by Calculated Risk on 9/03/2012 09:31:00 PM

Monday, September 03, 2012

Tuesday: ISM Mfg Index, Auto Sales, Construction Spending

Happy Labor Day!

On Tuesday:

• At 10:00 AM ET, the ISM Manufacturing Index for August is scheduled for release. The consensus is for an increase to 50.0, up from 49.8 in July. (below 50 is contraction).

• Also at 10:00 AM, Construction Spending for July will be released. The consensus is for a 0.4% increase in construction spending.

• All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 14.3 million SAAR in August from 14.1 million in July. The SAAR estimate is usually available around 4 PM ET.

The Asian markets are mostly green tonight, with the Nikkei up slightly and the Shanghai Composite up 0.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are up 1, and the DOW futures up 16 points.

Oil prices are still moving up with WTI futures are at $97.22 and Brent is at $116.09 per barrel. Using the calculator at Econbrowser suggests national gasoline prices at about $3.74 per gallon.

Weekend:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Here are the first week questions for the September contest. You can now enter with Facebook, Twitter, or OpenID logins:

WSJ: ECB's Draghi hints at Short Term Bond Buying

by Calculated Risk on 9/03/2012 06:08:00 PM

From the WSJ: ECB Chief Hints at Bond Purchases

The president of the European Central Bank dropped more hints about how the bank could support struggling countries, suggesting the bank was free to buy government bonds maturing in three years or less.Paul Murphy at Alphaville has the market reaction: A Draghi leak ...

The comments by Mario Draghi in a closed hearing at the European Parliament on Monday came ahead of the ECB's monthly policy meeting Thursday.

...

Mr. Draghi indicated Monday that the ECB would be open to buying bonds with a maturity of two to three years, stressing that such purchases wouldn't break European Union treaties, according to several lawmakers present at the hearing.

It will an interesting week!

ECB Meeting on Thursday: Expectations are for a Rate Cut, no Bond buying yet

by Calculated Risk on 9/03/2012 11:55:00 AM

From CNBC: Europe Shares Close Higher on Asset Purchase Hopes

Traders are hoping the ECB will cut rates and detail a new bond-buying plan to ease the funding pressures on Spain and Italy. All eyes will be on the European Central Bank on Thursday as investors await news on its next policy move.The ECB Governing Council meets on Thursday in Frankfurt with a press conference to follow. Analysts at Nomura are expecting a rate cut, but no bond buying yet for Spain and Italy. From Nomura:

• Having failed to cut in August, we now expect the ECB to cut the refi rate 25bp in September and leave the deposit rate at zero.And from Jack Ewing at the NY Times: In Pivotal Week for Euro Zone, a Test for the Central Bank’s Leader

• We also expect the ECB to announce on 6 September that it is ready to intervene but only when help has been requested.

• We expect Spain and Italy to resist calling for help, prompting renewed market deterioration.

[T]his Thursday, when the central bank meets again, Mr. Draghi, the bank’s president, could have a far harder time reconciling the expectations of twitchy financial markets with the limitations of his power. Although investors are counting on bold action, analysts say the bank probably needs more time to resolve internal differences and deliver on a promise to use its financial clout to tame runaway borrowing costs for the most troubled euro zone countries.

...

Some analysts do expect the central bank to cut the benchmark interest rate to 0.5 percent on Thursday, from its already record low level of 0.75 percent.

...

In any case, actual bond buying by the central bank is probably at least several weeks away. Mr. Draghi said in August that the bank would intervene in bond markets only in concert with the new European Union rescue fund, the European Stability Mechanism, or E.S.M.

Countries would need to ask the rescue fund for help, Mr. Draghi said, and the fund would take the lead in bond buying, with the central bank providing backup financial support. But the fund, meant to replace a temporary bailout fund, is in legal limbo at least until the German constitutional court rules Sept. 12 on a challenge to the country’s participation.

Winners: August Economic Prediction Contest

by Calculated Risk on 9/03/2012 09:20:00 AM

For the economic question contest in August, the leaders were (Congratulations all!):

1st: Richard Plaster

2nd tie: Bill Dawers, Lance Leger, Jeffrey McNamee, Jeremy Strouse, Bill (CR)

Weekend:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Here are the first week questions for the September contest. You can now enter with Facebook, Twitter, or OpenID logins:

Sunday, September 02, 2012

GDP and Employment drag from State and Local Governments

by Calculated Risk on 9/02/2012 05:55:00 PM

Two of the key U.S. economic trends I expected this year were 1) a recovery in residential investment, and 2) that most of the drag from state and local governments would be over by mid-year 2012. Just eliminating the drag from state and local governments would help GDP and employment growth.

