by Calculated Risk on 4/29/2014 10:17:00 AM

Tuesday, April 29, 2014

HVS: Q1 2014 Homeownership and Vacancy Rates

The Census Bureau released the Housing Vacancies and Homeownership report for Q1 2014 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate,except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.8% in Q1, from 65.2% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

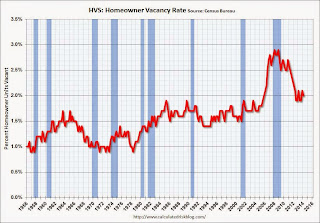

The HVS homeowner vacancy decreased to 2.0% in Q1.

The HVS homeowner vacancy decreased to 2.0% in Q1.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate increased slightly in Q1 to 8.3% from 8.2% in Q4.

The rental vacancy rate increased slightly in Q1 to 8.3% from 8.2% in Q4.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that most of the bubble excess is behind us.

Case-Shiller: Comp 20 House Prices increased 12.9% year-over-year in February

by Calculated Risk on 4/29/2014 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Defy Weak Sales Numbers According to the S&P/Case-Shiller Home Price Indices

Data through February 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the annual rates of gain slowed for the 10-City and 20-City Composites. The Composites posted 13.1% and 12.9% in the twelve months ending February 2014.

Both Composites remained relatively unchanged month-over-month. Thirteen of the twenty cities declined in February. Cleveland had the largest decline of 1.6% followed by Chicago and Minneapolis at -0.9%. Las Vegas posted -0.1%, marking its first decline in almost two years. Tampa showed its largest decline of 0.7% since January 2012.

“Prices remained steady from January to February for the two Composite indices,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The annual rates cooled the most we’ve seen in some time. The three California cities and Las Vegas have the strongest increases over the last 12 months as the West continues to lead. Denver and Dallas remain the only cities which have reached new post-crisis price peaks. The Northeast with New York, Washington and Boston are seeing some of the slowest year-over-year gains. However, even there prices are above their levels of early 2013. On a month-to-month basis, there is clear weakness. Seasonally adjusted data show prices rose in 19 cities, but a majority at a slower pace than in January.

Click on graph for larger image.

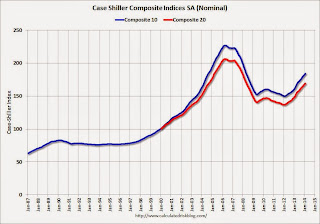

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.9% from the peak, and up 0.9% in February (SA). The Composite 10 is up 22.8% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 18.1% from the peak, and up 0.8% (SA) in February. The Composite 20 is up 23.4% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.1% compared to February 2013.

The Composite 20 SA is up 12.9% compared to February 2013.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in February seasonally adjusted. (Prices increased in 7 of the 20 cities NSA) Prices in Las Vegas are off 44.5% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was at the consensus forecast for a 13.0% YoY increase. I'll have more on prices later.

Monday, April 28, 2014

Tuesday: Case-Shiller House Prices

by Calculated Risk on 4/28/2014 07:15:00 PM

Here is another graphic of changing demographics: The Next America. Some people look at this graphic and see the need to support an aging population - I look at this graphic, and I see one of the wonders of the 20th Century (increased life expectancy) - I also see that soon (by 2020) all of the largest cohorts will be under 40!

For Tuesday ... just wondering ... Will S&P post the press release online on a timely basis? And will the S&P website crash again?

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February. The consensus is for a 13.0% year-over-year increase in the Composite 20 index (NSA) for February. The Zillow forecast is for the Composite 20 to increase 12.8% year-over-year, and for prices to increase 0.6% month-to-month seasonally adjusted.

• At 10:00 AM, Conference Board's consumer confidence index for April. The consensus is for the index to increase to 83.0 from 82.3.

