by Calculated Risk on 6/30/2014 08:18:00 PM

Monday, June 30, 2014

Tuesday: ISM Mfg Survey, Vehicle Sales, Construction Spending

From the National Restaurant Association: Restaurant Performance Index Rose to Its

Highest Level in More Than Two Years

Driven by stronger sales and traffic levels and an increasingly optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) rose to its highest level in more than two years. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.1 in May, the third consecutive monthly gain and strongest reading since March 2012. In addition, the RPI stood above 100 for the 15th consecutive month, which signifies expansion in the index of key industry indicators.

...

“Positive sales results fueled the May increase in the RPI, as nearly two-thirds of restaurant operators said their same-store sales rose above year-ago levels,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are increasingly optimistic about continued sales gains in the months ahead, a sentiment that is also showing up in their capital expenditure plans.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.1 in May, up from 101.7 in April. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and this is a solid reading.

Tuesday:

• Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).

• At 10:00 AM ET, the ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May. In May the employment index was at 52.8%, and the new orders index was at 56.9%.

• At 10:00 AM, Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

Weekly Update: Housing Tracker Existing Home Inventory up 14.0% YoY on June 30th, Above June 30, 2012 Level

by Calculated Risk on 6/30/2014 05:12:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 14.0% above the same week in 2013. (Note: There are differences in how the data is collected between Housing Tracker and the NAR).

Also inventory is now above the same week in 2012. This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

Fannie Mae: Mortgage Serious Delinquency rate declined in May, Lowest since October 2008

by Calculated Risk on 6/30/2014 04:28:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in May to 2.08% from 2.13% in April. The serious delinquency rate is down from 2.83% in May 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 2.10% from 2.15% in April. Freddie's rate is down from 2.85% in May 2013, and is at the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.75 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in late 2015.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Schedule Update: Reis Office, Aparment and Mall Surveys to be released this week

by Calculated Risk on 6/30/2014 01:55:00 PM

Just an update to the weekly schedule ... adding the quarterly Reis surveys of rents and vacancy rates for offices, apartments and malls.

Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

Early: Reis Q2 2014 Apartment Survey of rents and vacancy rates.

Early: Reis Q2 2014 Mall Survey of rents and vacancy rates.

Dallas Fed: Manufacturing Activty Increases "Picks Up Pace" in June

by Calculated Risk on 6/30/2014 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks Up Pace

Texas factory activity increased again in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 11 to 15.5, indicating output grew at a faster pace than in May.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing activity also reflected growth in June. The new orders index rose from 3.8 to 6.5 but remained below the levels seen earlier in the year. The capacity utilization index held steady at 9.2. The shipments index came in at 10.3, similar to its May level, with nearly a third of manufacturers noting an increase in volumes.

Perceptions of broader business conditions were more optimistic this month. The general business activity index rose from 8 to 11.4. ...

Labor market indicators reflected stronger employment growth and longer workweeks. The June employment index rebounded to 13.1 after dipping to 2.9 in May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

All of the regional surveys showed expansion in June, and it seems likely the ISM index will be at about the same level as in May, or increase slightly in June. The ISM index for June will be released tomorrow, Tuesday, July 1st.

NAR: Pending Home Sales Index increased 6.1% in May, down 5.2% year-over-year

by Calculated Risk on 6/30/2014 10:00:00 AM

From the NAR: Pending Home Sales Surge in May

Pending home sales rose sharply in May, with lower mortgage rates and increased inventory accelerating the market, according to the National Association of Realtors®. All four regions of the country saw increases in pending sales, with the Northeast and West experiencing the largest gains.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 6.1 percent to 103.9 in May from 97.9 in April, but still remains 5.2 percent below May 2013 (109.6).

...

The PHSI in the Northeast jumped 8.8 percent to 86.3 in May, and is now 0.2 percent above a year ago. In the Midwest the index rose 6.3 percent to 105.4 in May, but is still 6.6 percent below May 2013.

Pending home sales in the South advanced 4.4 percent to an index of 117.0 in May, and is 2.9 percent below a year ago. The index in the West rose 7.6 percent in May to 95.4, but remains 11.1 percent below May 2013.

Sunday, June 29, 2014

Monday: Chicago PMI, Pending Home Sales

by Calculated Risk on 6/29/2014 09:00:00 PM

Monday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

• At 10:00 AM, the Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Weekend:

• Demographics: Prime and Near-Prime Population and Labor Force

• Schedule for Week of June 29th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 11 (fair value).

Oil prices moved down slightly over the last week with WTI futures at $105.45 per barrel and Brent at $113.10 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.68 per gallon, up about 20 cents from a year ago. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demographics: Prime and Near-Prime Population and Labor Force

by Calculated Risk on 6/29/2014 12:33:00 PM

Earlier this week, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

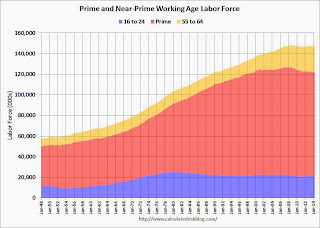

Here are a couple more graphs making this point. The first shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

Click on graph for larger image.

