by Calculated Risk on 12/31/2008 02:30:00 PM

Wednesday, December 31, 2008

Cartoon: Some Things Never Change

This cartoon is from 1992 ...

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Cartoon: CR on Vacation

by Calculated Risk on 12/31/2008 11:30:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

I'll be home tomorrow! Happy New Year to All!

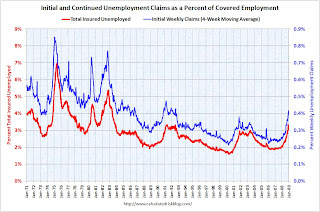

Weekly Unemployment Claims Decline

by Calculated Risk on 12/31/2008 08:59:00 AM

From the DOL: Unemployment Insurance Weekly Claims Report

In the week ending Dec. 27, the advance figure for seasonally adjusted initial claims was 492,000, a decrease of 94,000 from the previous week's unrevised figure of 586,000. The 4-week moving average was 552,250, a decrease of 5,750 from the previous week's unrevised average of 558,000.Although the data is seasonally adjusted, I'd discount the decline because of the holidays.

The advance seasonally adjusted insured unemployment rate was 3.4 percent for the week ending Dec. 20, an increase of 0.1 percentage point from the prior week's unrevised rate of 3.3 percent.

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 20 was 4,506,000, an increase of 140,000 from the preceding week's revised level of 4,366,000.

Note that the total insured unemployment is now over 4.5 million for the first time since 1982.

Tuesday, December 30, 2008

Office Rents off as much as 25% in New York

by Calculated Risk on 12/30/2008 06:43:00 PM

From the NY Times: A Renter’s Market for Manhattan Offices

Even to industry veterans who have lived through other downturns, the precipitous decline in the Manhattan office market, especially in Midtown, has been startling.And the market will probably be flooded with sublease space in 2009.

“We have fallen further faster than any time in the last 20 years,” said Mitchell S. Steir, chief executive of Studley, a national brokerage firm that represents tenants. “There has been more damage to real estate values in the last four months than in any other four-month period. The pace with which it has occurred has been astonishing.”

...

[B]rokers say that actual rents have fallen much further than the data suggests. Studley said that the asking rents for 40 percent of the spaces included in its research are listed as “negotiable.”

“No one knows what the rents are, because there has been very little activity for the past three months,” said Ruth Colp-Haber, a partner at Wharton Property Advisors, which represents small to medium-size tenants. “No one is paying attention to the asking rents.”

...

[A]ctual rents have slipped as much as 25 percent since the summer, said Mitchell L. Konsker, a vice chairman of Cushman & Wakefield.

New Commenting System

by Calculated Risk on 12/30/2008 02:30:00 PM

A few more vacation days ... I'll be back soon.

Hopefully next week I'll be moving to the new JS-Kit commenting system. This should help with improving the quality of the comments. For those interested, check on Mish's site.

Intermittent posting continues ...

Best to all

NY Times: Toxic Homes and Divorces

by Calculated Risk on 12/30/2008 11:32:00 AM

From the NY Times: Breaking Up Is Harder to Do After Housing Fall

With nearly one in six homes worth less than the mortgage owed on it, according to Moody’s Economy.com, divorce lawyers and financial advisers around the country say the logistics of divorce have been turned around. “We used to fight about who gets to keep the house,” said Gary Nickelson, president of the American Academy of Matrimonial Lawyers. “Now we fight about who gets stuck with the dead cow.”I know a couple with this problem - no one wants the house.

S&P Case-Shiller: Home prices off 18% in past year

by Calculated Risk on 12/30/2008 09:00:00 AM

From the WSJ: Case-Shiller Index Shows Sharpest Home-Price Declines in Sun Belt

Home prices continued to drop as the economic downturn deepened further in October, according to the S&P/Case-Shiller home-price indexes, a closely watched gauge of U.S. home prices, with home prices in the Sun Belt continuing to be hit hardest.I'll post graphs on Friday when I return.

"The bear market continues; home prices are back to their March 2004 levels," said David M. Blitzer, chairman of S&P's index committee. He added that both composite indexes and 14 of the 20 metropolitan areas are reporting new record declines. As of October, the 10-city index is down 25% from its mid-2006 peak and the 20-city is down 23%, Blitzer said.

The indexes showed prices in 10 major metropolitan areas fell 19% in October from a year earlier and 3.6% from September. The drop marks the 10-city index's 13th straight monthly report of a record decline.

In 20 major metropolitan areas, home prices dropped 18% from the prior year, also a record, and 2.2% from September.

Monday, December 29, 2008

GMAC Bailout

by Calculated Risk on 12/29/2008 10:08:00 PM

From the WSJ: U.S. Deepens Involvement With GMAC Move

The U.S. government Monday deepened its involvement in the U.S. automotive industry by committing $6 billion to stabilize GMACLLC, a financing company vital to the future of struggling carmaker General MotorsCorp.The bailout expands ...

In a sign that the government's role in the industry could become open ended, Treasury said late Monday it had set up a separate program within the Troubled Asset Relief Program, a fund originally designed to help banks, to make investments directed at the auto industry. A Treasury official said the new program didn't have a specific dollar limit.

In Monday's move, the Treasury said it purchased $5 billion in senior preferred equity in GMAC and offered a new $1 billion loan to General Motors so that the automaker could participate in a rights offering at GMAC. That loan comes in addition to the recent $17.4 billion emergency plan to rescue General Motors and Chrysler LLC.

Open Thread ...

by Calculated Risk on 12/29/2008 02:30:00 PM

Some more discussion in the comments ... I'll post tonight. Posting will be intermittent for the next few days.

Open Discussion

by Calculated Risk on 12/29/2008 11:30:00 AM

I'm hiking at the Canyon de Chelly in Arizona today. I'll post later today ...

Krugman: 50 Hoovers

by Calculated Risk on 12/29/2008 08:40:00 AM

Paull Krugman writes: Fifty Herbert Hoovers

No modern American president would repeat the fiscal mistake of 1932, in which the federal government tried to balance its budget in the face of a severe recession. The Obama administration will put deficit concerns on hold while it fights the economic crisis.State and local governments cut back every down turn, exacerbating the recession.

But even as Washington tries to rescue the economy, the nation will be reeling from the actions of 50 Herbert Hoovers — state governors who are slashing spending in a time of recession, often at the expense both of their most vulnerable constituents and of the nation’s economic future.

Krugman doesn't mention it, but most governments also tend to spend every dollar (or more!) during economic booms. Oh well ...

