with 9.2%, and Dallas with an 8.6% increase. Ten cities reported higher price increases in the year ending March 2017 than in the year ending February 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.8% in March. The 10-City Composite posted a 0.9% increase and the 20-City Composite reported a 1.0% increase. After seasonal adjustment, the National Index recorded a 0.3% month-over-month increase. Both the 10-City Composite and the 20-City Composite indices posted a 0.9% month-over-month increase after seasonal adjustment. Eighteen of the 20 cities reported increases in March before seasonal adjustment; after seasonal adjustment, 17 cities saw prices rise.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 6.4% from the peak, and up 0.8% in March (SA).

The Composite 20 index is off 3.9% from the peak, and up 0.9% (SA) in March.

The National index is 2.4% above the bubble peak (SA), and up 0.3% (SA) in March. The National index is up 38.4% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.2% compared to March 2016. The Composite 20 SA is up 5.9% year-over-year.

The National index SA is up 5.8% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Personal Income increased 0.4% in April, Spending increased 0.4%

by Calculated Risk on 5/30/2017 08:36:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $58.4 billion (0.4 percent) in April according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $53.2 billion (0.4 percent).The April PCE price index increased 1.7 percent year-over-year and the April PCE price index, excluding food and energy, increased 1.5 percent year-over-year.

...

Real PCE increased 0.2 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through April 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income and PCE was at expectations.

Black Knight: House Price Index up 1.3% in March, Up 5.8% year-over-year

by Calculated Risk on 5/30/2017 07:00:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: U.S. Home Prices Hit Another New Peak, Rising 1.3 Percent for the Month, Up 5.8 Percent Year-Over-Year

• At $272K, the national-level HPI continued its upward trend, hitting another new peak in March 2017, marking a 2.3 percent gain in home prices since the start of the yearThe year-over-year increase in this index has been about the same for the last year.

• Prices were up 1.3% for the month nationally and +5.8% Y/Y

• March marked 59 consecutive months of annual national home price appreciation

• Among the nation's 20 largest states, 8 hit new peaks. Of the nation’s 40 largest metros, 15 hit new peaks

Note that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for March will be released this morning.

Monday, May 29, 2017

Tuesday: Personal Income and Outlays, Case-Shiller House Prices

by Calculated Risk on 5/29/2017 08:05:00 PM

Weekend:

• Schedule for Week of May 28, 2017

• May 2017: Unofficial Problem Bank list declines to 140 Institutions

Tuesday:

• At 8:30 AM ET, Personal Income and Outlays for April. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to be up 0.1%.

• At 9:00 AM, S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices. The consensus is for a 5.8% year-over-year increase in the Comp 20 index for March.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $49.94 per barrel and Brent at $52.29 per barrel. A year ago, WTI was at $49, and Brent was at $49 - so oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.37 per gallon - a year ago prices were at $2.33 per gallon - so gasoline prices are up slightly year-over-year.

Hotels: Hotel Occupancy Rate Flat Year-over-Year

by Calculated Risk on 5/29/2017 11:06:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 20 May

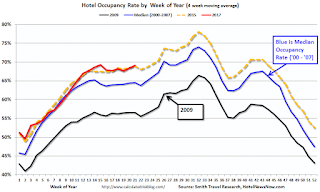

The U.S. hotel industry reported flat occupancy and slightly higher rates year over year during the week of 14-20 May 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 15-21 May 2016, the industry recorded the following in the three key performance metrics:

• Occupancy: Flat at 70.6%

• Average daily rate (ADR): +1.5% to US$127.91

• Revenue per available room (RevPAR): +1.5% to US$90.26

STR analysts note that occupancy for the week was pulled down due to comparison with a non-Mother’s Day Sunday in 2016.

