by Calculated Risk on 8/31/2012 09:27:00 PM

Friday, August 31, 2012

Unofficial Problem Bank list declines to 891 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 31, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The FDIC released its actions for July 2012 as anticipated. This week there were 10 removals and three additions leaving the Unofficial Problem Bank List with 891 institutions with assets of $331.5 billion, down from 898 institutions with assets of $346.7 billion. About two-thirds or $10.0 billion of the $15.2 billion decline in assets came from updating assets with figures from the second quarter. For the month of August 2012, the list declined by a net of nine institutions after 11 additions, 16 actions terminations, three unassisted mergers, and one failure. The singular failure is the lowest monthly total since the list was first published on August 7, 2009. A year ago, the list held 988 institutions with assets of $403.0 billion. This week the FDIC released the Official Problem Bank List for the second quarter that included 732 institutions with assets of $282 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Actions have been terminated against Park View Federal Savings Bank, Solon, OH ($805 million Ticker: PVFC); Cornerstone Community Bank, Chattanooga, TN ($420 million Ticker: CSBQ); PBK Bank, Inc., Stanford, KY ($116 million); The First Bank of Greenwich, Cos Cob, CT ($88 million); Community First Bank, Rosholt, WI ($68 million); Select Bank, Grand Rapids, MI ($66 million); and The State Exchange Bank, Lamont, OK ($50 million).

Three banks were removed as they found merger partners -- BankAtlantic, Fort Lauderdale, FL ($3.8 billion Ticker: BBX); Valliance Bank, McKinney, TX ($68 million); and Texas Coastal Bank, Pasadena, TX ($27 million).

The three additions were The Peoples Bank, Eatonton, GA ($137 million); The Peoples Bank, Covington, GA ($113 million); and First Community Bank of Crawford County, Van Buren, AR ($97 million). The other change was the FDIC issuing a Prompt Corrective Action order against Banks of Wisconsin, Kenosha, WI ($155 million).

Not surprising the FDIC took the long weekend off. We wish a happy Labor weekend to all and hope that anyone seeking a job lands one soon.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Two more reviews of Bernanke's Speech: Weak Labor Market "a grave concern"

by Calculated Risk on 8/31/2012 06:29:00 PM

"The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years."

Fed Chairman Ben Bernanke, August 31, 2012

From a research note today by Andrew Tilton at Goldman Sachs:

In the most striking line of the speech, Bernanke professed “grave concern” about the weak labor market and the potential human and economic cost of persistently high unemployment. Although consistent with prior comments about long-term unemployment and the risk of hysteresis, these are very strong words from a Fed chairman. When one has a “grave concern”, action—quite possibly aggressive action─is appropriate.And from Tim Duy at EconomistsView: Bernanke at Jackson Hole

The Chairman’s remarks strengthen our conviction that the Fed will ease in September, most likely by pushing out its guidance that rates will remain “exceptionally low at least through late 2014” to mid-2015 or beyond. We now think the probability of an announcement of further asset purchases is close to 50/50 in September, though our base-case forecast is still that this is more likely in December or early 2013. When and if asset purchases do occur, we expect them to be concentrated in agency mortgage-backed securities, and on an open-ended basis (i.e. a monthly rate of purchases) with changes in the rate of purchases conditional on the economic environment. Our views could still change depending on how economic data and financial conditions evolve between now and the September 13 announcement.

On net, Bernanke's speech leads me to believe the odds of additional easing at the next FOMC meeting are somewhat higher (and above 50%) than I had previously believed. His defense of nontraditional action to date and focus on unemployment point in that direction. This is the bandwagon the financial press will jump on. Still, the backward looking nature of the speech and the obvious concern that the Fed has limited ability to offset the factors currently holding back more rapid improvement in labor markets, however, leave me wary that Bernanke remains hesitant to take additional action at this juncture. This suggests to me that additional easing is not a no-brainer, but perhaps that is just my internal bias talking.

LPS: Mortgage delinquencies decreased in July

by Calculated Risk on 8/31/2012 03:54:00 PM

LPS released their First Look report for July this week. LPS reported that the percent of loans delinquent decreased in July from June.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased in July to 7.03% from 7.14% in June. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.57%, so delinquencies have fallen over half way back to normal.

The following table shows the LPS numbers for July 2012, and also for last month (June 2012) and one year ago (July 2011).