(out hiking today)

Sunday, December 28, 2008

Report: IndyMac Deal Near

by Calculated Risk on 12/28/2008 10:21:00 PM

From the NY Times: Private Equity Firms Are Near Deal to Buy IndyMac

The deal is in the final stages of negotiations, which are private, and could be announced as early as Monday ... The team of buyers include the private equity firms J. C. Flowers & Company and Dune Capital Management and the hedge fund Paulson & Company, the people involved in the deal said. It was unclear exactly how much capital the buyers would inject into IndyMac, but they would be shouldering a portion of the losses the bank may have on mortgages and other assets, these people said.Note: Light posting for next few days. Recharging my batteries in the mountains. Best to all.

The proposed deal is unusual because it is one of the first transactions involving unregulated private equity firms acquiring a majority stake in a bank holding company.

NY Times on Possible CRE Bailout

by Calculated Risk on 12/28/2008 08:54:00 AM

From the NY Times: A Wish List for Commercial Real Estate

Commercial real estate groups have been meeting with members of Congress, the Federal Reserve, the Treasury, the Federal Deposit Insurance Corporation as well as Mr. Obama’s transition team, to press their case. And they say they have a compelling one.This is similar to the WSJ article I covered last week. The answer is there is no reason for a CRE bailout:

[T]his is really about property investors who bought commercial buildings at the price peak and are now underwater. But say the owners default and the properties are transferred to the bondholders - what is the risk to the economy? None.The NY Times article claims CRE is in pretty good shape:

Although commercial real estate remains in better shaper than some other industries — there is a good balance between supply and demand, vacancy rates are modest and loan default rates have so far hovered at a rock-bottom 1 percent, according to trade groups — industry leaders warn that the sector faces significant problems.Default rates are low - but starting to rise. However the balance between supply and demand is poor and vacancy rates are rising rapidly.

WaMu "A thin file is a good file"

by Calculated Risk on 12/28/2008 12:30:00 AM

Here is an article from the NY Times on WaMu: By Saying Yes, WaMu Built Empire on Shaky Loans

Not much new, although I was aware of WaMu's lax lending, I wasn't aware of this flier:

By 2005, the word was out that WaMu would accept applications with a mere statement of the borrower’s income and assets — often with no documentation required — so long as credit scores were adequate, according to Ms. Zaback and other underwriters.Just great ...

“We had a flier that said, ‘A thin file is a good file,’ ” recalled Michele Culbertson, a wholesale sales agent with WaMu.

Note: light posting while I'm traveling for the holidays. Adventure pictures to come! Best to all.

Saturday, December 27, 2008

CRE Boom Ends in New York

by Calculated Risk on 12/27/2008 10:10:00 AM

From the NY Times: Downturn Ends Building Boom in New York

Nearly $5 billion in development projects in New York City have been delayed or canceled because of the economic crisis, an extraordinary body blow to an industry that last year provided 130,000 unionized jobs, according to numbers tracked by a local trade group.More bad CRE news ...

...

The long-term impact is potentially immense, experts said. Construction generated more than $30 billion in economic activity in New York last year, said Louis J. Coletti, the chief executive of the Building Trades Employers’ Association. The $5 billion in canceled or delayed projects tracked by Mr. Coletti’s association include all types of construction: luxury high-rise buildings, office renovations for major banks and new hospital wings. Mr. Coletti’s association, which represents 27 contractor groups, is talking to the trade unions about accepting wage cuts or freezes. So far there is no deal.

Not surprisingly, unemployment in the construction industry is soaring: in October, it was up by more than 50 percent from the same period last year, labor statistics show.

Friday, December 26, 2008

WSJ: Retailers Brace for Major Change

by Calculated Risk on 12/26/2008 08:55:00 PM

From the WSJ: Retailers Brace for Major Change a few excerpts:

More Bankruptcies: Corporate-turnaround experts and bankruptcy lawyers are predicting a wave of retailer bankruptcies early next year, after being contacted by big and small retailers either preparing to file for Chapter 11 bankruptcy protection or scrambling to avoid that fate.January is usually the busiest month for retailer bankruptcies ... and 2009 will probably be especially busy.

Analysts estimate that from about 10% to 26% of all retailers are in financial distress and in danger of filing for Chapter 11. AlixPartners LLP, a Michigan-based turnaround consulting firm, estimates that 25.8% of 182 large retailers it tracks are at significant risk of filing for bankruptcy or facing financial distress in 2009 or 2010. In the previous two years, the firm had estimated 4% to 7% of retailers then tracked were at a high risk for filing.

...

Store Closings: The International Council of Shopping Centers estimates that 148,000 stores will close in 2008, the most since 2001, and it predicts that there will be an additional 73,000 closures in the first half of 2009.

Note:light posting for the next few days. Best to all.

Cartoon: Can I have a pony?

by Calculated Risk on 12/26/2008 01:05:00 PM

| A late Christmas present ... Click on cartoon for larger image in new window. Cartoon from Stu Rees Stu Rees Cartoons |

Low Mortgage Rates, Few Qualify

by Calculated Risk on 12/26/2008 11:33:00 AM

From the Miami Herald: Refinance rates low; few qualify

Recent drops in interest rates have homeowners rushing to call local banks and mortgage lenders about refinancing. Loan applications are pouring in.This is a key point - these lower rates don't help underwater homeowners. Also, I think the 45% debt-to-gross income ratio is a little higher than most lenders will allow now.

Yet, South Florida homeowners are mostly getting a big fat ''No!'' from the bank when they ask to refinance. The chief reason: Falling home values mean they owe more than their homes are worth.

...

In South Florida, four in 10 homeowners who bought or refinanced over the past five years owe more on their home than it is worth, according to sales and mortgage data analyzed by Zillow.com ... Many of them chose adjustable-rate loans and other expensive mortgages because that was the only way they could afford the payments.

...

''This is only putting people who are in a good position in a better position,'' [Justin Miller, a broker with Resource Mortgage Group in Plantation] said.

...

Before LaPenta begins processing an application, he said he makes sure customers are aware of the essential criteria needed to refinance: 20 percent equity in the property, a homestead exemption, a credit score of 700 or higher, a mortgage debt-to-income ratio of no more than 45 percent and the ability to fully document income and assets.

Japan Industrial Output: Cliff Diving

by Calculated Risk on 12/26/2008 09:55:00 AM

From MarketWatch: Japan November industrial output falls 'off the cliff'

Japan's industrial output tumbled at a record pace in November, stoking fears the country's recession may stretch longer and be more painful than anticipated.I think the proper phrase is "cliff diving".

Industrial production fell as much as 8.1% in November from the previous month -- the biggest drop in the measure since the government started releasing comparable figures in 1953 -- as Japanese companies produced less automobiles and other machinery on vanishing demand.

The drop was steeper than the 6.8% fall expected by economists, and came after a 3.1% decline in October.