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, occupancy will now move mostly sideways until the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, May 28, 2017

May 2017: Unofficial Problem Bank list declines to 140 Institutions

by Calculated Risk on 5/28/2017 12:10:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2017.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for May 2017. During the month, the list dropped from 148 to 140 institutions after nine removals and one addition. Aggregate assets fell by $1.9 billion to $34.2 billion. A year ago, the list held 206 institutions with assets of $60.8 billion.

Actions were terminated against Delaware Place Bank, Chicago, IL ($231 million); TransPecos Banks, Pecos, TX ($153 million); First Federal Savings and Loan Association of Greensburg, Greensburg, IN ($147 million); CenTrust Bank, National Association, Northbrook, IL ($91 million); Foothills Community Bank, Dawsonville, GA ($84 million); and Forrest City Bank, National Association, Forrest City, AR ($50 million).

Guaranty Bank, Milwaukee, WI ($1.0 billion) departed the list on May, 05, 2017 as the fifth failure so far in 2017. On March 29, 2017, the FDIC terminated the deposit insurance of Builders Bank, Chicago, IL ($41 million) causing their removal. Pinnacle Bank, Rogers, AR ($78 million) found their way off the list through a voluntary merger.

This past Wednesday, the FDIC published industry income results for the first quarter of 2017 and provided an update on the Official Problem Bank List. The FDIC reported problem bank figures of 112 institutions with assets of $23.7 billion, which is the fewest number of problem banks since March 2008.

Saturday, May 27, 2017

Schedule for Week of May 28, 2017

by Calculated Risk on 5/27/2017 08:11:00 AM

The key report this week is the May employment report on Friday.

Other key indicators include Personal Income and Outlays for April, the May ISM manufacturing index, May auto sales, and the April Trade Deficit.

All US markets will be closed in observance of Memorial Day.

8:30 AM: Personal Income and Outlays for April. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to be up 0.1%.

9:00 AM ET: S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the February 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the Comp 20 index for March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 57.5, down from 58.3 in April.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in May, down from 177,000 added in April.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 234 thousand the previous week.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 54.8% in April. The employment index was at 52.0%, and the new orders index was at 54.8%.

10:00 AM: Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, down from the 211,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate to be unchanged at 4.4%.

The consensus is for the unemployment rate to be unchanged at 4.4%.This graph shows the year-over-year change in total non-farm employment since 1968.

In April, the year-over-year change was 2.24 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $46.1 billion in April from $43.7 billion in March.

Friday, May 26, 2017

Vehicle Sales Forecast: Sales below 17 Million SAAR in May

by Calculated Risk on 5/26/2017 07:02:00 PM

The automakers will report May vehicle sales on Thursday, June 1st.

Note: There were 25 selling days in May 2017, up from 24 in May 2016.

From Reuters: U.S. auto sales seen up 0.5 percent in May: JD Power and LMC

U.S. auto sales in May will edge up 0.5 percent from a year earlier, despite consumer discounts remaining at record levels, industry consultants J.D. Power and LMC Automotive said on Thursday.Overall sales are mostly moving sideways (and down a little from the record in 2016).

...

The seasonally adjusted annual rate for the month will be 16.9 million vehicles, down from 17.3 million last year. ...

The consultancies cut new vehicle sales forecast for 2017 to 17.2 million units from 17.5 million units. U.S. sales of new cars and trucks hit a record high of 17.55 million units in 2016. But as the market has begun to saturate, automakers have been hiking incentives to entice consumers to buy.

emphasis added

Freddie Mac: Mortgage Serious Delinquency rate unchanged in April

by Calculated Risk on 5/26/2017 02:44:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in April was at 0.92%, unchanged from 0.92% in March. Freddie's rate is down from 1.15% in April 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This matches last month as the lowest serious delinquency rate since May 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.4 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for April soon.