I've written extensively about the housing recovery, and it is time to take another look at state and local government spending. In early August, the Rockefeller Institute of Government put out a report on state and local government revenue through Q1. From the press release:

Overall state tax revenues are now above pre-recession levels, as well as above peak levels that came several months into the Great Recession. In the first quarter of 2012, total state tax revenues were 4.8 percent higher than during the same quarter of 2008.That is a little encouraging, but the news isn't as positive for local governments:

Starting at the end of 2008 and extending through 2009, states suffered five straight quarters of decline in tax revenues. They now have enjoyed nine consecutive periods of growth, and the second quarter of 2012 will likely extend the string to 10. Overall collections in 45 early-reporting states showed growth of 5.8 percent in the months of April and May of 2012 compared to the same months of 2011.

After adjusting for inflation, however, state tax revenues are still 1.6 percent lower compared to the same quarter four years ago, in 2008.

While state tax revenues have been recovering, many localities face significant fiscal challenges, according to the report’s author, Senior Policy Analyst Lucy Dadayan.The problem is local governments are mostly funded by property taxes, and property taxes react slowly to falling house prices - and property taxes are still declining. From the report:

“The Great Recession led to a growing divergence between state and local government tax performance,” Dadayan said. “State tax revenues collapsed steeply from 2008 to 2010 while local tax revenues continued to grow. Such trends have reversed since 2010, and state tax revenues started trending upward while local tax revenues have been mostly heading downward. Fiscal pressures are continuously mounting for local governments, and depressed housing prices are now causing declines in local property taxes.”

Collections from local property taxes made up 81.6 percent of such receipts during the first quarter of 2012. Local property tax revenues showed a decline of 0.9 percent in nominal terms in the first quarter of 2012 compared to the same quarter of 2011. Moreover, local property taxes were 4.6 and 1.3 percent lower than during the same quarters of 2009 and 2010, respectively.This suggests some further local cutbacks, although I still expect the drag to be less than the last few years.

Here is a graph showing the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 5 quarters (through Q2 2012).

However the drag from state and local governments is ongoing. State and local governments have been a drag on GDP for eleven consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented.

In real terms, state and local government spending is now back to Q4 2001 levels, even with a larger population.

The next graph is for state and local government employment. So far in 2012 - through July - state and local governments have lost 42,000 jobs (7,000 jobs were lost in July). In the first seven months of 2011, state and local governments lost 205,000 payroll jobs - and 230,000 for the year. So the layoffs have slowed.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Note: Of course the Federal government is still losing workers (38,000 over the last 12 months and another 2,000 in July), but it looks like state and local government employment losses might be slowing - but the job losses haven't stopped yet - and with property tax revenue still falling, more local jobs will probably be lost.

Yesterday:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Hotel Occupancy Rate above pre-recession levels

by Calculated Risk on 9/02/2012 12:03:00 PM

From HotelNewsNow.com: STR: US results for week ending 25 August

In year-over-year comparisons, occupancy ended the week with a 4.9-percent increase to 65.7 percent, average daily rate was up 5.3 percent to US$105.43 and revenue per available room ended the week with an increase of 10.5 percent to US$69.30.The 4-week average is above the pre-recession levels (the occupancy rate for the same week in 2007 was 64.2 percent).

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

The occupancy rate will decline over the next month as the summer travel season ends. The next key period is for fall business travel.

The recovery in the occupancy rate has helped hotel profitability, from HotelNewsNow.com: Hotel profitability bouncing back

The U.S. hotel industry achieved a net income of approximately $33 billion, or 21.4% of total revenues, during 2011—a healthy increase of 15.7% over 2010 levels, according to STR through its Hotel Operating Statistics, or HOST, program. STR is the parent company of HotelNewsNow.com.Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Yesterday:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Restaurant Performance Index declines in July

by Calculated Risk on 9/02/2012 09:06:00 AM

From the National Restaurant Association: Uncertainty Over Future Business Conditions Dampens Restaurant Performance Index

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.2 in July, down 1.1 percent from June and the lowest mark since a reading of 100.0 in October. However, July still represented the ninth consecutive month that the RPI stood above 100, which signifies continued expansion in the index of key industry indicators.

“Although restaurant operators reported positive same-store sales for the 14th consecutive month in July, their economic outlook for the months ahead continued to soften,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Only 22 percent of restaurant operators expect economic conditions to improve in the next six months, the lowest level in 10 months.”

