by Calculated Risk on 12/28/2015 07:02:00 PM

Monday, December 28, 2015

Tuesday: Case-Shiller House Prices

From Jann Swanson at Mortgage News Daily: TRID Causing Noticeable Delays -Ellie Mae

The new RESPA-TILA Know Before You Owe regulations, commonly called TRIID, was cited as a probable reason for a three day increase in the average time it took to close a mortgage loan in November compared to October. Ellie Mae said the average application-to-closing time of 49 days was the longest time to close a loan since February 2013. Conventional and FHA loans each took 49 days while VA loans took an average of 50.Tuesday:

...

"We are beginning to see the anticipated impacts of the Know Before You Owe changes that went into effect in October," said Jonathan Corr, president and CEO of Ellie Mae. "The time to close loans has crept up to 49 days, a 3-day increase over October, while the closing rate on purchased loans increased to 72 percent. Additionally, we've seen the percentage of refinances increase to 46 percent of all closed loans, most likely driven by a recent dip in rates over the last three months since the 2015 high point in August."

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices. The consensus is for a 5.4% year-over-year increase in the Comp 20 index for October. The Zillow forecast is for the National Index to increase 4.9% year-over-year in October.

Freddie Mac Mortgage Serious Delinquency rate declined in November, Fannie Mae Rate Unchanged

by Calculated Risk on 12/28/2015 03:05:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in November to 1.36%, down from 1.38% in October. Freddie's rate is down from 1.91% in November 2014, and the rate in November was the lowest level since October 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Fannie Mae reported today that the Single-Family Serious Delinquency rate was unchanged in November at 1.58%. The serious delinquency rate is down from 1.91% in November 2014.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.55 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2016.

The Fannie Mae serious delinquency rate has only fallen 0.33 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Question #10 for 2016: How much will housing inventory increase in 2016?

by Calculated Risk on 12/28/2015 12:31:00 PM

Yesterday I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

10) Housing Inventory: Housing inventory bottomed in early 2013. However, after slight increases in 2013 and 2014, inventory was down slightly year-over-year in 2015 (through November). Will inventory increase or decrease in 2016?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2015.

According to the NAR, inventory decreased to 2.04 million in November from 2.08 million in November 2014, and up from 1.99 million in November 2012. A small increase over the last three years.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Inventory decreased 1.9% year-over-year in November from November 2014 (blue line). Note that the blue line (year-over-year change) turned slightly positive in 2013, but has been slightly negative for the 2nd half of 2015.

The NAR numbers are the usual measure of inventory. However Zillow also has some inventory data (by state, city, zip code and more here). We have to be careful using the Zillow data because the coverage is probably increasing, but looking at the state level data, it appears inventory is down about 7% year-over-year. This ranges from a sharp year-over-year decrease in some states (like Utah) to a sharp increase in other areas (like North Dakota). Some cities, like Houston, are seeing a sharp increase in inventory due to lower oil prices. Real estate is local!

There are several reasons for the low inventory. Because of low inventory, potential sellers are concerned they will not be able to find a home to buy - so they do not list their home. Another reason for low inventory is that some homeowners are still "underwater" on their mortgages and can't sell. However negative equity is becoming less of a problem. Also some potential sellers haven't built up enough equity to sell and have a down payment for a new purchase.

Over time, as the market moves back to normal, it seems homeowners will sell for the usual reasons (changing jobs, kids, etc).

Right now my guess is active inventory will increase in 2016 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2016). I don't expect a double digit surge in inventory, but maybe a mid-single digit increase year-over-year. If correct, this will keep house price increases down in 2015 (probably lower than the 5% or so gains in 2014 and 2015).

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Dallas Fed: "Texas Manufacturing Activity Rises Again, but Outlook Worsens" in December

by Calculated Risk on 12/28/2015 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Rises Again, but Outlook Worsens

Texas factory activity increased for a third month in a row in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 5.2 to 13.4, indicating stronger growth in output.Output increased, but the general business activity index declined sharply. This was the last of the regional Fed surveys for December. Four out of five of the regional surveys indicated contraction in December, especially in oil producing areas.

...

