by Calculated Risk on 10/31/2009 10:35:00 PM

Saturday, October 31, 2009

October Economic Summary in Graphs

by Calculated Risk on 10/31/2009 06:31:00 PM

Here is a collection of real estate and economic graphs for data released in October ...

Note: Click on graphs for larger image in new window. For more info, click on link below graph to original post.

New Home Sales in September (NSA)

New Home Sales in September (NSA)The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. Sales in September 2009 (31 thousand) were below September 2008 (35 thousand). This is the 3rd lowest sales for September since the Census Bureau started tracking sales in 1963.

In September 2009, 31 thousand new homes were sold (NSA); the record low was 28 thousand in September 1981; the record high for September was 99 thousand in 2005.

From: New Home Sales Decrease in September

New Home Sales in September

New Home Sales in SeptemberThis graph shows shows New Home Sales vs. recessions for the last 45 years.

New Home sales fell off a cliff, but are now 22% above the low in January.

"Sales of new one-family houses in September 2009 were at a seasonally adjusted annual rate of 402,000 ...

This is 3.6 percent (±10.2%)* below the revised August rate of 417,000 and is 7.8 percent (±12.0%)* below the September 2008 estimate of 436,000."

From: New Home Sales Decrease in September

New Home Months of Supply in September

New Home Months of Supply in SeptemberThere were 7.5 months of supply in September - significantly below the all time record of 12.4 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of September was 251,000. This represents a supply of 7.5 months at the current sales rate."

From: New Home Sales Decrease in September

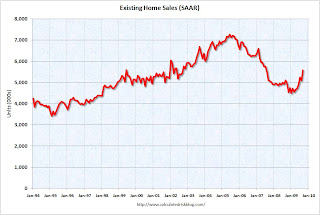

Existing Home Sales in September

Existing Home Sales in September This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

From: Existing Home Sales Increase in September

Existing Home Inventory September

Existing Home Inventory SeptemberAccording to the NAR, inventory decreased to 3.63 million in September (August inventory was revised upwards significantly). The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Typically inventory peaks in July or August, so some of this decline is seasonal.

From: Existing Home Sales Increase in September

Case Shiller House Prices for August

Case Shiller House Prices for AugustThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August.

From: Case-Shiller Home Price Index Increases in August

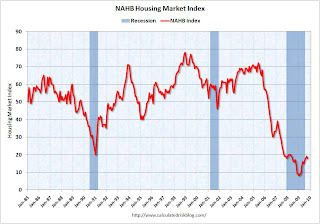

NAHB Builder Confidence Index in October

NAHB Builder Confidence Index in OctoberThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

From: NAHB: Builder Confidence Decreases Slightly in October

Architecture Billings Index for September

Architecture Billings Index for September"The Architecture Billings Index was up 1.4 points at 43.1, matching July's level, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008."

From: AIA: Architectural Billings Index Shows Contraction

Housing Starts in September

Housing Starts in SeptemberTotal housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.

Single-family starts were at 501 thousand (SAAR) in September, up 3.9% from the revised August rate, and 40 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for four months.

From: Housing Starts in September: Moving Sideways

Construction Spending increases in August

Construction Spending increases in AugustThe first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased in August, and nonresidential spending continued to decline.

Private residential construction spending is now 63.1% below the peak of early 2006.

Private non-residential construction spending is still only 12.6% below the peak of last September.

From: Construction Spending increases in August

September Employment Report

September Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 263,000 in September. The economy has lost almost 5.8 million jobs over the last year, and 7.2 million jobs during the 21 consecutive months of job losses.

The unemployment rate increased to 9.8 percent. This is the highest unemployment rate in 26 years.

Year over year employment is strongly negative.

From: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

September Employment Comparing Recessions

September Employment Comparing RecessionsThis graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses really picked up earlier this year, and the current recession is now the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession was worse).

The economy is still losing jobs at about a 3.2 million annual rate, and the unemployment rate will probably be above 10% soon.

From: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

September Retail Sales

September Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

On a monthly basis, retail sales decreased 1.5% from August to September (seasonally adjusted), and sales are off 5.7% from September 2008 (retail ex food services decreased 6.4%).

Excluding motor vehicles, retail sales were up 0.5%.

From: Retail Sales Decrease in September

LA Port Traffic in September

LA Port Traffic in SeptemberThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Loaded inbound traffic was 17.4% below September 2008.

Loaded outbound traffic was 8.6% below September 2008.

From: LA Area Port Traffic in September

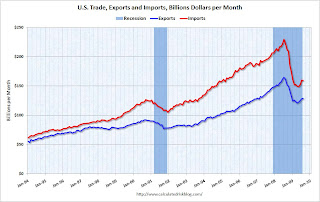

U.S. Imports and Exports Through August

U.S. Imports and Exports Through AugustThis graph shows the monthly U.S. exports and imports in dollars through August 2009.

Imports were down in August, and exports increased slightly. On a year-over-year basis, exports are off 21% and imports are off 29%.

From: Trade Deficit Decreases Slightly in August

Capacity Utilization in September

Capacity Utilization in September This graph shows Capacity Utilization. This series has increased for three straight months, and is up from the record low set in June (the series starts in 1967). Capacity Utilization had decreased in 17 of the previous 18 months.

Note: y-axis doesn't start at zero to better show the change.

An increase in capacity utilization is usually an indicator that the official recession is over.

From: Industrial Production, Capacity Utilization Increase in September

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty one states are showing declining three month activity. The index increased in 7 states, and was unchanged in 2.

A large percentage of states still showed declining activity in September.

From: Philly Fed State Coincident Indicators Show Widespread Weakness in September

Light vehicle sales in September

Light vehicle sales in SeptemberThis graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 9.22 million SAAR from AutoData Corp).

This is the third lowest monthly vehicle sales this year (SAAR).

From: Light Vehicle Sales 9.2 Million (SAAR) in September

Q3: Rental Vacancy Rate

Q3: Rental Vacancy RateThe rental vacancy rate increased to a record 11.1% in Q3 2009.

The homeowner vacancy rate was 2.6% in Q3 2009.

The homeownership rate increased slightly to 67.6% and is now at the levels of Q2 2000.

These excess units will keep pressure on rents and house prices for some time.

From: Q3: Record Rental Vacancy Rate, Homeownership Rate Increases Slightly

NMHC Quarterly Apartment Survey

NMHC Quarterly Apartment SurveyThis graph shows the quarterly Apartment Tightness Index.

“[T]he economic headwinds remain strong,” [NMHC Chief Economist Mark Obrinsky said], “as the employment market continues to sag, demand for apartment residences continues to slip. Though this quarter’s Market Tightness Index is improved compared to last quarter, it still indicates higher vacancies and lower rents.”

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

From: NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

U.S. Consumer Bankruptcy Filings in September

U.S. Consumer Bankruptcy Filings in SeptemberThis graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end

From: ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

Truck Tonnage Index in September

Truck Tonnage Index in September"The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.3 percent in September, after increasing 2.1 percent in both July and August. The latest decline lowered the SA index to 103.9 (2000=100). ...

Compared with September 2008, SA tonnage fell 7.3 percent, which was the best year-over-year showing since November 2008."

From ATA Truck Tonnage Index Declines in September

Restaurant Index Shows Contraction

Restaurant Index Shows ContractionThe restaurant business is still contracting ...

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From: Restaurant Index Shows Contraction, Less Capital Spending

Fannie Mae Serious Delinquencies

Fannie Mae Serious DelinquenciesFannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.45% in August, up from 4.17% in July - and up from 1.57% in August 2008.

From Fannie Mae: Delinquencies Increase Sharply in August

Housing: "First-time buyers and investors" are "market’s lifeblood"

by Calculated Risk on 10/31/2009 03:51:00 PM

From three DataQuick reports on Las Vegas, Miami and Phoenix ...

Las Vegas:

In September, a popular form of financing used by first-time home buyers – government-insured FHA loans – accounted for 53.8 percent of all home purchases, up from 52 percent in August. Absentee buyers bought 40.4 percent of all Las Vegas–area homes last month – the highest figure for any month this decade. Absentee buyers are often investors, but could include second-home buyers and others who, for various reasons, indicate at the time of sale that the property tax bill will be sent to a different address.Miami:

emphasis added

A popular form of financing used by first-time home buyers - government-insured FHA loans - accounted for 45.0 percent of all September purchases, while absentee buyers bought 29.7 percent of all homes last month, according to an analysis of public property records.Phoenix:

First-time buyers and investors remained the market’s lifeblood. Last month 46.7 percent of all Phoenix-area buyers used government-insured FHA loans, a popular choice among first-time buyers, according to an analysis of public property records. Absentee buyers made up 38.5 percent of all purchases ...We are far from a healthy market ...

Cartoon: "Trying to Reinflate the Bounce House"

by Calculated Risk on 10/31/2009 11:59:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

FDIC Bank Failure Update

by Calculated Risk on 10/31/2009 08:31:00 AM

| The media, and apparently FDIC employees, gather outside San Diego National Bank just minutes before the bank was seized last night. Photo credit: Lee. The mural is by Wyland. |  |

| This is one of the nine banks seized yesterday by the FDIC; a record for one week during this cycle. The second photo apparently shows the FDIC employees gathering beneath the whales ... Photo credit: Lee. |

The FDIC closed nine more banks on Friday, and that brings the total FDIC bank failures to 115 in 2009. The following graph shows bank failures by week in 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: Week 1 on graph ends Jan 9th.

After a busy summer, the FDIC slowed down in late September and early October with only five bank failures in four weeks. Now it appears the pace has picked up again. With 9 weeks to go, it seems 150 or so bank failures is likely this year.

The 2nd graph covers the entire FDIC period (annually since 1934).

The 2nd graph covers the entire FDIC period (annually since 1934).This is the most failures per year since 1992 (181 failures).

As far as failures per week - there were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits. Also the cumulative estimated losses for the DIF, since early 2007, is now about $47.5 billion.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

Friday, October 30, 2009

Unofficial Problem Bank List Grows to 500

by Calculated Risk on 10/30/2009 11:59:00 PM

Note: This was before the FDIC seized banks related to FBOP today.

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

The Unofficial Problem Bank List crossed a major threshold this week as 500 institutions are now listed.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The list grew by a net 18 institutions this week and nearly $44 billion in assets were added. Most of the increase comes is a result of the FDIC finally releasing its actions for September 2009. It will take another month to get their actions for October 2009.

The FDIC released 25 cease & desist order and 2 Prompt Corrective Actions. The list already included 8 of these 25 as they were identified through 8-K filings, media reports, or the State Banking Department of Illinois’ website.

From last week’s list, we dropped the 6 failures last Friday and another one that had failed back in July. Also, the FDIC issued a Cease & Desist Order on September 28, 2009 against Hillcrest Bank Florida that failed last Friday; hence, it never had time to appear on the list.

Most notable among the new additions are R-G Premier Bank of Puerto Rico ($6.5 billion); Central Pacific Bank, Honolulu, HI ($5.5 billion); and West Coast Bank, Lake Oswego, OR ($2.6 billion). The other 22 institutions added had an average asset size of $262 million.

Looking at the additions from a geographic perspective, there were four institutions headquartered in Washington, and two each in Florida, Georgia, Minnesota, and Wisconsin. There is a new addition from the FDIC issuing a Prompt Corrective Action Order on September 18th against Washita State Bank, Burns Flat, OK. Although not new to the list as they have been operating under a formal action, there were two other Prompt Corrective actions added. First, the OTS issued a PCA order on October 22nd against Century Bank, a Federal Savings Bank, Sarasota, FL; and the Federal Reserve issued a PCA order on October 27th against SolutionsBank, Overland Park, KS.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures 107 through 115: Nine Failed Banks in Arizona, California, Illinois and Texas

by Calculated Risk on 10/30/2009 10:13:00 PM

Nine set the bar much higher

Ten won't be the peak.

by Soylent Green is People

From the FDIC: U.S. Bank, NA, of Minneapolis, Minnesota, Assumes All of the Deposits of Nine Failed Banks in Arizona, California, Illinois and Texas

The Federal Deposit Insurance Corporation (FDIC) entered into a purchase and assumption agreement with U.S. Bank, NA, of Minneapolis, Minnesota, a wholly-owned subsidiary of U.S. Bancorp, to assume all of the deposits and essentially all of the assets of nine failed banks. ...Nine in one shot ...

The nine banks involved in today's transaction are: Bank USA, National Association, Phoenix, Arizona; California National Bank, Los Angeles, California; San Diego National Bank, San Diego, California; Pacific National Bank, San Francisco, California; Park National Bank, Chicago, Illinois; Community Bank of Lemont, Lemont, Illinois; North Houston Bank, Houston, Texas; Madisonville State Bank, Madisonville, Texas; and Citizens National Bank, Teague, Texas. As of September 30, 2009, the banks had combined assets of $19.4 billion and deposits of $15.4 billion.

The nine banks had 153 offices...

The FDIC estimates that the cost of the nine banks to the DIF will be a combined $2.5 billion. U.S. Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. The failure of the nine banks brings the nation's total number this year to 115.

Reports: U.S. set to seize FBOP, Pacific National Bank

by Calculated Risk on 10/30/2009 07:54:00 PM

While we wait for the FDIC ... it could get real busy ...

From the Chicago Tribune: U.S. set to seize FBOP, congressmen say (ht Josh)

Federal regulators are expected to seize Friday night the banks owned by Oak Park-based FBOP Corp., the troubled owner of Park National Bank of Chicago and eight other U.S. banks, people familiar with the situation say.And another report in California: Pacific National Bank Going to FDIC (ht Vladimir)

A takeover would occur even after several U.S. Congressman from the Illinois area, including Reps. Bobby Rush and Danny Davis and Sen. Roland Burris, called the FDIC asking it to hold off on closing the bank for at least a week, said Marilyn Katz, a spokeswoman for the bank.

San Francisco-based Pacific National Bank is being eyeballed for takeover by federal authorities, according to several sources in the Silicon Valley and San Francisco commercial real estate industry. ... The Federal Deposit Insurance Corp. was expected to take control as early as this afternoon. ... The bank ... reported assets of $2.1 billion

Fannie Mae: Delinquencies Increase Sharply in August

by Calculated Risk on 10/30/2009 05:40:00 PM

Here is the monthly Fannie Mae hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.45% in August, up from 4.17% in July - and up from 1.57% in August 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans. These rates are based on conventional single-family mortgage loans and exclude reverse mortgages and non-Fannie Mae mortgage securities held in our portfolio."

Just more evidence of the growing delinquency problem, although these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications.

Martin Wolf Interview, Wilbur Ross on CRE, and Market

by Calculated Risk on 10/30/2009 04:00:00 PM

Remember that rally yesterday? All gone and then some ... Click on graph for larger image in new window.

From Doug Short of dshort.com (financial planner).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The S&P was off 2.8% today ...

A great interview on Tech Ticker: "Still a Very Shaky Sort of World Recovery," FT's Martin Wolf Says

Martin Wolf, chief economics commentator for The Financial Times, talks about the U.S. and world economy.

"It's very difficult to believe in a really strong consumer-led recovery in the U.S.. I think this is still a very shaky sort of world recovery."And on the stock market:

"I think the market actually did a probably not unreasonable job - that is why I think it is not much of a bubble - of anticipating what was going to happen. And you sell on the news, isn't that the story? You buy on the hope and you sell on the news. We now know there is a reasonable recovery. By the way, in the early phases of a recovery, 3.5% annualized growth is not sensational by American standards. And remember if the U.S. is going to reduce its unemployment we will want to see annual growth - not annualized growth - of 4% to 5%."And from Bloomberg: Wilbur Ross Sees ‘Huge’ Commercial Real Estate Crash (ht James, others)

emphasis added

Billionaire investor Wilbur L. Ross Jr., said today the U.S. is in the beginning of a “huge crash in commercial real estate.”I'm not sure this is the beginning of a "huge crash" - prices are already down 41% from the peak according to the Moody’s/REAL Commercial Property Price Indices!

“All of the components of real estate value are going in the wrong direction simultaneously,” said Ross, one of nine money managers participating in a government program to remove toxic assets from bank balance sheets. “Occupancy rates are going down. Rent rates are going down and the capitalization rate -- the return that investors are demanding to buy a property -- are going up.”

Note: on CRE, also see MIT Professor David Geltner discussion on the CPII and the differences between price declines for healthy and distressed properties: Where we are in the aggregate: A two-year anniversary ...