Q2 GDP Forecasts

by Calculated Risk on 5/26/2017 11:54:00 AM

From Merrill Lynch:

[T]he data [today] pushed down 2Q GDP tracking by a tenth to 2.5% qoq saar. The main drag was from the weak durables report, while revisions to 1Q GDP caused some modest shifts in the 2Q components.From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 3.7 percent on May 26, down from 4.1 percent on May 16. The forecast for second-quarter real residential investment growth fell from 8.3 percent to 3.1 percent after Tuesday's housing related releases from the U.S. Census Bureau and Wednesday's existing-home sales release from the National Association of Realtors.From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.2% for 2017:Q2.

News from this week’s data releases reduced the nowcast for 2017:Q2 by 0.1 percentage point as the positive impact from wholesale inventories data was more than offset by the negative impact from the advance durable goods report and new home sales data.

Q1 GDP Revised up to 1.2% Annual Rate

by Calculated Risk on 5/26/2017 09:48:00 AM

From the BEA: Gross Domestic Product: First Quarter 2017 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 1.2 percent in the first quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.1 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 0.3% to 0.6%. (weak PCE). Residential investment was revised up slightly from 13.7% to +13.8%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 0.7 percent. With this second estimate for the first quarter, the general picture of economic growth remains the same; increases in nonresidential fixed investment and in personal consumption expenditures (PCE) were larger and the decrease in state and local government spending was smaller than previously estimated. These revisions were partly offset by a larger decrease in private inventory investment ...

emphasis added

Thursday, May 25, 2017

Friday: GDP

by Calculated Risk on 5/25/2017 09:56:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.9% decrease in durable goods orders.

• Also at 8:30 AM ET, Gross Domestic Product, 1st quarter 2017 (Second estimate). The consensus is that real GDP increased 0.8% annualized in Q1, up from the advance estimate of 0.7%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 97.6, down from the preliminary reading 97.7.

Philly Fed: State Coincident Indexes increased in 41 states in April

by Calculated Risk on 5/25/2017 01:48:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2017. Over the past three months, the indexes increased in 46 states and decreased in four, for a three-month diffusion index of 84. In the past month, the indexes increased in 41 states and decreased in nine, for a one-month diffusion index of 64.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In April, 41 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices. The reason for the recent decrease in the number of states with increasing activity is unclear - and might be revised away.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

Kansas City Fed: Regional Manufacturing Activity "Expanded Modestly" in May

by Calculated Risk on 5/25/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Modestly

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded moderately with strong expectations for future activity.The Kansas City region was hit hard by the decline in oil prices, but activity is expanding again.

“After slowing from a rapid rate of growth in February and March, we’ve seen more moderate growth the past two months,” said Wilkerson. “But firms are about as optimistic about future growth as they’ve ever been.”

...

The month-over-month composite index was 8 in May, up from 7 in April but down from 20 in March. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Activity at durable manufacturing plants eased slightly but remained positive, while nondurable activity improved, particularly for plastics and chemicals. Month-over-month indexes were mixed with little change overall. The production and shipments indexes edged slightly lower, while the employment and order backlog indexes inched higher. The new orders and new orders for exports indexes were both basically unchanged. The finished goods inventory index fell from 8 to 0, while the raw materials inventory index was stable.

emphasis added

Weekly Initial Unemployment Claims increase to 234,000

by Calculated Risk on 5/25/2017 08:34:00 AM

The DOL reported:

In the week ending May 20, the advance figure for seasonally adjusted initial claims was 234,000, an increase of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 232,000 to 233,000. The 4-week moving average was 235,250, a decrease of 5,750 from the previous week's revised average. This is the lowest level for this average since April 14, 1973 when it was 232,750. The previous week's average was revised up by 250 from 240,750 to 241,000.The previous week was revised up by 1,000.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 235,250 - the lowest since 1973.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, May 24, 2017

Thursday: Unemployment Claims

by Calculated Risk on 5/24/2017 07:14:00 PM

Some interesting analysis from Josh Lehner at the Oregon Office of Economic Analysis: States at Full Employment, A Prime-Age EPOP Story

The key economic question economists are trying to answer today is whether or not the U.S. economy is at full employment. Given it is more a concept then a hard calculation, you look for signs in the data that suggest the economy is there. In terms of jobs and the unemployment rate, there is no question the data do suggest this. However, at least nationally, wage growth is still relatively slow, albeit picking up some, and inflation remains consistently below target.The decline in the prime working age EPOP is a long term trend, and I suspect that after adjusted for the long term trend, and maybe a little for population (the 50 to 54 age cohort has a lower participation rate than most other prime cohorts), more states would be back to the levels of a decade ago.