Perceptions of broader business conditions weakened markedly in December. The general business activity index has been negative throughout 2015 and plunged to -20.1 this month. After pushing just above zero last month, the company outlook index fell 10 points in December to -9.7, its lowest level since August.

Labor market indicators reflected a notable rise in December. The employment index inched up further to 12.8; 26 percent of firms noted net hiring, while 14 percent noted net layoffs. The hours worked index suggested longer workweeks and rose to 15.2, its highest level since May 2010.

emphasis added

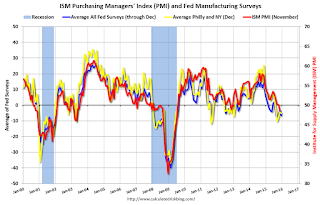

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

It seems likely the ISM index will be weak in December, and will probably show contraction again; a reading below 50. (although these regional surveys overemphasize oil producing areas).

Sunday, December 27, 2015

Sunday Night Futures

by Calculated Risk on 12/27/2015 08:26:00 PM

From the OC Register: On a roll: O.C. housing market wraps up a 'fantastic' 2015 (ht Ilya)

As the year draws to a close, the latest median home price hit $623,000 – just 3.4 percent below the $645,000 record high of June 2007. From January through November, the county’s median averaged about $604,000, up 4 percent from last year, according to data from real estate data firm Corelogic.I don't think renters would think 2015 was a "fantastic year". Also it has been almost 10 years since prices were close to this high, so inflation adjusted, prices aren't close to the previous highs.

...

In the view of John Burns, a real estate consultant based in Irvine, it was for the most part a “fantastic year... Prices, rents and sales volumes rose at a steady, sustainable pace, and construction levels hit their highest levels in at least 12 years.”

Weekend:

• Schedule for Week of December 27th

• Ten Economic Questions for 2016

Monday:

• At 10:30 AM ET, the Dallas Fed Manufacturing Survey for December. This is the last of the regional manufacturing surveys for December.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 5 and DOW futures are down 55 (fair value).

Oil prices were up over the last week with WTI futures at $37.92 per barrel and Brent at $37.73 per barrel. A year ago, WTI was at $54, and Brent was at $58 - so prices are down over 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at close to $2.00 per gallon (down about $0.30 per gallon from a year ago).

Ten Economic Questions for 2016

by Calculated Risk on 12/27/2015 12:18:00 PM

Here is a review of the Ten Economic Questions for 2015.

There are always some international economic issues, especially with Europe, China and other areas of the world struggling. However, my focus is on the US economy, with an emphasis on housing.

Here are my ten questions for 2016. I'll follow up with some thoughts on each of these questions.

1) Economic growth: Heading into 2016, most analysts are once again pretty sanguine. Even with weak growth in the first quarter, 2015 was a decent year (GDP growth will be around 2.5% in 2015). Right now analysts are expecting growth of 2.6% in 2016, although a few analysts are projecting a recession. How much will the economy grow in 2016?

2) Employment: Through November, the economy has added 2,308,000 jobs this year, or 210,000 per month. As expected, this was down from the 260 thousand per month in 2014. Will job creation in 2016 be as strong as in 2015? Or will job creation be even stronger, like in 2014? Or will job creation slow further in 2016?

3) Unemployment Rate: The unemployment rate was at 5.0% in November, down 0.8 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 4.6% to 4.8% range in Q4 2016. What will the unemployment rate be in December 2016?

4) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

5) Monetary Policy: The Fed raised rates this month, and now the question is how much will the Fed raise rates in 2016? The market is pricing in two 25 bps rate hikes in 2016, and most analysts expect three to four hikes in 2016. However, some analysts think the Fed is finished, the so-called "one and done" view. Will the Fed raise rates in 2016, and if so, by how much?

6) Real Wage Growth: Last year I was one of the most pessimistic forecasters on wage growth. That was unfortunately correct. Hopefully 2016 will be better for wages! How much will wages increase in 2016?

7) Oil Prices: The decline in oil prices was a huge story at the end of 2014, and prices have declined sharply again at the end of 2015. Will oil prices stabilize here (WTI is at $38 per barrel)? Or will prices decline further? Or will prices increase in 2016?

