by Calculated Risk on 8/31/2011 07:22:00 PM

Wednesday, August 31, 2011

Lawler: Census 2010: Homeownership Rates by Selected Age Groups

Update from Lawler: Yesterday I gave some stats on the "states" with the highest and lowest shares of owner-occupied homes owned free and clear. Those %'s were incorrect; they were %'s for the % of ALL occupied homes owner free and clear. (My bad).

From economist Tom Lawler:

While Census has not released “Summary File 1” for the US as a whole, it has released such data for all 50 states plus DC. As such, aggregate US data from these files, including homeownership rates by selected age groups, can be constructed using the mathematical tools called “addition” and “division.”

Note the sizable declines in homeownership rates over the last decade in the 25-54 year old age groups!

| US Homeownership by Age Group (Decennial Census) | ||||

|---|---|---|---|---|

| 1980 | 1990 | 2000 | 2010 | |

| 15 to 24 years | 22.1% | 17.1% | 17.9% | 16.1% |

| 25 to 34 years | 51.6% | 45.3% | 45.6% | 42.0% |

| 35 to 44 years | 71.2% | 66.2% | 66.2% | 62.3% |

| 45 to 54 years | 77.0% | 75.3% | 74.9% | 71.5% |

| 55 to 64 years | 77.6% | 79.7% | 79.8% | 77.3% |

| 65 years and over | 70.1% | 75.2% | 78.1% | 77.5% |

| Total | 64.4% | 64.2% | 66.2% | 65.1% |

Here is a comparison of the decennial Census homeownership rates (which reflect April 1st) and the Housing Vacancy Survey (which are yearly average estimates). HVS data by age group only go back to 1982.

| US Homeownership by Age Group (Housing Vacancy Survey) | ||||

|---|---|---|---|---|

| 1980 | 1990 | 2000 | 2010 | |

| 15 to 24 years | --- | 15.7% | 21.7% | 22.8% |

| 25 to 34 years | --- | 44.2% | 47.1% | 44.4% |

| 35 to 44 years | --- | 66.3% | 67.9% | 65.0% |

| 45 to 54 years | --- | 75.2% | 76.5% | 73.5% |

| 55 to 64 years | --- | 79.3% | 80.3% | 79.0% |

| 65 years and over | --- | 76.3% | 80.4% | 80.5% |

| Total | --- | 63.9% | 67.4% | 66.9% |

While the decennial Census data show that the homeownership rates for all age groups save for “geezers” in 2010 were down significantly from 1990, the HVS data do not show the same declines. Census officials are unsure of why there are such large discrepancies, but most – though not all -- feel that the decennial Census data are more accurate, and that there is “sumpin’ wrong” with the HVS data (the same is true for the HVS vacancy data), and not just for 2010, but for 2000 as well.

Some readers might be surprised at the sizable declines in the homeownership rates for younger householders from 1980 to 1990 – after all, they’ve been deluged with charts showing “aggregate” US homeownership rates over the last several years, but with little or no discussion of homeownership rates by age group. There was actually a fair amount written about the drop in younger householder homeownership rates from 1980 to 1990, with researchers attributing the decline to a number of factors – younger folks marrying later in life, job choices and labor mobility, and several other factors (I don’t plan to summarize the literature.)

Also from Tom Lawler: Number of Homes Owned Free and Clear

Here is a table derived from the decennial Census 2010 on the number of owner-occupied homes with a mortgage vs. those owned free and clear.

| Owner-Occupied Homes (Census 2010) | |

|---|---|

| Total | 75,986,074 |

| Owned with a mortgage or loan | 52,979,430 |

| Owned free and clear | 23,006,644 |

Update: By state with correction:

| % of OO Homes owned free and clear, 2010 | |

|---|---|

| US Total | 30.3% |

| Alabama | 36.6% |

| Alaska | 31.2% |

| Arizona | 27.9% |

| Arkansas | 38.9% |

| California | 22.3% |

| Colorado | 22.3% |

| Connecticut | 26.4% |

| Delaware | 28.2% |

| District of Columbia | 19.6% |

| Florida | 33.0% |

| Georgia | 25.6% |

| Hawaii | 29.3% |

| Idaho | 29.1% |

| Illinois | 28.3% |

| Indiana | 27.9% |

| Iowa | 34.8% |

| Kansas | 33.3% |

| Kentucky | 35.9% |

| Louisiana | 40.9% |

| Maine | 33.5% |

| Maryland | 21.2% |

| Massachusetts | 25.8% |

| Michigan | 31.3% |

| Minnesota | 27.2% |

| Mississippi | 41.5% |

| Missouri | 31.5% |

| Montana | 38.5% |

| Nebraska | 33.7% |

| Nevada | 21.4% |

| New Hampshire | 27.5% |

| New Jersey | 27.1% |

| New Mexico | 37.7% |

| New York | 33.0% |

| North Carolina | 30.3% |

| North Dakota | 42.9% |

| Ohio | 30.0% |

| Oklahoma | 37.7% |

| Oregon | 28.2% |

| Pennsylvania | 35.0% |

| Rhode Island | 26.2% |

| South Carolina | 33.9% |

| South Dakota | 39.1% |

| Tennessee | 34.1% |

| Texas | 34.4% |

| Utah | 23.7% |

| Vermont | 31.9% |

| Virginia | 25.3% |

| Washington | 25.6% |

| West Virginia | 47.7% |

| Wisconsin | 30.3% |

| Wyoming | 36.5% |

CR Note: So, in 2010, about 30.3% of owner-occupied homes were owned free and clear. There will be much more on the 2010 Census data once the Summary File is released.

