by Calculated Risk on 12/04/2018 11:50:00 AM

Tuesday, December 04, 2018

Update: Framing Lumber Prices Down Year-over-year

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs earlier in 2018, and are now down over 20% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through November 9, 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 22% from a year ago, and CME futures are down 29% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

CoreLogic: House Prices up 5.4% Year-over-year in October

by Calculated Risk on 12/04/2018 08:00:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports October Home Prices Increased by 5.4 Percent Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 5.4 percent year over year from October 2017. On a month-over-month basis, prices increased by 0.5 percent in October 2018. (September 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)CR Note: The CoreLogic YoY increase has been in the 5% to 7% range for the last few years. This is near the bottom of that range. The year-over-year comparison has been positive for over six consecutive years since turning positive year-over-year in February 2012.

Looking ahead, the CoreLogic HPI Forecast indicates home prices will increase by 4.8 percent on a year-over-year basis from October 2018 to October 2019. On a month-over-month basis, home prices are expected to decrease by 0.7 percent from October to November 2018. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Rising prices and interest rates have reduced home buyer activity and led to a gradual slowing in appreciation,” said Dr. Frank Nothaft, chief economist for CoreLogic. “October’s mortgage rates were the highest in seven and a half years, eroding buyer affordability. Despite higher interest rates, many renters view a home purchase as a way to build wealth through home-equity growth, especially in areas where rents are rising quickly. These include the Phoenix, Las Vegas and Orlando metro areas, where the CoreLogic Single-Family Rent Index rose 6 percent or more during the last 12 months.”

emphasis added

Monday, December 03, 2018

Tuesday: Corelogic House Prices

by Calculated Risk on 12/03/2018 09:17:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Now at 2-Month Lows

Mortgage rates didn't really improve today for the average lender, but they did manage to hit the lowest rates in 2 months on a technicality. The reason for this is simple. There was a big gap between the rates seen on October 2nd and October 3rd. Rates merely had to hold steady today in order to earn the "2-month" title. [30YR FIXED - 4.875]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for October.

Year-to-Date Performance: Employment, Vehicle Sales, New Home Sales

by Calculated Risk on 12/03/2018 03:33:00 PM

Here are three tables showing year-to-date performance for three key economic metrics: Employment, Vehicle Sales, and New Home Sales.

Each table shows measurements through the most recent report (October), full year, and percent change from the previous year.

Employment growth has picked up in 2017 and will likely be the 3rd best year since the great recession. Vehicle sales are mostly moving sideways year-over-year at a high level, and new home sales are up slightly.

Note: All data is based on monthly NSA data. Employment from the BLS, vehicle sales from BEA, and new home sales from Census.

| Employment Gains (000s) | |||

|---|---|---|---|

| Year | Through October | Full Year | YoY Change |

| 2010 | 851 | 1053 | |

| 2011 | 1744 | 2090 | 98.5% |

| 2012 | 1778 | 2151 | 2.9% |

| 2013 | 1987 | 2301 | 7.0% |

| 2014 | 2447 | 3005 | 30.6% |

| 2015 | 2214 | 2712 | -9.8% |

| 2016 | 1992 | 2344 | -13.6% |

| 2017 | 1797 | 2188 | -6.7% |

| 2018 | 2125 | NA | 18.3%1 |

| 1Year-over-year change for 2018 based on data through October. | |||

| Vehicle Sales (000s) | |||

|---|---|---|---|

| Year | Through October | Full Year | YoY Change |

| 2010 | 9,545 | 11,555 | |

| 2011 | 10,505 | 12,742 | 10.3% |

| 2012 | 11,946 | 14,433 | 13.3% |

| 2013 | 12,939 | 15,530 | 7.6% |

| 2014 | 13,662 | 16,452 | 5.9% |

| 2015 | 14,443 | 17,396 | 5.7% |

| 2016 | 14,414 | 17,465 | 0.4% |

| 2017 | 14,151 | 17,135 | -1.9% |

| 2018 | 14,205 | NA | 0.4%1 |

| 1Year-over-year change for 2018 based on data through October. | |||

| New Home Sales (000s) | |||

|---|---|---|---|

| Year | Through October | Full Year | YoY Change |

| 2010 | 279 | 322 | |

| 2011 | 258 | 305 | -5.3% |

| 2012 | 313 | 369 | 21.0% |

| 2013 | 366 | 429 | 16.3% |

| 2014 | 373 | 439 | 2.3% |

| 2015 | 427 | 501 | 14.1% |

| 2016 | 482 | 561 | 12.0% |

| 2017 | 518 | 613 | 9.3% |

| 2018 | 533 | NA | 2.9%1 |

| 1Year-over-year change for 2018 based on data through October. | |||

Construction Spending decreased slightly in October

by Calculated Risk on 12/03/2018 11:41:00 AM

From the Census Bureau reported that overall construction spending decreased slightly in October:

Construction spending during October 2018 was estimated at a seasonally adjusted annual rate of $1,308.8 billion, 0.1 percent below the revised September estimate of $1,310.8 billion. The October figure is 4.9 percent above the October 2017 estimate of $1,247.5 billion.Private spending decreased and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $998.7 billion, 0.4 percent below the revised September estimate of $1,003.0 billion. ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $310.2 billion, 0.8 percent above the revised September estimate of $307.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although has declined recently - and is still 21% below the bubble peak.

Non-residential spending is 11% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 5% below the peak in March 2009, and 19% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 2%. Non-residential spending is up 6% year-over-year. Public spending is up 8% year-over-year.

