by Calculated Risk on 2/24/2005 06:11:00 PM

Thursday, February 24, 2005

More on Housing

Here are three interesting stories about credit quality, refinancing and over-supply in the housing market.

From chief economist David Berson, "Data Pointing to Home Sales Slowdown":

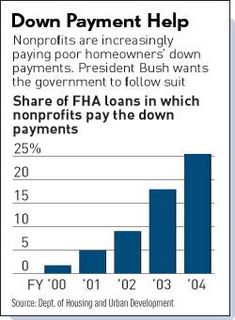

"Recent trends in production versus sales are a bit disturbing, and may suggest the excess inventories of unsold homes may have increased in early 2005 from already relatively high levels ... The obvious implication, if these data are indicative of actual trends, is that housing production may be exceeding demand."And this article about Downpayment Aassistance Programs (DAPs): "Plan To Boost Homeownership May Spur Problems, Critics Say" FHA loans are about 10% of all mortgages. They offer a 3% down payment loan - and that is still to0 much. So non-profit organization step in and pay the downpayment ... OK, actually the seller donates the downpayment to the non-profit and the non-profit gives it to the buyer. Amazing. DAPs were essentially non-existent 4 years ago and now make up 25% of FHA loans! See this chart:

Source: IBD

And finally this article related to my previous post "Americans using home equity pile up billions in extra debt". This chart shows Americans using their homes as ATMs:

Source: SacBee