Click on graph for larger image.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The near-prime group has been growing - especially the 55 to 64 age group.

The good news is the prime working age group will start growing again by 2020, and this should boost economic activity.

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased).

As Bruegel notes, the working age population in the US is expected to grow over the next few decades - so the US has much better demographics than Europe, China or Japan (not included).

The key points are:

1) A slowdown in the US was expected this decade just based on demographics (the housing bust, financial crisis were piled on top of weak demographics).

2) The prime working age population in the US will start growing again soon.

Saturday, June 28, 2014

Schedule for Week of June 29th

by Calculated Risk on 6/28/2014 01:11:00 PM

This will be a busy holiday week for economic data with several key reports including the June employment report on Thursday.

Other key reports include the ISM manufacturing index on Tuesday, June vehicle sales on Tuesday, and the May Trade Deficit and June ISM non-manufacturing index on Thursday.

Fed Chair Janet Yellen will speak on Financial Stability.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

10:00 AM ET: Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in May at 55.4%. The employment index was at 52.8%, and the new orders index was at 56.9%.

Early: Reis Q2 2014 Apartment Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in June, up from 180,000 in May.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 0.3% decrease in May orders.

11:00 AM: Speech by Fed Chair Janet Yellen, Financial Stability, At the Inaugural Michel Camdessus Central Banking Lecture at the International Monetary Fund, Washington, D.C.

Early: Reis Q2 2014 Mall Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 314 thousand from 312 thousand.

8:30 AM: Employment Report for June. The consensus is for an increase of 211,000 non-farm payroll jobs added in June, down from the 217,000 non-farm payroll jobs added in May.

The consensus is for the unemployment rate to be unchanged at 6.3% in May.

This graph shows the percentage of payroll jobs lost during post WWII recessions through May. The red line is back to zero!

This graph shows the percentage of payroll jobs lost during post WWII recessions through May. The red line is back to zero!The economy has added 9.4 million private sector jobs since employment bottomed in February 2010 (8.8 million total jobs added including all the public sector layoffs).

There are 617 thousand more private sector jobs now than when the recession started in 2007, and total employment is now 98 thousand above the pre-recession peak.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. Both imports and exports increased in April.

The consensus is for the U.S. trade deficit to be at $45.1 billion in May from $47.2 billion in April.

10:00 AM: ISM non-Manufacturing Index for June. The consensus is for a reading of 56.2, down from 56.3 in May. Note: Above 50 indicates expansion.

All US markets are closed in observance of the Independence Day holiday.

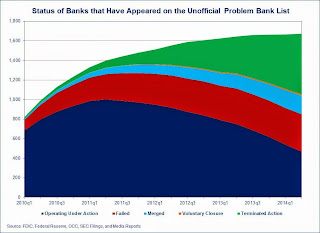

Unofficial Problem Bank list declines to 468 Institutions, Q2 2014 Transition Matrix

by Calculated Risk on 6/28/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 27, 2014.

Changes and comments from surferdude808:

FDIC providing an update on its enforcement action activities and a deeper scrubbing of the list drove a net decline in the Unofficial Problem Bank List to 468 institutions with assets of $149.2 billion. In all, there were 21 removals and one addition this week. A year ago, the list held 749 institutions with assets of $273.3 billion. During this June, the list declined by a net 28 institutions after 26 action terminations, two failures, one merger, and one addition. The failure this week, The Freedom State Bank, Freedom, OK surprisingly was not on the list as the only action issued by FDIC that can be located is a Prompt Corrective Action order only issued less than 60 days ago.

Removals this week were The Bank of Delmarva, Seaford, DE ($425 million); Community Bank of the South, Smyrna, GA ($348 million); Mercantile Bank, Quincy, IL ($347 million); The Pueblo Bank and Trust Company, Pueblo, CO ($320 million); First Farmers & Merchants Bank, Cannon Falls, MN ($265 million); Firstier Bank, Kimball, NE ($245 million); SouthPoint Bank, Birmingham, AL ($202 million); Marine Bank & Trust Company, Vero Beach, FL ($152 million); Bank of Fairfield, Fairfield, WA ($147 million); Concord Bank, St. Louis, MO ($138 million); Town & Country Bank, Las Vegas, NV ($120 million); Freedom Bank of America, Saint Petersburg, FL ($107 million); State Bank of Park Rapids, Park Rapids, MN ($100 million); Community Pride Bank, Isanti, MN ($94 million); First Bank, West Des Moines, IA ($90 million); First Carolina Bank, Rocky Mount, NC ($89 million); Sherburne State Bank, Becker, MN ($84 million); Bank of the Prairie, Olathe, KS ($80 million); Security Bank, New Auburn, WI ($75 million); Holladay Bank & Trust, Salt Lake City, UT ($51 million); and Maple Bank, Champlin, MN ($51 million).

The sole addition this week Community 1st Bank Las Vegas, Las Vegas, NM ($146 million).

We have updated the Unofficial Problem Bank List transition matrix through the second quarter of 2014. Full details are available in the accompanying table and a graphic depicting trends in how institutions have arrived and departed the list. Since publication of the Unofficial Problem Bank List started in August 2009, a total of 1,672 institutions have appeared on the list. New entrants have slowed since late 2012, but this quarter seven institutions were added up from only three being added in the previous two quarters.

