by Calculated Risk on 11/30/2018 07:01:00 PM

Friday, November 30, 2018

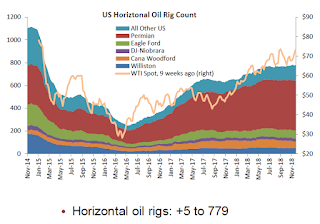

Oil Rigs Increased

A few comments from Steven Kopits of Princeton Energy Advisors LLC on November 30, 2018:

• Oil rigs gained +2 to 887

• Horizontal oil rigs gained more solidly, +5 at 779

• The model forecasts one more week of rig gains, after which numbers crash.

• Breakeven to add rigs rose to around $72 WTI, compared to $50.50 WTI on the screen as of the writing of this report

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Fannie Mae: Mortgage Serious Delinquency Rate Declined in October

by Calculated Risk on 11/30/2018 04:12:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 0.79% in October, from 0.82% in September. The serious delinquency rate is down from 1.01% in October 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency rate for Fannie Mae since September 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.73% are seriously delinquent. For loans made in 2005 through 2008 (5% of portfolio), 4.82% are seriously delinquent, For recent loans, originated in 2009 through 2018 (92% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q4 GDP Forecasts

by Calculated Risk on 11/30/2018 02:38:00 PM

From Merrill Lynch:

We continue to track 3Q GDP at 3.5% qoq saar while 4Q GDP is tracking higher at 2.7% [Nov 30 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.6 percent on November 29, up from 2.5 percent on November 21. [Nov 29 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q4 stands at 2.5%. [Nov 30 estimate]CR Note: These early estimates suggest GDP in the mid-to-high 2s for Q4.

NAR 2019 Home Price Forecast Correction

by Calculated Risk on 11/30/2018 12:54:00 PM

In the Pending Home Sales release yesterday, the NAR wrote:

Looking ahead to next year, existing sales are forecast to decline 0.4 percent and home prices to drop roughly 2.5 percent.Forecasting a price decline would be huge news!

However that was a typo in the release. As Andrea Riquier at MarketWatch noted on the NAR forecast (after contacting the NAR):

Home prices WILL NOT DECLINE 2.5%, price appreciation will decline to a 2.5% annual rate.This is still lower than the 3.1% median home price increase in 2019 that NAR economist Lawrence Yun was forecasting a few weeks.

Zillow Case-Shiller Forecast: Slower House Price Gains in October

by Calculated Risk on 11/30/2018 11:53:00 AM

The Case-Shiller house price indexes for September were released this week. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: September Case-Shiller Results and October Forecast: A Slow Return to the Push-Pull of a Normal Market

The U.S. National S&P CoreLogic Case-Shiller Home Price Index — which tracks home prices — rose 5.5 percent in September from a year earlier, in line with Zillow’s forecast last month.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be smaller in September than in August as house price growth slows.

...

Zillow forecasts an even slower 5.4 percent annual gain for October.

Chicago PMI Increased in November

by Calculated Risk on 11/30/2018 10:02:00 AM

From the Chicago PMI: Chicago Business Barometer Surges to 66.4 in November

The MNI Chicago Business Barometer surged to an 11-month high of 66.4 in November, up 8.0 points from October’s 58.4.This was well above the consensus forecast of 58.0.

Business activity recorded its most impressive performance so far this year in November, ending a three-month run of declines. Although broad-based, with increases across all five of the Barometer’s subcomponents, resurgent orders, solid output and higher unfinished orders were the month’s key drivers.

...

Building on October’s rise, the Employment indicator strengthened further in November, hitting a three-month high and moving further clear of the neutral-50 mark.

…

“The MNI Chicago Business Barometer clipped a run of three consecutive declines in emphatic style in November, boosted primarily by resurgent orders – stronger than typically seen at this time of year and enough to push the Barometer to its best level since December,” said Jamie Satchi, Economist at MNI Indicators.

