by Calculated Risk on 9/22/2012 10:56:00 PM

Saturday, September 22, 2012

Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

A few excerpts from a research note by Goldman Sachs chief economist Jan Hatzius:

• ... We now view the Fed as following a looser version of the “threshold rule” championed by Chicago Fed President Charles Evans.The keys will be to watch the unemployment rate and several core measures of inflation. As of August, the unemployment rate was at 8.1% - and mostly moving sideways - and core PCE for July was up 1.6% year-over-year (plenty of room to the 2½%-2¾% range).

• What are the thresholds? We read the committee as signaling that the federal funds rate will not rise until the unemployment rate has fallen to the 6½%-7% range. The corresponding threshold for the end of QE3 may be in the 7%-7½% range.

•These implicit commitments are undoubtedly subject to an inflation ceiling ... may be a year-on-year core PCE reading of 2½%-2¾%.

• All this is subject to change ... The flexibility to respond to such changes is a key advantage of keeping the thresholds implicit rather than explicit.

• ... Under the committee’s economic forecasts, we estimate that the funds rate would stay near zero until mid-2015, while QE3 would run through mid-2014 and total $1.2trn.

• Under our own economic forecasts, we estimate that the funds rate would stay near zero until mid-2016, while QE3 would run through mid-2015 and total just under $2trn.

• If the recovery continues to disappoint, additional steps are possible.

Earlier:

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

Summary for Week Ending Sept 21st

by Calculated Risk on 9/22/2012 01:05:00 PM

Once again, the housing news was mostly positive last week and manufacturing was mostly disappointing.

Housing starts were a little below expectations - mostly because of the volatile multi-family sector - but starts are still up sharply from a year ago. Two-thirds of the way through 2012, single family starts are on pace for 515 thousand this year, and total starts are on pace for about 740 thousand.

In 2011, there were 609 total starts, and a record low 430 thousand single family starts. So housing starts are on pace for about a 20% increase from 2011. No wonder builder confidence was at the highest level since June 2006. That is a significant increase and will give the economy a boost.

Existing home sales increased too. The key numbers in the existing home sales report are inventory and months-of-supply. Inventory was down 18.2% year-over-year in August, and months-of-supply declined to 6.1 months - the lowest for the month of August since 2005.

The decline in inventory has been stunning, even for those of us expecting a significant decline - and I expect the year-over-year declines will start to decrease in the coming months.

Unfortunately both regional manufacturing surveys released this week (Empire State and Philly Fed) both showed contraction in September (although the Philly Fed index was close to unchanged).

A final note: The Fed's Flow of Funds survey showed household mortgage debt has decreased by over $1 trillion from the peak. Some of this decline is from homeowners paying down their mortgage (perhaps to refinance), but most of the decline was due to foreclosures or short sales (defaults). This reminded me of some of my posts from years ago ... new readers might not realize I was once one of the biggest bears around, see: The Trillion Dollar Bear

Here is a summary of last week in graphs:

• Housing Starts increased to 750 thousand in August

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 750 thousand (SAAR) in August, up 2.3% from the revised July rate of 733 thousand (SAAR). Note that July was revised from 746 thousand.

Single-family starts increased 5.5% to 535 thousand in August.

Total starts are up 57% from the bottom start rate, and single family starts are up 51% from the low.

This was below expectations of 768 thousand starts in August, but the key is starts are up solidly from last year. Right now starts are on pace to be up about 25% from 2011. Also total permits are up sharply from last year.

• Existing Home Sales in August: 4.82 million SAAR, 6.1 months of supply

The NAR reports: August Existing-Home Sales and Prices Rise

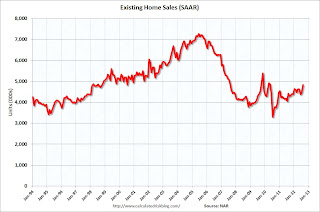

The NAR reports: August Existing-Home Sales and Prices RiseThis graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2012 (4.82 million SAAR) were 7.8% higher than last month, and were 9.3% above the August 2011 rate.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 18.2% year-over-year in August from August 2011. This is the eighteenth consecutive month with a YoY decrease in inventory.

Months of supply declined to 6.1 months in August.

This was above expectations of sales of 4.55 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index shows slight expansion in August

From AIA: Architecture Billings Index Inches Back into Positive Territory

From AIA: Architecture Billings Index Inches Back into Positive TerritoryThis graph shows the Architecture Billings Index since 1996. The index was at 50.2 in August, up from 48.7 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims at 382,000

The DOL reports: "In the week ending September 15, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 3,000 from the previous week's revised figure of 385,000." The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

The DOL reports: "In the week ending September 15, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 3,000 from the previous week's revised figure of 385,000." The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.This was above the consensus forecast of 373,000.

