by Calculated Risk on 10/30/2011 09:27:00 AM

Sunday, October 30, 2011

Visible Existing Home Inventory continues to decline year-over-year in October

I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

• In a few months, the NAR is expect to release revisions for their existing home sales and inventory numbers for the last few years. The sales revisions will be down (the NAR has pre-announced this), and the inventory is expected to be revised down too.

• Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be back to late 2005 / early 2006 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

Click on graph for larger image.

Click on graph for larger image.

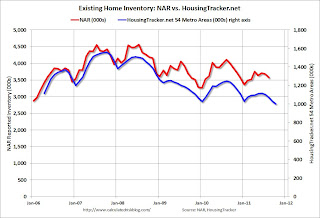

This graph shows the NAR estimate of existing home inventory through September (left axis) and the HousingTracker data for the 54 metro areas through October. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates in a few months).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the October listings - for the 54 metro areas - declined 16.4% from last year. Inventory was down 16.7% year-over-year in September.

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too.

Yesterday:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

Saturday, October 29, 2011

Unofficial Problem Bank list increases to 985 Institutions

by Calculated Risk on 10/29/2011 09:23:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 28, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The OCC finally released some information on its actions since September 23rd. This week, also, the FDIC released its actions through September. These releases contributed to many changes to the Unofficial Problem Bank List. In all, there were seven removals and 16 additions, which leaves the list with 985 institutions with assets of $406.6 billion. A year-ago, the list had 894 institutions with assets of $410.7 billion. For the month, there were 18 additions and 19 removals with 11 from failure, seven from action termination, and one unassisted merger. It was the fourth consecutive month for the list to have fewer institutions since its month-end peak of 1,001 in June, but the serial monthly decline was only a single institution.Earlier:

Among the seven removals this week is the failed All American Bank, Des Plaines, IL ($38 million). Other removals were from action termination including Marathon National Bank of New York, Astoria, NY ($818 million); West Pointe Bank, Oshkosh, WI ($371 million); Ojai Community Bank, Ojai, CA ($125 million Ticker: OJCB); Parkway Bank, Rogers, AR ($116 million); Regal Financial Bank, Seattle, WA ($101 million); and First National Bank and Trust, Barron, WI ($44 million).

Among the 16 additions are United Central Bank, Garland, TX ($2.6 billion); Falcon International Bank, Laredo, TX ($841 million); Valley Community Bank, Pleasanton, CA ($196 million Ticker: VCBC); and Americas United Bank, Glendale, CA ($106 million Ticker: AUNB). It looks like the OCC issued its first formal action against a thrift on September 15 to Stephens Federal Bank, Toccoa, GA ($196 million).

Other changes include the FDIC issuing Prompt Corrective Action orders against Fidelity Bank, Dearborn, MI ($867 million Ticker: DEAR); and Heartland Bank, Leawood, KS ($129 million Ticker: MBR).

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

Lawler to Census on Housing Data: "Splainin" Needed Not Just on Vacancy Rate

by Calculated Risk on 10/29/2011 04:31:00 PM

This is a very long article from economist Tom Lawler. The introduction is below. Here is the entire article in word format (typos and all).

In looking at the “disparities” between recent Census 2010 housing data and other Census “housing” reports, many folks have focused the most on differences in the Census 2010 vacancy rates and the Housing Vacancy Survey vacancy rates, and the possible implications of these disparities on measuring the “excess” supply of housing. Indeed, Census officials, reacting to numerous stories on this issue (thank CR for this), agreed that they had “some splainin’” to do, and said that they are “actively investigating” the differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, and plan to report the results of this research at the 2012 Federal Committee on Statistical Methodological Research Conference this coming January.

In looking at the advance program for that conference, the session devoted to this topic is labeled “Evaluation of Gross Vacancy Rates from the Decennial Census Versus Current Surveys.”

Census officials have been “mum,” however, about other “honkingly big” differences between Census 2010 and both the CPS/HVS and the CPS/ASEC, including big differences in household growth by age group, and sizable differences in homeownership rates by age group. There has also been no discussion about the growth in the housing stock as measured by Census 2010 and Census 2000 compared to other Census estimates of total housing production, and how the apparent “net loss” in the housing stock related to various factors (demolitions, disasters, conversions, etc.) last decade was MASSIVELY lower than that implied by the biennial “Component of Inventory Change” (CINCH) report using American Housing Survey Data (all aspects of which are inconsistent both with decennial Census data and ACS data).

