by Calculated Risk on 9/05/2012 02:31:00 PM

Wednesday, September 05, 2012

Lawler: Single Family Rental Market: Surging, But by How Much?

CR Note: Housing economist Tom Lawler estimates that there are about 2.1 million more single family home rented now than in 2006. This is a key reason for the decline in inventory.

From housing economist Tom Lawler:

Recently there have been a sizable number of media stories on the SF rental market, with the focus on its tremendous growth over the past few years. One reason for the jump in the number of articles is related to the significant increase in the number of entities who have entered this space. It seems almost as if everyone and their mother has either entered the SF rental market or is looking to enter it. Another is that investor demand for SF properties has been very strong while the supply of homes for sale, especially the supply of foreclosed homes, is down significantly, and as a result prices of “distressed” (and other) homes have increased significantly faster than many had expected. And finally, of course, there are stories that a “REO-to-Rental” securitization deal is in the works (if it comes it’ll probably be unrated, as (1) rating agencies don’t really have sufficient data to assign a rating; and (2) unlike in the past, currently rating agencies care about such things!)

Stories of the surge in the SF rental market are not, by the way, limited to California, Arizona, Nevada, or Florida, but are reasonably widespread across the country.

Of course, the explosion in the size of the SF rental market is not new: it was evident several years back. But the growing number of “new” players, combined with the sharply lower inventory of homes for sale and recent rebound in home prices, has made this an increasingly important “story” for the housing market.

It is, unfortunately, not easy to get a good handle on just how rapidly the SF rental market has grown, given the lack of good, timely information on the US housing market. Data from the American Community Survey, e.g., are only available for 2010, and there are some “issues” with that data (as evidenced by the ACS/decennial Census differences currently being explored by Census analysts). There are even bigger issues with data from the Housing Vacancy Survey, which deviated incredibly from the decennial Census (and ACS) on a wide range of “metrics,” and whose estimates appear to systematically understate the number of renter-occupied households. Moreover, the HVS does not explicitly release estimates of the number (or %) of owner vs. renter occupied homes by units in structure.

The HVS does, however, release estimates of (1) the rental and homeowner vacancy rates by units in structure; (2) the % of vacant homes that are 1-unit structures; and (3) the number of total homes for rent and for sale. While unfortunately a consistent time series of these estimates doesn’t go back very far, and unfortunately the HVS relies on the American Housing Survey for estimates of the characteristics of housing units (the AHS doesn’t come close to matching the ACS), the data may have some useful information on trends in the SF rental market.

Unfortunately (gosh, I use that adverb often when describing available US housing data), the HVS’ definition of “1-unit” structures includes not just SF detached and attached homes, but also mobile homes or trailers, tents, and boats.

With that in mind, here are some data on the share of occupied “SF” homes that were occupied by renters from (1) the American Community Survey, and (2) derived shares using the aforementioned tables from the Housing Vacancy Survey. The latter are for the second quarter of each year, as the tables released are quarterly, and it’s a pain to derive yearly average data. The ACS data are based on the one-year estimates. Also shown are comparable “SF” shares from Census 2000.

| Renter Share of Occupied "SF" Homes | ||||

|---|---|---|---|---|

| American Community Survey* | Housing Vacancy Survey** | |||

| SFD | SFD+SFA | SFD+SFA+ MH+Other | SFD+SFA+ MH+Other | |

| Census 2000 | 13.2% | 15.0% | 15.6% | |

| 2006 | 13.1% | 14.8% | 15.7% | 14.5% |

| 2007 | 13.4% | 15.0% | 15.9% | 14.7% |

| 2008 | 14.0% | 15.7% | 16.5% | 15.1% |

| 2009 | 14.8% | 16.5% | 17.3% | 15.4% |

| 2010 | 15.1% | 16.8% | 17.6% | 16.3% |

| 2011 | 18.0% | 16.7% | ||

| 2012 | 18.3% | 17.0% | ||

| SFD - Single family Detached SFA - Single family Attached MH - Manufactured Housing Other - Boats,RVs, Vans, Tents, Etc. * Yearly Average ** Q2 Average | ||||

As the table indicates, both surveys suggest that the renter share of the SF market has increased significantly since the beginning of the housing bust. Given the systematic tendency for the HVS to understate the renter share of the overall housing market (as well as the number of renter-occupied homes), it is not surprising that the HVS estimates (again, derived from table not in the press release) of the renter share of occupied “one-unit” homes is below that of the ACS, though the differential between the two hasn’t changed radically over time.

