by Calculated Risk on 1/31/2014 08:46:00 PM

Friday, January 31, 2014

Bank Failure #3 in 2014: Syringa Bank, Boise Idaho

From the FDIC: Sunwest Bank, Irvine, California, Assumes All of the Deposits of Syringa Bank, Boise Idaho

As of September 30, 2013, Syringa Bank had approximately $153.4 million in total assets and $145.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $4.5 million. ... Syringa Bank is the 3rd FDIC-insured institution to fail in the nation this year, and the first in Idaho.Still closing banks, just fewer this year ... and this was a pretty small hit to the DIF.

Reinhart and Rogoff: Great Recession may "surpass in severity" the Great Depression in many Countries

by Calculated Risk on 1/31/2014 05:21:00 PM

A new paper from Reinhart and Rogoff: Recovery from Financial Crisis: Evidence from 100 Episodes. Excerpt:

Examining the evolution of real per capita GDP around 100 systemic banking crises reveals that a significant part of the costs of these crises lies in the protracted and halting nature of the recovery. On average it takes about eight years to reach the pre-crisis level of income; the median is about 6 ½ years. Five to six years after the onset of the current crisis only Germany and the US (out of 12 systemic crisis cases) have reached their 2007-2008 peaks in per capita income. In a sample that covers 63 crises in advanced economies and 37 in larger emerging markets, more than forty percent of the post-crisis episodes experienced double dips. The analysis summarized here adds another dimension to an observation we have been emphasizing on the basis of our earlier work—namely, that the subprime crisis is not an anomaly in the context of the pre-WWII era. Postwar business cycles are not the right comparator for the severe crises that have swept advanced economies in recent years.The policies of austerity in Europe have failed miserably and many countries there are experiencing a worse slump than during the Depression (austerity in the US has held back the recovery too, but at least there was a little stimulus in 2009, and monetary policy was accommodative). As Reinhart and Rogoff note, higher inflation in Europe (and the US) would help.

...

Even after one of the most severe multi-year crises on record in the advanced economies, the received wisdom in policy circles clings to the notion that high-income countries are completely different from their emerging-market counterparts. The current phase of the official policy approach is predicated on the assumption that growth, financial stability and debt sustainability can be achieved through a mix of austerity and forbearance (and some reform). The claim is that advanced countries do not need to resort to the more eclectic policies of emerging markets, including debt restructurings and conversions, higher inflation, capital controls and other forms of financial repression. Now entering the sixth or seventh year (depending on the country) of crisis, output remains well below its pre-crisis peak in ten of the twelve crisis countries. The gap with potential output is even greater. Delays in accepting that desperate times call for desperate measures keeps raising the odds that, as documented here, this crisis may in the end surpass in severity the depression of the 1930s in a large number of countries.

emphasis added

Hotel Occupancy Rate increased 2.4% year-over-year in latest Survey

by Calculated Risk on 1/31/2014 01:48:00 PM

From HotelNewsNow.com: STR: US results for week ending 25 January

The U.S. hotel industry posted positive results in the three key performance measurements during the week of 19-25 January 2014, according to data from STR.The 4-week average of the occupancy rate is close to normal levels.

In year-over-year measurements, the industry’s occupancy increased 2.4 percent to 55.2 percent. Average daily rate rose 3.0 percent to finish the week at US$109.59. Revenue per available room for the week was up 5.5 percent to finish at US$60.54.

emphasis added

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

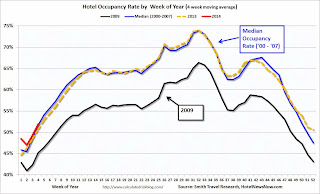

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels.

Through January 25th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking at pre-recession levels.

This is expected to be another solid year for the hotel industry. In response to the improved metrics, the AIA expects hotel construction to increase significantly in 2014: Nonresidential Building Activity Projected to Accelerate in 2014

Led by the hotel ... the commercial sector looks to see the biggest gains in construction spending, with demand for institutional projects increasing at a more moderate level.Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

...

“Since the overall economy is stabilizing, there should be a significant improvement in the outlook for the construction industry that has been recovering at a slow and steady pace the last two years,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “At a more granular level, the surging housing market, growing commercial property values, and declining office and retail vacancies are all contributing to what is expected to amount to a much greater spending on nonresidential building projects.”

HVS: Q4 2013 Homeownership and Vacancy Rates

by Calculated Risk on 1/31/2014 11:32:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q4 2013 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate,except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 65.2% in Q4, from 65.3% in Q3.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range - and given changing demographics, the homeownership rate is probably close to a bottom.

The HVS homeowner vacancy increased to 2.1% in Q4.

The HVS homeowner vacancy increased to 2.1% in Q4.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

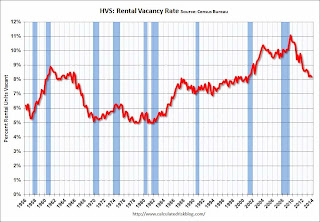

The rental vacancy rate decreased slightly in Q4 to 8.2% from 8.3% in Q3.

The rental vacancy rate decreased slightly in Q4 to 8.2% from 8.3% in Q3.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that most of the bubble excess is behind us.

Final January Consumer Sentiment at 81.2, Chicago PMI at 59.6

by Calculated Risk on 1/31/2014 09:55:00 AM

Click on graph for larger image.

• The final Reuters / University of Michigan consumer sentiment index for January decreased to 81.2 from the December reading of 82.5, but up from the preliminary January reading of 80.4.