Fannie Mae and Freddie Mac Serious Delinquency Rates mostly unchanged in July

by Calculated Risk on 8/31/2011 04:15:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 4.08% in July. This is down from 4.82% in July of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.51% in July from 3.50% in June. This is down from 3.89% in July 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Note that the Fannie and Freddie serious delinquency rates are much lower than the overall serious delinquency rate (LPS reported that the overall serious delinquency rate and in-foreclosure was 7.72% in July).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent.

Although the delinquency rate was unchanged in July, the serious delinquency rate has been falling as Fannie and Freddie work through the backlog of delinquent loans.

The normal serious delinquency rate is under 1%, and it doesn't look like the delinquency rate will be back to "normal" for a number of years.

Restaurant Performance Index declined in July

by Calculated Risk on 8/31/2011 01:41:00 PM

From the National Restaurant Association: Restaurant Industry Outlook Softened in July as Restaurant Performance Index Slipped to Its Lowest Level in 11 Months

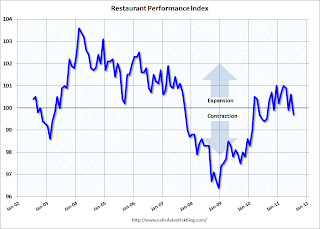

As a result of softer same-store sales and traffic levels and a dampened outlook among restaurant operators, the National Restaurant Association’s (www.restaurant.org) Restaurant Performance Index (RPI) fell below 100 in July. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.7 in July, down from 100.6 in June and the lowest level in 11 months.

“Although same-store sales and customer traffic levels remained positive in July, restaurant operators’ outlook for the economy took a pessimistic turn,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “This survey month was burdened with the debt ceiling crisis and the downgrade in the nation’s credit rating, which added an additional layer of uncertainty in an already fragile economic recovery.”

...

Restaurant operators reported somewhat softer same-store sales results in July. ... Restaurant operators also reported softer customer traffic levels in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index declined to 99.7 in July (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

This is a minor report, but still interesting (barely "D-List" data).

CoreLogic: Home Price Index increased 0.8% in July

by Calculated Risk on 8/31/2011 10:10:00 AM

• First on the Chicago PMI Chicago Business Barometer™ Slipped: The overall index decreased to 56.5 from 58.8 in July. This was above consensus expectations of 53.5. Note: any number above 50 shows expansion. The employment index increased to 52.1 from 51.5. The new orders index decreased to 56.9 from 59.4.

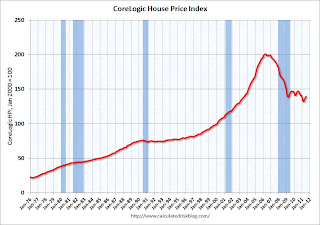

• Notes: This CoreLogic Home Price Index is for July. The Case-Shiller index released yesterday was for June. Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of May, June and July (July weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® July Home Price Index Shows Fourth Consecutive Month-Over-Month Increase

CoreLogic ... today released its July Home Price Index (HPI) which shows that home prices in the U.S. increased for the fourth consecutive month, inching up 0.8 percent on a month-over-month basis. On a year-over-year basis, however, national home prices, including distressed sales, declined by 5.2 percent in July 2011 compared to July 2010. In June 2011, prices declined by 6.0 percent* compared to June 2010. Excluding distressed sales, year-over-year prices declined by 0.6 percent in July 2011 compared to July 2010 and by 1.9* percent in June 2011 compared to June 2010. Distressed sales include short sales and real estate owned (REO) transactions. [*CR note: June index was revised up]

“While July’s numbers remained relatively positive, particularly for non-distressed sales which have been stable, seasonal influences are expected to fade in late summer. At that point the month-over-month growth will most likely turn negative. The slowdown in economic growth and increased uncertainty caused by the recent stock market volatility will continue to exert downward pressure on prices,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.8% in July, and is down 5.2% over the last year, and off 30.6% from the peak - and up 5.5% from the March low.

As Mark Fleming noted, some of this increase is seasonal (the CoreLogic index is NSA) and the index is still off 5.2% from last July. Month-to-month prices will probably turn negative later this year (the normal seasonal pattern).

Yesterday:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

• LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

ADP: Private Employment increased 91,000 in August

by Calculated Risk on 8/31/2011 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector rose 91,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated advance in employment from June to July was revised down modestly to 109,000, from the initially reported 114,000.Note: ADP is private nonfarm employment only (no government jobs).

...

Employment in the service-providing sector rose by 80,000 in August, marking 20 consecutive months of employment gains. Employment in the goods-producing sector rose by 11,000 in August, up from a loss of 2,000 jobs last month. Manufacturing employment slipped 4,000 in August.

This was slightly below the consensus forecast of an increase of 100,000 private sector jobs in August. The BLS reports on Friday, and the consensus is for an increase of 67,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

Of course the ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Purchase Activity "near 15-year lows"

by Calculated Risk on 8/31/2011 07:13:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 12.2 percent from the previous week. The seasonally adjusted Purchase Index increased 0.9 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Refinance application volume declined for a second week from recent highs, despite rates staying near a 10-month low, while purchase volume remained near 15-year lows," said Mike Fratantoni, MBA's Vice President of Research and Economics.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.32 percent from 4.39 percent, with points increasing to 1.30 from 0.88 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is now at the lowest levels since August 1995!

This doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the last three weeks, and this suggests weak home sales in the coming months.

Tuesday, August 30, 2011

LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

by Calculated Risk on 8/30/2011 08:14:00 PM

LPS Applied Analytics released their July Mortgage Monitor Report today. From LPS: LPS' Mortgage Monitor Report Shows Average Loan in Foreclosure Is Delinquent for Record 599 Days; First-Time Foreclosure Starts Near Three-Year Lows

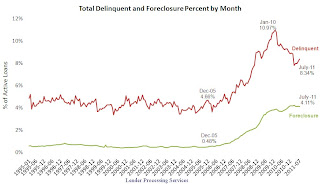

The July Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure timelines continue their steady upward trend, as a payment has not been made on the average loan in foreclosure in a record 599 days. Of the nearly 1.9 million loans that are 90 or more days delinquent but not yet in foreclosure, 42 percent have not made a payment in more than a year with an average delinquency of 397 days, also a new record. At the same time, first-time foreclosure starts in June were near three-year lows, and first-time delinquencies accounted for only 25 percent of new delinquent inventory.According to LPS, 8.34% of mortgages were delinquent in July, up from 8.15% in June, and down from 9.31% in July 2010.