At the end of the second quarter, only 468 or 28 percent of the banks that have been on a list at some point remain. Action terminations of 619 account for around 51 percent of the 1,204 institutions removed. However, a significant number of institutions have left the list through failure. So far, 381 institutions have failed accounting for nearly 32 percent of departures. Should another institution on the list not fail, then more than 22 percent of the 1,672 institutions making an appearance would have failed. A 22 percent default rate would be more than double the rate often cited by media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 141 | (55,759,559) | |

| Unassisted Merger | 32 | (6,697,723) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (5,411,792) | ||

| Still on List at 6/30/2014 | 58 | 13,590,663 | |

| Additions after 8/7/2009 | 478 | 135,599,760 | |

| End (6/30/2014) | 468 | 149,190,423 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 478 | 206,393,188 | |

| Unassisted Merger | 158 | 71,031,845 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 227 | 111,634,071 | |

| Total | 873 | 391,383,246 | |

| 1Institution not on 8/7/2009 or 6/30/2014 list but appeared on a weekly list. | |||

Friday, June 27, 2014

Bank Failure #12 in 2014: The Freedom State Bank, Freedom, Oklahoma

by Calculated Risk on 6/27/2014 05:30:00 PM

From the FDIC: Alva State Bank & Trust Company, Alva, Oklahoma, Assumes All of the Deposits of The Freedom State Bank, Freedom, Oklahoma

As of March 31, 2014, The Freedom State Bank had approximately $22.8 million in total assets and $20.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.8 million. ... The Freedom State Bank is the 12th FDIC-insured institution to fail in the nation this year, and the second in Oklahoma.There have been 12 failures so far in 2014, half the 24 failures in 2013. So it is possible there will be more failures this year than in 2013.

Lawler on Homebuilders Lennar and KB Home

by Calculated Risk on 6/27/2014 03:48:00 PM

Lennar Corporation, the second largest US home builder in 2013, reported that net home orders in the quarter ended May 31, 2014 totaled 6,183, up 8.4% from the comparable quarter of 2013. Sales per active community were down about 7.5% from a year ago. Home deliveries last quarter totaled 4,987, up 11.7% from the comparable quarter of 2013, at an average sales price of $322,000, up 13.8% from a year ago. The company’s order backlog at the end of May was 6,858, up 11.3% from last May, at an average order price of $343,000, up 13.6% from a year earlier.

Here is a comment from Lennar’s CEO in its press release.

"While the spring selling season was softer than anticipated by us and the investor community, the homebuilding recovery continued its progression at a slow and steady pace. The fundamentals of the homebuilding industry remain strong driven by high affordability levels, favorable monthly payment comparisons to rentals and overall supply shortages. Demand in most of our markets continues to outpace supply, which is constrained by limited land availability."With respect to land, the company said in its conference call that it owned or controlled bout 164,000 homesites at the end of May, up 18.3% from last May ... That lot inventory was 7.6 times Lennar’s expected level of home deliveries in 2014 – which is a lot!

In its conference call officials said that the company’s sizable land/lot position left it “well positioned” to take advantage of an increase in demand from first-time home buyers, but officials said that demand from first-time home buyers last quarter remained very weak – which officials attributed mainly to continued very tight mortgage lending standards. Officials also highlighted the company’s relatively new multifamily rental segment, which it apparently started on concerns that a higher share of householders, especially young adults/new householders, may be more likely to be renters and/or live in urban areas than has been the case in the past.

KB Home, the fifth largest US home builder in 2013, reported that net home orders in the quarter ended May 31, 2014 totaled 2,269, up 4.9% from the comparable quarter of 2013. Net orders per community last quarter were down 2.2% from a year ago. Home deliveries last quarter totaled 1,751, down 2.6% from the comparable quarter of 2013, at an average sales price of $319,700, up 10.1% from a year ago. The company’s order backlog at the end of May was 3,398, up 8.6% from last May.

In an excessively long opening remark on the company’s earnings conference call, KB Home’s CEO Jeff Mezger made two observations that raised analysts’ eyebrow: he said that (1) while mortgage credit remained tight, the company has seen evidence of easing in credit standards; and (2) the company has seen some “re-emergence” of first-time home buyers. Not surprisingly he faced questions on these observations in the Q&A session. On mortgage credit standards, Mezger pointed to “still high” but lower average credit scores on mortgage bonds issued, and to “anecdotal” reports of reduced “credit overlays” from “some lenders.” (No story here!). On the re-emergence of first-time home buyers, Mezger said that there’s been an increase in first-time home buyer purchases in some areas of Texas where job growth has been strong.

Here are net orders for the quarter ended May 31, 2014 for three large home builders. (Note: Hovnanian reported result for the quarter ended April 30, 2014, but it showed net orders for May 2014 in its earnings presentation).

| Net Home Orders, 3 Months Ending: | 5/31/2014 | 5/31/2013 | % Change |

|---|---|---|---|

| Lennar | 6,183 | 5,705 | 8.4% |

| KB Home | 2,269 | 2,162 | 4.9% |

| Hovnanian | 1,799 | 1,862 | -3.4% |

| Total | 10,251 | 9,729 | 5.4% |

Earlier this week, Census estimated that new SF home sales in the first five months of 2014 totaled 194,000 (not seasonally adjusted), up just 0.5% from the first five months of 2013.