• Also at 10:00 AM, the Q1 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

Weekly Update: Housing Tracker Existing Home Inventory up 8.2% year-over-year on April 28th

by Calculated Risk on 4/28/2014 04:08:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 8.2% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

A comment on the New Home Sales report

by Calculated Risk on 4/28/2014 12:12:00 PM

After a nice weekend of hiking, I'm ready to comment on the disappointing new home sales report for March. See last week: New Home Sales decline to 384,000 Annual Rate in March

New home sales is one of the key reports each month (see: Ranking Economic Data). However - as always - we shouldn't read too much into any one report.

The Census Bureau reported that new home sales in Q1 combined were 107,000 not seasonally adjusted (NSA). This is down slightly from 109,000 in Q1 2012 (NSA) - so essentially there was little change when comparing Q1 2014 to Q1 2013. This is what the public builders have been reporting too.

Weather probably played a small role in the disappointing year-over-year change, however higher mortgage rates and higher prices were probably larger factors. Also there were probably supply constraints in some areas and credit remains difficult for many potential borrowers.

In a way this reminds me of 1994/1995. 30 year fixed mortgage rates increased from around 7% in 1993 to over 9% at the end of 1994 (the Fed had raised the Fed Funds rate from 3% to 5 1/2% during that period). A number of analysts thought the economy was going into recession based on slightly higher taxes, a higher Fed Funds rate - and they were pointing to the slight decline in new home sales as an indicator. I disagreed.

I was one of the most optimistic people around at the end of 1994 and I was arguing that new home sales had bottomed in 1991, sales were still very low, housing was a slow moving market, and the demographics supported a higher sales rate over the next several years (new home sales were only 666 thousand in 1993, 670 thousand in 1994, and 667 thousand in 1995 - basically flat for a few years - and then increased to over 800 thousand in 1997).

Mortgage rates are up again - this time from 3.6% a year ago to over 4.3% now (and people are concerned about Fed "tapering"). However sales are even lower (only 429 thousand in 2013), demographics are once again favorable, and I still expect new home sales to increase to 750 thousand to 800 over the next several years. That will be a significant increase from the 384 thousand sales rate in March!

Maybe sales will move sideways for a little longer, but remember Q1 was a difficult comparison period. Sales in 2013 were up 16.6% from 2012, but sales in Q1 2013 were up over 25% from Q1 of the previous year! The comparisons to last year will be a little easier in a few months - and I still expect to see solid year-over-year growth later this year.

On revisions: Once again revisions were positive. December sales were revised down slightly, but sales in January were revised up by 15 thousand, and sales in February were revised up 9 thousand (a combined upward revision of 20 thousand) - so overall revisions were positive.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through March 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some more or move sideways (distressed sales will slowly decline and be partially offset by more conventional / equity sales). And I expect this gap to close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Dallas Fed: "Texas Manufacturing Picks Up and Outlook Improves Notably"

by Calculated Risk on 4/28/2014 10:40:00 AM

Another solid regional manufacturing survey, this one from the Dallas Fed: Texas Manufacturing Picks Up and Outlook Improves Notably

Texas factory activity increased for the 12th month in a row in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 17.1 to 24.7, reaching its highest level in four years and indicating stronger output growth.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Some other measures of current manufacturing activity also reflected more robust growth. The new orders index posted a four-year high, rising to 21.3. The capacity utilization index rose to a multiyear high as well, climbing from 13.1 to 18.7, with a third of manufacturers noting an increase. The shipments index fell 7 points to 12.4, indicating the volume of shipments grew but at a slower pace than in March.

Perceptions of broader business conditions were markedly more optimistic in April. The general business activity index rose for a second consecutive month, increasing from 4.9 to 11.7. The company outlook index jumped nearly 15 points to a four-year high of 23.4, reflecting a sharp rise in optimism among manufacturers.

Labor market indicators reflected stronger employment growth and longer workweeks. The April employment index rose to 19.7, its highest reading in more than two years.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

All of the regional surveys showed expansion in April, and it appears the ISM index will be stronger for the month. The ISM index for April will be released Thursday, May 1st and the consensus is for an increase to 54.2 from 53.7 in March.