On September 20th Census plans to release the 2011 ACS results, and the above data strongly suggest that the rental share of the SF market increased from 2010 – and the 2012 ACS data will almost certainly show a gain form 2011. A “reasonable” best guess, based on the admittedly “iffy” HVS data, would be that the 2012 ACS data will show that the renter share of occupied SF detached homes this year will be about 15.7%.

Assuming ACS data were correct, such a share increase would imply that the number of renter-occupied SF detached homes in the US this year is about 11.4 million, almost 2.1 million (or 22%) higher than in 2006, with most of that increase coming after 2007. Not coincidentally, foreclosures ramped up sharply in the latter part of 2007, and REO sales increased significantly in 2008 and remained high through last year.

Renter Share of Occupied SF Detached Homes (ACS-based)

Click on graph for larger image.

Click on graph for larger image.These data are broadly consistent both with anecdotal evidence and by statements from some of the “larger” players in the SF investor space that a fairly large % of investors buying “distressed” SF properties have purchased the home with the intent to rent the home for “several” years – partly because in many parts of the country distressed home prices were low relative to realizable rents (in other words, the “rental yield” was good), and partly because investors expected home prices several years down the road would be higher than current prices.

The surge in the number of properties purchased with the intent to rent (at least for a while) has also almost certainly contributed to the sharp decline in the number of homes listed for sale.

Bloomberg: Merkel Said to Tell Lawmakers She Supports Draghi and Weidmann

by Calculated Risk on 9/05/2012 11:46:00 AM

Thursday is Draghi day (ECB meeting) and the following might seem like a contradiction ...

From Bloomberg: Merkel Said to Tell Lawmakers She Backs Draghi and Weidmann

Chancellor Angela Merkel told lawmakers in Berlin today that she supports both European Central Bank chief Mario Draghi and Bundesbank President Jens Weidmann ... both Draghi and Weidmann are carrying out their respective mandates ... she therefore sees no contradition in supporting them both ...From the Financial Times: Mood improves on hopes for ECB action

The ECB is expected to outline how it may help reduce the borrowing costs of heavily indebted countries in the eurozone – leaks from the ECB reported by news agencies on Wednesday seem to confirm the plan is afoot ...More from Bloomberg: ECB Plan Said to Pledge Unlimited, Sterilized Bond-Buying

Excerpt with permission

Under the blueprint, which may be called “Monetary Outright Transactions,” the ECB would refrain from setting a public cap on yields ... The plan will only focus on government bonds rather than a broader range of assets and will target short-dated maturities of up to about three years, two of the people said.The history of the European crisis has been for policymakers to over promise and under deliver, but the consensus is Draghi will announce some buying of short term bonds.

Trulia: Asking House Prices increased in August, Rent increases slow

by Calculated Risk on 9/05/2012 10:00:00 AM

Press Release: Trulia Reports Asking Home Prices up 2.3 Percent, Biggest Year Over Year Increase Since Recession

Trulia today released the latest findings from the Trulia Price Monitor and the Trulia Rent Monitor, the earliest leading indicators available of trends in home prices and rents. Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through August 31, 2012.These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a SA basis.

Asking prices on for-sale homes–which lead sales prices by approximately two or more months – increased 2.3 percent in August year over year (Y-o-Y) and rose in 68 of the 100 largest metros. Excluding foreclosures, prices rose 3.8 percent Y-o-Y. These are the largest Y-o-Y gains since the recession. Meanwhile, asking prices rose nationally 1.8 percent quarter over quarter (Q-o-Q), seasonally adjusted. Month-over-month (M-o-M) asking prices rose by 0.8 percent, the seventh consecutive month of increases.

...

Nationally, rents rose 4.7 percent Y-o-Y in August, compared to 5.8 percent Y-o-Y in May – making it the slowest rise since March. At the regional level, rents jumped more than 10 percent Y-o-Y in Houston and Seattle, but slowed in Denver, San Francisco, Miami, Oakland and Boston.

...

“Asking prices rose 2.3 percent year over year in August, hitting two housing recovery milestones,” said Jed Kolko, Trulia’s Chief Economist. “First, asking prices rose faster than at any time since the recession. Second, asking prices excluding foreclosures are now rising faster than wages, putting an end to many years of affordability gains. In addition, price gains are catching up with slowing rent increases, which will tip some renters in favor of staying put in their rentals rather than buying a home.”