“However, many firms reported seeing the effects of higher China tariffs on their invoices for the first time, and voiced concern that business could be stifled going forward,” he added.

emphasis added

Thursday, November 29, 2018

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in October

by Calculated Risk on 11/29/2018 05:39:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in October was 0.71%, down from 0.73% in September. Freddie's rate is down from 0.86% in October 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since January 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate late last year was due to the hurricanes (These are serious delinquencies, so it took three months late to be counted).

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.7% range - but this is close to a bottom.

Note: Fannie Mae will report for October soon.

FOMC Minutes: "Further gradual increases"

by Calculated Risk on 11/29/2018 05:33:00 PM

Catching up … From the Fed: Minutes of the Federal Open Market Committee, November 7-8, 2018. A few excerpts:

In their discussion of monetary policy, participants agreed that it would be appropriate to maintain the current target range for the federal funds rate at this meeting. Participants generally judged that the economy had been evolving about as they had anticipated, with economic activity rising at a strong rate, labor market conditions continuing to strengthen, and inflation running at or near the Committee's longer-run objective. Almost all participants reaffirmed the view that further gradual increases in the target range for the federal funds rate would likely be consistent with sustaining the Committee's objectives of maximum employment and price stability.

Consistent with their judgment that a gradual approach to policy normalization remained appropriate, almost all participants expressed the view that another increase in the target range for the federal funds rate was likely to be warranted fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations. However, a few participants, while viewing further gradual increases in the target range of the federal funds rate as likely to be appropriate, expressed uncertainty about the timing of such increases. A couple of participants noted that the federal funds rate might currently be near its neutral level and that further increases in the federal funds rate could unduly slow the expansion of economic activity and put downward pressure on inflation and inflation expectations.

Participants emphasized that the Committee's approach to setting the stance of policy should be importantly guided by incoming data and their implications for the economic outlook. They noted that their expectations for the path of the federal funds rate were based on their current assessment of the economic outlook. Monetary policy was not on a preset course; if incoming information prompted meaningful reassessments of the economic outlook and attendant risks, either to the upside or the downside, their policy outlook would change. Various factors such as the recent tightening in financial conditions, risks in the global outlook, and some signs of slowing in interest-sensitive sectors of the economy on the one hand, and further indicators of tightness in labor markets and possible inflationary pressures, on the other hand, were noted in this context. Participants also commented on how the Committee's communications in its postmeeting statement might need to be revised at coming meetings, particularly the language referring to the Committee's expectations for "further gradual increases" in the target range for the federal funds rate. Many participants indicated that it might be appropriate at some upcoming meetings to begin to transition to statement language that placed greater emphasis on the evaluation of incoming data in assessing the economic and policy outlook; such a change would help to convey the Committee's flexible approach in responding to changing economic circumstances.

emphasis added

NAR: Pending Home Sales Index Decreased 2.6% in October

by Calculated Risk on 11/29/2018 10:03:00 AM

From the NAR: Pending Home Sales Slip 2.6 Percent in October

Pending home sales declined slightly in October in all regions but the Northeast, according to the National Association of Realtors®.This was well below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 2.6 percent to 102.1 in October, down from 104.8 in September. However, year-over-year contract signings dropped 6.7 percent, making this the tenth straight month of annual decreases.

...

The PHSI in the Northeast rose 0.7 percent to 92.9 in October, and is now 2.9 percent below a year ago. In the Midwest, the index fell 1.8 percent to 100.4 in October and is 4.9 percent lower than October 2017.

Pending home sales in the South fell 1.1 percent to an index of 118.9 in October, which is 4.6 percent lower than a year ago. The index in the West decreased 8.9 percent in October to 84.8 and fell 15.3 percent below a year ago.

emphasis added

Personal Income increased 0.5% in October, Spending increased 0.6%

by Calculated Risk on 11/29/2018 08:41:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $84.9 billion (0.5 percent) in October according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $81.7 billion (0.5 percent) and personal consumption expenditures (PCE) increased $86.9 billion (0.6 percent).The October PCE price index increased 2.0 percent year-over-year and the October PCE price index, excluding food and energy, also increased 1.8 percent year-over-year.

Real DPI increased 0.3 percent in October and Real PCE increased 0.4 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through October 2018 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income, and the increase in PCE, were both above expectations.