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| July 2012 | June 2012 | July 2011 | |

| Delinquent | 7.03% | 7.14% | 7.90% |

| In Foreclosure | 4.08% | 4.09% | 4.12% |

| Number of loans: | |||

| Loans Less Than 90 Days | 1,960,000 | 2,012,000 | NA |

| Loans 90 Days or more | 1,560,000 | 1,590,000 | NA |

| Loans In Foreclosure | 2,042,000 | 2,061,000 | NA |

| Total | 5,562,000 | 5,663,000 | NA |

The total number of delinquent loans, and in foreclosure, dropped about 100 thousand in July from June.

The percent of loans less than 90 days delinquent is close to normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process are still very high.

Fannie Mae and Freddie Mac Serious Delinquency rates declined in July

by Calculated Risk on 8/31/2012 01:54:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in July to 3.50% from 3.53% June. The serious delinquency rate is down from 4.08% in July last year, and this is the lowest level since April 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 3.42%, from 3.45% in June. Freddie's rate is only down slightly from 3.51% in July 2011. Freddie's serious delinquency rate peaked in February 2010 at 4.20%. This is the lowest level for Freddie since August 2009.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates some progress, the "normal" serious delinquency rate is under 1% - and it looks like it will be several years until the rates back to normal.

Analysis: Bernanke Clears the way for QE3 in September

by Calculated Risk on 8/31/2012 12:33:00 PM

First from Jon Hilsenrath and Kristina Peterson at the WSJ: Bernanke Signals Readiness to Do More

Federal Reserve Chairman Ben Bernanke offered a robust defense of the effectiveness of the central bank's easy-money policies in his speech Friday at the Fed conference here, and left little doubt that he is looking toward doing more to give the economy a lift at the Fed's next policy meeting in September.As Hilsenrath notes, Bernanke argued: 1) QE has been effective, 2) Additional QE would be helpful, 3) the costs of additional QE "appear manageable", and 4) the economy is "far from satisfactory.

• In Bernanke's view, QE has been effective. From his speech:

How effective are balance sheet policies? After nearly four years of experience with large-scale asset purchases, a substantial body of empirical work on their effects has emerged. Generally, this research finds that the Federal Reserve's large-scale purchases have significantly lowered long-term Treasury yields. ... These effects are economically meaningful.• The costs of additional QE are "manageable":

... a study using the Board's FRB/US model of the economy found that, as of 2012, the first two rounds of LSAPs may have raised the level of output by almost 3 percent and increased private payroll employment by more than 2 million jobs, relative to what otherwise would have occurred. The Bank of England has used LSAPs in a manner similar to that of the Federal Reserve, so it is of interest that researchers have found the financial and macroeconomic effects of the British programs to be qualitatively similar to those in the United States.

To be sure, these estimates of the macroeconomic effects of LSAPs should be treated with caution. ... Overall, however, a balanced reading of the evidence supports the conclusion that central bank securities purchases have provided meaningful support to the economic recovery while mitigating deflationary risks.

[T]he costs of nontraditional policies, when considered carefully, appear manageable, implying that we should not rule out the further use of such policies if economic conditions warrant.• The economy is still very weak:

[T]he economic situation is obviously far from satisfactory ... The unemployment rate remains more than 2 percentage points above what most FOMC participants see as its longer-run normal value ... Further, the rate of improvement in the labor market has been painfully slow. I have noted on other occasions that the declines in unemployment we have seen would likely continue only if economic growth picked up to a rate above its longer-term trend. In fact, growth in recent quarters has been tepid, and so, not surprisingly, we have seen no net improvement in the unemployment rate since January.Bernanke's comments suggest QE3 will be launched very soon, perhaps on September 13th following the next FOMC meeting.

Unless the economy begins to grow more quickly than it has recently, the unemployment rate is likely to remain far above levels consistent with maximum employment for some time.

I thought the odds of QE3 in August were high - and the minutes of the meeting indicated they were very very close. It is possible that the FOMC in September will announce an extension of the extended period until 2015 (from late 2014), and wait again for QE3, but that would seem at odds with Bernanke's comments today.

Bernanke: Monetary Policy since the Onset of the Crisis

by Calculated Risk on 8/31/2012 10:06:00 AM

From Fed Chairman Ben Bernanke at the Jackson Hole Economic Symposium: Monetary Policy since the Onset of the Crisis

The potential benefit of policy action, of course, is the possibility of better economic outcomes--outcomes more consistent with the FOMC's dual mandate. In light of the evidence I discussed, it appears reasonable to conclude that nontraditional policy tools have been and can continue to be effective in providing financial accommodation, though we are less certain about the magnitude and persistence of these effects than we are about those of more-traditional policies.QE has been effective and costs appear manageable.