More from Jed Kolko, Trulia Chief Economist: Asking Prices Rise 2.3% Year Over Year: Biggest Increase Since Recession

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/05/2012 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week to the lowest level since May 2012. The seasonally adjusted Purchase Index decreased 0.8 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.78 percent from 3.80 percent, with points decreasing to 0.37 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years.

Tuesday, September 04, 2012

Wednesday Preview

by Calculated Risk on 9/04/2012 08:06:00 PM

I've been puzzling over the MBA purchase index (to be released tomorrow). This index has mostly been moving sideways and hasn't indicated any pickup in home purchases. However there are other indicators (the Fed's recent Senior Loan Officer survey) that suggest there has been an increase in purchase activity.

It is probably worth asking if the data is being impacted by changes in behavior or in the sample. I don't know the answer, but the MBA index has been impacted by changes before.

First here is an excerpt from a Reuters article in October 2006: Greenspan: Housing market worst may be over

The U.S. housing market appears to be emerging from its recent travails and the “worst may well be over,” former Federal Reserve Chairman Alan Greenspan was quoted as saying on Friday.Of course Greenspan was wrong (as I noted at the time). Here was what I previously wrote: "In mid-2006, the MBA index did flatten out, and in late 2006 the index increased (and increased further in 2007). At that time I spoke with some mortgage brokers, and there was clear evidence of homebuyers applying for mortgages with multiple brokers - this lead to some double counting by the MBA. And in late 2006 the increase was because mortgage brokers started going out of business (this skewed the data, because the MBA samples only certain large brokers – and the large brokers were getting more applications as the weaker companies went under). I identified these flaws and stopped using the MBA index, but Greenspan blindly used the index and drew the wrong conclusion."

“I suspect that we are coming to the end of this downtrend, as applications for new mortgages, the most important series, have flattened out,” Greenspan said at an event in Calgary, Canada ...

Now I'm wondering if the index is being impacted by another change in the mix. Here was an interesting article today from Jon Prior at HousingWire: Credit union mortgage lending doubles in California

California credit unions took advantage of the Home Affordable Refinance Program and originated twice as many home loans in second quarter than the previous three months.Prior's article is focused on refinancing (the MBA Purchase index is for purchases, not refinance activity). But I wonder if some lenders who are not surveyed by the MBA are seeing an increase in activity? It is a puzzle ...

...

Chris Collver, senior regulatory analyst for CANV, said the trend will continue as large firms grow more conservative or exit the more exotic mortgage business entirely.

Credit unions took up about 2% of the space in 2005. That grew to 6.7% of the home credit market in 2011, according to Collver.

On Tuesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, the BLS will released Productivity and Costs for Q2. The consensus is for a 1.4% increase in unit labor costs.

• At 10:00 AM, the Trulia Price and Rent Monitors for August will be released. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

U.S. Light Vehicle Sales at 14.5 million annual rate in August

by Calculated Risk on 9/04/2012 02:55:00 PM

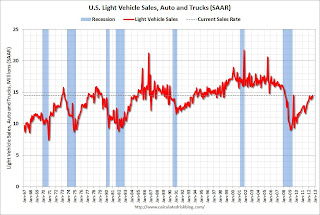

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.52 million SAAR in August. That is up 17% from August 2011, and up 3% from the sales rate last month.

This was above the consensus forecast of 14.3 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for August (red, light vehicle sales of 14.52 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

The year-over-year increase was fairly large because the auto industry was still recovering from the impact of the tsunami and related supply chain issues in 2011 (the issues were mostly over in September of 2011).

Sales have averaged a 14.17 million annual sales rate through the first seven months of 2012, up from 12.4 million rate for the same period of 2011.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

It looks like auto sales will be up slightly in Q3 compared to Q2, and make another small positive contribution to GDP.

Housing: Inventory down 23% year-over-year in early September

by Calculated Risk on 9/04/2012 01:55:00 PM

Note: I'll post an estimate for August auto sales around 4 PM ET.

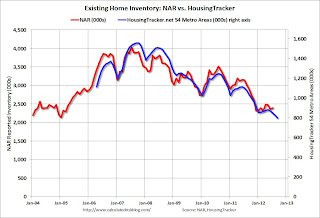

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 22.6% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through July (left axis) and the HousingTracker data for the 54 metro areas through early September.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. Inventory only increased a little this spring and has been declining for the last four months by this measure. It looks like inventory has peaked for this year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early September listings, for the 54 metro areas, declined 22.6% from the same period last year.

