by Calculated Risk on 11/26/2012 12:58:00 PM

Monday, November 26, 2012

Timiraos: "The FHA’s Biggest Loser"

A frequent topic on this blog back in 2005, 2006, 2007 and even in 2008 were FHA loans and DAPs (seller financed Down-payment Assistance Programs). With DAPs, the seller "donated" the down payment to a non-profit (for a fee of course), and the non-profit gave the down payment to the buyer. This allowed people to get around the FHA's down payment requirement, and to buy for no money down. For nerdy details, see Tanta's DAP for UberNerds

DAPs were finally banned in 2008 after wrecking havoc on the FHA's finances.

From Nick Timiraos at the WSJ: FHA’s Biggest Loser: No-Money-Down Mortgages

One of the biggest reasons the Federal Housing Administration is facing severe financial woes is a problem agency officials identified and sought to correct years ago.The FHA made many bad loans in fiscal years 2008 and 2009 (from October 2007 through October 2009) when private capital left the mortgage market, and the FHA saw a huge surge in market share. With falling house prices, and low down payment loans, many of these borrowers defaulted.

...

A big chunk of the losses leading to a $16.3 billion shortfall have come from programs that allowed home sellers to fund down payments via nonprofit groups that provided them to buyers as a “gift.” After trying for years, the FHA finally prevailed on Congress to shut down the programs in late 2008, but not before the agency backed billions in risky no-money-down loans as home prices were dropping fast.

...

Seller-funded down-payment assistance loans accounted for just 4% of outstanding loans at the end of September, but they represented 13% of all seriously delinquent mortgages, according to a recently released audit.

The audit said that had the FHA not allowed the programs to go forward, then the mortgage program’s $13.5 billion net worth deficit would have turned to a positive $1.77 billion.

However DAPs also played a significant role in negatively impacting the FHA - and that was obvious in early 2005!

Dallas Fed: Regional Manufacturing Activity "Growth Stalls" in November

by Calculated Risk on 11/26/2012 10:30:00 AM

From the Dallas Fed: Growth Stalls and Company Outlook Worsens

Texas factory activity was little changed in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, came in at 1.7, indicating output barely increased from October.This was below expectations of a reading of 4.7 for the general business activity index. Later this week two more regional manufacturing surveys will be released (Richmond and Kansas City).

Other survey measures suggested flat manufacturing activity in November. The new orders index came in at 0.4, suggesting that demand was unchanged from October.

...

Perceptions of broader business conditions worsened in November. The general business activity index fell to -2.8, returning to negative territory. The company outlook index moved down to -4.8, registering its first negative reading since April.

Labor market indicators were mixed. The employment index edged up to 6.7 in November, with more than 20 percent of firms reporting hiring compared with 15 percent reporting layoffs. The hours worked index dipped from -5.9 to -7.1.

Chicago Fed: Economic Activity Slower in October

by Calculated Risk on 11/26/2012 08:30:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slower in October

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.56 in October from 0.00 in September. All four broad categories of indicators that make up the index decreased from September, and only two made positive contributions to the index in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased from –0.36 in September to –0.56 in October—its eighth consecutive reading below zero. October’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity slowed, and growth was still below trend in October.

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, November 25, 2012

Sunday Night Futures

by Calculated Risk on 11/25/2012 08:59:00 PM

Monday economic releases:

• At 8:30 AM ET, the Chicago Fed will release their National Activity Index for October. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for November will be released. The consensus is for 4.7 for the general business activity index, up from 1.8 in October.

• Expected: LPS "First Look" Mortgage Delinquency Survey for October.

• Also on Monday, Euro zone finance ministers will discuss the funding situation for Greece.

The Asian markets are mostly green tonight, with the Nikkei up 0.8%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 6 and DOW futures are down 56.

Oil prices are down with WTI futures at $87.95 per barrel and Brent at $111.23 per barrel.

Here is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices. Notes: Add a California city to the graph - like Los Angeles or San Francisco - and you will see the recent sharp increase and decrease due to refinery problems. If you add New York, it will show the recent spike (much smaller than in California).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Weekend:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Four more questions this week for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Greece Update: Eurozone finance ministers meet Monday

by Calculated Risk on 11/25/2012 01:08:00 PM

The eurozone finance ministers are meeting on Monday, and trying to reach an agreement to disburse more funds to Greece.