As of the end of June, 4.1 million loans were either 90 or more days delinquent or in foreclosure, as delinquencies remain two times and foreclosures eight times pre-crisis levels. Foreclosure sales remain constricted, with foreclosure starts outnumbering sales by a factor of almost three to one.

LPS reports that 4.11% of mortgages were in the foreclosure process, down slightly from 4.12% in June, and up from 3.74% in July 2010. This gives a total of 12.45% delinquent or in foreclosure. It breaks down as:

• 2.48 million loans less than 90 days delinquent.

• 1.90 million loans 90+ days delinquent.

• 2.16 million loans in foreclosure process.

For a total of 6.54 million loans delinquent or in foreclosure in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has increased recently (part of the increase is seasonal), but the rate has fallen to 8.34% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.16 million) - and the average loan in foreclosure has been delinquent for a record 599 days!

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.Looking at this graph, one might expect the number of loans in the foreclosure process to be increasing sharply since there are so many more starts than sales.

And there are very few cures too - what is happening is a large number of loans each month have been moving from "in foreclosure" back to "90+ days delinquent" status - so the number of loans "in foreclosure" hasn't increased recently.

The third graph shows mortgage origination by the original term.

The third graph shows mortgage origination by the original term. This graph is interesting because of the surge in shorter duration loans.

This is probably being driven by two factors: 1) older borrowers are hoping to pay off their loans as part of their retirement planning and are taking out 15 year mortgages, and 2) many jumbo borrowers are probably taking out 5 year loans with a balloon payment since 30 year jumbo rates are much higher.

Earlier:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

Recession Measures

by Calculated Risk on 8/30/2011 05:39:00 PM

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that most major indicators are still way below the pre-recession peaks.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.5% below the previous pre-recession peak. However Gross Domestic Income (red) is now back to the pre-recession peak. (For a discussion of GDI, see here).

At the worst point, real GDP was off 5.1% from the 2007 peak. Real GDI was off 5.7% at the trough.

And real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through July.

This graph shows real personal income less transfer payments as a percent of the previous peak through July.

With the revisions, this measure was off almost 11% at the trough - a significant downward revision!

Real personal income less transfer payments is still 4.8% below the previous peak.

This graph is for industrial production through July.

This graph is for industrial production through July.

Industrial production had been one of the stronger performing sectors because of inventory restocking and some growth in exports.

However industrial production is still 6.5% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

On the timing of the trough of the recession, GDP and industrial production would suggest the end of Q2 2009 (and June 2009). The other two indicators would suggest later troughs.

And of course the recovery in all indicators has been very sluggish compared to recent recessions.

Earlier:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

FOMC Minutes: Discussed Options for additional monetary accommodation

by Calculated Risk on 8/30/2011 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, August 9, 2011. Excerpts:

Participants discussed the range of policy tools available to promote a stronger economic recovery should the Committee judge that providing additional monetary accommodation was warranted. Reinforcing the Committee's forward guidance about the likely path of monetary policy was seen as a possible way to reduce interest rates and provide greater support to the economic expansion; a few participants emphasized that guidance focusing solely on the state of the economy would be preferable to guidance that named specific spans of time or calendar dates. Some participants noted that additional asset purchases could be used to provide more accommodation by lowering longer-term interest rates. Others suggested that increasing the average maturity of the System's portfolio--perhaps by selling securities with relatively short remaining maturities and purchasing securities with relatively long remaining maturities--could have a similar effect on longer-term interest rates. Such an approach would not boost the size of the Federal Reserve's balance sheet and the quantity of reserve balances. A few participants noted that a reduction in the interest rate paid on excess reserve balances could also be helpful in easing financial conditions. In contrast, some participants judged that none of the tools available to the Committee would likely do much to promote a faster economic recovery, either because the headwinds that the economy faced would unwind only gradually and that process could not be accelerated with monetary policy or because recent events had significantly lowered the path of potential output. Consequently, these participants thought that providing additional stimulus at this time would risk boosting inflation without providing a significant gain in output or employment. Participants noted that devoting additional time to discussion of the possible costs and benefits of various potential tools would be useful, and they agreed that the September meeting should be extended to two days in order to provide more time.The forward guidance was included in the last FOMC statement. The other three options are: Additional asset purchases (QE3), extend maturities, and reduce interest paid on reserves. As Bernanke noted in his Jackson Hole speech, the next meeting has been extended to allow for more discussion of these options.

...

In the discussion of monetary policy for the period ahead, most members agreed that the economic outlook had deteriorated by enough to warrant a Committee response at this meeting. While all felt that monetary policy could not completely address the various strains on the economy, most members thought that it could contribute importantly to better outcomes in terms of the Committee's dual mandate of maximum employment and price stability. In particular, some members expressed the view that additional accommodation was warranted because they expected the unemployment rate to remain well above, and inflation to be at or below, levels consistent with the Committee's mandate. Those viewing a shift toward more accommodative policy as appropriate generally agreed that a strengthening of the Committee's forward guidance regarding the federal funds rate, by being more explicit about the period over which the Committee expected the federal funds rate to remain exceptionally low, would be a measured response to the deterioration in the outlook over the intermeeting period. A few members felt that recent economic developments justified a more substantial move at this meeting, but they were willing to accept the stronger forward guidance as a step in the direction of additional accommodation. Three members dissented because they preferred to retain the forward guidance language employed in the June statement.

