by Calculated Risk on 12/06/2018 08:19:00 AM

Thursday, December 06, 2018

ADP: Private Employment increased 179,000 in November

Private sector employment increased by 179,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was close to the consensus forecast for 175,000 private sector jobs added in the ADP report.

...

“Although the labor market performed well, job growth decelerated slightly,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. ”Midsized businesses added nearly 70 percent of all jobs this month. This growth points to the midsized businesses’ ability to provide stronger wages and benefits. It also suggests they could be more insulated from the global challenges large enterprises face.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is strong, but has likely peaked. This month’s report is free of significant weather effects and suggests slowing underlying job creation. With very tight labor markets, and record unfilled positions, businesses will have an increasingly tough time adding to payrolls.”

The BLS report for November will be released Friday, and the consensus is for 190,000 non-farm payroll jobs added in November.

CoreLogic: 2.2 million Homes still in negative equity at end of Q3 2018

by Calculated Risk on 12/06/2018 08:00:00 AM

From CoreLogic: CoreLogic Reports Homeowners with Negative Equity Declines by Only 81,000 in the Third Quarter of 2018

CoreLogic … today released the Home Equity Report for the third quarter of 2018. The report shows that U.S. homeowners with mortgages (which account for roughly 63 percent of all properties) have seen their equity increase by 9.4 percent year over year, representing a gain of nearly $775.2 billion since the third quarter of 2017.CR Note: A year ago, in Q3 2017, there were 2.6 million properties with negative equity - now there are 2.2 million.

Additionally, the average homeowner gained $12,400 in home equity between the third quarter of 2017 and the third quarter of 2018. While home equity grew in almost every state in the nation, western states experienced the most significant increases. California homeowners gained an average of approximately $36,500 in home equity, and Nevada homeowners experienced an average increase of approximately $32,600 in home equity.

From the second quarter of 2018 to the third quarter of 2018, the total number of mortgaged homes in negative equity decreased 4 percent to 2.2 million homes or 4.1 percent of all mortgaged properties. Year over year, the number of mortgaged properties in negative equity fell 16 percent from 2.6 million homes – or 5 percent of all mortgaged properties – in the third quarter of 2018.

“On average, homeowners saw their home equity increase again this quarter but not nearly as much as in previous quarters,” said Dr. Frank Nothaft, chief economist for CoreLogic. “During the third quarter, homeowners gained an average of $12,400 compared to the second quarter when the average home equity wealth increase was more than $16,000. This lower year-over-year gain reflects the slowing in appreciation we’ve seen in the CoreLogic Home Price Index.”

Negative equity, often referred to as being underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in a home’s value, an increase in mortgage debt or both. Negative equity peaked at 26 percent of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

The national aggregate value of negative equity was approximately $281.6 billion at the end of the third quarter of 2018. This is down quarter over quarter by approximately $1.1 billion, from $280.5 billion in the second quarter of 2018 and down year over year by approximately $2.7 billion, from $279 billion in the third quarter of 2017.

“The number of homes in a negative equity position have remained around 2.2 million for two consecutive quarters this year,” said Frank Martell, president and CEO of CoreLogic. “Without equity, those homeowners are unable to sell their homes and are more likely to transition from delinquency to foreclosure if they face financial distress.”

emphasis added

Wednesday, December 05, 2018

Thursday: ADP Employment, Unemployment Claims, Trade Deficit, ISM Non-Mfg, Q3 Flow of Funds

by Calculated Risk on 12/05/2018 07:30:00 PM

Thursday:

• At 8:15 AM ET, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 175,000 jobs added, down from 227,000 in October.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 234 thousand the previous week.

• At 8:30 AM, Trade Balance report for October from the Census Bureau. The consensus is the trade deficit to be $54.9 billion. The U.S. trade deficit was at $54.0 billion in September.

• At 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for a decrease to 59.0 from 60.3.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

Fed's Beige Book: Economic Growth "modest or moderate", Labor Market "Tightened further"

by Calculated Risk on 12/05/2018 02:06:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Philadelphia based on information collected on or before November 26, 2018."