"Industrial production in Japan is falling off the cliff," wrote Merrill Lynch Economist Takuji Okubo ...

Light posting today ... I'm traveling. Best to all.

Thursday, December 25, 2008

More Bad News for Retail Sales

by Calculated Risk on 12/25/2008 09:45:00 PM

From the WSJ: Retail Sales Plummet

[T]otal retail sales, excluding automobiles, fell over the year-earlier period by 5.5% in November and 8% in December through Christmas Eve, according to MasterCard Inc.'s SpendingPulse unit.These preliminary numbers suggest that retail sales in December were even weaker than in October and November.

When gasoline sales are excluded, the fall in overall retail sales is more modest: a 2.5% drop in November and a 4% decline in December.

"This will go down as the one of the worst holiday sales seasons on record," said Mary Delk, a director in the retail practice at consulting firm Deloitte LLP.

A Christmas Present for UberNerds

by Calculated Risk on 12/25/2008 12:17:00 PM

A special present for UberNerds - a previously unpublished Tanta post (written Dec 31, 2007):

And from Tanta's 2007 Post: A Very Nerdy Christmas (see her post for an explanation of the origins of the Mortgage Pig™)Pig Rulz

There have been some misconceptions in the comments about Mortgage Pig™. I do not wish to enter a new year on the wrong track.

Mortgage Pig™ does not have a "name" except Mortgage Pig™. Assertions about Mortgage Pig™'s "name," "address," "job," "significant other," or favorite swill are not canonical. Anyone who asserts knowledge of such things in any communication, written or otherwise, is creating an Internet Urban Legend. Next thing you know they'll be telling you that you can Get Rich Qwik in RE investing.

Happy Holidays to all! CR

Wednesday, December 24, 2008

Live from New York ...

by Calculated Risk on 12/24/2008 06:35:00 PM

Happy Holidays to all (live from Rockefeller Center):

GMAC Approved as Bank Holding Company

by Calculated Risk on 12/24/2008 05:32:00 PM

From the Fed: Order Approving Formation of Bank Holding Companies and Notice to Engage in Certain Nonbanking Activities. Here is interesting part on ownership:

To address concerns that GM could control GMAC and GMAC Bank for purposes of the BHC Act, GM has committed to the Board that before consummation of the proposal, GM will reduce its ownership interest in GMAC to less than 10 percent of the voting and total equity interest of GMAC. GM’s remaining equity interest in GMAC will be transferred to a trust that has a trustee acceptable to the Board and the Department of the Treasury, who will be entirely independent of GM and have sole discretion to vote and dispose of the GMAC equity interests. The trustee must dispose of the equity interests held in the trust within three years of the trust’s creation.

...

To ensure that Cerberus’s holdings in GMAC are consistent with the Board’s precedent on noncontrolling investments in banks and bank holding companies, each Cerberus fund that holds interests in GMAC will distribute its equity interests in the company to its respective investors. As a result of this distribution, the aggregate direct and indirect investments controlled by Cerberus and its related parties would not exceed 14.9 percent of the voting shares or 33 percent of the total equity of GMAC LLC.

...

In addition, Cerberus employees and consultants would cease providing services to, or otherwise functioning as dual employees of, GMAC, and neither Cerberus nor any affiliated entity will have any advisory relationships with GMAC or any investor regarding the vote or sale of shares or the management or policies of GMAC or GMAC Bank.

Oil Prices: Cliff Diving

by Calculated Risk on 12/24/2008 03:57:00 PM

From MarketWatch: Oil tumbles 9.3% as Cushing inventories hit record

Crude-oil futures fell for a third session Wednesday, tumbling 9.3% to close below $36 a barrel as government data showed inventories at a key delivery point hit a record.And all these Gulf States need $50 per barrel just to pay for their government programs.

Crude inventories at Cushing, Okla., the delivery point for crude futures contracts traded on the New York Mercantile Exchange, reached 28.7 million barrels in the week ended Dec. 19, the Energy Information Administration reported.

It was the highest since at least April 2004, when the government started collecting Cushing data.

...

Crude for February delivery ended down $3.63 at $35.35 a barrel in Nymex dealings.

And this is hitting other oil producers too, from Bloomberg: Russia’s Central Bank Devalues Ruble for Third Time in Week

Russia devalued the ruble for the third time in a week, sending the currency to its lowest level against the dollar since January 2006, as oil’s drop below $37 a barrel dimmed the outlook for growth.

...

The economy, which recovered from the government’s 1998 debt default to expand an average 7 percent in the eight years to 2007, may slip into a recession in the first half of 2009, Kremlin economic adviser Arkady Dvorkovich told Bloomberg Television on Dec. 19.

The government will post a budget deficit next year for the first time in a decade and will use its $132.6 billion reserve fund, or extra oil revenue the government has set aside, to cover the financing gap, Dvorkovich told reporters in Moscow today.

Conforming Mortgage Rates Fall, Jumbo Spread at Record

by Calculated Risk on 12/24/2008 01:01:00 PM

Freddie Mac reported Long-Term Rates Fall for Eight Consecutive Week Setting Another New Low

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.14 percent with an average 0.8 point for the week ending December 24, 2008, down from last week when it averaged 5.19 percent. Last year at this time, the 30-year FRM averaged 6.17 percent. The 30-year FRM has not been lower since Freddie Mac started the Primary Mortgage Market Survey in 1971.The MBA reported: Near Record Low Mortgage Rates Boost Mortgage Applications in Latest MBA Weekly Survey

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.04 percent from 5.18 percent, with points increasing to 1.17 from 1.13 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The contract rate for 30-year fixed-rate mortgages is the lowest recorded in the survey since the record low of 4.99 percent for the week ending June 13, 2003.Note the surge in refinance applications too!

However, Bloomberg reports: Jumbo Mortgage Shoppers Get Little Relief From Rates

Jumbo mortgage shoppers in the most expensive U.S. housing markets such as New York and San Francisco aren’t getting much relief from lower borrowing costs.It's jumbos rates that matter for most of California and other higher priced markets.

The average 30-year fixed rate for home loans of more than $729,750 remains almost 2 percentage points above conforming rates and the spread between them may set a record this month, according to financial data firm BanxQuote.

...

The difference between the two averaged 2.13 percentage points in December, 10 times the spread from 2000 to 2006 and above last month’s 1.95 percentage points that was the highest on record.

Savings Rate Starting to Recover

by Calculated Risk on 12/24/2008 11:33:00 AM

Here is a graph of the U.S. savings rate as a percent of disposable personal income. Click on graph for larger image in new window.

Click on graph for larger image in new window.

It looks like savings from lower gasoline prices is showing up as savings - as opposed to other consumption - and this process of increasing savings is a necessary step towards restoring healthy household balance sheets.