Here in Oregon we’re checking more of the boxes than the U.S. overall. Not only have we seen stronger wage gains, but we got the labor force response in terms of rising participation rates. Furthermore, now that the labor market is tight, we are seeing slower job growth which is also expected. Again, I don’t think we’re quite there just yet, but in looking across the nation it’s clear that Oregon is closer than most states.

...

Specifically, when it comes the share of the prime working-age population that actually has a job, those between 25 and 54 years old, just two — two! — states are back to where they were last decade, let alone the late 1990s.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 237 thousand initial claims, up from 232 thousand the previous week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

Black Knight: Mortgage Delinquencies Increased in April

by Calculated Risk on 5/24/2017 03:07:00 PM

From Black Knight: Black Knight Financial Services’ First Look at April 2017 Mortgage Data

• First-lien mortgage delinquencies rose by 13 percent, the largest monthly increase since November 2008According to Black Knight's First Look report for April, the percent of loans delinquent increased 12.9% in April compared to March, and declined 3.6% year-over-year.

• Month-over-month, the number of borrowers past due on mortgage payments increased by 241,000

• April’s delinquency rate increase was primarily calendar-driven (due to both the month ending on a Sunday and March being the typical calendar-year low) and largely isolated to early-stage delinquencies

• The inventory of loans in active foreclosure continues to decline, hitting a 10-year low in April

• At just 52,800, April saw the fewest monthly foreclosure starts since January 2005

The percent of loans in the foreclosure process declined 3.5% in April and were down 27.3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.08% in April, up from 3.62% in March.

The percent of loans in the foreclosure process declined in April to 0.85%.

The number of delinquent properties, but not in foreclosure, is down 74,000 properties year-over-year, and the number of properties in the foreclosure process is down 162,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2017 | Mar 2017 | Apr 2016 | Apr 2015 | |

| Delinquent | 4.08% | 3.62% | 4.24% | 4.72% |

| In Foreclosure | 0.85% | 0.88% | 1.17% | 1.63% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,072,000 | 1,831,000 | 2,146,000 | 2,381,000 |

| Number of properties in foreclosure pre-sale inventory: | 433,000 | 448,000 | 820,000 | 1,064,000 |

| Total Properties | 2,505,000 | 2,279,000 | 2,741,000 | 3,201,000 |

FOMC Minutes: More details on Balance Sheet Reduction

by Calculated Risk on 5/24/2017 02:05:00 PM

From the Fed: Minutes of the Federal Open Market Committee, May 2-3, 2017. Excerpts:

Participants continued their discussion of issues related to potential changes to the Committee's policy of reinvesting principal payments from securities held in the SOMA. The staff provided a briefing that summarized a possible operational approach to reducing the System's securities holdings in a gradual and predictable manner. Under the proposed approach, the Committee would announce a set of gradually increasing caps, or limits, on the dollar amounts of Treasury and agency securities that would be allowed to run off each month, and only the amounts of securities repayments that exceeded the caps would be reinvested each month. As the caps increased, reinvestments would decline, and the monthly reductions in the Federal Reserve's securities holdings would become larger. The caps would initially be set at low levels and then be raised every three months, over a set period of time, to their fully phased-in levels. The final values of the caps would then be maintained until the size of the balance sheet was normalized.