Officials have also not said much if anything about how some of these disparities are not new, but in fact have been evident as far back as at least 2000. Stated another way, the “measurement” issues are not just a “point in time,” issue, but there are time series issues as well, which make macroeconomic “analysis” of the housing market [difficult].

CR comment: The entire article is here and a must read for anyone using Census data to analyze the housing market. Hopefully we will have better data to work with in the future!

Earlier:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

Schedule for Week of Oct 30th

by Calculated Risk on 10/29/2011 12:49:00 PM

Earlier:

• Summary for Week ending Oct 28th

The key report this week will be the employment situation report for October on Friday. Also the FOMC statement and Fed Chairman Ben Bernanke's press briefing on Wednesday, will be closely watched.

Other key reports include the October ISM manufacturing index on Tuesday, auto sales also on Tuesday, and the ISM non-manufacturing index on Thursday.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a decrease to 58.0, down from the strong 60.4 in September.

10:30 AM: Dallas Fed Manufacturing Survey for October. The consensus is for contraction of -5.0 from expansion of 5.9 in September. This is the last of the regional Fed manufacturing surveys for October, and the results have been mixed - but generally better than for September.

10:00 AM: Construction Spending for September. The consensus is for a 0.3% increase in construction spending.

10:00 AM ET: ISM Manufacturing Index for October. The consensus is for a slight increase to 52.0 from 51.6 in September.

All day: Light vehicle sales for October. Light vehicle sales are expected to increase to 13.2 million (Seasonally Adjusted Annual Rate), from 13.1 million in September.

This graph shows the Edmunds.com September estimate for light vehicle sales of 13.4 million SAAR.

This graph shows the Edmunds.com September estimate for light vehicle sales of 13.4 million SAAR.Edmunds is forecasting 13.4 million:

An estimated 1,033,257 new cars will be sold in October, for a projected Seasonally Adjusted Annual Rate (SAAR) of 13.4 million units, forecasts Edmunds.com ... This sales pace would mark the highest monthly SAAR since August 2009, when sales were inflated by the Cash for Clunkers program.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 100,000 payroll jobs added in October, up from the 91,000 reported in September.

10:00 AM: Q3 Housing Vacancies and Homeownership report from the Census Bureau. As a reminder: Be careful with the Housing Vacancies and Homeownership report. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. Unfortunately the report is based on a fairly small sample, and does not track the decennial Census data.

12:30PM: FOMC Meeting Announcement. No changes are expected to interest rates. The Fed will release its quarterly economic forecasts prior to the press briefing. The Fed growth forecasts are expected to be revised down once again. I'll post a preview on Sunday.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a slight decrease to 400,000 from 402,000 last week. The 4-week average has declined recently, but is still above 400,000.

10:00 AM ET: Manufacturers' Shipments, Inventories and Orders for September. The consensus is for a 0.2% decrease in orders.

10:00 AM: ISM non-Manufacturing Index for October. The consensus is for a no change at 53.0 in October, the same as in September. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: Employment Report for October.

The consensus is for an increase of 90,000 non-farm payroll jobs in October, down from the 103,000 jobs added in September. However the September report was boosted by returning Verizon workers - excluding those workers, this would be an improvement over September, but still a very weak jobs report.

The consensus is for an increase of 90,000 non-farm payroll jobs in October, down from the 103,000 jobs added in September. However the September report was boosted by returning Verizon workers - excluding those workers, this would be an improvement over September, but still a very weak jobs report.This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The consensus forecast for October is in blue.

The consensus is for the unemployment rate to remain at 9.1% in October.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through September.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through September. Through the first nine months of 2011, the economy has added 1.074 million total non-farm jobs or just 119 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.6 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.341 million private sector jobs this year, or about 149 thousand per month.

There are a total of 13.992 million Americans unemployed and 6.24 million have been unemployed for more than 6 months. Very grim.

Summary for Week ending Oct 28th

by Calculated Risk on 10/29/2011 07:58:00 AM

Note: The graphs have been changed. If you click on a graph, a larger image will appear with thumbnails of all the graphs in the post below the larger image. This is very fast and does not use scripting like the previous graph gallery. To close the window, just click on the “X” in the upper right. For RSS readers, just the large image will appear. There are new graph galleries (very fast) that group graphs by topic (I’ll add all the previous galleries soon).