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.2 in July, down from 101.4 in June (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Yesterday:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Saturday, September 01, 2012

WSJ interview with Fed's Lockhart: Next Fed action could be a "package" of easing

by Calculated Risk on 9/01/2012 06:36:00 PM

Here is a brief interview of Atlanta Fed President Dennis Lockhart in the WSJ: Fed Official Says More Stimulus a 'Close Call'

"It's a close call" when it comes answering the question of whether the Fed should provide more aid to the economy, Federal Reserve Bank of Atlanta President Dennis Lockhart said.CR Note: If Lockhart is waiting for additional fiscal stimulus, it will be a long long wait. And the "fiscal cliff" will not be addressed until after the election.

...

"I'm increasingly of the view that we are on a track that you would, to simplify it, would say is about a 2% growth track with fluctuating job growth. But overall, not a strong enough pace to bring down unemployment to anything close to a notion of full employment in a reasonable time," Mr. Lockhart said.

"That's a very tough question. I am not highly confident in the ability of simply monetary action to jump-shift the economy onto a different track," ... "There really is a lot to be solved on the fiscal side to create the conditions, arguably, in which further monetary action could really boost the economy,"

...

If the Fed were to act, Mr. Lockhart said half-measures would not get the job done. While he didn't state what the steps could be, he said stimulus, if chosen, should be "a package. When I say package that means two or three things done at the same time to create maximum possible gains."

I think his most interesting comment is at the end about additional accommodation as "a package". That suggests that both extending the extended period until 2015 and another round of asset purchases might happen at the same time (perhaps conditional on the economy).

Earlier:

• Summary for Week Ending Aug 31st

• Schedule for Week of Sept 2nd

Schedule for Week of Sept 2nd

by Calculated Risk on 9/01/2012 12:57:00 PM

Earlier:

• Summary for Week Ending Aug 31st

The key report for this week will be the August employment report to be released on Friday, Sept 7th. Other key reports include the ISM manufacturing index on Tuesday, vehicle sales also on Tuesday, and the ISM non-manufacturing (service) index on Thursday.

On Thursday, September 6th, there is a Governing Council meeting of the European Central Bank in Frankfurt with a press conference to follow. ECB President Mario Draghi is expected to discuss how the ECB will help lower Spanish and Italian borrowing costs.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 14.3 million SAAR in August from 14.1 million in July (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the July sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the July sales rate. TrueCar is forecasting:

The August 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.2 million new car sales, up from 12.1 million in August 2011 and up from 14.1 million in July 2012.Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,287,603 new cars will be sold in August for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.5 million light vehicles.

10:00 AM ET: ISM Manufacturing Index for August.

10:00 AM ET: ISM Manufacturing Index for August. Here is a long term graph of the ISM manufacturing index. The ISM index has shown contraction for two consecutive months; the first contraction in the ISM index since the recession ended in 2009. The consensus is for an increase to 50.0, up from 49.8 in July. (below 50 is contraction).

10:00 AM: Construction Spending for July. The consensus is for a 0.4% increase in construction spending.

8:30 AM: Productivity and Costs for Q2. The consensus is for a 1.4% increase in unit labor costs.

10:00 AM: Trulia Price Rent Monitors for August. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 370 thousand from 374 thousand.

10:00 AM: ISM non-Manufacturing Index for August. The consensus is for an increase to 53.0 from 52.6 in July. Note: Above 50 indicates expansion, below 50 contraction.

During the day: Governing Council meeting of the European Central Bank with a press conference to follow.

8:30 AM: Employment Report for August. The consensus is for an increase of 125,000 non-farm payroll jobs in August, down from the 163,000 jobs added in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 125,000 non-farm payroll jobs in August, down from the 163,000 jobs added in July.The consensus is for the unemployment rate to be unchanged at 8.3%.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through June.

The economy has added 4.54 million private sector jobs since employment bottomed in February 2010 (4.00 million total jobs added with all the public sector layoffs).

The economy has added 4.54 million private sector jobs since employment bottomed in February 2010 (4.00 million total jobs added with all the public sector layoffs).There are still 4.3 million fewer private sector jobs now than when the recession started in 2007. (4.8 million fewer total nonfarm jobs).

Summary for Week Ending August 31st

by Calculated Risk on 9/01/2012 08:03:00 AM

The key event of the week was Fed Chairman Ben Bernanke’s speech on Friday at the Jackson Hole Economic Symposium. Here was my take on the speech: Analysis: Bernanke Clears the way for QE3 in September and a couple more views: Two more reviews of Bernanke's Speech: Weak Labor Market "a grave concern"

The economic data was still weak, but a little better than expected - since expectations are so low. Q2 GDP was revised up to a still weak 1.7% from 1.5% and personal income and spending increased in July. An important positive was that the Case-Shiller house price index turned positive on a year-over-year basis suggesting house prices might have bottomed earlier this year.