This was just above the consensus forecast of 81.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

• From the Chicago ISM:

January 2014:

The Chicago Business Barometer softened to 59.6 in January from a revised 60.8 in December, the third consecutive monthly fall following October’s jump to the highest since March 2011. In spite of January’s slower rate of expansion, the Barometer remained firm and consistent with the recent pick-up in GDP.This was close to the consensus estimate of 59.5.

...

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist at MNI Indicators said, “Business activity continued to ease in January but remained at a relatively high level. Production and New Orders remained firm, and while Employment fell back into contraction, this doesn‘t appear to be indicative of current demand conditions.”

“There have been concerns that putting the brakes on monetary easing could damage business. Most respondents, though, thought that the Federal Reserve’s decision to begin tapering their bond purchases in December would not have a significant impact on their business”, he added

BEA: Personal Income increased less than 0.1% in December, Core PCE prices up 1.2% year-over-year

by Calculated Risk on 1/31/2014 08:30:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $2.3 billion, or less than 0.1 percent ... in December according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $44.1 billion, or 0.4 percent.A key point is that the PCE price index was only up 1.1% year-over-year (1.2% for core PCE). PCE increased at a 2.5% in December, but core PCE only increased at a 1.1% annualized rate in December (Well below the Fed's target).

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in December, compared with an increase of 0.6 percent in November. ... PCE price index -- The price index for PCE increased 0.2 percent in December, compared with an increase of less than 0.1 percent in November. The PCE price index, excluding food and energy, increased 0.1 percent in December, the same increase as in November.

...

Personal saving -- DPI less personal outlays -- was $495.2 billion in December, compared with $541.0 billion in November. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.9 percent in December, compared with 4.3 percent in November.

Thursday, January 30, 2014

Friday: Personal Income, Chicago PMI, Consumer Sentiment,

by Calculated Risk on 1/30/2014 08:43:00 PM

Jed Kolko, writing at Economix, explains why the "headship rate" is more important than the homeownership rate: Why the Homeownership Rate Is Misleading

At this stage of the housing recovery, the falling homeownership rate turns out to be misleading. In fact, for young adults, who were hit especially hard in the recession and housing crisis, the decline in their homeownership rate might paradoxically be a sign of improvement.Friday:

...

When the homeownership rate steers us wrong, the “headship rate” ... can come to the rescue. It’s the percent of adults who head a household. Put another way, it is the ratio of households to adults. If there are 200 million adults living in 100 million households, the headship rate is 50 percent. A higher headship rate means fewer adults, on average, per household. Over the longer term, demographics explain shifts in the headship rate (and in labor force participation, for that matter). An aging population, for instance, typically increases the headship rate because older adults are more likely to head their household than younger adults are because many young adults live in their parents’ home or with housemates.

...

In fact, the headship rate is the key to how much the housing recovery contributes to economic growth. The headship rate and the population determine the total number of households, so a rise in the headship rate means more new households, all else equal.

...

Headship is poised to increase. Young adults still living with their parents won’t do so forever, and the Current Population Survey headship rate in 2013 – even with its recent rise — is still below its 20-year average. That will prompt more new construction.

• At 8:30 AM ET, the Personal Income and Outlays for December. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, the Chicago Purchasing Managers Index for January. The consensus is for an increase to 59.5, up from 59.1 in December.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 81.0, up from the preliminary reading of 80.4, and down from the December reading of 82.5.

• At 10:00 AM ET, Q4 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

Lawler on Homebuilders: Weak Net Orders, "Considerable optimism about the prospects for home sales in 2014"

by Calculated Risk on 1/30/2014 07:35:00 PM

From economist Tom Lawler:

Below is a summary table of some stats from large publicly-traded builders who have reported results for last quarter. Note that for the six builders in the table, “home sales” based on net orders in 2013 were up 5.7% from 2012, while “home sales” defined as closed sales were up 20.1% on the year.

The combination of higher mortgage rates and unusually aggressive home price increases in many parts of the country led to a substantial dip in new home contract signings in the second half of last year.

Most builders expressed considerable optimism about the prospects for home sales in 2014, and are planning accordingly, and most increased significantly their land/lot positions over the last year or two. Most builders also reported gross margins in the last quarter of 2013 that were at or near seven year highs. The combination of elevated land/lot positions and elevated margins suggests that any slower-than-expected pace of home sales would likely lead to little or no home price growth in 2014.

Builder results reported so far suggest that Census’ new home sales estimates for the fourth quarter of 2013 are likely to be revised downward.

M/I Homes reported that net home orders in the quarter ended December 31, 2013 totaled 793, up 17.8% from the comparable quarter of 2012. M/I’s average community county last quarter was up 16.9% from a year earlier. The company’s sales cancellation rate, expressed as a % of gross orders, was 19% last quarter, down from 21% a year ago. Home deliveries totaled 1,120 last quarter, up 26.3% from the comparable quarter of 2012, at an average sales price of $292,000, up $273,000 from a year ago. The company’s order backlog at the end of 2013 was 1,280, up 32.6% from the end of 2012.

M/I Homes has moved aggressively to increase market share over the last year, by increasing its “geographic footprint” and substantially increasing its land/lot holdings. At the end of 2012 the company owned or controlled 19,831 lots, up 39.6% from the end of 2012 and up 91.5% from the end of 2011.

PulteGroup reported that net home orders in the quarter ended December 31, 2013 totaled 3,214, down 18.1% from the comparable quarter of 2012. Home deliveries last quarter totaled 4,964, down 3.7% from the comparable quarter of 2012, at an average sales price of $325,000, up 13.2% from a year ago. The company’s order backlog at the end of 2013 was 5,772, down 10.6% from the end of 2012.