The key story of the week was the European agreement including 1) “develop a voluntary bond exchange with a nominal discount of 50% on notional Greek debt held by private investors”, 2) “to leverage the resources of the EFSF”, and 3) an “agreement … by the members of the European Council on bank recapitalisation and funding”. Here is the Euro Summit Statement. This is short on details, and without ECB support, mostly just “kicks the can” down the road a few more months.

Another key story was the updated HARP refinance program. Here is the statement from the FHFA: FHFA, Fannie Mae and Freddie Mac Announce HARP Changes to Reach More Borrowers. I wrote two short posts about this last week: A few comments on the HARP Refinance Program changes and More on HARP and Housing. I think this will be helpful and reach more borrowers.

I expect more housing related policy announcements within the next month or two, including the mortgage settlement with lenders are servicers, and a pilot program for Fannie/Freddie/FHA REO disposition.

The U.S. economic data was mixed, but seemed to indicate a little improvement. GDP growth was reported at 2.5% in Q3 (real, annualized). That was an improvement from the first half of the year, but still very sluggish.

New home sales were up slightly to a still very low 313 thousand in September. House prices indexes were mixed with Case-Shiller showing a small seasonal increase in prices – although the prices index will start showing declines soon and will probably fall to new post-bubble lows during the winter months.

Two regional manufacturing surveys were released - the Richmond Fed survey showed further contraction, but the Kansas City survey showed slightly faster expansion.

Next week will be very busy including the employment report and the FOMC meeting. I'll have some preview posts tomorrow (and later in the week for employment).

Here is a summary in graphs:

• Advance Estimate: Real Annualized GDP Grew at 2.5% in Q3

Click on graph for larger image.

Click on graph for larger image.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q2 at 2.5% annualized was below trend growth (around 3%) - and very weak for a recovery, especially with all the slack in the system.

• Real personal consumption expenditures increased 2.4 percent in the second quarter, compared with an increase of 0.7 percent in the second.

• Change in private inventories subtracted 1.08 percentage point.

According to the BEA, real GDP is finally just above the pre-recession peak. The estimate for real GDP in Q3 (2005 dollars) was $13,352.8 billion, 0.2% above the $13,326.0 billion in Q4 2007. Nominal GDP was reported as $15,198.6 billion in Q3 2011.

This graph is constructed as a percent of the previous peak. This shows when GDP has bottomed - and when GDP has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

This graph is constructed as a percent of the previous peak. This shows when GDP has bottomed - and when GDP has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

At the worst point, real GDP was off 5.1% from the 2007 peak. Now real GDP through Q3 2011 and shows real GDP is back to the the pre-recession peak.

Note: There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA will release GDI with the 2nd GDP estimate for Q3. GDI was back to the pre-recession peak in Q2.

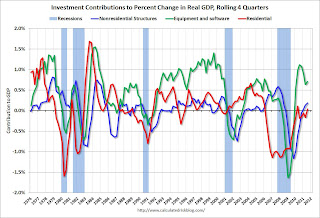

This following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

This following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.Residential Investment (RI) made a positive contribution to GDP in Q3 2011, and the four quarter rolling average finally turned positive in Q3.

Equipment and software investment has made a significant positive contribution to GDP for nine straight quarters (it is coincident). The contribution from nonresidential investment in structures was positive in Q3.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

• New Home Sales increase in September to 313,000

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 313 thousand. This was up from a revised 296 thousand in August (revised up from 295 thousand).

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 313 thousand. This was up from a revised 296 thousand in August (revised up from 295 thousand).

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The second graph shows New Home Months of Supply.

The second graph shows New Home Months of Supply.

Months of supply decreased to 6.2 in September. The all time record was 12.1 months of supply in January 2009. This is still slightly higher than normal (less than 6 months supply is normal).

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 61,000 units in September. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In September 2011 (red column), 25 thousand new homes were sold (NSA). This ties the record low for September set in 2010. The high for September was 99 thousand in 2005.

In September 2011 (red column), 25 thousand new homes were sold (NSA). This ties the record low for September set in 2010. The high for September was 99 thousand in 2005.This was above the consensus forecast of 300 thousand, and was tied the record low for the month of September set last year (NSA). New home sales have averaged only 300 thousand SAAR over the 17 months since the expiration of the tax credit ... mostly moving sideways at a very low level (with a little upward slope recently).

