by Calculated Risk on 2/21/2011 12:00:00 PM

Monday, February 21, 2011

Libya Update

Note: U.S. Markets are closed today in observance of Presidents' Day. Here are the weekly schedule and summary:

• Summary for Week ending February 19th

• Schedule for Week of February 20th

By requests, some links on Libya ...

• From the NY Times: Qaddafi’s Grip on Power Seems to Ebb as Forces Retreat

The 40-year-rule of Libyan strongman Col. Muammar el-Qaddafi appeared to teeter Monday as his security forces retreated to a few buildings in the Libyan capital of Tripoli, where fires burned unchecked and senior government officials and diplomats announced defections.• The Telegraph has a site that is updated frequently: Libya protests: live

... several senior officials — including the justice minister and members of the Libyan mission to the United Nations — announced their resignations.

• From al Jazeera: Libya Live Blog

Europe: ECB Lending Spike due to Irish Banks and other topics

by Calculated Risk on 2/21/2011 08:56:00 AM

A few European notes and stories ...

• From the WSJ: Irish Banks Behind ECB Lending Surge

An unusual surge in overnight lending from the European Central Bank last week was connected to Ireland's effort to wind down nationalized lenders Anglo Irish Bank Corp. and Irish Nationwide Building Society ... The two banks moved collateral from the ECB's longer-term refinancing facilities to the more expensive overnight-lending program as part of a plan to auction off deposits and certain other assets on their balance sheets, the person saidThe fear late last week was that some large European bank was in trouble, and now it appears this is just related to winding down the Irish banks.

• From AP: Ireland's Leading Party Wants New Bailout Terms. What a surprise (Not). The Irish election is this Friday, February 25th.

• From the NY Times: Greece’s Efforts to Limit Tax Evasion Have Little Success

Various studies have estimated that Greece may be losing as much as $30 billion a year to tax evasion — an amount that would have gone a long way to solving its debt problems. ... But payments have only trickled in.Another surprise. Tax evasion is an art form in many countries.

• From Bloomberg: German Business Confidence Unexpectedly Rises to Record Unexpectedly?

• Note: There is a meeting of several EU leaders, apparently including Angela Merkel and Nicolas Sarkozy, in Helsinki on March 4th, and then a special eurozone debt crisis summit on March 11th.

• The Ten Year yields for certain European countries declined slightly today. Here are the Ten Year yields for Portugal, Spain, Ireland and Greece.

Sunday, February 20, 2011

Libya Update

by Calculated Risk on 2/20/2011 08:34:00 PM

By requests, some links on Libya ...

• From the NY Times: Qaddafi’s Son Warns of Civil War as Libyan Protests Widen

• From the WSJ: Gadhafi's Son Warns of Civil War in Libya

Sunday, Moammar Gadhafi's son went on state television to proclaim that his father remained in charge with the army's backing and would "fight until the last man, the last woman, the last bullet."• From al Jazeera: Libya Live Blog

Seif al-Islam Gadhafi ... warned the protesters that they risked igniting a civil war in which Libya's oil wealth "will be burned."

• From Reuters: Libya tribal chief threatens to block oil exports

The "Curse of Negative Equity"

by Calculated Risk on 2/20/2011 03:12:00 PM

We will be discussing the impact of negative equity for years. Toluse Olorunnipa at the Miami Herald has an anecdote: The curse of negative home equity

Wesley Ulloa bought her first condo for $230,000 in 2007, and watched helplessly as it lost two-thirds of its value [to about $80,000 today] ... She’s one of hundreds of thousands of South Floridians coping with the reality of being underwater on their mortgages—one of the most widespread side effects of the real estate market collapse.The choices are to tough it out, try for a modification or short sale, or just default. All bad choices - and this will limit her choices in the future too.

“I get a little angry. I think ‘Man I bought this for $230,000 and for what I’m paying, I could be in a house’,” she said. “But I can’t dwell on it. I mean, what are you going to do?”

Olorunnipa also notes: "More than 300,000 South Florida mortgages—or 43 percent of them—are currently underwater ..."

That percentage comes from CoreLogic's Q3 2010 negative equity report (Q4 will be released in a few weeks).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the break down of equity by state (for home with a mortgage). Florida is bad, but Nevada and Arizona are in worse shape. And with house prices falling again, the number of homeowners with negative increase some more (depending on the number of modifications and foreclosures).

Earlier posts:

• Summary for Week ending February 19th

• Schedule for Week of February 20th

Summary for Week ending February 19th

by Calculated Risk on 2/20/2011 09:27:00 AM

Here is the economic schedule for the coming week.

Retail sales were weaker than expected in January, and the reports for November and December were revised down. This suggests consumption in Q4 will be revised down slightly, and that the first quarter started a little slower than expected.

