by Calculated Risk on 9/30/2011 09:06:00 PM

Friday, September 30, 2011

Real Estate Agent Tracker Tool

Mortgage broker Soylent Green is People sent me this ... Redfin is now putting real estate agent production data on line for consumers to see. Here is the link: Scouting Report - Search for Any Agent.

Update: This isn't everywhere.

Redfin provides the price range of homes sold, the median price, average days on market, price changes, and current listings.

If you don't know an agent, just put in blog friend Jim the Realtor: "Jim Klinge". He is pretty active in San Diego. According to Redfin, Jim has represented 31 Sellers and 23 Buyers in last 12 months. That is 54 total - one per week! And he still takes my phone calls :-)

If you sign up with Redfin (no spam), they provide some more information.

According to Soylent Green is People: "There is much wailing and gnashing of teeth about this. Perhaps those with weak constitutions should find another employment path than sales." CR says: Information is power! This is great.

Earlier:

• Personal Income decreased 0.1% in August, Spending increased 0.2%

• September Consumer Sentiment increases to 59.4, Chicago PMI fairly strong

• Fannie Mae and Freddie Mac Serious Delinquency Rates decline in August

• Hotels: Occupancy Rate increased 4.1 percent compared to same week in 2010

• Restaurant Performance Index declined in August

Bank Failure #74 in 2011: First International Bank, Plano, TX

by Calculated Risk on 9/30/2011 07:05:00 PM

First International now

America First

by Soylent Green is People

From the FDIC: American First National Bank, Houston, Texas, Assumes All of the Deposits of First International Bank, Plano, Texas

As of June 30, 2011, First International Bank had approximately $239.9 million in total assets and $208.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $53.8 million. ... First International Bank is the 74th FDIC-insured institution to fail in the nation this year, and the first in Texas.Friday is here!

Mortgage Settlement Update: California Drops Out of Talks

by Calculated Risk on 9/30/2011 06:31:00 PM

From the LA Times: California breaks from 50-state probe into mortgage lenders

California Atty. Gen. Kamala Harris will no longer take part in a national foreclosure probe of some of the nation's biggest banks, which are accused of pervasive misconduct in dealing with troubled homeowners.This is a major blow to the settlement talks.

Harris removed herself from talks by a coalition of state attorneys general and federal agencies investigating abusive foreclosure practices because the nation's five largest mortgage servicers were not offering California homeowners relief commensurate to what people in the state had suffered, Harris told the Times on Friday.

The big banks were also demanding to be granted overly broad immunity from legal claims that could potentially derail further investigations into Wall Street's role in the mortgage meltdown, Harris said.

“It has been a process of negotiating and sitting at a table in good faith but ultimately I have decided that we have to go our own course and take an independent path and that decision is because we need to bring relief to Californians that is equal to the pain California experienced and what is being negotiated now is insufficient," Harris [said]

Fannie Mae and Freddie Mac Serious Delinquency Rates decline in August

by Calculated Risk on 9/30/2011 04:21:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 4.03% in August. This is down from 4.08% in July, and down from 4.75% in August of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined to 3.49% in August from 3.51% in July. This is down from 3.83% in August 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent.

The serious delinquency rate has been falling as Fannie and Freddie work through the backlog of delinquent loans. The normal serious delinquency rate is under 1%, and at this pace of decline, the delinquency rate will be back to "normal" in four or five years!

Hotels: Occupancy Rate increased 4.1 percent compared to same week in 2010

by Calculated Risk on 9/30/2011 01:49:00 PM

Note: This is one of the industry specific measures that I follow. I only post this every few weeks or so.

From HotelNewsNow.com: STR: US hotel results week ending 24 September

In year-over-year comparisons for the week, occupancy rose 4.1 percent to 66.8 percent, average daily rate increased 4.0 percent to US$107.24, and revenue per available room finished the week up 8.3 percent to US$71.65.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.We are now headed into the fall business travel season. The 4-week average of the occupancy rate will increase again seasonally. For the month of September, the 4 week average of the hotel occupancy rate has been back to the pre-recession median level.

Even though the occupancy rate has recovered, ADR and RevPAR are still about 3% lower than before the recession for the comparable week.

The second graph shows the 4-week average of the occupancy rate as a percent of the median since 2000. Note: Since this is a percent of the median, the number can be above 100%.

The second graph shows the 4-week average of the occupancy rate as a percent of the median since 2000. Note: Since this is a percent of the median, the number can be above 100%.This shows the decline in the occupancy rate during and following the 2001 recession. The sharp decline in 2001 was related to 9/11, and the sharp increase towards the end of 2005 was due to Hurricane Katrina.

The occupancy rate really fell off a cliff in 2008, and has slowly recovered back to the median.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Restaurant Performance Index declined in August

by Calculated Risk on 9/30/2011 12:06:00 PM

From the National Restaurant Association: Restaurant Performance Index Fell to Lowest Level in 13 Months Amid Growing Operator Uncertainty

Dampened by softer sales and traffic levels and continued uncertainty among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) declined for the second consecutive month in August. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.4 in August, down 0.3 percent from July. In addition, August marked the second consecutive month that the RPI stood below 100, the level above which signifies expansion in the index of key industry indicators.

“The August decline in the Restaurant Performance Index resulted from softening of both current situation and expectations indicators, as well as Hurricane Irene,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Although restaurant operators reported net positive same-store sales results in August, their six-month outlook for both sales growth and the economy continued to deteriorate.”

...

Although restaurant operators reported net positive same-store sales in August, the overall results were softer than recent months. ... Meanwhile, restaurant operators reported a net decline in customer traffic for the first time in three months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index declined to 99.4 in August (below 100 indicates contraction).

Unfortunately the data for this index only goes back to 2002.

Note: August was an especially weak economic month following the debt ceiling debate, and it will be interesting to see if these indicators show some rebound in September and October.