On the other hand, the manufacturing surveys were once again disappointing.

Even the “better” news was pretty weak – definitely not “substantial and sustainable strengthening in the pace of the economic recovery”. Next week the focus will be on the August employment report and the European ECB meeting.

Here is a summary of last week in graphs:

• Case-Shiller: House Prices increased 0.5% year-over-year in June

Click on graph for larger image.

Click on graph for larger image.

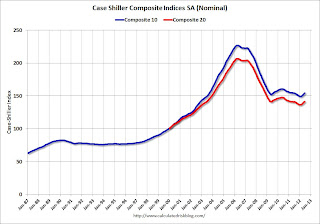

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.0% from the peak, and up 1.0% in June (SA). The Composite 10 is up 3.5% from the post bubble low set in March (SA).

The Composite 20 index is off 31.6% from the peak, and up 0.9% (SA) in June. The Composite 20 is up 3.6% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is up 0.1% compared to June 2011.

The Composite 20 SA is up 0.5% compared to June 2011. This was the first year-over-year since 2010 (when the tax credit boosted prices temporarily).

• Real House Prices, Price-to-Rent Ratio

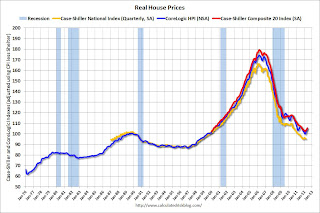

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

This graph shows the quarterly Case-Shiller National Index SA (through Q2 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q4 2010), and the Case-Shiller Composite 20 Index (SA) is back to July 2003 levels, and the CoreLogic index (NSA) is back to November 2003.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to June 2000, and the CoreLogic index back to October 2000.

As we've discussed before, in real terms, all of the appreciation early in the last decade is still gone.

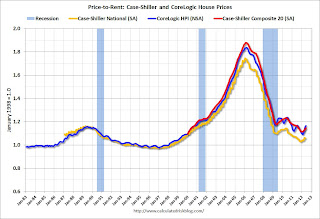

Here is a graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes compared to owners equivalent rent.

Here is a graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes compared to owners equivalent rent.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to August 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• Personal Income increased 0.3% in July, Spending increased 0.4%

This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. "Personal income increased $42.3 billion, or 0.3 percent ... Personal consumption expenditures (PCE) increased $46.0 billion, or 0.4 percent. ... Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in July, in contrast to a decrease of 0.1 percent in June."

A key point is the PCE price index has only increased 1.3% over the last year, and core PCE is up only 1.6%. The PCE price index - and core PCE - hardly increased in July.

• Weekly Initial Unemployment Claims at 374,000

"In the week ending August 25, the advance figure for seasonally adjusted initial claims was 374,000, unchanged from the previous week's revised figure of 374,000. The 4-week moving average was 370,250, an increase of 1,500 from the previous week's revised average of 368,750"

"In the week ending August 25, the advance figure for seasonally adjusted initial claims was 374,000, unchanged from the previous week's revised figure of 374,000. The 4-week moving average was 370,250, an increase of 1,500 from the previous week's revised average of 368,750"The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 370,250.

This was above the consensus forecast of 370,000.

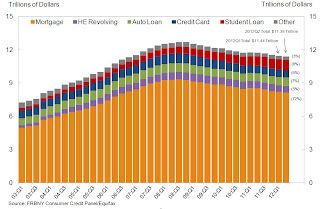

• Fed: Consumer Deleveraging Continued in Q2

From the NY Fed: Overall Delinquency Rates Down as Americans Paying More Debt on Time

From the NY Fed: Overall Delinquency Rates Down as Americans Paying More Debt on Time This graph shows aggregate consumer debt decreased in Q2. This was mostly due to a decline in mortgage debt.

However student debt is still increasing.

This graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

This graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed: "Overall delinquencies improved in 2012Q2. As of June 30, 9.0% of outstanding debt was in some stage of delinquency, compared with 9.3% at the end of 2012Q1. About $1.02 trillion of debt is delinquent, with $765 billion seriously delinquent (at least 90 days late or “severely derogatory”)."

• Other Economic Stories ...

• NAR: Pending home sales index increased 2.4% in July

• Fed's Beige Book: Economic activity increased "gradually", Residential real estate shows "signs of improvement"

• Chicago PMI declines to 53.0

• Fannie Mae and Freddie Mac Serious Delinquency rates declined in July

• LPS: Mortgage delinquencies decreased in July