Industrial production and capacity utilization decreased slightly in January; however the manufacturing surveys from the New York and Philly Fed both showed improvement in February, suggesting any slowdown in January was probably due to the weather.

Housing is still flat on the floor. Housing starts increased in January because of an increase in multi-family starts (as expected). Single-family starts decreased 1.0% to 413 thousand in January - the lowest level since early 2009.

Both the producer price index (PPI 0.8%, core PPI 0.5%) and consumer price index (CPI 0.4%, core CPI 0.2%) increased in January. Core measures are still low, but have also been increasing.

Below is a summary of the previous week, mostly in graphs.

• Retail Sales increased 0.3% in January

On a monthly basis, retail sales increased 0.3% from December to January(seasonally adjusted, after revisions), and sales were up 7.8% from January 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 13.7% from the bottom, and now 0.4% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 7.1% on a YoY basis (7.8% for all retail sales). This was below expectations for a 0.5% increase. Retail sales ex-autos were up 0.3%; also below expectations of a 0.5% increase. Although lower than expected, retail sales are now above the pre-recession peak in November 2007.

• Housing Starts increased in January

Total housing starts were at 596 thousand (SAAR) in January, up 14.6% from the revised December rate of 520 thousand, and up 25% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 596 thousand (SAAR) in January, up 14.6% from the revised December rate of 520 thousand, and up 25% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

The increase in starts in January was entirely because of multi-family starts. Single-family starts decreased 1.0% to 413 thousand in January - the lowest level since early 2009.

This was above expectations of 540 thousand starts, but still very low. The low level of starts is good news for housing, and I expect starts to stay low until more of the excess inventory of existing homes is absorbed. Multi-family starts will rebound in 2011, but completions will probably be at or near record lows since it takes over a year to complete most multi-family projects.

• Industrial Production, Capacity Utilization decrease slightly in January

This graph shows Capacity Utilization. This series is up 7.9 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 7.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.1% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.

Industrial production decreased in January due to a decline in utilities. Production is still 5.6% below the pre-recession levels at the end of 2007.

The decline was a combination of an upward revision to December and less demand for heating in January.

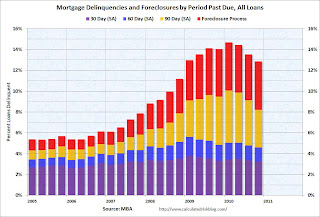

• MBA: Loans in Foreclosure Tie All-Time Record, fewer Short-term Delinquencies

The MBA reports that 12.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2010 (seasonally adjusted). This is down from 13.52 percent in Q3 2010.

The following graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.25% from 3.36% in Q3. This is below the average levels of the last 2 years, but still high.

Loans 30 days delinquent decreased to 3.25% from 3.36% in Q3. This is below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.34% from 1.44% in Q3; this is the lowest since Q2 2008.

The biggest decline was in the 90+ day delinquent bucket. This declined from 4.34% in Q3 3.63% in Q4. This is mostly due to modifications or putting the loans in the foreclosure process.

The percent of loans in the foreclosure process increased to 4.63% (tying the record set in Q1 2010). This is due to the foreclosure pause.

From the MBA: Short-term Delinquencies Fall to Pre-Recession Levels, Loans in Foreclosure Tie All-Time Record

• Core Measures show increase in Inflation

This graph shows these three measure of inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 0.95%, median CPI has increased 0.83%, and trimmed-mean CPI increased 0.97% - all less than 1%.

This graph shows these three measure of inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 0.95%, median CPI has increased 0.83%, and trimmed-mean CPI increased 0.97% - all less than 1%.

However, all three increased in January at a higher annualized rate: core CPI increased at an annualized rate of 2.1%, median CPI 2.0% annualized, and trimmed-mean CPI increased 2.7% annualized. This is just one month, but the annualized rate for these key measures is at or above the Fed's inflation target. With the slack in the system, I have been expecting these core measures to stay below 2% this year.

• NAHB Builder Confidence unchanged in February

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was unchanged at 16 in February. This was slightly below expectations of an increase to 17. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow).

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for over two years.

• Other Economic Stories ...

• CoreLogic: NAR’s 2010 existing home sales are overstated by 15% to 20%

• From the NY Fed: The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to improve in February

• From David Leonhardt at the NY Times Economix: Seattle’s Foreseeable Housing Bust

• From David Streitfeld article: Housing Crash Is Hitting Cities Thought to Be Stable

• From Nick Timiraos, Victoria McGrane and Ruth Simon at the WSJ: Big Banks Face Fines on Role of Servicers

• From the NY Fed: Quarterly Report on Household Debt and Credit

• An economic letter from Justin Weidner and John Williams at the SF Fed: What Is the New Normal Unemployment Rate?