This was below consensus expectations, and spending for August and September were revised down. A weak report.

ISM Manufacturing index increased to 59.3 in November

by Calculated Risk on 12/03/2018 10:03:00 AM

The ISM manufacturing index indicated expansion in November. The PMI was at 59.3% in November, up from 57.7% in October. The employment index was at 58.4%, up from 56.8% last month, and the new orders index was at 62.1%, up from 57.4%.

From the Institute for Supply Management: November 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in November, and the overall economy grew for the 115th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The November PMI® registered 59.3 percent, an increase of 1.6 percentage points from the October reading of 57.7 percent. The New Orders Index registered 62.1 percent, an increase of 4.7 percentage points from the October reading of 57.4 percent. The Production Index registered 60.6 percent, a 0.7 percentage-point increase compared to the October reading of 59.9 percent. The Employment Index registered 58.4 percent, an increase of 1.6 percentage points from the October reading of 56.8 percent. The Supplier Deliveries Index registered 62.5 percent, a 1.3-percentage point decrease from the October reading of 63.8 percent. The Inventories Index registered 52.9 percent, an increase of 2.2 percentage points from the October reading of 50.7 percent. The Prices Index registered 60.7 percent, a 10.9-percentage point decrease from the October reading of 71.6 percent, indicating higher raw materials prices for the 33rd consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 57.2%, and suggests manufacturing expanded at a faster pace in November than in October.

Ten Years Gone: Remembering Tanta

by Calculated Risk on 12/03/2018 08:40:00 AM

Ten years ago my friend and co-blogger Doris "Tanta" Dungey passed away. Please click on the links below for more about Tanta.

I'd just like to say it was an honor sharing this blog with her. I miss her. And I miss her unique and insightful views on daily events.

With her quick wit and extensive knowledge she would have been a major force on social media, especially Twitter. Tanta Vive!

NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47

WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis

CR writes: Sad News: Tanta Passes Away

Some of her incredible work: The Compleat UberNerd

And for much more: Tanta: In Memoriam

Sunday, December 02, 2018

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 12/02/2018 08:24:00 PM

Weekend:

• Schedule for Week of December 2, 2018

Monday:

• At 10:00 AM, ISM Manufacturing Index for November. The consensus is for 57.2%, down from 57.7%. The PMI was at 57.7% in October, the employment index was at 56.8%, and the new orders index was at 57.4%.

• At 10:00 AM, Construction Spending for October. The consensus is for 0.4% increase in spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 41 and DOW futures are up 435 (fair value).

Oil prices were up over the last week with WTI futures at $52.94 per barrel and Brent at $61.60 per barrel. A year ago, WTI was at $58, and Brent was at $63 - so WTI oil prices are down 10%, and Brent prices down about 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.44 per gallon. A year ago prices were at $2.46 per gallon, so gasoline prices are down slightly year-over-year.

November 2018: Unofficial Problem Bank list increased to 78 Institutions

by Calculated Risk on 12/02/2018 08:21:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2018. During the month, the list increased by three institutions to 78 banks. Aggregate assets declined from $56.3 billion to $53.9 billion, with most of the change coming from a $2.8 reduction because of a move to updated third quarter financials. A year ago, the list held 108 institutions with assets of $25.5 billion.

Additions this month include Eastern National Bank, Miami, FL ($414 million); The Morris County National Bank of Naples, Naples, TX ($100 million); and Columbia Savings and Loan Association, Milwaukee, WI ($24 million). Columbia Savings originally debuted on the list in July 2011 and was removed in August 2017. Perhaps the removal in 2017 was premature.

On November 20th, the FDIC released industry results for the third quarter of 2018 and disclosed that the Official Problem Bank List held 71 banks with assets of $53.3 billion.

Saturday, December 01, 2018

Schedule for Week of December 2, 2018

by Calculated Risk on 12/01/2018 08:11:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include the November ISM manufacturing and non-manufacturing indexes, November auto sales, and the October trade deficit.

Fed Chair Jerome Powell testifies on the Economic Outlook on Wednesday.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 57.2%, down from 57.7%.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 57.2%, down from 57.7%.Here is a long term graph of the ISM manufacturing index.

The PMI was at 57.7% in October, the employment index was at 56.8%, and the new orders index was at 57.4%.

10:00 AM: Construction Spending for October. The consensus is for 0.4% increase in spending.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 17.2 million SAAR in October, down from the BEA estimate of 17.5 million SAAR in October 2018 (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

10:00 AM: Corelogic House Price index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 175,000 jobs added, down from 227,000 in October.

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for a decrease to 59.0 from 60.3.

10:15 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the Joint Economic Committee, U.S. Senate

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 234 thousand the previous week.

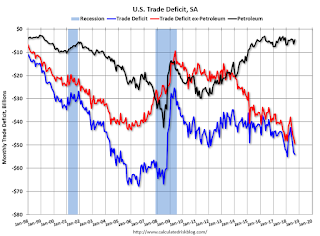

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $54.9 billion. The U.S. trade deficit was at $54.0 billion in September.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

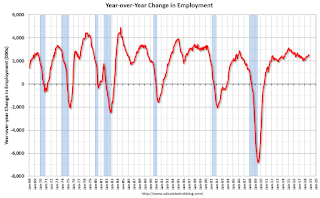

8:30 AM: Employment Report for November. The consensus is for 190,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for November. The consensus is for 190,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 250,000 jobs added in October, and the unemployment rate was at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In October the year-over-year change was 2.516 million jobs.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

3:00 PM: Consumer Credit from the Federal Reserve.