by Calculated Risk on 12/11/2017 10:06:00 AM

Monday, December 11, 2017

BLS: Job Openings "Little changed" in October

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.0 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, hires increased to 5.6 million and separations were little changed at 5.2 million. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.1 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was unchanged at 3.2 million in October. The quits rate was 2.2 percent. The number of quits was little changed for total private, for government, and in all industries. In the regions, the number of quits increased in the South and decreased in the Midwest.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in October to 5.996 million from 6.177 in September.

The number of job openings (yellow) are up 7.3% year-over-year.

Quits are up 3.3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are mostly moving sideways at a high level, and quits are increasing year-over-year. This is a solid report.

Sunday, December 10, 2017

Sunday Night Futures

by Calculated Risk on 12/10/2017 07:20:00 PM

Weekend:

• Schedule for Week of Dec 10, 2017

Monday:

• 10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3, and DOW futures are up 23 (fair value).

Oil prices were down over the last week with WTI futures at $57.16 per barrel and Brent at $63.14 per barrel. A year ago, WTI was at $52, and Brent was at $52 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.45 per gallon. A year ago prices were at $2.21 per gallon - so gasoline prices are up 24 cents per gallon year-over-year.

Hotel Occupancy Rate Increased Year-over-Year, On Pace for Record Year

by Calculated Risk on 12/10/2017 10:59:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 2 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 26 November through 2 December 2017, according to data from STR.Note: The hurricanes continue to drive demand in Texas and Florida, especially in Houston.

In comparison with the week of 27 November through 3 December 2016, the industry recorded the following:

• Occupancy: +1.3% to 56.6%

• Average daily rate (ADR): +0.2% to US$117.82

• Revenue per available room (RevPAR): +1.5% to US$66.71

Among the Top 25 Markets, Houston, Texas, reported the largest increase in RevPAR (+33.1% to US$74.18), due primarily to the highest rise in occupancy (+25.5% to 68.6%). Performance in the market continues to be boosted by post-Hurricane Harvey demand.

Tampa/St. Petersburg, Florida, posted the highest lift in ADR (+7.9% to US$113.10).

Orlando, Florida, experienced the second-highest increases in occupancy (+9.6% to 72.2%) and RevPAR (+15.7% to US$83.65).

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, December 09, 2017

Goldman: FOMC Preview

by Calculated Risk on 12/09/2017 05:23:00 PM

The FOMC meets on Tuesday and Wednesday, and almost all analysts expect a rate hike this week. Here are a few brief excerpts from a Goldman Sachs research note:

With the FOMC almost certain to deliver the third rate hike of 2017 at its December meeting next week, attention is instead likely to focus on the outlook for 2018 and beyond and in particular on how the Fed will react to a tax reform that now appears likely to become law.CR Note: I think FOMC members will wait until the tax cuts are passed before including the possible impact in their projections.

The economic data have improved slightly on net since the FOMC last met in early November. Growth momentum has remained strong, the unemployment rate has fallen further, and the latest inflation data were encouraging. Meanwhile, financial conditions have eased once again, as they have in the aftermath of each Fed tightening action so far in this hiking cycle.

In light of both the stronger growth momentum and the prospect of tax cuts, we expect the Summary of Economic Projections to upgrade GDP growth in 2018 and 2019 and to mark down the unemployment path by two-tenths to 3.9%, offset only partly by a one-tenth reduction in the longer-run unemployment rate to 3.5%. We expect the 2018 inflation projections to remain at 1.9% ... we continue to expect four rate hikes next year

Schedule for Week of Dec 10, 2017

by Calculated Risk on 12/09/2017 08:09:00 AM

The key economic reports this week are November retail sales and the Consumer Price Index (CPI).

For manufacturing, November industrial production, and the December New York Fed manufacturing survey will be released this week.

The FOMC meets this week and is expected to announce a 25bps increase in the Fed Funds rate.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased slightly in September to 6.093 million from 6.090 in August.

The number of job openings (yellow) were up 7.5% year-over-year, and Quits were up 3.5% year-over-year.

6:00 AM ET: NFIB Small Business Optimism Index for November.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is a 0.3% increase in PPI, and a 0.2% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.2% increase in core CPI.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 236 thousand the previous week.

8:30 AM ET: Retail sales for November be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM ET: Retail sales for November be released. The consensus is for a 0.3% increase in retail sales.This graph shows retail sales since 1992 through October 2017.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for a 0.1% decrease in inventories.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 18.0, down from 19.4.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.2%.