Pulte has been “de-leveraging” and focusing on “value creation” and cost control, meaning that the company has focused on profitability at the expense of market share (and has virtually eliminated its “spec” business). Pulte said that last quarter’s gross margin was its highest since 2005. On its conference call an official said that net orders were “flat” in December relative to November (orders normally fall MOM in December), and said that the company “liked what we’ve seen” so far in January. Pulte noted that it planned to increase its “land spend” in 2014.

On the home price front, Pulte noted that the YOY increase in average home prices was 6% for its Centex division, which focuses on first-time buyers, 13% for its Pulte division, which focuses on move-up buyers, and 11% for its Del Webb division, which focuses on the “active adult” market.

The Ryland Group reported that net home orders (including discontinued operations) in the quarter ended December 31, 2013 totaled 1,428, down 4.9% from the comparable quarter. The company’s community count at the end of 2013 was up 21,8% from a year earlier. Ryland’s sales cancellation rate, expressed as a % of gross orders, was 20.0% last quarter, up from 17.9% a year ago. Sales per community were down about 19% from a year ago. Home deliveries last quarter totaled 2,178, up 38% from the comparable quarter of 2012, at an average sales price of $314,000, up 16.3% from a year earlier. The company’s order backlog at the end of December was 2,626, up 9.5% from the end of 2012. Ryland owned or controlled 38,770 lots (including jvs) at the end of December, up 35.5% from the end of 2012 and up 76.9% from the end of 2012. Ryland’s orders last quarter were “disappointing” given its sharp increase in community count and appeared to reflect slower buying in response to the company’s aggressive price hikes, particularly in the West and Southeast.

In slides that went along with its earnings conference call, Ryland said it plans to increase its active community count in 2014 “in excess” of 20%.

Beazer Homes reported that net home orders in the quarter ended December 31, 2013 totaled 895, down 4.0% from the comparable quarter of 2012. Beazer’s average community count last quarter was down 8.6% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, ws 21.8% last quarter, down 26.4% from a year earlier. Home deliveries last quarter totaled 1,038, unchanged from the comparable quarter of 2012, at an average sales price of $279,500, up 18.6% from a year ago. The company’s order backlog at the end of 2013 was 1,750, down 3.7% from the end of 2012.

Beazer owned or controlled 28,978 lots at the end of 2013, up 15.4% from the end of 2012. Beazer’s “land spend” increased significantly beginning last spring, but the “conversion” to active communities has been slower than hoped for. In slides that went along with its earnings conference call, Beazer said that it expected its average community count in the quarter ending September 30, 2014 to be up by about 16% from the latest quarter.

Meritage Homes, MDC Holdings, and Standard Pacific Corp. are scheduled to release their quarterly results next week (February 5th.)

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/13 | 12/12 | % Chg | 12/13 | 12/12 | % Chg | 12/13 | 12/12 | % Chg |

| D.R. Horton | 5,454 | 5,259 | 3.7% | 6,188 | 5,182 | 19.4% | $263,542 | $236,067 | 11.6% |

| PulteGroup | 3,214 | 3,926 | -18.1% | 4,964 | 5,154 | -3.7% | $325,000 | $287,000 | 13.2% |

| NVR | 2,631 | 2,625 | 0.2% | 3,342 | 2,788 | 19.9% | $365,300 | $331,900 | 10.1% |

| The Ryland Group | 1,428 | 1,502 | -4.9% | 2,178 | 1,578 | 38.0% | $314,000 | $270,000 | 16.3% |

| Beazer Homes | 895 | 932 | -4.0% | 1,038 | 1,038 | 0.0% | $279,300 | $235,500 | 18.6% |

| M/I Homes | 793 | 673 | 17.8% | 1,120 | 887 | 26.3% | $292,000 | $273,000 | 7.0% |

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Calendar Year | '13 | '12 | % Chg | '13 | '12 | % Chg | '13 | '12 | % Chg |

| D.R. Horton | 25,315 | 22,513 | 12.4% | 25,161 | 19,954 | 26.1% | $255,646 | $228,395 | 11.9% |

| PulteGroup | 17,080 | 19,039 | -10.3% | 17,766 | 16,505 | 7.6% | $305,000 | $276,000 | 10.5% |

| NVR | 11,800 | 10,954 | 7.7% | 11,834 | 9,843 | 20.2% | $349,043 | $317,073 | 10.1% |

| The Ryland Group | 7,263 | 5,781 | 25.6% | 7,035 | 4,897 | 43.7% | $296,000 | $262,000 | 13.0% |

| Beazer Homes | 4,989 | 5,111 | -2.4% | 5,056 | 4,603 | 9.8% | $262,004 | $229,126 | 14.3% |

| M/I Homes | 3,787 | 3,020 | 25.4% | 3,472 | 2,765 | 25.6% | $286,000 | $264,000 | 8.3% |

| Total | 70,234 | 66,418 | 5.7% | 70,324 | 58,567 | 20.1% | $289,824 | $261,263 | 10.9% |

Vehicle Sales Forecasts: Decent Sales Expected for January

by Calculated Risk on 1/30/2014 04:09:00 PM

Note: The automakers will report January vehicle sales on Monday, February 3rd.

Here are a few forecasts:

From Edmunds.com: Winter Weather Freezes January Auto Sales ... Says Edmunds.com

Edmunds.com forecasts that 1,036,533 new cars and trucks will be sold in the U.S. in January for an estimated Seasonally Adjusted Annual Rate (SAAR) of 15.6 million. ...From Kelley Blue Book: New-Car Sales To Improve Nearly 2 Percent From Last Year; Kelley Blue Book Projects Best January Since 2007

January's weather complications mean that sales will likely be made up in February.

