by Calculated Risk on 10/31/2009 06:31:00 PM

Saturday, October 31, 2009

October Economic Summary in Graphs

Here is a collection of real estate and economic graphs for data released in October ...

Note: Click on graphs for larger image in new window. For more info, click on link below graph to original post.

New Home Sales in September (NSA)

New Home Sales in September (NSA)The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. Sales in September 2009 (31 thousand) were below September 2008 (35 thousand). This is the 3rd lowest sales for September since the Census Bureau started tracking sales in 1963.

In September 2009, 31 thousand new homes were sold (NSA); the record low was 28 thousand in September 1981; the record high for September was 99 thousand in 2005.

From: New Home Sales Decrease in September

New Home Sales in September

New Home Sales in SeptemberThis graph shows shows New Home Sales vs. recessions for the last 45 years.

New Home sales fell off a cliff, but are now 22% above the low in January.

"Sales of new one-family houses in September 2009 were at a seasonally adjusted annual rate of 402,000 ...

This is 3.6 percent (±10.2%)* below the revised August rate of 417,000 and is 7.8 percent (±12.0%)* below the September 2008 estimate of 436,000."

From: New Home Sales Decrease in September

New Home Months of Supply in September

New Home Months of Supply in SeptemberThere were 7.5 months of supply in September - significantly below the all time record of 12.4 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of September was 251,000. This represents a supply of 7.5 months at the current sales rate."

From: New Home Sales Decrease in September

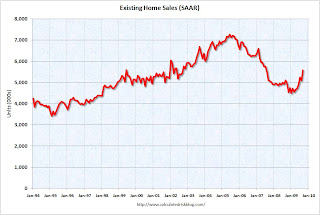

Existing Home Sales in September

Existing Home Sales in September This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

From: Existing Home Sales Increase in September

Existing Home Inventory September

Existing Home Inventory SeptemberAccording to the NAR, inventory decreased to 3.63 million in September (August inventory was revised upwards significantly). The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Typically inventory peaks in July or August, so some of this decline is seasonal.

From: Existing Home Sales Increase in September

Case Shiller House Prices for August

Case Shiller House Prices for AugustThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August.

From: Case-Shiller Home Price Index Increases in August

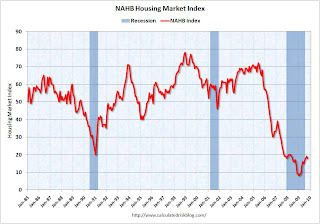

NAHB Builder Confidence Index in October

NAHB Builder Confidence Index in OctoberThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

From: NAHB: Builder Confidence Decreases Slightly in October

Architecture Billings Index for September

Architecture Billings Index for September"The Architecture Billings Index was up 1.4 points at 43.1, matching July's level, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008."

From: AIA: Architectural Billings Index Shows Contraction

Housing Starts in September

Housing Starts in SeptemberTotal housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.

Single-family starts were at 501 thousand (SAAR) in September, up 3.9% from the revised August rate, and 40 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for four months.

From: Housing Starts in September: Moving Sideways

Construction Spending increases in August

Construction Spending increases in AugustThe first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased in August, and nonresidential spending continued to decline.

Private residential construction spending is now 63.1% below the peak of early 2006.

Private non-residential construction spending is still only 12.6% below the peak of last September.

From: Construction Spending increases in August

September Employment Report

September Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 263,000 in September. The economy has lost almost 5.8 million jobs over the last year, and 7.2 million jobs during the 21 consecutive months of job losses.

The unemployment rate increased to 9.8 percent. This is the highest unemployment rate in 26 years.

Year over year employment is strongly negative.

From: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

September Employment Comparing Recessions

September Employment Comparing RecessionsThis graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses really picked up earlier this year, and the current recession is now the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession was worse).

The economy is still losing jobs at about a 3.2 million annual rate, and the unemployment rate will probably be above 10% soon.

From: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

September Retail Sales

September Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

On a monthly basis, retail sales decreased 1.5% from August to September (seasonally adjusted), and sales are off 5.7% from September 2008 (retail ex food services decreased 6.4%).

Excluding motor vehicles, retail sales were up 0.5%.

From: Retail Sales Decrease in September

LA Port Traffic in September

LA Port Traffic in SeptemberThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Loaded inbound traffic was 17.4% below September 2008.

Loaded outbound traffic was 8.6% below September 2008.

From: LA Area Port Traffic in September

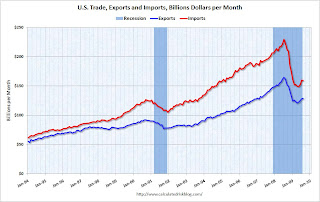

U.S. Imports and Exports Through August

U.S. Imports and Exports Through AugustThis graph shows the monthly U.S. exports and imports in dollars through August 2009.

Imports were down in August, and exports increased slightly. On a year-over-year basis, exports are off 21% and imports are off 29%.

From: Trade Deficit Decreases Slightly in August

Capacity Utilization in September

Capacity Utilization in September This graph shows Capacity Utilization. This series has increased for three straight months, and is up from the record low set in June (the series starts in 1967). Capacity Utilization had decreased in 17 of the previous 18 months.

Note: y-axis doesn't start at zero to better show the change.

An increase in capacity utilization is usually an indicator that the official recession is over.

From: Industrial Production, Capacity Utilization Increase in September

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty one states are showing declining three month activity. The index increased in 7 states, and was unchanged in 2.

A large percentage of states still showed declining activity in September.

From: Philly Fed State Coincident Indicators Show Widespread Weakness in September

Light vehicle sales in September

Light vehicle sales in SeptemberThis graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 9.22 million SAAR from AutoData Corp).

This is the third lowest monthly vehicle sales this year (SAAR).

From: Light Vehicle Sales 9.2 Million (SAAR) in September

Q3: Rental Vacancy Rate

Q3: Rental Vacancy RateThe rental vacancy rate increased to a record 11.1% in Q3 2009.

The homeowner vacancy rate was 2.6% in Q3 2009.

The homeownership rate increased slightly to 67.6% and is now at the levels of Q2 2000.

These excess units will keep pressure on rents and house prices for some time.

From: Q3: Record Rental Vacancy Rate, Homeownership Rate Increases Slightly

NMHC Quarterly Apartment Survey

NMHC Quarterly Apartment SurveyThis graph shows the quarterly Apartment Tightness Index.

“[T]he economic headwinds remain strong,” [NMHC Chief Economist Mark Obrinsky said], “as the employment market continues to sag, demand for apartment residences continues to slip. Though this quarter’s Market Tightness Index is improved compared to last quarter, it still indicates higher vacancies and lower rents.”

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

From: NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

U.S. Consumer Bankruptcy Filings in September

U.S. Consumer Bankruptcy Filings in SeptemberThis graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end

From: ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

Truck Tonnage Index in September

Truck Tonnage Index in September"The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.3 percent in September, after increasing 2.1 percent in both July and August. The latest decline lowered the SA index to 103.9 (2000=100). ...

Compared with September 2008, SA tonnage fell 7.3 percent, which was the best year-over-year showing since November 2008."

From ATA Truck Tonnage Index Declines in September

Restaurant Index Shows Contraction

Restaurant Index Shows ContractionThe restaurant business is still contracting ...

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From: Restaurant Index Shows Contraction, Less Capital Spending

Fannie Mae Serious Delinquencies

Fannie Mae Serious DelinquenciesFannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.45% in August, up from 4.17% in July - and up from 1.57% in August 2008.

From Fannie Mae: Delinquencies Increase Sharply in August