NAR: Pending Home Sales Index increases 3.4% in March, down 7.9% year-over-year

by Calculated Risk on 4/28/2014 10:00:00 AM

From the NAR: Pending Home Sales Increase in March

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 3.4 percent to 97.4 from an upwardly revised 94.2 in February, but is 7.9 percent below March 2013 when it was 105.7.Mr Yun's once again lowered his forecast for 2014, and is now down to 4.9 million "Existing-home sales are expected to total just over 4.9 million this year, below the nearly 5.1 million in 2013." This is down from his earlier forecast of 5.1 million existing home sales this year. I'll once again take the under on his current forecast - but I think that it would be a positive sign if sales were under 5 million in 2014 as long as distressed sales continue to decline and conventional sales increase.

...

The PHSI in the Northeast increased 1.4 percent to 78.8 in March, but is 5.9 percent below a year ago. In the Midwest the index slipped 0.8 percent to 94.5 in March, and is 10.1 percent below March 2013. Pending home sales in the South rose 5.6 percent to an index of 112.7 in March, but are 5.3 percent below a year ago. The index in the West increased 5.7 percent in March to 91.0, but is 11.1 percent below March 2013.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May.

Black Knight (formerly LPS): House Price Index up 0.7% in February, Up 7.6% year-over-year

by Calculated Risk on 4/28/2014 09:10:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight (formerly LPS), Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.7 Percent for the Month; Up 7.6 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services (formerly the LPS Data & Analytics division) released its latest Home Price Index (HPI) report, based on February 2014 residential real estate transactions. ... The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increase was less in February (7.6% YoY increase) than in January (8.0%), December (8.4%), November (8.5%) and October (8.8%), so this suggests price increases might be slowing.

The LPS HPI is off 13.5% from the peak in June 2006.

Note: The press release has data for the 20 largest states, and 40 MSAs. Prices increased in 19 of the 20 largest states in February and were unchanged in Ohio.

LPS shows prices off 43.7% from the peak in Las Vegas, off 36.7% in Orlando, and 34.1% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston and San Antonio metros). Prices are also at new highs in Honolulu.

Note: Case-Shiller for February will be released tomorrow.

Sunday, April 27, 2014

Monday: Pending Home Sales, Dallas Fed Mfg Survey

by Calculated Risk on 4/27/2014 08:30:00 PM

This will be a busy week ... Tim Duy has a preview of the FOMC meeting: FOMC Week

The FOMC will wrap up a two-day meeting this Wednesday. I suspect the subsequent statement will be met with little fanfare. There simply has been little in the way of data to prompt any new policy path. Steady as she goes.CR: I expect the FOMC to announce a $10 billion decrease in asset purchases, to blame the early year weakness mostly on the weather, and to express some concern about housing and also concern that inflation is too low. More of the same ...

To be sure, the Fed will be greeted by the Q1 GDP report Wednesday morning, and it is widely expected to be very weak. But incoming data (retail sales, auto sales, industrial production, and employment, for example) suggests that much of this weakness was weather related while the underlying pace of activity, albeit arguably unexciting, remains unchanged. In short, the economy is evolving largely according to the Fed's script, and thus we should expect no major policy change. I anticipate the statement will reflect a greater confidence that the first quarter growth hiccup was a weather effect, that low inflation remains a concern, and a reiteration of the Fed's commitment to a low-rate policy path as long as inflation remains a concern. And another $10 billion cut in asset purchases to push the taper further along.

The Fed may identify housing as an area of concern.

And Jim Hamilton has a discussion of the recent increase in gasoline prices: Oil and gasoline prices: many still missing the big picture

The international price of crude oil ultimately determines the price Americans pay for gasoline at the pump. Seasonal factors can bring the price temporarily below the long-run relation, and this accounted for the temporarily low gasoline prices that we saw last fall and winter. Movements in gasoline prices back up this spring are basically a return to normal.Monday:

And crude oil prices have remained stable despite impressive gains in U.S. production of shale oil, referring to oil produced from tight geological formations using horizontal fracturing methods. These new drilling techniques have added 2.5 million barrels of daily U.S. oil production since 2010. Why hasn’t that new oil brought lower prices?