New-vehicle sales are expected to improve 1.6 percent year-over-year in January to a total of 1.06 million units, and an estimated 15.9 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book. ... At 15.9 million, this would be the highest recorded January SAAR since 2007, when it was 16.4 million. ...From J.D. Power: Strong January New-Vehicle Sales Produce Sunny Forecast for Auto Industry

"January is typically the weakest sales month of the year as many consumers take advantage of holiday deals in December. However, winter storms also could impact new-vehicle sales this month, as much of the country deals with historically cold weather and snowstorms," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Early estimates indicate fleet sales will be down as well."

New-vehicle sales for January 2014 are expected to rise 3%, according to a sales forecast jointly issued by the Power Information Network (PIN) from J.D. Power and LMC Automotive. According to the forecast, consumers are expected to purchase 847,000 new vehicles in January 2014, meaning that dealerships would move more metal than in any January since 2004.It appears sales in January were OK even with the cold weather (January is usually the weakest month of the year, so there is a large seasonal adjustment).

A Comment on the Pending Home Sales Index

by Calculated Risk on 1/30/2014 12:09:00 PM

From the NAR: December Pending Home Sales Fall

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 8.7 percent to 92.4 in December from a downwardly revised 101.2 in November, and is 8.8 percent below December 2012 when it was 101.3. The data reflect contracts but not closings, and are at the lowest level since October 2011, when the index was 92.2.A few comments:

Lawrence Yun, NAR chief economist, said several factors are working against buyers. “Unusually disruptive weather across large stretches of the country in December forced people indoors and prevented some buyers from looking at homes or making offers,” he said. “Home prices rising faster than income is also giving pause to some potential buyers, while at the same time a lack of inventory means insufficient choice. Although it could take several months for us to get a clearer read on market momentum, job growth and pent-up demand are positive factors.”

...

The PHSI in the Northeast dropped 10.3 percent to 74.1 in December, and is 5.5 percent below a year ago. In the Midwest the index declined 6.8 percent to 93.6 in December, and is 6.9 percent lower than December 2012. Pending home sales in the South fell 8.8 percent to an index of 104.9 in December, and are 6.9 percent below a year ago. The index in the West, which is most impacted by constrained inventory, dropped 9.8 percent in December to 85.7, and is 16.0 percent below December 2012.

Total existing-home sales this year should hold close to 5.1 million, essentially the same as 2013, but inventory remains limited in much of the country.

emphasis added

• Mr. Yun blamed some of the decline on the weather (the weather was unusually bad in December), but the index was down sharply in the South too (probably not weather), and in the West (partially related to low inventories).

• My view is there were several reasons for the decline in this index: weather in some areas, fewer distressed sales, less investor buying, fewer "pending" short sales, and low inventories. I think fewer distressed sales, fewer "pending" short sales, and less investor buying are all signs of a healthier market - even if overall sales decline.

• Mr Yun is forecasting 5.1 million existing home sales in 2014, about the same as in 2013. I'll take the under on that forecast, and I think it would be a positive sign if sales were under 5 million in 2014 as long as distressed sales continue to decline and conventional sales increase.

• Of course, for housing, what really matters for the economy and employment is new home sales (not existing), and housing starts.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

Q4 GDP: Solid Report, Positives Looking Forward

by Calculated Risk on 1/30/2014 09:34:00 AM

The advance Q4 GDP report, with 3.2% annualized growth, was slightly above expectations. Personal consumption expenditures (PCE) increased at a 3.3% annualized rate - a solid pace.

However the Federal Government subtracted 0.98 percentage points from growth in Q4, and residential investment subtracted 0.32 percentage points. Imagine no Federal austerity - Q4 GDP would have been above 4%. Luckily it appears austerity at the Federal level will diminish in 2014, and of course I expect that residential investment will make a solid contribution this year.

Change in private inventories made another positive contributions in Q4 (added 0.42 percentage points). I expect inventories will probably be a drag in 2014.

On a Q4-over-Q4 basis, real GDP increased 2.7% (above the Fed's December projections of 2.2% to 2.3%). On an annual basis, real GDP increased 1.9%. Note: See GDP: Annual and Q4-over-Q4 for the difference in calculations.

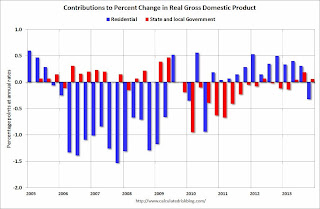

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local governments have added to GDP for three consecutive

quarters now.

I expect state and local governments to continue to make small positive contributions to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.

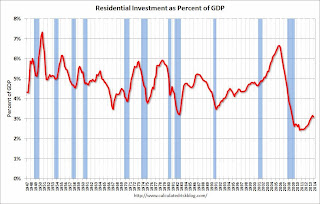

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

Overall this was a solid report, and there are several positives going forward: RI should make a positive contribution in 2014, the drag from the Federal Government should diminish, state and local governments should make a small positive contribution again this year, and investment in equipment and software and non-residential structures should also be positive in 2014.

Q4 GDP 3.2%, Weekly Initial Unemployment Claims increase to 348,000

by Calculated Risk on 1/30/2014 08:36:00 AM

I'll have more on GDP soon. From the BEA: Gross Domestic Product, 4th quarter and annual 2013 (advance estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 3.2 percent in the fourth quarter of 2013 (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.The DOL reports:

...

The increase in real GDP in the fourth quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, private inventory investment, and state and local government spending that were partly offset by negative contributions from federal government spending and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

In the week ending January 25, the advance figure for seasonally adjusted initial claims was 348,000, an increase of 19,000 from the previous week's revised figure of 329,000. The 4-week moving average was 333,000, an increase of 750 from the previous week's revised average of 332,250.The previous week was revised up from 326,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 333,000.