This is one of the areas some analysts really got wrong during the housing bubble. As an example, here is Larry Kudlow in 2006: Riding the Right Curve

Despite the grim picture the mainstream media continue to paint about just about everything ... there’s one thing they just can’t taint: This U.S. economy remains very healthy.By focusing on net wealth (inflated by the housing bubble and excessive stock prices), Mr. Kudlow completely missed the biggest story of our time. As I noted then, the savings rate (as calculated by the BEA), is the true savings rate. The savings rate was too low then - and the rate remains too low now - but it is starting to recover.

...

The latest chant is that ... a day of reckoning marked by a housing-price crash and an overwhelming debt burden is headed our way. This is utter nonsense.

...

Family net wealth, the nation’s true savings rate, advanced 8 percent in 2005 to a record level of $52 trillion.

Estimating PCE Growth for Q4 2008

by Calculated Risk on 12/24/2008 09:26:00 AM

Last quarter I was the first to note that PCE would probably be negative in the quarter based on the "two month estimate". That was the first decline in PCE since Q4 1991.

This quarter the two month estimate suggests PCE will be negative again. However most analysts might be a little too pessimistic for Q4 2008.

The BEA reports on Personal Income and Outlays:

Personal consumption expenditures (PCE) decreased $56.1 billion, or 0.6 percent.That may sound bad, but it is somewhat better than expected.

Maybe December will be especially weak, or maybe October and November will be revised downwards, but the two month estimate suggests real PCE will decline in Q4 by about 2.9% (annual rate).

Other components of GDP - especially invesment - will be very weak in Q4, but most estimates of negative 5% GDP change (annualized) included a decline of PCE in the negative 4% to 4.5% range.

As an example, here is the Northern Trust forecast (last page) of -5.0% GDP, and -4.0% PCE in Q4 2008. Since PCE accounts for about 71% of GDP, maybe these forecasts will be revised up slightly.

Weekly Unemployment Claims: 26 Year High

by Calculated Risk on 12/24/2008 09:10:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 20, the advance figure for seasonally adjusted initial claims was 586,000, an increase of 30,000 from the previous week's revised figure of 556,000. The 4-week moving average was 558,000, an increase of 13,750 from the previous week's revised average of 544,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 13 was 4,370,000, a decrease of 17,000 from the preceding week's revised level of 4,387,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims since 1968.

The four week moving average is at 558,000; the highest since December 1982.

Continued claims are now at 4.37 million.

This graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

This graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

By these measures, the current recession is already worse than the '01 recession, and close to the '90/'91 recession.

Hotels: Occupancy Rate Falling, Delinquencies Rising

by Calculated Risk on 12/24/2008 02:13:00 AM

From the Chicago Tribune: Chicago hotel occupancy falls 13% in November

Downtown Chicago hotels saw a 13.1 percent dive in the average occupancy rate, to 69 percent last month from a year earlier, according to Smith Travel Research. Nationwide, occupancy dropped 10.6 percent, to a 51.9 percent rate.A double digit RevPAR decline (revenue per available room) is stunning.

Pricing dropped as well, leading to double-digit declines in revenue per available room, a key measure of profitability. In downtown Chicago, the decline was 20.6 percent; nationally, it was 12.9 percent.

Also, Deutsche Bank reported in their Commercial Real Estate Outlook: Q4 2008 (no link), that "hotel loan deterioration now beginning to take-off" and that the 30-day delinquency rate has risen from 6bp to 55bp in just the last three months.

Falling hotel occupancy rates - leading to lower revenues and higher delinquency rates ... what a surprise!

Tuesday, December 23, 2008

Cerberus Limits Withdrawals

by Calculated Risk on 12/23/2008 08:15:00 PM

Video from CNBC.

From Bloomberg: Cerberus Caps Withdrawals From Hedge Fund After Loss

Cerberus Capital Management LLC, the $27 billion investment firm founded by billionaire Stephen Feinberg, limited investor withdrawals from one of its hedge funds after it lost 16 percent this year through November.As we all know, Cerberus is the three-headed dog who guards the gates of Hell. And at least one head is making sure investors' money doesn't escape from money hell.

Manhattan Office Vacancy Rate Rises to 10.9%

by Calculated Risk on 12/23/2008 07:12:00 PM

From Reuters: Manhattan office vacancy rate hits two-year high

The overall vacancy rate rose to 10.9 percent in the fourth quarter, the highest level in two years and more than three percentage points greater than a year ago, according to the report released by FirstService Williams.This fits with the report Mayor Bloomberg released on the NY City economy in November.

Space available directly from a landlord registered an 8.1 percent vacancy rate in the fourth quarter, while sublease space weighed in at 2.8 percent -- the highest rate in more than three years.

...

"With leasing activity languishing and tenant space choices growing exponentially, it is not surprising that the overall asking rent for Manhattan dropped by 4 percent from the previous quarter," Mark Jaccom, FirstService Williams chief executive, said in a statement.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual and projected (by the NYC OMB) rents and office vacancy rate for NYC Class A buildings (note: the Reuters story was all office space).

The Class A vacancy rate is expected to rise from about 7.5% to 13%, and rents are expect to decline by 20% or more from the peak.

Even More on Home Sales

by Calculated Risk on 12/23/2008 04:23:00 PM

Lots of housing news today ...

New Home Sales Lowest since 1982

Existing Home Sales Plunge

And here is an analysis of existing home turnover (not pretty), and NSA data showing the existing home sales plunge was worse than the headline number.

And now some more graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares New and Existing home sales. Although sales tracked pretty well from 1994 through 2005, existing home sales have outperformed new home sales for the last few years.

One of the key reason for the difference is lender REO sales (foreclosure resales).

From the NY Times:

Lawrence Yun, chief economist of the National Association of Realtors, said that 45 percent of all home sales in November were so-called “distressed sales,” meaning that the sellers faced foreclosure, or they were forced to sell their home for less than the value of the mortgage.If we remove REOs, existing home sales have tracked much closer to new home sales. REO sales are real sales, but this shows as long as the REO volume is high, new home sales (and non-REO existing home sales) will be under severe pressure.

The following graph shows both annual new home sales (from the Census Bureau) and sales through November.

In 2008, sales through November (before revisions) have totaled 461 thousand. This is slightly behind of the pace in 1991 (471 thousand sales through November).

In 2008, sales through November (before revisions) have totaled 461 thousand. This is slightly behind of the pace in 1991 (471 thousand sales through November). However sales slowed in the 2nd half of 2008, and it definitely appears that annual sales will be below the 509 thousand in 1991. This would mean sales would be the lowest since 1982 (412 thousand).

