by Calculated Risk on 12/31/2015 09:50:00 AM

Thursday, December 31, 2015

Chicago PMI declines to 42.9

Chicago PMI: Dec Chicago Business Barometer Down 5.8 points to 42.9

The Chicago Business Barometer contracted at the fastest pace since July 2009, falling 5.8 points to 42.9 in December from 48.7 in NovemberThis was well below the consensus forecast of 50.0.

...

There was also ongoing weakness in New Orders, which contracted at a faster pace, to the lowest level since May 2009. The fall in Production was more moderate but still put it back into contraction for the sixth time this year. The Employment component, which had recovered in recent months, dropped back below the 50 neutral mark in December, leaving it at the lowest since July.

The only positive this month came from a special question with 55.1% of the panel expecting demand to be stronger in 2016 compared with 14.3% who thought it would be lower. 30.6% of respondents thought demand would be unchanged.

...

Chief Economist of MNI Indicators Philip Uglow said, “The steepness of the decline in the Barometer in recent months ends a particularly volatile year, which has seen orders and output move in and out of contraction. It lends weight to the Fed’s gradual approach to tightening, with the flexibility to change direction if needed.”

emphasis added

Weekly Initial Unemployment Claims increase to 287,000

by Calculated Risk on 12/31/2015 08:36:00 AM

The DOL reported:

In the week ending December 26, the advance figure for seasonally adjusted initial claims was 287,000, an increase of 20,000 from the previous week's unrevised level of 267,000. The 4-week moving average was 277,000, an increase of 4,500 from the previous week's unrevised average of 272,500.The previous week was unrevised at 267,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 277,000.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Average weekly unemployment claims in 2015 were the lowest in over 40 years (when the workforce was much smaller).

Wednesday, December 30, 2015

Vehicle Sales Forecast: Record Production in 2016

by Calculated Risk on 12/30/2015 08:10:00 PM

Thursday:

• At 8:30 AM ET, initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

• At 9:45 AM, Chicago Purchasing Managers Index for December. The consensus is for a reading of 50.0, up from 48.7 in November.

The automakers will report December vehicle sales on Tuesday, January 5th. Sales in November were at 18.1 million on a seasonally adjusted annual rate basis (SAAR), and it possible sales in December will be over 18 million SAAR again.

From WardsAuto: North America Production Will Hit 18 Million Next Year

Forecast 2016 production totals 18.2 million vehicles, including 17.7 million light vehicles and 490,000 medium- and heavy-duty trucks. The LV total is 1.2% above the estimated 17.44 million in 2015, while the big-truck volume is 4.9% under 2015’s estimated total of 515,000.2015 was a record year for light vehicle production in the US, and it looks like 2016 will be even better.

Total estimated vehicle output in 2015 of 17.96 million units is 1.1% above 2014’s 17.42 million and will topple the previous high of 17.66 million in 2000. LV volume this year will be a new record – beating 2000’s 17.16 million – while big-truck output will be a 9-year high.

Zillow Forecast: Expect November Year-over-year Change for Case-Shiller Index slightly higher than in October

by Calculated Risk on 12/30/2015 04:31:00 PM

The Case-Shiller house price indexes for October were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: November Case-Shiller Forecast Shows Continued Growth

Similar to last month’s Zillow’s Home Value Index data, October S&P Case-Shiller data shows home prices continuing to climb. The 10- and 20-City Indices as well as the National Case-Shiller Index grew by nearly 1 percent between September and October. Similarly all three of the indices showed annual growth rates north of 5 percent. This marks the first time in over a year the national index has grown at 5 percent annually.This suggests the year-over-year change for the November Case-Shiller National index will be slightly higher than in the October report.

When November Case-Shiller data is released a month from now, we expect the data will show continuing growth month-over-month, though not at quite the same sizzling pace. We predict that the 10- and 20- City Indices will end November 0.5 percent above their October values (seasonally adjusted). We expect the national index to grow slightly faster than the other two, at a rate of 0.7 percent month-over-month.

Inline with continued monthly growth we also expect all rates still above 5 percent when November data is released. The table below shows the current changes in Case-Shiller data along with our forecasts for next month’s data.

Question #8 for 2016: How much will Residential Investment increase?

by Calculated Risk on 12/30/2015 12:38:00 PM

Over the weekend, I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

8) Residential Investment: Residential investment (RI) was up solidly in 2015. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2016? How about housing starts and new home sales in 2016?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2015.