This was the above the consensus forecast of 327,000.

Wednesday, January 29, 2014

Thursday: Q4 GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 1/29/2014 08:36:00 PM

It is likely that the Fed will change their forward guidance soon since the unemployment rate is approaching 6.5%. The Fed has been clear that 6.5% is not a trigger, but the wording will have to change soon.

It is very possible that there will be more emphasis on inflation as Cardiff Garcia at the FT Alphaville discusses The Fed’s converging misses on inflation and unemployment

[L]ooking ahead, there are at least two reasons why the Yellen Fed might soon consider, or at least should consider, downplaying the unemployment rate threshold in its forward guidance in favour of a greater emphasis on inflation.Thursday:

The first, and more widely discussed, is that there remains uncertainty about what is causing the demographic-adjusted decline in the labour force participation rate, and therefore it’s also uncertain how reliably the unemployment rate is reflecting labour market health. ...

The second reason is partly a matter of simple mathematics. The unemployment rate, now at 6.7 per cent, has been falling quickly towards the Fed’s central tendency forecast of 5.2-5.8 per cent for the long-term rate, while the latest year-on-year readings for both core and headline inflation (1.1 and 0.9 per cent respectively) have remained well below the Fed’s explicit 2 per cent target — as they have for nearly two years.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 327 thousand from 326 thousand.

• Also at 8:30 AM, the Q4 GDP report. This is the advance estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 3.0% annualized in Q4.

• At 10:00 AM ET, Pending Home Sales Index for December. The consensus is for a 0.5% decrease in the index.

Freddie Mac: Mortgage Serious Delinquency rate declined in December, Lowest since February 2009

by Calculated Risk on 1/29/2014 04:38:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in December to 2.39% from 2.43% in November. Freddie's rate is down from 3.25% in December 2012, and this is the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for December on Friday.

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen from 0.86 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until mid-to-late 2015.

Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of distressed sales for another 2+ years (mostly in judicial foreclosure states).

FOMC Statement: More Taper

by Calculated Risk on 1/29/2014 02:00:00 PM

Information received since the Federal Open Market Committee met in December indicates that growth in economic activity picked up in recent quarters. Labor market indicators were mixed but on balance showed further improvement. The unemployment rate declined but remains elevated. Household spending and business fixed investment advanced more quickly in recent months, while the recovery in the housing sector slowed somewhat. Fiscal policy is restraining economic growth, although the extent of restraint is diminishing. Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for the economy and the labor market as having become more nearly balanced. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

Taking into account the extent of federal fiscal retrenchment since the inception of its current asset purchase program, the Committee continues to see the improvement in economic activity and labor market conditions over that period as consistent with growing underlying strength in the broader economy. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions, the Committee decided to make a further measured reduction in the pace of its asset purchases. Beginning in February, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $30 billion per month rather than $35 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $35 billion per month rather than $40 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. The Committee also reaffirmed its expectation that the current exceptionally low target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Richard W. Fisher; Narayana Kocherlakota; Sandra Pianalto; Charles I. Plosser; Jerome H. Powell; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen.

emphasis added

CoreLogic: Completed Foreclosures Down 24% in 2013

by Calculated Risk on 1/29/2014 09:52:00 AM

From CoreLogic: The foreclosure inventory fell 31 percent nationally in 2013

CoreLogic® ... today released its December National Foreclosure Report, which provides data on completed U.S. foreclosures and the national foreclosure inventory. According to CoreLogic, there were 620,111 completed foreclosures across the country in 2013 compared to 820,498 in 2012, a decrease of 24 percent. For the month of December, there were 45,000 completed foreclosures, down from 52,000 in December 2012, a year-over-year decrease of 14 percent. On a month-over-month basis, completed foreclosures decreased 4.1 percent, from 47,000 reported in November 2013.

Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 4.8 million completed foreclosures across the country. As a basis of comparison, prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

As of December 2013, approximately 837,000 homes in the United States were in some stage of foreclosure, known as the foreclosure inventory, compared to 1.2 million in December 2012, a year-over-year decrease of 31 percent. The foreclosure inventory as of December 2013 represented 2.1 percent of all homes with a mortgage compared to 3.0 percent in December 2012. The foreclosure inventory was down 2.7 percent from November 2013 to December 2013.

“The foreclosure inventory fell by more than 30 percent in December on a year-over-year basis, twice the decline from a year ago,” said Mark Fleming, chief economist for CoreLogic. “The decline indicates that the distressed foreclosure inventory is healing at an accelerating rate heading into 2014.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows the foreclosure inventory by state (Foreclosure inventory are properties in the foreclosure process). The foreclosure inventory is still high in some judicial foreclosure states. From CoreLogic:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were Florida (6.7 percent), New Jersey (6.5 percent), New York (4.9 percent), Connecticut (3.6 percent) and Maine (3.6 percent).