Of course the U.S. population and the number of households were much lower in 1982. In 1982 there were 54.2 million owner occupied units in the U.S., in 1991 there were 61.0 million, and there are approximately 76 million today.

If we use a ratio of owner occupied units to compare periods, the low in 1982 was 412 thousand X (76/54.2) = 578 thousand units (based on the number of owner occupied units today).

The calculation for 1991 gives 634 thousand units (to compare to today).

By this measure, 2008 is the worst year for new home sales since the Census Bureau started tracking new home sales (starting in 1963).

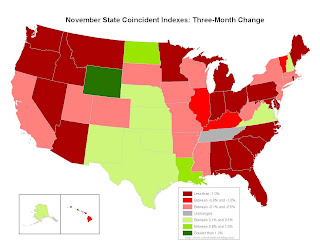

Philly Fed November State Coincident Indicators

by Calculated Risk on 12/23/2008 02:48:00 PM

Here is the Philadelphia Fed state coincident index release for September.

The Federal Reserve Bank of Philadelphia has released coincident indexes for all 50 states for November 2008. The indexes increased in eight states for the month, decreased in 37, and were unchanged in the remaining five (a one-month diffusion index of -58). For the past three months, the indexes increased in 11 states, decreased in 38, and remained unchanged only in Tennessee (a three-month diffusion index of -54).

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. Most states are in recession, although a portion of the central U.S. is still growing (from Texas up to Wymong). This might change with falling oil prices.

This is what a recession looks like based on the Philly Fed states indexes.

This is a graph of the monthly Philly Fed data of the number of states with one month increasing activity.

This is a graph of the monthly Philly Fed data of the number of states with one month increasing activity.Note: the Philly Fed calls some states unchanged with minor changes.

Most of the U.S. was has been in recession since late last year based on this indicator.

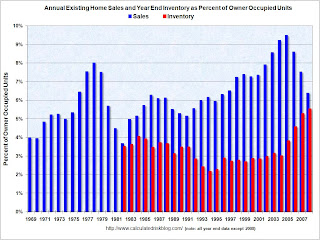

More on Existing Home Sales

by Calculated Risk on 12/23/2008 12:00:00 PM

OK, this is a long one on turnover and NSA (not seasonally adjusted) data. The NSA data was much worse than the seasonally adjusted data.

There have been 4.55 million existing home sales in 2008 through November. This puts 2008 on track for about 4.85+ million home sales, the fewest annual sales since 1997 (4.37 million). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows annual existing home sales (since 1969) and year end inventory (since 1982). For this graph, sales for 2008 were estimated at 4.85 million and year end inventory at 4.2 million.

This shows sales are the lowest level since 1997, and inventory is at (or will be close) to a record at year end. I expect inventory to decline in December, so 2008 might be below December 2007.

However this has been an above normal year for transactions based on the turnover rate. Long term real estate agents have told me this has been a decent year for volume, although many of the sales are "one and done". Usually real estate sales are like a chain reaction - one family both sells and buys, and the seller then goes out and buys ... and on and on. But with so many REO (Lender "Real Estate Owned") sales by banks, agents have told me they frequently just have the one sale, and there is no move-up buyer - no chain reaction. The second graph shows sales and inventory as a percent of Owner Occupied Units (a measure of turnover).

The second graph shows sales and inventory as a percent of Owner Occupied Units (a measure of turnover).

By this measure sales are still above the normal range of about 6% per year. Inventory is well above the usual range too. I've been expecting turnover to decline to the 5% to 6% per year range, and stay there for an extended period. With 76 million owner occupied households, this suggested that existing home sales would decline to the 3.8 to 4.5 million range. Sales are finally in the predicted range with November sales at a 4.49 million annual rate.

The turnover rate was boosted in recent years by:

Although slowing, the turnover rate is still above the median for the last 40 years and substantially above previous troughs. Both types of speculative buying is now over. And the Baby Boomers have probably bought move up homes, and the next major move will be downsizing in retirement (still a number of years away). And although REO sales will continue to be significant in 2009, they will probably slow some as foreclosures move up the price range.

And finally - and probably a very important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years. This suggests the turnover rate - and existing home sales - will decline further.

Not Seasonally Adjusted (NSA) data

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were about 17% lower in November 2008 than in November 2007 - this is a much larger decline than the reported seasonally adjusted decline.

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were about 17% lower in November 2008 than in November 2007 - this is a much larger decline than the reported seasonally adjusted decline.Note: I've disagreed with the NAR method for seasonal adjustment before. The NAR uses a standard procedure to adjust for weekends and holidays in November. But since the sales were signed in September and October, I think they should adjust for holidays in those months instead. Using a different method, I think sales were closer to 4.2 million SAAR in November than the NAR reported 4.5 million - but it will all come out eventually. (note that NSA sales were 17% below Nov 2007, but SA sales were reported as 10.5% lower).

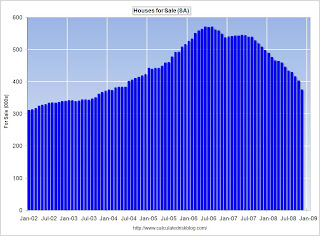

The second graph shows inventory by month starting in 2002.

The second graph shows inventory by month starting in 2002.Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have only increased slightly in 2008. In fact inventory for the last four months was slightly below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle (inventory has peaked for 2008), however there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time.

Existing Home Sales Plunge in November

by Calculated Risk on 12/23/2008 10:35:00 AM

From the NAR: Existing-Home Sales Decline in Economic Uncertainty

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 8.6 percent to a seasonally adjusted annual rate of 4.49 million units in November from a downwardly revised level of 4.91 million in October, and are 10.6 percent below the 5.02 million-unit pace in November 2007.

Lawrence Yun, NAR chief economist, expected a decline. “The quickly deteriorating conditions in the job market, stock market, and consumer confidence in October and November have knocked down home sales to another level. We hope the home sales impact from the stock market crash turns out to be short-lived, as was the case in 1987 and 2001,” he said.

...

Total housing inventory at the end of November rose 0.1 percent to 4.20 million existing homes available for sale, which represents an 11.2-month supply at the current sales pace, up from a 10.3-month supply in October.

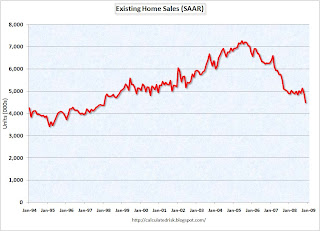

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2008 (4.49 million SAAR) were 8.6% lower than last month, and were 10.5% lower than November 2007 (5.02 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested said a couple of months ago that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.20 million in November, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.20 million in November, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was the peak for inventory this year. It is a little unusual for supply to increase in November (from October), and looking forward, usually supply falls sharply in December as homeowners take their properties off the market for the holidays. Something to watch for next month.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

I still expect sales to fall further over the next few months, although inventory has peaked for the year. I'll have more on existing home sales soon ...