Nearly all policymakers expressed a favorable view of this general approach. Policymakers noted that preannouncing a schedule of gradually increasing caps to limit the amounts of securities that could run off in any given month was consistent with the Committee's intention to reduce the Federal Reserve's securities holdings in a gradual and predictable manner as stated in the Committee's Policy Normalization Principles and Plans. Limiting the magnitude of the monthly reductions in the Federal Reserve's securities holdings on an ongoing basis could help mitigate the risk of adverse effects on market functioning or outsized effects on interest rates. The approach would also likely be fairly straightforward to communicate. Moreover, under this approach, the process of reducing the Federal Reserve's securities holdings, once begun, could likely proceed without a need for the Committee to make adjustments as long as there was no material deterioration in the economic outlook.

Policymakers agreed that the Committee's Policy Normalization Principles and Plans should be augmented soon to provide additional details about the operational plan to reduce the Federal Reserve's securities holdings over time. Nearly all policymakers indicated that as long as the economy and the path of the federal funds rate evolved as currently expected, it likely would be appropriate to begin reducing the Federal Reserve's securities holdings this year. Policymakers agreed to continue in June their discussion of plans for a change to the Committee's reinvestment policy.

emphasis added

A Few Comments on April Existing Home Sales

by Calculated Risk on 5/24/2017 11:59:00 AM

Earlier: NAR: "Existing-Home Sales Slip 2.3 Percent in April"

Two key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. The NAR reported sales of 5.57 million SAAR, Lawler projected 5.56 million SAAR, and the consensus was 5.67 million SAAR. See: Lawler: Early Read on Existing Home Sales in April

"I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.56 million in April, down 2.6% from March’s preliminary pace and up 1.5% from last April’s seasonally adjusted pace."2) Inventory is still very low and falling year-over-year (down 9.0% year-over-year in April). More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

I started the year expecting inventory would be increasing year-over-year by the end of 2017. That still seems possible, but inventory will have to start increasing a little pretty soon.

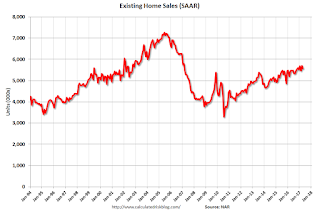

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in April (red column) were below April 2016. (NSA).

Note that sales NSA are now in the seasonally strong period (March through September).

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through April 2017. This graph starts in 1994, but the relationship had been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through April 2017. This graph starts in 1994, but the relationship had been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

AIA: Architecture Billings Index positive in April

by Calculated Risk on 5/24/2017 11:18:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Design billings increasing entering height of construction season

After beginning the year with a marginal decline, the Architecture Billings Index has posted three consecutive months of growth in design revenue at architecture firms. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI score was 50.9, down from a score of 54.3 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.2, up from a reading of 59.8 the previous month, while the new design contracts index increased from 52.3 to 53.2.

“Probably even better news for the construction outlook is that new project work coming into architecture firms has seen exceptionally strong growth so far this year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “In fact, new project activity has pushed up project backlogs at architecture firm to their highest level since the design market began its recovery earlier this decade.”

...

• Regional averages: South (55.3), Midwest (53.3), West (50.9), Northeast (50.7)

• Sector index breakdown: institutional (54.0), mixed practice (53.4), commercial / industrial (52.4), multi-family residential (49.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in April, down from 54.3 the previous month. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017 and early 2018.

NAR: "Existing-Home Sales Slip 2.3 Percent in April"

by Calculated Risk on 5/24/2017 10:13:00 AM

From the NAR: Existing-Home Sales Slip 2.3 Percent in April; Days on Market Falls to Under a Month

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, dipped 2.3 percent to a seasonally adjusted annual rate of 5.57 million in April from a downwardly revised 5.70 million in March. Despite last month's decline, sales are still 1.6 percent above a year ago and at the fourth highest pace over the past year.

...