Most of the twelve Federal Reserve Districts reported that their economies expanded at a modest or moderate pace from mid-October through late November, though both Dallas and Philadelphia noted slower growth compared with the prior Beige Book period. St. Louis and Kansas City noted just slight growth. On balance, consumer spending held steady – District reports on growth of nonauto retail sales appeared somewhat weaker while auto sales tended to improve, particularly for used cars. Tourism reports varied but generally kept pace with the economy. Tariffs remained a concern for manufacturers, but a majority of Districts continued to report moderate growth in the sector. All Districts reported growth in nonfinancial services – ranging from slight to strong. New home construction and existing home sales tended to decline or hold steady, while construction and leasing of nonresidential structures tended to rise or remain flat. Overall, lending volumes grew modestly, although a few Districts noted some slowing. Agricultural conditions and farm incomes were mixed; some Districts noted impacts from excessive rainfall and from tariffs, which have constrained demand. Most energy sectors saw little change or modest growth. Most Districts reported that firms remained positive; however, optimism has waned in some as contacts cited increased uncertainty from impacts of tariffs, rising interest rates, and labor market constraints.

Labor markets tightened further across a broad range of occupations. Over half of the Districts cited firms for which employment, production, and sometimes capacity expansion had been constrained by an inability to attract and retain qualified workers. In fact, several Chicago firms reported that some employees have simply quit – with no notice nor means of contact. Partly as a consequence of labor shortages, most Districts reported that employment growth leaned to the slower side of a modest to moderate pace. Conversely, most Districts reported that wage growth tended to the higher side of a modest to moderate pace. In addition to raising wages, most Districts noted examples of firms enhancing nonwage benefits, including health benefits, profit-sharing, bonuses, and paid vacation days.

emphasis added

Lawler: US Death Rate Up, Life Expectancy Down in 2017

by Calculated Risk on 12/05/2018 11:42:00 AM

CR Note: The summary paragraph is key. Demographics are worse than they appeared a few years ago.

From housing economist Tom Lawler: US Death Rate Up, Life Expectancy Down in 2017

The National Center for Health Statistics (NCHS) reported that there were 2,813,503 US deaths in 2017, 69,255 higher than in 2016. The “age-adjusted” death rate (per 100,000) increased to 731,9 in 2017 from 728.8 in 2016, while the estimated life expectancy at birth declined to 78.6 in 2017 from 78.7 in 2016.

Below is a table showing some historical death rates for selected age groups.

What is especially striking about this table is the sharp increase in death rates among 25-44 year old over the last five years.

| US Death Rates (deaths per 100,000 population), Total and Selected Age Groups (NCHS) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Yr | Total | 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65-74 | 75-84 | 85+ | Age Adj. |

| 2000 | 854 | 80 | 101 | 199 | 426 | 992 | 2399 | 5667 | 15524 | 869 |

| 2005 | 828 | 81 | 107 | 195 | 432 | 899 | 2110 | 5252 | 14982 | 815 |

| 2010 | 800 | 68 | 103 | 171 | 407 | 852 | 1875 | 4790 | 13934 | 747 |

| 2011 | 807 | 68 | 105 | 172 | 410 | 849 | 1846 | 4753 | 13779 | 741 |

| 2012 | 810 | 66 | 105 | 171 | 405 | 854 | 1803 | 4675 | 13679 | 733 |

| 2013 | 822 | 65 | 106 | 172 | 406 | 860 | 1802 | 4648 | 13660 | 732 |

| 2013 | 824 | 66 | 108 | 175 | 405 | 870 | 1786 | 4564 | 13408 | 725 |

| 2015 | 824 | 66 | 108 | 175 | 405 | 870 | 1786 | 4564 | 13408 | 725 |

| 2016 | 844 | 75 | 129 | 192 | 406 | 884 | 1789 | 4475 | 13392 | 729 |

| 2017 | 864 | 74 | 133 | 195 | 402 | 886 | 1791 | 4473 | 13574 | 732 |

The NCHS also reported that there were 70,237 drug overdose deaths in 2017, up from 63,632 in 2016. Here is a table showing some historical drug overdose deaths for selected age groups.