...

For the next several years, the world should be able to continue to increase field production of crude oil, as long as the price stays at current levels. The real message from the new technology is this: oil prices have been remarkably steady over the last several years because of– not in spite of– the important added contribution of tight oil.

• At 10:00 AM ET, Pending Home Sales Index for March. The consensus is for a 0.6% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for April. This is the last of the regional Fed manufacturing surveys for April.

Weekend:

• Schedule for Week of April 20th

• Ranking Economic Data

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 3 and DOW futures are up 23 (fair value).

Oil prices are mixed with WTI futures at $100.79 per barrel and Brent at $109.58 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.66 per gallon (up sharply over the last three months and more than 10 cents above the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Ranking Economic Data

by Calculated Risk on 4/27/2014 10:38:00 AM

Here is an update to a list I posted several years ago with my ranking of economic data releases.

These lists are not exhaustive (I'm sure I left a few off), and the rankings are not static. As an example, a few years ago I ranked initial weekly unemployment claims as ‘B List’ data, but now that claims are close to normal levels, I've moved weekly claims down to the 'C List'. Currently I'm watching measures of household debt a little closer and I've moved up the NY Fed's quarterly "Household Debt and Credit Report" to the C-list.

Note: There has been some research by Wall Street analysts about how "surprises" for many of these indicators impact the stock market. In general the ranking is similar with the employment situation report being #1.

The NAR existing home sales report is difficult to rank. 'For sale' inventory is important - almost "B-List" - but the headline sales number is more "C-List".

For each indicator I've included a link to the source and a recent post with graphs (in parenthesis).

Some of the lower ranked data is useful as leading indicators. As an example, the Architecture Billings Index is a leading indicator for investment in commercial real estate. And the NMHC apartment survey leads changes in apartment rents and vacancy rates. Also some of the lower ranked data helps forecast some of the more important data.

Both A-List reports (employment and GDP) will be released this week.

A-List

• BLS: Employment Situation Report, (March Employment Report: 192,000 Jobs, 6.7% Unemployment Rate and Comments on Employment Report)

• BEA: GDP Report (quarterly) (Q4 GDP Revised up to 2.6%)

B-List

• Census: New Home Sales (New Home Sales decline to 384,000 Annual Rate in March)

• Census: Housing Starts (Housing Starts at 946 Thousand Annual Rate in March and A comment on Housing Starts)

• ISM Manufacturing Index (ISM Manufacturing index increased in March to 53.7)

• Census: Retail Sales (Retail Sales increased 1.1% in March)

• BEA: Personal Income and Outlays (Personal Income increased 0.3% in February, Spending increased 0.3%)

• Fed: Industrial Production (Fed: Industrial Production increased 0.7% in March)

• BLS: Core CPI (Key Inflation Measures Shows Slight Increase, but still Low in March)

C-List

• NAR: Existing Home Sales (Existing Home Sales in March: 4.59 million SAAR, Inventory up 3.1% Year-over-year)

• DOL: Weekly Initial Unemployment Claims (Weekly Initial Unemployment Claims at 329,000)

• Manufacturers: Light Vehicle Sales (U.S. Light Vehicle Sales increase to 16.4 million annual rate in March, Highest since 2007)

• Philly Fed: Philly Fed Index (Philly Fed Manufacturing Survey indicated Faster Expansion in April)

• NY Fed Empire State Manufacturing Index (NY Fed: Empire State Manufacturing Survey indicates "business activity was flat" in April)

• Chicago ISM: Chicago PMI (Chicago PMI declines to 55.9)

• Census: Durable Goods

• ISM Non-Manufacturing Index (ISM Non-Manufacturing Index increases to 53.1 in March)