8) Residential Investment: Residential investment (RI) was up solidly in 2015. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2016? How about housing starts and new home sales in 2016?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% or so in 2015 (after increasing 7% in 2012, 11% in 2013, and 5% in 2014 according to Case-Shiller). What will happen with house prices in 2016?

10) Housing Inventory: Housing inventory bottomed in early 2013. However, after increase in 2013 and 2014, inventory was down slightly year-over-year in 2015 (through November). Will inventory increase or decrease in 2016?

There are other important questions, but these are the ones I'm focused on right now.

Saturday, December 26, 2015

Schedule for Week of December 27th

by Calculated Risk on 12/26/2015 08:11:00 AM

This will be a light week for economic data.

The key report this week is Case-Shiller house prices on Tuesday.

Happy New Year!

10:30 AM: Dallas Fed Manufacturing Survey for December. This is the last of the regional manufacturing surveys for December.

9:00 AM: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices.

9:00 AM: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the September 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.4% year-over-year increase in the Comp 20 index for October. The Zillow forecast is for the National Index to increase 4.9% year-over-year in October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.5% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for a reading of 50.0, up from 48.7 in November.

All US markets will be closed for New Year's Day.

Friday, December 25, 2015

Happy Holidays!

by Calculated Risk on 12/25/2015 08:31:00 AM

Happy Holidays and Merry Christmas to All!

One of my favorite poems ...

Out through the fields and the woodsLove greatly. Enjoy the season!

And over the walls I have wended;

I have climbed the hills of view

And looked at the world, and descended;

I have come by the highway home,

And lo, it is ended.

The leaves are all dead on the ground,

Save those that the oak is keeping

To ravel them one by one

And let them go scraping and creeping

Out over the crusted snow,

When others are sleeping.

And the dead leaves lie huddled and still,

No longer blown hither and thither;

The last lone aster is gone;

The flowers of the witch-hazel wither;

The heart is still aching to seek,

But the feet question ‘Whither?’

Ah, when to the heart of man

Was it ever less than a treason

To go with the drift of things,

To yield with a grace to reason,

And bow and accept the end

Of a love or a season?

Reluctance by Robert Frost From A Boy's Will, 1913.

Thursday, December 24, 2015

Review: Ten Economic Questions for 2015

by Calculated Risk on 12/24/2015 02:01:00 PM

At the end of each year, I post Ten Economic Questions for the coming year. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2015 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is a review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2015: How much will housing inventory increase in 2015?

Right now my guess is active inventory will increase further in 2015 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2015). I expect active inventory to move closer to 6 months supply this summer.According to the November NAR report on existing home sales, inventory was down 1.9% year-over-year in November, and the months-of-supply was at 5.1 months. Inventory could still increase in year-over-year in December, but it looks like inventory will be down slightly.

9) Question #9 for 2015: What will happen with house prices in 2015?

In 2015, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. Low inventories, and a better economy (with more consumer confidence) suggests further price increases in 2015. I expect we will see prices up mid single digits (percentage) in 2015 as measured by these house price indexes.If is still early - house price data is released with a lag - but the Case Shiller data for September showed prices up 4.9% year-over-year. The year-over-year change seems to be moving mostly sideways recently in the mid single digits. As expected.

8) Question #8 for 2015: How much will Residential Investment increase?

My guess is growth of around 8% to 12% for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts might shift a little more towards single family in 2015.Through November, starts were up 11% year-over-year compared to the same period in 2014. New home sales were up 14.5% year-over-year through November. About as expected.

7) Question #7 for 2015: What about oil prices in 2015?

It is impossible to predict an international supply disruption - if a significant disruption happens, then prices will obviously move higher. Continued weakness in Europe and China does seem likely - and I expect the frackers to slow down with exploration and drilling, but to continue to produce at most existing wells at current prices (WTI at $55 per barrel). This suggests in the short run (2015) that prices will stay well below $100 per barrel (perhaps in the $50 to $75 range) - and that is a positive for the US economy.WTI futures are close to $38 per barrel, so prices are lower than expected.

6) Question #6 for 2015: Will real wages increase in 2015?