...

In sum, both the benefits and costs of nontraditional monetary policies are uncertain; in all likelihood, they will also vary over time, depending on factors such as the state of the economy and financial markets and the extent of prior Federal Reserve asset purchases. Moreover, nontraditional policies have potential costs that may be less relevant for traditional policies. For these reasons, the hurdle for using nontraditional policies should be higher than for traditional policies. At the same time, the costs of nontraditional policies, when considered carefully, appear manageable, implying that we should not rule out the further use of such policies if economic conditions warrant.

...

the economic situation is obviously far from satisfactory.

...

Early in my tenure as a member of the Board of Governors, I gave a speech that considered options for monetary policy when the short-term policy interest rate is close to its effective lower bound. I was reacting to common assertions at the time that monetary policymakers would be "out of ammunition" as the federal funds rate came closer to zero. I argued that, to the contrary, policy could still be effective near the lower bound. Now, with several years of experience with nontraditional policies both in the United States and in other advanced economies, we know more about how such policies work. It seems clear, based on this experience, that such policies can be effective, and that, in their absence, the 2007-09 recession would have been deeper and the current recovery would have been slower than has actually occurred.

As I have discussed today, it is also true that nontraditional policies are relatively more difficult to apply, at least given the present state of our knowledge. Estimates of the effects of nontraditional policies on economic activity and inflation are uncertain, and the use of nontraditional policies involves costs beyond those generally associated with more-standard policies. Consequently, the bar for the use of nontraditional policies is higher than for traditional policies. In addition, in the present context, nontraditional policies share the limitations of monetary policy more generally: Monetary policy cannot achieve by itself what a broader and more balanced set of economic policies might achieve; in particular, it cannot neutralize the fiscal and financial risks that the country faces. It certainly cannot fine-tune economic outcomes.

As we assess the benefits and costs of alternative policy approaches, though, we must not lose sight of the daunting economic challenges that confront our nation. The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years.

Over the past five years, the Federal Reserve has acted to support economic growth and foster job creation, and it is important to achieve further progress, particularly in the labor market. Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.

Chicago PMI declines to 53.0

by Calculated Risk on 8/31/2012 09:51:00 AM

From Chicago ISM: Chicago Business Barometer Anemic

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER posted a small gain in August but remained steady for the last four months. Among the Business Activity measures, declines into contraction for both Order Backlogs and Supplier Deliveries offset minor gains in Production, New Orders, and Employment in August.The PMI decreased to 53.0 from 53.7. Expectations were for a decrease to 53.0.

• EMPLOYMENT recovered more than half of last month's slowing; • PRICES PAID slight gain; • ORDER BACKLOGS lowest since September 2009; • SUPPLIER DELIVERIES lowest since July 2009.

The employment index increased to 57.1 from 53.3, and new orders increased to 54.8 from 52.9.

Thursday, August 30, 2012

Friday: Bernanke, Bernanke, Bernanke

by Calculated Risk on 8/30/2012 09:10:00 PM

The focus on Friday will be Fed Chairman Ben Bernanke's speech at the Jackson Hole Economic Symposium.

Earlier this week, ECB President Mario Draghi cancelled his speech on Saturday. Here is an update on Europe, from the Financial Times: Brussels pushes for wide ECB powers

The European Central Bank would be given sweeping authority over all 6,000 eurozone banks under a plan being drawn up by the European Commission ... The plan, agreed at a meeting this week between top aides to José Manuel Barroso, commission president, and Michel Barnier, the EU’s senior financial regulator, would strip existing national supervisors of almost all authority to shut down or restructure their countries’ failing banks, giving those powers to Frankfurt.Europe will be back on the front pages next week.

Excerpt with permission.

On Friday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for August will be released. The consensus is for a decrease to 53.0, down from 53.7 in July.

• At 9:55 AM ET, the final Reuter's/University of Michigan's Consumer sentiment index for August will be released. The consensus is for a reading of 73.5, down from the preliminary August reading of 73.6, and up from the July reading of 72.3.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July will be released. The consensus is for a 0.9% increase in orders.

• Also at 10:00 AM, Fed Chairman Ben Bernanke will speak at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, "Monetary Policy Since the Crisis"

Lawler: On the relationship between pending home sales and closed sales

by Calculated Risk on 8/30/2012 06:55:00 PM

Yesterday the National Association of Realtors reported that its “National” Pending Home Sales Index increased by 2.4% on a seasonally adjusted basis in July to its highest level since April 2010.