Net, the “spring” new home buying season, while not really a “bust,” fell considerably short of “consensus” forecasts at the beginning of the year. While results varied considerably among large publicly-traded builders, overall net home orders appear to have fallen considerably short of builder expectations as well, and net order per community appear on aggregate to have declined about 6% YOY. The 13 large publicly-traded home builders I track in aggregate increased the number of lots they owned or controlled from the fall of 2011 to the fall of 2013 by about 30% -- with the bulk of the gain occurring since the middle of 2012 – and in aggregate these companies planned to increase both community counts and sales by 15-17% this year. One reason net orders have been below consensus is that many builders raised prices aggressively last year. Now that builders have substantially larger land/lot inventories – and a lot more of it is developed now compared to a year ago – it is a pretty good bet that builders’ “pricing power” has fallen sharply, and that new home prices will on average (and adjusted for mix) show little if any increase for the remainder of this year.

Chemical Activity Barometer for June Suggests "continued growth"

by Calculated Risk on 6/27/2014 02:38:00 PM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Leading Economic Indicator Continues Upward Trend Despite Impacts of Global Unrest

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), continued its upward growth this month, with a 0.5 percent gain from May. Measured on a three-month moving average (3MMA), the CAB’s 0.5 percent gain beat the average first quarter monthly gains of 0.3 percent. Though the pace of growth has slowed significantly, gains in June have brought the CAB up a solid 4.3 percent over this time last year.

“Overall, we are seeing signs of continued growth in the U.S. economy, and trends in construction-related chemistry show a market which has not yet reached its full potential,” said Dr. Kevin Swift, chief economist at ACC. “However, unrest in Iraq is already affecting chemical equity prices, and the potential for an energy price shock is worrying,” he added.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests continued growth.

Vehicle Sales Forecasts: Over 16 Million SAAR again in June

by Calculated Risk on 6/27/2014 11:45:00 AM

The automakers will report June vehicle sales on Tuesday, July 1st. Sales in May were at 16.71 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in June will be above 16 million (SAAR) again.

Note: There were only 24 selling days in June this year compared to 26 last year.

Here are a few forecasts:

From WardsAuto: Forecast Calls for Strong June Sales

A new WardsAuto forecast calls for strong U.S. light-vehicle sales in June, with competition in the midsize car segment and healthy inventories across all segments fueling growth. ... The projected 16.4 million-unit seasonally adjusted annual rate would be less than May’s 87-month-high 16.7 million SAAR ...From J.D. Power: J.D. Power and LMC Automotive Report: New-Vehicle Sales Continue Year-over-Year Growth

Total light-vehicle sales in June 2014 are expected to approach 1.4 million units, a 5 percent increase from June 2013. The pace of fleet volume growth continues to be lower than retail, with a 1 percent increase year over year, accounting for 19 percent of total sales in June. ... [16.3 million SAAR]

From TrueCar: June SAAR to Hit 16.4 Million Vehicles, According to TrueCar; 2014 New Vehicle Sales Expected to be up 1.0 Percent Year-Over-Year

Seasonally Adjusted Annualized Rate ("SAAR") of 16.4 million new vehicle sales is up 3.2 percent from June 2013 and down 1.8 percent over May 2014.Another solid month for auto sales.

Final June Consumer Sentiment increases to 82.5

by Calculated Risk on 6/27/2014 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for June increased to 82.5 from the May reading of 81.9, and was up from the preliminary June reading of 81.2.

This was above the consensus forecast of 82.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

Thursday, June 26, 2014

Zillow: Case-Shiller House Price Index expected to slow further year-over-year in May

by Calculated Risk on 6/26/2014 08:39:00 PM

The Case-Shiller house price indexes for April were released Tuesday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Indices Will Continue to Show More Marked Slowdowns

he Case-Shiller data for April 2014 came out this morning (research brief here), and based on this information and the May 2014 Zillow Home Value Index (ZHVI, released June 22), we predict that next month’s Case-Shiller data (May 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased by 9.6 percent and 9.7 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from April to May will be 0.4 percent for both the 20-City Composite Index and the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for May will not be released until Tuesday, July 29.So the Case-Shiller index will probably show another strong year-over-year gain in May, but lower than in April (10.8% year-over-year).

| Zillow May 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | May 2013 | 169.47 | 170.00 | 156.06 | 156.52 |

| Case-Shiller (last month) | Apr 2014 | 183.28 | 186.46 | 168.71 | 171.73 |

| Zillow Forecast | YoY | 9.7% | 9.7% | 9.6% | 9.6% |

| MoM | 1.4% | 0.4% | 1.4% | 0.4% | |

| Zillow Forecasts1 | 185.9 | 186.8 | 171.1 | 172.0 | |

| Current Post Bubble Low | 146.45 | 149.86 | 134.07 | 137.14 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 26.9% | 24.7% | 27.6% | 25.4% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Freddie Mac: Mortgage Serious Delinquency rate declined in May, Lowest since January 2009

by Calculated Risk on 6/26/2014 06:02:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 2.10% from 2.15% in April. Freddie's rate is down from 2.85% in May 2013, and this is the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for May on Monday, June 30th.