New Home Sales in November

by Calculated Risk on 12/23/2008 10:01:00 AM

The Census Bureau reports, New Home Sales in November were at a seasonally adjusted annual rate of 407 thousand. This is the lowest sales rate since 1982.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for November since 1981. (NSA, 28 thousand new homes were sold in November 2008, 27 thousand were sold in November 1981).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in November 2008 were at a seasonally adjusted annual rate of 407,000, according toAnd one more long term graph - this one for New Home Months of Supply.

estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 2.9 percent below the revised October of 419,000 and is 35.3 percent below the November 2007 estimate of 629,000.

"Months of supply" is at 11.5 months.

"Months of supply" is at 11.5 months. The months of supply for October was revised up to 11.8 months - the ALL TIME RECORD!

For new homes, both sales and inventory are falling quickly.

And on inventory:

TheInventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

seasonally adjusted estimate of new houses for sale at the end of November was 374,000. This represents a supply of 11.5 months at the current sales rate.

This is a another very weak report. I'll have some charts on existing home sales and more on new home sales later today ...

Existing Home Sale Decline Sharply in November

by Calculated Risk on 12/23/2008 10:00:00 AM

The NAR reported this morning that existing home sales were at a 4.49 million rate in November, 8.6% below the 4.91 million rate in October.

The months of supply increased to 11.2 months. I'll have some charts shortly (New Home sales is being released today too).

Frozen Wages

by Calculated Risk on 12/23/2008 09:14:00 AM

IN addition to more part time workers, freezing wages is becoming a common theme (hat tip Brian):

From Reuters: U.S. manufacturers cut jobs and pay amid downturn

According to the employment consulting firm Watson Wyatt, 11 percent of all the companies it recently surveyed either already had cut wages or planned to do so over the next 12 months, and 10 percent either have reduced their employer 401(k) match or planned to do so.From Cincinnati.com: No pay raise for salaried Duke workers

"Companies are trying to do things that are much more thoughtful as opposed to just, let's take 10 percent of the work force off," Jeffrey Joerres, chief executive of Manpower Inc, the world's No. 2 staffing company, said in a phone interview.

Between 1,500 and 1,700 employees of Duke Energy in Cincinnati and Northern Kentucky are included in a salaried employee wage freeze announced by the utility last week to help cope with the recession.From the San Francisco Chronicle: Wage freeze proposed for S.F. unions

About half of the Charlotte, N.C.-based company's 18,000 employees are included.

Duke said it was freezing 2009 wages for managers, supervisors and salaried workers in finance, human resources, information technology and other technical areas.

San Francisco's unionized city workers, including police officers, firefighters and nurses, should decide whether to forgo $35 million in cost-of-living raises in the coming months or face massive layoffs that would save the same amount, under a proposal announced Friday by Board of Supervisors President Aaron Peskin.From the Beaufort Ggazette: Education committee proposes wage freeze for state's teachers

A state-appointed education committee recommended last week that teacher pay in South Carolina be frozen for the next fiscal year because of declining sales-tax revenue.From FreshPlaza.com: US: Weyerhaeuser cuts dividend by 58%

With revenues expected to be significantly lower in the near future, the company is doing all it can to keep margins intact. Executives implemented a white-collar wage freeze ...From the WSJ: Trucking Firm YRC, Union Set Tentative 10% Wage Cut

YRC Worldwide Inc., one of the nation's largest trucking companies, will cut wages for 40,000 union workers by 10% if the workers approve a deal recommended by representatives of the International Brotherhood of Teamsters.From the WSJ: Unisys to Cut 1,300 Jobs, Suspend Raises

Unisys Corp. said it would cut 1,300 jobs, or 4.3% of its worldwide work force; consolidate plants; suspend its 401(k) matching program; and not offer raises to most employees next year.From the Huffington Post: FedEx Pay Cuts, 401k Freeze Coming

FedEx Corp. on Thursday announced more broad cost cuts _ including salary reductions _ as deteriorating economic conditions continue to drag down demand, warning the outlook for 2009 remains murky.Update: To be clear, here is how FedEx described the pay / benefit freeze:

...

The package delivery company said it will cut pay for senior executives and freeze 401(k) contributions for a year. On Jan. 1, CEO Smith will take a 20 percent pay cut, and the pay of other top brass will fall by 7.5 percent to 10 percent.

FedEx will also implement a 5 percent pay cut for all remaining U.S. "salaried exempt" personnel, which excludes hourly workers such as couriers and package handlers.

Base salary decreases, effective January 1, 2009:20% reduction for FedEx Corp. CEO Frederick W. Smith 7.5%-10.0% reduction for other senior FedEx executives 5.0% reduction for remaining U.S. salaried exempt personnel Elimination of calendar 2009 merit-based salary increases for U.S. salaried exempt personnel Suspension of 401(k) company matching contributions for a minimum of one year, effective February 1, 2009

White House: Hoocoodanode?

by Calculated Risk on 12/23/2008 12:19:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Monday, December 22, 2008

OTS Official Accused of Backdating IndyMac Capital Infusion

by Calculated Risk on 12/22/2008 08:14:00 PM

From the WSJ: OTS Let IndyMac Backdate Infusion

The Treasury Department's inspector general is probing the Office of Thrift Supervision for permitting a backdated capital infusion into IndyMac Bancorp a few months before its collapse in July.This was the culture at the OTS - anything to help the "customers". The OTS competed with other regulators for "customers" (aka banks), and the OTS offered more "flexible" supervision - perhaps even backdating capital infusions!

The infusion allowed the bank to be classified as "well capitalized," instead of "adequately capitalized," at the end of the first quarter. That let IndyMac avoid having to take certain steps with the Federal Deposit Insurance Corp.

A top OTS official, West Region Director Darrel Dochow, was removed from his current duties in connection with the inquiry, according to letters released Monday by the office of Sen. Charles Grassley (R., Iowa). An OTS spokesman said Mr. Dochow wasn't available for comment.

In a letter to Sen. Grassley, Treasury Inspector General Eric M. Thorson said the probe would examine why Mr. Dochow allowed IndyMac to record $18 million in capital as received from its holding company before March 31, 2008, even though the injection occurred after that date.

For a great article on the OTS, see the WaPo: Banking Regulator Played Advocate Over Enforcer

When Countrywide Financial felt pressured by federal agencies charged with overseeing it, executives at the giant mortgage lender simply switched regulators in the spring of 2007.What a weird regulatory structure. And finally, here is the head of OTS taking a chainsaw to regulations in 2003.