MBA: Mortgage Purchase Applications Increase Slightly

by Calculated Risk on 1/29/2014 07:01:00 AM

From the MBA: Mortgage Applications Essentially Flat in Latest MBA Weekly Survey

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 24, 2014. The results include an adjustment to account for the Martin Luther King, Jr. holiday. ...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.52 percent, the lowest rate since the week ending November 29, 2013, from 4.57 percent, with points increasing to 0.40 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 68% from the levels in early May.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 12% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, January 28, 2014

Wednesday: Fed Day

by Calculated Risk on 1/28/2014 08:42:00 PM

I expect the FOMC to announce additional tapering on Wednesday. Merrill Lynch economists think the Fed will change their forward guidance soon, but probably not at this meeting:

The market widely expects the Fed to continue to taper by US$10bn at its January meeting, and we do not expect it to disappoint. This action would bring its purchase pace to US$65bn per month (US$35bn Treasuries and US$30bn MBS). Less clear is what the Fed intends to do with its forward guidance, particularly the 6.5% unemployment threshold. As the unemployment rate has been falling for largely the "wrong" reasons, we anticipate the FOMC will drop this threshold altogether, in favor of vaguer but more robust qualitative guidance on the broad labor market conditions that would warrant a rate hike. This change likely will be made at one of the next few meetings - possibly this week. More troublesome for the Fed is the persistently low inflation rate; we expect some strengthening of guidance to suggest that the FOMC will not hike rates until inflation is much closer to the Fed's longer-run 2% target. However, that language change may be more likely later this year.Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the FOMC Meeting Announcement will be released. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

Zillow: Case-Shiller House Price Index expected to show 13.5% year-over-year increase in December

by Calculated Risk on 1/28/2014 06:48:00 PM

The Case-Shiller house price indexes for November were released today. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. It looks like another very strong month ...

From Zillow: Case-Shiller Forecast: Apprieciation Remains Strong

The Case-Shiller data for November came out this morning, and based on this information and the December 2013 Zillow Home Value Index (ZHVI, released January 22) we predict that next month’s Case-Shiller data (December 2013) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 13.5 and 13.6 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from November to December will be 0.7 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for December will not be released until Tuesday, Feb. 25.The following table shows the Zillow forecast for the December Case-Shiller index.

The Zillow Home Value Index continues to show slow moderation in home value appreciation, as well as a fair amount of volatility in home value growth as the housing recovery continues. Case-Shiller indices have shown very little slowing in monthly appreciation and have not yet recorded monthly declines (at least not in their seasonally-adjusted monthly numbers). Even when the Case-Shiller indices do begin to show monthly depreciation in some areas, they will continue to show an inflated picture of home prices, especially when considering year-over-year growth. The Case-Shiller indices are biased toward the large, coastal metros currently seeing enormous home value gains, and they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed.

In contrast, the ZHVI does not include foreclosure resales and shows home values for December 2013 up 6.4 percent from year-ago levels. More on the differences between a repeat sales index, including the Case-Shiller indices, and an imputed hedonic index like the ZHVI can be found here. We expect home value appreciation to continue to moderate through the end of 2013 and into 2014, rising 4.8 percent between December 2013 and December 2014 — a rate much more in line with historic appreciation rates.

| Zillow December Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Dec 2012 | 158.60 | 159.28 | 146.08 | 146.75 |

| Case-Shiller (last month) | Nov 2013 | 180.15 | 179.7 | 165.80 | 165.41 |

| Zillow Forecast | YoY | 13.6% | 13.6% | 13.5% | 13.5% |

| MoM | 0.0% | 0.7% | 0.0% | 0.7% | |

| Zillow Forecasts1 | 180.2 | 180.9 | 165.8 | 166.6 | |

| Current Post Bubble Low | 146.45 | 149.67 | 134.07 | 136.91 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 23.0% | 20.9% | 23.7% | 21.7% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Lawler: D.R. Horton sales up slightly year-over-year

by Calculated Risk on 1/28/2014 03:06:00 PM

From housing economist Tom Lawler:

D.R. Horton, the largest US home builder, reported that net home orders in the quarter ended December 31, 2013 totaled 5,454, up 3.7% from the comparable quarter of 2012, and up “contra-seasonal” 5.7% from the previous quarter’s weak level. The average net order price last quarter was $275,600, up 10.3% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 23% last quarter, up slightly from 22% a year ago. Home deliveries totaled 6,188 last quarter, up 19.4% from the comparable quarter of 2012, at an average home sales price of $263,542 up 11.6% from a year ago. The company’s order backlog at the end of last year was 7,684, up 5.0% from the end of 2012, at an average order price of $275,052, up 14.4% from a year earlier. The company said that its average community count last quarter was up 13% from the comparable quarter of 2012.

Horton noted in its press release that its weekly sales pace “accelerated” in January. In its press conference, officials noted that the strong home price gains last year reflected both increased pricing power in most of its markets and a higher mix of larger homes and sales to “move-up” buyers. Officials said that of the purchase mortgages closed by Horton’s mortgage subsidiary last quarter, 41% were to first-time home buyers, down from 50% in the comparable quarter of 2012 – suggesting that sales to first-time home buyers were weak last quarter.

According to officials, Horton’s gross margin last quarter was at its highest level since 2006. Officials were “very optimistic” about the 2014 “spring” (really winter/spring) selling season, and said that they were “well-positioned” from a community count and “spec inventory” position to take advantage of strong sales. Based on these expectations officials said they expected to “hold” these exceptionally high margins, but officials noted that home price gains in 2014 were likely to be much more modest in 2014. Given Horton’s elevated margins and “strong” spec inventory position, weaker-than-expected sales over the next few months could lead to flat to slightly lower home prices.

In response to a question in the Q&A session, a Horton official noted that home prices in Phoenix, which increased about 25% last year, had begun to “plateau,” and the official expected prices in Phoenix this year to be flat to slightly down.

At the end of December Horton owned or controlled 175,000 lots, down slightly from 177,300 at the end of 2012, but up significantly from 120,600 at the end of 2011.

emphasis added

Comment on House Prices: Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 1/28/2014 12:22:00 PM

I've been hearing some reports of a slowdown in house price increases (more than the usual seasonal slowdown), but this slowdown in price increases is not showing up yet in the Case-Shiller index. I expect to see smaller year-over-year price increases going forward.