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.75 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2015.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of distressed sales for perhaps 2 more years (mostly in judicial foreclosure states).

Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group

by Calculated Risk on 6/26/2014 03:46:00 PM

As follow-up to my previous post, earlier today the Census Bureau released the population estimates by age for 2013: As the Nation Ages, Seven States Become Younger, Census Bureau Reports

The median age declined in seven states between 2012 and 2013, including five in the Great Plains, according to U.S. Census Bureau estimates released today. In contrast, the median age for the U.S. as a whole ticked up from 37.5 years to 37.6 years.I think the headline should have been something like: Baby Boomers lose Title as Largest 5-Year Cohort!

Note: This is a positive for apartments, see: The Favorable Demographics for Apartments and Apartments: Supply and Demand

The table below shows the top 11 cohorts by size for 2010, 2013 (released today), and Census Bureau projections for 2020 and 2030.

As I noted earlier, by 202 8 of the top 10 cohorts will be under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

As the graph in the previous post indicated, even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon.

There will be plenty of "gray hairs" walking around in 2020 and 2030, but the key for the economy is the population in the prime working age will be increasing again soon.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2013 | 2020 | 2030 |

| 1 | 45 to 49 years | 20 to 24 years | 25 to 29 years | 35 to 39 years |

| 2 | 50 to 54 years | 50 to 54 years | 30 to 34 years | 40 to 44 years |

| 3 | 15 to 19 years | 25 to 29 years | 35 to 39 years | 30 to 34 years |

| 4 | 20 to 24 years | 30 to 34 years | Under 5 years | 25 to 29 years |

| 5 | 25 to 29 years | 45 to 49 years | 55 to 59 years | 5 to 9 years |

| 6 | 40 to 44 years | 55 to 59 years | 20 to 24 years | 10 to 14 years |

| 7 | 10 to 14 years | 15 to 19 years | 5 to 9 years | Under 5 years |

| 8 | 5 to 9 years | 40 to 44 years | 60 to 64 years | 15 to 19 years |

| 9 | Under 5 years | 10 to 14 years | 15 to 19 years | 20 to 24 years |

| 10 | 35 to 39 years | 5 to 9 years | 10 to 14 years | 45 to 49 years |

| 11 | 30 to 34 years | Under 5 years | 50 to 54 years | 50 to 54 years |

The Future is still Bright!

by Calculated Risk on 6/26/2014 12:56:00 PM

Trulia chief economist Jed Kolko wrote this morning:

"Median age in US ~38. But modal age is 23. Five most common ages: 23, 24, 22, 54, 53."This is an important change in the modal age. As I've noted before, by 2020, eight of the top ten largest cohorts (five year age groups) will be under 40, and by 2030 the top 11 cohorts will be the youngest 11 cohorts.

Demographics is a key driver of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of these younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through May 2014.

Click on graph for larger image.

Click on graph for larger image.There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The good news is the prime working age group will start growing again by 2020, and this should boost economic activity.

But that is medium term - in the near term, the reasons for a pickup in economic growth are still intact:1) the housing recovery should continue, 2) household balance sheets are in much better shape. This means less deleveraging, and probably a little more borrowing, 3) State and local government austerity is over (in the aggregate),4) there will be less Federal austerity this year, 5) commercial real estate (CRE) investment will probably make a small positive contribution this year.

For new readers: I was very bearish on the economy when I started this blog in 2005 - back then I wrote mostly about housing (see: LA Times article and more here for comments about the blog). I started looking for the sun in early 2009, and now I'm more optimistic.

Last year I wrote The Future's so Bright .... In that post I outlined why I was becoming more optimistic.

Here are some updates to the graphs I posted last year. Several of these graphs have changed direction (as predicted) since I wrote that post. For example, state and local government employment is now increasing, and household debt has started increasing.

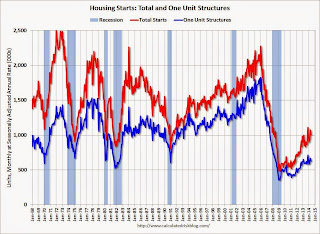

This graph shows total and single family housing starts. Even after the 28.2% increase in 2012, and 18.5% increase in 2013 (to 925 thousand starts), starts are still way below the average level of 1.5 million per year from 1959 through 2000.

This graph shows total and single family housing starts. Even after the 28.2% increase in 2012, and 18.5% increase in 2013 (to 925 thousand starts), starts are still way below the average level of 1.5 million per year from 1959 through 2000.Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase another 50% or so over the next few years from the May 2014 level of 1 million starts (SAAR).

Residential investment and housing starts are usually the best leading indicator for the economy, so this suggests the economy will continue to grow over the next couple of years.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, 249,000 in 2011, and 33,000 in 2012.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, 249,000 in 2011, and 33,000 in 2012. In 2013, state and local government employment increased by 44,000 jobs.