Real House Prices and Price-to-Rent

by Calculated Risk on 8/30/2011 11:25:00 AM

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through June) and CoreLogic House Price Indexes (through June) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to May 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to May 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to May 2000.

Earlier:

• Case Shiller: Home Prices increased in June

Case Shiller: Home Prices increased in June

by Calculated Risk on 8/30/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June (actually a 3 month average of April, May and June).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities), plus the Q2 2011 quarterly national house price index.

Note: Case-Shiller reports NSA, I use the SA data. The composite indexes were up about 1.1% in June (from May) Not Seasonally Adjusted (NSA), but flat Seasonally Adjusted (SA).

From S&P: Nationally, Home Prices Went Up in the Second Quarter of 2011 According to the S&P/Case-Shiller Home Price Indices

Data through June 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... show that the U.S. National Home Price Index increased by 3.6% in the second quarter of 2011, after having fallen 4.1% in the first quarter of 2011. With the second quarter’s data, the National Index recovered from its first quarter low, but still posted an annual decline of 5.9% versus the second quarter of 2010. Nationally, home prices are back to their early 2003 levels.

...

As of June 2011, 19 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were up versus May – Portland was flat. However, they were all down compared to June 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.9% from the peak, and up slightly in June (SA). The Composite 10 is 1.5% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.9% from the peak, and down slightly in June (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.9% compared to June 2010.

The Composite 20 SA is down 4.6% compared to June 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in June seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.7% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in June seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.7% from the peak.From S&P (NSA):

“Nineteen of the 20 MSAs and both Composites were up in June over May. Portland was flat. Cleveland has improved enough that average home prices in this market are back above its January 2000 levels. Only Detroit and Las Vegas remain below those levelsThere could be some confusion between the SA and NSA numbers, but this increase was mostly seasonal. I'll have more later ...

Monday, August 29, 2011

House Price Preview

by Calculated Risk on 8/29/2011 09:00:00 PM

The Case-Shiller House Price index for June will be released tomorrow morning. Here is a roundup of a few other indexes:

• CoreLogic: Home Price Index increased 0.7% in June

[H]ome prices in the U.S. increased by 0.7 percent in June 2011 compared to May 2011, the third consecutive month-over-month increase. According to CoreLogic, national home prices, including distressed sales, declined by 6.8 percent in June 2011 compared to June 2010• FNC: June Home Prices Up for Third Straight Month

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ 1 (RPI) indicates that single-family home prices were up in June at a seasonally unadjusted rate of 0.9%. As a gauge of underlying home value, the RPI excludes sales of foreclosed homes, which are often sold with large price discounts due to poor property conditions.• FHFA Expanded House Price Index (quarterly)

The expanded FHFA national series was down 1.1 percent in Q2 (Seasonally adjusted), and down 6.1% from Q2 2010 ...• Zillow: Real Estate Market Reports indicated house prices declined 0.1% in June.

• From RadarLogic Housing Markets Continue to Show Weakness

The RPX Composite price, which tracks housing values in 25 major metropolitan markets in the United States, declined 4.7 percent year over year through June. [CR Note: The 25-city composite index increased 1.7% in June 2011.]The Case-Shiller index for June will be released Tuesday, August 30th at 9 AM ET. The consensus is for flat prices in June.

Last month, we predicted that the S&P/Case-Shiller 10-City composite for May 2011 would be about 154 and the 20-City composite would be roughly 141. In fact, the 10-City composite was 153.64 and the 20-City composite was 139.87.

This month, we expect the June 2011 10-City composite index to be about 156 and the 20-City index to be roughly 142.

We expect RPX values to decline in coming months ... and we expect that similar declines will be observed in the S&P/Case-Shiller Composite indices.

Earlier:

• Personal Income increased 0.3% in July, Spending increased 0.8%

• Comparison of Regional Fed Manufacturing Surveys and ISM

Weekend:

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

HousingTracker: Homes For Sale inventory down 14.1% Year-over-year in August

by Calculated Risk on 8/29/2011 03:32:00 PM

In June, Tom Lawler posted on how the NAR estimates existing home inventory. The NAR does NOT aggregate data from the local boards (see Tom's post for how the NAR estimates inventory). Sometime this fall, the NAR will revise down their estimates of inventory and sales for the last few years. Also the NAR methodology for estimating sales and inventory will likely (hopefully) be changed.

I think the HousingTracker / DeptofNumbers data that Tom mentioned might provide a timely estimate of changes in inventory. Ben at deptofnumbers.com is tracking the aggregate monthly inventory for 54 metro areas.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the NAR estimate of existing home inventory through July (left axis) and the HousingTracker data for the 54 metro areas through August. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates this fall).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the August listings - for the 54 metro areas - declined 14.1% from last year.

Of course there is a large percentage of distressed inventory, and various categories of "shadow inventory" too. But the decline in listed inventory is something to watch carefully all year.

Earlier:

• Personal Income increased 0.3% in July, Spending increased 0.8%

• Comparison of Regional Fed Manufacturing Surveys and ISM

Weekend:

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

Europe Update: Finland and Germany discussing Bailout for Greece

by Calculated Risk on 8/29/2011 01:48:00 PM

Perhaps some progress on the next bailout for Greece ...

From Dow Jones: Finland Working To Resolve Collateral Issue - Foreign Minister

Finland expects a solution to be found for its demand for collateral from Greece before contributing to the bailout fund, the country's European Affairs and Foreign Minister said Monday.From Bloomberg: Germany’s Hoyer Tells Finns to ‘Not Rock the Boat’ on Euro

"Finland is not out to cause problems, but to find solutions," Alexander Stubb told a joint news conference in Helsinki, after a lunch with German Deputy Foreign Minister Werner Hoyer

German Deputy Foreign Minister Werner Hoyer warned euro-area countries not to destabilize the currency after Finland demanded collateral in return for agreeing to a second Greek aid package.The Greek 2 year yield is at 45.6% and the 10 year yield increased to 18.1% today.