Friday, December 08, 2017

AAR: Rail Carloads decreased, Intermodal Solid in November

by Calculated Risk on 12/08/2017 04:16:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

In November 2017, like in October 2017, U.S. rail traffic had both a glass-is-half-empty and a glass-is-half-full feel to it. It’s half empty because total carloads were down 0.9% (11,442 carloads) in November, their fifth straight year-over-year monthly decline after eight straight monthly increases. Railroads, of course, are concerned with their total level of business, not just particular commodities, so total carloads matter. Eight of the 20 categories the AAR tracks had carload declines in November, but three of these were especially important: coal (down 22,560 carloads, or 5.0%), grain (down 16,311 carloads, or 12.7%), and petroleum and petroleum products (down 3,877 carloads, or 7.2%). All three of these categories saw carload declines in November for reasons that don’t have much to do with the state of the economy. So, the half-full feel comes from the fact that many traffic categories that are more sensitive to the economy did relatively well in November (e.g., steel, up 6.9%; stone, clay, and glass products, up 6.0%; chemicals up 3.6%). That’s a good sign for the economy going forward. The fact that intermodal originations were up 3.8% (50,029 containers and trailers) in November and will almost certainly set a new annual record in 2017 is a good sign as well.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

Originated carloads on U.S. railroads totaled 1,307,521 in November 2017, down 0.9% (11,442 carloads) from November 2016 thanks mainly to big declines in carloads of coal, grain, and petroleum products. Total carloads averaged 261,504 per week in November 2017, ahead of November 2015 (260,453) but otherwise the lowest weekly average for November since sometime prior to 1988, when our data begin.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. intermodal originations totaled 1.37 million containers and trailers in November 2017. That’s 3.8%, or 50,029 units, higher than in November 2016 and the tenth straight monthly increase. Weekly volume in November 2017 averaged 273,832 units, the eighth largest weekly average for any month on record and the fourth highest for any month this year.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

by Calculated Risk on 12/08/2017 02:35:00 PM

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just ten months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,510,000 under President G.H.W. Bush (light purple), and 11,756,000 under President Obama (dark blue).

During the first ten months of Mr. Trump's term, the economy has added 1,670,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first ten months of Mr. Trump's term, the economy has added 30,000 public sector jobs.

After ten months of Mr. Trump's presidency, the economy has added 1,700,000 jobs, about 383,000 behind the projection.

Solid Seasonal Retail Hiring in November

by Calculated Risk on 12/08/2017 11:00:00 AM

According to the BLS employment report, retailers hired seasonal workers in October and November at a higher pace than last year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 595 thousand workers (NSA) net in October and November, this is up from just over 509 thousand for the same period last year, and about the same level as the previous four years. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are optimistic about the holiday season, even though some retailers are probably having trouble finding seasonal hires.

Comment on Employment Report: Some Additional Hurricane Bounce Back

by Calculated Risk on 12/08/2017 10:00:00 AM

The headline jobs number was strong at 228 thousand, probably somewhat due to an additional bounce back from the hurricanes, and above expectations. The previous two months were revised up slightly by a combined 3 thousand jobs.

The September jobs report was revised up again (now up to 38 thousand), and that keeps the record job streak alive, now at 86 consecutive months (93 months if we remove the decennial Census hiring and firing).

Earlier: November Employment Report: 228,000 Jobs Added, 4.1% Unemployment Rate

In November, the year-over-year change was 2.07 million jobs. This is still generally trending down.

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in November.

Wage growth had been trending up, although the acceleration in wage growth stalled this year.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 4.8 million, was essentially unchanged in November but was down by 858,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find full-time jobs.The number of persons working part time for economic reasons increased slightly in November. The number working part time for economic reasons suggests a little slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 8.0% in November.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.58 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.62 million in October

This is the lowest level since June 2008.

This is trending down, but still a little elevated.

The headline jobs number was solid and the unemployment rate unchanged at a low level - both positive signs and a continuation of multi-year trends. However wage growth was disappointing again.

November Employment Report: 228,000 Jobs Added, 4.1% Unemployment Rate

by Calculated Risk on 12/08/2017 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 228,000 in November, and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. ... The unemployment rate held at 4.1 percent in November, and the number of unemployed persons was essentially unchanged at 6.6 million.

...

The change in total nonfarm payroll employment for September was revised up from +18,000 to +38,000, and the change for October was revised down from +261,000 to +244,000. With these revisions, employment gains in September and October combined were 3,000 more than previously reported.

...

In November, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $26.55. Over the year, average hourly earnings have risen by 64 cents, or 2.5 percent.

emphasis added

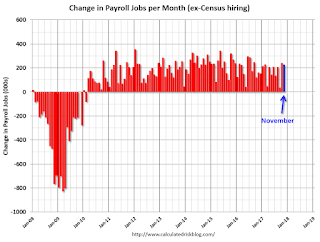

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 228 thousand in November (private payrolls increased 221 thousand).

Payrolls for September and October were revised up by a combined 3 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November the year-over-year change was 2.07 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in November at 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate was unchanged in November at 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio decreased to 60.1% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in October at 4.1%.

This was above expectations of 185,000 jobs, and the previous two months combined were revised up slightly.

I'll have much more later ...