September Consumer Sentiment increases to 59.4, Chicago PMI fairly strong

by Calculated Risk on 9/30/2011 09:55:00 AM

• First on the Chicago PMI Chicago Business Barometer™ Rebounded: The overall index increased to 60.4 from 56.5 in August. This was above consensus expectations of 55.4. Note: any number above 50 shows expansion. The employment index increased to 60.6 from 52.1. "EMPLOYMENT expanded to highest level in 4 months". The new orders index increased to 65.3 from 56.9. "NEW ORDERS erased net declines accumulated since April"

• The final September Reuters / University of Michigan consumer sentiment index increased to 59.4 from 55.7 in August.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate.

Note: It usually takes 2 to 4 months to bounce back from an event driven decline in sentiment (if the August decline was event driven) - and any bounce back from the debt ceiling debate would be to an already weak reading.

This was still very weak, but above the consensus forecast of 57.8.

Personal Income decreased 0.1% in August, Spending increased 0.2%

by Calculated Risk on 9/30/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for August:

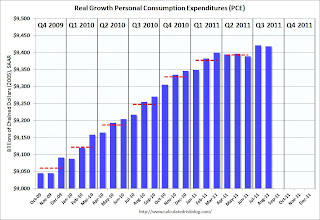

Personal income decreased $7.3 billion, or 0.1 percent ... in August ... Personal consumption expenditures (PCE) increased $22.7 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased less than 0.1 percent in August, in contrast to an increase of 0.4 percent in July. ... The price index for PCE increased 0.2 percent in August,compared with an increase of 0.4 percent in July. The PCE price index, excluding food and energy, increased 0.1 percent

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased 0.2 in August, and real PCE decreased slightly as the price index for PCE increased 0.2 percent in August.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

The personal saving rate was at 4.5% in August.

Personal saving -- DPI less personal outlays -- was $519.3 billion in August, compared with $550.5 billion in July. Personal saving as a percentage of disposable personal income was 4.5 percent in August, compared with 4.7 percent in July.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the August Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the August Personal Income report.Using the two month method to estimate Q3 PCE gives a 1.1% annualized rate (another weak quarter), however it appears PCE increased in September (auto sales are up) and June was especially weak in Q2 - so real PCE growth will probably be in the 1.5% range in Q3 (still weak).

Misc: Foreclosure "Closer", One in Five Modifications Redefault and More

by Calculated Risk on 9/30/2011 12:29:00 AM

• A story about the guy that checks the house after foreclosure from the NY Times: The Closer

When a lender forecloses on a property, one of the first things he does is send somebody out to see if there is a house still standing and whether there’s anybody living there. That’s my job. Sometimes the houses are crack dens or meth labs, sometimes the sites of cock- or dog-fighting operations, sometimes the backyard is filled with pot. And sometimes the house is a waterfront mansion in a gated golf community worth well over seven figures. Variety is the rule.• From Bloomberg: One in Five Modified Loans Default Again, U.S. Comptroller Says (ht Mike in Long Island)

One in five homeowners whose mortgages were modified under a program aimed at reducing foreclosures defaulted again within a year after their payments were cut, the U.S. Comptroller of the Currency reported today.• From Catherine Rampell at Economix: Job Losses Across the Developed World (ht Picosec)

Across the developed world, the biggest job losses in the 2008-9 downturn were in mining, manufacturing and utilities, according to new data from the Organization for Economic Cooperation and Development.Check out the chart. Construction job losses in the U.S. were small compared to Spain, Ireland and Portugal.

Thursday, September 29, 2011

Freddie Mac: Record Low Mortgage Rates

by Calculated Risk on 9/29/2011 05:24:00 PM

Probably deserves a mention ... from Freddie Mac: Fixed-Rate Mortgages Lowest on Record

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), coming on the heels of the Federal Reserve's recent announcements. The conventional 30-year fixed averaged an all-time record low at 4.01 percent; likewise the 15-year fixed averaged an all-time record low at 3.28 percent for the week.Earlier:

...

"Fixed mortgage rates fell to all-time record lows this week following the Federal Reserve's announcement of its Maturity Extension Program and additional purchases of mortgage-backed securities. Interest rates for ARMs, however, were nearly unchanged as the Federal Reserve plans to sell $400 billion in short-term Treasury securities, which serve as benchmarks for many ARMs." [said Frank Nothaft, vice president and chief economist, Freddie Mac]

• Weekly Initial Unemployment Claims decline sharply to 391,000

• Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

• Kansas City Manufacturing Survey: Manufacturing activity expands "modestly" in September

• Employment: Comment on preliminary annual benchmark revision

Employment: Comment on preliminary annual benchmark revision

by Calculated Risk on 9/29/2011 01:45:00 PM

This morning the BLS released the preliminary annual benchmark revision of +192,000 payroll jobs. The final revision will be published next February when the January 2012 employment report is released February 3, 2012. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

Establishment survey benchmarking is done on an annual basis to a population derived primarily from the administrative file of employees covered by unemployment insurance (UI). The time required to complete the revision process—from the full collection of the UI population data to publication of the revised industry estimates—is about 10 months. The benchmark adjustment procedure replaces the March sample-based employment estimates with UI-based population counts for March. The benchmark therefore determines the final employment levels ...Using the preliminary benchmark estimate, this means that payroll employment in March 2011 was 192,000 higher than originally estimated. In February 2012, the payroll numbers will be revised up to reflect this estimate. The number is then "wedged back" to the previous revision (March 2010).

Click on graph for larger image.

Click on graph for larger image.This graph shows the impact of the preliminary benchmark revision on job losses in percentage terms from the start of the employment recession.

The red line on the graph is the current estimate, and the dotted line shows the impact of estimated coming benchmark revision. This puts the current payroll employment about 6.7 million jobs below the pre-recession peak in December 2007. Still very ugly.

For details on the benchmark revision process, see from the BLS: Benchmark Article and annual benchmark revision for the new preliminary estimate.

The following table shows the benchmark revisions since 1979.

| Year | Percent benchmark revision | Benchmark revision (in thousands) |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -378 |

| 2011 | 0.1 | 192 (estimate) |

| * less than 0.05% | ||

Kansas City Manufacturing Survey: Manufacturing activity expands "modestly" in September

by Calculated Risk on 9/29/2011 11:00:00 AM

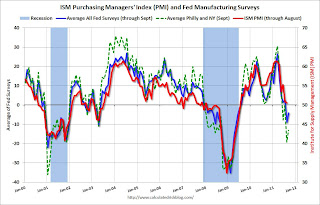

This is the last of the regional Fed surveys for September. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were weak in September, but not as weak as in August.