The benefits were clear: Countrywide's new regulator, the Office of Thrift Supervision, promised more flexible oversight of issues related to the bank's mortgage lending. For OTS, which depends on fees paid by banks it regulates and competes with other regulators to land the largest financial firms, Countrywide was a lucrative catch.

But OTS was not an effective regulator.

| This photo from 2003 shows two regulators: John Reich (then Vice Chairman of the FDIC and later at the OTS) and James Gilleran of the Office of Thrift Supervision (with the chainsaw) and representatives of three banker trade associations: James McLaughlin of the American Bankers Association, Harry Doherty of America's Community Bankers, and Ken Guenther of the Independent Community Bankers of America. |

Housing Bust Impacting Labor Mobility

by Calculated Risk on 12/22/2008 07:30:00 PM

From the WSJ: U.S. State-to-State Migration Slowed, Census Reports

The great migration south and west in the U.S. is slowing, thanks to a housing crisis that is making it hard for many to move.As I noted early this year, approximately 1 in 8 households (the same proportion as with negative equity) will probably not accept a job transfer now because of depressed home values - and that is about 200,000 fewer households per year that will probably not move for better job opportunities.

...

Most southern and western states are not growing nearly as fast as they were at the start of the decade, pausing a long-term trend fueled by the desire for open spaces and warmer climates, according to population estimates released Monday by the Census Bureau.

...

"People want to go to where it's warm and where there are a lot of amenities, that's a long- term trend in this country," said William Frey, a demographer at the Brookings Institution in Washington.

"But people have stopped moving," he said. "It's a big risk when you move to a new place. You need to know that moving and getting a new mortgage is going to pay off for you."

One of the strengths of the U.S. labor market has been the flexibility associated with labor mobility - households could easily move from one region to another for better employment. The housing bust is now limiting this flexibility.

White House: No one could have known

by Calculated Risk on 12/22/2008 04:24:00 PM

Never mind that many people saw this coming - obviously the White House wasn't listening.

From the White House: Statement by the Press Secretary on Irresponsible Reporting by New York Times

Most people can accept that a news story recounting recent events will be reliant on '20-20 hindsight'. Today's front-page New York Times story relies on hindsight with blinders on and one eye closed.The "most significant factor" was "cheap money flowing into the U.S."? Uh, no.

The Times' 'reporting' in this story amounted to finding selected quotes to support a story the reporters fully intended to write from the onset, while disregarding anything that didn't fit their point of view. To prove the point, when they filed their story, NYT reporters were completely unfamiliar with the President's prime time address to the nation where he laid out in detail all of the causes of the housing and financial crises. For example, the President highlighted a factor that economists agree on: that the most significant factor leading to the housing crisis was cheap money flowing into the U.S. from the rest of the world, so that there was no natural restraint on flush lenders to push loans on Americans in risky ways. This flow of funds into the U.S. was unprecedented. And because it was unprecedented, the conditions it created presented unprecedented questions for policymakers.

In his address the President also explained in detail the failure of financial institutions to perform normal and necessary due diligence in creating, buying and selling new financial products -- a problem that almost no one saw as it was happening.

The most significant causes of the credit crisis were innovation in mortgage securitization coupled with almost no regulatory oversight (because of ideologues who opposed oversight and regulation). This led to lax lending standards (liar loans, DAPs, widespread use of Option ARMs as affordability products, etc.) and excessive speculation.

Oh well ... I agree the White House missed the story, but the idea that "no one saw" the problem coming is nonsense.

Credit Crisis Indicators

by Calculated Risk on 12/22/2008 02:29:00 PM

The sharp decline in treasury yields had continued across the board. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The 10-year yield is at 2.11% today, slightly above the record low of 2.07% set last Thursday.

This graph shows the 10 year yield since 1962. The smaller graph shows the ten year yield for this year - talk about cliff diving!

The yield on 3 month treasuries is 0.00% (bad). Right at ZERO when I checked!

Here are a few other indicators of credit stress:

| The TED spread was stuck above 2.0 for some time. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5. |

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding close to zero. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

|

It appears the Fed is finally getting some rates down - but clearly the 3-month treasury yield at zero is not a sign of a healthy economy.

REIS: Commercial Real Estate Loan Defaults May Triple

by Calculated Risk on 12/22/2008 11:43:00 AM

From Bloomberg: Commercial Loan Defaults May Triple as Rental Income Declines

U.S. commercial properties at risk of default could triple if rental income from office, retail and apartment buildings drops by even 5 percent, a likely possibility given the recession, according to research by New York-based real estate analysts at Reis Inc.At the end of Q3, REIS reported office vacancy rates hit 13.6% (see WSJ: Office Space Is Emptying Out). Clearly REIS expects a significant increase in the vacancy rate in Q4 2008 (to 14.6%), and then a further increase in 2009 to 15.6%. Although that 2009 projection might be low ...

Lenders that used optimistic rent estimates to grant mortgages beginning in 2005 stand to lose as much as $23.1 billion, or 7.02 percent, of total unpaid balances if landlords lose 5 percent of net operating income, according to Reis. ...

[O]ffice vacancies are forecast to rise to 15.6 percent next year from an estimated 14.6 percent at the end of 2008. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions (hat tip Will)

Changes in the unemployment rate and the office vacancy rate are highly correlated. As the unemployment rate continues to rise over the next year or more, I'd expect the office vacancy rate to rise sharply - possible to 17% or more by the end of 2009 (significantly higher than the REIS forecast).

REIS believes the rise in defaults will primarily because of the overly optimistic projections used when properties were purchased in recent years:

“A large decline in net operating income isn’t necessary to shift a lot of properties underlying CMBS loans into debt- service coverage ratios that would be worrisome,” [Victor Calanog, REIS director of research] said in an interview.As I've noted several times, many existing properties were recently purchased at prices that were based on overly optimistic pro forma income projections. These loans typically included reserves to pay interest until rents increased (like a negatively amortizing option ARM), and it is likely that many of these deals will blow up when the interest reserve is depleted - probably in the 2009-2010 period.

...

Over the last three years, lenders raised income projections for commercial properties by as much as 15 percent more than those properties’ historical performance, he said.

“That optimism might not be warranted,” Calanog said. “There’s a big pool of loans underwritten in 2005 and 2006 coming due in 2010 and 2011 that I believe will experience a rise in delinquencies and defaults.”

Loans from those years assumed strong growth in rents, a scenario that seems unlikely as the recession deepens, Calanog said.

WSJ: Commercial Property Investors Seek Bailout

by Calculated Risk on 12/22/2008 10:43:00 AM

From the WSJ: Developers Ask U.S. for Bailout as Massive Debt Looms

With a record amount of commercial real-estate debt coming due, some of the country's biggest property developers have become the latest to go hat-in-hand to the government for assistance.Although the headline says "developers" this is really about property investors who bought commercial buildings at the price peak and are now underwater. But say the owners default and the properties are transferred to the bondholders - what is the risk to the economy? None.