This year, through May 2014, state and local employment is up 46,000. So it appears that most of the state and local government layoffs are over - and the economic drag on the economy is over.

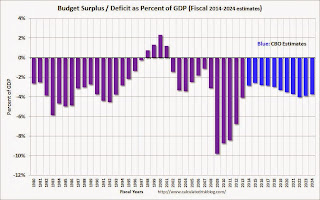

And here is a key graph on the US deficit. This graph, based on the CBO's May projections, shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

And here is a key graph on the US deficit. This graph, based on the CBO's May projections, shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably remain under 3% for several years.

Here are a couple of graph on household debt (and debt service):

This graph from the the NY Fed shows aggregate household debt increased $129 billion in Q1 2014 from Q4 2013.

This graph from the the NY Fed shows aggregate household debt increased $129 billion in Q1 2014 from Q4 2013.From the NY Fed: "In its Q1 2014 Household Debt and Credit Report, the Federal Reserve Bank of New York announced that outstanding household debt increased $129 billion from the previous quarter. The increase was led by rises in mortgage debt ($116 billion), student loan debt ($31 billion) and auto loan balances ($12 billion), slightly offset by a $27 billion declines in credit card and HELOC balances. Total household indebtedness stood at $11.65 trillion, 1.1 percent higher than the previous quarter. Overall household debt remains 8.1 percent below the peak of $12.68 trillion reached in Q3 2008. "

There will be some more deleveraging ahead for certain households (mostly from foreclosures and distressed sales), but it appears that in the aggregate, household deleveraging is over.

This graph is from the Fed's Q1 Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

This graph is from the Fed's Q1 Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.The overall Debt Service Ratio decreased in Q1, and is at a record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) are near the low for the last 30 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape than a few years ago.

And for commercial real estate, here is the AIA Architecture Billings Index. This is usually a leading indicator for commercial real estate, and even though the index has been moving sideways near the expansion / contraction line recently, the readings over the last year suggest some increase in CRE investment in 2014.

And for commercial real estate, here is the AIA Architecture Billings Index. This is usually a leading indicator for commercial real estate, and even though the index has been moving sideways near the expansion / contraction line recently, the readings over the last year suggest some increase in CRE investment in 2014.Overall it appears the economy is poised for more growth over the next few years.

As I noted at the beginning of this post, in the longer term I remain very optimistic. The renewing of America was one of the key points I made when I posted the following animation of the U.S population by age, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Kansas City Fed: Regional Manufacturing "Activity Slowed Somewhat" in June

by Calculated Risk on 6/26/2014 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity slowed somewhat, while producers’ expectations for future factory activity showed little change and remained at solid levels.The last regional Fed manufacturing survey for June will be released on Monday, June 30th (Dallas Fed). In general the regional surveys have indicated growth in June at about the same pace as in May.

“We saw some moderation in factory growth in June and many contacts mentioned difficulties finding qualified workers,” said Wilkerson. “However, many respondents noted solid expectations for future months.”

The month-over-month composite index was 6 in June, down from 10 in May and 7 in April. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index dropped from 14 to 2, and the new orders, employment, and new orders for exports indexes also declined.

emphasis added

Personal Income increased 0.4% in May, Spending increased 0.2%

by Calculated Risk on 6/26/2014 08:57:00 AM

The BEA released the Personal Income and Outlays report for May:

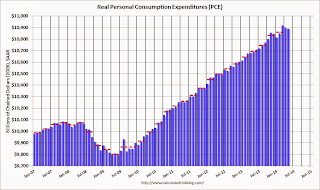

Personal income increased $58.8 billion, or 0.4 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $18.3 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in May, compared with a decrease of 0.2 percent in April. ... The price index for PCE increased 0.2 percent in May, the same increase as in April. The PCE price index, excluding food and energy, increased 0.2 percent in May, the same increase as in April. ... The May price index for PCE increased 1.8 percent from May a year ago. The May PCE price index, excluding food and energy, increased 1.5 percent from May a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Note: Usually the two-month and mid-month methods can be used to estimate PCE growth for the quarter (using the first two months and mid-month of the quarter). However this isn't very effective if there was an "event", and in Q1 PCE was especially weak in January and February - and then surged in March.

Still, using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 2.3% annual rate in Q2 2014 (using the mid-month method, PCE was increasing less than 1.5%). Since the comparison to March will be difficult, it appears PCE growth will be below 2% in Q2 (another weak quarter).

On inflation: The PCE price index increased 1.8 percent year-over-year, and at a 2.8% annualized rate in May. The core PCE price index (excluding food and energy) increased 1.5 percent year-over-year in May, and at a 2.0% annualized rate in May.

Weekly Initial Unemployment Claims decrease to 312,000

by Calculated Risk on 6/26/2014 08:34:00 AM

The DOL reports:

In the week ending June 21, the advance figure for seasonally adjusted initial claims was 312,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 312,000 to 314,000. The 4-week moving average was 314,250, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 500 from 311,750 to 312,250.The previous week was revised up from 312,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 314,250.