The NAR’s PHSI did not signal the “dip” in June/July closed existing home sales, for reasons that are difficult to discern. It’s not easy to figure out “fallout” rates from the PHSI for several reasons: first, the PHSI is an index number with 2001 “activity” equal to 100, making numerical comparisons to the NAR’s existing home sales estimate difficult, especially since there is a “discontinuity” in the NAR’s existing home sales methodology in 2007; and second, the NAR’s PHSI is based on a sample size not much more than half that used to estimate existing home sales. To really delve into the relationship between pending sales and closed sales, one needs to get local data—which unfortunately isn’t available to the public in that many places.

Click on graph for larger image.

Click on graph for larger image.

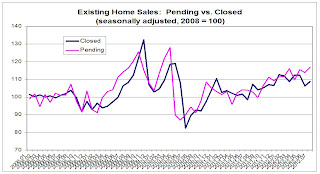

CR Note: This graph from Tom Lawler shows Pending and Closed home sales since January 2008. For this graph, Tom Lawler set both series to 100 in 2008.

More from Lawler: For fun, however, I looked at pending sales vs. closed sales data reported by MRIS for the mid-Atlantic region. While I have limited historical data, that data suggests that (1) contract fallout over the past two and a half years is up considerably from earlier periods; and (2) that increased fallout coincided with a significant increase in the share of pending sales that were “contingent. Other MRIS data/analyses suggests that a rise in the share of pending contracts that are short-sales, which (1) take much longer time to close; and (2) which have very high contract fall-out rates, has significantly impacted the relationship between pending sales and closed sales.

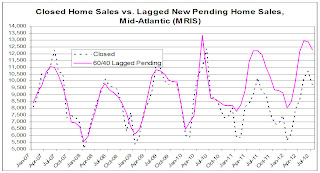

Here is a chart showing closed home sales by MRIS for the mid-Atlantic region compared to lagged new pending contracts, using a weighting of 60% for the previous month and 40% for two months earlier.

Here is a chart showing closed home sales by MRIS for the mid-Atlantic region compared to lagged new pending contracts, using a weighting of 60% for the previous month and 40% for two months earlier.

This chart suggests that over the last two years the number of closed home sales has been significantly lower than one would have expected based on the past relationship between past new pending sales and closed sales. While not shown here, a more “sophisticated” look at leads and lags suggests that the reason is not simply delayed closings, but is mainly contract fallout.

CR Note: It appears short sales are distorting the relationship between pending and closed sales, and the "pending home sales" report should currently be taken with an extra grain of salt.

WSJ: Bernanke Jackson Hole Speech Preview

by Calculated Risk on 8/30/2012 03:51:00 PM

Fed Chairman Ben Bernanke is scheduled to speak on Friday at 10 AM ET at the Jackson Hole Economic Symposium.

From Jon Hilsenrath at the WSJ: Bernanke's Dilemma Over His Legacy

[W]hen the chairman speaks Friday morning at the central bank's annual retreat here, he must once again address whether there is more the Fed can do to get the economy going and whether it is worth taking chances on controversial new programs. All along he has argued these efforts are worth it and appears likely to stick to that line in his speech.I'd like to think that Bernanke isn't thinking about his legacy, but that he is focused on what is best for the economy. So far the inflation critics have been wrong, and high inflation still seems very unlikely with a depressed economy, and significant resource slack.

Beyond big issues of the moment—such as whether the Fed will launch a new bond-buying program—a broader question looms in Jackson Hole about Mr. Bernanke's legacy. Long after his term as chairman ends in 17 months, will he be remembered as the Fed chief who did too little to combat high unemployment or the one who did too much and unleashed inflation and financial instability with the actions he took? Critics make both arguments.

More from Hilsenrath:

The Fed signaled strongly in the minutes of its August 1 policy meeting that in September it is likely to offer new assurances that interest rates will stay low beyond 2014 and that it is seriously considering more bond purchases. One issue Mr. Bernanke might clear up on Friday: Whether U.S. economic data since that meeting—some of it modestly stronger—has changed his outlook.Bernanke will not announce a new program at Jackson Hole. The most he will do is argue the Fed can do more and still has tools that will be effective - and he will probably say that help from fiscal authorities to provide more stimulus in the short term, and a credible long term plan to reduce the deficit, would be very helpful (good luck).

Goldman Sachs chief U.S. economist Jan Hatzius estimates that a $500 billion bond-buying program would boost growth by 0.2 percentage points for a year and bring down the unemployment rate by 0.1 percentage point.

I think the key will be how he describes the economy and his view of growth prospects.