• Empire State and Philly Fed Manufacturing Surveys show contraction in September

From the Philly Fed: September Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 5 points, to a reading of -1.9."

From the Philly Fed: September Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 5 points, to a reading of -1.9."From MarketWatch: Empire State index hits nearly two-year low

This graph compares the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys increased slightly in September, and has remained negative for four consecutive months. This suggests another weak reading for the ISM manufacturing index.

• Fed's Q2 Flow of Funds: Household Mortgage Debt down $1 Trillion from Peak

The Federal Reserve released the Q2 2012 Flow of Funds report this week: Flow of Funds.

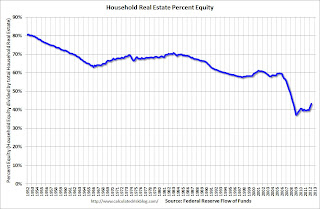

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2012, household percent equity (of household real estate) was at 43.1% - up from Q1, and the highest since Q2 2008. This was because of a small increase in house prices in Q2 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 43.1% equity - and over 10 million have negative equity.

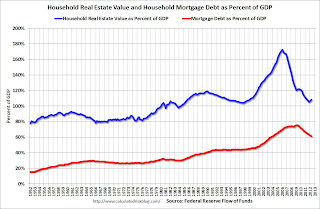

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt declined by $51 billion in Q2. Mortgage debt has now declined by $1.05 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up slightly in Q2 (as house prices increased), but is still near the lows of the last 30 years. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging (defaulting) ahead for households.

• Other Economic Stories ...

• LA area Port Traffic: Imports and Exports down YoY in August

• NAHB Builder Confidence increases in September, Highest since June 2006

• The Trillion Dollar Bear

Schedule for Week of Sept 23rd

by Calculated Risk on 9/22/2012 08:01:00 AM

Note: I'll post the weekly summary soon ... There are two key housing reports to be released this week: Case-Shiller house price index for July on Tuesday, and August New Home sales on Wednesday.

Other key reports include the third estimate of Q2 GDP on Thursday, and August Personal Income and Spending on Friday.

9:00 AM: LPS "First Look" Mortgage Delinquency Survey for August.

10:30 AM: Dallas Fed Manufacturing Survey for September. The consensus is for 0.5 for the general business activity index, up from -1.6 in August.

3:00 PM: San Francisco Fed President John Williams (voting member) speaks at The City Club of San Francisco, Jamison Roundtable Luncheon.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July.

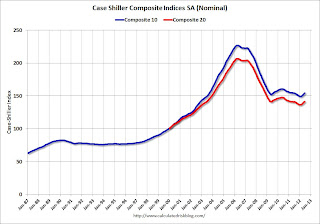

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through June 2012 (the Composite 20 was started in January 2000).

The consensus is for a 1.2% year-over-year increase in the Composite 20 index (NSA) for July. The Zillow forecast is for the Composite 20 to increase 1.6% year-over-year, and for prices to increase 1.0% month-to-month seasonally adjusted.

10:00 AM: FHFA House Price Index for July 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.8% increase in house prices.

10:00 AM: Conference Board's consumer confidence index for September. The consensus is for an increase to 64.8 from 60.6 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September. The consensus is for an increase to -4 for this survey from -9 in August (above zero is expansion).

10:00 AM ET: New Home Sales for August from the Census Bureau.

10:00 AM ET: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an increase in sales to 380 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 372 thousand in July. Watch for possible upgrades to the sales rates for previous months.

8:30 AM: Gross Domestic Product, 2nd quarter 2012 (third estimate); Corporate Profits, 2nd quarter 2012 (revised estimate) . This is the third estimate from the BEA. The consensus is that real GDP increased 1.7% annualized in Q2, unchanged form the second estimate.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 5.0% decrease in durable goods orders.

10:00 AM ET: Pending Home Sales Index for September. The consensus is for a 0.3% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for September. This is the last of the regional surveys for September. The consensus is for an a reading of 5, down from 8 in August (above zero is expansion).

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for an increase to 53.1, up from 53.0 in August.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 79.0, down from the preliminary September reading of 79.2, and up from the August reading of 74.3.

Friday, September 21, 2012

Sheila Bair: Former BofA CEO considered a "country bumpkin"

by Calculated Risk on 9/21/2012 06:43:00 PM

From former FDIC Chairperson Sheila Bair writing at Fortune: Sheila Bair and the bailout bank titans (ht Soylent Green is People)

I let my gaze drift toward Kenneth Lewis, who stood awkwardly at the end of the big conference table, away from the rest of the group. Lewis, the head of the North Carolina-based Bank of America (BAC) -- had never really fit in with this crowd. He was viewed somewhat as a country bumpkin by the CEOs of the big New York banks, and not completely without justification. He was a decent traditional banker, but as a dealmaker his skills were clearly wanting, as demonstrated by his recent, overpriced bids to buy Countrywide Financial, a leading originator of toxic mortgages, and Merrill Lynch, a leading packager of securities based on toxic mortgages originated by Countrywide and its ilk. His bank had been healthy going into the crisis but would now be burdened by those ill-timed, overly generous acquisitions of two of the sickest financial institutions in the country.I don't know about Lewis being a "country bumpkin", but the Countrywide acquisition had to be one of the worst ever - and it was obvious to many of us at the time.