From the Financial Times: Greece upbeat about signing debt deal

Eurozone finance ministers will make another attempt on Monday ... to settle differences over debt relief measures for Athens and give a green light to disburse up to €44bn of aid.And from Bloomberg: Euro Ministers Take Third Swing at Clearing Greek Payment

The stumbling blocks to a deal, in addition to Berlin’s reluctance to accept drastic interest rate cuts, include opposition by some eurozone members to returning profits from the European Central Bank’s purchases of Greek bonds, and a gloomy assessment of Greece’s growth prospects until 2020 by the IMF.

excerpt with permission

Finance chiefs from the 17-member single currency return to Brussels tomorrow ...I expect an agreement will be reached soon that will buy more time.

Euro-area finance ministers held a conference call yesterday to prepare for the Brussels meeting. A breakthrough hinges on coming up with 10 billion euros ($13 billion) through reductions in interest rates charged by creditors and a debt buyback financed by bailout funding. The gap emerged when the finance chiefs agreed this month to give Greece two more years to meet targets.

Update: Case-Shiller House Prices will probably decline month-to-month Seasonally starting in October

by Calculated Risk on 11/25/2012 10:32:00 AM

This is just a reminder: The Not Seasonally Adjusted (NSA) monthly Case-Shiller house price indexes will show month-to-month declines soon, probably starting with the October report to be released in late December. The CoreLogic index has already started to decline on a month-to-month basis. This is not a sign of impending doom - or another collapse in house prices - it is just the normal seasonal pattern.

Even in normal times house prices tend to be stronger in the spring and early summer, than in the fall and winter. Currently there is a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

In the coming months, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. As an example, the September CoreLogic report showed a 0.3% month-to-month decline in September from August, but prices were up 5.0% year-over-year. That was the largest year-over-year increase since 2006.

I think house prices have already bottomed, and that prices will be up close to 5% year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

Note: The Case-Shiller September report will be released this coming Tuesday. For this graph, I used Zillow's forecast for September.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years. The CoreLogic index turned negative in the September report (CoreLogic is 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA will probably turn negative month-to-month in the October report (also a three month average, but not weighted).

Saturday, November 24, 2012

Jim the Realtor: Upcoming REO listings

by Calculated Risk on 11/24/2012 07:48:00 PM

I haven't checked in with Jim the Realtor in San Diego for some time. In this video below, Jim reviews a few upcoming REO listings in North County San Diego. Jim says: "there are only 16 houses owned by banks that aren't on the market" in the North County area (152 homes closed in the area last month, so the bank owned REO will not have much of an impact).

The first house is interesting. It looks like the bank will actually make money when they sell it.

The third house is good for a laugh (starts about 4:20). The bank has made some absurd repairs, like putting in a low end vanity in the master bath to replace a built-in that went all the way across the bathroom. (around 9:20 - Jim can't help but laugh).

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Unofficial Problem Bank list unchanged at 857 Institutions

by Calculated Risk on 11/24/2012 05:27:00 PM

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 23, 2012. (repeat from last week, table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, a very quiet week for the Unofficial Problem Bank List as it went without change. You have to go back to January 6th of this year for the last time it went a week unchanged. The list stands at 857 institutions with assets of $329.2 billion. A year ago, the list held 980 institutions with assets of $400.5 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Next week, the FDIC will likely release its actions through October 2012 and the Official Problem Bank List as of September 30, 2012. The difference between the two lists will likely drop from 187 at last issuance to the low 170s.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Schedule for Week of Nov 25th

by Calculated Risk on 11/24/2012 01:01:00 PM

Earlier:

• Summary for Week Ending Nov 23rd

Negotiations concerning the "fiscal slope" in the US will be back in the headlines this week. And, in Europe, the discussion on funding for Greece will resume on Monday.

There are two key housing reports this week: Case-Shiller house prices on Tuesday, and New Home Sales on Wednesday.

Revised Q3 GDP will be released on Thursday, and the October Personal Income and Outlays report will be released on Friday.

For manufacturing, three regional manufacturing reports will be released (Richmond, Dallas and Kansas City Fed surveys), plus the Chicago PMI will be released Friday.