• House Prices: Case-Shiller and CoreLogic (CoreLogic: House Prices up 12.2% Year-over-year in February and Comment on House Prices: Graphs, Real Prices, Price-to-Rent Ratio, Cities)

• BLS: Job Openings and Labor Turnover Survey (BLS: Jobs Openings increase to 4.2 million in February)

• Census: Construction Spending (Construction Spending increased slightly in February)

• Census: Trade Balance (Trade Deficit increased in February to $42.3 Billion)

• MBA: Mortgage Delinquency Data (Quarterly) (MBA: Mortgage "Delinquency and Foreclosure Rates Decline to Lowest Level in Six Years" in Q4)

• LPS: Mortgage Delinquency Data (Black Knight: Mortgage delinquency rate in March lowest since October 2007)

• CoreLogic and Zillow: Negative Equity Report and Zillow (quarterly) (CoreLogic: 4 Million Residential Properties Returned to Positive Equity in 2013 and Zillow: Negative Equity declines further in Q4 2013)

• AIA: Architecture Billings Index (AIA: Architecture Billings Index indicated contraction in March)

• NY Fed: Household Debt and Credit Report (Quarterly) (NY Fed: Household Debt increased in Q4, Delinquency Rates Improve)

D-List

• Fed: Household Debt Service and Financial Obligations Ratios (Quarterly) (Fed: Q4 Household Debt Service Ratio near 30 year low)

• Fed: Flow of Funds (Quarterly) (Mortgage Equity Withdrawal Still Negative in Q4)

• Richmond Fed: Richmond Fed Manufacturing Index

• Kansas City Fed: Kansas City Fed Manufacturing Index

• Dallas Fed: Dallas Fed Manufacturing Index

• Reis: Office, Mall, Apartment Vacancy Rates (Quarterly) (Reis: Office Vacancy Rate declined slightly in Q1 to 16.8% and Reis: Apartment Vacancy Rate declined to 4.0% in Q1 2014 and Reis: Mall Vacancy Rates unchanged in Q1)

• NMHC Apartment Survey (Quarterly) (NMHC Survey: Apartment Market Conditions Softer in Q4)

• Reuters / Univ. of Michigan Consumer Sentiment Index (Final April Consumer Sentiment at 84.1)

• MBA: Mortgage Purchase Applications Index (MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey)

• NAHB: Housing Market Index (NAHB: Builder Confidence increased slightly in April to 47)

• Census: Housing Vacancy Survey (Quarterly) (HVS: Q4 2013 Homeownership and Vacancy Rates)

• Fed: Senior Loan Officer Survey (Quarterly) (Fed Survey: Banks eased lending standards, Experienced increased demand)

• ATA: Trucking (ATA Trucking Index increased in February)

• NFIB: Small Business Survey (NFIB: Small Business Optimism Index increases in March)

• STR: Hotel Occupancy (Hotels: Occupancy Rate, RevPAR decrease in latest weekly survey)

• NRA: Restaurant Performance Index

• Fed: Consumer Credit

• DOT: Vehicle Miles Driven (DOT: Vehicle Miles Driven decreased 0.8% year-over-year in February)

• LA and Long Beach Port Traffic: LA area Port Traffic: Up year-over-year in March, Exports at New High)

• BLS: Producer Price Index

• ADP Employment Report

• Conference Board Confidence Index

• NAR: Pending Home Sales

Sources (Government):

BEA: Bureau of Economic Analysis

BLS: Bureau of Labor Statistics

Census: Census Bureau

DOL: Dept of Labor

DOT: Dept. of Transportation

Fed: Federal Reserve

Sources (Industry):

AIA: American Institute of Architects

ISM: Institute for Supply Management

LPS: Black Knight

MBA: Mortgage Bankers Association

NAHB: National Association of Homebuilders

NAR: National Association of Realtors

NFIB: National Federation of Independent Business

NRA: National Restaurant Association

STR: Smith Travel Research