| Drug Overdose Deaths by Selected Age Groups | |||||||

|---|---|---|---|---|---|---|---|

| Year | 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | Total |

| 2000 | 1,435 | 3,169 | 6,469 | 4,389 | 1,013 | 854 | 17,415 |

| 2005 | 2,918 | 5,340 | 8,506 | 8,968 | 2,761 | 1,203 | 29,813 |

| 2010 | 3,571 | 7,572 | 8,546 | 11,299 | 5,486 | 1,722 | 38,329 |

| 2011 | 3,762 | 8,445 | 9,130 | 11,933 | 6,060 | 1,892 | 41,340 |

| 2012 | 3,518 | 8,508 | 8,948 | 11,895 | 6,423 | 2,094 | 41,502 |

| 2013 | 3,664 | 8,947 | 9,320 | 12,045 | 7,551 | 2,344 | 43,982 |

| 2014 | 3,798 | 10,055 | 10,134 | 12,263 | 8,122 | 2,568 | 47,055 |

| 2015 | 4,235 | 11,880 | 11,505 | 12,974 | 8,901 | 2,760 | 52,404 |

| 2016 | 5,376 | 15,443 | 14,183 | 14,771 | 10,632 | 3,075 | 63,632 |

| 2017 | 5,455 | 17,400 | 15,949 | 15,996 | 11,747 | 3,529 | 70,237 |

The NCHS did note that provisional data for the first four months of 2018 suggest that drug overdose death rates declined very slightly from last year’s alarmingly high rates.

According to the NCHS, there were 47,143 suicides in the US last year, up from 44,965 in 2016.

| US Suicide Deaths | US Drug Overdose Deaths | |||||

|---|---|---|---|---|---|---|

| Year | Total | Men | Women | Total | Men | Women |

| 1999 | 29,199 | 23,458 | 5,741 | 16,849 | 11,258 | 5,591 |

| 2016 | 44,965 | 34,727 | 10,238 | 63,632 | 41,558 | 22,074 |

| 2017 | 47,173 | 36,782 | 10,391 | 70,237 | 46,552 | 23,685 |

The NCHS death data highlight some serious issues facing the US. They also highlight the serious issues associated with the latest medium- and long-term population projections from Census. Below is a table comparing the so-called “Census 2017” Population Projections for deaths compared to the NCHS data.

| US Deaths: Census 2017 Projections Vs. Actuals | |||||

|---|---|---|---|---|---|

| Census 2017 Projections | NCHS | Census Avg. | |||

| 12 months ended: | Calendar Year | Vs. | |||

| 6/30/2017 | 6/30/2018 | Average | 2017 | NCHS | |

| Total | 2,688,802 | 2,717,297 | 2,703,050 | 2,813,503 | -110,454 |

| <1 | 39,741 | 39,250 | 39,496 | 22,335 | 17,161 |

| 1-14 | 13,787 | 13,688 | 13,738 | 9,580 | 4,158 |

| 15-24 | 23,543 | 22,804 | 23,174 | 32,025 | -8,852 |

| 25-34 | 43,981 | 43,340 | 43,661 | 60,215 | -16,555 |

| 35-44 | 62,599 | 61,705 | 62,152 | 79,796 | -17,644 |

| 45-54 | 151,976 | 145,945 | 148,961 | 170,142 | -21,182 |

| 55-64 | 330,420 | 327,584 | 329,002 | 372,006 | -43,004 |

| 65-74 | 493,422 | 500,663 | 497,043 | 531,610 | -34,568 |

| 75-84 | 619,610 | 638,667 | 629,139 | 657,759 | -28,621 |

| 85+ | 909,723 | 923,651 | 916,687 | 878,035 | 38,652 |

First, there is obvious “mistake” in the Census 2017 projections for “infant” deaths. Second, the Census 2017 death projections for 15-84 year olds for calendar year 2017 (approximated in the above table) were a whopping 170,424 below actual deaths for this broad age group. The Census 2017 death projections for subsequent years have the same “issues,” overstating infant, child, and 85+ deaths and significantly understating likely deaths for all other age groups. These “issues” make the Census 2017 population projections of little use for those who use population projections to forecast key economic variables such as labor force growth, household growth, etc.

Note: ADP Employment, ISM Non-Mfg Rescheduled to Thursday

by Calculated Risk on 12/05/2018 08:20:00 AM

Due to the national day of mourning for former President George H.W. Bush, the ADP Employment report, and the ISM non-manufacturing survey will be released on Thursday.

The Federal Reserve Beige Book will be released at 2 PM today as scheduled.

Fed Chair Jerome Powell's testimony on the economic outlook has been postponed.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 12/05/2018 07:00:00 AM

From the MBA: Mortgage Applications Rise in Latest MBA Weekly Survey

Mortgage applications increased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 30, 2018. The results for the week ending November 23, 2018, included an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 36 percent compared with the previous week and was 0.2 percent higher than the same week one year ago.