HousingTracker reported that the early September listings, for the 54 metro areas, declined 22.6% from the same period last year.

This decline in active inventory remains a huge story, and the lower level of inventory is pushing up house prices.

Construction Spending decreased in July

by Calculated Risk on 9/04/2012 11:40:00 AM

Catching up ... This morning the Census Bureau reported that overall construction spending decreased in July:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during July 2012 was estimated at a seasonally adjusted annual rate of $834.4 billion, 0.9 percent below the revised June estimate of $842.2 billion. The July figure is 9.3 percent above the July 2011 estimate of $763.5 billion.Both private construction spending and public spending declined:

Spending on private construction was at a seasonally adjusted annual rate of $558.7 billion, 1.2 percent below the revised June estimate of $565.6 billion. ... In July, the estimated seasonally adjusted annual rate of public construction spending was $275.7 billion, 0.4 percent below the revised June estimate of $276.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 61% below the peak in early 2006, and up 19% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 30% from the recent low.

Public construction spending is now 15% below the peak in March 2009 and near the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 19%. Non-residential spending is also up year-over-year mostly due to energy spending (power and electric). Public spending is still down year-over-year, although it now appears public construction spending is moving sideways.

The slight decline in residential construction spending in July followed several months of solid gains. The solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit).

ISM Manufacturing index decreases slightly in August to 49.6

by Calculated Risk on 9/04/2012 10:00:00 AM

This is the third consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.6% in August, down slightly from 49.8% in July. The employment index was at 51.6%, down from 52.0%, and the new orders index was at 47.1%, down from 48.0%.

From the Institute for Supply Management: August 2012 Manufacturing ISM Report On Business®

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 49.6 percent, a decrease of 0.2 percentage point from July's reading of 49.8 percent, indicating contraction in the manufacturing sector for the third consecutive month. This is also the lowest reading for the PMI™ since July 2009. The New Orders Index registered 47.1 percent, a decrease of 0.9 percentage point from July, indicating contraction in new orders for the third consecutive month. The Production Index registered 47.2 percent, a decrease of 4.1 percentage points and indicating contraction in production for the first time since May 2009. The Employment Index remained in growth territory at 51.6 percent, but registered its lowest reading since November 2009 when the Employment Index registered 51 percent. The Prices Index increased 14.5 percentage points from its July reading to 54 percent. Comments from the panel generally reflect a slowdown in orders and demand, with continuing concern over the uncertain state of global economies."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.0%. This suggests manufacturing contracted in August for the third consecutive month.

This was another weak report.

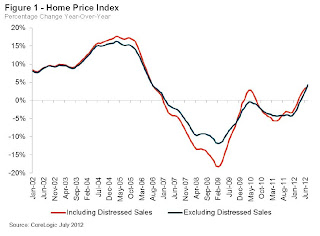

CoreLogic: House Price Index increases in July, Up 3.8% Year-over-year

by Calculated Risk on 9/04/2012 08:54:00 AM

Notes: This CoreLogic House Price Index report is for July. The Case-Shiller index released last week was for June. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® July Home Price Index Rises 3.8 Percent Year-Over-Year—Biggest Increase Since 2006

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 3.8 percent in July 2012 compared to July 2011. This was the biggest year-over-year increase since August 2006. On a month-over-month basis, including distressed sales, home prices increased by 1.3 percent in July 2012 compared to June 2012. The July 2012 figures mark the fifth consecutive increase in home prices nationally on both a year-over-year and month-over-month basis.

Excluding distressed sales, home prices nationwide increased on a year-over-year basis by 4.3 percent in July 2012 compared to July 2011. On a month-over-month basis excluding distressed sales, home prices increased 1.7 percent in July 2012 compared to June 2012, also the fifth consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that August home prices, including distressed sales, will rise by 4.6 percent on a year-over-year basis from August 2011 and at least 0.6 percent on a month-over-month basis from July 2012.

“The housing market continues its positive trajectory with significant price gains in July and our expectation of a further increase in August,” said Mark Fleming, chief economist for CoreLogic. “While the pace of growth is moderating as we transition to the off-season for home buying, we expect a positive gain in price levels for the full year.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.3% in July, and is up 3.8% over the last year.

The index is off 27% from the peak - and is up 9.7% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has been positive for five consecutive months.

The second graph is from CoreLogic. The year-over-year comparison has been positive for five consecutive months.Excluding the tax credit bump, these are the first year-over-year increases since 2006 - and this is the largest year-over-year increase since 2006.