From the Kansas City Fed: Growth in Manufacturing Activity Edged Higher

Growth in Tenth District manufacturing activity edged higher in September. Expectations moderated slightly, but producers on net still anticipated increased activity over the next six months. Price indexes moved up modestly, with slightly more producers planning to raise selling prices.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The month-over-month composite index was 6 in September, up from 3 in August and 3 in July ... The employment index increased for the second straight month, but the new orders for exports index fell slightly after rising last month.

“Factory activity in our region continues to grow modestly, and firms generally expect this trend to continue,” said Wilkerson. “Price indexes also edged higher this month after generally decelerating earlier in the summer.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 3rd and this suggests another weak reading in September.

Earlier:

• Weekly Initial Unemployment Claims decline sharply to 391,000

• Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

by Calculated Risk on 9/29/2011 10:00:00 AM

• From the BLS: Current Employment Statistics Preliminary Benchmark Announcement

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued on February 3, 2012, with the publication of the January 2012 Employment Situation news release.Usually the final benchmark revision is pretty close to the preliminary revision.

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2011 total nonfarm employment of 192,000 (0.1 percent).

• The BEA reported that GDP increased at a 1.3% real annual rate in Q2 (third estimate), revised up from the previously reported 1.0% increase. It was still a weak quarter, but the internals were positive: the contributions from consumption and trade were revised up, and the contribution from "change in private inventories" was revised down.

• From the NAR: Pending Home Sales Decline in August

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, declined 1.2 percent to 88.6 in August from 89.7 in July but is 7.7 percent above August 2010 when it stood at 82.3. The data reflects contracts but not closings.• From Bloomberg: German Parliament Backs Euro Rescue Fund

The lower house of parliament passed the measure with 523 votes in favor and 85 against, granting the fund powers to buy bonds in secondary markets, enable bank recapitalizations and offer precautionary credit lines.A key point: German Chancellor Merkel's ruling coalition party backed the bill.

Weekly Initial Unemployment Claims decline sharply to 391,000

by Calculated Risk on 9/29/2011 08:30:00 AM

The DOL reports:

In the week ending September 24, the advance figure for seasonally adjusted initial claims was 391,000, a decrease of 37,000 from the previous week's revised figure of 428,000. The 4-week moving average was 417,000, a decrease of 5,250 from the previous week's revised average of 422,250.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 417,000.

This is the lowest level for weekly claims since early April, although the 4-week average is still elevated.

Wednesday, September 28, 2011

Treasury: Mortgage loan fraud suspicious activity reports increased in Q2, Most occurred during bubble

by Calculated Risk on 9/28/2011 09:31:00 PM

From Treasury: Second Quarter Mortgage Loan Fraud Suspicious Activity Persists

The Financial Crimes Enforcement Network (FinCEN) today reported in its Second Quarter 2011 Analysis of mortgage loan fraud suspicious activity reports (MLF SARs) that financial institutions filed 29,558 MLF SARs in the second quarter of 2011 up from 15,727 MLF SARs reported in the same quarter of 2010.The most common mortgage loan fraud suspicious activity was the misrepresentation of income, occupancy, debts, or assets (about 30%). Some of the more current frauds are related to debt elimination and short sale fraud (unfortunately attempted short sale fraud is very common).

A large majority of the MLF SARs examined in the second quarter involved mortgages closed during the height of the real estate bubble. The upward spike in second quarter MLF SAR numbers is directly attributable to mortgage repurchase demands and special filings generated by several institutions. For instance, FinCEN noted that 81 percent of the MLF SARs filed during the quarter involved suspicious activities that occurred before 2008; 63 percent involved suspicious activities that occurred four or more years ago.

"We're continuing to see a large number of SARs filed on activity that occurred more than two years ago, an indication that financial institutions are uncovering fraud as they sift through defaulted mortgages," said FinCEN Director James H. Freis, Jr.

FinCEN has some Mortgage Fraud SAR Datasets breaking down the data by state, MSA and county. California was #1 in Q2 (Nevada or Florida have usually been #1). San Jose-Sunnyvale-Santa Clara, CA was the #1 MSA.

And in a related story from the AP: Santa Rosa Hells Angels leaders indicted on loan fraud. This involved a mortgage broker and false statement of income and assets to buy marijuana "grow houses". Oh my ...

Lawler: Best Guess for August Pending Home Sales

by Calculated Risk on 9/28/2011 05:31:00 PM

From economist Tom Lawler:

It is difficult to “work up” an estimate of the NAR’s Pending Home Sales Index from local Realtor associations/boards/MLS, for several reasons. First, many of these A/B/M’s don’t release “new” pending sales data (that is, data on contracts signed in a month). Indeed, many don’t track such data at all, and as a result the NAR’s PHSI is based on a sample size about half as large as that used to estimate closed existing home sales. And second, some publicly-released A/B/M reports are run early in the month, and have preliminary pending sales that are often revised by a lot in subsequent months.

As such, my estimate of the NAR’s PHSI is subject to far more uncertainty than are my estimates for closed existing home sales.

Based on the data I do have, however, I estimate that the NAR’s August Pending Home Sales Index will probably come in about 3.5% higher than the July PHSI on a seasonally adjusted basis. While, as always, reported YOY gains vary massively across various A/B/M’s, almost all showed YOY gains and many – including but not limited to several in the Midwest – showed hefty YOY increases. Of course, July’s PHSI on a seasonally adjusted basis was 9% higher than last August’s, and this August had one more business day than last August. As such, a national YOY gain in unadjusted pending sales for August of close to 12% would produce a flat seasonally adjusted reading versus July.

In looking at various regional reports, only a handful showed YOY declines (including a few but not even close to all Florida markets), several showed modest single-digit gains (including several in the Northeast), but quite a few showed YOY gains of 20% or more (and a few by a LOT more).

A 3.5% gain would be well above the “consensus” forecast of a moderate decline.

CR Note: The NAR is scheduled to release Pending Home sales for August tomorrow (Thursday) at 10 AM ET. The consensus is for a 2% decrease in the index.

Europe Update

by Calculated Risk on 9/28/2011 03:54:00 PM

From the WSJ: Euro-Zone Bailout Plan Progresses

The euro zone is on track to expand its bailout fund ... But the debate ... has already moved on to two thornier issues: a more radical increase in the scope of bailouts, and possible debt restructuring for Greece.And a roundup of events from the Financial Times: Rolling blog: the eurozone crisis

Greece's failure to close its budget shortfall is prompting some European governments, led by Germany, to push for a re-examination of the international bailout program for Athens ... In return, Germany is under pressure to agree to "leverage" the euro-zone bailout fund ...

• José Manual Barroso, president of the European Commission, gave his annual State of the Union address ... in which he insisted Greece would remain a member of the euro, and formally approved proposals for a tax on financial transactions ...The Greek 2 year yield is at 70%. The Greek 1 year yield is at 131%.

• The European Commission confirmed that the troika would return to Athens on Thursday ... and said an additional ‘eurogroup meeting’ (where European finance ministers meet up) would be held in October to “consider the disbursement of the next tranche” of bailout money

• Finland voted to approve expanding the powers of the [EFSF]

• German inflation hit a 3-year high

• French president Nicolas Sarkozy pledged to [reduce the French] budget deficit to 3 per cent of gross domestic product in 2013

The Portuguese 2 year yield is up to 18% and the Irish 2 year yield was down sharply to 7.6%. Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Fed's Rosengren: Housing and Economic Recovery

by Calculated Risk on 9/28/2011 01:43:00 PM

From Boston Fed President Eric Rosengren: Housing and Economic Recovery

A few excepts and couple of graphs that highlight two topics we've discussed for years:

[E]even though residential investment is a small share of GDP (today only 2.2 percent), it is quite interest-sensitive – it can decline quite dramatically as interest rates rise, and expand quickly when interest rates are relatively low. So it has been a disproportionally important part of the monetary policy transmission mechanism.

In the current situation, however, U.S. mortgage rates are quite low but residential investment has not been the engine of growth that it normally is in economic recoveries. As shown in Figure 4, exports have been a source of strength in the first two years of the U.S. recovery, and business fixed investment has grown at approximately the same rate in this recovery as in the previous three. Yet the household sector has been particularly weak. Consumption, which accounts for approximately 70 percent of U.S. GDP, has grown only about half as much in the first two years of the recovery as it did in the previous three recoveries. And the shortfall for residential investment is even more striking. In the previous three recoveries, residential investment grew over 30 percent on average in the first years of the recovery – but has actually decreased in the first two years of this recovery. ...

CR Note: Residential investment (RI) is usually an engine of recovery, but with the huge overhang of existing vacant housing units, RI didn't contribute during the first two years this time. This is exactly what we've expected.

The weak housing sector also has an impact on employment. Figure 9 shows that far fewer jobs have been created in the first two years of this recovery (the left bar in each pair) than in previous recoveries (the right bar in the pair). In fact, construction jobs have continued to decline during the first two years of this recovery – we have lost over a half a million construction jobs since the recovery began. While construction employment is typically volatile during a recovery, on average the sector adds roughly 150,000 jobs.

Indeed, ... employment in construction has declined by 9 percent in the first two years of this recovery compared to growth over 4 percent during the previous three recoveries. And weak construction employment and activity also reduces the demand for labor in sectors that support construction.

CR Note: Employment is been especially weak in this recovery, and construction employment was especially hard hit. In addition to the excess housing inventory, there is excess capacity in most industries - and households have too much debt and are deleveraging.

The little bit of good news is that Residential Investment will make a positive contribution to growth this year (mostly from multi-family and home improvement), and construction employment will probably increase this year (not much).

Existing Home Inventory continues to decline year-over-year in September

by Calculated Risk on 9/28/2011 10:24:00 AM

In June, Tom Lawler posted on how the NAR estimates existing home inventory. The NAR does NOT aggregate data from the local boards (see Tom's post for how the NAR estimates inventory).

In a few months the NAR will revise down their estimates fpr inventory and sales of existing homes for the last few years. Also the NAR methodology for estimating sales and inventory will be changed.

I think the HousingTracker / DeptofNumbers data that Tom mentioned provides a timely estimate of changes in inventory. Ben at deptofnumbers.com is tracking the aggregate monthly inventory for 54 metro areas.

![]() Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the NAR estimate of existing home inventory through August (left axis) and the HousingTracker data for the 54 metro areas through September. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates this fall).

![]() The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the September listings - for the 54 metro areas - declined 16.7% from last year.

Of course there is a large percentage of distressed inventory, and various categories of "shadow inventory" too. But the decline in listed or "visible" inventory is a key story in 2011 - and listed inventory for September is probably down to the lowest level since September 2005.

Note: inventory surged in the late 2005 and early 2006 - a key sign that the housing bubble was bursting.

MBA: Mortgage Purchase Application Index increases

by Calculated Risk on 9/28/2011 07:22:00 AM

Note: The graph below includes the enhanced sample discussed last week. "The survey captures more than 75% of all U.S. retail and consumer direct mortgage applications, compared to 50% previously." For a discussion of the changes, see: Presentation to Discuss Enhancements to MBA’s Weekly Applications Survey.

There is also additional data. The weekly survey now includes mortgage rates for both conforming and jumbo loans. There is also a new Monthly Profile report (see sample here: Monthly Profile of State and National Mortgage Activity). This report breaks down the monthly application data by product type, size of loans, and state data. This appears very useful for short-term prepay modeling given the differences across states. This report is only available to subscribers.

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 11.2 percent from the previous week. The seasonally adjusted Purchase Index increased 2.6 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Mortgage rates declined last week, at least partially in response to the Fed's announcement that they would shift their portfolio towards longer-term Treasury securities, and that they would resume buying mortgage-backed securities," said Mike Fratantoni, MBA's Vice President of Research and Economics. "With lower rates, refinance application volume increased to its highest level since August 19, 2011. Purchase application volume also increased. However, the increase was in conventional purchase applications, which were up by 4.9 percent. Purchase applications for government loans fell by 0.6 percent over the week, likely influenced by the pending decline in FHA loan limits."

...

The average loan size of all loans for home purchase in the US was $212,700 in August 2011, up from $211,200 in July 2011. The average loan size for a refinance was $241,300, up from $209,200 in July.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.25 percent from 4.29 percent, with points decreasing to 0.35 from 0.41 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 4.51 percent from 4.55 percent, with points decreasing to 0.38 from 0.46 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.August was an especially weak month for this index. This increase was pretty small, and although this doesn't include the large number of cash buyers, this suggests fairly weak home sales in September and October.

Tuesday, September 27, 2011

Europe Update: Nothing Settled Yet

by Calculated Risk on 9/27/2011 08:34:00 PM

A few articles ...

From the WSJ: Greece Passes Property-Tax Law, Clearing a Path for Additional Aid

Greece's parliament approved a new property-tax law in a closely watched vote Tuesday ... The approval of the property tax is expected to open the way for the return to Athens this week of a troika of inspectors from the International Monetary Fund, the European Union and the European Central Bank.The next step will be the return of the inspectors ... and the vote on the EFSF in Germany.

From the NY Times: Merkel Rallies Wary Coalition Ahead of Vote on Greek Aid

[L]awmakers in Slovenia voted Tuesday to approve their share of the rescue fund’s guarantees. Finland’s Parliament is expected to reluctantly approve the fund measure in a vote on WednesdayThe German parliament will vote on Thursday and Friday.

[T]he German finance minister, Wolfgang Schäuble, ruled out an increase in the size of the euro zone bailout fund, though not necessarily an increase in its ability to borrow. ... Mr. Schäuble also said Tuesday that it was likely that the rescue mechanism would be further “enhanced,” though he would not give details.And the Financial Times is reporting: Split opens over Greek bail-out terms. Apparently some officials (Germany and a few others) are arguing that the private sector should take a larger haircut. So this isn't settled yet.

Eurozone finance ministers had originally hoped to sign off on the next aid tranche to Greece on Monday, but a decision is now expected to delay the next €8bn payment until an emergency meeting in two weeks.Greece apparently has enough cash until mid-October ...

excerpt with permission

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

• Real House Prices and House Price-to-Rent

ATA Trucking Index decreased slightly in August

by Calculated Risk on 9/27/2011 04:53:00 PM

From ATA: ATA Truck Tonnage Index Edged 0.2% Lower in August

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index declined 0.2% in August after falling a revised 0.8% in July 2011. July’s decrease was less than the 1.3% ATA reported on August 23, 2011. The latest drop put the SA index at 114.4 (2000=100) in August, down from the July level of 114.6.

...

Compared with August 2010, SA tonnage was up a solid 5.2%. In July, the tonnage index was 4.5% above a year earlier.

“Freight has been going sideways for much of this year, but it isn’t falling significantly either, which suggests the U.S. economy just might skirt another recession,” ATA Chief Economist Bob Costello said.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Moving sideways all year ...

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

• Real House Prices and House Price-to-Rent

Real House Prices and House Price-to-Rent

by Calculated Risk on 9/27/2011 01:42:00 PM

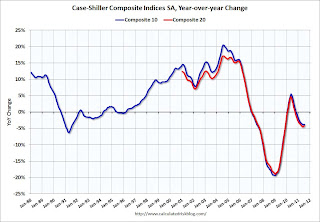

An update: Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through July) and CoreLogic House Price Indexes (through July) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to July 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to August 2000, and the CoreLogic index back to July 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to July 2000.

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

by Calculated Risk on 9/27/2011 11:15:00 AM

From CoreLogic: CoreLogic® Reports Shadow Inventory Continues to Decline

CoreLogic ... reported today that the current residential shadow inventory as of July 2011 declined slightly to 1.6 million units, representing a supply of 5 months. This is down from 1.9 million units, a supply of 6 months, from a year ago, and follows a decline from April 2011 when shadow inventory stood at 1.7 million units. The moderate decline in shadow inventory is being driven by a pace of new delinquencies that is slower than the disposition pace of distressed assets.

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLSs) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders.

...

Of the 1.6 million properties currently in the shadow inventory, 770,000 units are seriously delinquent (2.2-months’ supply) [down from 790,000 units in April], 430,000 are in some stage of foreclosure (1.2-months’ supply) [down from 440,000] and 390,000 are already in REO (1.1-months’ supply) [down from 440,000].

...

Mark Fleming, chief economist for CoreLogic, commented, “The steady improvement in the shadow inventory is a positive development for the housing market. However, continued price declines, high levels of negative equity and a sluggish labor market will keep the shadow supply elevated for an extended period of time.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

So the key number in this report is that as of July, there were 1.6 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

Note: The unlisted REO seems a little high since total REO has dropped sharply over the last couple of quarters.

Earlier:

• Case Shiller: Home Prices increased Seasonally in July

Case Shiller: Home Prices increased Seasonally in July

by Calculated Risk on 9/27/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July (actually a 3 month average of May, June and July).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data. The composite indexes were up about 0.9% in July (from June) Not Seasonally Adjusted (NSA), but flat Seasonally Adjusted (SA).

From S&P: Home Prices Continue to Show Seasonal Strength According to the S&P/Case-Shiller Home Price Indices

Data through June 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed a fourth consecutive month of increases for the 10- and 20-City Composites, with both up 0.9% in July over June. Seventeen of the 20 MSAs and both Composites posted positive monthly increases; Las Vegas and Phoenix were down over the month and Denver was unchanged.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32% from the peak, and down slightly in July (SA). The Composite 10 is 1.4% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and up slightly in July (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.8% compared to July 2010.

The Composite 20 SA is down 4.2% compared to July 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.As S&P noted, prices increased in 17 of 20 cities not seasonally adjusted (NSA). However seasonally adjusted, prices only increased in 9 cities.

Most of this prices increase was mostly seasonal. As S&P's David Blitzer said: "This is still a seasonal period of stronger demand for houses, so monthly price increases are expected ... ". The question is what happens later this year. I'll have more later ...

Merkel: Germany will help stabilize Greece

by Calculated Risk on 9/27/2011 08:41:00 AM

From the NY Times: German Leader Reaffirms Backing for Greece

Promising that Athens would live up to its commitments, the Greek prime minister urged Europe to pull together to take the steps needed to head off a potentially disastrous escalation in the sovereign debt crisis.And from the Financial Times: Rolling blog: the eurozone crisis

In a speech to the same group of German business leaders, Chancellor Angela Merkel said Germany would provide all the help it could to stabilize Greece.

...

Mrs. Merkel urged lawmakers to back the bill “in a spirit of friendship, a spirit of partnership, not in a spirit of imposing something.”

“If Europe isn’t doing well, then over the medium term Germany won’t do well,” she said.

Our Athens reporter, Dimitris Kontogiannis, has set out the main details of the property tax ...It sounds like the property tax will pass - and that the German parliament will approve the changes to the EFSF on Thursday.

• The new tax will apply, with a few exceptions, to all electricity-powered buildings

• Those who refuse to pay will have their electricity cut off...

• The government estimates the new tax could raise €2bn-€2.5bn a year...

Monday, September 26, 2011

Europe: A few key dates

by Calculated Risk on 9/26/2011 10:21:00 PM

To help keep track ...

• There is a vote on Tuesday in Greece concerning the new property tax around 12 PM ET (there will be protests too). I think this also includes some cuts in public sector too.

• Prime Minister George Papandreou will be in Germany on Tuesday for a meeting with Chancellor Angela Merkel.

• The "troika" inspectors (EU-IMF-ECB) will not return until the new legislation is passed.

• The EU Finance Ministers meet on Monday, October 3rd, and there is very little time for the inspectors to complete their work and still allow the Finance Ministers to vote on the release of the next loan installment. Greece needs the disbursement by mid-October to meet their obligations through the end of the year.

• On Thursday, the German Parliament will vote on increasing the European Financial Stability Facility (EFSF) according to the agreement reached on July 21st.

On August Home Sales:

• New Home Sales decline slightly in August

• Last week: Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

On Pace for Record Low New Home Sales in 2011

by Calculated Risk on 9/26/2011 07:35:00 PM

Alejandro Lazo at the LA Times wrote today: New home sales stuck at the bottom in August

"This year is shaping up to be the worst year on record for new home sales," [Patrick Newport, U.S. economist with IHS Global Insight] wrote in a note.The Census Bureau started tracking New Home sales in 1963, and the record low was 412,000 in 1982 - until that record was broken in 2009 - and then again in 2010 - and it looks another new record in 2011.

Here is a table of the last ten years - remember that sales in 2009 and 2010 were boosted by the tax credit.

| New Home Sales | ||

|---|---|---|

| Year | Total | Total through August |

| 2000 | 877 | 608 |

| 2001 | 908 | 644 |

| 2002 | 973 | 670 |

| 2003 | 1,086 | 759 |

| 2004 | 1,203 | 841 |

| 2005 | 1,283 | 906 |

| 2006 | 1,051 | 756 |

| 2007 | 776 | 577 |

| 2008 | 485 | 365 |

| 2009 | 375 | 261 |

| 2010 | 323 | 231 |

| 2011 | 3031 | 211 |

| 1Current 2011 Pace | ||

On August Home Sales:

• New Home Sales decline slightly in August

• Last week: Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

Report: Plan to increase European Bank Capital

by Calculated Risk on 9/26/2011 03:55:00 PM

From CNBC: Officials Working on a Sovereign Debt TARP for Europe?

European officials are working on a detailed plan aimed at shoring up European bank stability, according to an official who spoke with CNBC’s Steve Liesman.More details at the article.

The plan appears to have a lot of moving parts. It would involve money from the European Financial Stability Facility (EFSF), a bailout vehicle created in 2010 to alleviate the sovereign debt crisis in Europe, to capitalize a special purpose vehicle that would be created by the European Investment Bank, a bank owned by the member states of the European Union.

The Greek 2 year yield was up to 71%. The Greek 1 year yield is at 138%.

The Portuguese 2 year yield is up to 18.2% and the Irish 2 year yield was down to 8.8%.

The Italian 10 year yield was up slightly to 5.6%.

On August Home Sales:

• New Home Sales decline slightly in August

• Last week: Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

Misc: Dallas Fed Manufacturing Survey picks up, Home Sales Distressing Gap

by Calculated Risk on 9/26/2011 12:09:00 PM

On New Home sales: Since new home sales are reported when contracts are signed, and consumer sentiment fell off a cliff in August following the debt ceiling debate, I thought we might see an even large decline for August new home sales. This was still a weak report - the 16th month in a row with sales around 300 thousand SAAR - but I thought it might even be worse.

• Dallas Fed: Texas Manufacturing Activity Picks Up

Texas factory activity increased in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 1.1 to 5.9, suggesting growth picked up this month after stalling in August.Some improvement. There will be two more regional manufacturing surveys released this week and the ISM survey next week.

Most other measures of current manufacturing conditions also indicated growth in September. The new orders index edged down from 4.8 to 3.6 this month, suggesting order volumes continued to increase, but at a slightly decelerated pace. The shipments index rose from 6.7 to 9.4, reaching its highest level since March. The capacity utilization index remained in negative territory in September but rose from –2.8 to –1.3.

Perceptions of general business conditions worsened in September. The general business activity index remained negative for the fifth month in a row and fell from –11.4 to –14.4; ten percent of manufacturers perceived an increase in activity this month, while one quarter noted a decrease. The company outlook index fell from 7.2 in August to a near-zero reading in September. Still, the great majority of respondents said their outlooks were unchanged or improved from last month.

Labor market indicators reflected higher labor demand growth. The employment index came in at 13.4, up notably from 5.4 in August. One quarter of manufacturers reported hiring new workers, while 12 percent reported layoffs. The hours worked index moved back into positive territory in September, suggesting average workweeks lengthened.

• Distressing Gap: The following graph shows existing home sales (left axis) and new home sales (right axis) through August. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different. Also the National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009 and 2010. Even with these revisions, most of the "distressing gap" will remain.

On August Home Sales:

• New Home Sales decline slightly in August

• Last week: Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

New Home Sales decline slightly in August

by Calculated Risk on 9/26/2011 10:00:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 295 thousand. This was down from a revised 302 thousand in July (revised up from 298 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in August 2011 were at a seasonally adjusted annual rate of 295,000 ... This is 2.3 percent (±13.9%) below the revised July rate of 302,000, but is 6.1 percent (±18.8%) above the August 2010 estimate of 278,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply increased slightly to 6.6 in August. The all time record was 12.1 months of supply in January 2009. This is still higher than normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of August was 162,000. This represents a supply of 6.6 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 60,000 units in August. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2011 (red column), 26 thousand new homes were sold (NSA). The record low for August was 23 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for August was 110 thousand in 2005.

This was at the consensus forecast of 295 thousand, and was not far above the record low for the month of August set last year. New home sales have averaged only 300 thousand SAAR over the 16 months since the expiration of the tax credit ... moving sideways at a very low level.

Chicago Fed: Economic activity weakened in August

by Calculated Risk on 9/26/2011 08:30:00 AM

This is a composite index from the Chicago Fed: Index shows economic activity weakened in August

Led by declines in production- and employment-related indicators, the Chicago Fed National Activity Index decreased to –0.43 in August from +0.02 in July. Contributions from three of the four broad categories of indicators that make up the index declined from July, and three of the four were negative in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

...

The index’s three-month moving average, CFNAI-MA3, ticked down to –0.28 in August from –0.27 in July. August’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was still growing in August, but below trend.

Weekend:

• Schedule for Week of Sept 25th

• Summary for Week Ending Sept 23rd

Sunday, September 25, 2011

Europe Update: Merkel says "Barrier" around Greece Needed

by Calculated Risk on 9/25/2011 08:36:00 PM

The clock is ticking ...

From Bloomberg: ‘Barrier’ Around Greece Needed: Merkel

German Chancellor Angela Merkel said euro-region leaders must erect a firewall around Greece to avert a cascade of market attacks on other European states ...From the NY Times: Investors Ask if Anything Can Save Greece From Default

“We have to be in a position to react,” Merkel said. “We have to be able to put up a barrier.” Even so, “I don’t rule out at all that at some point we will have the question whether one can do an insolvency of states just like with banks.”

Merkel rejected Greece leaving the euro area, saying that “we can’t force it, but I don’t believe in that in any case” ... “Maybe Greece leaves, the next country leaves and then the next country after that,” she said. “They would speculate against all the countries.” ...

Merkel suggested that Greece may be able to get the next tranche of bailout aid, after a team of officials from the IMF, the ECB and the European Commission assess the Greek government’s progress ... Merkel is due to host Greek Prime Minister George Papandreou for talks in Berlin on Sept. 27, two days before German lawmakers vote on the enhanced rescue fund...

Under intense pressure from the United States, euro zone leaders spent the weekend in Washington working to craft a rescue plan to bolster sickly banks and buy the bonds of weak countries like Italy. But past efforts to bring an end to the debt crisis in Europe — including a second, €109 billion rescue plan for Greece forged by Europe and the International Monetary Fund in July — have failed to stand up. Investors remain skeptical that another plan will be any different.I'm not sure what the barrier will be, but just about everyone is now accepting that Greece will default (except a few Greek politicians). The question remains when - and what happens after they default.

...

With Greek government debt trading on the open market below 40 cents on the dollar, it is quickly approaching what debt experts call the recovery rate — the price investors would get for their bonds if the country officially defaulted.

In effect, that means investors have given up.

Update on Gasoline Prices

by Calculated Risk on 9/25/2011 04:14:00 PM

From Reuters: U.S. gasoline prices slide; more to come-survey

The average price for a gallon of gasoline in the United States tumbled 12.23 cents in the past two weeks and appeared poised to drop even more as crude oil prices weaken, the nationwide Lundberg survey showed on Sunday.Gasoline prices jumped from about $3.10 per gallon in early February to over $3.50 per gallon in early March as Brent crude oil prices increased from about $100 per barrel to over $120 per barrel. (WTI increased from around $85 per barrel to over $110 per barrel early this year).

The national average price was $3.5446 on Sept. 23, down from $3.67 two weeks ago ...

Since oil prices have declined back to the early February levels (Bloomberg: WTI is at $80 per barrel and Brent is at $104), gasoline prices will probably decline too.

Note: This graph show oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Schedule for Week of Sept 25th

• Summary for Week Ending Sept 23rd

Bank Failures per Week in 2011

by Calculated Risk on 9/25/2011 02:01:00 PM

I haven't updated this graph for some time ...

There have been 395 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | |

|---|---|

| 2007 | 3 |

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 157 |

| 20111 | 73 |

| Total | 395 |

| 1Through Sept 23, 2011. | |

This graph shows the cumulative bank failures by week in 2008, 2009, 2010 and 2011.

There are still quite a few problem banks, so there are probably quite a few banks failures to come.

Report: Six Week deadline to Prepare New European Plan

by Calculated Risk on 9/25/2011 09:23:00 AM

A little Sunday morning speculation ...

From the Telegraph: Multi-trillion plan to save the eurozone being prepared

German and French authorities have begun work on a three-pronged strategy behind the scenes amid escalating fears that the eurozone’s sovereign debt crisis is spiralling out of control.Earlier:

...

According to sources, progress has been made at the G20 meeting in Washington ... the world’s leading economies set themselves a six-week deadline to resolve the crisis – to unveil a solution by the G20 summit in Cannes on November 4.

...

First, Europe’s banks would have to be recapitalised with many tens of billions of euros to reassure markets that a Greek or Portuguese default would not precipitate a systemic financial crisis. ... Officials are confident that some banks could raise the funds privately, but if they are unable they would either be recapitalised by the state or by the European Financial Stability Facility (EFSF) ...

The second leg of the plan is to bolster the EFSF. Economists have estimated it would need about Eu2 trillion of firepower to meet Italy and Spain’s financing needs in the event that the two countries were shut out of the markets. Officials are working on a way to leverage the EFSF through the European Central Bank to reach the target.