The euro is “of utmost importance to all of us in Europe, in particular for countries like Finland and Germany,” Hoyer told reporters at a joint news conference in Helsinki today with Finnish Foreign Trade Minister Alexander Stubb. “So let us not rock the boat.”

...

Germany is “approaching the question with care” and will wait to see the outcome of the collateral model that transpires, Hoyer said. “Finland doesn’t have the reputation as a troublemaker, so I’m very optimistic.”

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 286, down from 389 on Aug 4th, and the Spanish spread is at 279, down from 398 on Aug 4th. Moving sideways.

The Portuguese 2 year yield is down a little to 13.2%. Also the Irish 2 year yield is at 8.6%. And the French 10 year is at 2.9%. So this is a Greek issue right now.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Earlier:

• Personal Income increased 0.3% in July, Spending increased 0.8%

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

Texas Manufacturing Activity "Flat" in August

by Calculated Risk on 8/29/2011 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Flat

Texas factory activity was largely unchanged in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained positive but fell from 10.8 to 1.1, suggesting growth stalled this month.This was above the consensus view of -6.

The new orders index fell from 16 to 4.8 this month, suggesting order volumes continued to increase, but at a decelerated pace. ... The capacity utilization index dipped into negative territory in August, with one-quarter of manufacturers noting a decrease ... The employment index came in at 5.4, down from 12.1 in July. Twenty-three percent of manufacturers reported hiring new workers, while 17 percent reported layoffs. The hours worked index fell from 7.9 to –2.2, suggesting average workweeks shrank.

This is the last of the regional Fed surveys for August. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were very weak in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

The early surveys in August were especially weak (Philly Fed and Empire State), although the surveys later in the month were a little better. Both the Kansas City and Texas surveys showed slight expansion in August, although the Richmond survey showed contraction. The ISM index for August will be released Thursday, Sept 1st, and the consensus is for a decrease to 48.5 from 50.9 in July.

Earlier:

• Personal Income increased 0.3% in July, Spending increased 0.8%

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

Pending Home Sales decreased in July

by Calculated Risk on 8/29/2011 10:00:00 AM

From the NAR: Pending Home Sales Slip in July but Up Strongly From One Year Ago

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, slipped 1.3 percent to 89.7 in July from 90.9 in June but is 14.4 percent above the 78.4 index in July 2010. The data reflects contracts but not closings.The consensus was for a 1% decrease in the index. This suggests existing home sales will stay weak.

...

The PHSI in the Northeast declined 2.0 percent to 67.5 in July but is 9.7 percent above July 2010. In the Midwest the index slipped 0.8 percent to 79.1 in July but is 18.8 percent above a year ago. Pending home sales in the South fell 4.8 percent to an index of 94.4 but are 9.5 percent higher than July 2010. In the West the index rose 3.6 percent to 110.8 in July and is 20.6 percent above a year ago.

Earlier:

• Personal Income increased 0.3% in July, Spending increased 0.8%

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

Personal Income increased 0.3% in July, Spending increased 0.8%

by Calculated Risk on 8/29/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $42.4 billion, or 0.3 percent ... in July ... Personal consumption expenditures (PCE) increased $88.4 billion, or 0.8 percent.The following graph shows real Personal Consumption Expenditures (PCE) through July (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE increased 0.5 percent ... The price index for PCE increased 0.4 percent in July

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased 0.8 in July, and real PCE increased 0.5% as the price index for PCE increased 0.4 percent in July.

Note: The PCE price index, excluding food and energy, increased 0.2 percent, the same increase as in June.

The personal saving rate was at 5.0% in July.

Personal saving -- DPI less personal outlays -- was $582.8 billion in July, compared with $638.6 billion in June. Personal saving as a percentage of disposable personal income was 5.0 percent in July, compared with 5.5 percent in June.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the June Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the June Personal Income report.Real PCE was revised up a little for Q2 too. This was a solid increase in spending and above the consensus of 0.5% - however I expect August to be weaker due to the confidence shattering debt ceiling debate.

NY Times: Headwinds for the Big Banks

by Calculated Risk on 8/29/2011 12:00:00 AM

Nothing new, but a summary of some of the headwinds for the large banks face - and the prospects for more layoffs (ht Brian).

From Eric Dash at the NY Times: As Fortunes Dim, Banks Confront a Leaner Future

Battered by a weak economy, the nation’s biggest banks are cutting jobs, consolidating businesses and scrambling for new sources of income ... UBS has announced 3,500 layoffs, 5 percent of its staff, and Citigroup is quietly cutting dozens of traders. Bank of America could cut as many as 10,000 jobs, or 3.5 percent of its work force. ABN Amro, Barclays, Bank of New York Mellon, Credit Suisse, Goldman Sachs, HSBC, Lloyds, State Street and Wells Fargo have in recent months all announced plans to cut jobs — tens of thousands all told.Yesterday:

...

Lending, the prime driver of revenue, has been depressed for several years and is not expected to pick up anytime soon ... Trading profits have also been waning amid a slowdown in volumes, and Wall Street’s once-lucrative mortgage packaging business is unlikely to bring in the blockbuster fees it earned during the housing boom.

On top of that, the financial regulations enacted by Congress last year are causing banks to add more risk managers and compliance staff ...