Total housing inventory at the end of April climbed 7.2 percent to 1.93 million existing homes available for sale, but is still 9.0 percent lower than a year ago (2.12 million) and has fallen year-over-year for 23 consecutive months. Unsold inventory is at a 4.2-month supply at the current sales pace, which is down from 4.6 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.57 million SAAR) were 2.3% lower than last month, and were 1.6% above the April 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.93 million in April from 1.80 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.93 million in April from 1.80 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 9.0% year-over-year in April compared to April 2016.

Inventory decreased 9.0% year-over-year in April compared to April 2016. Months of supply was at 4.2 months in April.

This was below the consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 5/24/2017 07:00:00 AM

From the MBA: Refis Apps Up, Purchase Apps Slightly Down in Latest MBA Weekly Survey

Mortgage applications increased 4.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 19, 2017.

... The Refinance Index increased 11 percent from the previous week to its highest level since March 2017. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.17 percent, from 4.23 percent, with points increasing to 0.39 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity picked up a little as rates declined - but remains historically low - and will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up 3% year-over-year.

Tuesday, May 23, 2017

Wednesday: Existing Home Sales, FOMC Minutes and More

by Calculated Risk on 5/23/2017 08:18:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for March 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.67 million SAAR, down from 5.71 million in March. Housing economist Tom Lawler estimates the NAR will report sales of 5.56 million SAAR for April.

• During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes for the Meeting of May 2 - 3, 2017

Chemical Activity Barometer increases in May

by Calculated Risk on 5/23/2017 05:41:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Remains Strong but Hints at Slowing Pace of Economic Growth and Business Activity Into 2018

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), rose 0.4 percent in May, following a downward revision of 0.1 percent for April. Compared to a year earlier, the CAB is up 5.0 percent year-over-year, a modest slowing that still suggests continued growth through year-end 2017. All data is measured on a three-month moving average (3MMA).

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production in 2017.

Richmond Fed: Regional Manufacturing Activity Mostly Unchanged in May

by Calculated Risk on 5/23/2017 02:39:00 PM

Earlier from the Richmond Fed: Manufacturing Firms were Somewhat Less Upbeat about Activity in May Compared to Prior Months

Manufacturers in the Fifth District were somewhat less upbeat in May than in the prior three months, according to the latest survey by the Federal Reserve Bank of Richmond. The index for shipments and the index for new orders decreased notably, with the shipments index falling to slightly below 0. The index for employment was relatively flat, but the decline in the other two indexes resulted in a decline in the composite index from 20 in April to 1 in May. The majority of firms continued to report higher wages, but more firms reported a decline in the average workweek than reported an increase. ...Based on the regional surveys released so far, it appears manufacturing growth slowed in May. The ISM index will probably show slower growth this month.

emphasis added

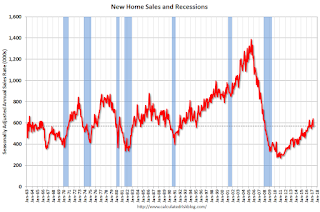

A few Comments on April New Home Sales

by Calculated Risk on 5/23/2017 12:26:00 PM

New home sales for April were reported at 569,000 on a seasonally adjusted annual rate basis (SAAR). This was well below the consensus forecast, however the three previous months combined were revised up significantly. Overall this was a decent report.

Sales were only up 0.5% year-over-year in April.

Earlier: New Home Sales decrease to 569,000 Annual Rate in April.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 0.5% year-over-year in April.

For the first four months of 2017, new home sales are up 11.3% compared to the same period in 2016.

This was a strong year-over-year increase through April, however sales were weak in Q1 2016, so this was also an easy comparison.

New Home Sales decrease to 569,000 Annual Rate in April

by Calculated Risk on 5/23/2017 10:24:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 569 thousand.

The previous three months combined were revised up significantly.

"Sales of new single-family houses in April 2017 were at a seasonally adjusted annual rate of 569,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.4 percent below the revised March rate of 642,000, but is 0.5 percent above the April 2016 estimate of 566,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in April to 5.7 months.