Ouch!

Zillow forecasts Case-Shiller House Price index to show 1.6% Year-over-year increase for July

by Calculated Risk on 9/21/2012 02:22:00 PM

Note: The Case-Shiller report to be released next Tuesday is for July (really an average of prices in May, June and July).

Zillow Forecast: July Case-Shiller Composite-20 Expected to Show 1.6% Increase from One Year Ago

On Tuesday, Sept. 25, the Case-Shiller Composite Home Price Indices for July will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 1.6 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be up 1.1 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from June to July will be 1 percent for both the 20-City Composite and the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below and are based on a model incorporating the previous data points of the Case-Shiller series and the July Zillow Home Value Index data, and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

Case-Shiller July data confirms what we have been seeing for several months in other data points: The housing market has started its recovery, albeit appreciation is not back to “normal” pre-housing recession levels and most likely won’t be for the next few years. Zillow’s Home Value Index for August was released on Wednesday and shows a small decline in home values across the nation after nine consecutive months of appreciation. We expect Case-Shiller indices to moderate and likely report monthly declines toward the end of the year tracking the Zillow Home Value Index. Monthly depreciation toward the end of the year is largely a function of declining overall monthly sales volume which will increase the percentage of foreclosure re-sales in the transactional mix being tracked by Case-Shiller.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | July 2011 | 156.33 | 154.12 | 142.89 | 141.12 |

| Case-Shiller (last month) | June 2012 | 155.02 | 154.38 | 142.21 | 141.31 |

| Zillow June Forecast | YoY | 1.1% | 1.1% | 1.6% | 1.6% |

| MoM | 1.9% | 1.0% | 2.1% | 1.0% | |

| Zillow Forecasts1 | 158.0 | 155.9 | 145.2 | 143.1 | |

| Current Post Bubble Low | 146.52 | 149.19 | 134.10 | 136.45 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 7.8% | 4.5% | 8.3% | 4.8% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

State Unemployment Rates increased in 26 States in August

by Calculated Risk on 9/21/2012 10:49:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in August. Twenty-six states recorded unemployment rate increases, 12 states and the District of Columbia posted rate decreases, and 12 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 12.1 percent in August. Rhode Island and California posted the next highest rates, 10.7 and 10.6 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Two states - New Jersey and New York - are at the maximum unemployment rate for the recession, and New Jersey set a new cycle high in August at 9.9%.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009, although New Jersey is close. In early 2010, 18 states and D.C. had double digit unemployment rates.

Over There: Greek and Spanish Aid

by Calculated Risk on 9/21/2012 08:46:00 AM

A plan for Spain will probably be announced next Thursday, and Greece will need additional aid by November.

From the Financial Times: EU in talks over Spanish rescue plan

EU authorities are working behind the scenes to pave the way for a new Spanish rescue programme and unlimited bond buying by the European Central Bank, by helping Madrid craft an economic reform programme ...From the WSJ: Fight Looms on Greek Bailout

...

The plan, due to be unveiled next Thursday, will focus on structural reforms to the Spanish economy long requested by Brussels, rather than new taxes and spending cuts.

Excerpt with permission.

A report by international inspectors, due in October, will state how big the funding shortfall is in Greece's bailout program, but European officials say the deficit is far too big for Greece to close on its own.

That means the International Monetary Fund, the European Central Bank, and euro-zone governments such as Germany will have to negotiate over which of them will make painful concessions to ease Greece's debt-service burden.

...

The trio must agree to a plan by November at the latest, when the government in Athens—already in financial arrears—could run out of money altogether.

...

The €173 billion ($226 billion) bailout plan agreed with Athens in March this year—Greece's second bailout since 2010—is already badly off track, euro-zone officials admit.

Thursday, September 20, 2012

Friday: State Employment Report

by Calculated Risk on 9/20/2012 09:01:00 PM

First, from Freddie Mac: Mortgage Rates Back To Record Lows

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates at or near their all-time record lows helping to keep homebuyer affordability high. The average 30-year fixed rate mortgage matched its all-time record low at 3.49 percent, and the average 15-year fixed fell to a new all-time record low at 2.77 percent.And from David Wessel at the WSJ: Depression Lessons: Should Fed Stand Down to Compel Congressional Action?