• From the Philly Fed: Philly Fed Survey highest since January 2004

• Unofficial Problem Bank list increases to 951 Institutions

Best wishes to all!

Saturday, February 19, 2011

Middle East Update

by Calculated Risk on 2/19/2011 11:00:00 PM

Earlier: Schedule for Week of February 20th

A few links ...

• From Bloomberg: Bahrain Vows to Ease Tension; Mideast Unrest Spreads

Bahrain’s authorities backed down from a standoff with protesters in a bid to ease tensions as government forces in Yemen, Libya and Djibouti shot at demonstrators ... In Yemen, gunfire broke out in the capital yesterday, leaving one man dead, shot in the neck by government supporters, as the unrest entered the ninth day.• From the LA Times: Bahrain protesters back at Pearl Square despite violence

The thousands who paraded in Pearl Square on Saturday night believed they had journeyed too far to stop their uprising now. Just as the Egyptians in Tahrir Square mourned their dead and vowed their passing would produce major social change, the Bahrainis now found resolve in their grief.• From the NY Times: Cycle of Suppression Rises in Libya and Elsewhere

Libyan security forces moved against protesters Saturday in Benghazi, the country’s second-largest city and the epicenter of the most serious challenge to four decades of Col. Muammar el-Qaddafi’s rule, opposition leaders and residents said. The death toll rose to at least 104 people, most of them in Benghazi ...• From the NY Times: Oil Flows, but High Prices Jangle Nerves

The turmoil in North Africa and the Middle East has helped drive oil prices up to more than $102 a barrel for an important benchmark crude, Brent, although so far there have been no significant disruptions in production or supply ... While Egypt and Tunisia have little oil, Libya is one of Africa’s largest holders of crude oil reserves, Algeria and Iran are major suppliers and Bahrain and Yemen both border Saudi Arabia on the peninsula that produces most of the world’s oil.

Report: FDIC plans to sue former WaMu execs for over $1 Billion

by Calculated Risk on 2/19/2011 07:31:00 PM

From Kirsten Grind at the Puget Sound Business Journal: FDIC to seek $1B from former WaMu execs

The Federal Deposit Insurance Corp. plans to file a civil suit against at least three former Washington Mutual executives, including former chief executive Kerry Killinger, seeking to collect more than $1 billion in damages ...This dwarfs the $300 million lawsuit against IndyMac executives filed last year.

Schedule for Week of February 20th

by Calculated Risk on 2/19/2011 01:35:00 PM

There are three key housing reports to be released this week: Case-Shiller house prices on Tuesday, January Existing Home Sales on Wednesday, and January New Home sales on Thursday. Other key economic reports include the 2nd estimate of Q4 GDP to be released on Friday, and Durable Goods on Thursday.

US markets will be closed in observance of Presidents' Day.

9:00 AM: S&P/Case-Shiller Home Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

Click on and graph for larger image in graph gallery.

Click on and graph for larger image in graph gallery.This graph shows the seasonally adjusted Composite 10 and Composite 20 indices through November (the Composite 20 was started in January 2000).

Prices are falling again, and the Composite 20 index will be close to a new post-bubble low in December. The consensus is for prices to decline about 0.5% in December; the sixth straight month of house price declines.

Morning: Moody's/REAL Commercial Property Price Index (CPPI) for December.

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for an increase to 64.0 from 60.6 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February. The consensus is for the index to close to the 18 reading last month (above zero is expansion).

1:00 PM: Minneapolis Fed President Narayana Kocherlakota speaks in Pierre, South Dakota.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index increased slightly at the end of last year, and has declined slightly again over the last month to 1997 levels.

Early: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

This graph shows the Architecture Billings Index since 1996. The index showed expansion in December at 54.2; the highest level since December 2007.

This graph shows the Architecture Billings Index since 1996. The index showed expansion in December at 54.2; the highest level since December 2007.This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for sales of 5.2 million at a Seasonally Adjusted Annual Rate (SAAR) in January, slightly below the 5.28 million SAAR in December.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Housing economist Tom Lawler is forecasting a decline to 5.17 millon (SAAR) in January. This would put the months-of-supply in the low 8 months range, probably up slightly from the 8.1 months reported in December.

Along with the release of January existing home sales, the NAR will release revisions for the past three years (2008 through 2010). In addition, the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). These revisions will be announced mid-year.

12:30 PM: Kansas City Fed President Thomas Hoenig speaks in Washington on the economic outlook

1:30 PM: Philadelphia Fed President Charles Plosser speaks in Alabama on the economic outlook

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a slight decrease to 403 thousand compared to 410 thousand last week.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 3.0% increase in durable goods orders after decreasing 2.5% in December.

8:30 AM ET: Chicago Fed National Activity Index (January). This is a composite index of other data.

