by Calculated Risk on 9/07/2012 02:00:00 PM

Friday, September 07, 2012

LPS: House Price Index increased 0.7% in June

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses June closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic) and the LPS index is seasonally adjusted.

From LPS: U.S. Home Prices Up 0.7 Percent for the Month; Up 0.9 Percent for the Past Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on June 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS index increased 0.7% in June (seasonally adjusted) and is up 4.0% this year, and up 0.9% year-over-year.

The LPS HPI is off 23.5% from the peak in June 2006.

Earlier:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Employment: Another Weak Report (more graphs)

by Calculated Risk on 9/07/2012 10:26:00 AM

The economy has added 1.11 million jobs over the first eight months of the year (1.21 million private sector jobs). At this pace, the economy would add around 1.8 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

Government payrolls declined another 7 thousand in August, bringing government job losses to 93,000 for 2012 through August (61,000 state and local jobs losses so far in 2012, and 32,000 fewer Federal jobs).

Some numbers: There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.7%.

The change in payroll employment for July was revised down from +163,000 to +141,000, and June was revised down from +64,000 to +45,000, for a total revision of minus 41,000 over those two months.

The average workweek was unchanged at 34.4 hours, and average hourly earnings declined slightly. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.4 hours in August. ... In August, average hourly earnings for all employees on private nonfarm payrolls edged down by 1 cent to $23.52. Over the past 12 months, average hourly earnings rose by 1.7 percent." This is sluggish earnings growth.

There are a total of 12.5 million Americans unemployed and 5.0 million have been unemployed for more than 6 months.

This was another weak employment report, especially with the downward revisions and slight decline in hourly earnings. Here are a few more graph ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.6% in August (this was up slightly in August.)

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

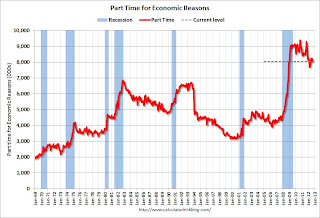

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 8.0 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decrease in August to 8.03 millon from 8.25 million in August.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased in August to 14.7%, down from 15.0% in July.

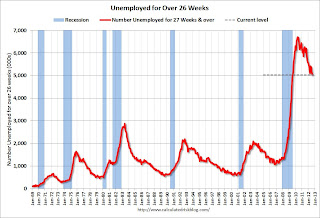

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.03 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.18 million in July. This is generally trending down and is at the lowest level since 2009. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

So far in 2012 - through August - state and local government have lost 61,000 jobs (10,000 jobs were added in August). In the first eight months of 2011, state and local governments lost 168,000 payroll jobs - and 230,000 for the year. So the layoffs have slowed, but they haven't stopped.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is losing workers too (43,000 over the last 12 months, although 3,000 added in August). I think state and local government employment losses might slow further over the next several months.

Overall this was another weak report.

August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

by Calculated Risk on 9/07/2012 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 96,000 in August, and the unemployment rate edged down to 8.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in food services and drinking places, in professional and technical services, and in health care.

...

Both the civilian labor force (154.6 million) and the labor force participation rate (63.5 percent) declined in August. The employment-population ratio, at 58.3 percent, was little changed.

...

The change in total nonfarm payroll employment for June was revised from +64,000 to +45,000, and the change for July was revised from +163,000 to +141,000.

Click on graph for larger image.

Click on graph for larger image.This was another weak month, especially with the downward revisions to the June and July reports.

This was below expectations of 125,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio declined to 58.3% in August (black line). This is a new low for the year, and just above the cycle low.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another weak report. (expected was 125,000). I'll have much more later ...

Thursday, September 06, 2012

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 9/06/2012 08:14:00 PM

At 8:30 AM ET on Friday, the employment report for August will be released. The consensus is for an increase of 125,000 non-farm payroll jobs in August, down from the 163,000 jobs added in July. The consensus is for the unemployment rate to be unchanged at 8.3%.

Some previews:

From Tim Duy at EconomistsView: Fed Watch: Quick Employment Report Preview

From me: Employment Situation Preview

From Nelson Schwartz at the NY Times Economix: Betting on Job Growth

[C]hief United States economist at Morgan Stanley, Vincent Reinhart, raised his prediction for Friday’s government report to 125,000 total nonfarm payroll jobs from an earlier estimate of 100,000.From the WSJ Real Time Economics: Jobs Gain of 200,000 Still Isn’t Enough

TrimTabs Investment Research, usually a Sad Sack when it comes to job estimates, said its calculations of tax-withholding data show August payrolls increased by a hefty 185,000.And two more questions for the September economic contest:

A Draghi Kind of Day

by Calculated Risk on 9/06/2012 04:15:00 PM

First, Tim Duy models a few employment indicators Fed Watch: Quick Employment Report Preview

The model forecasts a nonfarm payroll gain of 198k for August. To be sure, the standard error of 88k is large in terms of payroll forecasts; I wouldn't be surprised by anything between 110k and 290k. That said, the current consensus is 125k with a range of 70k to 177k, which seems low to me.And a few articles on the ECB:

From the NY Times: Central Bank to Snap Up Debt, Saying, ‘Euro Is Irreversible’

Mario Draghi, the E.C.B. president, overcame objections by Germany and won nearly unanimous support from the bank’s board for a program of buying government bonds that would effectively spread responsibility for repaying national debts to the euro zone countries as a group.From the WSJ: ECB Unveils Bond-Buying Program

The E.C.B. will buy bonds on open markets, without setting any limits, of countries that ask for help, which Spain is expected to do. The E.C.B. said it would act only after countries agreed on conditions with the euro zone rescue fund, which will be known as the European Stability Mechanism. The E.S.M. would buy bonds directly from governments, taking responsibility for imposing the conditions, while the E.C.B. would intervene in secondary markets.

The bank and its president, Mr. Draghi, have had the quiet support of all European leaders in taking this latest bold action ... Crucially, support for Mr. Draghi includes Berlin and the German chancellor, Angela Merkel.

From the Financial Times: Draghi outlines bond buying plan

And some in-depth analysis at Alphaville including OMT! and Seniority, the SMP, and the OMT

Here are the full ‘technical features’, which Mario Draghi read out at Thursday’s press conference. Three big things stick out:Much more at Alphaville.

- The ECB will apparently make a ‘legal act’ to confirm that its bond holdings under “Outright Monetary Transactions” are pari passu, not senior. ...

- The ECB will relax collateral requirements ... That’s a big, big move for Spanish banks in particular ...

- Conditionality. A slight chink? The ECB could buy bonds under an EFSF-ESM precautionary credit line for a sovereign, short of a maximal full bailout. Here’s the EFSF’s guidelines on the conditions of precautionary credit lines, for example.

Employment Situation Preview

by Calculated Risk on 9/06/2012 12:42:00 PM

In July, the BLS reported there were 163,000 payroll jobs added. This followed three weak months: 68,000 payroll jobs were added in April, 87,000 in May, and 64,000 in June. Some of the spring weakness might have been "payback" for the mild weather earlier in the year, so it might help to look at the average per month. So far this year, the economy has added 151,000 payroll jobs per month (161,000 private sector per month).

Also, there is a strong possibility that the seasonal factors are a little distorted by the deep recession and financial crisis - this is the third year in a row we've some late spring weakness. In 2010, payrolls picked up in October following a weak period (looking at the data ex-Census), in 2011, payrolls picked up in September. If there is a seasonal distortion, the next four months will probably see some increase too.

Bloomberg is showing the consensus is for an increase of 125,000 payroll jobs in August, and for the unemployment rate to remain unchanged at 8.3%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 201,000 private sector payroll jobs in August. This is the strongest ADP report since March, and this would seem to suggest that the consensus for the increase in total payroll employment is too low. However the ADP report hasn't been very useful in predicting the BLS report for any one month.

• The ISM manufacturing employment index decreased in August to 51.6%, down from 52.0% in July. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased about 12,000 in August.

The ISM non-manufacturing (service) employment index increased in August to 53.8%, up from 49.3% in July. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for services, suggests that private sector BLS reported payroll jobs for services increased about 160,000 in August.

Added together, the ISM reports suggests about 148,000 jobs added in August.

• Initial weekly unemployment claims averaged about 371,000 in August, up from the 366,000 average for July - but below the 382,000 average for April, May and June. This was about the same level as in the January, February and March period when the BLS reported an average of 226,000 payroll jobs added per month.

For the BLS reference week (includes the 12th of the month), initial claims were at 374,000; down from 388,000 during the reference week in July.

• The final July Reuters / University of Michigan consumer sentiment index increased to 74.3, up from the July reading of 72.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This level still suggests a weak labor market.

• The small business index from Intuit showed 30,000 payroll jobs added, down from 45,000 in July.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Rate at 8.1% in August

U.S. unemployment, as measured by Gallup without seasonal adjustment, is 8.1% for the month of August, down slightly from 8.3% measured in mid-August and 8.2% for the month of July. Gallup's seasonally adjusted unemployment rate for August is also 8.1%, a slight uptick from 8.0% at the end of July.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). Note: So far the Gallup numbers haven't been useful in predicting the BLS unemployment rate.

• Conclusion: The overall feeling is that economic activity picked up a little in August, and that would seem to suggest a stronger than consensus employment report. Also it is possible that there have been some seasonal factor distortions.