The months of supply increased in April to 5.7 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of April was 268,000. This represents a supply of 5.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2017 (red column), 54 thousand new homes were sold (NSA). Last year, 55 thousand homes were sold in April.

The all time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

This was below expectations of 604,000 sales SAAR, however the previous months were revised up. I'll have more later today.

Monday, May 22, 2017

Tuesday: New Home Sales

by Calculated Risk on 5/22/2017 07:09:00 PM

From Matthew Graham at Mortgage News Daily: Low and Sideways, Mortgage Rates Play Waiting Game

Mortgage rates were slightly higher for the 3rd straight day, continuing a modest bounce back from the year's lowest rates last Wednesday. ...Tuesday:

While the general movement in rates has been slightly higher, it hasn't lifted rates much above 2017's lows. Especially when considered next to anything before last Wednesday, recent rate offerings have been low and the trend has been sideways. Most lenders continue to offer conventional 30yr fixed rates of 4.0% on top tier scenarios. The only difference from Friday would be marginally higher upfront costs, but several lenders are effectively "unchanged."

emphasis added

• At 8:30 AM ET, New Home Sales for April from the Census Bureau. The consensus is for a decrease in sales to 604 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 621 thousand in March.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May.

Merrill: "Revising down our inflation forecasts"

by Calculated Risk on 5/22/2017 11:25:00 AM

A few excerpts from a Merrill Lynch research note: Revising down our inflation forecasts

After two consecutive disappointing CPI reports, it is clear that inflation is now set for a slower finish this year. After refreshing our models, we now see core CPI inflation ending the year at 1.9% 4Q/4Q, down from our prior forecast of 2.3% and slowing from 2.2% 4Q/4Q 2016 growth. The downgrade largely reflects transitory weakness from wireless telephone services that should revert next year, allowing for core CPI to accelerate back to 2.2% by the end of 2018.

We are also revising our core PCE inflation forecasts. Assuming we see a sluggish 0.1% mom reading in April, the trajectory for core PCE will be knocked lower as the % yoy clip drops to 1.5%. As a result, we take down our 4Q/4Q 2017 core PCE estimate to 1.7% yoy from 1.9%. That said, we continue to expect core PCE to hit 2% by the end of 2018, reaching the Fed’s target.

The main takeaway from these forecast changes is that inflation is still set to move higher, but it is happening later.

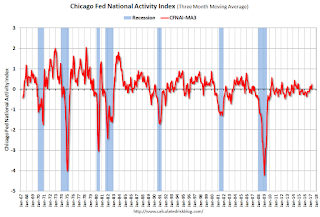

Chicago Fed "Increased Economic Growth in April"

by Calculated Risk on 5/22/2017 08:55:00 AM

From the Chicago Fed: Chicago Fed National Activity Index Points to Increased Economic Growth in April

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.49 in April from +0.07 in March. Two of the four broad categories of indicators that make up the index increased from March, and only one category made a negative contribution to the index in April. The index’s three-month moving average, CFNAI-MA3, increased to +0.23 in April from a neutral reading in March.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in April (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, May 21, 2017

Sunday Night Futures

by Calculated Risk on 5/21/2017 08:09:00 PM

Weekend:

• Schedule for Week of May 21, 2017

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for April. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 3, and DOW futures are up 19(fair value).

Oil prices were up over the last week with WTI futures at $50.73 per barrel and Brent at $53.61 per barrel. A year ago, WTI was at $48, and Brent was at $49 - so oil prices are up about 5% to 8% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.36 per gallon - a year ago prices were at $2.29 per gallon - so gasoline prices are up about 7 cents a gallon year-over-year.

Existing Home Sales: Take the Under

by Calculated Risk on 5/21/2017 02:15:00 PM

The NAR will report April Existing Home Sales on Wednesday, May 24th at 10:00 AM ET.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.67 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.56 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.71 million SAAR in March.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 7 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last seven years, the consensus average miss was 150 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | --- |

| 1NAR initially reported before revisions. | |||