by Calculated Risk on 10/24/2011 11:22:00 AM

Monday, October 24, 2011

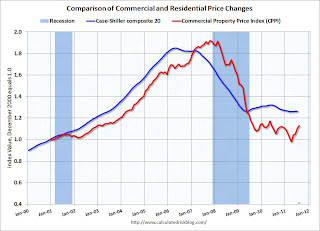

Moody's: Commercial Real Estate Prices increased 2.4% in August

From Bloomberg: Moody’s U.S. Commercial Property Index Rose 2.4% in August

The Moody’s/REAL Commercial Property Price Index advanced 2.4 percent from July. It’s up 7.2 percent from a year earlier ... Moody’s doesn’t see “significant” price gains in the near term as loan originations based on commercial-mortgage backed securities slow and demand for vacant space continues to “languish,” the company said. ... The share of distressed deals was 21.7 percent, the lowest since January 2010.Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 7.2% from a year ago, and down about 41% from the peak in 2007. This index is very volatile because there are relatively few transactions - and some of the recent increase was due to fewer distressed sales - and some of the increase was probably seasonal.