They're warning policymakers that thousands of office complexes, hotels, shopping centers and other commercial buildings are headed into defaults, foreclosures and bankruptcies. The reason: according to research firm Foresight Analytics LCC, $530 billion of commercial mortgages will be coming due for refinancing in the next three years -- with about $160 billion maturing in the next year.

With the automakers there was a concern that a large number of jobs would be lost without a bailout. How many jobs will be lost if the ownership of an office building or mall changes? Very few.

The article suggests there is a concern that some owners will not be able to refinance because of the credit crisis, even though their properties have strong positive cash flow. But that seems like a liquidity issue for the Fed and the banks, and doesn't seem to require a bailout from the Treasury.

I don't see the argument for a bailout.

Sunday, December 21, 2008

NY Times: More Part Time Workers

by Calculated Risk on 12/21/2008 11:20:00 PM

From the NY Times: More Firms Cut Labor Costs Without Layoffs

A growing number of employers, hoping to avoid or limit layoffs, are introducing four-day workweeks, unpaid vacations and voluntary or enforced furloughs, along with wage freezes, pension cuts and flexible work schedules. These employers are still cutting labor costs, but hanging onto the labor.

...

Several employees at Hot Studio said they did not mind the policy, particularly as they have heard of layoffs elsewhere in the economy. “People feel they’d much rather have a job in six months than get a bonus right now,” said Jon Littell, a Web designer.

The magnanimous feeling will probably pass, said Truman Bewley, an economics professor at Yale University who has studied what happens to wages during a recession. If the sacrifices look as though they are going to continue for many months, he said, some workers will grow frustrated, want their full compensation back and may well prefer a layoff that creates a new permanence.

“These are feel-good, temporary measures,” he said.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the number of employees working part time for economic reasons for the last 50 years. IMPORTANT: The BLS made a change in Jan 1994, and prior to that change more workers fell into this category.

From the BLS:

Reasons for working part time. Persons who work part time do so either for noneconomic reasons (that is, because of personal constraints or preferences) or for economic reasons (that is, because of business-related constraints such as slack work or the lack of full-time opportunities). Because respondents typically are not familiar with this distinction, the question was reworded to provide examples of the two types of reasons. More importantly, the measurement of working part time involuntarily (or for economic reasons) was modified to better reflect the concept. Starting in 1994, workers who usually work part time and are working part time involuntarily must want and be available for full-time work.Although the chart is not population adjusted, this suggests that there is a larger move to part time employment in the current downturn than in previous downturns. I tend to focus on the unemployment rate, but employees working part time (for economic reasons) is an important part of the weak employment picture.

Japan Exports Decline 27%

by Calculated Risk on 12/21/2008 09:01:00 PM

From Bloomberg: Japan Exports Plunge Record 27% as Recession Deepens

Japan’s exports plunged the most on record in November as global demand for cars and electronics collapsed ... Exports fell 26.7 percent from a year earlier ...And this isn't just because of exports to the U.S. or Europe:

Exports to Asia fell 27 percent, the most since 1986, after the first decline in six years in October. Shipments to China, Japan’s largest trading partner, fell 25 percent, the steepest drop in 13 years.This looks like a worldwide recession including China (see: Forecaster: Negative Q4 GDP in China)

U.S. retail gasoline prices decline to $1.66 per gallon

by Calculated Risk on 12/21/2008 07:20:00 PM

From Bloomberg: U.S. Retail Gasoline Falls to $1.66 a Gallon, Lundberg Says

The average price of regular gasoline at U.S. filling stations fell to $1.66 a gallon as the nation’s recession sapped demand.

Gasoline slipped 9 cents, or 5.1 percent, in the two weeks ended Dec. 19, according to oil analyst Trilby Lundberg’s survey of 7,000 filling stations nationwide.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the nominal weekly U.S. gasoline prices since 1993 (source: EIA)

Gasoline prices are close to the 2000 through 2003 price range, when the median prices was just over $1.50 per gallon.

UK: Up to 15 national retail chains expected to go BK in January

by Calculated Risk on 12/21/2008 12:19:00 PM

From The Times: High street braced for Christmas sales carnage

UP to 15 national retail chains are predicted to go bust before the middle of January, forcing thousands more shopworkers onto the dole.The pattern will probably be similar in the U.S. with a number of retailers filing for bankruptcy in January (usually the worst month of the year for retail BKs), with more retail layoffs, and even more empty retail stores (see: Retail Space to be Vacated from some retail numbers from reader wc)

The prediction came from insolvency expert Begbies Traynor as well-known retail chains clamour to sell enough goods to meet their quarterly rent payments on Christmas Day. Nick Hood, partner at Begbies Traynor ... refused to name specific store groups, but this weekend it emerged that The Officers Club, a 150-strong national menswear chain, had been put up for distressed sale through KPMG, while the specialist tea retailer, Whittards, and music store Zavvi remained on the critical list.

...

Rupert Eastell, head of retail at BDO Stoy Hayward, said: “From tomorrow until mid-January, it’s going to be the worst three weeks for retailers in 20 years.”

Last Minute Gift Idea

by Calculated Risk on 12/21/2008 05:56:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

This works for mini-me too.

Saturday, December 20, 2008

Real Estate and Tax Advantages

by Calculated Risk on 12/20/2008 11:24:00 PM

How come so many people write about real estate as a tax advantaged investment, and they never mention the tax disadvantage?

Take this article in the NY Times: Tax Break May Have Helped Cause Housing Bubble

Luckily the title contained the word "may" because it is pretty easy to demonstrate that the '97 tax change was a minor factor (at most) in the real estate bubble. But I have a question about this section:

Together with the other housing subsidies that had already been in the tax code — the mortgage-interest deduction chief among them — the law gave people a motive to buy more and more real estate.Yes, there is a mortgage interest deduction, and a capital gains exclusion for a primary residence - but there is also a property tax for real estate. This is a tax disadvantage compared to stocks and bonds.

...

Referring to the special treatment for capital gains on homes, Charles O. Rossotti, the Internal Revenue Service commissioner from 1997 to 2002, said: “Why insist in effect that they put it in housing to get that benefit? Why not let them invest in other things that might be more productive, like stocks and bonds?”

If you own a $500 thousand home, you probably pay $5 to $10 thousand per year in property taxes. If you own $500 thousand in stocks and bonds, how much do you pay per year in property taxes (just for owning them - not selling them)?

I'm not arguing for or against any particular tax treatment here, I just think when comparing the tax treatment of various assets, maybe we should consider all taxes.