There was a small Not Seasonally Adjusted decline in November, but that decline was smaller than usual - and prices are still increasing fairly quickly on a seasonally adjusted basis.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (about 38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Earlier: Case-Shiller: Case-Shiller: Comp 20 House Prices increased 13.7% year-over-year in November

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2004 levels (and also back up to Q3 2008), and the Case-Shiller Composite 20 Index (SA) is back to June 2004 levels, and the CoreLogic index (NSA) is back to October 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 2001 levels, the Composite 20 index is back to May 2002, and the CoreLogic index back to May 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 2000 levels, the Composite 20 index is back to Aug 2002 levels, and the CoreLogic index is back to February 2003.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 44% above January 2000 (44% nominal gain in 14 years).

These are nominal prices, and as I noted above real prices (adjusted for inflation) are up about 38% since January 2000 - so the increase in Phoenix from January 2000 until now is just a little above the change in overall prices due to inflation.

Two cities - Denver (up 45% since Jan 2000) and Dallas (up 32% since Jan 2000) - are at new highs (no other Case-Shiller Comp 20 city is very close). Denver is up slightly more than inflation over that period, and Dallas slightly less. Detroit prices are still below the January 2000 level.

BLS: State unemployment rates were "generally lower" in December

by Calculated Risk on 1/28/2014 10:40:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in December. Thirty-nine states and the District of Columbia had unemployment rate decreases from November, two states had increases, and nine states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island had the highest unemployment rate among the states in December, 9.1 percent. The next highest rates were in Nevada, 8.8 percent, and Illinois, 8.6 percent. North Dakota continued to have the lowest jobless rate, 2.6 percent.

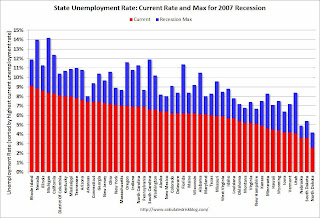

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan, Nevada and Florida have seen the largest declines and many other states have seen significant declines.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at 9% in only one state: Rhode Island.

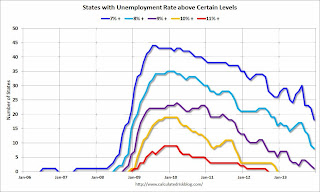

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently one state has an unemployment rate at or above 9% (purple), eight states at or above 8% (light blue), and 18 states at or above 7% (blue).

Case-Shiller: Comp 20 House Prices increased 13.7% year-over-year in November

by Calculated Risk on 1/28/2014 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Winter Shows No Signs of Cooling in Home Prices According to the S&P/Case-Shiller Home Price Indices

Data through November 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed that the 10-City and 20-City Composites increased 13.8% and 13.7% year-over-year. Dallas posted its highest annual return of 9.9% since its inception in 2000. Chicago also stood out with an annual rate of 11.0%, its highest since December 1988.

For the month of November, the two Composites declined 0.1%. After nine consecutive months of gains, this marks the first decrease since November 2012. Nine out of 20 cities recorded positive monthly returns ...

“November was a good month for home prices,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Despite the slight decline, the 10-City and 20-City Composites showed their best November performance since 2005. Prices typically weaken as we move closer to the winter. Las Vegas, Los Angeles and Phoenix stand out as they have posted 20 or more consecutive monthly gains.

“Beginning June 2012, we saw a steady rise in year-over-year increases. November continued that trend with another strong month although the rate of increase slowed. Looking at the year-over-year returns, the Sun Belt continues to push ahead with Atlanta, Las Vegas, Los Angeles, Miami, Phoenix, San Diego, San Francisco and Tampa taking eight of the top nine spots. Detroit continues to recover but remains the only city with prices below its 2000 level."

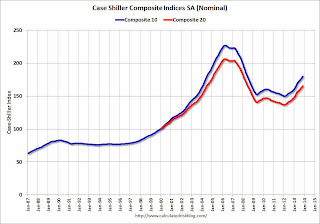

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 20.8% from the peak, and up 0.9% in November (SA). The Composite 10 is up 20.1% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 19.9% from the peak, and up 0.9% (SA) in November. The Composite 20 is up 20.8% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.9% compared to November 2012.

The Composite 20 SA is up 13.7% compared to November 2012.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in November seasonally adjusted. (Prices increased in 9 of the 20 cities NSA) Prices in Las Vegas are off 45.8% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was at the consensus forecast for a 13.7% YoY increase. I'll have more on prices later.

Black Knight: Mortgage Delinquency Rate increased in December, Down almost 10% year-over-year

by Calculated Risk on 1/28/2014 07:01:00 AM

According to the Black Knight (formerly LPS) First Look report for December, the percent of loans delinquent increased seasonally in December compared to November, and declined about 9.9% year-over-year.

Also the percent of loans in the foreclosure process declined further in December and were down 28% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 6.47% from 6.45% in November. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.48% in December from 2.50% in November. The is the lowest level since late 2008.

The number of delinquent properties, but not in foreclosure, is down 332,000 properties year-over-year, and the number of properties in the foreclosure process is down 472,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for December in early February.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| December 2013 | November 2013 | December 2012 | |

| Delinquent | 6.47% | 6.45% | 7.17% |

| In Foreclosure | 2.48% | 2.50% | 3.44% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,964,000 | 1,958,000 | 2,031,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,280,000 | 1,283,000 | 1,545,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,244,000 | 1,256,000 | 1,716,000 |

| Total Properties | 4,488,000 | 4,497,000 | 5,292,000 |

Monday, January 27, 2014

Tuesday: Case-Shiller House Prices, Durable Goods, Richmond Fed Mfg Survey and More

by Calculated Risk on 1/27/2014 08:34:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight (formerly LPS): U.S. Home Prices Up 0.3 Percent for the Month; Up 8.5 Percent Year-Over-Year

oday, the Data & Analytics division of Black Knight Financial Services (formerly the LPS Data & Analytics division) released its latest Home Price Index (HPI) report, based on November 2013 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increase was slightly less in November than in October. The LPS HPI is off 13.9% from the peak in June 2006.