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish. Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year since then.

But even with the recent increases, RI as a percent of GDP is still very low - close to the lows of previous recessions - and it seems likely that residential investment as a percent of GDP will increase further in 2016.

Housing starts are on pace to increase over 10% in 2015. And even after the significant increase over the last four years, the approximately 1.1 million housing starts in 2015 will still be the 11th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the seven lowest years were 2008 through 2014). The other lower years were the bottoms of previous recessions.

New home sales in 2015 were up close to 14% compared to 2014 at close to 500 thousand.

Here is a table showing housing starts and new home sales over the last decade. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That means starts will come close to increasing 40% over the next few years from the 2015 level.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2068 | --- | 1,283 | --- |

| 2006 | 1801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1003 | 8.5% | 437 | 1.9% |

| 20151 | 1110 | 10.6% | 498 | 14.0% |

| 12015 estimated | ||||

Most analysts are looking for starts to increase to around 1.25 million in 2016, and for new home sales around 560 thousand. This would be an increase of around 12% for both starts and new home sales.

I think there will be further growth in 2016, but I'm a little more pessimistic than some analysts. Some key areas - like Houston - will be hit hard by the decline oil prices. And I think growth will slow for multi-family starts. Also, to achieve double digit growth for new home sales in 2016, the builders would have to offer more lower priced homes (the builders have focused on higher priced homes in recent years). There has been a shift to offering more affordable new homes, but it takes time.

My guess is growth of around 4% to 8% in 2016 for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts will shift a little more towards single family in 2016.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

NAR: Pending Home Sales Index decreased 0.9% in November, up 2.7% year-over-year

by Calculated Risk on 12/30/2015 10:02:00 AM

From the NAR: Pending Home Sales Decline Modestly in November

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.9 percent to 106.9 in November from an upwardly revised 107.9 in October but is still 2.7 percent above November 2014 (104.1). Although the index has increased year-over-year for 15 consecutive months, last month's annual gain was the smallest since October 2014 (2.6 percent).This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

...

The PHSI in the Northeast decreased 3.0 percent to 91.8 in November, but is still 4.3 percent above a year ago. In the Midwest the index rose 1.0 percent to 104.9 in November, and is now 4.1 percent above November 2014.

Pending home sales in the South increased 1.3 percent to an index of 119.9 in November and are 0.5 percent higher than last November. The index in the West declined 5.5 percent in November to 100.4, but remains 4.5 percent above a year ago.

emphasis added

Tuesday, December 29, 2015

From CNBC: "Luxury home prices finally getting too high?"

by Calculated Risk on 12/29/2015 08:54:00 PM

Wednesday:

• At 10:00 AM ET, Pending Home Sales Index for November. The consensus is for a 0.5% increase in the index.

Note: Long time reader and mortgage broker "Soylent Green Is People" sent me a note yesterday: "the unthinkable is occurring: seems like Irvine home prices have hit an air pocket, falling in some cases."

Irvine is expensive, but not a "luxury home" market. But this has me thinking that we might be seeing a slowdown in prices increases (or flat prices) in some areas.

From Denise Garcia at CNBC: Luxury home prices finally getting too high?

The tables have turned in the real estate industry as luxury listing prices fell for the first time since 2012, according to a Redfin report. The brokerage firm suggests that the drop in prices stems from wealthy buyers and foreign investors refusing to buy at the top of the market.These are listing prices, not sale prices - and it has seemed like many homes were listed at absurd asking prices. I doubt we will see a significant price decline in these areas, but prices might flatten out.

Prices for luxury homes fell by 2.2 percent in the third quarter, compared to a year ago, according to the report.

Question #9 for 2016: What will happen with house prices in 2016?

by Calculated Risk on 12/29/2015 02:01:00 PM

Over the weekend, I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

7) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% or so in 2015 (after increasing 7% in 2012, 11% in 2013, and 5% in 2014 according to Case-Shiller). What will happen with house prices in 2016?

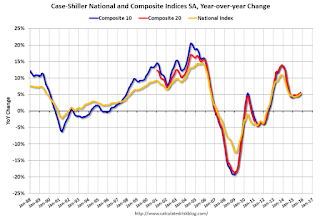

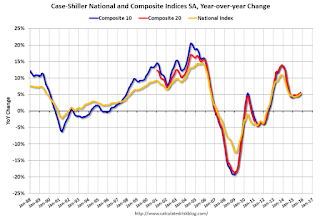

The following graph shows the year-over-year change in the seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 5.1% compared to October 2014, the Composite 20 SA was up 5.6% and the National index SA was up 5.2% year-over-year. Other house price indexes have indicated similar gains (see table below).