The NY Fed will release their Q3 Report on Household Debt and Credit on Tuesday, and the FDIC is expected to release the Q3 Quarterly Banking Profile this week.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for November. The consensus is for 4.7 for the general business activity index, up from 1.8 in September.

Expected: LPS "First Look" Mortgage Delinquency Survey for October.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through August 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.9% year-over-year increase in the Composite 20 index (NSA) for September. The Zillow forecast is for the Composite 20 to increase 3.0% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. The consensus is for a decrease to -8 for this survey from -7 in October (below zero is contraction).

10:00 AM: FHFA House Price Index for September 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.5% increase in house prices.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for an increase to 72.8 from 72.2 last month.

3:00 PM: New York Fed to Release Q3 Report on Household Debt and Credit

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

10:00 AM ET: New Home Sales for October from the Census Bureau.

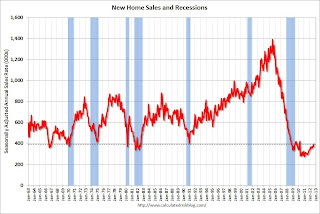

10:00 AM ET: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for a decrease in sales to 387 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 389 thousand in September.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 390 thousand from 410 thousand.

8:30 AM: Q3 GDP (second release). This is the second release from the BEA. The consensus is that real GDP increased 2.8% annualized in Q3, revised up from 2.0% in the advance release.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for November. The consensus is for an a reading of -1, up from -4 in October (below zero is contraction).

8:30 AM ET: Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.

Summary for Week Ending Nov 23rd

by Calculated Risk on 11/24/2012 08:03:00 AM

Last week was a short holiday week and I hope everyone is enjoying their Thanksgiving weekend!

Overall the economic data was positive last week, especially the housing data. Housing starts were at the highest level in four years, but are still very low - and both comments are important. Housing (residential investment) is now a tail wind for the economy, and housing can increase significantly from here.

Also the existing home sales market continues to show improvement. The keys for the existing home report are inventory and the number of conventional sales. Inventory is down significantly, and conventional sales are increasing. There will be more housing data next week (New home sales and the Case-Shiller house price indexes).

Initial weekly unemployment claims were still elevated because of Hurricane Sandy, but I expect claims will decline back to the pre-storm level pretty quickly.

Early in the week I spoke with Joe Weisenthal at Business Insider, and he wrote a way too nice article: The Genius Who Invented Economics Blogging Reveals How He Got Everything Right And What's Coming Next.

As I noted, I just track economic data and make a few forecasts - and I didn't invent economic blogging (although I've been at it for eight years). Professor Krugman added a few nice comments: All Hail Calculated Risk.

Excuse my blushing - thanks to all for reading!

Here is a summary of last week in graphs:

• Housing Starts increased to 894 thousand SAAR in October

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 894 thousand (SAAR) in October, up 3.6% from the revised September rate of 863 thousand (SAAR). Note that September was revised down from 872 thousand.

Single-family starts decreased slightly to 594 thousand in October.

Total starts are up about 87% from the bottom start rate, and single family starts are up about 70% from the low.

This was above expectations of 840 thousand starts in October. This was mostly because of the volatile multi-family sector that increased sharply in October, however single family starts have increased recently too. Starts are still very low, but on pace to be up about 25% from 2011.

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in October 2012 (4.79 million SAAR) were 2.1% higher than last month, and were 10.9% above the October 2011 rate.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.Months of supply declined to 5.4 months in October.

This was slightly above expectations of sales of 4.74 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• Weekly Initial Unemployment Claims decline to 410,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

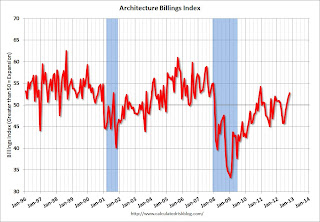

• AIA: Architecture Billings Index increases in October, Highest in Two Years

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year (it will be some time before investment in offices and malls increases significantly).

• Final November Consumer Sentiment at 82.7

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.This was below the consensus forecast of 84.0. Overall, consumer sentiment has been improving; the recent decline in sentiment might be related to the stock market decline (the consumer sentiment index is impacted by employment, gasoline prices, the stock market and more).