Tuesday:

• At 8:30 AM ET, the Durable Goods Orders report for December from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders.

• At 9:00 AM, the S&P/Case-Shiller House Price Index for November. The consensus is for a 13.7% year-over-year increase in the Composite 20 index (NSA) for August.

• Also at 9:00 AM, the Chemical Activity Barometer (CAB) for January from the American Chemistry Council. This appears to be a leading economic indicator.

• At 10:00 AM, the Conference Board's consumer confidence index for January. The consensus is for the index to increase to 79.0 from 78.1.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January. This is the last of the regional Fed surveys for January. The consensus is a reading of 10, down from 13 in December (above zero is expansion).

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for December 2013.

Weekly Update: Housing Tracker Existing Home Inventory up 1.8% year-over-year on Jan 27th

by Calculated Risk on 1/27/2014 05:30:00 PM

Here is another weekly update on housing inventory ... for the 15th consecutive week housing inventory is up year-over-year (but not by much). This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for December). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 1.8% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low - and barely up year-over-year - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

New Home Prices: New Record for Average and Median in 2013

by Calculated Risk on 1/27/2014 03:25:00 PM

Here are two graphs I haven't for some time ...

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in December 2013 was $270,200; the average sales price was $311,400."

The following graph shows the median and average new home prices.

Click on graph for larger image.

Click on graph for larger image.

During the bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. With fewer foreclosures now, it appears the builders have moved to higher price points.

The average price in 2013 was $320,900, above the previous high of $313,600 in 2007. The median price in 2013 was $265,800, above the previous high of $247,900 in 2009.

The second graph shows the percent of new home sales by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 39%. And less than 10% were under $150K in 2013.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 39%. And less than 10% were under $150K in 2013.

Earlier on New Home Sales:

• New Home Sales at 414,000 Annual Rate in December

• New Home Sales: Weak Finish, Solid Growth in 2013

New Home Sales: Weak Finish, Solid Growth in 2013

by Calculated Risk on 1/27/2014 11:35:00 AM

Earlier: New Home Sales at 414,000 Annual Rate in December

Although sales in December were weak, the Census Bureau reported annual sales were up 16.4% from 2012. This was the highest level for sales since 2008, but still the sixth worst year on record.

Sales would have been higher in 2013, except some homebuilders were land constrained (not enough entitled land), and many homebuilders pushed prices sacrificing a little volume. Still a 16% annual increase in sales is solid growth.

This table shows the annual sales rate for the last ten years.

| Annual New Home Sales | ||

|---|---|---|

| Year | Sales (000s) | Change in Sales |

| 2004 | 1,203 | 10.8% |

| 2005 | 1,283 | 6.7% |

| 2006 | 1,051 | -18.1% |

| 2007 | 776 | -26.2% |

| 2008 | 485 | -37.5% |

| 2009 | 375 | -22.7% |

| 2010 | 323 | -13.9% |

| 2011 | 306 | -5.3% |

| 2012 | 368 | 20.3% |

| 2013 | 428 | 16.4% |

Even with the sharp increase in sales over the last two years, 2013 was the sixth worst year for new home sales since 1963.

The sales rate was only lower than 2013 in the worst housing bust years of 2009 through 2012, and the worst year of early '80s recession (1982).

| Worst Years for New Home Sales since 1963 | ||

|---|---|---|

| Rank | Year | New Home Sales (000s) |

| 1 | 2011 | 306 |

| 2 | 2010 | 323 |

| 3 | 2012 | 368 |

| 4 | 2009 | 375 |

| 5 | 1982 | 412 |

| 6 | 2013 | 428 |

| 7 | 1981 | 436 |

| 8 | 1969 | 448 |

| 9 | 1966 | 461 |

| 10 | 1970 | 485 |

| 11 | 2008 | 485 |

Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the 428 thousand sales in 2013. This suggests significant upside over the next several years. So I expect the housing recovery to continue.

Note: Inventories of completed and "under construction" homes are still historically low. The Census Bureau reported 40 thousand completed homes for sale, just above the record low set in June 2013. And there were 97 thousand homes "under construction" in December, well below the median of 185 thousand over the last 40 years. So there are no concerns about too much inventory (inventory is probably too low in some areas).

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some (distressed sales will slowly decline and be partially offset by more conventional sales). And I expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 414,000 Annual Rate in December

by Calculated Risk on 1/27/2014 10:00:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 414 thousand.

November sales were revised down from 464 thousand to 445 thousand, and October sales were revised down from 474 thousand to 463 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in December 2013 were at a seasonally adjusted annual rate of 414,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.0 percent below the revised November rate of 445,000, but is 4.5 percent above the December 2012 estimate of 396,000.

An estimated 428,000 new homes were sold in 2013. This is 16.4 percent above the 2012 figure of 368,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Even with the increase this year, new home sales are still near the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in December to 5.0 months from 4.7 months in November.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of December was 171,000. This represents a supply of 5.0 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is near the record low. The combined total of completed and under construction is still very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In December 2013 (red column), 28 thousand new homes were sold (NSA). Last year 28 thousand homes were also sold in December. The high for December was 87 thousand in 2005, and the low for December was 23 thousand in 1966 and 2010.

This was below expectations of 450,000 sales in December, and there were downward revisions to prior months.

I'll have more later today - but this was a weak ending to a solid year.