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-15 | 5.6% |

| Case-Shiller National | Oct-15 | 5.2% |

| CoreLogic | Oct-15 | 6.8% |

| Zillow | Oct-15 | 4.3% |

| Black Knight | Sept-15 | 5.1% |

| FNC | Oct-14 | 5.9% |

| FHFA Purchase Only | Oct-15 | 6.1% |

There were some special factors in 2012 and 2013 that led to sharp price increases. This included limited inventory, fewer foreclosures, continued investor buying in certain areas, and a change in psychology as buyers and sellers started believing house prices had bottomed. In some areas, like Phoenix, there appeared to be a strong bounce off the bottom, but that bounce mostly ended in 2014.

Currently investor buying has slowed, as have distressed sales - however inventory is still low in many areas. In 2016, inventories will probably remain low, but I expect inventories to increase on a year-over-year basis.

Low inventories, and a decent economy suggests further price increases in 2016. However I expect we will see prices up less in 2016, than in 2015, as measured by these house price indexes - mostly because I expect more inventory.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Real Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/29/2015 11:01:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.2% year-over-year in October

The year-over-year increase in prices is mostly moving sideways now around 5%. In October 2013, the National index was up 10.9% year-over-year (YoY). In October 2015, the index was up 5.2% YoY.

Here is the YoY change since January 2014 for the National Index:

| Month | YoY Change |

|---|---|

| Jan-14 | 10.5% |

| Feb-14 | 10.1% |

| Mar-14 | 8.9% |

| Apr-14 | 7.9% |

| May-14 | 7.0% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.6% |

| Nov-14 | 4.6% |

| Dec-14 | 4.6% |

| Jan-15 | 4.3% |

| Feb-15 | 4.2% |

| Mar-15 | 4.3% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

| Jun-15 | 4.4% |

| Jul-15 | 4.5% |

| Aug-15 | 4.6% |

| Sep-15 | 4.9% |

| Oct-15 | 5.2% |

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 5.1% below the bubble peak. However, in real terms, the National index is still about 19.1% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through September) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through September) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to August 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to October 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.3% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to June 2003 levels, the Composite 20 index is back to January 2003 levels, and the CoreLogic index is back to October 2003.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

Case-Shiller: National House Price Index increased 5.2% year-over-year in October

by Calculated Risk on 12/29/2015 09:21:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("September" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Continued Increases in Home Prices for October According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a slightly higher year-over-year gain with a 5.2% annual increase in October 2015 versus a 4.9% increase in September 2015. The 10-City Composite increased 5.1% in the year to October compared to 4.9% previously. The 20-City Composite’s year-over-year gain was 5.5% versus 5.4% reported in September.

...

Before seasonal adjustment, the National Index posted a gain of 0.1% month-over-month in October. The 10-City Composite was unchanged and the 20-City Composite reported gains of 0.1% month-over-month in October. After seasonal adjustment, the National Index posted a gain of 0.9%, while the 10-City and 20-City Composites both increased 0.8% month-over-month. Ten of 20 cities reported increases in October before seasonal adjustment; after seasonal adjustment, all 20 cities increased for the month.

emphasis added

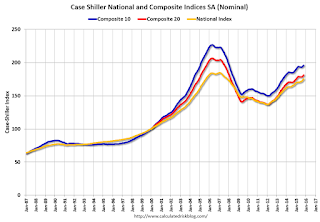

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 13.7% from the peak, and up 0.8% in October (SA).

The Composite 20 index is off 12.3% from the peak, and up 0.8% (SA) in October.

The National index is off 5.1% from the peak, and up 0.9% (SA) in October. The National index is up 28.2% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.1% compared to October 2014.

The Composite 20 SA is up 5.6% year-over-year..

The National index SA is up 5.2% year-over-year.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in October seasonally adjusted. (Prices increased in 10 of the 20 cities NSA) Prices in Las Vegas are off 39.0% from the peak.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 55% above January 2000 (55% nominal gain in almost 16 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 15% above the change in overall prices due to inflation.

Five cities - Charlotte, Boston, Dallas, Denver and Portland - are above the bubble highs (other Case-Shiller Comp 20 city are close - San Francisco and Seattle). Detroit prices are barely above the January 2000 level.

I'll have more on house prices later.