8:30 St. Louis Fed President James Bullard speaks in Bowling Green, Kentucky on "Monetary Policy Outlook for 2011"

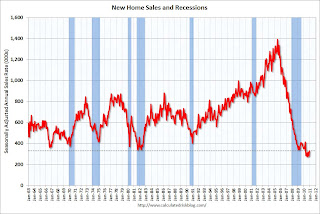

10:00 AM: New Home Sales for January from the Census Bureau. The consensus is for an decrease in sales to 310 thousand (SAAR) in January from 329 thousand in December.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.New home sales collapsed in May and have averaged only 294 thousand (SAAR) over the last eight months. Prior to the last eight months, the record low was 338 thousand in Sept 1981.

10:00 AM: 10:00 FHFA House Price Index for December. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

11:00 AM: Kansas City Fed regional Manufacturing Survey for February. The index was at 7 in January.

8:30 AM: Q4 GDP (second estimate). This is the second estimate for Q4 from the BEA, and the consensus is for real GDP growth to be revised to an increase of 3.3% annualized from the advance estimate of 3.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for an increase to 75.4 from the preliminary reading of 75.3.

10:15 Richmond Fed President Jeffrey Lacker and Fed Board nominee Peter Diamond will comment on stress tests at US Monetary Policy Forum, New York, New York

1:30 PM: Vice Chairman Janet Yellen, Panel Discussion on Unconventional Monetary Policy at U.S. Monetary Policy Forum

Possible: FDIC Q4 Quarterly Banking Report

Best Wishes to All!

Unofficial Problem Bank list increases to 951 Institutions

by Calculated Risk on 2/19/2011 09:32:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 18, 2011.

Changes and comments from surferdude808:

Despite well wishes for a safe banking week, it was anything but with several failures and numerous additions to the Unofficial Problem Bank List. In all, there were six removals and 13 additions this week, which leaves the Unofficial Problem Bank List with 951 institutions with assets of $418.6 billion.CR Note: The FDIC will probably release the Q4 Quarterly Banking Profile in the next couple of weeks, and that will include the number of banks on the official problem bank list at the end of 2010.

Assets increased by $5.6 billion, which is the largest weekly increase since November 5, 2010. Furthermore, the asset total of $418.6 billion is the highest it has been in nearly three months when they were $419.6 billion at November 19, 2010.

Among the removals are an action termination against Eaton National Bank & Trust Co., Eaton, OH ($190 million) and an unassisted merger as American State Bank, Tulsa, OK ($13 million) merged into Peoples Bank, Tulsa, OK.

All of the failures this week were on the Unofficial Problem Bank List and they include Habersham Bank, Clarkesville, GA ($396 million Ticker: HABC); San Luis Trust Bank, FSB, San Luis Obispo, CA ($306 million Ticker: SNLS); Citizens Bank of Effingham, Springfield, GA ($221 million); and Charter Oak Bank, Napa, CA ($136 million). Interestingly, Habersham Bank must have been on double secret probation with the FDIC as they never disclosed the Cease & Desist order Habersham Bank was under. In addition, the OTS issued a Prompt Corrective Acton order against San Luis Trust Bank, FSB only nine days before its failure.

As anticipated, the OCC released its actions through the middle of January 2011, which contributed to the numerous additions this week. Among the 13 additions are Wilmington Trust FSB, Baltimore, MD ($1.8 billion Ticker: WL); Southern Community Bank and Trust, Winston Salem, NC ($1.7 billion Ticker: SCMF); Queensborough National Bank & Trust Company, Louisville, GA ($941 million); Horry County State Bank, Loris, SC ($804 million Ticker: HCFB); and One Bank & Trust, National Association, Little Rock, AR ($439 million).

Other changes include Prompt Corrective Action orders issued by the Federal Reserve against the Bank of Whitman, Colfax, WA ($722 million) and Idaho Banking Company, Boise, ID ($195 million) and the OCC against Western Springs National Bank and Trust, western Springs, IL ($196 million).

Next week we anticipate the FDIC will release its actions through January 2011. Perhaps we should not issue any well wishes for a safe banking for the upcoming week given the carnage this past week.

Friday, February 18, 2011

Bank Failure #22 for 2011: San Luis Trust Bank, FSB, San Luis Obispo, California

by Calculated Risk on 2/18/2011 09:14:00 PM

From the FDIC: First California Bank, Westlake Village, California, Assumes All of the Deposits of San Luis Trust Bank, FSB, San Luis Obispo, California

As of December 31, 2010, San Luis Trust Bank, FSB had approximately $332.6 million in total assets and $272.2 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $96.1 million. ... San Luis Trust Bank, FSB is the twenty-second FDIC-insured institution to fail in the nation this year