...

“Treasury rates continued to slide last week, driven mainly by concerns over slowing global economic growth and U.S. and China trade uncertainty. The 30-year fixed-rate fell for the third week in a row to 5.08 percent and has declined a total of nine basis points over this span,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Application activity increased over the week for both purchase and refinance loans, and were 10 percent and 7 percent higher, respectively, than the week before the Thanksgiving holiday. Additionally, we saw a decrease in the average loan size for purchase applications to the lowest since December 2017 ($298,000 from $313,000). This is perhaps an indication that there are fewer jumbo borrowers, or maybe first-time buyers are having better success reaching the market as we close out the year.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 5.08 percent from 5.12 percent, with points decreasing to 0.44 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 0.2% year-over-year.

Tuesday, December 04, 2018

Wednesday: ADP Employment, ISM Non-Mfg, Beige Book

by Calculated Risk on 12/04/2018 08:18:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Deeper into 2 Month Lows as Stocks Swoon

On a somewhat frustrating note, mortgage rates didn't experience nearly as big of a move as the broader bond market. For instance, 10yr Treasuries--the most widely-used benchmark for longer-term interest rates) dropped 0.05% today. Mortgages only managed to drop by 0.02% in terms of effective rates. [30YR FIXED - 4.875]Wednesday:

emphasis added

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 175,000 jobs added, down from 227,000 in October.

• At 10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for a decrease to 59.0 from 60.3.

• POSTPONED: At 10:15 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the Joint Economic Committee, U.S. Senate

• At 2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Excerpt from Toll Brothers Earnings Press Release

by Calculated Risk on 12/04/2018 05:03:00 PM

Via housing economist Tom Lawler: Excerpt from Toll Brothers Earnings Press Release

“In our fourth quarter, despite a healthy economy, we saw a moderation in demand. Fourth quarter contracts declined 15% in dollars and 13% in units compared to a difficult comp from one year ago. Fourth quarter demand slowed to a per community pace more consistent with FY 2016’s fourth quarter, which was still strong.Lawler adds: Toll Brothers’ fiscal fourth quarter (and fiscal year) ended October 31, 2018. For the three months ending 10/31/18 Toll Brothers’ net contracts in California totaled 226 (at an average contract price of $1,815,800), down 39.4% from the comparable quarter of 2017 (when the average contract price was $1,624,400).

“In November, we saw the market soften further, which we attribute to the cumulative impact of rising interest rates and the effect on buyer sentiment of well-publicized reports of a housing slowdown. We saw similar consumer behavior beginning in late 2013, when a rapid rise in interest rates temporarily tempered buyer demand before the market regained momentum.

“California has seen the biggest decline. Significant price appreciation over the past few years, fewer foreign buyers in certain communities, and the impact of rising interest rates all contributed to this slowdown. But California is the world’s fifth largest economy with diverse, job-creating industries, including vibrant technology companies, a large concentration of wealth, and desirable lifestyle options. With our attractive coastal California land, our leading brand, and the state’s constrained supply of housing, we continue to believe in our long-term position in the California market.”

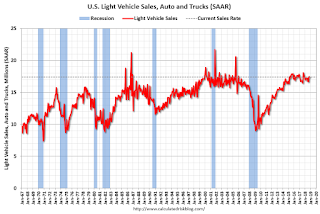

November Vehicles Sales: 17.4 Million SAAR, On Pace to be unchanged in 2018

by Calculated Risk on 12/04/2018 02:59:00 PM

The BEA released their estimate of November vehicle sales. The BEA estimated sales of 17.40 million SAAR in November 2018 (Seasonally Adjusted Annual Rate), down 0.5% from the October sales rate, and down 0.7% from November 2017.

Through November, light vehicle sales are on pace to be mostly unchanged in 2018 compared to 2017.

This would make 2018 the fourth best year on record after 2016, 2015, 2000, and tied with 2017.

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 are estimated based on the pace of sales during the first eleven months.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

My guess is vehicle sales will finish the year with sales slightly lower than in 2017 (sales in late 2017 were boosted by buying following the hurricanes), and will probably be just over 17 million for the year (the lowest since 2014). But sales will be close to last year.

A small decline - or no change - in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

As I noted last year, this means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).