This was close to the consensus forecast of 313,000. The 4-week average is now at normal levels for an expansion.

Wednesday, June 25, 2014

Thursday: May Personal Income and Outlays, Weekly Unemployment Claims

by Calculated Risk on 6/25/2014 08:23:00 PM

First, according to Mortgage News Daily, 30 year mortgage rates have fallen to 4.13% today, down from 4.18% yesterday, and down from 4.59% a year ago.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 313 thousand from 312 thousand last week.

• Also at 8:30 AM, Personal Income and Outlays for May. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

Merrill Lynch on Q1 GDP Revision

by Calculated Risk on 6/25/2014 02:09:00 PM

From Merrill Lynch:

In the final release of 1Q GDP, growth was revised down significantly to -2.9% qoq saar from -1.0% previously. This was a big disappointment ...

The downward revision owed to two primary factors: weaker consumer spending on healthcare and a wider trade deficit. Updated data on healthcare spending contributed to a 1.2pp downward revision to GDP growth ... The large change to healthcare spending was due to the BEA significantly overestimating the impact of the Affordable Care Act (ACA).

The other major moving part was in net exports, largely due to a wider services trade deficit. ... This equates to an additional 0.6pp drag on GDP growth.

...

We caution against reading too much into the weakness, as it is clear that special factors during the quarter distorted growth. The severe winter weather weighed heavily on consumption, fixed investment and trade. Furthermore, there was a notable inventory drawdown that amounted to a 1.7pp drag on growth, following two strong quarters of inventory build in 3Q and 4Q of 2013. Despite the deeper contraction in this final release, we are not revising 2Q GDP growth. We continue to expect a 4.0% rebound in the second quarter, and the recent data suggest that we are headed in that direction. However, uncertainty around this number remains elevated: there could continue to be special factors at play stemming from the weakness in 1Q. Moreover, benchmark GDP revisions, released with the first estimate of 2Q GDP in July, could alter the trajectory.

Assuming 4.0% growth in 2Q and solid 3.0% growth in 2H, growth will still only average 1.7% this year. It certainly was not the start of the year we were hoping for.

emphasis added

DOT: Vehicle Miles Driven increased 1.8% year-over-year in April

by Calculated Risk on 6/25/2014 11:17:00 AM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 1.8% (4.6 billion vehicle miles) for April 2014 as compared with April 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 254.9 billion vehicle miles.

Cumulative Travel for 2014 changed by 0.0% (0.3 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways ...

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 77 months - 6+ years - and still counting. Currently miles driven (rolling 12 months) are about 2.3% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In April 2014, gasoline averaged of $3.74 per gallon according to the EIA. That was up from April 2013 when prices averaged $3.64 per gallon.

In April 2014, gasoline averaged of $3.74 per gallon according to the EIA. That was up from April 2013 when prices averaged $3.64 per gallon. Of course gasoline prices are just part of the story. The lack of growth in miles driven over the last 6+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven.

Q1 GDP Revised Down to -2.9% Annual Rate

by Calculated Risk on 6/25/2014 08:35:00 AM

From the BEA: Gross Domestic Product: First Quarter 2014 (Third Estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 2.9 percent in the first quarter of 2014 according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2013, real GDP increased 2.6 percent....Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 3.1% to 1.0%. Ouch!

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, real GDP was estimated to have decreased 1.0 percent. With the third estimate for the first quarter, the increase in personal consumption expenditures (PCE) was smaller than previously estimated, and the decline in exports was larger than previously estimated ...

The decrease in real GDP in the first quarter primarily reflected negative contributions from private inventory investment, exports, state and local government spending, nonresidential fixed investment, and residential fixed investment that were partly offset by a positive contribution from PCE. Imports, which are a subtraction in the calculation of GDP, increased.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 6/25/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 20, 2014. ...

The Refinance Index decreased 1 percent from the previous week to the lowest level since May 2014. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier to the lowest level since May 2014. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.33 percent from 4.36 percent, with points decreasing to 0.18 from 0.24 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 18% from a year ago.

Tuesday, June 24, 2014

Wednesday: Ugly 3rd Estimate of Q1 GDP, Durable Goods

by Calculated Risk on 6/24/2014 08:33:00 PM

From Neil Irwin at The Upshot (NY Times): Rise in Home Prices Is Slowing, and That’s a Good Thing

Home price numbers tend to move in more steady, gradual waves than other economic data. They also come out with long delays; the April Case-Shiller numbers are actually based on transactions that closed from February through April — and those home sales generally went under contract a month or two before they closed.Wednesday:

So the latest home price readings are very much a look in the rearview mirror, and it’s a look that suggests a deceleration is underway. ... The healthiest thing for the housing market would be home price rises that thread the needle: high enough that homeowners are building equity and homebuilders have incentive to start new construction, but low enough that they don’t significantly outpace wage growth and result in unaffordable housing and a painful correction. The April home price numbers suggest we may be heading there.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Q1 GDP (third estimate). This is the third estimate of Q1 GDP from the BEA. The consensus is that real GDP decreased 1.8% annualized in Q1, revised down from the second estimate of a 1.0% decrease.