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

Sunday, August 28, 2011

FDIC-insured institutions’ Real Estate Owned (REO) decreased in Q2

by Calculated Risk on 8/28/2011 05:21:00 PM

Last week I noted that 1-4 family Real Estate Owned (REO) by FDIC insured institutions declined to an estimated 80,600 in Q2. As Tom Lawler noted, the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

For Q2 2011, the FDIC reported (See Table V-A) the value was $12.09 billion, down from $13.28 billion in Q1, and down from a high of $14.76 billion in Q3 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The left scale is the dollars reported in the FDIC Quarterly Banking Profile, and the right scale is an estimate of REOs using an average of $150,000 per unit. Using this estimate for the average per REO, that gives 80.6 thousand REO at the end of Q2, down from 88.5 thousand at the end of Q1. This is about 5 times the carrying value in 2003.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Commercial, Farm Land).

Of course this is just a small portion of the total REO. Here is a repeat of the graph I posted last week showing REO inventory for Fannie, Freddie, FHA, Private Label Securities (PLS), and FDIC insured institutions. (economist Tom Lawler has provided some of this data).

Total REO decreased to 493,000 in Q2 from almost 550,000 in Q1.

Total REO decreased to 493,000 in Q2 from almost 550,000 in Q1.

As Tom Lawler noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is around 548,000 in Q2.

Important: REO inventories have declined over the last couple of quarters. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my earlier post on Mortgage Delinquencies and REOs.

Yesterday:

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

Report: Major Exchanges Expect to Open Monday

by Calculated Risk on 8/28/2011 11:35:00 AM

From CNBC: Major Exchanges in NY Still Expect to Open Monday

Main U.S. stock exchanges Nasdaq, NYSE and BATS expect to open trading on Monday as usual despite Hurricane Irene, although a final decision, especially on opening the Big Board floor, is yet to come.Best wishes to all in Irene's path.

The main question right now is whether public transportation in New York City will be restored by Monday morning. ... The U.S. Securities and Exchange Commission and market operators NYSE Euronext, Nasdaq OMX Group and others plan a conference call at 1 p.m. ET Sunday to discuss power outages and New York City transportation ...

Yesterday:

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

IMF's Lagarde: European banks need "urgent recapitalization"

by Calculated Risk on 8/28/2011 08:50:00 AM

From the International Monetary Fund Managing Director, Christine Lagarde: Global Risks Are Rising, But There Is a Path to Recovery. Some excerpts:

The global economy continues to grow, yet not enough. Some of the main causes of the 2008 crisis have been addressed, yet not adequately. There remains a path to recovery, yet we do not have the luxury of time.Sounds like the TARP.

...

Developments this summer have indicated that we are in a dangerous new phase. The stakes are clear: we risk seeing the fragile recovery derailed. So we must act now.

...

[European] banks need urgent recapitalization. They must be strong enough to withstand the risks of sovereigns and weak growth. This is key to cutting the chains of contagion. If it is not addressed, we could easily see the further spread of economic weakness to core countries, or even a debilitating liquidity crisis. The most efficient solution would be mandatory substantial recapitalization—seeking private resources first, but using public funds if necessary. One option would be to mobilize EFSF or other European-wide funding to recapitalize banks directly, which would avoid placing even greater burdens on vulnerable sovereigns.

Yesterday:

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

Saturday, August 27, 2011

Unofficial Problem Bank list increases to 988 Institutions

by Calculated Risk on 8/27/2011 07:46:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 27, 2011.

Changes and comments from surferdude808:

Activities of the FDIC contributed to many changes to the Unofficial Problem Bank List this week as they released their enforcement actions through July 2011. In all, there were eight additions and four removals, which leaves the list at 988 institutions with assets of $403.0 billion compared with 984 institutions and assets of $412.5 billion last week. Asset figures were updated from 2011q1 to 2011q2, which caused aggregate assets to drop by $11.1 billion. The net of additions and removals this week caused assets to rise $1.7 billion.CR note: The FDIC released the Q2 Quarterly Banking Profile last week. The FDIC reported:

For the month of August, there were 14 additions, eight unassisted mergers, seven failures, and six action terminations for a net decline of seven institutions. On a monthly basis, the list has experienced a net decline in three of the past five months mainly from a slowing of new additions, increasing unassisted mergers, and a steady pace of failures.

The removals this week were all action terminations by the FDIC against Bank of the Bluegrass and Trust Company, Lexington, KY ($219 million); CrossFirst Bank Leawood (f/k/a Town & Country Bank), Leawood, KS ($86 million); Princeville State Bank, Princeville, IL ($62 million); and Utah Community Bank, Sandy, UT ($30 million).

Among the eight additions this week are Alliance Bank, Lake City, MN ($624 million); International Finance Bank, Miami, FL ($419 million); First State Bank, Lonoke, AR ($264 million); and The Citizens Bank of Logan, Logan, OH ($256 million).

Other additions include the FDIC issuing Prompt Corrective Action orders against Central Progressive Bank, Lacombe, LA ($398 million) and SunFirst Bank, Saint George, UT ($213 million).

The following demographic changes were made to the list: First Capital Bank, Marianna, FL ($44 million) changes its name to Chipola Community Bank; Golden Coast Bank, Long Beach, CA ($41 million) changed its name to Evergreen International Bank; Atlantic Coast Bank, Waycross, GA ($804 million) moved its headquarters to Jacksonville, FL; Heritage First Bank, Orange Beach, Al ($54 million) moved its headquarters to Gulf Shores; The Palmetto Bank, Laurens, SC ($1.3 billion) moved its headquarters to Greenville; and United Trust Bank, Bridgeview, IL ($42 million) moved its headquarters to Palos Heights.

The number of institutions on the FDIC's "Problem List" fell for the first time in 19 quarters. The number of "problem" institutions declined from 888 to 865. This is the first time since the third quarter of 2006 that the number of "problem" banks fell. Total assets of "problem" institutions declined from $397 billion to $372 billion.The differences are due to timing and definition. The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

Earlier:

• Summary for Week Ending August 26th (with plenty of graphs)

• Schedule for Week of Aug 28th

Schedule for Week of Aug 28th

by Calculated Risk on 8/27/2011 02:19:00 PM

Earlier:

• Summary for Week ending August 26th (with plenty of graphs)

This will be a busy week for economic data. The key release is the August employment report on Friday. Other key releases will be the July Personal Income & Outlays report on Monday, Case-Shiller house prices on Tuesday, the ISM manufacturing index on Thursday, and auto sales also on Thursday.