• Case Shiller: Home Prices increased Seasonally in August

S&P/Case-Shiller released the monthly Home Price Indices for August (actually a 3 month average of June, July and August).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 32.2% from the peak, and down 0.2% in August (SA). The Composite 10 is 1.0% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 32.0% from the peak, and down 0.1% in August (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

The Composite 10 SA is down 3.6% compared to August 2010. The Composite 20 SA is down 3.9% compared to August 2010. This is slightly smaller year-over-year decline than in July.

This graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 6 of the 20 Case-Shiller cities in August seasonally adjusted. Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 9.0% from the peak.

This graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 6 of the 20 Case-Shiller cities in August seasonally adjusted. Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 9.0% from the peak.As S&P noted, prices increased in 10 of 20 cities not seasonally adjusted (NSA). However seasonally adjusted, prices only increased in 6 cities.

• Real House Prices and House Price-to-Rent

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

This graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through August) and CoreLogic House Price Indexes (through August) in nominal terms (as reported).

This graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through August) and CoreLogic House Price Indexes (through August) in nominal terms (as reported).In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to July 2003.

The next graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The next graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to June 2000.

In real terms, all appreciation in the last decade is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to August 2000 levels, and the CoreLogic index is back to July 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to 2000 levels (nationally) and will probably be back to 1999 levels in the next few months.

• Personal Income increased 0.1% in September, Spending increased 0.6%

This graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars).

This graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). PCE increased 0.6 in August, and real PCE increased 0.5%.

Note: The PCE price index, excluding food and energy, decreased 0.2 percent.

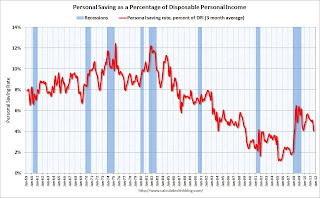

The personal saving rate was at 3.6% in Setpember.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the September Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the September Personal Income report.Spending is growing faster than incomes - and the saving rate has been declining. That can't continue for long ...

• Consumer Sentiment increased in October, still very weak

The final October Reuters / University of Michigan consumer sentiment index increased to 60.9, up from the preliminary October reading of 57.5, and up from 59.4 in September.

The final October Reuters / University of Michigan consumer sentiment index increased to 60.9, up from the preliminary October reading of 57.5, and up from 59.4 in September.In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate.

This was still very weak, but above the consensus forecast of 58.0.

• NMHC Apartment Survey: Market Conditions Tighten Slightly in Recent Survey

From the National Multi Housing Council (NMHC): Development Ramps Up as Demand Swells Finds NMHC Quarterly Survey

This graph shows the quarterly Apartment Tightness Index.

This graph shows the quarterly Apartment Tightness Index.The index has indicated tighter market conditions for the last seven quarters and although down from the record 90 earlier this year, this still suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q3 2011 to 5.6%, down from 6.0% in Q2 2011, and 9.0% at the end of 2009. Based on this index, I expect the declines in vacancy rates to slow.

New multi-family construction is one of the few bright spots for the U.S. economy and this survey indicates demand for apartments is still strong.

• ATA Trucking Index increased 1.6% in September

From ATA: ATA Truck Tonnage Index Increased 1.6% in September

From ATA: ATA Truck Tonnage Index Increased 1.6% in SeptemberHere is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Sluggish growth after stalling earlier this year ...

• Other Economic Stories ...

• Chicago Fed: Economic activity improved in September

• From NY Fed President William Dudley: The National and Regional Economic Outlook

• DOT: Vehicle Miles Driven decreased 1.7% in August compared to August 2010

• A few comments on the HARP Refinance Program changes

• Moody's: Commercial Real Estate Prices increased 2.4% in August

• Richmond Fed: Manufacturing Contraction Persists in October; Employment Turns Negative

• From the Kansas City Fed: Growth in Manufacturing Activity Edged Higher

Friday, October 28, 2011

Friday Evening Reading on Europe

by Calculated Risk on 10/28/2011 09:47:00 PM

From the Financial Times: Italy gives EU a post-party hangover

Italy was forced to pay a record 6.06 per cent at an auction of its benchmark 10-year bonds, up from 5.86 per cent a month ago, despite intervention by the European Central Bank on the open market.From the NY Times: Hitches Signal Further Difficulties for Euro Zone

excerpt with permission

Elsewhere in the troubled euro zone, a big loss by an Austrian bank served as a reminder of the fragility of financial institutions, while a German supreme court decision scrambled efforts to speed up political decision making. In the meantime, the head of Europe’s bailout fund turned to China to invest in the fund.From the NY Times: China Is Asked for Investment in Euro Rescue