As the labor market tightens, we should start seeing some wage pressure as companies have to compete more for employees. Whether real wages start to pickup in 2015 - or not until 2016 or later - is a key question. I expect to see some increase in both real and nominal wage increases this year. I doubt we will see a significant pickup, but maybe another 0.5 percentage points for both, year-over-year.Through November, nominal hourly wages were up 2.3 year-over-year .

Note: I was more pessimistic than most on wages in 2015, and that was about right.

5) Question #5 for 2015: Will the Fed raise rates in 2015? If so, when?

The FOMC will not want to immediately reverse course, so the might wait a little longer than expected. Right now my guess is the first rate hike will happen at either the June, July or September meetings.The FOMC waited until December.

4) Question #4 for 2015: Will too much inflation be a concern in 2015?

Due to the slack in the labor market (elevated unemployment rate, part time workers for economic reasons), and even with some real wage growth in 2015, I expect these measures of inflation will stay mostly at or below the Fed's target in 2015. If the unemployment rate continues to decline - and wage growth picks up - maybe inflation will be an issue in 2016.Several key measures show inflation has increased a little, and is close to the Fed's target.

So currently I think core inflation (year-over-year) will increase in 2015, but too much inflation will not be a serious concern this year.

3) Question #3 for 2015: What will the unemployment rate be in December 2015?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to close to 5% by December 2015. My guess is based on the participation rate staying relatively steady in 2015 - before declining again over the next decade. If the participation rate increases a little, then I'd expect unemployment in the low-to-mid 5% range.The unemployment rate was 5.0% in November.

2) Question #2 for 2015: How many payroll jobs will be added in 2015?

Energy related construction hiring will decline in 2015, but I expect other areas of construction to be solid.Through November 2015, the economy has added 2,308,000 jobs, or 210,000 per month. This is in the expected range of 200,000 to 225,000 per month in 2015 (lower than 2014, but still solid).

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - and more companies will have difficulty finding qualified candidates. Even with the overall boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2015 than in 2014.

So my forecast is for gains of about 200,000 to 225,000 payroll jobs per month in 2015. Lower than 2014, but another solid year for employment gains given current demographics.

1) Question #1 for 2015: How much will the economy grow in 2015?

Lower gasoline prices suggest an increase in personal consumption expenditures (PCE) excluding gasoline. And it seems likely PCE growth will be above 3% in 2015. Add in some more business investment, the ongoing housing recovery, some further increase in state and local government spending, and 2015 should be the best year of the recovery with GDP growth at or above 3%.Once again GDP was weaker than expected. It looks like GDP will be in the 2s again this year. Based on the November Personal Income and Outlays report, PCE growth will probably be just below 3% this year.

I missed on a few things this year: housing inventory didn't increase, the FOMC waited until December, oil prices declined more than I expected and GDP was lower than expected.

I was close on new home sales, housing starts, house prices, inflation, payroll jobs, and wages.

Black Knight's First Look at November Mortgage Data, "Fewer than 700,000 Active Foreclosures Remain"

by Calculated Risk on 12/24/2015 11:06:00 AM

From Black Knight: Black Knight Financial Services’ “First Look” at November 2015 Mortgage Data, Foreclosure Starts Hit Nine-Year Low; Fewer than 700,000 Active Foreclosures Remain

According to Black Knight's First Look report for November, the percent of loans delinquent increased 3% in November compared to October, and declined 18.3% year-over-year.

The percent of loans in the foreclosure process declined 3% in November and were down 21% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.92% in November, up seasonally from 4.77% in October.

The percent of loans in the foreclosure process declined in November to 1.38%.

The number of delinquent properties, but not in foreclosure, is down 546,000 properties year-over-year, and the number of properties in the foreclosure process is down 185,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for November in early January.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2015 | Oct 2015 | Nov 2014 | Nov 2013 | |

| Delinquent | 4.92% | 4.77% | 6.03% | 6.45% |

| In Foreclosure | 1.38% | 1.43% | 1.75% | 2.54% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,491,000 | 2,415,000 | 3,037,000 | 3,252,000 |

| Number of properties in foreclosure pre-sale inventory: | 698,000 | 721,000 | 883,000 | 1,281,000 |

| Total Properties | 3,189,000 | 3,136,000 | 3,921,000 | 4,533,000 |