Also the FOMC minutes for the August 9th meeting, to be released on Tuesday, might include a discussion of additional policy options.

8:30 AM: Personal Income and Outlays for July. The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE decreased 0.2 in June, and real PCE decreased less than 0.1% as the price index for PCE decreased 0.2 percent in June. On a quarterly basis, PCE barely increased in Q2 from Q1.

The consensus is for a 0.3% increase in personal income in July, and a 0.5% increase in personal spending, and for the Core PCE price index to increase 0.2%.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 1% decrease in the index.

10:30 AM: Dallas Fed Manufacturing Survey for August. The Texas production index increased 10.8 in July. The consensus is for a reading of -6 (contraction) in August. This is the last of the regional surveys, and most of the surveys have been weak.

9:00 AM: S&P/Case-Shiller Home Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June.

9:00 AM: S&P/Case-Shiller Home Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The consensus is for flat prices in June. The CoreLogic index showed a 0.7% increase in June.

10:00 AM: Conference Board's consumer confidence index for August. The consensus is for a decrease to 52.5 from 59.6 last month due to the debt ceiling debate.

2:00 PM: FOMC Minutes, Meeting of Aug 9, 2011. The minutes could include a discussion of additional policy options.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months and was at the lowest level in 15 years last week.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for +100,000 payroll jobs in August, down from the +114,000 reported in July.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for a decrease to 53.5, down from 58.8 in July.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for July (Factory Orders). The consensus is for a 1.8% increase in orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 407,000 from 417,000 last week.

10:00 AM: Construction Spending for July. The consensus is for a 0.1% increase in construction spending.

10:00 AM: ISM Manufacturing Index for August. The consensus is for a decrease to 48.5 from 50.9 in July. Based on the regional manufacturing surveys, the ISM index will probably be below 50 in August for the first time since July 2009 (indicating contraction).

All day: Light vehicle sales for August. Light vehicle sales are expected to decrease to 12.1 million (Seasonally Adjusted Annual Rate), from 12.2 million in July.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate. Edmunds is forecasting:

An estimated 1,087,000 new cars will be sold in August for a projected Seasonally Adjusted Annualized Rate (SAAR) of 12.3 million, forecasts Edmunds.com, the premier online resource for automotive information. The sales pace is virtually flat compared to July’s 12.2 million SAAR.

8:30 AM: Employment Report for August.

The consensus is for an increase of 67,000 non-farm payroll jobs in August, down from the 117,000 jobs added in July. The lower number is partially related to the Verizon strike that is now over.

The consensus is for an increase of 67,000 non-farm payroll jobs in August, down from the 117,000 jobs added in July. The lower number is partially related to the Verizon strike that is now over.This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The consensus forecast for August is in blue.

The consensus is for the unemployment rate to hold steady at 9.1% in August.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions. This shows the severe job losses during the recent recession.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions. This shows the severe job losses during the recent recession. Through the first seven months of 2011, the economy has added 930,000 total non-farm jobs or just 133 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.8 million fewer payroll jobs than at the beginning of the 2007 recession.

Summary for Week Ending August 26th

by Calculated Risk on 8/27/2011 08:10:00 AM

The focus last week was on Fed Chairman Ben Bernanke’s speech at Jackson Hole. Although Bernanke did not discuss additional monetary easing, he did note that the September meeting will be expanded to two days to allow for a "fuller discussion" of policy options. For more on his speech, see: A few articles on Bernanke's Speech

The data last week was weak again. Second quarter GDP growth was revised down to a 1.0% annual rate, from the already weak 1.3% advance estimate. July New Home sales were under 300 thousand on a seasonally adjusted annual rate (SAAR) basis. And mortgage delinquencies increased slightly in Q2.

Two more regional manufacturing surveys for August were released; the Richmond Fed survey indicated activity declined in August; however the Kansas City survey showed modest growth.

In Europe, the negotiations over the Greek bailout plan heated up, and the Greek bond yields are soaring. Otherwise the European bond markets were relatively quiet for the week.

Here is a summary in graphs:

• Q2 real GDP growth revised down to 1.0% annualized rate

From the BEA: Gross Domestic Product, Second Quarter 2011 (second estimate "Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.0 percent in the second quarter of 2011". Growth was revised down from 1.3%, and was slightly below the consensus of 1.1%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

The dashed line is the current growth rate. Growth in Q2 at 1.0% annualized was below trend growth (around 3%) - and very weak for a recovery, especially with all the slack in the system.

The alternate measure of GDP - Gross Domestic Income - grew at a 1.6% annualized rate in Q2 and is now back above the pre-recession peak.

• New Home Sales in July at 298,000 Annual Rate

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 298 thousand. This was down from a revised 300 thousand in June (revised from 312 thousand).

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 298 thousand. This was down from a revised 300 thousand in June (revised from 312 thousand).

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 61,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

This graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

This graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2011 (red column), 27 thousand new homes were sold (NSA). The record low for July was 26 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for July was 117 thousand in 2005.

This was below the consensus forecast of 313 thousand, and was just above the record low for the month of July. New home sales have averaged only 300 thousand SAAR over the 15 months since the expiration of the tax credit ... moving sideways at a very low level.

• MBA: Mortgage Delinquencies increased slightly in Q2

The MBA reported that 12.87 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2011 (seasonally adjusted). This is up slightly from 12.84 percent in Q1 2011. From the MBA: Delinquencies Rise, Foreclosures Fall in Latest MBA Mortgage Delinquency Survey

This graph shows the percent of loans delinquent by days past due.

This graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent increased to 3.46% from 3.35% in Q1. This is probably related to the increase in the unemployment rate. Delinquent loans in the 60 day bucket increased slightly to 1.37% from 1.35%.

There was a slight decrease in the 90+ day delinquent bucket. This decreased to 3.61% from 3.65% in Q1 2011. The percent of loans in the foreclosure process decreased to 4.43%.

So short term delinquencies ticked up, and the 90+ day and in-foreclosure rates declined.

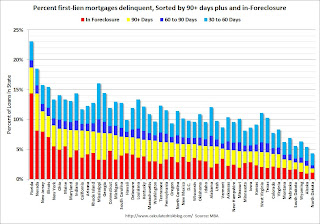

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.Florida, Nevada, New Jersey and Illinois are the top four states with percent of loans in the foreclosure process.

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Ohio and Maine.

Note: the MBA's National Delinquency Survey (NDS) covered "MBA’s National Delinquency Survey covers about 43.9 million first-lien mortgages on one- to four-unit residential properties" and the "The NDS is estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives almost 50 million total first lien mortgages or about 6.4 million delinquent or in foreclosure.

This graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line) since Q1 2007. The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process).

This graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line) since Q1 2007. The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process). Some states have made progress: Arizona, Michigan, Nevada and California. Other states, like New Jersey and New York, have made little or no progress in reducing serious delinquencies.

Arizona, Michigan, Nevada and California are all non-judicial foreclosure states. States with little progress like New Jersey, New York, Illinois and Florida are all judicial states.

Note: This data is for 42 states only and D.C.

• Regional Manufacturing Surveys

There were two more regional manufacturing surveys released this week: Richmond Fed and Kansas City Fed. From the Richmond Fed: Manufacturing Activity Pulled Back Markedly in August; Shipments and New Orders Declined. And from the Kansas City Fed: Manufacturing Sector Continues to Expand Modestly

Here is a table of the regional surveys in July and August; the Dallas Fed Texas Manufacturing will be released on Monday, August 29th.

| Manufacturing Survey | July | August |

|---|---|---|

| Empire State | -3.76 | -7.7 |

| Philly Fed | 3.2 | -30.7 |

| Richmond Fed | -1 | -10 |

| Kansas City Fed | 3 | 3 |

| Dallas Fed | 10.8 | --- |

Most of the regional surveys were very weak in August. The ISM index for August will be released Thursday, Sept 1st.

• Final August Consumer Sentiment at 55.7, Down Sharply from July

The final August Reuters / University of Michigan consumer sentiment index increased slightly to 55.7 from the preliminary reading of 54.9. This was down sharply from 63.7 in July.

The final August Reuters / University of Michigan consumer sentiment index increased slightly to 55.7 from the preliminary reading of 54.9. This was down sharply from 63.7 in July. In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. I think consumer sentiment declined sharply in August because of the heavy coverage of the debt ceiling debate.

This was slightly below the consensus forecast of 56.0.

• Weekly Initial Unemployment Claims increased to 417,000

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 407,500.

Weekly claims have increased for two consecutive weeks and the 4-week average is still elevated.

• Moody's: Commercial Real Estate Prices increased in June

From Bloomberg: Commercial Property Prices Rose 0.9% in June, Moody’s Says. Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

From Bloomberg: Commercial Property Prices Rose 0.9% in June, Moody’s Says. Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted. CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 6.6% from a year ago and down about 45% from the peak in 2007. Some of this is probably seasonal, although Moody's mentioned a price pickup "beyond trophy properties and major U.S. coastal cities". Note: There are few commercial real estate transactions compared to residential, so this index is very volatile.

• Other Economic Stories ...

• Chicago Fed: Economic growth below trend in July

• ATA Trucking index decreased 1.3% in July

• Europe Update: Greek Bond Yields Surge

• Update on Q2 REO Inventory

• FHFA Introduces Expanded House Price Index

Have a great weekend. Stay safe on the East Coast!

Friday, August 26, 2011

A few articles on Bernanke's Speech

by Calculated Risk on 8/26/2011 09:46:00 PM

• From Jon Hilsenrath at the WSJ: Speech Hints at Options for Fed

The next big moment comes on Sept. [20 and 21] when Fed policy makers meet in Washington in a session, Mr. Bernanke disclosed Friday, that has been expanded to two days from one "to allow a fuller discussion" of the options.• From Binyamin Appelbaum at the NY Times: Bernanke Blames Politics for Financial Upheaval

...

The Fed chairman, who was appointed by a Republican and reappointed by a Democrat, aimed his sharpest remarks at U.S. lawmakers and the White House, scolding them for a divisive debate about raising the federal debt limit earlier this month that, he said, "disrupted financial markets and probably the economy as well."

Mr. Bernanke said he remained optimistic about future growth — he gave no indication that the Fed would increase its economic aid programs, though he said the central bank’s policy-making board would revisit the issue at a scheduled meeting in September — but he warned that the government had emerged as perhaps the greatest threat to recovery.• From Neil Irwin at the WaPo: Fed chief scolds Congress on debt-ceiling showdown

...

“The country would be well served by a better process for making fiscal decisions,” he said.

Federal Reserve Chairman Ben S. Bernanke chided Congress on Friday for its contentious approach to the national debt, saying the brinksmanship displayed by lawmakers could endanger the U.S. economy.• My earlier post: Analysis: Bernanke highlights September FOMC meeting, Suggests more Fiscal Stimulus

I think it is quite clear the debt ceiling debate disrupted the economy. The key is the September meeting has been expanded to two days to allow for a "fuller discussion" of policy options - and the FOMC will be watching the incoming data over the next few weeks to see if the economy is bouncing back a little for the debate induced slowdown.