The ISM manufacturing reports suggest a gain of around 148,000 payroll jobs, and the ADP report (private only), also suggests the consensus is too low. Initial weekly unemployment claims were near the low for the year during August.

A negative is the weak small business numbers from Intuit.

Overall it seems like the August report will be somewhat stronger than expected.

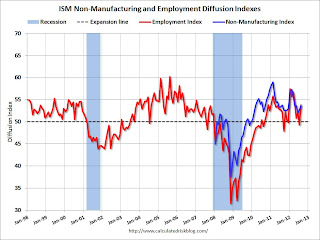

ISM Non-Manufacturing Index increases in August

by Calculated Risk on 9/06/2012 10:00:00 AM

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 32nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 53.7 percent in August, 1.1 percentage points higher than the 52.6 percent registered in July. This indicates continued growth this month at a slighter faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55.6 percent, which is 1.6 percentage points lower than the 57.2 percent reported in July, reflecting growth for the 37th consecutive month. The New Orders Index decreased by 0.6 percentage point to 53.7 percent. The Employment Index increased by 4.5 percentage points to 53.8 percent, indicating growth in employment after one month of contraction. The Prices Index increased 9.4 percentage points to 64.3 percent, indicating substantially higher month-over-month prices when compared to July. According to the NMI™, 10 non-manufacturing industries reported growth in August. Respondents' comments continue to be mixed, and for the most part reflect uncertainty about business conditions and the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in August than in July. The internals were mixed with the employment index up sharply, but new order down slightly.

Weekly Initial Unemployment Claims decline to 365,000

by Calculated Risk on 9/06/2012 08:30:00 AM

The DOL reports:

In the week ending September 1, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 12,000 from the previous week's revised figure of 377,000. The 4-week moving average was 371,250, an increase of 250 from the previous week's revised average of 371,000.The previous week was revised up from 374,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 371,250.

This was below the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

ADP: Private Employment increased 201,000 in August

by Calculated Risk on 9/06/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 201,000 from July to August, on a seasonally adjusted basis. The estimated gain from June to July was revised up from the initial estimate of 163,000 to 173,000.This was above the consensus forecast of an increase of 149,000 private sector jobs in August. The BLS reports on Friday, and the consensus is for an increase of 125,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector expanded 185,000 in August, up from 156,000 in July. Employment in the private, goods-producing sector added 16,000 jobs in August. Manufacturing employment rose 3,000, following an increase of 6,000 in July.

ADP hasn't been very useful in predicting the BLS report, but this suggests a stronger than consensus report.

Wednesday, September 05, 2012

Thursday: Draghi, Unemployment Claims, ADP, ISM Services

by Calculated Risk on 9/05/2012 07:18:00 PM

Usually during the first week of the month, all of the discussion would be about the employment report. This month focus is on the ECB ...

ECB Governing Council meeting times:

• 7:45 AM ET (1.45 PM CET) Monetary Policy Decision. The expectation is rates will be cut 25 bps.

• 8:30 AM ET (2.30 PM CET) ECB President Mario Draghi Press conference. The expectation is Draghi will announce some sort of short term bond buying program.

Note: I'll post the US data in the morning. For updates on the ECB, I recommend Alphaville. Here is the ECB website and press conference page.

From Cardiff Garcia at Alphaville: More questions pre-Draghi

There are some obvious questions going into Draghi’s meeting on Thursday after a few of the early details were reported today — What will be the terms of conditionality? Where on the curve will the buying be concentrated? — and we’ve got a few more.From the WSJ: ECB Said to Ready Measures as Euro Zone Slide Deepens

The euro zone's economic downturn accelerated during the summer, economic reports Wednesday suggest, raising concerns that even aggressive anticrisis measures from the European Central Bank won't be enough to keep the euro bloc from sliding into a deep recession.On Thursday:

...

The reports raise a vexing problem for ECB policy makers. Even if they announce detailed plans to buy government bonds as a means to lower borrowing costs for crisis-hit countries, the measures' effectiveness may be limited by high unemployment, weak consumer confidence and stagnant growth prospects.

"In the next three to six months, there is nothing the ECB can do to prevent a further slowdown from materializing," said Carsten Brzeski, economist at ING Bank.

• At 8:15 AM ET, the ADP Employment Report for August will be released. This report is for private payrolls only (no government). The consensus is for 149,000 payroll jobs added in August, down from the 163,000 reported last month.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 370 thousand from 374 thousand.

• At 10:00 AM, the ISM non-Manufacturing Index (Services) for August will be released. The consensus is for an increase to 53.0 from 52.6 in July.

Another question for the September economic contest: