by Calculated Risk on 2/15/2011 05:17:00 PM

Tuesday, February 15, 2011

CoreLogic: NAR’s 2010 existing home sales are overstated by 15% to 20%

CoreLogic released their U.S. Housing and Mortgage Trends Report: 2010 Year End Summary today.

From the report:

During 2010 CoreLogic estimates home sales totaled 3.6 million, down 12%from 4.1 million in 2009. Sales remain extremely low relative to the last decade as sales last year were more than 50% below the level in 2005 and about 33% below the level in 2000. Although it’s been widely reported that the National Association of Realtors’s (NAR) existing home sales data fell only 5% to 4.9 million in 2010, down from 5.2 million in 2009 and flat relative to 2008, the CoreLogic data indicates otherwise.CoreLogic also discusses the impact of lower sales on months-of-supply and potentially prices, however it also appears the NAR data overstates the level of inventory too - so it is hard to tell if months-of-supply will be revised up (or even down). As I've mentioned before, I expect that later this year, the NAR will revise down both sales and inventory numbers for the last few years.

...

Historically, the CoreLogic existing sales data have covered about 85% to 90% of all NAR’s existing home sales data. However, in 2006 NAR’s sales data became elevated relative to the CoreLogic, MBA, HMDA and Census sales related data, and that trend has continued and become more pronounced through 2010. There are several reasons for the divergence, including benchmarking drift, more sales going through MLS systems due to consolidation and a lower share of for sale by owners (FSBO) home sales. Net, NAR’s existing home sales data are overstated by about 15% to 20.

Also from the report:

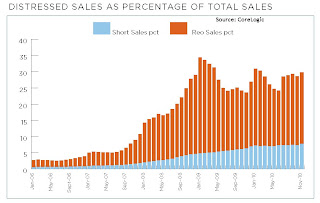

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph (posted with permission) shows the percentage of short sales and REO (lender Real Estate Ownder) sales since January 2006 through November 2010. There is a seasonal pattern for conventional sales (strong in the spring and summer, and weak in the winter), however distressed sales happen all year - so the percentage of distressed sales increases every winter. Notice that the percentage of distressed sales increased in 2010 following the expiration of the tax credits. Recent reports suggest the percent of distressed sales will be very high in January.