by Calculated Risk on 5/27/2017 08:11:00 AM

Saturday, May 27, 2017

Schedule for Week of May 28, 2017

The key report this week is the May employment report on Friday.

Other key indicators include Personal Income and Outlays for April, the May ISM manufacturing index, May auto sales, and the April Trade Deficit.

All US markets will be closed in observance of Memorial Day.

8:30 AM: Personal Income and Outlays for April. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to be up 0.1%.

9:00 AM ET: S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the February 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the Comp 20 index for March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 57.5, down from 58.3 in April.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in May, down from 177,000 added in April.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 234 thousand the previous week.

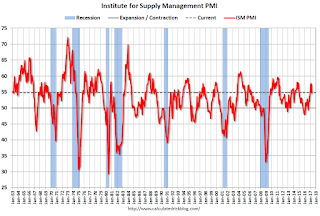

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 54.8% in April. The employment index was at 52.0%, and the new orders index was at 54.8%.

10:00 AM: Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, down from the 211,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate to be unchanged at 4.4%.

The consensus is for the unemployment rate to be unchanged at 4.4%.This graph shows the year-over-year change in total non-farm employment since 1968.

In April, the year-over-year change was 2.24 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $46.1 billion in April from $43.7 billion in March.