The complex deal would see the EFSF provide a loss-bearing “equity” tranche of any bail-out fund and the ECB the rest in protected “debt”.

...

As quid pro quo for an enhanced bail-out, the Germans are understood to be demanding a managed default by Greece but for the country to remain within the eurozone.

• Schedule for Week of Sept 25th

• Summary for Week Ending Sept 23rd

Saturday, September 24, 2011

Report: Germany and France Open to New Proposal

by Calculated Risk on 9/24/2011 10:45:00 PM

From the NY Times: Europe Seeks to Ratchet Up Effort on Debt

Under increasing pressure from global investors and world leaders, European government officials indicated Saturday that they were working to intensify their response to the continent’s growing debt problems.If this follows previous leaks, German Finance Minister Wolfgang Schaeuble will probably deny this tomorrow.

...

French and German officials here continued to insist publicly that they were focused on the July plan, but in private meetings this weekend they made clear that they now understand the need for a new proposal ...

“The threat of cascading default, bank runs and catastrophic risk must be taken off the table, as otherwise it will undermine all other efforts, both within Europe and globally,” Treasury Secretary Timothy F. Geithner said in a statement on Saturday. “Decisions as to how to conclusively address the region’s problems cannot wait until the crisis gets more severe.

Unofficial Problem Bank list at 986 Institutions

by Calculated Risk on 9/24/2011 07:23:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 23, 2011.

Changes and comments from surferdude808:

Finally, the OCC released some information on its recent enforcement action activity. Interestingly, the information only included actions against national banks as the OCC has yet to release any activity with thrifts since the merger with the OTS this summer. This week, there were five removals and seven additions and the changes leave the Unofficial Problem Bank List with 986 institutions and assets of $400.4 billion. Comparatively, there were 872 institutions with assets of $422.4 billion on the list a year ago.Earlier:

The removals include an action termination against Border Capital Bank, National Association, McAllen, TX ($171 million); and two unassisted mergers -- GreenBank, Greenville, TN ($2.3 billion Ticker: GRNB) and The Merchants & Farmers Bank, Melville, LA ($8 million). Other removals include the two failures -- Bank of the Commonwealth, Norfolk, VA ($985 million Ticker: CWBS) and Citizens Bank of Northern California, Nevada City, CA ($289 million Ticker: CZNB).

Among the additions are Citizens National Bank of Texas, Waxahachie, TX ($526 million); Grayson National Bank, Independence, VA ($358 million Ticker: GSON); Fidelity National Bank, West Memphis, AR ($327 million); and Intercredit Bank, National Association, Miami, FL ($256 million). Long-time readers may remember that Intercredit Bank, N.A. was removed in July when the OCC terminated a Formal Agreement only to return this week under a Consent Order. The OCC is asymmetrical in the publication of its actions with terminations happening more real-time while new actions are issued with a lag. Perhaps the removal of Border Capital Bank, N.A. may prove premature if its Formal Agreement is actually replaced by a Consent Order like Intercredit Bank, N.A.

Next week, we expect the FDIC to release its actions through August 2011.

• Schedule for Week of Sept 25th

• Summary for Week Ending Sept 23rd

Schedule for Week of Sept 25th

by Calculated Risk on 9/24/2011 02:11:00 PM

Earlier:

• Summary for Week Ending Sept 23rd

There are two key housing reports to be released early in the week: New Home sales on Monday, and Case-Shiller house prices on Tuesday.

Other key releases include the third estimate of Q2 GDP on Thursday, and August Personal Income and Outlays on Friday. Several high frequency releases will be closely watched: weekly initial unemployment claims, consumer sentiment (final) and three more regional Fed manufacturing surveys and the Chicago Purchasing Managers Index.

8:30 AM ET: Chicago Fed National Activity Index (August). This is a composite index of other data.

9:15 AM: Speech, Fed Governor Sarah Bloom Raskin, "Monetary Policy and Job Creation" At the University of Maryland Smith School of Business Distinguished Speaker Series, Washington, D.C.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight decrease in sales to 295 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 298 thousand in July. Given that new home sales are reported when contracts are signed - and August was an especially weak month due to the debt ceiling debate - sales might fall even further.

10:30 AM: Dallas Fed Manufacturing Survey for September. The Texas production index increased 1.1 in August.

9:00 AM: S&P/Case-Shiller Home Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July.

9:00 AM: S&P/Case-Shiller Home Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The consensus is for prices to increase 0.1% in July. The CoreLogic index showed a 0.8% increase in July (NSA). Based on other price indexes, the Case-Shiller index will probably increase a little more than the consensus.

10:00 AM: Conference Board's consumer confidence index for September. The consensus is for an increase to 46.2 from 44.5 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September. The consensus is for the index to be at -9, up slightly from -10 in August (below zero is contraction).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak over the last month.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.4% decrease in durable goods orders after increasing 4.0% in July.

5:00 PM: Speech, Fed Chairman Ben Bernanke, "Lessons from Emerging Market Economies on the Sources of Sustained Growth", At the Cleveland Clinic Ideas for Tomorrow Speaker Series, Cleveland, Ohio

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 420,000 from 423,000 last week.

8:30 AM: Q2 GDP (third estimate). This is the third estimate for Q2 GDP from the BEA.

8:30 AM: Q2 GDP (third estimate). This is the third estimate for Q2 GDP from the BEA.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The first estimate was for 1.3% real annualized growth in Q2. Growth was revised down to 1.0% in the 2nd estimate. The consensus is for an upward revision to 1.2% in Q2.

10:00 AM: Pending Home Sales Index for August. The consensus is for a 2% decrease in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for September. The index was at 3 in August (slight expansion).

8:30 AM: Personal Income and Outlays for July. The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars).

8:30 AM: Personal Income and Outlays for July. The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). PCE increased 0.8 in July, and real PCE increased 0.5% as the price index for PCE increased 0.4 percent in July.

The consensus is for a 0.1% increase in personal income in August, and a 0.2% increase in personal spending, and for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a decrease to 55.4, down from 56.5 in August.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for no change from the preliminary reading of 57.8.