As [economist James] Tobin put it in the American Economic Review in June 1965: “The monetary authorities should have tried harder to promote expansion in 1933-36 and 1937-40 — nothing would have been lost and something might have been gained. Throughout the period the authorities were too little concerned with deflationary risks immediately at hand and too much concerned to forestall the hypothetical future dangers of excess liquidity.”Friday:

... Friedman and co-author Anna Schwartz quote at length from a December 1935 technical memo from Fed files that made the case for tightening the credit spigot. ... The subsequent tightening by the Fed was, Friedman and Schwartz concluded, a mistake followed by “a failure to recognize that the action had misfired.”

• At 10:00 AM ET, the BLS will release the Regional and State Employment and Unemployment (Monthly) report for August 2012.

Earlier: The Trillion Dollar Bear

Lawler: ACS 2011: Big Shift to Rental Market

by Calculated Risk on 9/20/2012 05:49:00 PM

CR Note: This is a fairly long technical piece. These are just excerpts. The complete article is here.

From housing economist Tom Lawler: ACS 2011: Big Shift to Rental Market; Gross Vacancy Rate Virtually Unchanged Despite Drop in Vacant Homes for Rent and For Sale; Household “Estimate” Shockingly Low

The Census Bureau released it ACS 2011 one-year estimates, and for housing folks the data were in some cases interesting and in other cases quite puzzling. ...

A few things jump out: first, the ACS estimate for occupied housing units increased by just 424,306 in 2011, and at 114.992 million was 1.724 million lower than the “official” Census household count on April 1, 2010. Second, the ACS’ estimate of the gross vacancy rate in 2011 was virtually unchanged from 2010, despite a decline in the number of homes for rent or for sale. The reason was an increase in both housing units for seasonal/recreational/occasional use (up 181,000) and an increase in “other” – homes vacant and held of the market for unknown reasons (in the above I included “usual residence elsewhere” and migrant workers” in “other” to be consistent with the other measures.)

Third, the ACS homeownership rate fell from 65.4% in 2010 to 64.6% in 2011, which is a full 1.5 percentage points lower than the HVS.

In terms of the jump in the ACS’ estimate of the number of renters in 2011 vs. 2010, almost half of the 1.033 million increase reflected a jump in the number of householders renting SF detached homes. The ACS estimate of the percent of the occupied SF detached home market that was occupied by renters for 2011 was 15.7%, up from 15.1% in 2010 and 13.1% in 2006. The renter-share of the occupied SF detached housing market increased by over three percentage points from 2006 to 2011 in eleven states plus DC, with the biggest increases coming in Nevada, Arizona, Oregon, and California. (The full list is Arizona, California, Colorado, DC, Florida, Georgia, Michigan, Nevada, Ohio, Oregon, Utah, and Washington.)

...

what is a reasonable assumption to make about the increase in US households in 2011, much less so far in 2012? HVS and ACS data suggest very slow growth in 2011, but neither has been consistent with decennial Census results, and HVS data suggest only a modest pickup in 2012. CPS/ASEC data, in contrast, suggest much faster growth in households since early 2010, but CPS/ASEC data are not consistent with decennial Census data either!

Gosh, it’s no wonder there’s so much confusion on the US housing outlook!

CR Note: This was an excerpt from an article by Tom Lawler.

The Trillion Dollar Bear

by Calculated Risk on 9/20/2012 03:10:00 PM

Memories ... some new readers might not realize that once upon a time I was one of the most bearish analysts around.

The Flow of Funds report today showed that household mortgage debt has declined by more than $1 trillion following the housing bust (see previous post). Most of that decline is due to defaults (as opposed to homeowners paying down debt). And that reminds me of a post I wrote almost 5 years ago.

From the WSJ in December 2007: How High Will Subprime Losses Go?

The global race is on to find the best phrase to describe the housing and credit mess. The U.K.’s Telegraph quotes an economist who says it “could make 1929 look like a walk in the park” if central banks don’t solve the crisis in a matter of weeks.Many people thought I was crazy.

The report cites the recent prediction from Barclays Capital that losses from the subprime-mortgage meltdown could hit $700 billion. That would top Merrill Lynch’s recent estimate of $500 billion. The Australian newspaper notes that a $700 billion “bloodbath” — potentially leading the U.S. economy into “the blackest year since the Great Depression” — would top the GDPs of all but 15 nations.

Back in the U.S., the Calculated Risk blog sidestepped the colorful language and went straight for the big number: “The losses for the lenders and investors might well be over $1 trillion.”

And if you look at the post the WSJ referenced, the first paragraph starts: "Within the next couple of years, probably somewhere between 10 million and 20 million U.S. homeowners will owe more on their homes, than their homes are worth."

I was a grizzly bear!