• Also at 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.4% increase in durable goods orders.

House Prices: Real Prices and Price-to-Rent Ratio decline slightly in April

by Calculated Risk on 6/24/2014 04:20:00 PM

I've been expecting a slowdown in year-over-year prices as "For Sale" inventory increases, and it appears the slowdown has started. The Case-Shiller Composite 20 index was up 10.8% year-over-year in April; the smallest year-over-year increase since early 2013. Still, this is a very strong year-over-year change.

On a seasonally adjusted monthly basis, the Case-Shiller Composite 20 index was up 0.2% in April - and the Composite 10 was close to unchanged - the smallest monthly increase since prices bottomed in early 2012.

On a real basis (inflation adjusted), prices actually declined slightly for the first time since 2012. The price-rent ratio also declined slightly in April for the Case-Shiller Composite 20 index.

It is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through April) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through April) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to mid-2004 levels (and also back up to Q2 2008), and the Case-Shiller Composite 20 Index (SA) is back to November 2004 levels, and the CoreLogic index (NSA) is back to December 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 2001 levels, the Composite 20 index is back to August 2002, and the CoreLogic index back to December 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q1 2002 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to April 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels.

Comments on Housing and the New Home Sales report

by Calculated Risk on 6/24/2014 01:39:00 PM

In early May I wrote: What's Right with Housing? I concluded with "Housing is a slow moving market - and the recovery will not be smooth or fast with all the residual problems. But overall housing is clearly improving and the outlook remains positive for the next few years."

Here are a few positive updates:

1) Existing home sales were down 5.0% year-over-year in May. This is good news because the decline is due to fewer foreclosures and short sales.

2) Mortgage delinquencies are down sharply. See: Black Knight: Mortgage Loans in Foreclosure Process Lowest since July 2008 and Fannie Mae and Freddie Mac: Mortgage Serious Delinquency rate declined in April

3) The impact from rising mortgage rates is mostly behind us. In fact, mortgage rates are now down year-over-year. On June 23, 2013, 30 year mortgage rates were at 4.49%. On June 23, 2014, 30 year fixed rates were at 4.18%.

4) Existing home inventory is increasing, and house price increases are slowing. Sometimes rising inventory is a sign of trouble (I was pointing to this in 2005), but now inventory is so low that it is a positive that inventory is increasing. This will also slow house price increases (I think that will be a positive for housing too - a more normal market).

Overall the housing recovery is ongoing and should continue.

Also this morning the Census Bureau reported that new home sales were at a seasonally adjusted annual rate (SAAR) of 504 thousand in May. That is the highest level since May 2008. As usual, I don't read too much into any one report. In fact, through May this year, sales were 196,000, Not seasonally adjusted (NSA) - only up 2% compared to the same period in 2013 - not much of an increase.

This was a disappointing start to the year, probably mostly due to higher mortgage rates and higher prices. Also there were probably supply constraints in some areas and credit remains difficult for many potential borrowers.

Also early 2013 was a difficult comparison period. Annual sales in 2013 were up 16.3% from 2012, but sales in the first five months of 2013 were up 23% from the same period in 2012!

Click on graph for larger image.

Click on graph for larger image.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The comparisons to last year will be a little easier starting in July, and I still expect to see solid year-over-year growth later this year.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through May 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through May 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will slowly decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

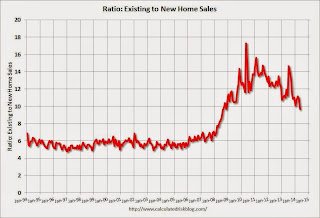

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down - and is currently at the lowest level since November 2008. I expect this ratio to continue to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase sharply to 504,000 Annual Rate in May

by Calculated Risk on 6/24/2014 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 504 thousand.

April sales were revised down from 433 thousand to 425 thousand, and March sales were revised up from 407 thousand to 410 thousand.

Sales of new single-family houses in May 2014 were at a seasonally adjusted annual rate of 504,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 18.6 percent above the revised April rate of 425,000 and is 16.9 percent above the May 2013 estimate of 431,000.

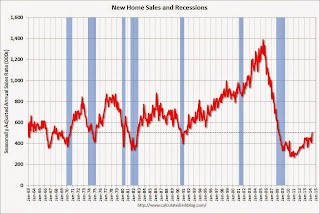

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This is the highest sales rate since May 2008. Even with the increase in sales over the previous two years, new home sales are still just above the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 4.5 months from 5.3 months in April.

The months of supply decreased in May to 4.5 months from 5.3 months in April. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of May was 189,000. This represents a supply of 4.5 months at the current sales rate."

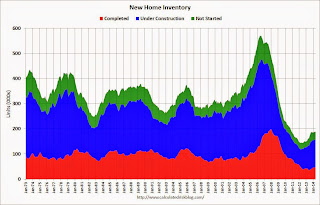

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2014 (red column), 49 thousand new homes were sold (NSA). Last year 40 thousand homes were also sold in May. The high for May was 120 thousand in 2005, and the low for May was 26 thousand in 2010.

This was well above expectations of 441,000 sales in May, and sales were up 16.9% year-over-year.

I'll have more later today .