China is expected to demand significant concessions, including financial guarantees and limits on what Beijing sees as discriminatory trade policies, in exchange for any investment in Europe’s emergency stability fund.From the NY Times: Greeks Direct Anger at Germany and European Union

Beyond populist talk, which ranges from euro-skepticism to anti-German demagoguery, experts say the concessions that Greece has made in exchange for the foreign aid it needs to stave off default — including allowing European Union officials to monitor Greek state affairs closely — are unprecedented for a member nation, making Greece a bellwether for the future of European integration.From Kash Mansori at Street Light: Worrying Signs

I am not impressed by the direction in which things have been heading in Europe this week. My sense is that, like me, many financial market participants have been suffering from so much 'crisis exhaustion' that they were willing to give this week's rescue package the benefit of the doubt and believe that it was in fact sufficient to permanently put things on a stable footing. Everyone wants this crisis to be over. But the inadequacies of the plan are real, and will only become more apparent over time. I hate to say it, but I fear that we haven't reached the final fix yet.And a great cartoon from Paul Krugman: Here We Go Again

Bank Failure #85: All American Bank, Des Plaines, Illinois

by Calculated Risk on 10/28/2011 07:17:00 PM

International savior.

Done the Chi-Town way.

by Soylent Green is People

From the FDIC: International Bank of Chicago, Chicago, Illinois, Assumes All of the Deposits of All American Bank, Des Plaines, Illinois

As of June 30, 2011, All American Bank had approximately $37.8 million in total assets and $33.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.5 million. ... All American Bank is the 85th FDIC-insured institution to fail in the nation this year, and the ninth in Illinois.Pretty sad when the All American Bank fails ... oh well, it is Friday!

Report: Mortgage Settlement deal could be reached within a month

by Calculated Risk on 10/28/2011 03:55:00 PM

From Reuters: Analysis: Mortgage probe may open new path for housing relief

Settlement talks continue with the banks, state attorneys general and some federal agencies over foreclosure shortcuts and other abuses. A deal could be struck within a month, according to people familiar with the matter.It appears there will be two more housing related announcements soon: this mortgage settlement, and an REO disposition program for Fannie/Freddie/FHA (also the changes to the HARP refinance program were announced this week).

...

Five major banks could be required to commit roughly $15 billion to reduce principal balances for struggling homeowners and modify loans in other ways under a proposed deal to settle allegations linked to the "robo-signing" scandal.

That amount would be part of broader sanctions that could total $25 billion ... Much of the exact language has yet to be hashed out but it could provide for the first broad use of principal writedowns ...

Q3 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

by Calculated Risk on 10/28/2011 01:21:00 PM

The BEA released the underlying detail data today for the Q3 Advance GDP report. As expected, the recent pickup in non-residential structure investment has been for power and communication. Here is a look at office, mall and lodging investment:

Click on graph for larger image.

Click on graph for larger image.

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and then declined sharply. Investment has increased a little recently (probably mostly tenant improvements as opposed to new office buildings).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). Mall investment declined in Q3.

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by over 80%.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). This is happening again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

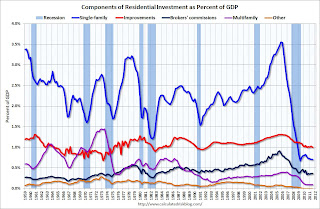

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $151 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (about 1.0% of GDP), significantly above the level of investment in single family structures of $106 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions increased slightly in Q3, and are moving sideways as a percent of GDP.

And investment in multifamily structures is still moving sideways as a percent of GDP (increasing slowly in dollars). This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging - and for residential investment.

Consumer Sentiment increases in October, still very weak

by Calculated Risk on 10/28/2011 09:55:00 AM

The final October Reuters / University of Michigan consumer sentiment index increased to 60.9, up from the preliminary October reading of 57.5, and up from 59.4 in September.

Click on graph for larger image.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate.

This was still very weak, but above the consensus forecast of 58.0.